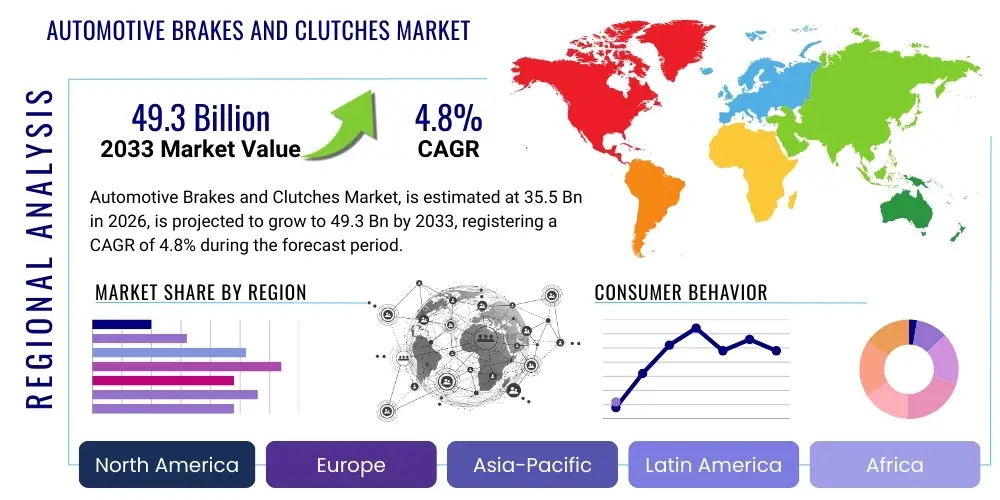

Automotive Brakes and Clutches Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441724 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Brakes and Clutches Market Size

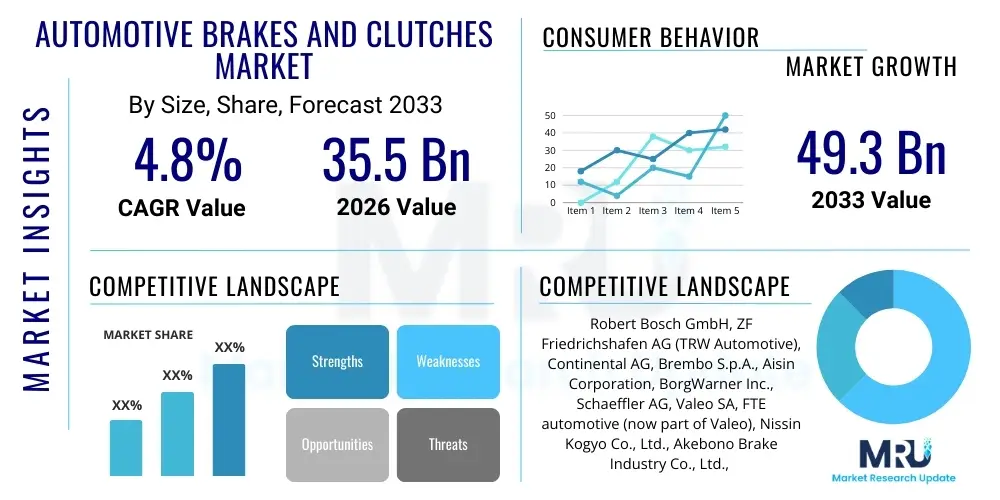

The Automotive Brakes and Clutches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 49.3 Billion by the end of the forecast period in 2033.

Automotive Brakes and Clutches Market introduction

The Automotive Brakes and Clutches Market encompasses the design, manufacturing, distribution, and maintenance of essential components critical for vehicle safety, motion control, and power transmission. Brakes, including disc, drum, ABS, and ESC systems, are fundamentally responsible for decelerating and stopping vehicles reliably, a function that has become increasingly sophisticated with the integration of electronic control systems. Clutches, conversely, manage the mechanical connection between the engine and the gearbox, facilitating smooth gear changes and efficient power delivery, particularly in vehicles equipped with manual transmissions or complex automated manual transmission (AMT) systems. These components are vital across all vehicle types, ranging from light passenger cars to heavy-duty commercial vehicles, ensuring both operational efficiency and occupant safety.

The product description for this market spans a wide array of specialized components. Brake systems incorporate friction materials (pads and linings), calipers, rotors, master cylinders, and advanced electronic modules. Modern braking systems are increasingly leaning towards regenerative capabilities in hybrid and electric vehicles, significantly altering material and design requirements. Clutch systems involve key assemblies such as the clutch plate, pressure plate, flywheel, release bearings, and sophisticated hydraulic or mechanical actuation mechanisms. The core benefits derived from high-quality brake and clutch systems include enhanced vehicle control, reduced stopping distances, prolonged component life, and improved fuel efficiency due to optimized power flow, all contributing directly to stringent global safety standards.

Major applications of these components exist primarily within Original Equipment Manufacturers (OEMs) for new vehicle assembly and the robust aftermarket sector for replacement and maintenance activities. Driving factors for market growth include mandatory vehicle safety regulations imposed by governmental bodies globally, the continuous expansion of the global vehicle fleet, and the increasing demand for high-performance braking systems tailored for high-speed or heavy-load applications. Furthermore, the paradigm shift toward Electric Vehicles (EVs) is generating new demand for specialized electro-mechanical braking systems and single-speed reduction gear clutches, pushing manufacturers towards advanced material science and design innovation.

Automotive Brakes and Clutches Market Executive Summary

The Automotive Brakes and Clutches Market is characterized by steady growth, driven primarily by regulatory mandates concerning vehicle safety and the rapid technological integration in the automotive sector. Business trends indicate a strong focus on lightweight materials, such as composites and high-grade ceramics, to improve fuel economy and battery range, particularly in the competitive EV segment. There is also a distinct movement toward modular designs and simplified actuation systems, aimed at reducing manufacturing complexity and maintenance costs. Key industry stakeholders are investing heavily in electronic brake systems (EBS) and brake-by-wire technology, which promise superior control and seamless integration with advanced driver-assistance systems (ADAS), fundamentally reshaping the product landscape and value proposition for both OEM and aftermarket channels.

Regional trends highlight Asia Pacific (APAC) as the dominant growth engine, attributed to surging vehicle production in economies like China, India, and Southeast Asia, coupled with rising disposable incomes that increase vehicle ownership rates and subsequent demand for aftermarket components. North America and Europe, while mature markets, are leading in the adoption of advanced systems, focusing on premium brake components (like carbon-ceramic brakes) and sophisticated clutch mechanisms (such as dual-clutch transmissions). These regions are stringent regarding emissions and safety standards, propelling innovation in low-dust friction materials and highly efficient power transmission systems. The aftermarket in these regions maintains robust demand due to the aging vehicle fleet requiring regular component replacement.

Segment trends reveal that the Electronic Braking System (EBS) segment, including ABS and ESC, is experiencing the fastest rate of penetration, driven by mandates in developing regions. In terms of vehicle type, the Passenger Vehicle (PV) segment holds the largest market share due to high production volumes, but the Heavy Commercial Vehicle (HCV) segment shows substantial potential, particularly with the transition to automated manual transmissions (AMT) replacing traditional manual systems, leading to higher demand for specialized heavy-duty clutches. The Aftermarket remains critical, especially for friction materials, representing a stable revenue stream for component suppliers globally, emphasizing durability and cost-effectiveness in replacement parts.

AI Impact Analysis on Automotive Brakes and Clutches Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Automotive Brakes and Clutches Market frequently center on how AI enhances active safety features, optimizes predictive maintenance, and facilitates the development of fully autonomous driving systems. Common questions revolve around the role of AI algorithms in interpreting sensor data for instantaneous brake pressure adjustment, predicting component failure based on usage patterns, and the necessary integration protocols for brake-by-wire systems governed by central AI control units. Users are keenly interested in whether AI integration will lead to a complete overhaul of mechanical components or simply augment existing electronic systems, particularly in the context of achieving Level 4 and Level 5 autonomy where fault tolerance and immediate decision-making are paramount for vehicle deceleration and stopping maneuvers.

The incorporation of AI fundamentally shifts the functionality of braking and clutch systems from purely mechanical or hydraulic operations to intelligent, data-driven actions. AI systems process inputs from radar, lidar, and cameras to anticipate collision risks, allowing for preemptive brake engagement that significantly reduces reaction time compared to human drivers or even older electronic stability programs. This capability ensures optimal braking force distribution across individual wheels instantaneously, improving stability during emergency stops and reducing wear disparity across friction materials. Furthermore, AI-driven predictive maintenance models analyze telemetry data, such as vibration patterns, temperature fluctuations, and hydraulic pressure changes, to determine the exact end-of-life cycle for clutch plates or brake pads, enabling highly efficient fleet management and minimizing unexpected vehicle downtime.

In the domain of clutches, while the primary mechanism remains mechanical, AI influences the actuation process, especially in AMT systems. AI algorithms optimize shift points and clutch engagement speed based on current driving conditions, road inclination, and driver input, leading to smoother transitions, enhanced fuel economy, and reduced wear on the transmission system. As autonomous vehicles proliferate, the entire dynamic control system, including steering, acceleration, and deceleration, will be managed by a robust AI platform, demanding extremely reliable, redundant, and ultra-fast responsive brake-by-wire technologies that can execute nuanced, instantaneous commands derived from complex sensor fusion algorithms. This integration necessitates new certification and testing standards for components that are integral to autonomous decision-making processes.

- AI enables highly precise, real-time control of brake actuation in ADAS and autonomous vehicles (AVs).

- Predictive maintenance using AI algorithms forecasts the lifespan of friction materials, clutch plates, and hydraulic fluids, reducing unscheduled downtime.

- Integration of AI systems is crucial for ensuring redundancy and safety in brake-by-wire architectures, essential for Level 4/5 autonomy.

- AI optimizes clutch engagement and gear shifting in automated manual transmissions (AMT) for better efficiency and comfort.

- AI drives the development of regenerative braking optimization strategies in Electric Vehicles (EVs), maximizing energy recovery.

DRO & Impact Forces Of Automotive Brakes and Clutches Market

The Automotive Brakes and Clutches Market is shaped by a powerful interplay of technological advancements and regulatory pressures. The primary Drivers include stringent global safety regulations, such as mandatory adoption of ABS and ESC systems in numerous countries, which consistently elevate the demand for sophisticated braking technologies. Furthermore, the rapid growth in the global vehicle parc, particularly in emerging markets, ensures a continuous stream of demand for both OEM fitting and regular aftermarket replacements. The ongoing shift toward electrification is also a significant driver, necessitating specialized friction materials and highly integrated electro-mechanical braking systems designed for high-torque EVs, thereby forcing immediate innovation across the supply chain.

However, the market faces significant Restraints. The most notable constraint is the high initial cost associated with advanced braking systems, such as brake-by-wire and carbon-ceramic components, which can deter adoption in price-sensitive segments. Additionally, the increasing consumer preference for fully automatic transmissions and EVs (which often lack traditional clutch assemblies) poses a long-term challenge to the growth of the conventional clutch segment. Furthermore, the complex interplay between component suppliers and regulatory bodies, coupled with the long product development cycles required for safety-critical components, often slows down the widespread introduction of genuinely transformative technologies, maintaining a degree of inertia within the market.

Opportunities are predominantly centered around the transition to sustainable mobility and the connected vehicle ecosystem. The growth of hybrid and battery electric vehicles creates substantial demand for regenerative braking systems and optimized friction interfaces that work effectively under various thermal and kinetic loads. Moreover, the vast and fragmented global Aftermarket offers significant potential for growth through digitalization of distribution channels and the introduction of performance-enhancing upgrade kits. The Impact Forces driving market dynamics include continuous material science innovation, particularly in ceramics and lightweight composites, and the necessity for global suppliers to maintain dual product portfolios—one for traditional Internal Combustion Engine (ICE) vehicles and another for the rapidly evolving electric and autonomous vehicle platforms. The balance between cost, performance, and regulatory compliance dictates the pace of technological diffusion across all major geographic regions.

Segmentation Analysis

The Automotive Brakes and Clutches Market is meticulously segmented based on product type, vehicle application, sales channel, and technological implementation to provide a granular view of market dynamics and opportunity mapping. Understanding these segments is crucial for manufacturers to tailor their R&D and market entry strategies, addressing the specific performance requirements and regulatory landscapes pertinent to each category. The inherent safety criticality of these components means that material composition and manufacturing precision are key differentiating factors within each segment, influencing pricing and market share distribution.

Product segmentation reveals distinct trends, with disc brakes dominating new vehicle installations due to superior heat dissipation and performance, while drum brakes maintain strong relevance in rear axle applications for smaller passenger cars and specific commercial vehicles due to their cost-effectiveness. The fastest-growing sub-segment is Electronic Braking Systems (EBS), driven by global safety mandates. Clutch segmentation is shifting towards sophisticated multi-plate clutches and dual-clutch transmissions (DCTs) in performance and high-end vehicles, although traditional single-plate dry clutches remain the standard in manual economy cars and heavy-duty trucks, providing robust torque handling capabilities.

Segmentation by sales channel highlights the enduring significance of the OEM segment, which benefits from long-term supply agreements and precise component integration during vehicle design. However, the Aftermarket segment, covering repair, replacement, and upgrades, constitutes a vast and resilient revenue stream. Aftermarket players focus heavily on distribution efficiency, competitive pricing, and compliance with general quality standards, often requiring suppliers to manage two separate product lines optimized for volume and cost versus those prioritized for cutting-edge integration.

- Product Type:

- Brake Systems: Disc Brakes, Drum Brakes, Anti-lock Braking System (ABS), Electronic Stability Control (ESC), Electronic Brakeforce Distribution (EBD), Friction Materials (Pads, Linings).

- Clutch Systems: Clutch Plates, Pressure Plates, Flywheels (Single Mass, Dual Mass), Release Bearings, Clutch Actuation Systems (Hydraulic, Mechanical).

- Vehicle Type:

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Electric Vehicles (EVs) & Hybrids

- Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent Aftermarket, Dealer Networks)

- Technology:

- Hydraulic Braking Systems

- Pneumatic Braking Systems (primarily HCVs)

- Mechanical Systems

- Electric & Electro-Mechanical Braking Systems (Brake-by-Wire)

Value Chain Analysis For Automotive Brakes and Clutches Market

The value chain for the Automotive Brakes and Clutches Market is complex, involving multiple tiers of specialization, starting from raw material sourcing and culminating in vehicle assembly or end-user installation. The upstream analysis begins with the critical procurement of raw materials, which include specialized steels, cast iron, aluminum alloys, friction material compounds (ceramics, metallic fibers, organic resins), and hydraulic fluids. Tier 3 and Tier 2 suppliers focus heavily on standardizing these materials and processing them into basic components like castings, forgings, and specialized powders. The quality and stability of raw material pricing significantly affect the downstream manufacturing costs, especially for friction materials, which require highly specialized chemical formulations to meet stringent environmental and performance criteria.

The core manufacturing process, conducted by Tier 1 suppliers, involves precision machining, complex assembly, and integrating mechanical components with electronic modules (e.g., combining friction pads with caliper assemblies, or pressure plates with actuators). These Tier 1 entities, often large multinational corporations, invest heavily in automation and quality control to ensure components meet the exacting specifications of OEMs. This stage is crucial for innovation, particularly in developing lightweight materials and intelligent systems compliant with the demands of modern vehicle architectures. The integration of sensors and electronic controls into traditional mechanical parts represents a shift toward mechatronics, requiring specialized skill sets within the manufacturing phase.

Downstream analysis focuses on distribution and sales channels, primarily bifurcated between OEM integration and the global Aftermarket. For OEM sales, components are delivered directly to vehicle assembly lines on a just-in-time (JIT) basis, requiring robust logistics and tight inventory management. The Aftermarket utilizes extensive distribution networks, including authorized dealers, independent wholesalers, and increasingly, e-commerce platforms. This channel relies on effective inventory management across thousands of SKUs and competitive pricing strategies. Direct and indirect channels both play critical roles; OEMs primarily rely on highly integrated direct supply relationships, while the Aftermarket thrives on indirect distribution through specialized regional distributors who cater to garage owners and service centers, ensuring broad accessibility and prompt availability of replacement parts across diverse geographic territories.

Automotive Brakes and Clutches Market Potential Customers

The potential customer base for the Automotive Brakes and Clutches Market is broadly divided into three main segments: global Original Equipment Manufacturers (OEMs), the vast network of independent service providers and repair garages, and government agencies responsible for maintaining public transport and military fleets. OEMs, including major global automotive conglomerates such as Toyota, Volkswagen Group, General Motors, and Tata Motors, represent the largest volume buyers, purchasing components in bulk for integration into millions of new vehicles annually. Their purchasing criteria are primarily focused on system performance, cost efficiency, reliability, and the ability of suppliers to comply strictly with their quality assurance protocols and global supply chain requirements, necessitating extensive validation and testing processes before contract award.

The second substantial customer segment is the independent aftermarket network, encompassing regional distributors, large retail chains specializing in automotive parts (e.g., AutoZone, Halfords), and thousands of local repair workshops and independent garages. These buyers prioritize product availability, competitive unit cost, ease of installation, and perceived durability, as they serve the repair and maintenance needs of the existing global vehicle fleet. For this segment, brand recognition and the ability to offer a comprehensive product catalog covering diverse vehicle makes and models are critical determinants of supplier success. The demand here is cyclical, heavily influenced by maintenance schedules and the average age of vehicles in operation across various countries.

A growing and specialized customer segment includes manufacturers of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) providers, who require next-generation, high-redundancy, electro-mechanical braking systems. Furthermore, major logistics and transportation companies operating large fleets of commercial vehicles represent significant end-users, requiring robust, heavy-duty clutch and brake systems designed for extreme load and high-mileage use. These fleet customers prioritize total cost of ownership (TCO), fuel efficiency gains, and component longevity, often favoring suppliers who can provide integrated telematics and predictive maintenance services alongside their hardware components. Government agencies and specialized vehicle builders (military, emergency services) also form a niche market demanding high-specification, often customized, components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 49.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, ZF Friedrichshafen AG (TRW Automotive), Continental AG, Brembo S.p.A., Aisin Corporation, BorgWarner Inc., Schaeffler AG, Valeo SA, FTE automotive (now part of Valeo), Nissin Kogyo Co., Ltd., Akebono Brake Industry Co., Ltd., Mando Corporation, WABCO Holdings Inc. (now ZF), Knorr-Bremse AG, Tenneco Inc., Clutch Masters, Exedy Corporation, AP Racing, EBC Brakes, Federal-Mogul LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Brakes and Clutches Market Key Technology Landscape

The technology landscape of the Automotive Brakes and Clutches Market is currently undergoing profound transformation, driven primarily by electrification and the push towards autonomous functionality. Traditional hydraulic braking systems, while remaining dominant in conventional vehicles, are being rapidly complemented and, in some cases, replaced by electro-mechanical systems, commonly referred to as Brake-by-Wire (BBW). BBW systems replace the direct hydraulic connection between the brake pedal and the wheel brakes with sensors and actuators controlled electronically by a central ECU. This technology is vital for autonomous vehicles as it provides superior response time, allows for precise electronic control necessary for ADAS functions like lane keeping and automatic emergency braking, and integrates seamlessly with regenerative braking to maximize energy recovery in EVs, thereby extending battery range significantly.

In clutch technology, the focus remains on efficiency and enhanced driver comfort, leading to the proliferation of Dual-Clutch Transmissions (DCTs) and highly optimized Automated Manual Transmissions (AMTs). DCTs provide the efficiency of a manual gearbox combined with the operational ease of an automatic, utilizing two separate clutches for odd and even gears to pre-select the next gear, minimizing torque interruption. Furthermore, the rising demand for lightweight components has fueled material science innovations. Manufacturers are utilizing high-strength composite materials, particularly carbon fiber and advanced ceramics, in friction materials and disc rotors. These materials offer reduced unsprung mass, superior heat resistance, and extended service life, which are essential for high-performance and heavy-duty applications where thermal stability is critical to safety.

Another crucial technological development involves integrated stability control platforms. Modern braking systems are no longer isolated but are inherently connected to the vehicle's dynamic control software. Technologies like Electronic Stability Control (ESC) and Traction Control Systems (TCS) utilize complex algorithms to selectively apply individual brakes to mitigate skidding or wheel spin. Looking forward, the application of sensors within the brake and clutch assemblies for real-time diagnostics and condition monitoring is becoming standard. These integrated sensors collect data on temperature, wear, and vibration, feeding into vehicle telematics systems to enable AI-driven predictive maintenance, improving reliability and operational efficiency for both passenger and commercial vehicle fleets.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily fueled by high volume vehicle production in China, which leads both the conventional and EV markets, and robust manufacturing growth in India and Southeast Asian nations. Regulatory harmonization and rising safety consciousness are driving the mandatory fitment of advanced braking systems like ABS and ESC, transitioning the market from basic mechanical components to electronically controlled assemblies. The region is characterized by a high demand for cost-effective aftermarket components due to the enormous and diverse existing vehicle parc.

- Europe: Europe is a highly mature market characterized by stringent safety and environmental regulations, pushing the adoption of premium and advanced technologies. The region is a pioneer in brake-by-wire and regenerative braking systems, driven by the massive push toward vehicle electrification and demanding Euro NCAP safety standards. European OEMs prioritize suppliers who can deliver lightweight, high-performance braking components (including carbon-ceramic options) and highly efficient DCT systems to meet demanding performance specifications and fuel economy targets.

- North America: This region is defined by strong demand for large passenger vehicles and light trucks, necessitating robust braking systems capable of handling significant loads. North America is a key adopter of advanced safety features and ADAS integration, driving demand for intelligent braking solutions and high-quality friction materials. The Aftermarket segment is exceptionally strong here, supported by an established distribution network and consumer preference for do-it-yourself (DIY) repairs or authorized dealer services, ensuring continuous high volume demand for replacement parts.

- Latin America (LATAM): LATAM is an emerging market with slower adoption rates of high-end technologies, although regulatory changes are beginning to mandate basic electronic safety features (like ABS). The market is highly price-sensitive, leading to a strong preference for cost-effective, durable components in both the OEM and Aftermarket segments. Brazil and Mexico are the regional production hubs, acting as key centers for component manufacturing and assembly, focusing primarily on components for compact and light commercial vehicles.

- Middle East and Africa (MEA): MEA presents a mixed market environment. The Gulf Cooperation Council (GCC) countries show high demand for high-performance and luxury vehicle components, similar to Europe and North America. In contrast, the African continent relies heavily on the importation of low-cost components for older vehicle fleets. The primary growth driver in the MEA region is infrastructure development and fleet modernization, generating steady demand for heavy-duty commercial vehicle brakes and clutch systems, although challenges related to counterfeiting persist, particularly in the aftermarket.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Brakes and Clutches Market.- Robert Bosch GmbH

- ZF Friedrichshafen AG (TRW Automotive)

- Continental AG

- Brembo S.p.A.

- Aisin Corporation

- BorgWarner Inc.

- Schaeffler AG

- Valeo SA

- FTE automotive (now part of Valeo)

- Nissin Kogyo Co., Ltd.

- Akebono Brake Industry Co., Ltd.

- Mando Corporation

- WABCO Holdings Inc. (now ZF)

- Knorr-Bremse AG

- Tenneco Inc.

- Clutch Masters

- Exedy Corporation

- AP Racing

- EBC Brakes

- Federal-Mogul LLC

Frequently Asked Questions

How is vehicle electrification impacting demand for traditional clutch systems?

The shift towards Battery Electric Vehicles (BEVs) significantly reduces the demand for traditional multi-speed transmission clutch systems, as BEVs typically utilize single-speed reduction gearboxes. However, the demand for specialized clutches remains stable or increases within the Hybrid Electric Vehicle (HEV) and Plug-in Hybrid Electric Vehicle (PHEV) segments, where clutches are vital for managing power flow between the engine, motor, and transmission systems.

What is the main driver behind the adoption of Brake-by-Wire technology?

The main driver for Brake-by-Wire (BBW) adoption is the necessity for seamless integration with Advanced Driver-Assistance Systems (ADAS) and autonomous driving platforms. BBW systems provide the electronic precision and high-speed responsiveness required for AI to execute instantaneous, nuanced brake control, optimizing both safety functions (like emergency braking) and regenerative energy recovery in electric vehicles.

Which geographic region exhibits the highest growth rate for automotive brake and clutch components?

The Asia Pacific (APAC) region, driven primarily by the sustained high volume of vehicle manufacturing and increasing regulatory enforcement of safety standards in markets like China and India, consistently registers the highest growth rate for both OEM and aftermarket automotive brake and clutch components globally.

What material innovation is critical for the future of braking systems?

The most critical material innovation involves advanced lightweight composites, including specialized ceramics and carbon materials, used in friction pads and rotors. These materials improve thermal management, reduce component weight (contributing to better fuel efficiency/range), and offer extended durability, crucial for high-performance vehicles and heavy commercial applications.

Do stringent safety regulations primarily affect the OEM or the Aftermarket segment?

Stringent safety regulations primarily impact the Original Equipment Manufacturer (OEM) segment, dictating the minimum technological specifications (e.g., mandatory ABS/ESC fitment) for new vehicles. However, these regulations have a secondary, long-term effect on the Aftermarket by gradually increasing the complexity and quality requirements for replacement components over time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager