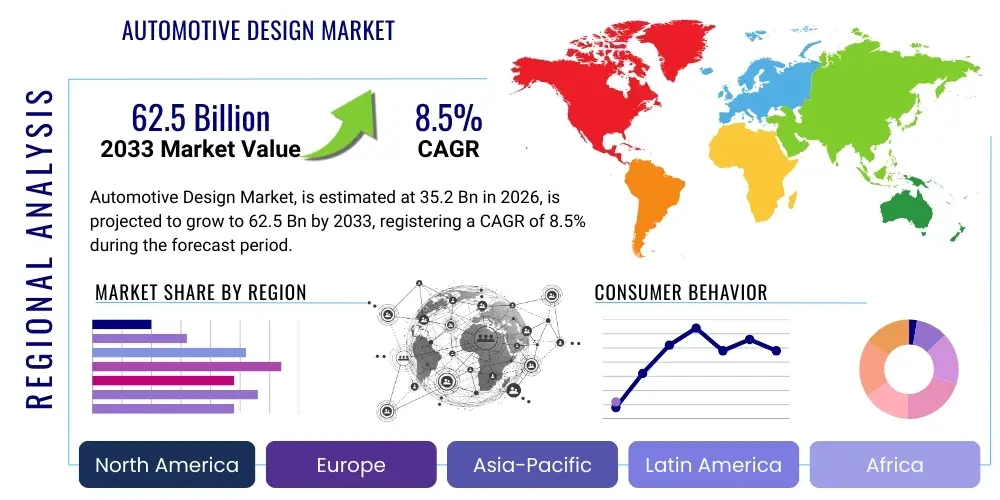

Automotive Design Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441620 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Design Market Size

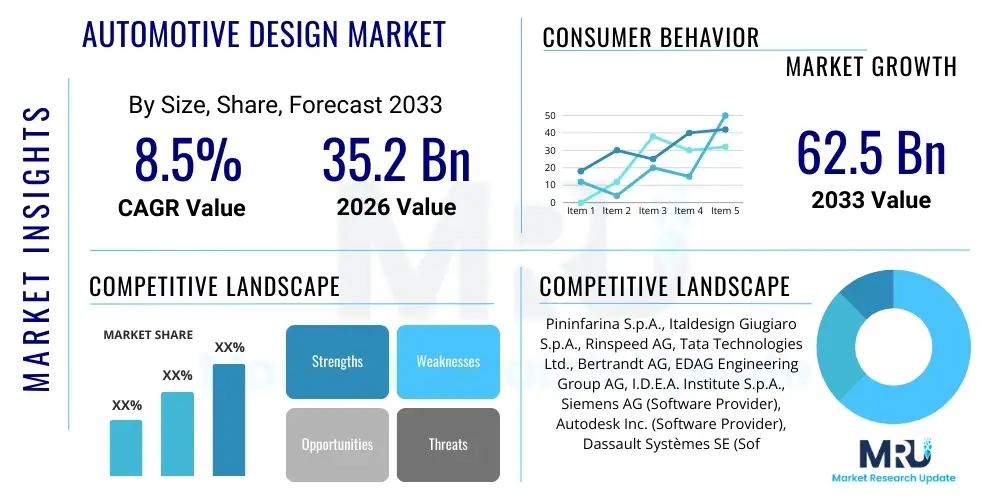

The Automotive Design Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 35.2 Billion in 2026 and is projected to reach USD 62.5 Billion by the end of the forecast period in 2033.

Automotive Design Market introduction

The Automotive Design Market encompasses all processes, tools, and services utilized in conceiving, developing, and styling vehicles, ranging from initial conceptual sketches and digital modeling to final production surfacing and ergonomics testing. This domain is critical to the automotive industry as it dictates brand identity, consumer appeal, aerodynamic efficiency, safety compliance, and the integration of advanced technologies like electric powertrains and autonomous driving systems. Key activities include exterior styling, interior design, HMI (Human-Machine Interface) development, and engineering validation specific to aesthetic and functional requirements. Modern automotive design is characterized by a rapid shift towards sustainable materials, modular platforms, and personalized digital experiences within the vehicle cabin.

Major applications of automotive design span across passenger vehicles (sedans, SUVs, trucks), commercial vehicles, and specialty vehicles. The core benefit derived from robust design processes is enhanced market competitiveness, reduced production time via optimized digital workflows, and compliance with increasingly stringent global safety and environmental regulations. Furthermore, superior design is essential for Electric Vehicles (EVs), where battery packaging, aerodynamic optimization, and novel cabin layouts redefine traditional design constraints.

Driving factors propelling this market include the global transition to electrification, demanding ground-up redesigns for battery integration and thermal management; the proliferation of advanced driver-assistance systems (ADAS) and autonomous technologies, necessitating new sensor integration aesthetics and interior layouts; and consumer demand for personalized, connectivity-rich vehicle experiences. The constant need for manufacturers to differentiate their products in highly competitive global markets through distinctive visual appeal and innovative functional design further fuels market expansion, emphasizing the role of digital tools like Computer-Aided Styling (CAS) and Virtual Reality (VR) visualization in accelerating the design lifecycle.

Automotive Design Market Executive Summary

The Automotive Design Market is experiencing profound transformation driven by three major business trends: the electrification revolution, the integration of generative AI in styling processes, and the shift towards subscription-based or software-defined vehicle architectures. Business trends indicate a movement away from traditional outsourcing models to more integrated partnerships between OEMs and specialized design houses focusing on high-level digital conceptualization and HMI development. This integration is vital for speed and maintaining design fidelity across global product lines. Furthermore, sustainability is no longer a niche consideration but a core design principle, influencing material selection, manufacturing processes, and end-of-life considerations, thereby driving innovation in lightweight and recycled materials.

Regional trends highlight the Asia Pacific (APAC) region, particularly China and India, as the fastest-growing market due to escalating domestic vehicle production, rapid adoption of EVs, and significant investment in indigenous design capabilities focused on local consumer preferences. North America and Europe remain mature markets but are leading in the adoption of advanced digital design tools (VR/AR) and complex HMI solutions, largely driven by strict safety standards and high consumer expectations for premium digital experiences. Segment trends indicate that the Interior Design segment is rapidly gaining significance over Exterior Design, largely because the rise of autonomous driving shifts the driver's focus from the road to the in-car environment, making comfort, connectivity, and personalized experiences paramount.

Segmentation analysis reveals that the Software segment, particularly solutions enabling real-time rendering and collaborative design, is witnessing the highest growth. Key segments like styling and conceptualization services are being augmented by data analytics and consumer behavioral insights, allowing designers to create highly targeted and market-ready vehicles. Overall, the market's executive summary points to a future where design is inextricably linked with digital engineering and software integration, requiring design firms and OEM internal teams to merge creative skills with deep technical knowledge of electrical architectures and software platforms to ensure competitive advantage.

AI Impact Analysis on Automotive Design Market

Common user questions regarding AI in automotive design center heavily on automation, job displacement, and the creative potential of algorithms. Users frequently ask: "How will AI change the role of a car designer?", "Can AI generate entirely new car concepts?", and "What are the ethical implications of using AI-generated designs?" The key themes emerging from this analysis are the expectation that AI will automate tedious, iterative tasks like rendering, simulation optimization, and regulatory checking, thereby freeing human designers to focus on high-level creativity and brand storytelling. Concerns revolve around whether AI will dilute the emotional or artistic value of design, or if it will simply become a powerful co-pilot tool that accelerates the ideation and validation phases, allowing for the exploration of thousands of design permutations impossible through traditional means.

The consensus view suggests that AI, particularly generative design tools, will revolutionize the process by optimizing vehicle structures for weight, aerodynamics, and crash safety much earlier in the design cycle. This integration enables designers to receive real-time performance feedback based on functional requirements, blurring the lines between engineering constraints and aesthetic intent. Furthermore, AI tools are proving highly effective in personalizing the interior HMI experience, learning driver preferences to adjust lighting, climate, and infotainment presentation dynamically, moving design from a static product feature to a fluid, personalized service.

Ultimately, the impact of AI is seen as a force multiplier, enhancing design efficiency and allowing designers to better manage the complexity introduced by electrification and autonomy. AI algorithms are instrumental in analyzing vast datasets of consumer feedback, market trends, and historical design successes, offering predictive insights that guide concept development toward higher market acceptance rates. This shift requires design professionals to acquire skills in prompt engineering, data interpretation, and algorithmic workflow management to harness these new capabilities effectively.

- AI accelerates concept generation and iteration cycles significantly.

- Generative design tools optimize structural components for weight and material usage.

- Predictive algorithms analyze consumer preference data to inform styling decisions.

- Automated HMI (Human-Machine Interface) design adapts to driver behavior in real-time.

- AI assists in regulatory compliance checks and aerodynamic performance simulation during early design stages.

- It automates low-level tasks, allowing human designers to focus on artistic and brand-specific elements.

- Enhances virtual and augmented reality prototyping by providing highly realistic, AI-rendered environments.

DRO & Impact Forces Of Automotive Design Market

The Automotive Design Market is currently shaped by strong drivers centered on technological mandates, significant restraints related to cost and integration complexity, and substantial opportunities driven by market paradigm shifts. The primary drivers include the mandatory global transition towards Electric Vehicles (EVs), which necessitates completely new exterior forms and cabin layouts optimized for battery architecture, and the rapid deployment of autonomous driving technologies, demanding seamless integration of Lidar, radar, and camera systems aesthetically into vehicle bodies. Opportunities are vast, primarily residing in developing sophisticated software-defined vehicle (SDV) architectures and offering specialized design services for niche segments such as eVTOL (electric Vertical Take-Off and Landing) aircraft and advanced mobility solutions, presenting significant diversification potential beyond traditional passenger cars.

Restraints largely involve the high initial investment required for sophisticated digital design platforms, including advanced simulation software and high-performance computing infrastructure necessary for large-scale data processing and rendering. Furthermore, the complexity of integrating diverse design teams—spanning styling, UX/UI, and core engineering—across global footprints poses significant management and data harmonization challenges, potentially slowing down time-to-market. The market is also heavily influenced by impact forces such as stringent environmental regulations (e.g., Euro 7 and CAFE standards), which mandate lightweighting and aerodynamic efficiency improvements, forcing design changes that often conflict with traditional styling cues, demanding innovative material and structural solutions.

The major impact force remains the technological obsolescence risk associated with rapidly evolving digital tools. Design studios must constantly invest in the latest software—from generative AI tools to high-fidelity VR/AR collaboration platforms—to maintain relevance. Political and economic stability also exerts influence; trade disputes and shifts in regional manufacturing policies can disrupt global supply chains for materials and components, directly impacting design choices related to sourcing and vehicle architecture standardization. Therefore, balancing creative ambition with engineering feasibility and regulatory compliance defines the core challenge for market participants.

Segmentation Analysis

The Automotive Design Market is extensively segmented based on design phase, vehicle type, service offering, and application, reflecting the diverse requirements of modern vehicle development programs. The analysis shows a growing distinction between physical styling services and high-value digital engineering and software integration services. Key segments experiencing rapid growth include digital modeling and visualization (driven by AEO/GEO optimization of design processes), and specialized HMI/UX design, reflecting the shift in customer value perception towards in-car technology experiences. The segmentation highlights the market's transition from a purely aesthetic focus to a holistic, engineering-driven design approach where sustainability and digital integration are primary concerns across all vehicle categories.

- By Vehicle Type:

- Passenger Vehicles (Sedan, SUV, Hatchback)

- Commercial Vehicles (Light Commercial Vehicles, Heavy-Duty Trucks)

- Electric Vehicles (BEV, PHEV, FCEV)

- Specialty Vehicles (Motorcycles, Recreational Vehicles, Autonomous Shuttles)

- By Service Offering:

- Exterior Design (Styling, Aerodynamics, Surfacing)

- Interior Design (Ergonomics, HMI/UX Design, Packaging)

- Digital Modeling and Visualization (CAS, Clay Modeling, VR/AR Prototyping)

- Engineering Design and Simulation (FEA, CFD Analysis)

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Tier 1 Suppliers

- Specialized Design Houses/Studios

- By Technology Used:

- Computer-Aided Styling (CAS)

- Virtual Reality (VR) and Augmented Reality (AR) Tools

- Generative Design Software

- 3D Scanning and Printing

Value Chain Analysis For Automotive Design Market

The value chain for the Automotive Design Market is complex, beginning with upstream analysis focused on conceptualization and technology providers, extending through core design execution, and culminating in downstream validation and manufacturing integration. Upstream activities involve technology providers supplying critical software licenses (e.g., CAD/CAE tools, visualization engines), raw materials for physical modeling (clay, resins), and essential consulting services focused on early-stage trend forecasting and market research. Strategic partnerships at this stage are crucial, as the choice of foundational software dictates the workflow efficiency and the ability to interface seamlessly with engineering platforms downstream. Furthermore, specialized market research firms provide the behavioral and trend data that designers leverage to initiate concepts that are commercially viable and aesthetically relevant.

The core execution phase involves specialized design studios (internal OEM or external firms) responsible for transforming initial concepts into detailed, validated designs. This stage includes exterior and interior styling, digital sculpting, HMI development, and rigorous engineering feasibility checks. Distribution channels in this market are predominantly direct and service-oriented. Direct channels involve in-house OEM design centers managing proprietary projects. Indirect channels heavily rely on specialized design houses and external engineering consultants who offer their expertise on a project basis to multiple OEMs globally. The selection of an external firm is often based on portfolio specialization (e.g., EV architecture experience, luxury styling expertise) and geographic proximity to major manufacturing hubs.

Downstream analysis focuses on integrating the validated design into the manufacturing process, involving tooling design, production planning, and quality control. Collaboration between the design team and manufacturing engineering is essential to ensure design intent is maintained within cost and production constraints. The efficiency of the design value chain is increasingly measured by its ability to facilitate rapid iterations and minimize the time between initial concept and production readiness, often relying on digital twin technologies to simulate the entire lifecycle. The movement toward global platform sharing and modular design architectures further emphasizes the need for centralized digital distribution of design data across different regions and production facilities.

Automotive Design Market Potential Customers

Potential customers for the Automotive Design Market are primarily concentrated within the automotive manufacturing ecosystem, spanning from multinational corporations to nimble technology startups focused on niche mobility solutions. The dominant buyers are Original Equipment Manufacturers (OEMs), including traditional gasoline vehicle producers, major electric vehicle manufacturers, and specialized luxury or performance brands. These OEMs continuously invest in design services—both internal and outsourced—to refresh their product portfolios, develop new vehicle platforms (especially EVs), and differentiate their brands globally. Their procurement needs range from full vehicle program design to specific module design, such as advanced lighting systems or next-generation infotainment displays.

Another significant customer segment comprises Tier 1 suppliers, who often require specialized design services for components that integrate deeply with the vehicle's aesthetic and functional architecture, such as seating systems, instrument panels, and exterior lighting clusters. As the boundary between vehicle design and component functionality blurs (e.g., smart surfaces, integrated sensors), Tier 1 suppliers increasingly commission design firms to ensure their components meet the high aesthetic and ergonomic standards set by the OEM’s overarching design language. This often involves detailed material selection, surfacing, and HMI compatibility testing to ensure seamless integration into the final product.

Furthermore, emerging mobility solution providers, including developers of last-mile delivery vehicles, autonomous shuttles, and eVTOL aircraft, represent a rapidly growing customer base. These entities require completely bespoke design solutions unconstrained by legacy automotive structures. Their primary focus is on maximizing passenger space, minimizing footprint, optimizing for electric propulsion, and achieving regulatory certification, demanding design firms capable of addressing novel engineering challenges alongside compelling aesthetic development. These customers seek end-to-end design partners who can handle conceptualization, engineering, and digital modeling services simultaneously.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.2 Billion |

| Market Forecast in 2033 | USD 62.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pininfarina S.p.A., Italdesign Giugiaro S.p.A., Rinspeed AG, Tata Technologies Ltd., Bertrandt AG, EDAG Engineering Group AG, I.D.E.A. Institute S.p.A., Siemens AG (Software Provider), Autodesk Inc. (Software Provider), Dassault Systèmes SE (Software Provider), FEV Group GmbH, Ricardo PLC, Magna International Inc. (Design Services), AVL List GmbH, Altran Technologies (Capgemini Engineering), Semcon AB, Horiba Mira Ltd., ARRK Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Design Market Key Technology Landscape

The technological landscape of the Automotive Design Market is dominated by advanced digital tools that facilitate collaboration, speed, and accuracy across the design lifecycle. Computer-Aided Styling (CAS) and Computer-Aided Engineering (CAE) platforms form the foundation, allowing designers to create highly detailed surface models and perform initial structural and thermal analyses. However, the market is rapidly integrating next-generation technologies. Virtual Reality (VR) and Augmented Reality (AR) tools are becoming indispensable, enabling designers, engineers, and market research teams to collaboratively review and experience full-scale vehicle designs in immersive digital environments without requiring expensive physical prototypes. This dramatically reduces the iteration time and cost associated with design validation and refinement.

A major disruptive force is the emergence of Generative Design and Artificial Intelligence (AI) algorithms. Generative design allows engineers to input functional parameters (e.g., maximum weight, stress tolerance, material type), and the software autonomously generates hundreds of optimized design solutions, often resulting in complex, bionic structures that are lighter and stronger than traditionally designed parts. This technology is particularly valuable in EV lightweighting efforts. Furthermore, sophisticated HMI simulation tools are essential for designing safe and intuitive in-car digital interfaces, utilizing eye-tracking and behavioral data analysis to optimize driver interaction and minimize distraction, a crucial element for future autonomous vehicles.

Material science innovation also plays a critical technological role, particularly the integration of high-strength, lightweight composites and sustainable materials. Designers must be proficient in using simulation software that accurately models the aesthetic and structural behavior of these novel materials. Finally, the implementation of cloud-based collaborative platforms and Digital Twin technology ensures that all stakeholders, regardless of geographic location, are working on the most current design files, providing a single source of truth for the vehicle program. This distributed digital workflow is essential for multinational OEMs operating global design studios and requires robust cybersecurity measures to protect intellectual property.

Regional Highlights

The Automotive Design Market exhibits significant regional disparities in growth dynamics and technological adoption. Asia Pacific (APAC) stands out as the epicenter of growth, primarily fueled by massive investment in Electric Vehicle (EV) development, particularly in China and South Korea, and the burgeoning manufacturing sector in India and Southeast Asia. Chinese domestic manufacturers are aggressively pursuing unique brand identities and often commission localized design services to cater specifically to regional preferences for connectivity, large digital displays, and spacious interiors. This rapid expansion in both volume and complexity makes APAC the region with the highest CAGR, characterized by a blend of domestic design houses and increased footprint of European and North American firms establishing satellite studios.

Europe remains a powerhouse for high-end styling, innovation, and specialized engineering design, driven by stringent European Union regulations concerning emissions, safety (Euro NCAP), and pedestrian protection. Traditional design houses in Italy and Germany continue to set global trends, focusing heavily on premium brand identity, aerodynamic efficiency, and cutting-edge material use. The regional market is highly advanced in utilizing sophisticated digital tools, including real-time VR collaboration and advanced CAE simulations, reflecting the region's commitment to quality and engineering depth. European design services are often exported globally, setting the standard for exterior surfacing and interior ergonomics, particularly for luxury and performance vehicle segments.

North America is characterized by high demand for digital HMI and UX design, driven by consumer expectations for seamless integration of personal electronics (Apple CarPlay, Android Auto) and over-the-air update capabilities. The United States and Canada are leading the charge in autonomous vehicle design, requiring specialized services for sensor integration, fail-safe redundancy systems, and new cabin layouts that facilitate non-driving activities. Furthermore, North America is a major adopter of generative design techniques, particularly by startups focused on electric trucks and novel utility vehicles, seeking to optimize structural components for production scale and efficiency. The market is also heavily influenced by regulatory pressures related to crash standards and the push for vehicle lightweighting to meet corporate average fuel economy (CAFE) standards.

- Asia Pacific (APAC): Highest growth market driven by EV mandates in China and India; focus on localized aesthetic preferences and mass-market customization.

- Europe: Dominates premium and performance design; strong emphasis on sophisticated engineering integration, safety compliance (Euro standards), and sustainable materials use.

- North America: Leader in autonomous vehicle design integration and advanced digital HMI/UX development; significant investment in design optimization for electric trucks and LCVs.

- Latin America (LATAM): Market stability driven by standardization of global platforms; gradual adoption of digital tools focused on cost-efficiency and local manufacturing feasibility.

- Middle East & Africa (MEA): Emerging market driven by infrastructure projects and demand for luxury/specialty vehicles; procurement of design services primarily outsourced to European firms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Design Market.- Pininfarina S.p.A.

- Italdesign Giugiaro S.p.A.

- Rinspeed AG

- Tata Technologies Ltd.

- Bertrandt AG

- EDAG Engineering Group AG

- I.D.E.A. Institute S.p.A.

- Siemens AG (Software Provider)

- Autodesk Inc. (Software Provider)

- Dassault Systèmes SE (Software Provider)

- FEV Group GmbH

- Ricardo PLC

- Magna International Inc. (Design Services)

- AVL List GmbH

- Altran Technologies (Capgemini Engineering)

- Semcon AB

- Horiba Mira Ltd.

- ARRK Engineering

- Koninklijke Philips N.V. (HMI/UX focus)

- Icona Design Group

Frequently Asked Questions

Analyze common user questions about the Automotive Design market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving current growth in the Automotive Design Market?

The primary driver is the accelerating global transition to Electric Vehicles (EVs). This transition demands fundamental redesigns of vehicle architectures, requiring specialized design services for battery packaging, thermal management, aerodynamic optimization, and new cabin layouts unique to electric platforms, leading to high investment in innovative styling and engineering design.

How is Generative AI specifically changing the initial conceptualization phase of vehicle design?

Generative AI tools are transforming conceptualization by rapidly exploring vast design spaces based on predefined performance and aesthetic parameters. AI can generate thousands of optimized structural forms for components (e.g., chassis nodes) and assist with initial exterior surface generation, significantly reducing the manual sketching and digital modeling time required in the early phase.

Which geographic region is projected to experience the fastest growth in automotive design services?

The Asia Pacific (APAC) region, driven by countries like China and India, is projected to exhibit the fastest growth. This is due to rising domestic vehicle production, substantial governmental backing for new energy vehicle design, and increasing consumer demand for highly customized, localized digital vehicle experiences.

What role do Virtual Reality (VR) and Augmented Reality (AR) play in modern automotive design workflows?

VR and AR are essential for collaborative design validation and prototyping. These technologies enable global design teams and stakeholders to review full-scale, highly realistic digital prototypes in real-time, allowing for immediate feedback on ergonomics, aesthetics, and design feasibility before costly physical models are created, thereby accelerating time-to-market.

How has the rise of autonomous driving technology affected interior design priorities?

The move toward autonomous driving has shifted interior design priorities dramatically from a driver-centric cockpit to a multifunctional living space. Designers are focusing heavily on creating flexible seating arrangements, sophisticated HMI/UX solutions for non-driving tasks, enhanced connectivity, and premium materials to maximize comfort and utility during periods when the vehicle is controlling motion.

What is the significance of the shift toward Software-Defined Vehicles (SDVs) for the design market?

The SDV paradigm means that vehicle functionality is increasingly managed by software and electronics. For design, this requires specialized HMI and UX design expertise to create fluid, updatable digital interfaces and systems that seamlessly integrate physical controls with digital screens. Design teams must now collaborate closely with software engineers to ensure hardware and digital elements harmonize.

Which design segment, Exterior or Interior, is seeing greater investment growth currently?

The Interior Design segment is currently experiencing higher proportional investment growth. This is largely because the shift to EVs and autonomous concepts makes the cabin the primary differentiator and value driver. Investment is focused on advanced ergonomics, sustainable cabin materials, and cutting-edge infotainment and connectivity integration (HMI/UX).

What are the key constraints limiting the rapid adoption of new design technologies?

The primary constraints include the high capital expenditure required for sophisticated digital infrastructure (such as generative AI platforms and high-performance computing clusters), the complexity of integrating diverse software tools across the global value chain, and the persistent shortage of specialized talent proficient in both design creativity and advanced digital engineering (CAD/CAE/AI proficiency).

Why is aerodynamic optimization critical in modern automotive design, especially for EVs?

Aerodynamic optimization is crucial for EVs because it directly impacts driving range and efficiency. Designers must prioritize low drag coefficients (Cd) to maximize the distance an EV can travel on a single charge. This often leads to highly stylized, sleek exterior forms, integrated door handles, and specialized wheel designs that minimize air resistance while maintaining brand aesthetic.

How do stringent environmental regulations influence material selection in vehicle design?

Environmental regulations, particularly in Europe, push designers toward using lightweight, sustainable, and easily recyclable materials. This includes bio-based composites, recycled plastics, and low-mass aluminum alloys. The choice of material is now dictated not just by structural integrity or cost, but by the vehicle's entire lifecycle environmental impact, necessitating specialized material design consulting.

What is a key difference between traditional automotive design outsourcing and modern partnerships?

Traditional outsourcing focused on specific, isolated tasks (e.g., clay modeling). Modern partnerships are deep, integrated collaborations where external design houses act as strategic partners, contributing to platform development, engineering feasibility studies, and digital integration from the earliest conceptual stages, focusing on speed and shared intellectual property development.

Which type of specialized design service is essential for meeting crash safety standards in new designs?

Engineering Design and Simulation services, specifically using Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD), are essential. These services allow designers to test structural integrity, predict crash performance, and optimize component geometries for safety compliance and regulatory approval (like Euro NCAP) digitally, minimizing physical testing iterations.

How are OEM internal design centers balancing internal capacity with the use of external design firms?

OEMs maintain strong internal design teams for core brand identity, proprietary platforms, and high-level conceptualization. They utilize external design houses for surge capacity, specialized expertise (e.g., niche vehicle segments like performance or autonomy), and access to cutting-edge digital tools and talent pools that might be impractical to maintain entirely in-house.

What are the core intellectual property considerations in the market when using external design services?

IP considerations center on the ownership of digital models, design patents, and software algorithms used during the process. Contracts must clearly define who owns the rights to the conceptual styling, the underlying engineering data, and any novel HMI solutions developed, especially given the high value placed on unique aesthetic and functional IP in the competitive automotive sector.

Beyond aesthetics, what is a crucial non-visual element that designers must integrate effectively today?

Designers must crucially integrate vehicle acoustics and vibrational dampening (NVH - Noise, Vibration, Harshness). In EVs, the absence of engine noise amplifies other sounds (wind, tire noise), requiring specialized acoustic design integration into the cabin structure and materials to maintain the perception of premium quality and passenger comfort.

How is 3D printing impacting the prototyping phase of automotive design?

3D printing dramatically reduces the time and cost associated with producing physical prototypes for design validation. Designers use high-fidelity 3D printing for immediate verification of small components, intricate interior features, and complex exterior details, allowing for rapid iteration and fitting checks much earlier than traditional tooling processes permit.

In the context of the Value Chain, what is the 'upstream analysis' focused on?

Upstream analysis in the design value chain focuses on the foundational inputs necessary for design, primarily including market research (trend data, consumer behavior insights), the provision of core software technologies (CAD/CAE licenses), and specialized material research necessary to define the initial design constraints and opportunities.

Why is the need for highly skilled digital sculptors increasing despite the rise of AI tools?

While AI can generate initial forms, human digital sculptors are still essential for the final, high-quality Class-A surfacing. This requires nuanced artistic judgment and technical precision to ensure manufacturability and maintain the specific emotional and aesthetic intent that defines a luxury or high-performance vehicle brand, a task currently beyond full AI automation.

What challenges do specialized design firms face when working with multinational OEMs?

Specialized firms face challenges related to managing data compatibility across different OEM proprietary software platforms, aligning designs with diverse regional regulatory requirements (e.g., US vs. EU lighting standards), and maintaining seamless, secure communication and IP protection across multiple global time zones and jurisdictions.

How does the concept of 'modular design' affect the creative freedom of automotive designers?

Modular design, using common platforms (like EV skateboards), constrains creative freedom in terms of fundamental vehicle proportions and hard points (e.g., wheel placement). However, it liberates designers to focus intensely on the 'top hat'—the visible cabin and exterior body—allowing for greater creative variety and rapid differentiation using shared engineering underpinnings.

What is the future outlook for the role of physical clay modeling in automotive design?

While digital modeling is dominant, physical clay modeling remains vital, especially in luxury and high-performance segments, as it provides a tangible, tactile evaluation of complex surfaces and reflections that digital screens cannot perfectly replicate. The future sees clay modeling continuing, but primarily driven by data from digital models via robotic milling machines (milled clay modeling).

How are customer feedback loops being integrated into the early design stages?

Customer feedback is integrated early through AI-driven sentiment analysis of social media and market data, coupled with virtual reality clinics. Prospective customers can interact with VR prototypes and their behavioral data (e.g., where they look, what controls they use) is captured and immediately fed back into the design process for rapid optimization.

What distinguishes the design approach for autonomous shuttles compared to traditional passenger cars?

Autonomous shuttle design focuses entirely on functional utility, ingress/egress ease, high durability, and maximizing interior volume for standing/sitting passengers rather than driver appeal. Exterior design prioritizes sensor visibility and pedestrian communication interfaces, often resulting in boxier, more utilitarian forms optimized for dense urban environments.

What is meant by AEO (Answer Engine Optimization) in the context of automotive design content?

AEO in design content means structuring information, particularly technical specifications and functional definitions (like HMI standards or aerodynamic principles), in a clear, concise, and structured way (like tables and lists) so that search engines and AI models can directly extract and present these specific answers to user queries regarding vehicle design processes and technologies.

Why is cross-functional collaboration between design and engineering now more critical than ever?

Electrification and complexity require design and engineering to work concurrently from the project start. Decisions about battery placement or sensor integration affect styling, and styling choices impact thermal management and aerodynamics. Integrated, cloud-based design platforms facilitate this necessary cross-functional collaboration to prevent costly late-stage conflicts and rework.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager