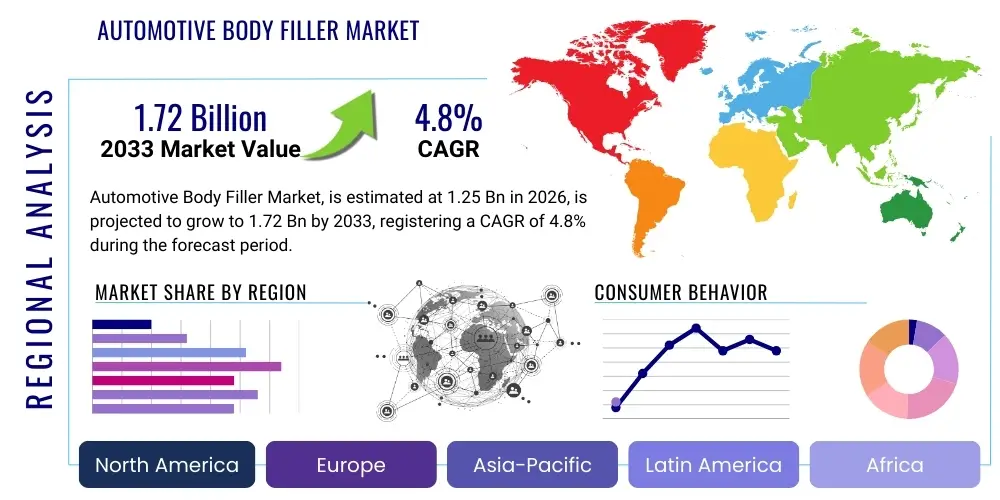

Automotive Body Filler Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441794 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Automotive Body Filler Market Size

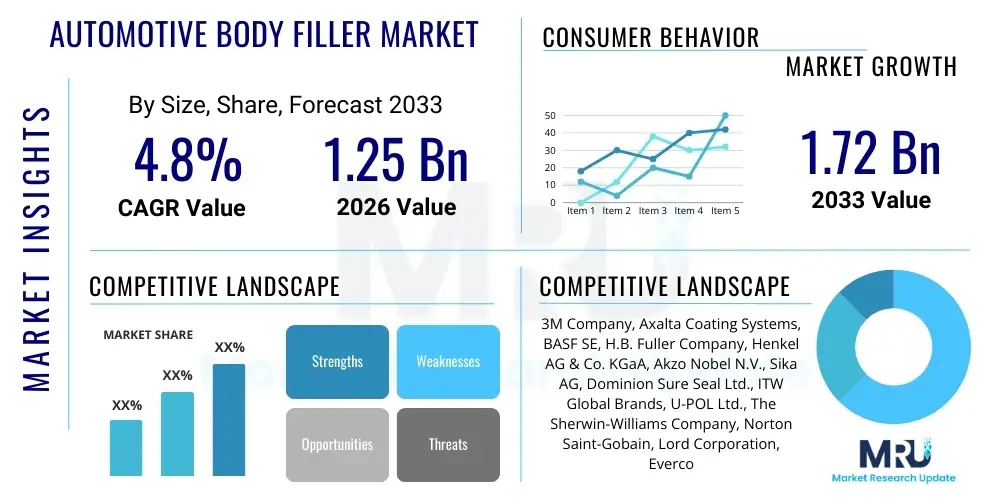

The Automotive Body Filler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.72 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fueled primarily by the robust expansion of the global vehicle parc, increasing road traffic incidents necessitating complex repairs, and the rapid digitalization of collision repair services worldwide. The valuation reflects the increasing premium placed on high-performance, lightweight filler solutions that meet stringent environmental and performance standards in mature economies while capitalizing on volume growth in emerging markets.

Automotive Body Filler Market introduction

Automotive body fillers, often known as putties or autobody compounds, are integral products within the vehicle refinishing and collision repair industry. These specialized composite materials are primarily used to fill minor depressions, dents, scratches, and surface imperfections on vehicle bodies following collision damage or restoration work. The core function is to restore the original contour and surface profile of the vehicle panel, providing a perfectly smooth substrate necessary for the subsequent application of primers, basecoats, and clearcoats, ensuring a high-quality, undetectable repair.

The product portfolio encompasses various chemical compositions, predominantly based on unsaturated polyester resins (UPR), but also including specialized epoxy and polyurethane formulations designed for specific applications, such as high-strength structural repairs or compatibility with advanced lightweight substrates like aluminum and composites. Major applications span the automotive aftermarket, including independent body shops, franchised collision centers, and professional restoration facilities, catering to both passenger vehicles (PV) and commercial vehicles (CV). These fillers offer significant benefits, including cost-effectiveness compared to replacing entire panels, rapid application, quick sanding capabilities, and adaptability to complex curves and deep imperfections.

Driving factors for sustained market growth include the escalating average age of vehicles globally, leading to higher repair frequency; the increasing complexity and expense associated with modern vehicle body panels (which discourages replacement); and technological advancements resulting in low-VOC, user-friendly, and lightweight filler formulations that comply with evolving global environmental regulations. Furthermore, the expansion of the automotive insurance sector and the standardization of repair procedures contribute significantly to consistent demand across all major geographies.

Automotive Body Filler Market Executive Summary

The Automotive Body Filler Market is currently shaped by several transformative business trends emphasizing sustainability, efficiency, and material compatibility. There is a discernible trend toward the development and adoption of ultra-lightweight and low-density fillers, often incorporating specialized microspheres, which directly addresses the weight reduction mandates critical for optimizing fuel efficiency and battery range in electric vehicles. Furthermore, market competition is intensifying, leading manufacturers to differentiate their products through enhanced features such as non-shrinkage formulas, superior adhesion to dissimilar substrates, and rapid curing times suitable for high-throughput body shop environments.

Regionally, the Asia Pacific (APAC) market maintains its dominance, driven by exponential growth in the vehicle population, extensive manufacturing bases in countries like China and India, and a lower average vehicle age requiring frequent maintenance cycles. North America and Europe, while representing mature markets, exhibit a strong demand for premium, high-performance fillers compliant with strict environmental directives, particularly those that minimize Volatile Organic Compound (VOC) emissions. Strategic acquisitions and vertical integration among key players are evident across geographies, aimed at strengthening supply chain control and expanding product penetration into specialized repair niches.

Segment trends confirm that polyester fillers remain the foundational material type due to their optimal balance of cost and performance. However, high-value, niche segments like epoxy and polyurethane fillers are experiencing above-average growth rates, propelled by their necessity in repairing modern materials such as high-strength steel and carbon fiber components. The aftermarket distribution channel overwhelmingly accounts for the largest market share, but direct relationships with large collision chain operators are becoming increasingly vital for securing consistent high-volume orders and providing specialized technical support and training to ensure optimal product usage.

AI Impact Analysis on Automotive Body Filler Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Automotive Body Filler Market primarily revolve around automation, precision, and supply chain optimization. Common questions include whether AI can accurately assess body damage to determine the precise volume and type of filler needed, how robotic systems utilize AI for automated filler application and sanding, and the potential for ML algorithms to predict optimal filler formulations based on specific environmental and substrate conditions. Users express expectations for AI to minimize material waste, eliminate human variability in application, and drastically reduce repair cycle times, thus enhancing overall body shop profitability and quality control. The key theme is the shift from manual, subjective repair assessment to standardized, data-driven processes.

AI's initial influence is most keenly felt in the diagnostic phase of collision repair, where advanced computer vision algorithms can analyze high-resolution 3D scans of damaged panels to generate highly accurate damage maps. This allows body shops to calculate precisely the volume of filler required, reducing inventory guesswork and ensuring consistent application depth. Furthermore, AI is increasingly integrated into robotic systems that perform repetitive tasks such as sanding and priming. These robots use ML models trained on thousands of flawless repair sequences, ensuring ultra-consistent sanding patterns and optimal surface preparation for filler application, which directly impacts the durability and aesthetic quality of the final paint job. This shift elevates the necessity for consistent, high-quality filler formulations compatible with robotic dispensing systems.

- AI-driven computer vision systems enhance precision in damage assessment, optimizing filler material usage.

- Machine Learning algorithms predict raw material price fluctuations, improving supply chain efficiency for filler manufacturers.

- Robotic process automation, guided by AI, standardizes filler application and precise sanding, reducing human error.

- Predictive modeling assists manufacturers in developing specialized, low-shrinkage filler formulations tailored for specific modern substrates.

- AI-enabled quality control systems detect inconsistencies in cured filler surface contours before the painting stage.

- Optimized inventory management systems in body shops utilize AI to forecast filler consumption based on historical repair data.

DRO & Impact Forces Of Automotive Body Filler Market

The Automotive Body Filler Market dynamics are characterized by a strong, consistent baseline demand tempered by stringent regulatory constraints and continuous innovation imperatives. The primary drivers include the steady expansion of the global vehicle fleet, which naturally increases the pool of vehicles requiring collision and cosmetic repairs, and the continuous trend of consumers seeking cost-effective alternatives to expensive panel replacement. These market forces ensure a robust demand stream for both standard and high-performance filler products across all major vehicle segments globally, making the repair and refinishing sector recession-resistant to a certain degree.

However, the market faces significant restraints, most notably the growing regulatory pressure to reduce Volatile Organic Compound (VOC) content in refinishing products, particularly in North America and Western Europe. This constraint forces manufacturers into substantial R&D investments to reformulate traditional polyester fillers into low-VOC or water-based alternatives, which must maintain equivalent performance characteristics (adhesion, sanding ease, shrinkage) while increasing manufacturing costs. Additionally, the proliferation of advanced lightweight materials (e.g., carbon fiber and specialized aluminum alloys) in modern vehicles presents a technical challenge, requiring highly specialized, often more expensive, filler chemistries to ensure proper bonding and long-term durability, thereby segmenting the market further.

Opportunities for growth are abundant in the expansion of high-strength filler formulations designed specifically for new materials and complex structural repairs, particularly relevant to the rapid growth of the Electric Vehicle (EV) market where specialized thermal and structural requirements apply. Furthermore, the modernization and industrialization of collision repair processes in emerging economies offer fertile ground for expansion. Key impact forces shaping the competitive landscape include moderate power held by raw material suppliers (due to petrochemical volatility) and high competitive rivalry among filler manufacturers. Buyer power is also considerable, especially from large multinational collision repair chains that demand preferential pricing, consistent supply, and specialized product training, leveraging their purchasing volume for leverage.

Segmentation Analysis

The Automotive Body Filler Market is systematically segmented based on composition, end-use application, and distribution channel, providing essential insights into diverse product demands across the global repair ecosystem. This detailed segmentation allows manufacturers to target their product development and marketing strategies effectively, addressing the unique requirements of various market participants, from individual repair technicians seeking ease of application to large commercial fleet operators prioritizing durability and rapid curing times. Understanding these sub-markets is crucial for strategic planning and maintaining competitiveness in a technologically evolving industry.

Segmentation by material type highlights the chemical backbone of the product, with Unsaturated Polyester (UP) fillers leading due to their versatility and economical nature. However, specialized segments like Epoxy and Polyurethane fillers are gaining importance as they offer superior adhesion, higher tensile strength, and reduced shrinkage, necessary for high-end repairs and specialized substrates found in luxury or performance vehicles. Application segmentation differentiates between the massive volume demands of the Passenger Vehicle (PV) market, which dominates volume, and the rigorous performance needs of the Commercial Vehicle (CV) market, which requires robust, impact-resistant formulations suitable for heavy-duty environments and large surface areas. The aftermarket distribution channel remains the backbone of sales, reflecting the decentralized nature of collision repair services globally.

- By Type:

- Unsaturated Polyester Fillers (UP)

- Epoxy Fillers

- Polyurethane (PU) Fillers

- Lightweight/Micro-sphere Fillers

- Fiberglass Reinforced Fillers

- Specialty Fillers (e.g., Plastic Repair Fillers)

- By Application:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Automotive Restoration

- By End-Use:

- Collision Repair Centers (Independent and Franchised)

- Automotive OEM Facilities (Minor defect correction)

- Independent Repair Garages (IRG)

- By Distribution Channel:

- Aftermarket (Wholesalers, Distributors, Retailers)

- Original Equipment Manufacturer (OEM)

Value Chain Analysis For Automotive Body Filler Market

The value chain for the Automotive Body Filler Market is characterized by a high degree of integration between specialized chemical suppliers upstream and a highly fragmented network of repair professionals downstream. Upstream analysis focuses on the procurement of critical raw materials, primarily petrochemical derivatives such as unsaturated polyester resins, epoxy resins, isocyanates (for PU), and specialized inert fillers like talc, calcium carbonate, and glass microspheres. Price volatility in the global petrochemical commodity markets significantly influences the manufacturing costs of the final filler product. Manufacturers establish long-term relationships with select chemical suppliers to ensure consistent quality and supply stability, which is essential for maintaining consistent product performance.

Midstream activities involve R&D, formulation, mixing, and packaging. The formulation stage is highly proprietary, focusing on achieving minimal shrinkage, optimal adhesion, and user-friendly sanding characteristics while meeting increasingly strict VOC regulations. Investment in advanced mixing equipment and quality control is critical at this stage. Manufacturers often utilize automated blending systems to ensure uniform dispersion of fillers and catalysts, which impacts the final product's curing time and structural integrity. Branding, regulatory compliance filing, and technical documentation are also crucial elements carried out in this segment.

Downstream activities are dominated by distribution and application. The distribution channel is segmented into direct sales to large, multi-location collision repair chains and indirect sales through vast networks of regional distributors, automotive paint wholesalers, and specialized jobbers. The effectiveness of the indirect channel is paramount, as these entities provide localized inventory, technical training, and just-in-time delivery to thousands of independent repair shops (IRGs). Application involves the skilled labor within body shops. Training and technical support provided by manufacturers or their distributors are essential to ensure the correct usage, including proper surface preparation and catalyst mixing ratios, which directly influence the success and longevity of the repair.

Automotive Body Filler Market Potential Customers

The primary consumers of automotive body fillers are diverse entities operating within the maintenance, repair, and refurbishment sectors of the transportation industry. The largest and most influential customer segment is the collision repair industry, encompassing major franchised body shop networks (often affiliated with insurance companies), independent collision repair specialists, and dealership service centers. These customers represent the highest volume demand due to the constant necessity for repairs resulting from road accidents and general wear and tear, seeking products that offer speed, reliability, and cost-efficiency to maximize throughput.

A secondary, yet crucial, customer base includes specialized automotive restorers and custom fabrication shops. These professionals require high-quality, specialized fillers with exceptional feather-edging capabilities and minimal shrinkage, often used for complex shape reconstruction on classic or high-value vehicles where aesthetic perfection is paramount. Furthermore, heavy-duty vehicle maintenance and fleet operators (managing trucking, transit, or municipal fleets) constitute a consistent customer segment, prioritizing durability, impact resistance, and specialized fillers capable of handling large surface areas and the rigorous stress of commercial operation.

Although they utilize lower volume compared to the aftermarket, Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers are also potential customers. Fillers are occasionally used during the assembly line process for minor cosmetic adjustments or defect corrections before the final paint booth. These requirements are extremely stringent, demanding fillers that are highly compatible with OEM paint systems and cure flawlessly within standardized manufacturing cycle times, often involving specialized high-temperature resistance capabilities. These customers prioritize technical specifications and rigorous quality assurance certifications above all else.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.72 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Axalta Coating Systems, BASF SE, H.B. Fuller Company, Henkel AG & Co. KGaA, Akzo Nobel N.V., Sika AG, Dominion Sure Seal Ltd., ITW Global Brands, U-POL Ltd., The Sherwin-Williams Company, Norton Saint-Gobain, Lord Corporation, Evercoat, MIPA SE, Roberlo, Starchem, Body Parts Manufacturing, Dynatrade Automotive Group, Promatech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Body Filler Market Key Technology Landscape

Technological innovation in the Automotive Body Filler Market is predominantly focused on achieving compliance with environmental standards while simultaneously enhancing performance characteristics vital for modern repair processes. A major technological thrust involves the development of low-VOC and styrene-free formulations, utilizing advanced resin chemistry to maintain superior adhesion and rapid curing without the health and environmental risks associated with high solvent content. This involves migrating towards proprietary blend technologies that substitute volatile organic compounds with less harmful diluents, ensuring the user experience, particularly sanding ease and feather-edging capability, is not compromised.

Another crucial technological area is the integration of ultra-lightweight components, such as specialized glass or plastic microspheres (microballoons), into filler compounds. This technology significantly reduces the density of the applied filler, which is increasingly important for minimizing added weight on high-performance vehicles and Electric Vehicles (EVs) where every kilogram counts toward maximizing efficiency and range. These lightweight fillers must maintain robust structural integrity and resistance to vibration and thermal expansion, leading to complex material science challenges that drive innovation in resin and additive selection.

Furthermore, application technology is rapidly advancing, focusing on precision and speed. UV-curing technology is emerging as a niche yet high-potential solution, allowing specialized UV-curable putties to harden almost instantaneously under ultraviolet light. While UV fillers are currently best suited for small, cosmetic repairs, their potential for drastically cutting cycle times in high-volume body shops is immense. Alongside this, manufacturers are developing specialized fillers tailored specifically for composite and carbon fiber substrates, requiring highly flexible, crack-resistant formulas that can handle the unique thermal expansion properties of these advanced materials without failure.

Regional Highlights

Global demand for automotive body fillers is geographically diversified, with distinct consumption patterns and regulatory landscapes shaping regional market performance.

- Asia Pacific (APAC): APAC is the epicenter of market growth, driven by China, India, and Southeast Asian nations. This region benefits from explosive growth in new vehicle sales, a massive and rapidly aging vehicle parc, and lower labor costs which favor collision repair over replacement. The demand here is volume-driven, with a strong focus on cost-effective, high-volume polyester fillers. However, increasing awareness of air quality and adoption of international standards are slowly driving demand for medium-grade, low-VOC products in major urban centers.

- North America: This mature market is characterized by high rates of professional collision repair services and strict regulations, particularly concerning VOC emissions (e.g., California regulations). Demand centers on premium, professional-grade fillers (Epoxy and high-performance Polyester) that offer ultra-fast curing, minimal shrinkage, and superior compatibility with advanced paint systems. The robust insurance industry dictates high-quality, standardized repair procedures, maintaining consistent demand for high-specification products.

- Europe: Europe is highly regulated, necessitating significant adoption of low-VOC and water-based filler technologies. Key countries like Germany, France, and the UK prioritize technological innovation, leading to strong demand for specialized fillers designed for high-strength steel and aluminum structures found in European vehicles. The focus is on sustainability, performance, and efficiency, with moderate growth driven by technological upgrades rather than sheer volume expansion.

- Latin America (LATAM): Growth in LATAM is driven by urbanization and rising vehicle ownership, particularly in countries like Brazil and Mexico. The market balances cost-sensitivity with a growing need for quality repairs. Distribution channels are often fragmented, relying heavily on local wholesalers.

- Middle East and Africa (MEA): This region shows specialized demand tied to high-value vehicle segments in the GCC countries and robust growth in vehicle imports across Africa. Demand is sensitive to oil price fluctuations but is consistently supported by harsh environmental conditions (heat, dust) requiring durable filler solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Body Filler Market.- 3M Company

- Axalta Coating Systems

- BASF SE

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Akzo Nobel N.V.

- Sika AG

- Dominion Sure Seal Ltd.

- ITW Global Brands

- U-POL Ltd.

- The Sherwin-Williams Company

- Norton Saint-Gobain

- Lord Corporation

- Evercoat (Illinois Tool Works Inc.)

- MIPA SE

- Roberlo

- Starchem

- Body Parts Manufacturing

- Dynatrade Automotive Group

- Promatech

Frequently Asked Questions

Analyze common user questions about the Automotive Body Filler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers increasing the demand for automotive body fillers?

Key drivers include the continuous expansion of the global vehicle fleet, which leads to a higher frequency of collision repairs, the increasing expense and complexity of modern body panels making repair more feasible than replacement, and technological advancements creating faster-curing, more user-friendly filler formulations for professional body shops.

How do environmental regulations impact the formulation and use of body fillers?

Environmental regulations, particularly those governing VOC emissions, force manufacturers to invest heavily in R&D to develop low-VOC, styrene-free, or water-based fillers. This shift ensures compliance in markets like North America and Europe while maintaining the necessary performance attributes such as adhesion, ease of sanding, and minimal shrinkage.

Which type of automotive body filler dominates the market, and why?

Unsaturated Polyester (UP) fillers currently dominate the market volume due to their advantageous combination of cost-effectiveness, versatility, ease of application, and good sanding characteristics. They are the standard solution for the vast majority of non-structural and cosmetic collision repairs across the globe.

What is the primary role of AI and automation in the future of body filler application?

AI and automation are expected to revolutionize quality control and efficiency. AI-driven computer vision systems will precisely map damage and quantify filler needs, while robotic systems, guided by ML, will ensure consistent, flawless application and sanding, significantly reducing human error and repair cycle times in high-volume environments.

Which regional market offers the highest growth potential for body filler manufacturers?

The Asia Pacific (APAC) region offers the highest growth potential due to rapid motorization, extensive manufacturing activities, and a large, aging vehicle population requiring frequent collision repair services. Countries like China and India represent major opportunities for volume-based market expansion in the near future.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager