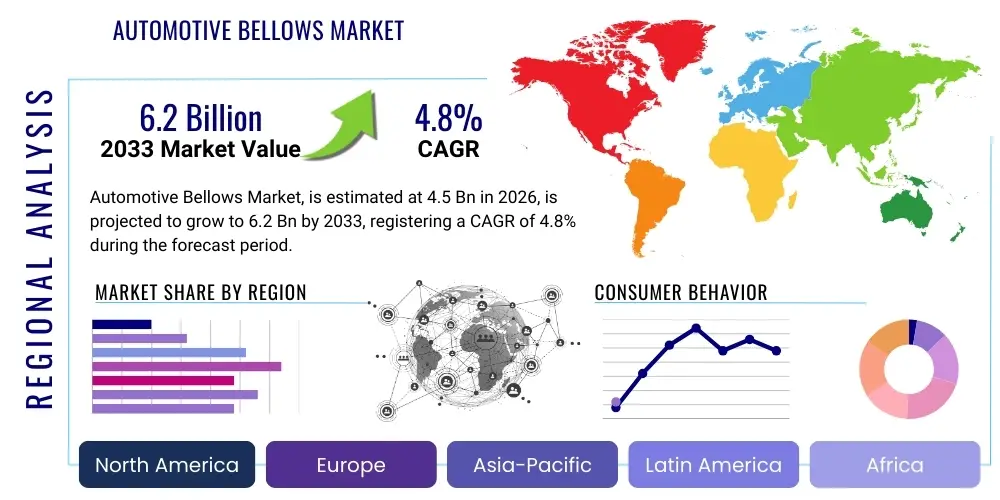

Automotive Bellows Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442159 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Bellows Market Size

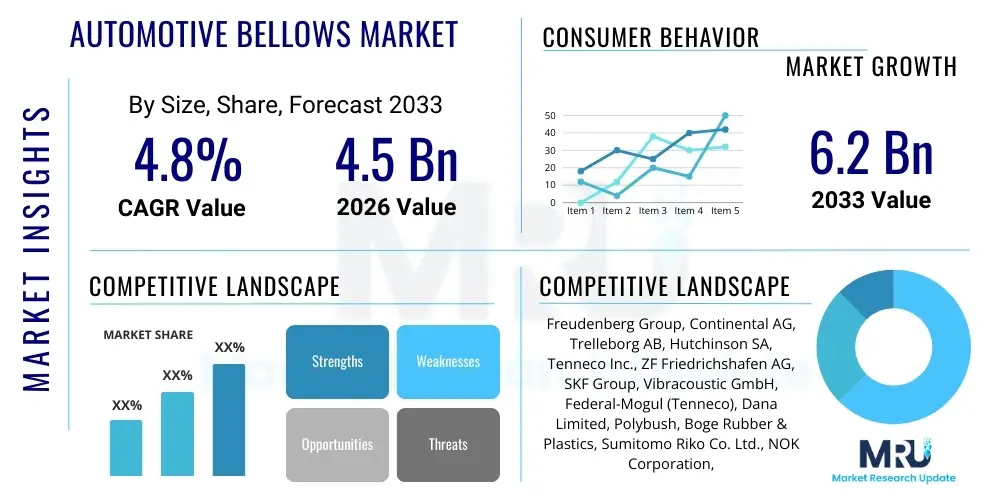

The Automotive Bellows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.2 billion by the end of the forecast period in 2033.

Automotive Bellows Market introduction

The Automotive Bellows Market encompasses the global supply chain responsible for manufacturing, distributing, and selling specialized flexible, expandable seals and protective components critical for numerous vehicle subsystems. These components, characterized by their convoluted or roll-up geometry, are fundamentally engineered to isolate vibrations, compensate for thermal expansion and contraction, and, most importantly, provide hermetic sealing to protect sensitive mechanical assemblies from detrimental external contaminants such as dirt, water, road salt, and abrasive particles. The performance requirements for automotive bellows are extremely rigorous, demanding high resistance to mechanical fatigue, ozone exposure, chemical compatibility with lubricants, and stability across a wide temperature spectrum, driving constant innovation in material science, particularly in specialized rubbers like EPDM, Silicone, and high-performance thermoplastic elastomers (TPEs).

Functionally, automotive bellows are indispensable across all major vehicular systems. In the chassis and suspension, they operate as dust boots for shock absorbers and protective covers for complex air spring systems, managing significant vertical and lateral movement while maintaining system cleanliness. Within the drivetrain, constant velocity (CV) joint boots are arguably the highest volume application, essential for retaining lubricating grease and preventing water ingress that would rapidly degrade the joint. Furthermore, in engine and exhaust systems, metallic bellows or high-heat resistant polymer variants are deployed as flexible coupling joints, absorbing vibrational energy and accommodating thermal expansion, thereby mitigating stress on rigid piping and turbocharger connections. The reliability of these components directly translates to vehicle safety, operational efficiency, and minimized total cost of ownership for the end-user.

The market expansion is fundamentally driven by sustained global automotive production volumes, particularly the burgeoning middle class demand in emerging markets like the Asia Pacific region, which necessitates millions of protective bellows annually for new vehicles. Simultaneously, the accelerating technological complexity in vehicle design, including advanced steering geometries and the proliferation of sophisticated air suspension in premium vehicles, mandates bellows with increasingly precise specifications and higher material resilience. A significant driving factor is the regulatory push for enhanced vehicle durability and extended component lifespan, compelling OEMs to source higher quality, certified sealing solutions. The rapid shift towards electric vehicles (EVs) introduces new high-value applications, such as thermal management bellows for battery cooling circuits and specialized protective components for critical high-voltage cabling harnesses, ensuring the market remains dynamic and technologically focused.

Automotive Bellows Market Executive Summary

The Automotive Bellows Market exhibits robust and strategic growth, positioned resiliently against minor fluctuations in the overall automotive sector due to the non-negotiable requirement for protective sealing in mission-critical applications across both Internal Combustion Engine (ICE) and Electric Vehicle (EV) platforms. Current business trends are heavily tilted toward material substitution, where high-performance Thermoplastic Elastomers (TPEs) are steadily gaining market share over traditional elastomers. This shift is motivated by the corporate push for sustainability, easier recycling, lower weight (crucial for EV range extension), and optimization of manufacturing processes like injection molding. Key market participants are concentrating their strategic efforts on vertical integration and securing long-term supply agreements with major global OEMs, focusing R&D on bespoke solutions for next-generation suspension and EV battery management systems.

Geographically, the market landscape is segmented by maturity and primary demand source. The Asia Pacific (APAC) region continues to dominate in terms of volume output and consumption, driven by high manufacturing output and immense aftermarket demand fueled by large, aging vehicle populations in countries like China and India. Conversely, North America and Europe, while growing at a slightly slower pace, represent the technological vanguard, prioritizing advanced material solutions, stringent performance guarantees, and specialized products for premium and heavy-duty sectors. Regulatory environments, such as the upcoming Euro 7 emission standards, indirectly influence bellow design by demanding better heat management components in complex engine bays, pushing suppliers in Europe towards high-temperature resistant materials like Silicone and fluoroelastomers.

Analysis of segment trends highlights the pivotal role of the Aftermarket channel. This segment provides significant revenue stability, acting as a buffer against cyclical downturns in new vehicle sales, as replacement demand for worn-out components remains consistent, driven by the five-to-ten-year age profile of vehicles requiring major system repairs. Application-wise, while CV joint boots remain a cornerstone, the fastest proportional growth is observed in bellows related to EV thermal management and air suspension systems, requiring tight material tolerances and guaranteed long-term sealing capabilities under challenging duty cycles. The overall market narrative is one of incremental technological improvement, driven by a non-negotiable mandate for enhanced durability and material lightness across all vehicle segments.

AI Impact Analysis on Automotive Bellows Market

User queries regarding the influence of Artificial Intelligence (AI) on the Automotive Bellows Market frequently focus on how AI-driven simulation tools can overcome the physical limits of traditional prototyping and testing. Users are highly interested in the potential for AI and Machine Learning (ML) to perform real-time predictive modeling of component degradation, asking if these technologies can accurately forecast the remaining useful life (RUL) of bellows based on operating conditions and material data. There is significant concern about maintaining quality at scale, leading to questions regarding the deployment of AI-powered vision systems for automated, high-speed inspection to ensure zero-defect output, particularly critical for components integrated into safety-related systems like steering and suspension. Furthermore, users explore how AI can optimize manufacturing energy consumption and material waste management.

AI is fundamentally transforming the upstream and manufacturing aspects of the automotive bellows industry. In design and R&D, generative design algorithms, powered by ML, are used to explore thousands of geometry permutations rapidly, optimizing the convolution count, wall thickness variance, and material distribution to minimize stress concentrations and achieve weight reduction without compromising essential stroke or pressure capability. This reduces the development cycle from months to weeks, enabling faster integration of novel materials like highly flexible TPEs. These AI tools process massive datasets related to fatigue test results, chemical resistance data, and dynamic operational forces to suggest the most robust and resource-efficient designs, surpassing the capacity of traditional human engineering analysis.

In the production environment, the adoption of AI-driven quality assurance is becoming standard. High-speed industrial cameras linked to ML models analyze surface integrity, dimensional accuracy, and material consistency during the molding or vulcanization stage. These systems identify subtle defects invisible to human inspectors or traditional gauges, such as micro-cracks or imperfect curing, leading to highly consistent batch quality and significantly reduced scrap rates. Furthermore, predictive maintenance programs, utilizing AI to analyze sensor data from manufacturing machinery (injection molders, hydraulic presses), forecast equipment failure and optimize maintenance schedules, thereby maximizing operational uptime and overall equipment effectiveness (OEE) across production facilities globally, particularly benefiting large-scale suppliers.

- AI-enhanced Generative Design: Optimizing complex bellow geometries for dynamic stress and maximizing service life.

- Predictive Quality Control: Machine vision and ML algorithms analyzing polymer flow and surface flaws in real time during molding processes.

- Material Performance Prediction: AI modeling chemical aging and thermal fatigue in various material compounds (rubber vs. TPE).

- Supply Chain Optimization: Utilizing advanced analytics to forecast volatile aftermarket demand and manage raw material inventory buffers.

- Robotic Process Automation (RPA): Integrating AI in assembly and handling of delicate bellow components for improved precision and reduced handling damage.

DRO & Impact Forces Of Automotive Bellows Market

The operational landscape of the Automotive Bellows Market is intrinsically governed by a continuous tug-of-war between strong, foundational growth drivers and persistent structural restraints, defining the overall market opportunity and impact forces. The primary drivers are deeply rooted in the structural necessity of protection and isolation within vehicles, amplified by increasing vehicle complexity and global safety standards. Conversely, the market must navigate challenges such as the acute sensitivity to fluctuations in the petrochemical feedstock market, which dictates raw material costs, and the pressure from aftermarket consolidation aimed at driving down unit pricing. Despite these restraints, substantial opportunities emerge from technological paradigm shifts, especially the proliferation of Electric Vehicles and advanced autonomous steering systems, where traditional designs are insufficient, compelling high-value material and design innovation.

Drivers: The market’s sustained momentum is anchored by regulatory and consumer demand for vehicle durability. In modern vehicles, components must withstand extended warranties and challenging operating conditions; this dictates that bellows must provide reliable protection for safety-critical systems. The evolution of vehicle architecture, including the widespread adoption of all-wheel drive systems, independent suspension, and electronically controlled active dampening, increases the quantity and complexity of protective bellows required per vehicle. Moreover, the robust and growing aftermarket segment, driven by the sheer volume of aging vehicles requiring replacement parts, ensures a steady revenue stream independent of new car sales cycles. This systemic necessity ensures that demand for quality protective components remains high across all geographic regions and vehicle categories.

Restraints: Significant limitations include the vulnerability of profit margins to volatile raw material prices, particularly for specialized synthetic rubbers like HNBR or Silicone, whose costs are closely tied to global energy markets. Manufacturing bellows is capital-intensive, requiring high-precision molds and vulcanization equipment, creating high barriers to entry and intense competition among established players who utilize aggressive pricing strategies, especially in the high-volume OE segment. Furthermore, the push for component integration and modular assemblies by OEMs occasionally leads to system designs where the protective function is integrated into a larger component, potentially reducing the standalone bellows volume, forcing manufacturers to innovate or diversify their offerings rapidly.

Opportunities: The transition to EVs provides the most significant long-term market opportunities. Electric platforms require specialized bellows for insulating and protecting sensitive high-voltage cabling and managing the complex thermal cycles of large battery packs, demanding new materials that can handle dielectric stress and extreme temperatures. Furthermore, the development of sophisticated air suspension systems for luxury SUVs and heavy commercial vehicles offers a high-value opportunity, as these systems rely on large, durable, and highly engineered rubber or TPE air spring bellows. Embracing digital manufacturing technologies, such as customized tooling for short-run specialty bellows, allows suppliers to capture niche, high-margin opportunities in specialized vehicle segments.

Segmentation Analysis

Segmentation of the Automotive Bellows Market provides a critical framework for understanding demand patterns, technological specialization, and competitive positioning across the global industry. The core differentiation rests on Material Type, as the choice of polymer directly dictates the component's performance characteristics—from flexibility and fatigue life to thermal and chemical resistance. For instance, metallic bellows serve niche high-heat or high-pressure applications (e.g., turbocharger connections), while TPEs dominate the standard suspension and steering boots due to their balanced cost and performance profile, highlighting the diversity required in product portfolios.

Application segmentation reveals the functional priorities: Drivetrain (CV joint boots) demands extreme mechanical resilience and lubricant retention, whereas Exhaust Systems require materials that can withstand continuous temperatures exceeding 600°C. The segmentation by Sales Channel, OEM vs. Aftermarket, defines operational strategy; OEM supply mandates rigorous quality certification and tight cost control, while the Aftermarket thrives on broad product coverage, efficient logistics, and rapid fulfillment. Recognizing these differential segment needs is paramount for allocating R&D resources, optimizing manufacturing capacity, and ensuring effective market penetration across diverse geographical regions and regulatory regimes.

- By Material Type:

- Rubber Bellows (EPDM, Silicone, Neoprene, NBR, HNBR, ACM) - Preferred for traditional applications and high-temperature sealing.

- Thermoplastic Elastomers (TPEs/TPUs) - Growing segment due to lightweighting, recyclability, and ease of processing.

- Plastics (Polyurethane, PVC) - Used in less demanding, non-critical sealing roles.

- Metallic Bellows (Stainless Steel, Inconel Alloys) - Essential for high-pressure or extreme heat exhaust and turbocharger expansion joints.

- By Application:

- Steering System Bellows (Rack and Pinion Boots, Tie Rod Boots) - Focus on protecting sensitive mechanisms.

- Suspension System Bellows (Shock Absorber Dust Boots, Air Spring Systems Bellows) - High dynamic load and fatigue resistance required.

- Drivetrain System Bellows (CV Joint Boots, Driveshaft Seals) - Largest volume segment, critical for lubricant retention.

- Brake and Clutch System Bellows (Master Cylinder Boots) - Requirement for compatibility with brake fluids.

- Exhaust System Bellows (Decoupling Joints, Flex Pipes) - High heat and vibration absorption.

- HVAC and Thermal Management Bellows (EV cooling lines, Sensor Protection) - Specialized growth area requiring chemical and dielectric resistance.

- By Vehicle Type:

- Passenger Vehicles (PC) - Highest volume consumer across all applications.

- Light Commercial Vehicles (LCV) - Emphasis on robustness and load-bearing capacity.

- Heavy Commercial Vehicles (HCV) - Demand for metallic and extremely durable rubber bellows for sustained, heavy-duty operation.

- By Sales Channel:

- OEM (Original Equipment Manufacturer) - Direct supply for new vehicle assembly, characterized by high volume, low margin.

- Aftermarket (Independent Aftermarket and OES) - Replacement demand, characterized by lower volume, higher margin, and logistical complexity.

Value Chain Analysis For Automotive Bellows Market

The Value Chain of the Automotive Bellows Market is initiated by the sophisticated material development and sourcing phase. Upstream players, primarily specialized chemical and polymer manufacturers (e.g., DuPont, Dow, Wacker), provide the compounded elastomers and TPE pellets customized to stringent automotive specifications regarding abrasion resistance, temperature tolerance, and oil compatibility. This collaboration is crucial because minor variations in feedstock quality can severely impact the performance and certification status of the final bellow. Sourcing agreements often involve long-term relationships due to the proprietary nature of high-performance polymer formulas and the high cost associated with qualifying new material suppliers for OEM platforms.

The core manufacturing stage is capital-intensive and technology-driven, involving specialized molding techniques such as compression molding, injection molding (especially for TPEs), and sophisticated rubber extrusion and vulcanization processes. Precision tooling and automated handling systems are essential to maintain the tight dimensional tolerances required, especially for multi-layered or asymmetric bellows designs. Rigorous testing protocols, including mechanical cycling under simulated road conditions and environmental degradation tests, are integrated throughout the production process. Manufacturers strategically locate facilities near major OEM assembly clusters, often utilizing advanced logistics and JIT (Just-in-Time) delivery systems to minimize warehousing costs and maximize responsiveness to fluctuating production schedules.

Distribution constitutes the final, often complex, stage. For the OEM channel, delivery is direct or via Tier 1 suppliers, forming a highly efficient but low-margin process. For the aftermarket, the structure is significantly more diffused and relies on large wholesalers, regional distributors, and online parts platforms. Indirect sales channels necessitate extensive inventory management systems to track thousands of part numbers across various makes and models globally. The ultimate consumer—the vehicle owner or fleet operator—purchases the bellow components through repair shops or authorized service networks. Success in the aftermarket depends heavily on brand recognition, catalog depth, packaging quality, and competitive pricing strategies targeting service technicians.

Automotive Bellows Market Potential Customers

Potential customers for automotive bellows are strategically distributed across the entire lifespan of a vehicle, starting from initial design to end-of-life maintenance. The most influential customers are the Tier 1 and Tier 2 system suppliers, such as chassis, steering, and suspension module manufacturers (e.g., ZF, Dana, Tenneco), who integrate bellows into complex assemblies like complete axle modules or steering racks before shipment to the vehicle manufacturer (OEM). These buyers demand strict adherence to technical specifications, guaranteed volume supply, and cost optimization, as the bellow is often a critical, but relatively low-cost, component of a high-value system.

Direct Original Equipment Manufacturers (OEMs)—including multinational automakers like BMW, Hyundai, and Stellantis—constitute another crucial segment. While often sourcing through Tier 1 suppliers, OEMs directly dictate the performance requirements and approve the material and design specifications. Their purchasing decisions are heavily influenced by long-term durability metrics, global sourcing capabilities, and a supplier’s capacity to innovate components that meet future safety and weight reduction targets for upcoming vehicle platforms, particularly in the rapidly evolving EV domain.

Finally, the vast Independent Aftermarket (IAM) forms a continuous and stable customer base. This includes national and international automotive parts wholesalers (e.g., LKQ Corporation), regional distributors, and thousands of independent repair garages and quick-service chains. These customers purchase bellows for replacement and repair. Their key criteria are accessibility, vehicle application coverage, and the ease of installation, leading to high demand for complete repair kits that include the necessary clamps, grease, and installation instructions, often favoring suppliers with established aftermarket brands recognized for reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freudenberg Group, Continental AG, Trelleborg AB, Hutchinson SA, Tenneco Inc., ZF Friedrichshafen AG, SKF Group, Vibracoustic GmbH, Federal-Mogul (Tenneco), Dana Limited, Polybush, Boge Rubber & Plastics, Sumitomo Riko Co. Ltd., NOK Corporation, Cooper-Standard Automotive Inc., Parker-Hannifin Corporation, Qingdao Huida Metal Bellows Co., Roechling Automotive, Wacker Chemie AG, EPDM Gasket Company, GKN Driveline (Part of Melrose Industries), Metaldyne Performance Group (MPG), Holley Performance Products, VOSS Automotive GmbH, Hella GmbH & Co. KGaA, BorgWarner Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Bellows Market Key Technology Landscape

The technological evolution in the Automotive Bellows Market is fundamentally driven by the intersecting demands of lightweighting, performance consistency under extreme conditions, and manufacturing efficiency. A primary area of focus is the rapid refinement of Thermoplastic Elastomers (TPEs), particularly advanced grades of TPU and TPO, designed to replace traditional cross-linked rubbers. These materials offer competitive dynamic fatigue properties while providing superior environmental resistance (ozone, UV, hydrolysis) and the ability to be processed via highly efficient injection molding, often resulting in quicker cycle times and reduced material scrap compared to complex rubber vulcanization processes. This material substitution is critical for meeting the strict weight targets imposed by both regulatory standards and EV range maximization goals.

In design and engineering, the utilization of sophisticated digital simulation tools forms the backbone of modern bellow development. Advanced Finite Element Analysis (FEA) is utilized to meticulously model the localized stress and strain distribution across the bellows’ convoluted geometry under various displacement and angular conditions. This allows engineers to optimize wall thickness tapering and convolution pitch, preventing premature cracking or fatigue failure at critical points. Furthermore, topology optimization software is increasingly used, especially in metal bellow design for exhaust systems, to minimize material usage while maintaining the high stiffness and expansion compensation capacity necessary to decouple engine movement from the exhaust line.

Manufacturing process innovation centers on improving precision and integration. Multi-component injection molding (overmolding) technology allows for the creation of bellows where the flexible boot, rigid mounting flange, and internal stops are molded as a single, cohesive unit using different materials (e.g., a flexible TPE body molded onto a rigid plastic collar). This minimizes assembly steps, enhances sealing integrity, and reduces the potential for failure at connection points. Additionally, advancements in laser cutting and automated assembly robots ensure high-speed, repeatable quality control for complex bellow designs, solidifying the market's move towards 'smart manufacturing' characterized by reduced human intervention and highly traceable production data, crucial for stringent automotive quality standards.

Regional Highlights

The Automotive Bellows Market displays significant variance in market maturity and growth dynamics across global regions. The Asia Pacific (APAC) region continues to be the undisputed global leader in terms of volume, primarily due to the concentration of major global automotive manufacturing activities in countries like China, India, and South Korea. This region benefits from lower manufacturing costs, large domestic markets driving OEM demand, and an enormous, rapidly aging vehicle parc that fuels constant and high-volume aftermarket demand for replacement components like CV joint boots and suspension dust covers. Manufacturers operating here emphasize cost-competitiveness alongside adequate material performance to meet diverse road conditions.

Europe and North America represent markets focused on technological sophistication and regulatory compliance. In Europe, the stringent environmental regulations (e.g., REACH, RoHS) necessitate a move towards sustainable and fully recyclable materials, accelerating the adoption of advanced TPEs. Demand here is disproportionately high for specialty products, including high-performance air spring bellows for luxury and heavy-duty vehicles, and specialized components for high-temperature applications associated with stringent emissions controls. North America similarly prioritizes durability, driven by harsh winter conditions requiring bellows resistant to road salt and extreme temperature variations, leading to strong demand in the heavy commercial vehicle sector and the premium aftermarket segment.

The emerging markets of Latin America (LATAM) and the Middle East & Africa (MEA) are characterized by potential high-growth trajectories tied to rising vehicle ownership rates and improving infrastructure. While volume is currently lower than in mature markets, the annual increase in vehicle parc translates directly into future aftermarket opportunities. Bellows supplied to these regions must often be engineered for exceptional robustness to handle rough road surfaces and challenging climates (high dust, extreme heat), leading to specific material requirements focused on abrasion and heat resistance. Establishing robust local distribution networks and manufacturing footprints in key hubs like Mexico, Brazil, and South Africa is crucial for unlocking this future growth potential.

- Asia Pacific (APAC): Highest production and consumption volume; driven by new vehicle sales and massive aftermarket repair cycles in China and India; focus on balanced cost-performance ratios.

- Europe: Technological leader in TPE and sustainable materials; high demand for air suspension and high-heat resistant bellows for advanced engine systems and EVs; strong regulatory pressure dictates material choice.

- North America: Focus on premium quality, heavy-duty applications (trucking and SUVs), and components designed for extreme weather resistance; sophisticated aftermarket logistics infrastructure.

- Latin America (LATAM): Growth market driven by urbanization and industrial expansion; needs robust, affordable bellows suitable for poor infrastructure conditions.

- Middle East & Africa (MEA): Emerging market concentrated around commercial vehicle fleet growth and high temperature tolerance requirements; dependent on global imports for specialty bellows.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Bellows Market.- Freudenberg Group

- Continental AG

- Trelleborg AB

- Hutchinson SA

- Tenneco Inc.

- ZF Friedrichshafen AG

- SKF Group

- Vibracoustic GmbH

- Federal-Mogul (Tenneco)

- Dana Limited

- Polybush

- Boge Rubber & Plastics

- Sumitomo Riko Co. Ltd.

- NOK Corporation

- Cooper-Standard Automotive Inc.

- Parker-Hannifin Corporation

- Qingdao Huida Metal Bellows Co.

- Roechling Automotive

- Wacker Chemie AG

- EPDM Gasket Company

- GKN Driveline (Part of Melrose Industries)

- Metaldyne Performance Group (MPG)

- Holley Performance Products

- VOSS Automotive GmbH

- Hella GmbH & Co. KGaA

- BorgWarner Inc.

- Toyoda Gosei Co., Ltd.

- Pirelli S.p.A.

- LORD Corporation (Parker Hannifin)

Frequently Asked Questions

Analyze common user questions about the Automotive Bellows market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key performance requirements for CV joint boots?

CV joint boots require exceptional mechanical fatigue resistance, high tear strength, superior flexibility at extreme temperatures (-40°C to +100°C), and critical chemical compatibility to prevent degradation when exposed to specialized CV joint greases, ensuring the retention of lubricant and exclusion of all external contaminants.

In the context of material, why are Thermoplastic Elastomers (TPEs) increasingly preferred over traditional rubber for steering bellows?

TPEs are favored primarily due to their lighter weight, better material recyclability, and ease of mass production via high-speed injection molding, which offers cost savings and reduces cycle times compared to vulcanized rubber. They provide adequate durability and resistance for typical steering and suspension applications while supporting OEM lightweighting mandates.

Which geographical region is expected to demonstrate the highest growth rate for automotive bellows?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by continued massive scaling of automotive production hubs, increasing consumer demand for new vehicles, and the corresponding rapid expansion of the vehicle parc fueling the sustained and necessary growth of the high-volume aftermarket segment.

How do bellows contribute to NVH (Noise, Vibration, and Harshness) reduction in vehicles?

Bellows contribute to NVH reduction primarily in the exhaust system and air spring assemblies. Exhaust bellows, often metallic, absorb vibrational energy and engine movement, preventing structural noise transmission. Air spring bellows isolate the chassis from road inputs, damping high-frequency vibrations and improving overall ride comfort.

What is the main challenge facing manufacturers in the metallic automotive bellows segment?

The main challenge in the metallic bellows segment (used primarily in exhaust systems) is the requirement for specialized high-temperature alloys, complex forming processes to ensure consistent convolution depth, and intense quality control to prevent micro-fissures that could lead to leakage under extreme pressure and thermal cycling conditions typical of modern turbocharged engines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager