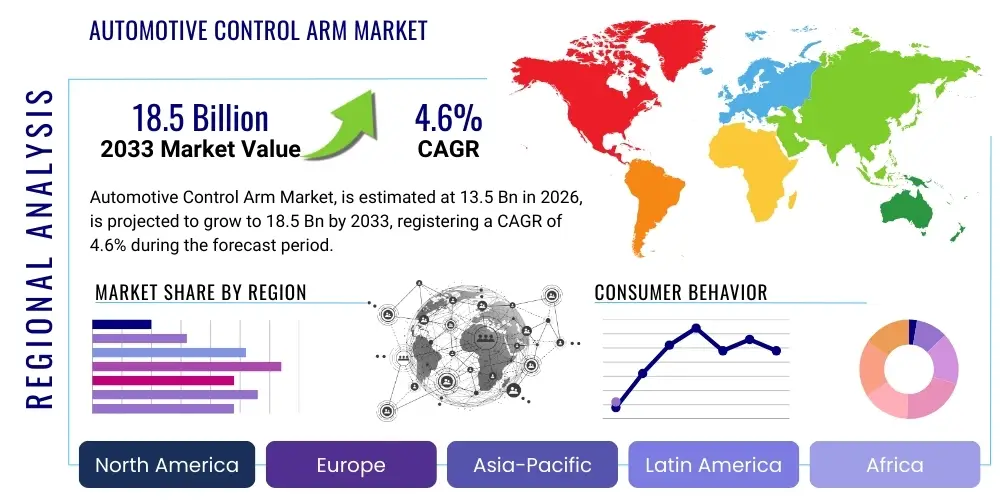

Automotive Control Arm Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442903 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Automotive Control Arm Market Size

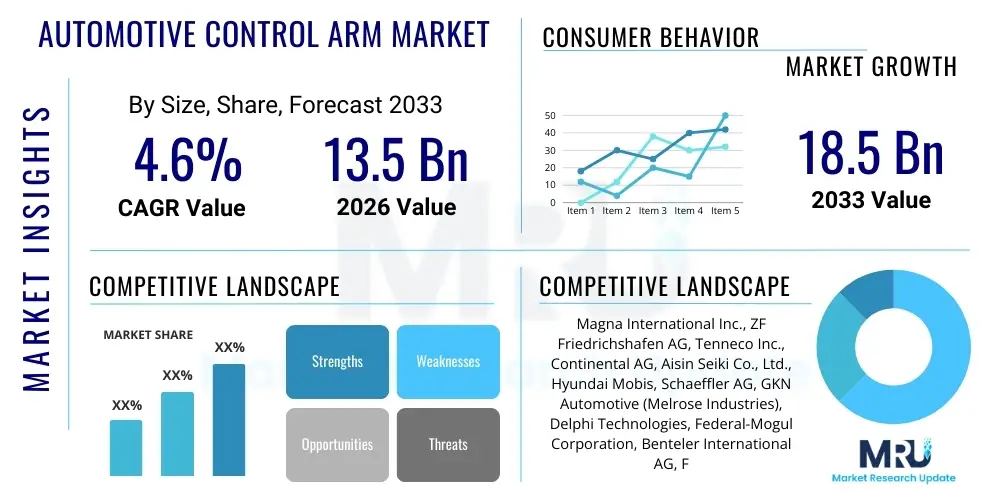

The Automotive Control Arm Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.6% between 2026 and 2033. The market is estimated at $13.5 Billion in 2026 and is projected to reach $18.5 Billion by the end of the forecast period in 2033.

This steady growth trajectory is primarily underpinned by the persistent global demand for passenger and commercial vehicles, coupled with stringent vehicle safety regulations that necessitate high-quality, durable suspension components. Control arms, being essential parts of a vehicle’s suspension system responsible for connecting the wheel hub to the chassis, are crucial for ride stability, handling, and overall safety. The expansion of the global vehicle parc, especially in emerging economies across Asia Pacific, further drives the aftermarket segment, which relies heavily on replacement control arms due to wear and tear over time.

Furthermore, advancements in automotive design, particularly the shift towards lightweighting materials such as high-strength steel and aluminum alloys, are influencing the manufacturing processes of control arms. Original Equipment Manufacturers (OEMs) are increasingly adopting specialized control arm designs, including stamped steel, forged aluminum, and cast iron varieties, to meet enhanced performance metrics and improve fuel efficiency. The ongoing electrification of the global vehicle fleet also plays a role, as Electric Vehicles (EVs) often require specific suspension tuning and robust components to handle the added weight of battery packs, thereby sustaining investment in control arm innovation and production capacity expansions globally.

Automotive Control Arm Market introduction

The Automotive Control Arm Market encompasses the production, distribution, and utilization of critical suspension linkage components designed to manage the vertical movement of the wheels relative to the vehicle body, ensuring optimal steering and handling. Control arms, also known as A-arms or wishbones, are pivotal structural elements in both front and rear independent suspension systems, allowing wheels to move up and down while maintaining proper alignment. They facilitate the necessary connection between the wheel assembly and the vehicle’s frame or chassis, acting as the pivot point that governs wheel geometry during motion. The function is multifaceted, primarily focused on absorbing road shocks, maintaining consistent tire contact, and resisting lateral forces exerted during cornering and braking, thereby guaranteeing passenger comfort and vehicle stability under diverse operating conditions.

Major applications of control arms span the entire spectrum of automotive manufacturing, including passenger cars (sedans, SUVs, hatchbacks), light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and increasingly, electric vehicles (EVs) and hybrid vehicles. The control arm market is bifurcated into OEM (Original Equipment Manufacturer) sales, which cater to new vehicle assembly lines, and the highly essential aftermarket segment, which addresses replacement needs stemming from component failure, accident damage, or routine maintenance. Key benefits derived from high-quality control arms include enhanced vehicle control, improved tire wear characteristics, reduction in noise, vibration, and harshness (NVH) levels, and crucial compliance with stringent global safety standards related to crashworthiness and vehicle dynamics.

The market is primarily driven by global vehicle production output, stricter governmental regulations concerning vehicular safety and emissions, and technological developments focused on material science and manufacturing precision. Factors such as the rising average age of vehicles on the road, particularly in mature markets like North America and Europe, significantly boost the demand in the aftermarket sector. Moreover, the increasing adoption of multi-link suspension systems, which utilize multiple control arms per wheel for superior kinematic performance, is fueling technological advancements and market growth globally. This dynamic relationship between safety mandates, technological evolution, and vehicle longevity ensures a stable and growing demand curve for automotive control arms across all major regions.

Automotive Control Arm Market Executive Summary

The global Automotive Control Arm Market demonstrates robust resilience driven by fundamental business trends centered on lightweighting strategies and enhanced vehicle safety features. Key manufacturers are focusing their investment on adopting advanced materials like aluminum alloys and high-strength, low-alloy (HSLA) steels to reduce overall vehicle mass, which directly contributes to improved fuel economy in Internal Combustion Engine (ICE) vehicles and extended range in Electric Vehicles (EVs). Furthermore, the trend toward modular design and integration of suspension systems is compelling suppliers to offer pre-assembled control arm modules, streamlining the assembly process for OEMs and ensuring consistent performance quality. The aftermarket segment is undergoing a professionalization trend, with increasing emphasis on certified replacement parts that meet or exceed OEM specifications, combating the proliferation of lower-quality, uncertified components.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, primarily fueled by massive automotive production output in China, India, and Japan, alongside rapidly expanding vehicle sales and increasing infrastructure development across Southeast Asia. Europe remains a critical hub for premium and high-performance control arm technology, driven by stringent European safety norms (e.g., Euro NCAP) and the presence of sophisticated luxury and sports car manufacturers demanding superior suspension kinematics. North America contributes substantially through both large-scale domestic vehicle production and a mature, extensive aftermarket ecosystem that consistently requires replacement parts due to high annual mileage and varied climatic conditions affecting component lifespan. The market structure across these regions reflects a balanced dependency on both new vehicle sales (OEM) and maintenance cycles (Aftermarket).

In terms of segmentation, the material type segment showcases a noticeable shift towards aluminum control arms, moving away from traditional cast iron, particularly in premium vehicle applications where weight reduction is paramount. However, stamped steel remains highly competitive due to its cost-effectiveness and proven durability, dominating the mid-range and commercial vehicle segments. By vehicle type, Passenger Vehicles (PVs), especially the SUV and crossover categories, hold the largest market share globally, reflecting consumer preference for these body styles, which often require complex and heavy-duty suspension setups. The market is also strategically segmenting based on distribution channels, with authorized service centers and specialized online platforms becoming increasingly vital for the efficient distribution of aftermarket control arm units to end-users.

AI Impact Analysis on Automotive Control Arm Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Automotive Control Arm Market typically revolve around three core themes: How AI optimizes the design and simulation of control arms for reduced weight and improved performance; the role of predictive maintenance driven by AI in the aftermarket; and the integration of AI-enabled quality control systems during manufacturing. Users frequently inquire if AI algorithms can generate novel lightweight material combinations or structural geometries that traditional finite element analysis (FEA) methods might miss, focusing on topological optimization. Concerns often arise about the cost implications of implementing these advanced AI tools in standardized component production. The consensus expectation is that AI will primarily enhance efficiency, leading to faster design iteration cycles, minimized material usage, and significantly reduced component failure rates through highly accurate defect detection during the production phase, thereby elevating the overall quality and reliability of automotive control arms globally.

- AI-driven Topological Optimization: Utilizing generative design algorithms to minimize material mass while maintaining or enhancing structural integrity and load-bearing capacity of control arms.

- Predictive Maintenance Integration: Employing machine learning models to analyze sensor data from vehicle suspension systems (e.g., vibration, stress) to predict the lifespan and likely failure point of control arms, optimizing replacement schedules.

- Manufacturing Process Optimization: Implementing AI vision systems for high-speed, non-destructive quality inspection, detecting micro-cracks, alignment errors, and material inconsistencies during casting, forging, or stamping processes.

- Supply Chain Efficiency: Applying AI and machine learning to forecast demand fluctuations for specific control arm types (OEM vs. Aftermarket) and optimize inventory management, reducing lead times and minimizing stockouts.

- Simulation Enhancement: Accelerating computational fluid dynamics (CFD) and FEA simulations by using AI to refine mesh generation and process large datasets, allowing for rapid iteration in material and joint behavior testing.

DRO & Impact Forces Of Automotive Control Arm Market

The dynamics of the Automotive Control Arm Market are characterized by a strong interplay between market drivers, technological restraints, and significant opportunities, which collectively shape the impact forces influencing market growth. Key drivers include the mandatory enhancement of vehicle safety standards worldwide, the sustained growth in global vehicle production, particularly SUVs and premium vehicles requiring complex suspension systems, and the robust demand for replacement parts driven by the increasing average vehicle age and mileage accumulation globally. These factors create a foundational demand base that is relatively inelastic to minor economic fluctuations. Conversely, restraints primarily involve the high capital investment required for adopting advanced manufacturing techniques, such as precision forging and advanced heat treatment processes, and the volatile nature of raw material prices, particularly steel and aluminum, which directly impact profit margins across the supply chain. Furthermore, the complexity of designing control arms for specialized applications, such such as those required for high-performance electric vehicles, poses a continuous engineering challenge.

Opportunities for market players are abundant, notably stemming from the burgeoning market for electric vehicles, which necessitates bespoke control arm designs to manage increased vehicle weight and specialized chassis dynamics. There is a substantial opportunity in developing lightweight composite or hybrid material control arms that offer superior strength-to-weight ratios compared to traditional metal components. Expansion in the organized aftermarket across developing economies, coupled with increased consumer awareness regarding the importance of high-quality suspension components, represents another high-growth avenue. Impact forces are predominantly driven by regulatory adherence—specifically, safety and crash testing mandates—and the continuous pressure from OEMs to reduce cost while improving component durability. The shift towards autonomous driving systems also impacts design, requiring ultra-reliable components capable of sustaining constant, precise operation. The market is thus poised between cost pressure and the imperative for continuous technical sophistication and material innovation.

The market is highly susceptible to the competitive pricing strategies prevalent in the aftermarket, where counterfeit and uncertified components pose a threat to legitimate manufacturers, impacting both revenue and brand integrity. However, this challenge is mitigated by the increasing regulatory scrutiny on automotive parts quality. Overall, the dominant impact force remains the vehicle parc size, ensuring that even if new vehicle sales plateau in mature markets, the replacement cycle continues to generate substantial and predictable revenue streams. Successful market penetration necessitates a balanced approach, incorporating cost-effective manufacturing for high-volume products (stamped steel) while aggressively pursuing technological leadership in premium materials (forged aluminum and composites) to capture high-margin opportunities in the performance and EV segments.

Segmentation Analysis

The Automotive Control Arm Market is extensively segmented based on several critical dimensions, including material type, control arm type, vehicle type, distribution channel, and application, allowing for a granular understanding of market dynamics and targeted strategic investment. Understanding these segmentations is paramount for manufacturers to align their production capabilities with specific market needs, ranging from the cost sensitivity of the stamped steel segment to the high-performance demands of forged aluminum required by premium vehicle OEMs. The market structure reflects the complexity of modern vehicle suspension systems, where different component materials and designs are optimized for specific vehicle weights, performance requirements, and price points across the global automotive landscape. This comprehensive segmentation aids in identifying regional demand patterns and technological adoption rates across diverse vehicle platforms, ensuring tailored marketing and supply chain optimization.

- By Material Type:

- Stamped Steel

- Cast Iron

- Forged Aluminum

- Composite Materials (Emerging)

- By Control Arm Type:

- Lower Control Arm (Dominant in most vehicles)

- Upper Control Arm (Common in double-wishbone and multi-link setups)

- By Vehicle Type:

- Passenger Vehicles (PVs)

- Sedans

- SUVs/Crossovers (Fastest Growing)

- Hatchbacks

- Commercial Vehicles (CVs)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric and Hybrid Vehicles (EV/HEV)

- Passenger Vehicles (PVs)

- By Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

- Independent Aftermarket (IAM)

- OES (Original Equipment Supplier) Aftermarket

- By Application:

- Front Suspension System

- Rear Suspension System (Growing due to multi-link adoption)

Value Chain Analysis For Automotive Control Arm Market

The value chain for the Automotive Control Arm Market begins with upstream activities dominated by raw material suppliers, primarily providers of high-grade steel (including HSLA steel), aluminum ingots and alloys, and increasingly, specialized resins and carbon fibers for composite variants. The quality and stable pricing of these raw materials are foundational, as they determine the ultimate structural integrity and cost profile of the finished control arm. Key upstream processes involve procurement and primary material processing such as steel rolling, aluminum casting, or forging, which require significant energy input and capital expenditure. Strong supplier relationships and long-term contracts are essential in this stage to mitigate supply chain disruptions and raw material price volatility, ensuring predictable input costs for Tier 1 and Tier 2 component manufacturers.

Midstream processing involves Tier 1 and Tier 2 manufacturers executing complex activities such as stamping, forging, casting, machining, welding, and subsequent surface treatments (e.g., e-coating or powder coating for corrosion resistance). This is the value-addition heart of the chain, where technological expertise in metallurgy and precision engineering is paramount. The integration of advanced manufacturing technologies, like robotic welding and automated quality inspection, defines competitiveness at this stage. Following component manufacturing, control arms move into the distribution phase. Direct distribution channels involve sales directly to Original Equipment Manufacturers (OEMs) for integration into new vehicle assembly lines, demanding just-in-time (JIT) delivery and zero-defect quality assurance. This channel is characterized by high volume and predefined specifications, often negotiated through multi-year contracts.

Indirect distribution primarily serves the highly fragmented aftermarket segment, utilizing a complex network of intermediaries including authorized dealers, independent distributors, wholesalers, and specialized automotive repair shops. The aftermarket requires extensive inventory management, broad product cataloging (covering numerous vehicle models and years), and efficient logistics to ensure timely availability of replacement parts. Online distribution platforms and e-commerce portals are rapidly gaining importance, providing direct access to Independent Aftermarket (IAM) channels and reducing the reliance on traditional brick-and-mortar distributors. Success in the downstream market hinges on brand reputation, catalog accuracy, and the ability to manage a diverse, global inventory of components for various vehicle types and generations, directly linking component longevity and consumer safety.

Automotive Control Arm Market Potential Customers

The primary customers and end-users of automotive control arms are categorized into two major groups: the Original Equipment Manufacturers (OEMs) and the expansive Aftermarket service providers and vehicle owners. OEMs, including globally recognized automotive giants such as Volkswagen Group, Toyota Motor Corporation, General Motors, and Tesla, represent the largest volume purchasers. They demand control arms that meet stringent performance criteria, precise dimensions, and specific material compositions to integrate seamlessly into their unique vehicle suspension designs. These manufacturers prioritize consistency, low failure rates, and logistical efficiency (JIT delivery) to maintain high-volume assembly line operations, often requiring suppliers to co-develop components years ahead of vehicle launch. The OEM customer base drives innovation in lightweighting and material science within the control arm industry.

The second major group, the Aftermarket, is highly segmented and includes authorized service centers managed by OEMs (OES), large independent service chains, local automotive repair garages, specialized body shops, and ultimately, individual vehicle owners seeking replacements. Aftermarket demand is driven by component lifespan, accident repair, and preventative maintenance cycles. These buyers prioritize product availability, competitive pricing, and certified quality that assures safety. Repair shops act as crucial gatekeepers, often influencing the final choice of component brand, leaning towards distributors who offer comprehensive catalog coverage and reliable product guarantees. The increasing average age of vehicles and higher annual mileage in markets across North America and Europe guarantee sustained demand from this segment, making independent repair shops and authorized dealerships key targets for component suppliers focusing on replacement revenue.

Furthermore, an emerging customer segment includes fleet operators and government agencies that manage large collections of vehicles (e.g., logistics companies, municipal transport, police fleets). These customers require durable, heavy-duty control arms designed for constant operation and high utilization, focusing on minimizing vehicle downtime and ensuring long-term operational cost efficiency. Suppliers targeting this segment must offer products engineered for robustness and prolonged service life under severe operating conditions. The transition of the automotive industry toward electrification also identifies Electric Vehicle manufacturers as a specialized customer group, requiring control arms optimized for heavier, battery-laden chassis platforms, which often demand specialized material science and enhanced load ratings to ensure optimal handling and battery protection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $13.5 Billion |

| Market Forecast in 2033 | $18.5 Billion |

| Growth Rate | 4.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magna International Inc., ZF Friedrichshafen AG, Tenneco Inc., Continental AG, Aisin Seiki Co., Ltd., Hyundai Mobis, Schaeffler AG, GKN Automotive (Melrose Industries), Delphi Technologies, Federal-Mogul Corporation, Benteler International AG, Farsens, ThyssenKrupp AG, Meritor, Inc., Mando Corporation, ACDelco, TRW Automotive (ZF Group), Sankei Industry Co., Ltd., Sogefi S.p.A., and Mitsubishi Heavy Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Control Arm Market Key Technology Landscape

The technological landscape of the Automotive Control Arm Market is fundamentally characterized by innovations in material science and manufacturing processes aimed at achieving optimal strength-to-weight ratios and enhanced durability. A primary technological focus is on lightweighting, driven by global fuel efficiency and EV range requirements. This involves the increasing adoption of high-pressure die casting (HPDC) and semi-solid forming (thixoforming) techniques for aluminum alloys, which allow for the creation of complex, hollow, and thin-walled structures with minimal porosity, significantly reducing mass compared to traditional cast iron or heavy steel. Furthermore, advancements in advanced high-strength steel (AHSS) stamping and welding technologies enable the production of stamped steel control arms that are simultaneously lighter and stronger, ensuring safety compliance without necessitating a complete material overhaul for cost-sensitive segments. Precision welding techniques, such as laser welding and friction stir welding, are crucial for assembling multi-piece control arms, guaranteeing structural integrity and fatigue resistance over the vehicle's lifetime.

Another significant technological shift involves the integration of advanced coating and surface treatment methodologies to enhance corrosion resistance and component lifespan, crucial particularly in regions exposed to harsh weather conditions and road salt usage (e.g., North America and parts of Europe). Techniques like electrocoating (e-coating) and specialized powder coating processes provide a robust barrier against environmental degradation, extending the replacement cycle and reinforcing the quality image of OEM-grade parts. Alongside material improvements, manufacturing digitalization, including the widespread deployment of Finite Element Analysis (FEA) and Computational Aided Engineering (CAE) tools, has become standard practice. These tools allow engineers to accurately simulate real-world stress, load cycles, and fatigue behavior under various conditions, enabling highly optimized designs that minimize material usage while strictly adhering to safety factors, drastically reducing the physical prototyping phase.

The emerging technological frontier focuses on composite materials, utilizing glass fiber or carbon fiber reinforced polymers (CFRP) to create ultra-lightweight control arms, primarily targeting high-performance vehicles and specialized EV platforms where minimizing unsprung mass is critical. While cost remains a significant barrier for mass-market adoption of full composite arms, hybrid designs combining metal mounting points with composite bodies are gaining traction. Furthermore, the push towards modular suspension systems requires suppliers to develop control arms that incorporate integrated bushings, ball joints, and potentially sensor mounts directly into the design, simplifying vehicle assembly and improving maintenance efficiency. The continuous refinement of noise, vibration, and harshness (NVH) mitigation technologies within the control arm structure, through optimized bushing design and material damping, represents a persistent, subtle area of technical development that directly impacts passenger comfort and perceived vehicle quality.

Regional Highlights

- Asia Pacific (APAC): APAC represents the undisputed growth engine for the Automotive Control Arm Market, driven by massive domestic production volumes in China, which leads global vehicle manufacturing, and robust expansion in India and Southeast Asian nations. The region benefits from increasing industrialization, rising disposable incomes leading to higher vehicle ownership rates, and the subsequent high demand for both OEM components and replacement parts. Government initiatives promoting domestic manufacturing and the rapid adoption of electric vehicles in countries like China further solidify APAC's dominance. The market here is characterized by fierce price competition in the lower and mid-range segments, alongside rapidly growing demand for advanced aluminum control arms in premium and electric vehicle categories. The sheer size of the vehicle parc ensures strong, sustained demand for aftermarket components.

- Europe: Europe is characterized by a strong emphasis on technological sophistication, quality, and regulatory compliance (especially stringent safety standards). Western European nations drive demand for high-performance and lightweight control arms, utilizing forged aluminum and increasingly complex multi-link suspension systems in premium and luxury vehicles. The region is a pioneer in EV technology, necessitating specialized control arms designed for enhanced weight management and dynamic performance. The European aftermarket is highly organized, valuing certified parts and reliable supply chains, providing stable, high-margin revenue for established suppliers focusing on precision engineering and durability. Eastern Europe provides cost-effective manufacturing hubs, balancing the high R&D costs prevalent in the West.

- North America (NA): The North American market is defined by high annual mileage, a large preference for heavy vehicles (trucks and SUVs), and a vast, demanding aftermarket. Demand for durable, heavy-duty control arms, particularly those engineered to withstand diverse weather extremes and rough road conditions, is consistently strong. The replacement market is exceptionally robust due to the longer average service life of vehicles compared to other regions. While there is a strong presence of domestic OEM manufacturing (especially for light trucks), the region relies heavily on imports, creating complex supply chain dynamics. Investment is focused on supporting the massive shift toward large-format electric trucks and SUVs, requiring control arm components with significantly higher load-bearing capabilities.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions are emerging markets presenting significant long-term growth potential. LATAM's growth is tied to stabilizing economies and expanding vehicle production in countries like Brazil and Mexico, focusing predominantly on cost-effective stamped steel components for mass-market vehicles. MEA markets are characterized by a high reliance on imported vehicles and a necessity for extremely durable control arms capable of handling challenging road infrastructure and high temperatures, particularly in the Middle East. Aftermarket demand is rapidly professionalizing across both regions as vehicle ownership matures, creating opportunities for suppliers who can manage complex logistics and provide reliable, mid-range quality components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Control Arm Market.- Magna International Inc.

- ZF Friedrichshafen AG

- Tenneco Inc.

- Continental AG

- Aisin Seiki Co., Ltd.

- Hyundai Mobis

- Schaeffler AG

- GKN Automotive (Melrose Industries)

- Delphi Technologies

- Federal-Mogul Corporation

- Benteler International AG

- Farsens

- ThyssenKrupp AG

- Meritor, Inc.

- Mando Corporation

- ACDelco

- TRW Automotive (ZF Group)

- Sankei Industry Co., Ltd.

- Sogefi S.p.A.

- Mitsubishi Heavy Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Control Arm market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Automotive Control Arm Aftermarket?

The primary driver for the Automotive Control Arm Aftermarket is the increasing average age and mileage of the global vehicle fleet, leading to natural wear and tear of suspension components. High mileage combined with varied road conditions necessitates periodic replacement, ensuring sustained demand for certified replacement parts across all major vehicle segments and geographies.

How is the shift towards Electric Vehicles (EVs) impacting control arm design?

The transition to EVs necessitates control arms capable of handling significantly higher vehicle weight due to integrated battery packs. This requires manufacturers to utilize advanced materials like forged aluminum and high-strength steels to maintain structural integrity and minimize unsprung mass, optimizing for both vehicle range and dynamic stability.

Which material type is currently dominating the Automotive Control Arm Market by volume?

Stamped steel control arms currently dominate the market by volume due to their cost-effectiveness, proven durability, and applicability across mass-market passenger vehicles and light commercial vehicles. However, forged aluminum is rapidly gaining share, particularly in premium, performance, and EV segments where lightweighting is a critical design imperative.

What is the role of AI in the manufacturing of control arms?

AI is primarily used in two areas: topological optimization for generating lighter, stronger designs, and automated quality control. AI-powered vision systems inspect every component for manufacturing defects (such as micro-cracks or welding inconsistencies) with high accuracy and speed, ensuring superior product quality and reliability before integration into the vehicle.

Which geographical region exhibits the fastest growth rate for control arm sales?

The Asia Pacific (APAC) region, spearheaded by high volume production in China and rapidly increasing vehicle sales in India and Southeast Asia, exhibits the fastest growth rate. This growth is sustained by continuous expansion in OEM manufacturing capacity and a rapidly maturing aftermarket fueled by rising consumer affluence and vehicle ownership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Control Arm Shaft Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cast Iron Control Arms, Cast Aluminum Control Arms, Stamped Steel Control Arms), By Application (Multi-link suspension, Double Wishbone Suspension, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Forged Aluminum Automotive Control Arm Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (OEM, Aftermarket), By Application (MacPherson strut, Multi-link suspension, Double Wishbone Suspension, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager