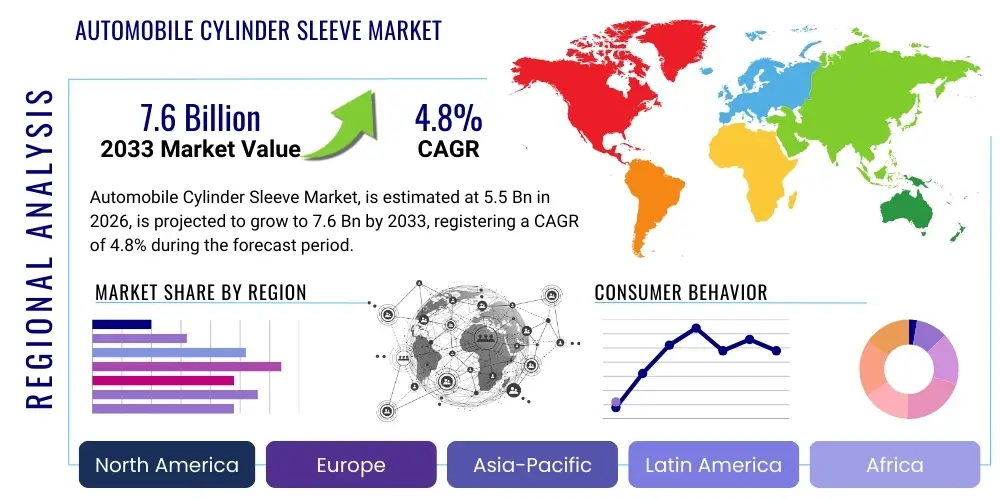

Automobile Cylinder Sleeve Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442045 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Automobile Cylinder Sleeve Market Size

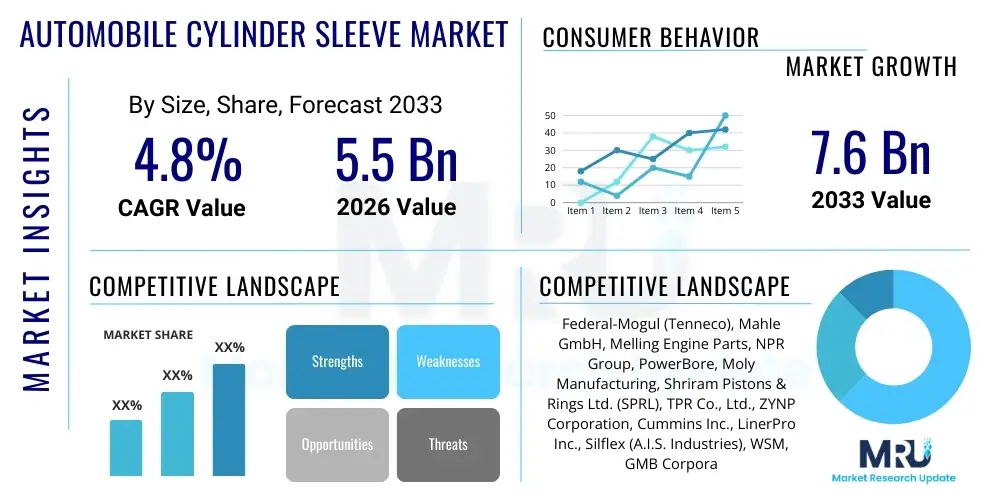

The Automobile Cylinder Sleeve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.5 Billion in 2026 and is projected to reach $7.6 Billion by the end of the forecast period in 2033.

Automobile Cylinder Sleeve Market introduction

The Automobile Cylinder Sleeve Market encompasses the manufacturing, distribution, and sale of cylindrical components that are inserted into engine blocks to form the inner wall of the combustion chamber. These sleeves, crucial for the functionality and longevity of internal combustion engines (ICE), provide a wear-resistant surface for the piston to reciprocate against. They are integral in maintaining precise cylinder geometry, optimizing heat transfer, and ensuring effective sealing during the combustion process, thereby contributing directly to engine efficiency and overall performance across various vehicle types.

The primary applications of cylinder sleeves are observed across light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), passenger cars, and off-road equipment, predominantly in diesel and gasoline engines. The continued global reliance on ICE technology, especially in high-payload logistics and developing economies, ensures sustained demand for both original equipment manufacturing (OEM) and aftermarket replacement. Advances in metallurgy and surface treatment technologies are constantly improving the durability and thermal properties of these sleeves, addressing the demands for higher compression ratios and stringent emission standards.

Key market benefits include enhanced engine durability, ease of repair and maintenance (as replacing the sleeve is often simpler and more cost-effective than replacing the entire engine block), and the ability to utilize lighter engine block materials like aluminum while retaining the wear resistance of traditional cast iron or specialty steel liners. Market growth is primarily driven by the expanding global vehicle parc, the high replacement rate in the aftermarket segment due to standard engine wear, and continuous technological innovation focusing on lightweight materials and improved friction reduction coatings to meet modern fuel economy targets.

Automobile Cylinder Sleeve Market Executive Summary

The global Automobile Cylinder Sleeve Market is experiencing moderate growth, primarily underpinned by robust demand in the aftermarket segment coupled with steady, albeit slowing, new vehicle production rates globally. Business trends indicate a strategic shift among leading manufacturers towards establishing localized production hubs in high-growth regions, particularly Asia Pacific (APAC), to mitigate supply chain risks and leverage lower operational costs. Furthermore, there is a pronounced push towards developing advanced composite and thin-walled cylinder liners, driven by stringent fuel efficiency norms requiring engine lightweighting and improved thermal management capabilities.

Regionally, APAC currently dominates the market, fueled by massive vehicle production bases in China, India, and Southeast Asian nations, alongside a rapidly expanding vehicle fleet requiring routine maintenance and engine overhauls. Europe and North America represent mature markets characterized by higher average vehicle ages and strong demand for premium, high-performance cylinder sleeves, particularly within the heavy-duty commercial vehicle sector. Emerging markets in Latin America and the Middle East and Africa (MEA) offer high growth potential due to increasing industrialization and urbanization leading to greater commercial fleet usage.

Segmentation trends highlight the dominance of the 'Wet Liner' segment in heavy-duty applications due to superior cooling capacity, while 'Dry Liners' maintain prominence in light-duty passenger vehicles due to simplicity and reduced block complexity. By material, cast iron remains the staple, but high-strength aluminum and steel alloys are gaining traction in performance and lightweight applications. The aftermarket segment is poised to outgrow the OEM segment over the forecast period, reflecting the global trend of consumers holding onto vehicles for longer periods, necessitating more frequent engine reconditioning.

AI Impact Analysis on Automobile Cylinder Sleeve Market

User inquiries regarding AI's impact on the Automobile Cylinder Sleeve Market frequently revolve around optimizing manufacturing precision, predicting component failure rates, and accelerating material innovation cycles. Key themes include the use of machine learning (ML) for predictive maintenance strategies in heavy-duty fleets, demanding better tolerance control in sleeve production; the role of AI in quality inspection (defect detection on casting/honing surfaces); and the potential for generative design algorithms to simulate complex thermal stress patterns, thereby optimizing sleeve thickness and material composition for specific engine architectures. Users are particularly concerned with how AI integration can maintain high precision standards while reducing waste and improving production throughput in casting and machining operations.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the R&D and manufacturing phases of cylinder sleeves. In R&D, sophisticated algorithms can rapidly simulate millions of material combinations and geometry variations under extreme thermal and mechanical loads, dramatically shortening the time required for developing lighter, more durable cylinder liners suitable for high-efficiency ICEs. This capability allows manufacturers to design sleeves with highly specific surface finishes and coating profiles (like thermal barrier coatings) optimized for friction reduction and longevity, something traditional iterative testing struggles to achieve efficiently.

Furthermore, in the manufacturing process, AI-driven solutions are enhancing precision and reducing variability. ML models analyze real-time data from casting, honing, and boring machines to autonomously adjust parameters, ensuring consistent metallurgical quality and dimensional accuracy. This minimizes scrap rates and improves overall production efficiency. For end-users, AI facilitates predictive engine maintenance: by analyzing operational sensor data, ML identifies subtle deviations in engine performance linked to cylinder wear, prompting proactive replacement of sleeves before catastrophic engine failure, thereby driving steady, high-margin demand in the advanced aftermarket sector.

- AI-driven optimization of casting and machining parameters for enhanced dimensional accuracy.

- Machine learning applied to non-destructive testing for automated defect detection (quality control).

- Generative design and simulation for lightweight material composition and thermal stress optimization.

- Predictive maintenance platforms utilizing operational data to forecast cylinder sleeve wear and replacement cycles.

- Supply chain optimization using AI to manage volatile raw material procurement (e.g., iron, specialty alloys).

DRO & Impact Forces Of Automobile Cylinder Sleeve Market

The Automobile Cylinder Sleeve Market dynamics are shaped by a complex interplay of drivers, restraints, and opportunities. The primary driver is the steady growth in global vehicle production, particularly the robust expansion of commercial vehicle fleets in developing economies, which rely heavily on durable internal combustion engines. Additionally, the growing global vehicle parc and the high necessity for engine overhaul and repair activities in the aftermarket segment ensure sustained demand for replacement sleeves. Technological advancements aimed at boosting engine efficiency and managing thermal stress in modern, downsized, and turbocharged ICEs also mandate the use of higher-quality, specialized cylinder liners.

However, the market faces significant restraints, most notably the accelerating global transition towards electric vehicles (EVs). Since EVs do not utilize cylinder sleeves, widespread EV adoption poses a long-term existential threat to the market, forcing manufacturers to diversify or pivot focus entirely to the aftermarket and hybrid engine sectors. Furthermore, fluctuating prices of raw materials such as cast iron, aluminum, and specialty alloys, coupled with stringent global emission regulations (e.g., Euro 7, EPA standards) requiring expensive component upgrades and R&D investment, can increase production costs and pressure profit margins for sleeve manufacturers.

Opportunities for growth are concentrated in material science and surface engineering. The demand for lightweight cylinder sleeves (e.g., aluminum sleeves with specialized bore coatings like plasma-transferred wire arc (PTWA) or iron-based coatings) presents a strong growth avenue. Furthermore, expanding geographical reach into underserved aftermarket segments in Africa and Latin America offers high revenue potential. The market structure, characterized by moderate capital intensity and a reliance on specialized metallurgical expertise, indicates a relatively strong bargaining power for established suppliers, while buyer power remains moderate due to the non-negotiable nature of the component's functionality (Impact Force Analysis).

Segmentation Analysis

The Automobile Cylinder Sleeve market is comprehensively segmented based on several critical parameters, including the type of liner, the material used, the specific vehicle application, and the sales channel through which the product is distributed. Understanding these segmentations is vital for manufacturers and suppliers to tailor their product offerings, marketing strategies, and distribution logistics effectively. The core segmentation revolves around the physical configuration of the sleeve, dictating its cooling properties and integration complexity within the engine block.

Segmentation by Liner Type (Wet, Dry, and Finned/Air-cooled) directly relates to engine cooling systems and thermal management requirements. Wet liners offer superior heat dissipation and are predominantly utilized in heavy-duty diesel engines where operational temperatures are high. Dry liners, favored in lighter-duty applications, simplify engine block construction but offer less direct contact with coolant. Segmentation by Material (Cast Iron, Steel Alloy, Aluminum Alloy, and Composites) reflects the performance requirements, cost sensitivity, and lightweighting goals of specific engine manufacturers. Cast iron remains the cost-effective and durable standard, while steel and specialized alloys address high-performance and high-durability niches.

Furthermore, segmentation by Sales Channel (OEM and Aftermarket) highlights the dual nature of market demand. The OEM channel is governed by long-term contracts, strict quality specifications, and high volume requirements, whereas the Aftermarket segment is driven by accessibility, pricing, and the diversity of components needed for repairs across a vast range of engine models globally. The Aftermarket typically offers higher growth stability due to mandatory engine servicing schedules and average vehicle lifecycles extending globally.

- By Liner Type

- Wet Liner

- Dry Liner

- Air-cooled Liner (Finned)

- By Material

- Cast Iron

- Steel Alloy

- Aluminum Alloy and Composite Materials

- By Vehicle Type

- Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Off-Road Vehicles and Equipment

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Automobile Cylinder Sleeve Market

The value chain for the Automobile Cylinder Sleeve Market begins upstream with the sourcing of critical raw materials, primarily high-grade iron ore, scrap metal, and various alloying elements such as chromium, molybdenum, nickel, and copper, which are essential for producing specialized cast iron or steel alloys necessary for high wear resistance and thermal stability. These raw materials are processed by dedicated metallurgical suppliers and then fed into the casting facilities of cylinder sleeve manufacturers. The efficiency and quality control at this initial stage are crucial, as the chemical composition determines the final product's strength and friction characteristics. Strong supplier relationships and long-term contracts are essential for stabilizing costs in this volatile raw material market.

The midstream segment involves the manufacturing process itself, which is highly technical, encompassing specialized operations like centrifugal casting, continuous casting, and gravity casting, followed by intensive machining, honing, and sometimes surface treatments such as plasma coating or induction hardening. These processes require significant capital investment in precision machinery and high levels of operational expertise to ensure components meet the ultra-tight tolerances required for modern engines. Quality assurance and testing, including dimensional checks and metallurgical analysis, form a critical part of the manufacturing stage before the sleeves are packaged for distribution.

Downstream distribution channels segment into two distinct routes: direct sales to Original Equipment Manufacturers (OEMs) and sales through the aftermarket network. Direct distribution to OEMs involves Just-In-Time (JIT) delivery logistics, large volume fulfillment, and adherence to stringent contractual quality specifications for new vehicle assembly lines. Conversely, the aftermarket distribution is complex, relying on a vast network of authorized distributors, wholesalers, engine rebuilders, and independent repair shops. This channel often involves indirect sales, requiring inventory management for thousands of different engine models and demanding a fast, reliable supply chain to support maintenance and repair operations globally.

Automobile Cylinder Sleeve Market Potential Customers

The primary customers in the Automobile Cylinder Sleeve Market are broadly categorized into Original Equipment Manufacturers (OEMs) and the diverse entities that constitute the aftermarket segment. OEMs, including major global automotive manufacturers (e.g., Ford, Daimler, Toyota, Volkswagen) and engine builders (e.g., Cummins, Caterpillar), are volume buyers who procure sleeves directly for integrating into newly constructed engine blocks. Their procurement decisions are based heavily on supplier reputation, ability to meet complex technical specifications (including lightweighting and thermal resistance), long-term supply stability, and competitive pricing based on large production volumes. Securing OEM contracts is crucial for market share and technological validation.

The second, and often higher growth, customer segment resides in the aftermarket. This includes large-scale global automotive parts distributors and wholesalers who maintain extensive inventories of replacement components across various engine platforms. Their purchasing criteria center on breadth of product catalog, availability, brand trust, and competitive cost efficiency to serve a wide range of engine repair needs, from passenger car engine overhauls to heavy-duty truck fleet maintenance. These buyers represent the necessary cycle of wear and repair that sustains market demand long after the initial vehicle sale.

Further down the aftermarket chain are specialized engine rebuilders, machine shops, and independent repair garages. These end-users are highly technical and require sleeves that precisely match OE specifications for specific engine types. Their demand is driven by localized repair jobs and engine refurbishment projects. Additionally, fleet operators, especially those managing heavy commercial vehicles or large agricultural and construction equipment, act as significant buyers. These customers prioritize durability and minimal downtime, often seeking premium, heavy-duty sleeves that offer extended service life and reliability under strenuous operating conditions, making them sensitive to quality over initial cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.5 Billion |

| Market Forecast in 2033 | $7.6 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Federal-Mogul (Tenneco), Mahle GmbH, Melling Engine Parts, NPR Group, PowerBore, Moly Manufacturing, Shriram Pistons & Rings Ltd. (SPRL), TPR Co., Ltd., ZYNP Corporation, Cummins Inc., LinerPro Inc., Silflex (A.I.S. Industries), WSM, GMB Corporation, Varma Automotive, Kolbenschmidt Pierburg AG (Rheinmetall Automotive), Darton International, CWT Industries, Midwest Engine Company, Advance Sleeves. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automobile Cylinder Sleeve Market Key Technology Landscape

The technology landscape for the Automobile Cylinder Sleeve Market is dominated by advancements in casting techniques, precision machining, and surface engineering, all aimed at enhancing durability, reducing friction, and facilitating engine lightweighting. Traditional manufacturing relies heavily on centrifugal casting (spin casting), which produces dense, fine-grained structures crucial for wear resistance, especially utilized in producing wet liners for heavy-duty applications. However, modern approaches are exploring continuous casting and proprietary lost-foam techniques to improve material utilization and achieve more complex internal geometries.

A major area of technological focus is the development of ultra-thin, high-strength cylinder liners, particularly for aluminum engine blocks. This necessity has driven innovation in materials, moving beyond standard grey cast iron to include specialized high-chromium alloys, compacted graphite iron (CGI), and high-strength steel alloys. The challenge lies in retaining the exceptional wear properties of iron while minimizing weight, leading to the adoption of advanced material formulations that can withstand higher thermal stresses generated by modern turbocharged engines.

Perhaps the most significant technological development involves surface coating and finishing. Technologies such as Plasma Transferred Wire Arc (PTWA) spraying, Twin Wire Arc Spraying (TWAS), and Nikasil (nickel silicon carbide) coatings are increasingly used, particularly by premium OEMs, to deposit extremely hard, low-friction layers directly onto the aluminum bore or inner liner surface. Honing technology has also evolved, incorporating plateau honing and controlled surface roughness to optimize oil retention and minimize friction, directly improving fuel economy and reducing internal engine emissions. These surface technologies represent the future direction for meeting ambitious performance and efficiency targets.

Regional Highlights

The Automobile Cylinder Sleeve Market exhibits significant regional variations driven by differing regulatory environments, vehicle production volumes, and fleet composition.

- Asia Pacific (APAC): APAC is the unquestionable growth engine and largest consumer market, primarily due to the massive vehicle manufacturing bases in China, India, and Japan, coupled with rapid infrastructure development driving demand for commercial vehicles (HCVs and LCVs). The aftermarket demand is exceptionally high, supported by the presence of a vast and rapidly aging vehicle population, necessitating frequent engine overhauls and cylinder sleeve replacements. India, in particular, showcases high growth potential driven by domestic manufacturing and a strong repair culture, requiring robust local supply chains.

- Europe: The European market is characterized by high adoption of advanced engine technologies and stringent emission regulations (e.g., Euro VI and future Euro VII). This region demands premium, high-specification cylinder sleeves incorporating advanced friction-reducing coatings and lightweight materials to comply with CO2 reduction targets. While the transition to electric vehicles is fastest here, demand remains strong in the high-performance segment and the specialized heavy-duty commercial vehicle sector.

- North America: North America represents a mature, stable market defined by high average vehicle life and a vast installed base of gasoline and heavy-duty diesel engines. The market is primarily replacement-driven, with strong emphasis on quality and durability. Demand for heavy commercial vehicle sleeves (for trucking and construction) is robust, supported by significant logistics and industrial sectors. The focus here is on reliable, high-mileage performance sleeves.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions offer emerging market opportunities, characterized by growing urbanization, increasing industrial activity, and improving access to imported automotive technology. Demand is price-sensitive but increasing steadily, particularly in the aftermarket for established engine platforms where repair, rather than replacement, is the dominant maintenance strategy. Investment in local manufacturing is gradually increasing to service these growing regional fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automobile Cylinder Sleeve Market.- Federal-Mogul (Tenneco)

- Mahle GmbH

- Melling Engine Parts

- NPR Group (Nippon Piston Ring)

- PowerBore

- Moly Manufacturing

- Shriram Pistons & Rings Ltd. (SPRL)

- TPR Co., Ltd.

- ZYNP Corporation

- Cummins Inc. (Component Division)

- LinerPro Inc.

- Silflex (A.I.S. Industries)

- GMB Corporation

- Kolbenschmidt Pierburg AG (Rheinmetall Automotive)

- Darton International

- CWT Industries

- Midwest Engine Company

- Advance Sleeves

- Cylinder Liner India Limited (CLIL)

- Eaton Corporation

Frequently Asked Questions

Analyze common user questions about the Automobile Cylinder Sleeve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Wet Liner and a Dry Liner?

A Wet Liner is designed to be in direct contact with the engine's coolant throughout its outer surface, offering superior heat transfer and cooling, primarily used in heavy-duty engines. Conversely, a Dry Liner is pressed into the engine block and is not directly exposed to the coolant, relying on the block material for heat dissipation, making it preferred for lighter-duty, simpler engine designs.

How is the growth of Electric Vehicles (EVs) impacting the demand for cylinder sleeves?

The increasing adoption of EVs presents a fundamental long-term restraint on the cylinder sleeve market as electric motors do not require these components. However, the market is currently sustained by the vast and growing aftermarket for existing Internal Combustion Engine (ICE) vehicles, and by continued demand from hybrid and commercial vehicle sectors, offsetting the immediate reduction in OEM gasoline/diesel engine production.

Which material is most commonly used for manufacturing standard cylinder sleeves?

Grey Cast Iron (GCI) remains the most prevalent material globally due to its excellent combination of high mechanical strength, inherent lubricity, resistance to scuffing and wear, and cost-effectiveness. However, specialized applications increasingly use high-performance materials like Compacted Graphite Iron (CGI) and steel alloys for improved weight and strength ratios.

What are the key technological trends influencing cylinder sleeve design?

Key trends include engine lightweighting, driven by the need for reduced emissions and improved fuel efficiency, leading to the widespread adoption of thin-walled sleeves and specialized surface coatings (such as PTWA, Nikasil, or Cermet coatings) to minimize friction and enhance thermal management capabilities in high-output, downsized engines.

Is the aftermarket or OEM segment expected to generate higher revenue growth?

The Aftermarket segment is generally expected to generate higher and more stable revenue growth over the forecast period. This is driven by the global trend of consumers retaining vehicles longer, mandatory maintenance cycles, and the high replacement rate required for engine refurbishment across expansive commercial and passenger vehicle fleets worldwide.

The Automobile Cylinder Sleeve Market is highly competitive, necessitating constant innovation in metallurgy and manufacturing processes to meet the dual challenge of enhancing engine performance while minimizing environmental impact. Manufacturers must continuously invest in advanced coating technologies and automated quality control systems, particularly those utilizing AI and ML, to maintain precision standards and cost efficiency. The geographic concentration of vehicle production in APAC dictates that market success hinges on strategic manufacturing presence and efficient supply chain management in this region. Moreover, market participants are increasingly looking towards the hybrid vehicle sector as a transitional revenue source, compensating for the gradual decline in pure ICE vehicle production in developed economies, thereby securing future stability in a rapidly evolving automotive landscape.

Future growth will largely depend on the ability of sleeve manufacturers to integrate seamlessly with lightweight engine block designs, offering custom solutions that prevent bore distortion under extreme operating conditions. This requires deep collaboration with OEM engine designers early in the product lifecycle. The aftermarket dynamic, specifically the management of inventory for diverse legacy engine models, also presents a complex operational challenge that leading players must master through robust logistics and digital inventory tracking. Finally, sustainability goals are pressuring the industry to adopt cleaner casting methods and utilize recycled material content where feasible, adding another layer of regulatory and operational complexity to the value chain.

In summary, while the market faces headwinds from electrification, its foundation remains solid due to the irreplaceable function of the cylinder sleeve in billions of operational engines globally. Strategic focus on specialized, high-margin products (e.g., performance coatings, heavy-duty sleeves) and leveraging the expansive global aftermarket will be critical determinants of success. Regional market strategies must be diversified: focusing on volume and competitive pricing in APAC, and prioritizing high-technology, quality compliance in Europe and North America to capture value effectively across all key segments and geographies.

The continued strong demand in the Heavy Commercial Vehicle (HCV) sector, particularly for long-haul logistics and construction, provides a strong base for the wet liner and high-durability cast iron segments. These applications require maximum engine resilience and uptime, driving premium pricing for sleeves engineered to withstand prolonged, high-load usage cycles. The reliance on advanced diesel technology in this sector ensures sustained OEM and aftermarket procurement for the foreseeable future, despite pressures from alternative fuels and electrification in the passenger car segment.

Furthermore, global regulatory bodies are increasingly mandating extended warranty periods for engine components, placing greater pressure on manufacturers to guarantee component longevity. This environment favors market leaders capable of providing robust quality assurance and traceability throughout the manufacturing process. Smaller market players must specialize or consolidate to compete effectively, often focusing on niche engine rebuilding markets or specific legacy engine platforms that require unique or hard-to-source sleeves, thereby mitigating direct competition with large-scale, vertically integrated suppliers.

Investment in R&D is shifting towards thermal and fatigue modeling. Manufacturers are exploring advanced ceramic composites and plasma coatings not just for friction reduction, but also for thermal insulation capabilities, aiming to keep combustion heat within the cylinder to improve thermodynamic efficiency. This focus on material science represents the cutting edge of cylinder sleeve development, essential for maximizing the lifespan and performance output of the final generation of high-efficiency internal combustion engines before full market saturation by electric powertrains is achieved globally.

The economic resilience of the aftermarket sector is primarily tied to global macroeconomic factors, particularly the availability of disposable income for vehicle maintenance and repair. In periods of economic uncertainty, consumers and fleet operators often opt for engine refurbishment (which requires new sleeves) rather than purchasing entirely new vehicles or engines, stabilizing demand for the aftermarket segment. This counter-cyclical nature provides a valuable buffer for cylinder sleeve manufacturers against downturns in new vehicle sales, underscoring the strategic importance of developing and maintaining comprehensive aftermarket product catalogs.

In essence, the future market landscape will be characterized by technological bifurcation: high-volume, cost-optimized production for standard aftermarket needs, juxtaposed with specialized, technology-intensive manufacturing for high-performance OEMs and demanding hybrid engine platforms. Mastering this dual strategy—maintaining cost efficiency in high-volume production while simultaneously innovating in metallurgy and surface engineering—will define leadership in the Automobile Cylinder Sleeve Market through 2033.

The role of distribution channels in emerging economies cannot be overstated. Establishing efficient, temperature-controlled logistics networks is crucial, especially for delicate components and specialized coated sleeves. Counterfeiting remains a significant challenge in several regions, necessitating strong brand protection strategies, verifiable product authenticity markings, and close cooperation with regulatory authorities to ensure market confidence in certified replacement parts. Manufacturers who invest in supply chain transparency and anti-counterfeiting measures gain a distinct competitive advantage in sensitive aftermarket regions.

Finally, the long-term viability of suppliers hinges on their adaptability to the evolving powertrain mix, particularly their ability to transition capital and expertise to support next-generation mobility solutions or specialize deeply in the enduring heavy-duty sector. While the cylinder sleeve remains a mature product, the technological requirements imposed by modern engine standards necessitate its continuous evolution, maintaining its status as a critical, high-precision component in the automotive ecosystem.

The market also faces pressure from engine block manufacturers who are increasingly adopting bore coating technologies directly onto aluminum engine blocks, potentially bypassing the need for traditional sleeves in certain passenger car applications. This technique, utilizing technologies like iron plating or proprietary spray coatings, forces traditional sleeve manufacturers to focus their R&D efforts on areas where integrated coatings are impractical or insufficient, such as extreme thermal load conditions found in diesel or performance racing engines, or where the engine block material itself lacks the necessary wear characteristics, reinforcing the differentiation between sleeves and coatings.

To successfully navigate these technological disruptions, collaboration between cylinder sleeve manufacturers and advanced metallurgical research institutions has intensified. This collaboration aims to unlock new material compositions, such as advanced powder metallurgy techniques or novel composite structures, which could significantly improve the mechanical properties and thermal efficiency of sleeves without increasing weight or manufacturing complexity excessively. Such proactive research is essential to future-proof the product against competing bore technologies and environmental compliance demands.

From a manufacturing process standpoint, achieving zero-defect production is paramount. The precision required for modern sleeves—especially regarding internal diameter tolerances, circularity, and surface finish—demands the widespread implementation of automated gauging systems and high-resolution imaging inspection. Industry leaders are leveraging robotics and automated material handling to reduce human error and ensure repeatable quality, thereby reinforcing their reliability as trusted suppliers for both stringent OEM and quality-conscious aftermarket buyers globally.

The regulatory framework governing engine durability and emissions acts as a continuous quality filter, ensuring that only suppliers capable of meeting or exceeding strict international standards can participate in the formal market. For instance, the durability requirements imposed by heavy-duty emissions standards often dictate the minimum lifespan of cylinder sleeves, driving continuous demand for high-strength, premium liners capable of sustained operation under intense pressure and high temperatures. This external regulatory pressure indirectly favors large, technically advanced manufacturers who possess the necessary testing and certification capabilities.

In the context of geographical expansion, manufacturers are strategically evaluating countries with high anticipated growth in vehicle registration and limited local cylinder sleeve production capacity. Establishing strategic warehousing and regional logistics centers in these areas, particularly parts of Southeast Asia and Africa, enables faster fulfillment of aftermarket demand, reducing dependency on lengthy international shipping routes and providing a crucial competitive edge in time-sensitive repair markets.

Finally, the financial health of the market is closely linked to commodity markets, particularly the cost of iron, steel, and energy required for casting processes. Effective risk management strategies, including hedging and long-term procurement agreements, are vital for maintaining stable pricing structures and protecting margins against unforeseen spikes in input costs. The ability to utilize alternative, less volatile materials without compromising performance is a critical factor distinguishing sustainable market players.

The evolution towards downsized, turbocharged gasoline engines, common in modern passenger cars, presents a unique challenge for cylinder sleeve design. These engines operate at higher specific outputs and thermal loads, necessitating sleeves with enhanced resistance to thermal fatigue and bore polishing. Manufacturers must provide solutions that effectively manage the increased heat while ensuring that the thin-walled structure of the sleeve does not compromise structural integrity during engine operation, pushing the boundaries of material science and casting technology.

The aftermarket sector's complexity is further magnified by the sheer diversity of engine models requiring sleeves. A typical engine rebuilder needs access to a wide range of specifications, often for engines dating back decades. This requires cylinder sleeve manufacturers to balance the economic feasibility of producing high-volume standard parts with the necessity of maintaining inventory for low-volume, specialized or obsolete engine models. Catalog management and digital parts identification systems become essential tools for efficient service delivery in this fragmented environment.

Market consolidation among smaller and medium-sized regional players is anticipated as competition intensifies and regulatory burdens increase. Larger, multinational corporations often acquire specialized firms to gain access to proprietary metallurgical processes or to expand their geographical footprint and product portfolio immediately. This trend highlights the importance of innovation and specialization as key defensive and growth strategies for all market participants, regardless of size.

The utilization of data analytics and simulation tools is becoming standard practice in predicting sleeve performance under various real-world driving conditions, far beyond traditional laboratory testing. By integrating feedback from operational fleets (IoT data) into design cycles, manufacturers can refine sleeve characteristics—such as wall thickness variations or specific material compositions—to optimize performance for regional climate or fuel quality differences, thereby offering highly customized and regionally tailored products that maximize engine lifespan and customer satisfaction.

In conclusion, the Automobile Cylinder Sleeve Market, while facing profound structural shifts due to electrification, maintains its relevance through technological innovation and its entrenched position within the indispensable global aftermarket. Strategic maneuvering in material science, precision manufacturing, and supply chain efficiency will be the defining factors that allow key players to thrive in this evolving but essential component sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager