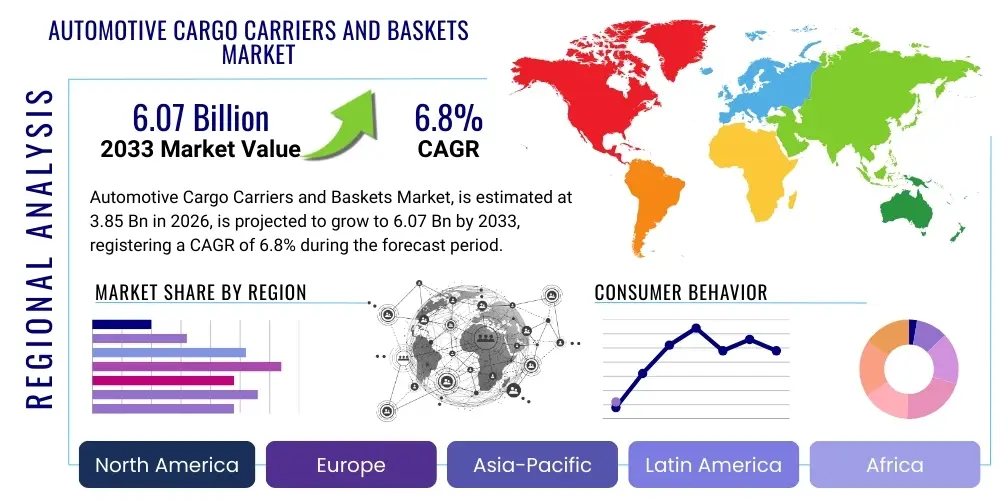

Automotive Cargo Carriers and Baskets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443501 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Cargo Carriers and Baskets Market Size

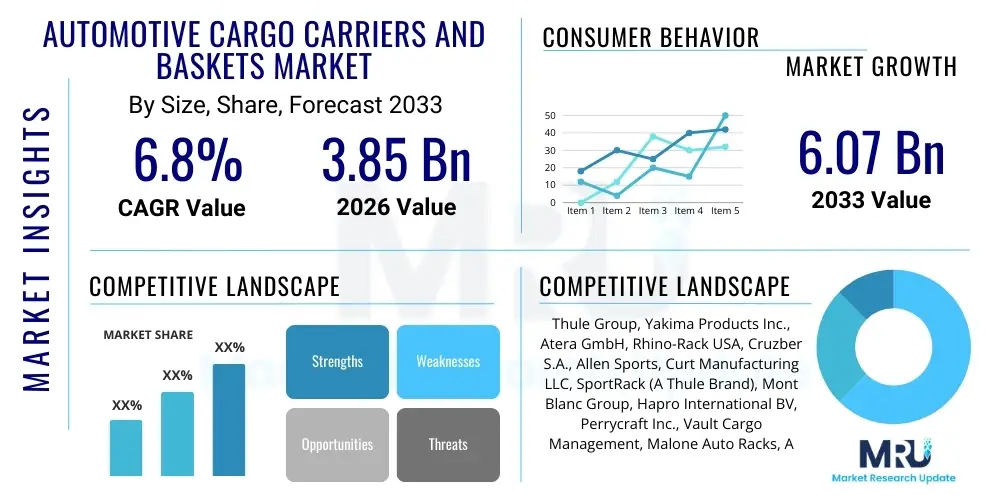

The Automotive Cargo Carriers and Baskets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.85 Billion in 2026 and is projected to reach USD 6.07 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the burgeoning popularity of outdoor recreational activities, an increase in vehicle ownership globally, especially SUVs and Crossovers, and the expanding aftermarket sector which focuses heavily on vehicle personalization and utility enhancement. The shift towards weekend getaways and domestic tourism, often requiring additional storage capacity beyond the vehicle’s interior space, solidifies the sustained demand for robust and aerodynamic cargo solutions. Furthermore, advancements in material science, leading to lighter yet stronger carriers, are improving fuel efficiency and contributing positively to market expansion, making these accessories more appealing to environmentally conscious consumers.

Automotive Cargo Carriers and Baskets Market introduction

The Automotive Cargo Carriers and Baskets Market encompasses a broad range of exterior and interior vehicle accessories designed to enhance the luggage capacity and utility of passenger vehicles, including roof boxes, roof racks, hitch-mounted carriers, and specialized cargo baskets. These products cater primarily to individuals and families requiring supplementary storage for travel, sports equipment (skis, bikes), camping gear, or commercial purposes. The primary driver of this market is the increasing consumer inclination towards active, outdoor lifestyles and the corresponding rise in demand for SUVs and light trucks, vehicles often customized for adventure travel. Benefits derived from utilizing these systems include optimized space utilization, secure transportation of bulky or awkwardly shaped items, and protection of interior vehicle space from dirt and damage. Technological advancements, such as improved aerodynamic designs to minimize drag and the integration of quick-mount systems for ease of installation, are continually pushing product innovation, ensuring market vitality and sustained interest among vehicle owners seeking enhanced functional capabilities from their automobiles. The necessity of transporting large equipment safely and efficiently positions cargo carriers and baskets as essential aftermarket enhancements.

Automotive Cargo Carriers and Baskets Market Executive Summary

The global Automotive Cargo Carriers and Baskets Market is characterized by robust business trends driven by significant aftermarket growth, a focus on material innovation, and intense competition among key players specializing in recreational vehicle accessories. Regional trends indicate that North America and Europe currently dominate the market due to high disposable incomes, deeply ingrained outdoor recreation cultures, and a large installed base of suitable vehicles, particularly large SUVs and trucks. However, the Asia Pacific region is rapidly emerging as a high-growth area, spurred by urbanization, rising middle-class spending power, and increasing sales of compact and mid-sized SUVs in developing economies like China and India, prompting manufacturers to localize production and distribution strategies. Segment trends reveal that roof box carriers maintain the largest revenue share owing to their security and weather resistance, while hitch-mounted carriers are experiencing the fastest growth, favored for their easy accessibility and minimal impact on vehicle aerodynamics and roof clearance. The material segment is witnessing a significant shift towards high-strength, lightweight plastics and composites, moving away from traditional heavy metals, aligning with global automotive trends emphasizing weight reduction for better fuel economy and electric vehicle efficiency. Strategic mergers and acquisitions focused on expanding geographic reach and enhancing product portfolios are defining the competitive landscape, compelling market participants to invest heavily in design patents and rigorous testing protocols to ensure product safety and compliance with varied international standards.

AI Impact Analysis on Automotive Cargo Carriers and Baskets Market

User queries regarding the influence of Artificial Intelligence (AI) in the Automotive Cargo Carriers and Baskets market frequently center on how AI can optimize product design, streamline supply chain logistics, and enhance the consumer purchasing experience. Common concerns revolve around the integration of smart features into carriers, such as sensors for load monitoring or connectivity with vehicle telematics systems, and the application of machine learning (ML) for demand forecasting and inventory management, particularly in the complex aftermarket distribution network. Users are keen to understand how AI-driven design algorithms can improve the aerodynamic profiles of carriers, reducing fuel consumption, and how personalized recommendations based on vehicle type, usage patterns, and geographic location can be leveraged to guide consumers toward the optimal cargo solution. The key themes highlight expectations for increased efficiency in manufacturing through predictive maintenance, enhanced customer service via AI chatbots for technical support, and the utilization of visual AI for quality control during the production process, thereby ensuring higher product reliability and safety standards crucial for exterior vehicle accessories.

- AI-driven optimization of aerodynamic design minimizes drag coefficient, enhancing vehicle efficiency, a critical factor for both combustion and electric vehicles.

- Machine Learning (ML) algorithms facilitate predictive demand forecasting, optimizing inventory levels for diverse carrier types across global distribution channels, reducing warehousing costs and stockouts.

- AI-powered visual inspection systems enhance manufacturing quality control, automatically detecting structural defects in materials or assembly during production.

- Personalized recommendation engines utilize customer purchase history and vehicle specifications (make, model, year) to suggest compatible and appropriate cargo solutions, improving conversion rates.

- Integration of smart sensors with ML allows for real-time monitoring of load weight and distribution, providing safety alerts to the driver via vehicle infotainment systems.

DRO & Impact Forces Of Automotive Cargo Carriers and Baskets Market

The Automotive Cargo Carriers and Baskets Market growth is significantly propelled by the increasing consumer embrace of outdoor activities and the accompanying surge in ownership of Sports Utility Vehicles (SUVs) and Crossovers, which inherently lend themselves well to accessory customization and extra storage capacity. Conversely, stringent regulatory standards, particularly concerning vehicle safety, roof load limits, and aerodynamic testing for accessory attachment, act as notable restraints, forcing manufacturers to adhere to complex and expensive certification processes. Opportunities abound in the burgeoning electrification of the automotive industry, where lightweight carrier solutions that minimize impact on battery range are highly sought after, presenting a niche for advanced material integration. The primary impact force driving current market dynamics is technological innovation, specifically the development of modular and multipurpose carrier systems that offer superior flexibility and rapid installation mechanisms, thereby overcoming historical barriers related to complexity and storage when the carrier is not in use. Furthermore, the robust growth of the e-commerce distribution channel is transforming how consumers research and purchase these accessories, impacting traditional automotive retail outlets and increasing direct-to-consumer sales, compelling established brands to optimize their digital presence and logistics networks to maintain competitive advantage in a rapidly evolving retail landscape.

Segmentation Analysis

The Automotive Cargo Carriers and Baskets market is intricately segmented based on product type, material composition, vehicle compatibility, and distribution channel, reflecting the diverse needs of end-users ranging from recreational enthusiasts to commercial fleet operators. Analyzing these segments provides crucial insights into market trends, growth opportunities, and areas of strategic focus for market participants. The segmentation by Product Type, differentiating between roof boxes, roof racks, and hitch carriers, highlights varying consumer preferences regarding security, accessibility, and aerodynamic efficiency. Material-based segmentation, contrasting steel, aluminum, and advanced plastics, indicates the industry's drive towards lighter, more durable, and corrosion-resistant solutions, critical for market expansion in diverse climatic conditions and for enhancing the overall performance characteristics of the attached systems. Furthermore, the distinction between vehicle types serviced, such as passenger cars, SUVs, and light trucks, allows manufacturers to tailor product sizes and mounting methodologies, ensuring seamless integration and adherence to OEM specifications. The evolution of the e-commerce distribution channel fundamentally impacts market reach, providing consumers globally with direct access to specialized products and detailed product information, thereby circumventing traditional retail limitations and fostering a more competitive pricing environment across all segmented product categories.

- By Product Type: Roof Boxes (Cargo Boxes), Roof Racks (Base Racks/Crossbars), Hitch-Mounted Carriers, Cargo Bags/Baskets.

- By Material: Steel, Aluminum, Plastics/Composites (ABS, High-Density Polyethylene), Combination Materials.

- By Vehicle Type: Passenger Cars, SUVs/Crossovers, Light Commercial Vehicles (LCVs)/Pickup Trucks.

- By Distribution Channel: OEM (Original Equipment Manufacturer), Aftermarket (Online Retail, Specialty Stores, Automotive Parts Stores).

Value Chain Analysis For Automotive Cargo Carriers and Baskets Market

The value chain for the Automotive Cargo Carriers and Baskets Market begins with upstream activities, primarily involving the sourcing and processing of raw materials such as high-grade aluminum alloys, structural steel, and specialized engineering plastics (like ABS and HDPE). Key considerations at this stage include cost fluctuations of petroleum-derived polymers and metals, along with maintaining stringent material quality standards necessary for exterior automotive accessories subjected to harsh weather and dynamic stresses. Component manufacturing and assembly follow, where specialized processes like injection molding, metal stamping, and welding are executed to produce locking mechanisms, mounting hardware, and the main body components of the carriers. This manufacturing stage is critical for ensuring product structural integrity, aerodynamic efficiency, and compatibility with a wide range of vehicle models, demanding high precision and adherence to safety certifications from regulatory bodies globally. Downstream analysis focuses primarily on the diverse and complex distribution channels utilized, which involve both direct sales to Original Equipment Manufacturers (OEMs) for factory integration or authorized accessory programs, and the robust aftermarket segment.

The distribution ecosystem is segmented into direct channels, typically involving large manufacturers selling directly to major retailers, specialized recreational vehicle stores, and increasingly, through dedicated brand e-commerce platforms, offering greater control over pricing and brand message. Indirect channels encompass traditional wholesalers, regional distributors, and third-party online marketplaces such as Amazon and eBay, which provide extensive market coverage and convenience for the end consumer but introduce more complexity in managing inventory and maintaining pricing consistency across numerous sales points. The rise of digital marketplaces has dramatically altered the competitive landscape, necessitating significant investment in digital marketing and warehousing efficiency to meet rapid fulfillment demands. Furthermore, installation and post-sale support, whether provided by professional installers at automotive garages or through detailed self-installation guides, form a crucial final step in the value chain, directly impacting customer satisfaction and brand loyalty in this utility-driven market. Effective value chain management, particularly optimizing logistics from overseas manufacturing facilities to regional warehouses, is paramount to mitigating costs and maintaining competitive advantage in a market increasingly sensitive to supply chain disruptions and expedited delivery expectations.

Automotive Cargo Carriers and Baskets Market Potential Customers

The primary end-users and potential buyers of Automotive Cargo Carriers and Baskets are overwhelmingly comprised of recreational users and active lifestyle consumers who require expanded storage capacity beyond what their standard vehicle offers to accommodate equipment for activities such as skiing, cycling, camping, and extended road trips. This demographic is characterized by high engagement in outdoor pursuits, a propensity to own SUVs or larger family vehicles, and a willingness to invest in premium accessories that enhance travel convenience and safeguard valuable gear. A significant sub-segment of potential customers includes families undertaking long-distance vacations or requiring transport solutions for bulk items, positioning convenience, ease of installation, and secure locking mechanisms as paramount purchasing criteria. Furthermore, small to medium-sized commercial enterprises, including construction contractors, delivery services, and mobile technicians utilizing light commercial vehicles, represent a secondary but substantial customer base. These commercial users prioritize durability, high weight capacity, and ease of access offered particularly by heavy-duty cargo baskets and utility racks, viewing these products as necessary tools for daily operational efficiency rather than merely lifestyle enhancements.

The purchasing decisions across these diverse customer segments are influenced by factors such as vehicle compatibility, brand reputation for safety and quality, aesthetic integration with the vehicle design, and the overall perceived value of the system in relation to the frequency of use. For the growing market of electric vehicle (EV) owners, the selection criterion is highly focused on aerodynamic efficiency and minimal weight, as these factors directly impact the vehicle's driving range and charging frequency, pushing demand toward lightweight composite materials and sleek, low-profile designs. Distribution channels also heavily influence customer acquisition, with younger, digitally savvy consumers often preferring the detailed research and competitive pricing available through specialized online retailers, while older, brand-loyal customers may still rely on professional advice and installation services offered by traditional brick-and-mortar automotive parts and accessory stores. Manufacturers are increasingly targeting specific niche markets, such as overlanding enthusiasts and specialized sports teams, by developing ultra-rugged and highly modular carrier systems capable of handling extreme loads and conditions, ensuring market penetration across the full spectrum of potential customer needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.85 Billion |

| Market Forecast in 2033 | USD 6.07 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thule Group, Yakima Products Inc., Atera GmbH, Rhino-Rack USA, Cruzber S.A., Allen Sports, Curt Manufacturing LLC, SportRack (A Thule Brand), Mont Blanc Group, Hapro International BV, Perrycraft Inc., Vault Cargo Management, Malone Auto Racks, ARB Corporation, Rola, Swagman Racks, Whispbar. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Cargo Carriers and Baskets Market Key Technology Landscape

The technological landscape of the Automotive Cargo Carriers and Baskets market is continuously evolving, driven primarily by the need for enhanced safety, improved fuel efficiency through aerodynamics, and greater user convenience in installation and functionality. A major area of technological advancement is material science, where manufacturers are increasingly leveraging advanced composite materials, reinforced plastics, and lightweight aluminum alloys to significantly reduce the overall weight of the carriers. This reduction is crucial not only for easing user handling and installation but also for minimizing the impact on vehicle performance, a factor of paramount importance for the rapidly growing segment of electric vehicles where minimizing weight directly translates to maximizing driving range. Furthermore, the development of specialized polymer coatings and UV stabilizers ensures high durability and resistance against corrosion and fading, extending the product lifespan and maintaining aesthetic appeal even under prolonged exposure to harsh environmental conditions. The ongoing pursuit of material innovation aims to strike an optimal balance between low weight, high structural strength, and cost-effectiveness, critical factors determining market competitiveness.

Another pivotal technological focus is on the mechanism and design of attachment systems. Quick-release and tool-free mounting systems, utilizing sophisticated clamping and locking mechanisms, have become standard features, drastically simplifying the installation and removal process for the average consumer, addressing a historical pain point associated with traditional rack systems. Aerodynamic optimization represents a third key area; manufacturers are employing sophisticated computational fluid dynamics (CFD) analysis during the design phase to sculpt carriers and racks that minimize air resistance and wind noise. This focus has led to the development of low-profile, sleek roof boxes and specialized wing-shaped crossbars (often referred to as 'aero-bars') that reduce drag, thereby mitigating the negative effect on fuel economy or EV range. Beyond mechanical and material advancements, the early integration of smart technology is also beginning to surface. This includes carriers with integrated LED lighting for enhanced visibility and safety, especially with hitch-mounted systems obscuring vehicle taillights, and the potential for embedded sensors capable of communicating load status or confirming secure attachment to the vehicle's onboard telematics systems, further enhancing the safety and user experience of these essential automotive accessories.

Regional Highlights

- North America: North America holds a dominant position in the global Automotive Cargo Carriers and Baskets Market, characterized by high consumer spending power and a strong cultural affinity for large vehicles (SUVs, pickup trucks) and extensive outdoor recreational activities such, as camping, biking, and off-roading. The U.S. and Canada represent mature markets with high penetration rates for both OEM and aftermarket cargo solutions. Demand is consistently high for robust, high-capacity roof boxes and hitch carriers, driven by frequent long-distance travel and severe weather conditions requiring durable, weather-proof storage. The market here is also characterized by rapid adoption of premium, aerodynamic, and feature-rich products from established international and domestic brands, emphasizing quality, stringent safety certifications, and aesthetic vehicle integration.

- Europe: Europe represents a significant and highly competitive market, distinguished by a strong focus on design aesthetics, regulatory compliance (especially concerning road safety and vehicle dimensions), and environmental considerations. Countries like Germany, France, and Scandinavia show high demand for high-end roof boxes and sleek, low-profile racks, reflecting the popularity of winter sports (skiing) and regulated vehicle usage in dense urban environments where minimizing vehicle height is often critical. The push towards electric vehicles in Europe is accelerating demand for extremely lightweight and highly aerodynamic carrier systems to preserve battery efficiency. Furthermore, strict testing requirements, such as TÜV certification, necessitate continuous investment in quality assurance and material engineering among key European manufacturers.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market segment during the forecast period, driven by the rapid urbanization, increasing disposable incomes, and the corresponding growth in the sales of mid-sized SUVs and compact cars, particularly in emerging economies like China, India, and Southeast Asia. While traditional passenger cars still form a large portion of the fleet, the rising aspirational middle class is increasingly engaging in leisure travel and outdoor activities, boosting the necessity for supplementary storage solutions. The market here is characterized by a strong mix of high-quality international brands and competitively priced localized products. Distribution channels are rapidly shifting towards e-commerce platforms, offering manufacturers a cost-effective way to reach a dispersed and geographically diverse consumer base across the region, focusing on accessibility and value for money.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are characterized by nascent but developing markets for automotive cargo carriers, primarily driven by commercial applications (LCVs) and the growing popularity of off-road and adventure travel, particularly in areas with challenging road infrastructure. Growth is steady but heavily influenced by economic stability and import duties, impacting the final cost of premium products. Demand often leans toward durable, basic cargo baskets and utilitarian roof racks designed for heavy-duty use and rugged conditions. The penetration of local manufacturing is lower, leading to higher reliance on imported products, but regional assembly partnerships are gradually emerging to address logistics challenges and improve supply chain responsiveness to local market demands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Cargo Carriers and Baskets Market.- Thule Group

- Yakima Products Inc.

- Atera GmbH

- Rhino-Rack USA

- Cruzber S.A.

- Allen Sports

- Curt Manufacturing LLC

- SportRack (A Thule Brand)

- Mont Blanc Group

- Hapro International BV

- Perrycraft Inc.

- Vault Cargo Management

- Malone Auto Racks

- ARB Corporation

- Rola

- Swagman Racks

- Whispbar

- ProRac Systems

- Buyers Products Company

- Kuang Yu Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Cargo Carriers and Baskets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Automotive Cargo Carriers market?

The primary factor driving growth is the increasing participation in outdoor recreational and sports activities globally, coupled with the rising consumer preference for spacious vehicles like SUVs and Crossovers, which are compatible with various supplementary storage accessories.

Which type of cargo carrier currently holds the largest market share?

Roof boxes (or cargo boxes) typically hold the largest revenue share due to their superior protection against weather elements, enhanced security features, and capacity for large, non-standard items like skis and camping gear, making them a preferred solution for extended family travel.

How is the shift towards Electric Vehicles (EVs) impacting carrier design and demand?

The shift towards EVs is intensifying the demand for ultra-lightweight and highly aerodynamic carrier solutions. Manufacturers are focusing on advanced composites and low-profile designs to minimize weight and air resistance, crucial factors for preserving the EV's battery range and overall efficiency.

Which geographical region is anticipated to demonstrate the fastest market growth?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by rapid economic development, increasing disposable income among the middle class, growing sales of mid-sized utility vehicles, and expanding engagement in domestic tourism and leisure activities.

What are the key materials used in manufacturing modern cargo carriers?

Modern cargo carriers are primarily constructed using high-strength, lightweight materials including aluminum alloys (for racks), specialized engineering plastics such as ABS and HDPE (for boxes), and reinforced composite materials, selected for their durability, corrosion resistance, and reduced weight.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager