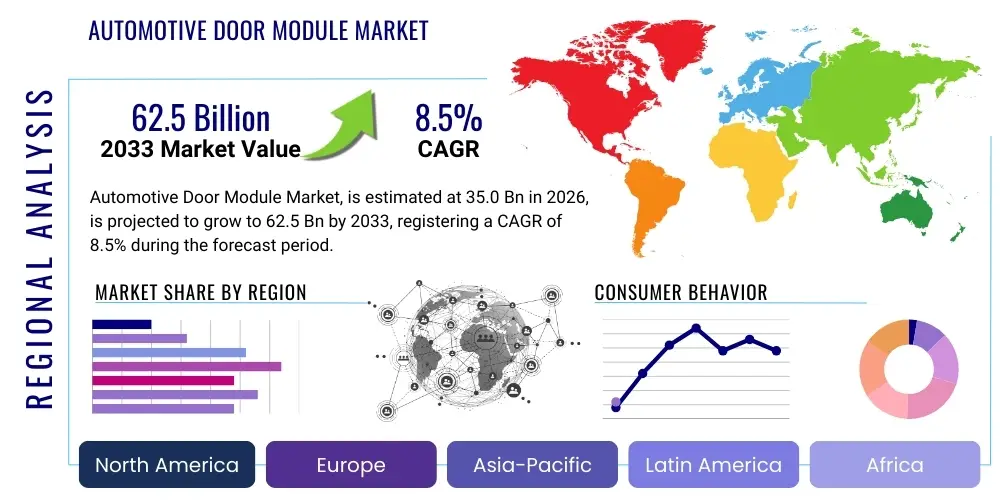

Automotive Door Module Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443443 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Door Module Market Size

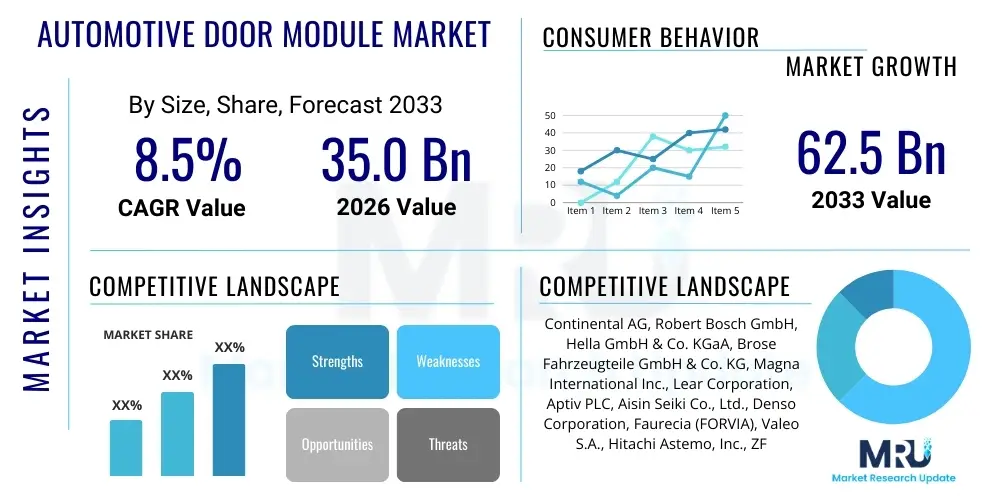

The Automotive Door Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 35.0 Billion in 2026 and is projected to reach USD 62.5 Billion by the end of the forecast period in 2033.

Automotive Door Module Market introduction

The Automotive Door Module Market encompasses the integrated systems designed to manage and control various functionalities within a vehicle's doors, transitioning from discrete electrical components to unified, often centralized, electronic control units (ECUs). These modules integrate critical functions such as power window operation, central locking, mirror control, memory seating adjustments, lighting, and sophisticated safety features like anti-pinch mechanisms. The modular approach significantly reduces wiring complexity, minimizes vehicle weight, and facilitates faster assembly processes for Original Equipment Manufacturers (OEMs), driving widespread adoption across vehicle segments.

The core product, the Automotive Door Module (ADM), serves as a crucial node in the vehicle's body electronics network, communicating typically via Controller Area Network (CAN) or Local Interconnect Network (LIN) protocols. These systems are increasingly sophisticated, supporting advanced connectivity features and diagnostics capabilities. Major applications span from basic passenger vehicles requiring reliable window and lock operation to high-end luxury vehicles incorporating complex soft-close, keyless entry, and advanced personalized lighting sequences, demonstrating the scalability and versatility of the technology.

Key driving factors include stringent global safety regulations mandating sophisticated locking and anti-entrapment systems, the accelerating trend toward vehicle electrification requiring optimized power management across all auxiliary systems, and increasing consumer demand for enhanced comfort and convenience features. The integration of high-reliability microcontrollers and robust packaging solutions ensures longevity and performance under various environmental conditions, further cementing the door module's role as an indispensable component in modern vehicular architecture.

Automotive Door Module Market Executive Summary

The Automotive Door Module market is experiencing robust expansion fueled by several overarching business trends, notably the shift towards highly integrated, software-defined vehicle architectures where door modules serve as distributed intelligence hubs. Key manufacturers are focusing on miniaturization, standardization of interfaces, and the incorporation of cybersecurity features to protect sensitive vehicle data and functions, positioning modularization as a cornerstone of efficient automotive production. Technological advancements in lightweight materials and energy-efficient motor control are also impacting component design, addressing the critical industry need for enhanced efficiency and reduced overall vehicle mass.

Regional trends highlight the Asia Pacific (APAC) region as the dominant growth engine, primarily driven by mass vehicle production in China and India, coupled with increasing consumer adoption of mid-range vehicles featuring enhanced electronic content. North America and Europe, while mature markets, emphasize innovation focused on premium features, sophisticated diagnostic capabilities, and adherence to rigorous electromagnetic compatibility (EMC) standards. Regulatory pressure for improved pedestrian and occupant safety continues to shape module design globally, driving demand for more reliable sensor integration within the door structure.

Segment trends reveal that the Passenger Car segment retains the largest market share due to sheer volume, yet the commercial vehicle segment is showing accelerated growth due to the integration of automated functions for driver efficiency and compliance with fleet management standards. Functionally, there is a clear migration toward Centralized Door Modules (CDM), which offer superior flexibility, cost reduction through parts count optimization, and easier software updating capabilities compared to traditional decentralized architectures, influencing procurement strategies among leading OEMs.

AI Impact Analysis on Automotive Door Module Market

Analysis of common user questions regarding AI's impact on the Automotive Door Module Market typically revolves around operational efficiency, user experience personalization, and the transition toward autonomous vehicle requirements. Users frequently inquire how AI can optimize the door opening/closing sequence for energy savings in Electric Vehicles (EVs), improve predictive maintenance for electrical components like window motors and locks, and enable advanced, context-aware personalized settings (e.g., automatically adjusting door stiffness or mirror position based on driver biometric cues or external weather data). Key concerns include the robustness and cybersecurity implications of AI-driven control logic embedded within a critical body control system, and the complexity associated with validating and updating AI algorithms over the vehicle's lifespan. The consensus expectation is that AI will transform door modules from passive control units into active, intelligent subsystems integral to the vehicle's holistic environmental awareness and occupant safety strategy.

AI integration introduces substantial opportunities for enhancing both the functionality and longevity of door modules. By leveraging machine learning algorithms, ADMs can analyze historical usage patterns, environmental factors, and electrical load fluctuations to anticipate potential hardware failures, such as sticky window mechanisms or failing actuators, triggering proactive service alerts. This capability drastically reduces warranty claims and improves overall customer satisfaction. Furthermore, AI facilitates the creation of truly adaptive human-machine interfaces (HMIs) by enabling features like gesture-controlled doors, personalized lighting pathways integrated into the door panel, and refined acoustic feedback systems tied to door operation.

The implementation of AI also extends to manufacturing and supply chain efficiency. Predictive quality control in the assembly line can use vision systems and deep learning to identify defects in wiring harnesses or PCB soldering within the module assembly with greater accuracy than traditional inspection methods. In use, optimization algorithms can manage the power consumption of door-related systems (windows, locks, lighting) dynamically, minimizing drain on the high-voltage battery in EVs, which is crucial for maximizing driving range. This sophisticated energy management requires specialized, edge-computing capabilities embedded directly within the module’s ECU.

- AI-driven predictive maintenance for motors, locks, and sensors, reducing component failure rates.

- Enhanced personalization of door functions, including adaptive locking speed and mirror alignment based on user profile and external context.

- Optimization of power consumption for door-related auxiliary systems in Electric Vehicles (EVs) using intelligent load balancing.

- Integration of advanced safety features like anomaly detection in anti-pinch systems.

- Facilitation of sophisticated, gesture-controlled or biometric-activated door entry and exit systems.

DRO & Impact Forces Of Automotive Door Module Market

The market dynamics of the Automotive Door Module sector are dictated by a confluence of accelerating drivers and persistent restraints, creating opportunities particularly in the domain of autonomous and electric vehicles. The primary drivers include increasing regulatory mandates for vehicle safety, such as reinforced side-impact protection and anti-entrapment features in power windows, coupled with relentless consumer demand for high-tech comfort features like sophisticated ambient lighting, soft-close doors, and advanced keyless access systems. These factors necessitate higher functional integration and complexity within the door module, propelling market growth. Furthermore, the global proliferation of vehicle electrification, where weight reduction and optimized energy consumption are paramount, favors the compact, centralized design of modern door modules, positioning them as essential components for overall vehicle efficiency. The shift towards software-defined vehicles also benefits module manufacturers capable of providing over-the-air (OTA) update compatibility for enhanced functionality post-purchase.

Conversely, significant restraints hinder market growth and pose challenges to manufacturers. High initial development and integration costs for advanced modules, especially those incorporating multiple sensors and high-speed communication interfaces (e.g., Ethernet), can deter adoption in economy vehicle segments. Furthermore, the inherent complexity arising from integrating multiple disparate functions (mechanical, electrical, electronic, and software) into a compact unit introduces challenges related to electromagnetic interference (EMI) and rigorous validation requirements. System reliability and cybersecurity vulnerabilities represent persistent impact forces; a single failure in the centralized door module can compromise multiple critical functions, demanding extremely robust hardware and secure software architecture. Supply chain volatility, particularly concerning microcontrollers and specialized electronic components, also continues to exert downward pressure on production schedules and cost stability.

Despite these restraints, substantial opportunities are emerging, particularly centered on leveraging lightweight composite materials for module housing and integrating advanced networking protocols to support Level 3 and higher autonomous driving features, where door status and integrity become vital inputs for safety protocols. The development of standardized, scalable module platforms that can be rapidly adapted across different vehicle lines represents a key opportunity for suppliers to secure long-term OEM contracts. The growing aftermarket customization sector for luxury and performance vehicles, demanding retrofitting of high-end door functionalities, also presents an ancillary revenue stream. The impact forces are driving the industry toward specialization, emphasizing suppliers who can master fault tolerance, functional safety (ISO 26262 compliance), and integrated diagnostics capabilities within their door module offerings.

Segmentation Analysis

The Automotive Door Module Market is segmented based on several critical parameters, including the component type, the specific functionality offered, the type of vehicle employing the module, and the sales channel through which the product is distributed. This segmentation allows for precise market sizing and strategic targeting based on technological sophistication and end-user requirements. The component segmentation differentiates between the core electronic hardware and the peripherals, highlighting the increasing value share of the Electronic Control Unit (ECU) and associated smart sensors. Functionality segmentation analyzes the market structure based on the level of centralization and the specific feature set supported, revealing the trend toward integrated systems capable of handling multiple functions simultaneously.

Vehicle type segmentation confirms the passenger car category's dominance, but strategic investments are being redirected towards light and heavy commercial vehicles where durability and efficiency-focused automation are becoming essential. The most influential segmentation factor remains the technological architecture (Centralized vs. Decentralized), which determines the complexity of the wiring harness and the flexibility for future updates. Centralized systems, by consolidating control logic, are increasingly preferred by OEMs seeking to implement standardized software layers across their vehicle platforms, thereby reducing manufacturing complexity and Bill of Materials (BOM) costs associated with redundant components.

- By Component Type:

- Electronic Control Unit (ECU) / Printed Circuit Board (PCB)

- Actuators and Motors (e.g., Window Lift Motor, Locking Actuator)

- Sensors (e.g., Anti-Pinch Sensor, Temperature Sensor, Hall Effect Sensor)

- Wiring Harness and Connectors

- By Vehicle Type:

- Passenger Cars (PC)

- Commercial Vehicles (CV)

- By Functionality:

- Power Window Control

- Central Locking and Security Features

- Mirror Adjustment and Folding

- Advanced HMI Integration (Lighting, Sound)

- By Architecture:

- Centralized Door Module (CDM)

- Decentralized/Distributed Door Module (DDM)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Door Module Market

The value chain for the Automotive Door Module Market begins with the Upstream Analysis, which involves the sourcing and processing of raw materials and specialized components. This stage is dominated by semiconductor manufacturers providing microcontrollers, memory chips, and communication chips (CAN/LIN transceivers), alongside suppliers of complex wiring harnesses, plastic resins for housing, and precision mechanical components like gears and motor magnets. The quality and reliability of these upstream inputs directly dictate the performance and longevity of the final module. Price volatility and supply concentration in the semiconductor sector represent key risks at this foundational level, requiring suppliers to maintain robust sourcing strategies and dual-sourcing agreements to mitigate potential production delays.

The core manufacturing and assembly phase, which is primarily executed by Tier 1 automotive suppliers, transforms these raw components into integrated door modules. This stage involves sophisticated PCB assembly, software loading and testing, and final integration checks for functional safety compliance. Distribution channels are predominantly Direct, utilizing a highly controlled OEM-centric model. Tier 1 suppliers negotiate long-term contracts directly with vehicle manufacturers (OEMs) for specific vehicle platforms, ensuring just-in-time delivery to assembly plants worldwide. The relationship is highly collaborative, often involving joint development efforts early in the vehicle design cycle to ensure optimal integration and weight management. Indirect sales, constituting the Aftermarket channel, involve distributing replacement modules and enhancement kits through authorized distributors and independent repair shops, forming a smaller but necessary segment focusing on maintenance and repair.

Downstream Analysis focuses on the end-user adoption and post-sale service lifecycle. OEMs integrate the door modules into the vehicle body, and the module's performance is critically evaluated during vehicle testing and validation phases. Post-sales support and maintenance involve the replacement of faulty modules, often facilitated by the supplier network. As vehicles become more connected and software-centric, the downstream value is increasingly derived from over-the-air (OTA) software updates, which enable functional improvements or bug fixes without hardware replacement. This trend elevates the importance of software development capabilities and cybersecurity within the traditional hardware manufacturing value chain, shifting profitability toward high-margin software integration services.

Automotive Door Module Market Potential Customers

The primary and largest segment of potential customers for Automotive Door Modules consists of Original Equipment Manufacturers (OEMs) across the global automotive industry. These include major multinational corporations producing light passenger vehicles, such as Toyota, Volkswagen Group, General Motors, and Hyundai, which require millions of standardized, high-volume door modules annually for new vehicle assembly lines. Strategic purchasing decisions by OEMs prioritize cost efficiency, component reliability, compliance with strict functional safety standards (ISO 26262), and the technical capacity of the supplier to meet complex integration requirements, particularly for highly automated or electric vehicle platforms.

A rapidly growing customer segment comprises manufacturers of specialized vehicles, including luxury and premium brands (e.g., BMW, Mercedes-Benz, Tesla) and niche vehicle producers. These customers demand highly customized, feature-rich door modules incorporating advanced features like capacitive touch sensors, soft-close mechanisms, advanced ambient lighting systems, and connectivity for vehicle access using smartphones. For these high-end applications, the emphasis shifts from sheer volume to technological innovation, bespoke design, and seamless integration with the vehicle's proprietary electronic architecture, leading to higher average selling prices (ASPs) per module.

Secondary but significant end-users are participants in the global automotive Aftermarket. This includes authorized dealership service centers, independent repair shops, and specialized body repair facilities that require replacement door modules, actuators, and associated sensors for vehicle maintenance and accident repair. Furthermore, performance tuning and customization companies constitute a small but highly valuable customer base in the aftermarket, seeking high-performance or enhanced security door modules to upgrade older vehicles or customize new ones. For this segment, component availability, compatibility, and ease of installation are the critical purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.0 Billion |

| Market Forecast in 2033 | USD 62.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Hella GmbH & Co. KGaA, Brose Fahrzeugteile GmbH & Co. KG, Magna International Inc., Lear Corporation, Aptiv PLC, Aisin Seiki Co., Ltd., Denso Corporation, Faurecia (FORVIA), Valeo S.A., Hitachi Astemo, Inc., ZF Friedrichshafen AG, Keboda Technology Co., Ltd., Marquardt GmbH, Visteon Corporation, Stoneridge Inc., KOSTAL Group, Minda Industries Ltd., Cebi International S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Door Module Market Key Technology Landscape

The technological landscape of the Automotive Door Module Market is characterized by a strong push toward electronic integration, advanced networking, and lightweighting solutions. The shift from basic relays and electromechanical switches to sophisticated Electronic Control Units (ECUs) using multi-core microcontrollers is fundamental. These ECUs utilize advanced signal processing techniques to manage complex functions such as highly sensitive anti-pinch logic and multi-channel communication (CAN-FD, LIN, and increasingly, Automotive Ethernet) to interface reliably with the vehicle’s central gateway and other body control units. Functional safety is paramount, driving the mandatory implementation of hardware and software redundancy compliant with stringent international standards like ISO 26262 up to ASIL B or C, ensuring module integrity even during failure events.

Another crucial technological development involves the deployment of smart sensing technologies integrated directly into the door structure. Capacitive sensors are replacing traditional mechanical buttons for door handle and locking mechanisms, supporting advanced keyless entry and proximity detection. Furthermore, the adoption of MOSFET-based motor control (rather than traditional relays) provides superior energy efficiency, faster response times, and finer motor positioning control crucial for features like soft-close doors and precision mirror alignment, which is particularly vital for camera-based mirror systems in modern EVs. This shift ensures minimal power loss and extends the component lifecycle while reducing audible noise during operation.

The future technology trajectory focuses heavily on standardization and modularity to address the challenges of complexity and variant proliferation. Suppliers are investing in platform solutions—highly configurable hardware and software stacks that can serve multiple vehicle lines with minimal adaptation. Moreover, the integration of wireless communication standards (e.g., Bluetooth Low Energy or NFC) within the door module is essential for modern passive entry/passive start (PEPS) systems and digital key functionality, enabling secure vehicle access using mobile devices. Materials science also plays a vital role, with manufacturers utilizing composite and high-strength, lightweight plastics for module casings to reduce overall vehicle mass, aligning with mandated fuel economy and EV range optimization goals.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the Automotive Door Module Market, primarily due to high-volume manufacturing hubs in China, Japan, South Korea, and India. The region is characterized by explosive growth in middle-class vehicle ownership and rapid adoption of electric vehicles, driving substantial demand for standardized door modules. While cost competitiveness remains a crucial factor, there is an increasing trend, particularly in premium vehicle manufacturing in Japan and South Korea, toward integrating advanced features like smart access systems and sophisticated infotainment controls within the door architecture. Local governmental policies promoting EV adoption further accelerate the demand for lightweight and energy-optimized door modules.

- Europe: Europe represents a mature market focusing intensely on high functional safety standards, premium features, and advanced regulatory compliance (e.g., stricter pedestrian safety mandates impacting door handle design and deployment). Key drivers include the rapid expansion of the luxury and high-performance vehicle segments, which utilize complex centralized modules integrating soft-close features, advanced diagnostics, and sophisticated ambient lighting systems. European OEMs lead in the implementation of Automotive Ethernet within vehicle architectures, necessitating suppliers to offer door modules capable of high-bandwidth communication for future connected car services.

- North America: The North American market is driven by high consumer expectations for comfort, convenience, and large vehicle platforms (trucks and SUVs). This region sees strong adoption of centralized, high-specification door modules supporting features like memory seats linked to key fobs, integrated diagnostics for self-service, and robust security systems. Significant investment in the electrification of the automotive fleet, particularly by major domestic manufacturers, dictates a strong focus on modular designs that minimize component weight and optimize energy efficiency to maximize EV range, requiring high-efficiency motor control ECUs.

- Latin America & Middle East/Africa (LAMEA): These regions present emerging opportunities, particularly in Latin America, driven by increasing vehicle production and the gradual adoption of basic electronic safety and convenience features. The focus in these markets is generally on cost-effective, high-durability door modules that can withstand diverse environmental conditions. The Middle East segment, dominated by luxury and premium vehicle imports, mirrors European and North American demand for high-end functionality, while African markets show steady growth driven by localization of assembly operations requiring simpler, robust componentry.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Door Module Market.- Continental AG

- Robert Bosch GmbH

- Hella GmbH & Co. KGaA

- Brose Fahrzeugteile GmbH & Co. KG

- Magna International Inc.

- Lear Corporation

- Aptiv PLC

- Aisin Seiki Co., Ltd.

- Denso Corporation

- Faurecia (FORVIA)

- Valeo S.A.

- Hitachi Astemo, Inc.

- ZF Friedrichshafen AG

- Keboda Technology Co., Ltd.

- Marquardt GmbH

- Visteon Corporation

- Stoneridge Inc.

- KOSTAL Group

- Minda Industries Ltd.

- Cebi International S.A.

Frequently Asked Questions

Analyze common user questions about the Automotive Door Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Automotive Door Module and why are they becoming centralized?

An Automotive Door Module (ADM) is an integrated electronic unit controlling door functions like power windows, locks, and mirrors. They are becoming centralized (Centralized Door Modules or CDMs) to reduce overall vehicle weight, simplify wiring harnesses, lower manufacturing complexity, and enable easier software updates (OTA functionality) across the vehicle platform.

How is the rise of Electric Vehicles (EVs) impacting the design requirements for door modules?

EVs demand highly optimized and lightweight components to maximize battery range. This requires door modules to focus intensely on energy efficiency through advanced motor control electronics (MOSFETs) and robust thermal management, while also utilizing lightweight materials for module housing and component reduction via centralization.

What role does functional safety (ISO 26262) play in the development of door modules?

Functional safety standards (like ISO 26262) are critical because door functions are linked to occupant safety (e.g., anti-pinch mechanisms, emergency unlocking). Suppliers must design modules with high integrity, redundancy, and validated software to prevent systematic failures, typically requiring compliance up to Automotive Safety Integrity Level (ASIL) B or C.

Which geographical region dominates the Automotive Door Module Market share?

The Asia Pacific (APAC) region currently holds the largest market share, driven primarily by high-volume vehicle production, particularly in China and India, coupled with rapid technological uptake and growing consumer demand for feature-rich vehicles in the mass market segments.

What are the key technological trends affecting future Automotive Door Module innovation?

Key trends include the integration of AI for predictive maintenance and personalized settings, the adoption of high-speed communication protocols like Automotive Ethernet, widespread use of contactless access systems (NFC/BLE), and a move towards standardized, scalable software platforms that support OTA updates for life-cycle flexibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager