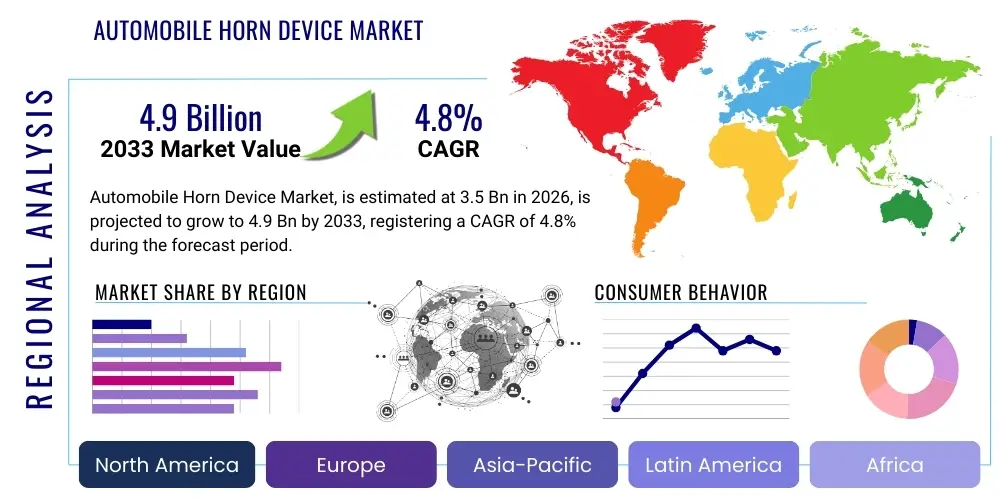

Automobile Horn Device Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442655 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Automobile Horn Device Market Size

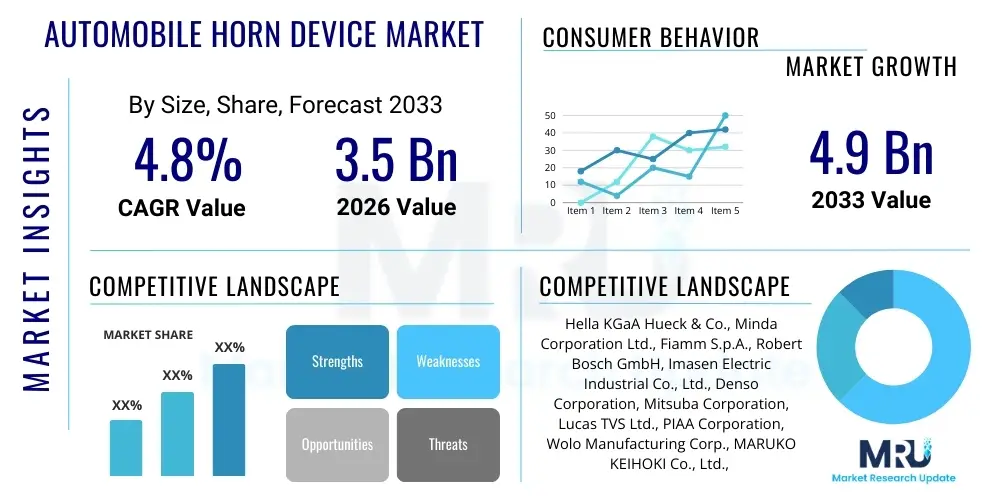

The Automobile Horn Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by stringent global vehicular safety regulations mandating the installation of functional signaling devices, coupled with the rising production and sale of passenger and commercial vehicles across emerging economies. Technological advancements focusing on enhanced durability, optimized acoustic performance, and reduced power consumption are further solidifying market momentum and driving revenue growth across original equipment manufacturers (OEMs) and the automotive aftermarket segments.

Automobile Horn Device Market introduction

The Automobile Horn Device Market encompasses the manufacturing, distribution, and sale of electronic and pneumatic warning systems designed for installation in motor vehicles, vital for signaling intent and alerting pedestrians or other drivers to potential hazards. These devices are essential components of passive and active vehicle safety infrastructure, ensuring clear auditory communication in dense traffic environments or during emergency situations. The primary function remains consistent: generating an audible signal meeting established regulatory sound pressure levels (SPL) to ensure adequate visibility through sound. Market growth is structurally linked to overall automotive industry performance, fleet modernization cycles, and global road safety initiatives implemented by governmental bodies worldwide.

Product descriptions within this market range from conventional electromagnetic (snail or disc) horns, which dominate the passenger vehicle segment due to cost-effectiveness and compact size, to specialized air horns and electronic multi-tone systems used extensively in heavy commercial vehicles, buses, and specialized utility vehicles where higher decibel outputs and specific signaling patterns are required. These devices utilize electrical power to vibrate a diaphragm or compress air, translating mechanical energy into acoustic warnings. The increasing complexity of urban traffic and rising safety awareness have pushed manufacturers toward developing more reliable, weatherproof, and energy-efficient horn assemblies that seamlessly integrate with modern vehicle architecture and electrical systems, often designed to meet specific regional acoustic standards like those set by the UNECE or national transportation authorities.

Major applications span all vehicle categories, including passenger cars (sedans, SUVs, hatchbacks), light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and two-wheelers, with mandatory installation driving core demand. Key benefits derived from these devices include significantly improved road safety through effective hazard signaling, compliance with mandatory vehicle equipment regulations, and providing drivers with a crucial non-verbal communication tool. The principal driving factors propelling market expansion include rapidly increasing vehicle production globally, particularly in Asia Pacific economies like China and India; the enforcement of strict vehicle safety standards, especially concerning pedestrian protection; and a growing preference among consumers and OEMs for technologically advanced, durable, and aesthetically integrated acoustic warning systems that offer consistent performance under varied environmental conditions, such as extreme temperature or high humidity.

Automobile Horn Device Market Executive Summary

The global Automobile Horn Device Market is experiencing robust growth characterized by several interconnected business trends. A significant trend involves the strategic shift towards high-performance electronic horns that offer customization and enhanced reliability over traditional mechanical counterparts, driven by OEM demand for integration with sophisticated vehicle electrical architectures. Furthermore, consolidation among leading component suppliers to achieve economies of scale and optimize global supply chains is a key business dynamic. The aftermarket segment, fueled by replacement cycles and performance upgrades, represents a substantial revenue stream, pushing manufacturers to offer diversified product portfolios tailored for older vehicle models and unique consumer preferences, while simultaneously navigating challenges related to counterfeit products and unauthorized imports that affect overall market quality perception and pricing strategies.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by unparalleled growth in automotive manufacturing, high population density leading to increased traffic complexity, and improving regulatory enforcement regarding vehicle safety standards across emerging nations. North America and Europe, while mature markets, emphasize high-quality, durable horns that comply with stringent noise pollution regulations (limiting maximum decibel output in certain zones), pushing innovation toward frequency-optimized and less abrasive sounds. Latin America and the Middle East & Africa (MEA) are emerging as high-growth potential regions, spurred by urbanization, infrastructure development, and increasing foreign direct investment in localized automotive assembly plants, which mandates the supply of compliant automotive components, including acoustic devices, thereby stimulating regional production and distribution network optimization.

Segmentation trends indicate a strong market preference for electromagnetic horns, primarily due to their low cost, established manufacturing processes, and wide adoption in entry-level and mid-range vehicles. However, the pneumatic horn segment, though smaller in volume, maintains high value in the HCV and specialized vehicle sectors where raw power and distinctive tone are essential for long-haul trucking and emergency response. In terms of sales channels, the OEM segment accounts for the largest share, benefiting from high-volume contracts and mandatory installation requirements for new vehicles. The aftermarket segment is vital for sustaining long-term revenue, offering opportunities for specialized product differentiation, particularly in regions with long average vehicle lifespan and high rates of self-maintenance or repair outside authorized service networks, necessitating robust inventory management and accessible distribution channels globally.

AI Impact Analysis on Automobile Horn Device Market

Common user questions regarding AI's impact on the Automobile Horn Device Market frequently revolve around whether autonomous vehicles will render traditional horns obsolete, how AI will manage auditory warnings in complex urban scenarios, and the role of machine learning in optimizing signaling effectiveness and mitigating noise pollution. Users often inquire about the potential for predictive signaling—where AI anticipates necessary warnings before the driver manually intervenes—and the development of context-aware horn systems. These concerns highlight a public and industry interest in understanding the shift from manual, reactive signaling to automated, proactive auditory communication managed by vehicle intelligence systems. The consensus theme is a transformation towards highly integrated, software-defined acoustic warnings, rather than total obsolescence of the horn device itself, ensuring safety remains paramount while acoustic alerts become more intelligent and less intrusive.

The integration of Artificial Intelligence, primarily through Advanced Driver Assistance Systems (ADAS) and eventual full autonomy, fundamentally alters the functional requirements of the horn device. In autonomous vehicles (AVs), AI algorithms determine the necessity, urgency, and optimal acoustic profile for a warning signal based on real-time sensor fusion data, including pedestrian trajectories, proximity to other vehicles, and environmental factors (e.g., speed, road geometry, background noise). This shift moves the horn from a purely manual input device to an automated peripheral output, demanding greater connectivity, faster response times, and highly reliable performance even under infrequent use. AI also influences the design by potentially standardizing audible signals globally or adapting them based on localized cultural norms or regulatory requirements, managed dynamically by the vehicle's central computing unit. This requires horn devices to be digitally addressable and capable of generating varied acoustic outputs.

Furthermore, AI algorithms are critical in addressing the societal challenge of noise pollution in urban centers. By analyzing traffic flow, time of day, and environmental data, AI can optimize the acoustic pressure level (decibels) and frequency of the horn blast, ensuring the warning is effective for the immediate recipient without unnecessarily contributing to excessive environmental noise. For example, an AV might only utilize a minimal acoustic warning when communicating with an immediately adjacent vehicle or pedestrian, reserving high-power blasts only for imminent, high-speed collision risks where maximum attention is required. This precision signaling requires the horn device to possess advanced electronic controls and variable output capabilities, thereby integrating it tightly into the vehicular sensor and decision-making framework, transforming it into an intelligent safety actuator rather than a simple on/off switch. This trend emphasizes reliability and software-driven optimization in future product development cycles.

- AI drives the transition from reactive, manual signaling to proactive, automated acoustic warnings based on real-time sensor data.

- Machine learning algorithms optimize horn decibel output and frequency to maximize effectiveness while minimizing noise pollution in dense urban areas.

- Autonomous Vehicles (AVs) require digitally controlled, context-aware horn systems capable of generating varied, standardized acoustic signals based on external conditions.

- Predictive signaling capabilities, managed by AI, aim to warn drivers, pedestrians, or cyclists moments before manual intervention would traditionally occur.

- AI impacts the manufacturing process through quality control (acoustic testing consistency) and optimizing supply chain logistics based on regional safety mandates.

DRO & Impact Forces Of Automobile Horn Device Market

The Automobile Horn Device Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the mandatory integration of horns in all motor vehicles globally, driven by fundamental safety regulations (e.g., UNECE R28 and national equivalents). The rapid expansion of vehicle fleets in developing economies and the sustained demand for replacement horns in the aftermarket also significantly propel market volume. Moreover, increasing consumer awareness regarding road safety and the adoption of technologically advanced vehicles with high-quality components further stimulates demand for durable and consistent acoustic warning systems. These drivers create a stable, high-volume baseline for the market, making it resilient to minor economic fluctuations and ensuring continuous procurement from major OEM stakeholders worldwide.

However, the market faces several notable restraints. The primary restraint is the stringent regulation of noise pollution in developed urban centers, leading to restrictions on horn loudness and usage patterns, which can limit the adoption of high-power pneumatic or specialty horns in passenger vehicles. Furthermore, the market is subject to intense price competition, particularly in the aftermarket segment, leading to margin pressures and the proliferation of low-quality, non-compliant products, posing a safety risk and eroding brand value for established manufacturers. Another technical restraint is the shift towards electric and hybrid vehicles, where traditional engine noise is absent, requiring specialized horn designs (like Acoustic Vehicle Alerting Systems or AVAS, though distinct from the driver-activated horn, they compete for electrical power and component space) that must be optimized for low power draw without compromising acoustic performance in quiet operation modes.

Opportunities for growth are primarily centered on technological innovation and market expansion. The development of intelligent, digitally controlled horn systems integrated with ADAS offers a significant opportunity for premiumization and higher ASPs. Manufacturers can capitalize on the trend towards customized and personalized acoustic warning signals, especially in performance vehicles or for regional specificity. Geographically, untapped potential lies in improving penetration in emerging markets with underdeveloped regulatory frameworks but rapidly growing vehicle populations, offering manufacturers the chance to establish long-term supply relationships with nascent local OEMs. The market also benefits from opportunities in specialized vehicles, such as electric public transport or construction equipment, requiring robust, often multi-frequency, warning systems for enhanced safety compliance in complex operational environments, driving innovation in ruggedized and durable product designs.

Segmentation Analysis

The Automobile Horn Device Market is extensively segmented based on Product Type, Sales Channel, Vehicle Type, and Technology, reflecting the diversity of automotive applications and regulatory requirements. Analyzing these segments provides crucial insights into market dynamics and consumer preferences across different geographical and operational domains. The segmentation by Product Type includes disc horns, trumpet/snail horns, and air horns, each catering to specific acoustic requirements and installation constraints. Trumpet horns, for instance, are widely used across passenger vehicles for a high-frequency, penetrating sound, while air horns are essential for large commercial vehicles where volume is critical for distant signaling and compliance with heavy vehicle safety mandates.

Segmentation by Sales Channel distinguishes between Original Equipment Manufacturers (OEMs) and the Aftermarket (AM). The OEM channel represents primary demand, driven by large volume production contracts and rigorous quality assurance processes, accounting for the majority revenue share. Conversely, the Aftermarket is characterized by replacement sales, upgrades, and customization, offering higher profit margins but requiring extensive distribution networks and brand recognition among repair shops and individual consumers. The aftermarket is highly sensitive to product lifespan, warranty periods, and the ease of installation, leading to product diversification strategies focused on universal compatibility and robust packaging solutions tailored for retail display and distribution through traditional and e-commerce channels.

Further segmentation includes Vehicle Type, categorizing demand across Passenger Vehicles (PVs), Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). PVs constitute the largest volume segment, focusing on cost-effective, standard electromagnetic horns. HCVs demand high-output, durable horns (often pneumatic) designed for continuous operation in harsh environments, justifying a higher price point. Technology segmentation, although often overlapping with product type, focuses on the energy source and sound generation mechanism, including electromagnetic, pneumatic, and increasingly, electronic multi-tone systems that allow for software-controlled acoustic profiles and integration with vehicle diagnostics. The convergence of these segmentations reveals that future growth is concentrated in the electronic and connected horn categories, driven by increasing vehicle digitization and the need for adaptable safety features.

- By Product Type:

- Disc Horns (Flat/Round)

- Trumpet/Snail Horns (Coiled/Spiral)

- Air Horns (Pneumatic)

- Electronic/Multi-tone Horns

- By Vehicle Type:

- Passenger Vehicles (PVs)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

- By Technology:

- Electromagnetic Horns

- Pneumatic Horns

- Electro-Pneumatic Systems

- Digital Signal Processing (DSP) Based Horns

Value Chain Analysis For Automobile Horn Device Market

The Value Chain for the Automobile Horn Device Market begins with the upstream procurement of raw materials, which primarily includes high-grade metals (like steel and brass) for diaphragms and casings, specialized plastics (such as ABS or polycarbonate) for housing and mounting brackets, copper wiring for electromagnets, and electronic components (e.g., relays and integrated circuits) for electronic variants. Upstream suppliers are typically specialized commodity producers, and the stability of global metal prices significantly influences manufacturing costs and subsequently, the final pricing offered to OEMs. Manufacturers focus heavily on optimizing material sourcing for longevity, acoustic efficiency, and resistance to environmental factors like moisture and dust, ensuring that component failure rates are minimized to meet stringent OEM quality standards and reduce warranty claims in the downstream market.

The midstream involves the manufacturing and assembly process, which requires specialized tooling for stamping, winding, and acoustic calibration. Leading manufacturers leverage automation and proprietary acoustic engineering techniques to achieve precise sound pressure levels (SPL) and stable frequency outputs across high volumes, complying with diverse international standards (e.g., SAE, ISO, and regional traffic authority mandates). Direct distribution largely involves the supply to Original Equipment Manufacturers (OEMs), who incorporate the horns during vehicle assembly. These relationships are critical, often involving long-term contracts and adherence to Just-In-Time (JIT) inventory management, demanding extreme reliability and consistent quality control from horn suppliers, sometimes including co-development of specific horn designs tailored to vehicle aesthetic and electrical specifications.

The downstream sector is defined by two primary channels: the OEM channel and the Aftermarket channel. Indirect distribution channels primarily serve the aftermarket, utilizing a multi-layered structure involving national distributors, regional wholesalers, and specialized automotive parts retailers or e-commerce platforms. This indirect network is crucial for reaching independent repair shops and end-consumers requiring replacement or upgrade components. Direct engagement through branded service centers also occurs, but the bulk of aftermarket sales rely on robust logistical infrastructure to ensure widespread availability and competitive pricing. The efficiency of this downstream distribution is vital for capturing replacement demand, particularly in regions where the average vehicle age is high, necessitating readily available and affordable replacement components across the geographic landscape.

Automobile Horn Device Market Potential Customers

The primary customer base for the Automobile Horn Device Market can be broadly categorized into Original Equipment Manufacturers (OEMs) and the expansive Aftermarket ecosystem. OEMs, including global automotive giants producing passenger cars, trucks, and motorcycles (such as Toyota, Volkswagen, Ford, Daimler, and major Chinese manufacturers), represent the largest volume purchasers. These customers require massive volumes of standardized, high-quality horns integrated directly into new vehicle designs. Their procurement decisions are driven by factors such as regulatory compliance, component durability, long-term reliability guarantees, competitive unit pricing, and the supplier's ability to maintain a globalized supply chain and ensure localized delivery to various assembly plants across different continents, demanding sophisticated logistical planning and supplier certification processes.

The Aftermarket segment constitutes the second major customer base, encompassing independent workshops, authorized service centers, retail auto parts stores, and individual vehicle owners seeking replacements or performance upgrades. Within this segment, demand is highly fragmented and sensitive to pricing and availability. Customers in the aftermarket often prioritize ease of installation (plug-and-play compatibility), robust warranty coverage, and, for specialized segments, enhanced acoustic performance (e.g., train horns, high-performance disc horns). This segment also includes specialized vehicle modification enthusiasts and fleet operators managing older vehicles, who often seek cost-effective yet reliable alternative components when official OEM parts are prohibitively expensive or difficult to source, driving demand for both standard replacement units and customized acoustic systems.

Beyond traditional manufacturers and aftermarket consumers, governmental and institutional entities represent another set of potential customers. This includes public transportation authorities purchasing buses or trains, military and defense organizations acquiring specialized tactical vehicles, and municipal services procuring emergency response vehicles (ambulances, fire trucks). These customers often have unique, highly demanding specifications regarding resilience, acoustic standards, and power consumption, sometimes requiring customized multi-tone or specialized air horns for maximum safety and operational effectiveness in extreme conditions or highly regulated environments. The purchasing decisions of these institutional customers are governed by strict public tender processes, safety certification requirements, and long-term service contracts that prioritize operational reliability and standardized deployment across large vehicle fleets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hella KGaA Hueck & Co., Minda Corporation Ltd., Fiamm S.p.A., Robert Bosch GmbH, Imasen Electric Industrial Co., Ltd., Denso Corporation, Mitsuba Corporation, Lucas TVS Ltd., PIAA Corporation, Wolo Manufacturing Corp., MARUKO KEIHOKI Co., Ltd., SORL Auto Parts, Inc., Stebel S.p.A., Kleinn Air Horns, Uno Minda, BKL Auto Parts Co., Ltd., ACDelco (General Motors), RoadMate Horns, Horn Blast Systems, Car Mate Mfg. Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automobile Horn Device Market Key Technology Landscape

The technology landscape of the Automobile Horn Device Market is primarily dominated by mature electromagnetic technology, supplemented by specialized pneumatic systems, with increasing investment in advanced electronic solutions. Electromagnetic horns (disc and trumpet variants) utilize a simple mechanism where an electromagnet pulls an armature that vibrates a metal diaphragm, producing sound. Key technological advancements here focus on optimizing the coil design, diaphragm material, and resonator housing to enhance acoustic efficiency, durability, and resistance to environmental corrosion. Modern electromagnetic horns are also designed to be lighter and more compact, facilitating easier integration into the limited space available in contemporary vehicle front ends, while maintaining compliance with stringent global sound pressure level (SPL) mandates, ensuring acoustic quality and regulatory adherence across diverse climates.

Pneumatic (Air) horns, traditionally reserved for heavy vehicles, operate by compressing air (often via a dedicated compressor or tapping into the vehicle’s existing air brake system) and forcing it through a trumpet or bell, creating a powerful, low-frequency sound highly effective over long distances. Technological evolution in this segment focuses on developing compact, integrated air compressors and improving the reliability of the mechanical valve systems to prevent moisture damage and ensure instantaneous activation. A key trend involves electro-pneumatic hybrids, which use electrical solenoids to control air flow precisely, allowing for varied tones or sequential blasts essential for emergency signaling, thereby marrying the power of pneumatic systems with the control precision of electronic circuitry for specialized high-demand applications.

The most forward-looking technology involves entirely electronic horn systems, often employing digital signal processing (DSP) chips and high-power speakers to synthesize diverse acoustic profiles. These systems offer unparalleled flexibility, allowing vehicles to generate different sounds for varied situations (e.g., softer alerts for cyclists, louder warnings for high-speed scenarios) or to comply with multiple regional standards via software updates. This technology is critical for integration into electric vehicles (EVs) and autonomous vehicles (AVs), where the horn must function as a digitally controlled peripheral, managed by the central ADAS system. The development focus here is on achieving high fidelity and adequate SPL using low power consumption, along with ensuring the cybersecurity of the system, given its deep integration into the vehicle’s networked safety infrastructure, requiring rigorous testing and certification for functional safety compliance.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, driven by massive vehicle production in countries like China, India, and Japan. High population density and resulting traffic congestion necessitate functional acoustic warning systems, ensuring mandatory fitment policies are rigorously enforced. The region's growth is characterized by high volume demand for cost-effective electromagnetic horns in the PV segment and increasing procurement of specialized horns for rapidly modernizing commercial transport fleets. South Korea and Japan also serve as hubs for advanced acoustic engineering and export-oriented manufacturing, emphasizing quality and technological integration.

- North America: North America represents a mature, high-value market defined by strict safety standards (e.g., FMVSS) and a strong consumer preference for durable, reliable components. The region is a key early adopter of advanced electronic and integrated acoustic systems, particularly due to the accelerating penetration of ADAS and electric vehicles. The large truck and commercial vehicle market sustains strong demand for powerful air horns, while passenger vehicle manufacturers focus on regulatory compliance, ensuring the horn system performs consistently under diverse environmental conditions, including extreme cold and heat.

- Europe: The European market is characterized by stringent noise pollution regulations (limiting maximum acoustic output) and a strong focus on high-quality componentry, often supplied by Tier 1 German, Italian, and French manufacturers. Regulatory compliance with UNECE standards drives product development, emphasizing acoustic quality and directional sound projection to minimize disturbance while maximizing effectiveness. The shift towards electric and hybrid vehicles is significantly influencing product design, necessitating low-power, electronically integrated horn systems that blend seamlessly with the vehicle's electrical architecture and noise mitigation strategies.

- Latin America: Latin America presents a significant growth opportunity, supported by ongoing urbanization, economic development, and increasing local vehicle assembly activities (e.g., Brazil, Mexico). The market relies heavily on imports and localized manufacturing for aftermarket replenishment and OEM supply. Challenges include navigating economic volatility and ensuring product compliance across varying national standards, but the underlying demand for basic, reliable electromagnetic horns remains robust due to increasing vehicle ownership rates and improving road infrastructure, driving predictable growth in volume-based segments.

- Middle East & Africa (MEA): This region is characterized by fragmented demand, with the GCC countries (UAE, Saudi Arabia) showing a preference for high-end, technologically sophisticated components imported for premium vehicle segments, while Africa primarily drives demand for durable, cost-effective replacement horns in the aftermarket. Infrastructure projects and growing commercial vehicle fleets in countries like South Africa and Nigeria are boosting demand for robust air and trumpet horns capable of withstanding harsh driving conditions, intense heat, and dusty environments, favoring manufacturers who can demonstrate superior product resilience.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automobile Horn Device Market.- Hella KGaA Hueck & Co.

- Minda Corporation Ltd.

- Fiamm S.p.A.

- Robert Bosch GmbH

- Imasen Electric Industrial Co., Ltd.

- Denso Corporation

- Mitsuba Corporation

- Lucas TVS Ltd.

- PIAA Corporation

- Wolo Manufacturing Corp.

- MARUKO KEIHOKI Co., Ltd.

- SORL Auto Parts, Inc.

- Stebel S.p.A.

- Kleinn Air Horns

- Uno Minda

- BKL Auto Parts Co., Ltd.

- ACDelco (General Motors)

- RoadMate Horns

- Horn Blast Systems

- Car Mate Mfg. Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automobile Horn Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Automobile Horn Device Market?

The primary driver is the global enforcement of mandatory vehicular safety regulations by governmental and regional bodies (such as UNECE), which mandate the installation of functional acoustic warning systems on all new motor vehicles, ensuring continuous demand from the OEM sector and regulatory compliance across all automotive manufacturing jurisdictions worldwide.

How is the transition to electric vehicles (EVs) impacting horn technology?

The transition to EVs requires horn devices to be highly energy efficient, digitally integrated, and sometimes involves the co-development of standard horns with Acoustic Vehicle Alerting Systems (AVAS) to compensate for the absence of engine noise at low speeds. This shift accelerates the adoption of advanced electronic horn systems with optimized power consumption and high reliability for silent vehicle operation.

Which segment holds the largest market share by sales channel?

The Original Equipment Manufacturer (OEM) segment holds the largest market share by sales channel, driven by high-volume contracts for the installation of horns in newly manufactured passenger cars, commercial vehicles, and two-wheelers across global assembly lines, guaranteeing high, stable volumes for key component suppliers in this sector.

What technological trends are emerging in the horn device manufacturing space?

Key technological trends include the integration of horn systems with Advanced Driver Assistance Systems (ADAS) for proactive, automated signaling, the development of electronic horns with dynamic, software-controlled acoustic profiles, and increased focus on lightweight, durable materials to enhance weather resistance and product lifespan while reducing overall vehicle mass and material costs.

What are the main regional challenges faced by horn manufacturers?

Manufacturers face significant regional challenges related to regulatory divergence, specifically varying mandates on maximum permitted sound pressure levels (noise pollution constraints, especially in Europe), differences in quality standards across APAC markets, and the need to manage supply chain logistics effectively to meet highly localized demand and distribution requirements globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager