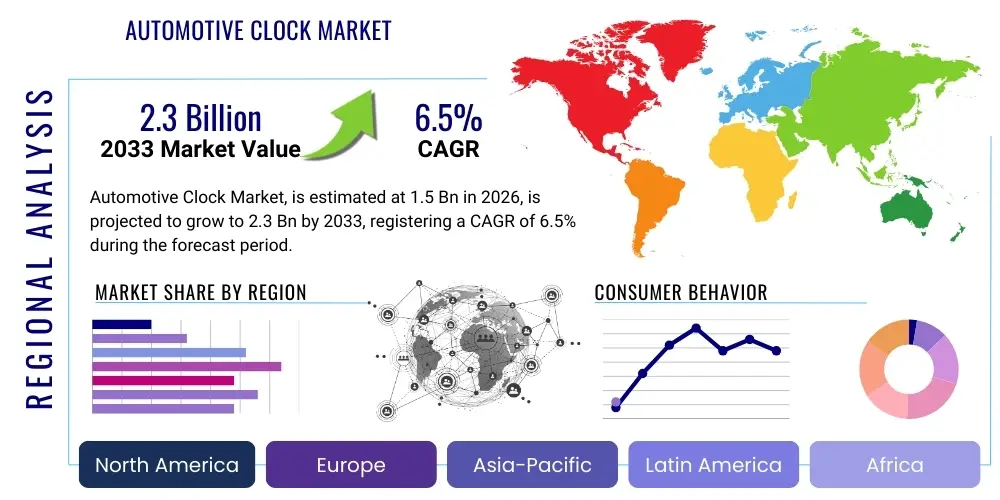

Automotive Clock Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442243 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Automotive Clock Market Size

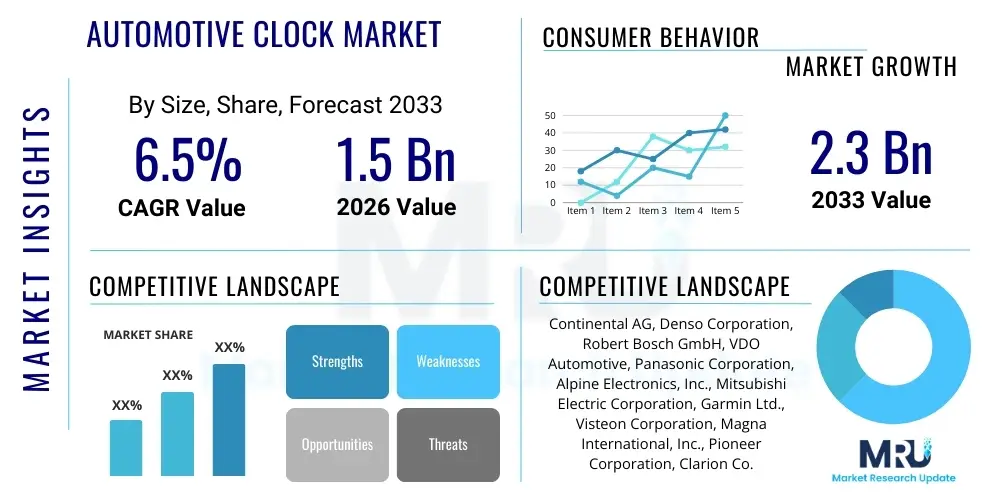

The Automotive Clock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.5 Billion USD in 2026 and is projected to reach $2.3 Billion USD by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating trend toward vehicle digitalization and the integration of sophisticated Human-Machine Interface (HMI) systems in modern automobiles. As consumer expectations shift toward personalized, high-resolution digital cockpits, the basic function of timekeeping is being transformed into a key component of the overall vehicle informatics system, driving up the average selling price and market volume.

Market expansion is significantly underpinned by the increasing global production of passenger and commercial vehicles, especially in emerging economies across Asia Pacific. Furthermore, the mandatory implementation of advanced safety features and the proliferation of connected vehicle technologies necessitate precise and reliable time synchronization across various electronic control units (ECUs). This dependency on accurate time data, sourced either via embedded GPS or network time protocol (NTP) synchronized systems, ensures that automotive clocks evolve from simple dashboard accessories into critical elements of vehicle communication architecture, contributing substantially to the market valuation increase throughout the forecast years.

Technological advancements, particularly the shift from traditional analog clocks to sophisticated digital displays utilizing TFT or OLED technology, are central to the projected market size increase. These modern displays offer enhanced aesthetic appeal, greater functional integration, and the ability to display contextual information beyond mere time, such as navigation prompts or vehicle status alerts. Consequently, Tier 1 suppliers are investing heavily in miniaturization, power efficiency, and seamless integration capabilities, positioning the automotive clock as an integral part of the evolving digital cabin concept, thereby solidifying the forecasted market capitalization by 2033.

Automotive Clock Market introduction

The Automotive Clock Market encompasses the manufacturing, distribution, and integration of devices designed to provide time display and synchronization within passenger and commercial vehicles. Historically, these were mechanical or quartz-based analog devices, but the modern market is dominated by digital clocks integrated into central infotainment systems, instrument clusters, or specialized display panels. Key products range from simple, dedicated digital modules to complex, highly customizable software-driven time displays that are essential components of the vehicle's electronic architecture. These clocks serve fundamental purposes including maintaining accurate time for driver convenience, timestamping critical data for logging and diagnostics, and ensuring synchronization across various vehicle systems like navigation, telematics, and advanced driver assistance systems (ADAS).

Major applications for contemporary automotive clocks extend far beyond basic time display; they are crucial elements in complex vehicle operations. For instance, in connected car environments, accurate time stamping is vital for communicating with external networks (V2X communication), verifying secure transactions, and performing over-the-air (OTA) software updates. The primary benefits derived from high-quality automotive clocks include enhanced driver experience through clear, integrated displays; improved system reliability via precise synchronization; and support for regulatory compliance that often requires robust data logging capabilities tied to accurate time references. The transition to higher quality displays and the emphasis on design integration within the digital cockpit are driving factors shaping the market.

Driving factors propelling market growth include the rising global penetration of digital cockpits, where the clock function is intrinsically linked to larger, integrated screen experiences. Furthermore, the surging production of electric vehicles (EVs) and autonomous vehicles (AVs) demands extremely high levels of system synchronization and reliability, mandating advanced clock solutions that utilize satellite time references (GPS/GNSS) for unparalleled accuracy. Regulatory pressures emphasizing vehicle safety and data logging standards also contribute to the necessity for robust, secure, and accurate timekeeping modules, ensuring sustained demand across all vehicle segments globally.

Automotive Clock Market Executive Summary

The Automotive Clock Market is experiencing a fundamental transition driven by technological disruption and shifting consumer preferences toward digital interfaces. Business trends indicate a strong move by major suppliers, including Continental and Denso, toward developing highly flexible, scalable clock software solutions integrated into centralized domain controllers rather than standalone hardware components. Key strategic initiatives focus on miniaturization, enhancing display quality (OLED becoming prominent in high-end segments), and ensuring seamless integration with vehicle operating systems such as Android Automotive. Manufacturers are prioritizing solutions that offer customizable aesthetics and personalization features, reflecting the vehicle's overall brand identity and the driver's specific preferences, thereby increasing software complexity and value within the hardware component.

Regional trends highlight the Asia Pacific (APAC) region as the dominant force in terms of volume, led by massive production bases in China, Japan, and South Korea, which are rapidly adopting advanced digital cockpits, often driven by competitive pricing and rapid technology integration cycles. North America and Europe, while having lower unit volumes, lead in value due to the high penetration of premium vehicles that demand sophisticated features like highly accurate GPS-synchronized clocks and integrated luxury designs. Strict European regulations regarding data security and time accuracy for telematics systems also ensure sustained high-value component demand in that region, contrasting with APAC's volume-driven growth.

Segment trends underscore the clear dominance and forecasted rapid expansion of the Digital Clock segment over traditional Analog clocks, correlating directly with the adoption rate of digital instrument clusters and central infotainment displays. Furthermore, within the application segments, the Passenger Vehicle category maintains the largest market share due to higher production volumes and greater consumer demand for advanced HMI features. However, the Commercial Vehicle segment is projected to exhibit steady growth, driven by increasing regulatory requirements for fleet management, mandatory telematics integration, and the need for reliable time synchronization for logistics and route optimization applications.

AI Impact Analysis on Automotive Clock Market

User inquiries regarding AI's influence on the automotive clock market frequently center on how machine learning can enhance the functionality beyond passive time display. Common questions revolve around predictive time adjustments (e.g., automatically compensating for time zone changes based on predicted routes), personalized time display formats linked to driver recognition, and the integration of real-time time-based operational data into predictive maintenance schedules. Key concerns include data latency, the reliability of AI-driven synchronization methods, and how embedded AI might contribute to a more context-aware cockpit experience. Users expect AI to transform the clock from a simple timer into an intelligent component that dynamically manages and presents time relative to the vehicle's immediate operational context and the driver's behavioral patterns, minimizing distraction and maximizing utility.

The core theme summarizing user expectations is the shift toward intelligence embedded within the timing system. Instead of merely displaying time, AI algorithms are expected to analyze vehicle usage patterns, route data, and external inputs (like traffic flow or weather) to optimize time-related functions. For instance, AI could be used to prioritize clock display visibility based on driving complexity or integrate time data seamlessly into complex multimodal interfaces. This evolution signifies a move toward a 'smart time manager' within the vehicle ecosystem, ensuring that timing information is always relevant, contextually appropriate, and contributing to overall system safety and operational efficiency.

Furthermore, the integration of AI influences the design and testing of highly accurate clock systems. AI models can predict potential synchronization drifts or hardware failures based on environmental factors or voltage fluctuations, enabling proactive diagnostic alerts before critical timing errors occur. This application of predictive analytics significantly improves the reliability and longevity of automotive timing components. As autonomous driving systems rely heavily on microsecond accuracy for sensor fusion and decision-making, AI ensures the absolute stability and trustworthiness of the vehicle's internal time reference system, positioning the clock module as a sophisticated, mission-critical computing element.

- AI enables personalized clock interface design based on driver profiles and driving conditions.

- Predictive maintenance schedules utilize AI-analyzed timestamped operational data for component lifespan estimation.

- Advanced synchronization algorithms use machine learning to mitigate signal interference and ensure ultra-high timing accuracy (crucial for ADAS/AV).

- Integration with voice assistants allows for context-aware time management and scheduling reminders based on real-time location.

- AI facilitates dynamic adjustment of time zone and daylight saving changes based on navigation data without manual input.

- Optimized power management for clock modules using AI to reduce energy consumption during vehicle standby states.

DRO & Impact Forces Of Automotive Clock Market

The dynamics of the Automotive Clock Market are governed by a complex interplay of internal technological advancements and external market pressures. Key drivers include the pervasive trend of automotive digitalization, necessitating robust and highly accurate time synchronization components for integrated electronic systems, particularly infotainment and ADAS modules. Coupled with this is the opportunity presented by the rapid expansion of the electric vehicle sector, which requires specialized, highly efficient clock systems optimized for low power consumption and reliable operation within high electromagnetic interference (EMI) environments. Restraints, however, temper this growth, primarily concerning the high initial investment required for adopting advanced display technologies like OLEDs and the persistent global volatility in the semiconductor supply chain, impacting the reliable production of crucial clock synchronization chips.

The primary impact forces include regulatory mandates, specifically those governing vehicle safety and data recording (e.g., Event Data Recorders, EDRs), which necessitate extremely reliable and accurate internal clocks for forensic and diagnostic purposes. Competition among Tier 1 suppliers to provide vertically integrated cockpit solutions forces innovation, making the clock function a feature rather than a separate component, thereby intensifying the speed of technological integration. Market opportunities are abundant in customizing the HMI experience, allowing automotive clocks to serve as highly integrated, aesthetically pleasing, and functionally rich elements of the dashboard, moving away from purely utilitarian devices to high-design components.

Therefore, the market equilibrium is maintained by the need for cost-effective mass production (restraint) versus the technological imperative for ultra-accurate, highly integrated systems (driver). The long-term trajectory suggests that the benefits of sophisticated time synchronization for vehicle performance, security, and connectivity will outweigh the short-term supply chain challenges and initial investment hurdles. Success in this market relies on suppliers' ability to deliver scalable, reliable, and aesthetically integrated clock solutions that meet rigorous OEM standards for both functionality and digital cockpit design coherence.

Segmentation Analysis

The Automotive Clock Market is comprehensively segmented based on product type, vehicle type, and distribution channel, providing crucial insights into market dynamics and growth potential across various categories. The segmentation by type differentiates between Analog and Digital clocks, reflecting the ongoing technological migration within the automotive industry. Analog clocks, though decreasing in market share, maintain niche presence in luxury and classic vehicle segments, valued for their aesthetic appeal. Conversely, Digital clocks, which include standard LCD/LED displays and advanced TFT/OLED integrations, dominate the market due to their versatility, ability to integrate with complex informatics systems, and superior functionality in modern digital cockpits, directly mirroring the rapid pace of vehicle technology modernization globally.

The market is further segmented by vehicle type, distinguishing between Passenger Vehicles and Commercial Vehicles. Passenger vehicles represent the largest segment, driven by high global sales volumes and the strong consumer demand for sophisticated infotainment and aesthetic interior features. The segment benefits significantly from the quick adoption of new display technologies and customization options. Commercial vehicles (including heavy-duty trucks, buses, and light commercial vehicles) constitute a smaller yet growing segment, where the focus is less on aesthetics and more on functional reliability, mandatory telematics integration, and synchronization with fleet management systems for operational efficiency and regulatory compliance, ensuring a steady, stable demand profile.

Understanding these segments is essential for strategic planning, as it highlights key areas for investment. The Digital Clock segment within Passenger Vehicles offers the highest growth potential in terms of value and feature integration, necessitating R&D focus on advanced materials and software capabilities. Conversely, the Commercial Vehicle segment demands highly robust, resilient components capable of enduring demanding operational environments, suggesting a specialization focus on durability and long-term reliability rather than pure aesthetic innovation. The shift toward electrification is also beginning to create sub-segments demanding highly power-efficient timing solutions across all vehicle types.

- By Product Type:

- Analog Clock

- Digital Clock (LCD, TFT, OLED)

- By Vehicle Type:

- Passenger Vehicle (PV)

- Commercial Vehicle (CV)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Integration Type:

- Standalone Unit

- Integrated into Infotainment/Instrument Cluster

Value Chain Analysis For Automotive Clock Market

The value chain of the Automotive Clock Market begins with upstream analysis, which involves the sourcing and processing of raw materials and foundational electronic components. Key inputs include quartz crystals for timing accuracy, semiconductor chips (microcontrollers and dedicated clock integrated circuits, or ICs), and display components such as TFT or OLED panels. Suppliers in this phase are typically large electronic component manufacturers (e.g., specialized IC foundries, display manufacturers), whose operations are often geographically centralized, particularly in East Asia. The quality and reliability of these upstream components directly dictate the final product’s performance and lifespan, making supply chain resilience and component sourcing a critical strategic factor for Tier 1 suppliers.

The middle segment of the chain is dominated by Tier 1 automotive suppliers (e.g., Continental, VDO, Denso). These companies integrate the sourced components, develop proprietary firmware and software interfaces, and manufacture the final automotive clock modules, often incorporating complex synchronization systems (GPS/NTP) and vehicle communication interfaces (CAN bus, Ethernet). This stage involves rigorous testing, adherence to stringent automotive standards (e.g., AEC-Q100 for ICs), and system validation before delivery to Original Equipment Manufacturers (OEMs). Direct distribution occurs mainly through B2B channels, where Tier 1 suppliers deliver just-in-time (JIT) components directly to OEM assembly lines globally, establishing long-term contractual relationships based on quality and volume.

Downstream analysis focuses on the final assembly by automotive OEMs and the subsequent distribution through direct (OEM authorized dealers) and indirect (independent repair shops, online retailers) aftermarket channels. While the majority of sales are driven by OEM integration during initial vehicle manufacturing, the aftermarket segment provides spare parts, replacement units, and upgrade kits, though typically at a much lower volume. Direct distribution channels ensure high-volume, standardized delivery for new vehicles, while the aftermarket addresses specific repair needs and consumer desires for enhanced features or customization, with indirect channels playing a significant role in providing accessible repair solutions globally.

Automotive Clock Market Potential Customers

The primary customer base for the Automotive Clock Market is bifurcated into Original Equipment Manufacturers (OEMs) and the automotive Aftermarket. OEMs represent the largest segment by volume and value, consisting of global vehicle manufacturers (e.g., Toyota, Volkswagen, Ford, Tesla). These customers require millions of units annually, placing extreme emphasis on component reliability, strict adherence to quality control standards (ISO/TS 16949), deep system integration capabilities, and competitive pricing based on mass production contracts. OEM buying decisions are highly technical, often involving multi-year development cycles where the clock system must seamlessly interface with the vehicle's domain controller and overall cockpit architecture, demanding high levels of technical collaboration with Tier 1 suppliers.

Tier 1 suppliers, such as infotainment system manufacturers or instrument cluster specialists (e.g., Harman, Bosch, Visteon), also function as critical immediate customers. They purchase timing components and specialized ICs from semiconductor firms to build the larger integrated digital cockpit modules that are then sold to the OEMs. Their requirements focus heavily on component performance, power efficiency, and compatibility with proprietary software frameworks, ensuring the final integrated product meets the OEM’s specifications for both functional performance and aesthetic design. The rapid convergence of disparate cockpit functions means these Tier 1 customers are increasingly demanding highly robust, software-configurable clock solutions.

The Aftermarket segment constitutes the secondary customer base, comprising independent repair facilities, specialized vehicle modifiers, and end consumers seeking replacement or upgrade parts. This segment prioritizes accessibility, ease of installation, and often offers opportunities for suppliers focusing on customized or specialized digital upgrades that replace older or damaged units. While smaller in scale, the aftermarket demands a broader range of products, catering to diverse vehicle models and ages, with pricing and immediate availability being key purchasing determinants for replacement units, contrasting sharply with the long-term strategic procurement models utilized by OEMs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.5 Billion USD |

| Market Forecast in 2033 | $2.3 Billion USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Denso Corporation, Robert Bosch GmbH, VDO Automotive, Panasonic Corporation, Alpine Electronics, Inc., Mitsubishi Electric Corporation, Garmin Ltd., Visteon Corporation, Magna International, Inc., Pioneer Corporation, Clarion Co., Ltd., HELLA GmbH & Co. KGaA, BorgWarner Inc., Preh GmbH, Gentex Corporation, ZF Friedrichshafen AG, Nippon Seiki Co., Ltd., Delphi Technologies, Faurecia SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Clock Market Key Technology Landscape

The modern Automotive Clock Market is defined by sophisticated electronic and display technologies that ensure high accuracy, durability, and seamless visual integration. A primary technology involves high-precision timing mechanisms, moving beyond standard quartz oscillators to incorporate GPS/GNSS (Global Navigation Satellite System) synchronization and Network Time Protocol (NTP) integration, especially in connected vehicles. This technological shift ensures microsecond accuracy, which is non-negotiable for systems like ADAS, V2X communications, and reliable data logging. Furthermore, the underlying microcontroller units (MCUs) are becoming more powerful, designed to handle complex algorithmic computations for drift correction and time zone management automatically, often housed within robust, automotive-grade packages (AEC-Q100 certified) to withstand extreme in-cabin temperatures and vibration.

The visualization aspect of the automotive clock heavily relies on advanced display technologies. Traditional Liquid Crystal Displays (LCDs) are rapidly being superseded by Thin-Film Transistor (TFT) LCDs and increasingly, Organic Light-Emitting Diode (OLED) displays, particularly in premium vehicle segments. OLED technology offers superior contrast ratios, faster response times, and allows for flexible, non-rectangular display shapes that integrate seamlessly into complex dashboard designs, meeting the aesthetic demands of modern automotive interior design. Connectivity protocols also form a crucial part of the technology landscape; clock modules communicate time data across the vehicle network primarily via Controller Area Network (CAN) bus systems, though newer high-bandwidth vehicles are adopting Automotive Ethernet, enabling faster and more reliable distribution of synchronization signals across ECUs.

Finally, software and firmware development represent a key technological differentiator. Modern automotive clocks are software-defined, allowing for customizable user interfaces, over-the-air (OTA) update capabilities for time zone changes or daylight saving adjustments, and integration with the vehicle’s operating system (e.g., QNX, Linux, Android Automotive). Suppliers are utilizing highly robust real-time operating systems (RTOS) to manage timing criticality and minimize latency. The push towards virtualization in the cockpit also means the clock function is often a virtualized element running on a powerful central domain controller, requiring sophisticated software partitioning and virtualization technology to ensure functional safety while coexisting with non-critical infotainment applications.

Regional Highlights

Regional dynamics significantly influence the Automotive Clock Market, with Asia Pacific (APAC) maintaining market leadership in terms of volume due to its position as the global hub for vehicle manufacturing. Countries like China, India, Japan, and South Korea exhibit high production volumes of both passenger and commercial vehicles, coupled with a rapid consumer shift towards digital cockpits, driving mass adoption of integrated digital clock solutions. The fierce competition among local manufacturers in China also drives down component costs and accelerates the adoption cycle for new display technologies, resulting in rapid market penetration across various price points.

North America and Europe, while possessing slower unit volume growth compared to APAC, are key markets for value and technological advancement. These regions are characterized by stringent safety and quality regulations, driving demand for premium, highly reliable, and precisely synchronized clock systems, often utilizing GPS and high-grade components. The high penetration of luxury and high-end vehicles in these regions ensures sustained demand for advanced OLED-based integrated clock displays and complex software architectures that support sophisticated HMI functions and connected car services, resulting in higher average revenue per unit.

The Middle East and Africa (MEA) and Latin America (LATAM) represent emerging markets where growth is steadily increasing. In these regions, demand is primarily driven by regulatory mandates for vehicle safety features and increasing urbanization, which boosts commercial vehicle sales requiring basic, reliable, and durable clock systems for logistics. While penetration rates of high-end digital cockpits remain lower, the increasing affordability of standard digital vehicle components is expected to propel growth in the mid-range segments throughout the forecast period, transitioning away from purely analog solutions.

- Asia Pacific (APAC): Dominates the market in terms of production volume and unit sales; characterized by rapid integration of digital cockpits, competitive pricing, and high production capacity (China, Japan, South Korea).

- North America: High-value market segment focusing on premium vehicle integration, stringent quality standards, and early adoption of advanced synchronization technologies (GPS-enabled clocks); strong emphasis on telematics integration.

- Europe: Driven by strict regulatory frameworks regarding vehicle data integrity and safety, necessitating highly accurate and reliable timing systems; characterized by high demand for aesthetic integration into premium European brands (Germany, UK).

- Latin America (LATAM): Emerging market showing steady growth, driven by increasing vehicle electrification and regulatory pressures requiring modern safety and data logging features.

- Middle East and Africa (MEA): Growth centered around fleet management systems and commercial vehicle upgrades; characterized by demand for robust, temperature-resilient digital clock solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Clock Market.- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- VDO Automotive

- Panasonic Corporation

- Alpine Electronics, Inc.

- Mitsubishi Electric Corporation

- Garmin Ltd.

- Visteon Corporation

- Magna International, Inc.

- Pioneer Corporation

- Clarion Co., Ltd.

- HELLA GmbH & Co. KGaA

- BorgWarner Inc.

- Preh GmbH

- Gentex Corporation

- ZF Friedrichshafen AG

- Nippon Seiki Co., Ltd.

- Delphi Technologies

- Faurecia SE

Frequently Asked Questions

Analyze common user questions about the Automotive Clock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from analog to digital automotive clocks?

The shift is primarily driven by the overarching trend of vehicle digitalization, consumer demand for integrated, customizable digital cockpits, and the functional necessity for time synchronization across multiple ECUs (Electronic Control Units) in modern connected vehicles, which analog clocks cannot support efficiently.

How is the accuracy of automotive clocks maintained in advanced vehicles?

Advanced automotive clocks maintain high accuracy by integrating GPS/GNSS satellite signals or using Network Time Protocol (NTP) synchronization via the vehicle's telematics unit. This ensures precise, continuous time reference, essential for ADAS systems and reliable data logging required by regulatory standards.

What impact do electric vehicles (EVs) have on the automotive clock market?

EVs drive demand for specialized, highly power-efficient digital clock modules to minimize drain on the battery, particularly when the vehicle is parked. They also necessitate robust synchronization components critical for charging management and battery diagnostic systems.

Are automotive clocks sold mainly through OEM or aftermarket channels?

The vast majority of automotive clock units, particularly sophisticated digital systems, are sold through the Original Equipment Manufacturer (OEM) channel, as they are integrated components of the vehicle's initial electronic architecture. Aftermarket sales are smaller, catering mainly to replacement parts and niche customization.

Which geographical region shows the fastest growth rate for the automotive clock market?

The Asia Pacific (APAC) region is expected to demonstrate the fastest growth rate in terms of volume and consumption. This is attributed to the high volume of vehicle production, rapid technological adoption in major economies like China, and increasing consumer acceptance of digital cockpit features.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager