Automotive Door Stabilizer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442352 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Door Stabilizer Market Size

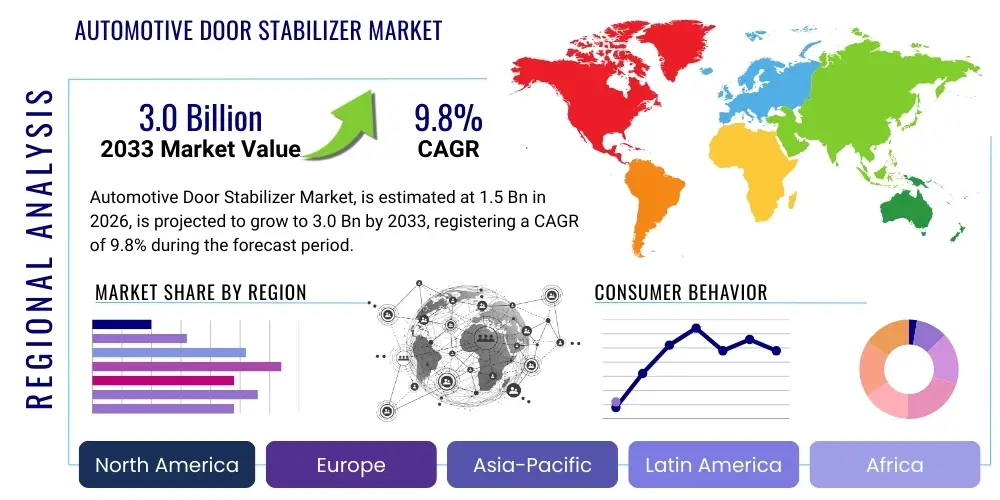

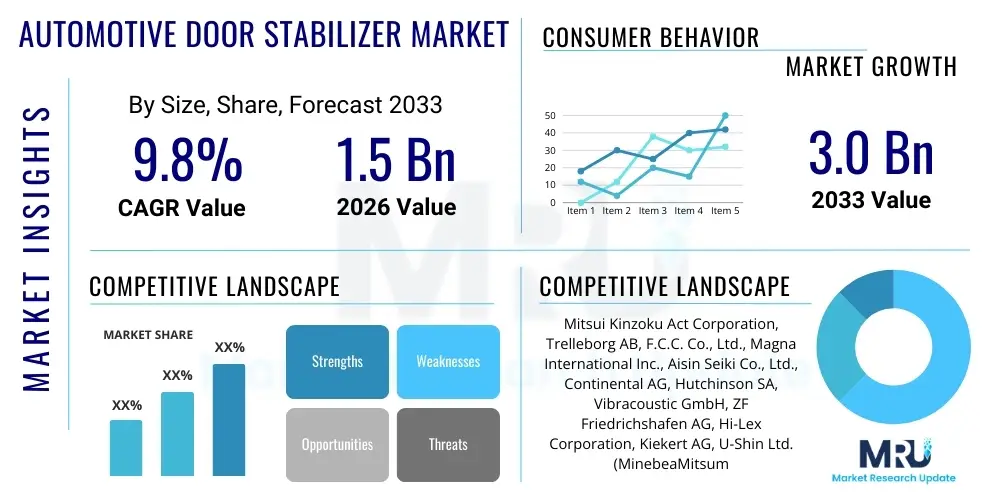

The Automotive Door Stabilizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [9.8]% between 2026 and 2033. The market is estimated at [USD 1.5 Billion] in 2026 and is projected to reach [USD 3.0 Billion] by the end of the forecast period in 2033.

Automotive Door Stabilizer Market introduction

The Automotive Door Stabilizer Market encompasses the specialized components designed to enhance the rigidity, sound dampening, and overall operational quality of vehicle doors. These devices are strategically installed to fill the minor gaps between the door and the vehicle frame, mitigating vibrations, rattles, and excessive movement typically associated with vehicle dynamics, especially at high speeds or over uneven terrain. Functionally, door stabilizers utilize mechanisms, often involving specialized resins, elastomers, or adjustable latch systems, to ensure a tight, precise fit, which contributes significantly to the perceived quality and structural integrity of the automobile. This technology moves beyond basic latching mechanisms by offering a performance upgrade that aligns with consumer demands for quieter cabins and enhanced handling characteristics, making them increasingly standard features in luxury and premium vehicle segments, and subsequently filtering down into mass-market models as component costs decrease and quality expectations rise.

The primary applications of automotive door stabilizers span passenger vehicles, commercial vehicles, and high-performance sports cars, where the benefits of improved chassis rigidity and reduced cabin noise are highly valued. Key benefits include superior acoustic performance, minimization of structural flexing during hard cornering, enhanced safety by ensuring door integrity in minor impacts, and an overall improvement in the tactile feel of door opening and closing. The increased demand for these stabilizers is driven by several macroeconomic and automotive trends, most notably the transition towards electric vehicles (EVs). Since EVs lack the masking noise of internal combustion engines, road and chassis noise—including subtle door rattles—become far more prominent, necessitating sophisticated stabilization solutions to maintain passenger comfort and meet stringent NVH (Noise, Vibration, and Harshness) standards. Furthermore, global regulatory pressures focused on vehicle safety and structural rigidity continue to propel the adoption of advanced stabilization components across various vehicle classes.

Driving factors for sustained market growth include stringent safety regulations worldwide, particularly concerning side-impact protection and structural integrity, alongside fierce competition among Original Equipment Manufacturers (OEMs) to deliver premium cabin experiences. The proliferation of advanced features like frameless windows and panoramic roofs in mainstream vehicles necessitates robust stabilization solutions to manage structural loads and maintain acoustic integrity. Technological advancements, such as the development of lightweight, high-strength materials like specialized polymer composites, are enabling suppliers to offer effective stabilizers that do not add significant weight, appealing to the industry’s focus on weight reduction for fuel efficiency and extended EV range. Consequently, the automotive door stabilizer has transitioned from a niche luxury component to an essential element of modern vehicle design focused on quality, safety, and occupant comfort.

Automotive Door Stabilizer Market Executive Summary

The Automotive Door Stabilizer Market is characterized by robust business trends centered on technological integration and supply chain optimization, responding directly to evolving OEM requirements for enhanced vehicle dynamics and superior NVH characteristics. Major business activity revolves around developing high-performance, lightweight materials, specifically focusing on advanced thermoplastic elastomers and specialized cushioning resins that offer superior dampening characteristics under extreme thermal and mechanical stresses. Strategic partnerships between tier-one suppliers and established automotive sensor manufacturers are becoming prevalent, exploring opportunities to integrate stabilization systems with active safety features or vehicle dynamic control systems, although this is still in an nascent stage. The market exhibits consolidation in the premium segment, where established suppliers leverage deep integration with OEM platform architectures, while emerging players focus on disruptive material science and cost-effective stabilization solutions for the mass-market segment, driving competitive pricing and rapid innovation cycles. Furthermore, the trend toward global platform sharing by major automakers necessitates standardized yet highly adaptable stabilizer designs, offering growth opportunities for suppliers capable of large-scale, consistent production.

Regional trends indicate that Asia Pacific (APAC), particularly China, Japan, and South Korea, dominates the market share due to burgeoning vehicle production, rapid adoption of advanced automotive technologies, and a consumer base increasingly demanding high-quality vehicle interiors. Europe remains a key region, driven by strict regulatory requirements regarding vehicle safety and the strong presence of luxury and performance vehicle manufacturers, which prioritize dynamic performance and minimized cabin noise. North America shows steady growth, fueled by the rising consumer preference for large SUVs and light trucks, vehicles that greatly benefit from enhanced door rigidity and stability, particularly in areas with varied road conditions. While growth in established regions is steady, emerging markets in Latin America and the Middle East are accelerating their adoption of these components as local manufacturing capabilities improve and global quality standards are integrated into domestically produced vehicles, presenting significant future expansion potential for global suppliers.

Segmentation trends highlight that the Passenger Vehicle segment maintains the largest market share, directly corresponding to the high volume of production and stringent quality expectations within this category. Within the component types, the adjustable latch stabilizer systems are gaining traction over fixed elastomeric buffers, primarily due to their ability to provide custom-tuned door closure sound and greater consistency across manufacturing tolerances, appealing directly to OEM quality standards. The Aftermarket segment, while smaller, is growing steadily, driven by vehicle owners seeking to upgrade older models or improve the structural feel of lower-end vehicles through retrofitted stabilization kits. The EV segment is anticipated to exhibit the fastest growth rate in the forecast period, accelerating the demand for premium stabilizers specifically engineered to minimize acoustic ingress and structural flex, compensating for the inherently quiet operation of electric powertrains. This segment is expected to attract significant R&D investment, leading to specialized, lighter-weight stabilization solutions tailored for EV battery platforms.

AI Impact Analysis on Automotive Door Stabilizer Market

Common user questions regarding AI's impact on the Automotive Door Stabilizer Market often center around whether AI can optimize the physical design of these components, how machine learning might improve manufacturing precision, and if predictive maintenance using AI could monitor stabilizer performance over the vehicle's lifecycle. Users frequently inquire about the feasibility of integrating AI-driven systems into door mechanisms to provide "active" noise cancellation or dynamic adjustment of the door fitment based on driving conditions (speed, road roughness, temperature). The central theme is the transition from passive stabilization technology to intelligent, adaptive systems. Concerns also exist about the data privacy implications of embedding sensors within door systems and the necessary computational infrastructure needed to support real-time adjustments. Analysis reveals a high expectation for AI to significantly enhance quality control during production and enable personalized NVH tuning, transforming the stabilizer from a simple mechanical part into a data-generating, adaptive subsystem integral to the vehicle’s dynamic performance management.

- AI-driven topology optimization facilitates the design of door stabilizers using minimal material while maximizing rigidity and NVH performance, leading to lighter components.

- Machine learning algorithms enhance manufacturing precision by analyzing sensor data from production lines, identifying and correcting minute deviations in molding or assembly processes in real-time.

- Predictive maintenance analytics, powered by embedded micro-sensors in high-end stabilizers, forecast component wear and failure, alerting users or maintenance systems before performance degradation occurs.

- Generative design tools, leveraging AI, rapidly explore millions of design iterations to achieve optimal acoustic dampening profiles, dramatically reducing R&D cycles.

- AI integration into vehicle dynamics control (VDC) systems could enable active adjustment of electronically controlled stabilizers to momentarily enhance chassis stiffness during aggressive maneuvering.

- Enhanced quality control using computer vision and deep learning models to inspect stabilizer components for defects faster and more accurately than human inspection.

DRO & Impact Forces Of Automotive Door Stabilizer Market

The dynamics of the Automotive Door Stabilizer Market are profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and technological trajectory. Primary drivers include the increasingly rigorous global standards for vehicle safety, which mandate robust structural components capable of withstanding severe impacts, where door stabilizers play a crucial role in maintaining door rigidity and alignment. Concurrently, the consumer demand for luxury and comfort continues to rise, especially concerning cabin acoustics and the tactile quality of the vehicle, pushing OEMs to adopt sophisticated NVH mitigation components like advanced stabilizers. The explosive growth in the electric vehicle (EV) segment acts as a significant catalyst, compelling manufacturers to invest heavily in components that address noise and vibration issues exacerbated by the silence of the electric powertrain, thereby creating specialized demand for high-performance stabilizers. Furthermore, advancements in material science, particularly in specialized polymers and high-damping elastomers, enable continuous product improvement and cost optimization, sustaining market viability across various price points.

However, the market faces notable restraints, predominantly related to the overall complexity of vehicle manufacturing and cost pressures. Integrating high-precision stabilization systems adds to the bill of materials, posing a challenge, especially for economy and mass-market vehicle segments where cost efficiency is paramount. Design complexity and the requirement for highly precise fitment within the door assembly process can lead to manufacturing hurdles, requiring specialized tooling and stringent quality control, potentially increasing production time and scrap rates. Furthermore, while the general benefits are clear, the precise impact of stabilizers on consumer perception is sometimes subtle, making it difficult for OEMs to market the incremental benefits, thus sometimes leading to their categorization as non-essential components during cost-cutting phases. Trade tensions and volatility in raw material prices, particularly specialized plastics and metals, also introduce supply chain instability that can restrict profit margins for suppliers operating globally, requiring continuous optimization of sourcing and logistics strategies.

Significant opportunities abound, particularly in exploiting the potential of smart and active stabilization technologies, which utilize sensor feedback to dynamically adjust component tension or dampening characteristics based on real-time vehicle inputs. The burgeoning aftermarket segment offers substantial, albeit niche, growth potential, allowing suppliers to target performance enthusiasts and vehicle customization markets seeking improved structural feedback. Moreover, geographical expansion into rapidly industrializing regions of Southeast Asia, Africa, and Eastern Europe, where vehicle parc is rapidly expanding and quality expectations are maturing, represents a long-term growth avenue. Leveraging digitalization and AI in the design and production process—as noted in the AI Impact Analysis—allows for highly personalized and performance-optimized solutions. Finally, the development of integrated modules, where the stabilizer is bundled with latching systems and door check mechanisms as a single unit, simplifies OEM assembly and reduces complexity, potentially lowering overall system costs and accelerating market penetration.

Segmentation Analysis

The Automotive Door Stabilizer Market is strategically segmented based on factors such as Component Type, Vehicle Type, Sales Channel, and Material Type, reflecting the diverse application landscape and technological complexity of the automotive industry. Component Type differentiation, including fixed elastomeric buffers, adjustable mechanical latches, and high-performance damping elements, allows manufacturers to cater to varying levels of NVH and structural rigidity requirements across different vehicle platforms. The dominance of Passenger Vehicles highlights the focus on consumer comfort and safety, while the rapidly growing Electric Vehicle segment demands specific material compositions tailored for superior acoustic performance and weight savings. Analysis by Sales Channel clarifies the high reliance on the OEM channel, reflecting the critical nature of these components to core vehicle design, while the burgeoning aftermarket provides opportunities for specialized upgrades and replacements, influencing competitive dynamics and distribution strategies across the globe.

- By Component Type:

- Fixed Elastomeric Stabilizers

- Adjustable Latch Stabilizers (Mechanical/Torsion based)

- High-Performance Damping Elements (e.g., fluid-filled or advanced polymer composites)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy-Duty Trucks)

- Electric Vehicles (EVs)

- By Material Type:

- Plastics and Polymers (e.g., POM, Nylon, Specialized Resins)

- Elastomers (Rubber, TPE, Silicone)

- Metals and Alloys (Used for structural housing and latch mechanisms)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Automotive Door Stabilizer Market

The value chain for the Automotive Door Stabilizer Market begins with upstream activities involving raw material procurement and highly specialized component manufacturing. Upstream suppliers are crucial, providing advanced engineered plastics, specialized rubber, high-grade damping polymers (TPEs), and precision metal components required for the stabilizer mechanism. Given the strict NVH and durability requirements, material selection is critical, often involving proprietary polymer blends to achieve optimal dampening characteristics. Precision molding and tooling operations constitute the next critical step, where components must be manufactured to extremely tight tolerances to ensure proper fitment and performance, distinguishing leading suppliers who invest heavily in sophisticated manufacturing technologies and quality assurance protocols. This phase is capital intensive and highly regulated due to automotive safety standards, necessitating long-term relationships between raw material providers and tier-two component manufacturers.

The midstream involves the tier-one automotive suppliers, who integrate the various components into the final door stabilizer assembly. These suppliers handle design validation, performance testing (NVH characteristics, longevity, environmental resistance), and customization according to specific OEM platform requirements. The complexity here lies in managing diverse product portfolios compatible with different door architectures—from traditional hinged doors to sliding or advanced frameless systems—and ensuring compliance with global safety and environmental regulations (e.g., REACH, RoHS). Downstream activities focus heavily on distribution, which is predominantly direct-to-OEM, given that stabilizers are crucial, non-optional safety and performance components integrated early in the vehicle assembly process. The supply chain demands synchronized, just-in-time delivery to global assembly plants, requiring robust logistics and inventory management systems from key suppliers.

The distribution channel is dichotomous: the OEM channel represents the vast majority of sales, characterized by long-term contracts, rigorous quality audits, and high-volume delivery. Indirect sales occur primarily through the aftermarket, where distribution involves authorized dealers, independent garages, and online retail platforms selling replacement or performance upgrade kits. Direct-to-OEM sales require deep technical collaboration and often co-development, securing substantial market presence but demanding continuous investment in R&D. Indirect distribution, while offering higher margins, requires effective branding and marketing strategies to reach end consumers or independent repair shops, often focusing on ease of installation and measurable performance improvements (e.g., reduction in door rattle, enhanced luxury feel). Successful market participation requires mastery of both the technical precision needed for OEM integration and the logistical efficiency required for global deployment across diverse manufacturing bases.

Automotive Door Stabilizer Market Potential Customers

The primary customers and end-users of automotive door stabilizers are Original Equipment Manufacturers (OEMs) across the global automotive landscape. OEMs purchase these components in high volume for integration into new vehicle production lines, viewing them as essential elements for achieving desired levels of structural rigidity, interior acoustic quality, and perceived value. The customer base spans the entire spectrum of automotive manufacturing, from high-end luxury vehicle producers (who prioritize superior NVH performance and tactile quality) and sports car manufacturers (who focus on enhancing chassis stability during dynamic driving) to mass-market and economy vehicle makers (who aim for cost-effective solutions to meet basic safety and quality standards). The shift towards electric vehicle production significantly expands this customer group, as EV manufacturers are highly motivated to adopt advanced stabilizers to mitigate road noise and ensure cabin tranquility, which directly impacts customer satisfaction in the absence of engine noise.

A secondary, yet rapidly growing, customer segment is the Automotive Aftermarket. This includes independent garages, authorized service centers, and specialized performance tuning shops. These buyers procure stabilizers for replacement parts in routine maintenance, particularly following accidents where door assemblies are damaged, or for upgrade kits. Performance enthusiasts often seek aftermarket stabilizers to enhance the ‘solid’ feel of their vehicle’s structure, especially for models where these components were not initially installed or were of a basic design. The growth of DIY mechanics and online parts platforms further caters to individual vehicle owners seeking to perform quality improvements themselves. Suppliers targeting the aftermarket must prioritize standardized sizing, ease of installation, and clear articulation of performance benefits to capture this fragmented but profitable customer segment, often relying on strong branding and positive reviews within enthusiast communities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | [USD 1.5 Billion] |

| Market Forecast in 2033 | [USD 3.0 Billion] |

| Growth Rate | [9.8% CAGR] |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsui Kinzoku Act Corporation, Trelleborg AB, F.C.C. Co., Ltd., Magna International Inc., Aisin Seiki Co., Ltd., Continental AG, Hutchinson SA, Vibracoustic GmbH, ZF Friedrichshafen AG, Hi-Lex Corporation, Kiekert AG, U-Shin Ltd. (MinebeaMitsumi Group), SMR Automotive Mirrors UK Ltd., Sango Co., Ltd., Stabilus S.A., Schaeffler AG, Faurecia SE, Inteva Products, Huf Hülsbeck & Fürst GmbH & Co. KG, Adient plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Door Stabilizer Market Key Technology Landscape

The technological landscape of the Automotive Door Stabilizer Market is rapidly advancing, moving beyond simple passive components toward precision-engineered, materials-optimized, and increasingly intelligent systems. A major technological focus is the development of advanced polymer and elastomer formulations. Suppliers are investing heavily in specialized thermoplastic elastomers (TPEs) and high-density, high-damping rubbers that provide superior vibration absorption across a wide range of temperatures and mechanical loads. These materials are crucial for meeting stringent NVH standards, especially in EVs where low-frequency structural noise is highly noticeable. Furthermore, manufacturers are employing advanced simulation tools, such as Finite Element Analysis (FEA) and computational fluid dynamics, to predict and optimize the interaction between the stabilizer, the door structure, and the vehicle body, ensuring maximum performance and longevity before physical prototyping, significantly accelerating product development cycles and reducing R&D costs.

Another pivotal technological trend is the proliferation of adjustable and mechanical latch stabilizer systems. These components utilize sophisticated spring mechanisms, cam followers, or precision-machined metal housings combined with high-performance polymers to allow for minute adjustments in door fitment. This adjustability addresses manufacturing tolerances and allows OEMs to tune the door closing "feel" or acoustic signature—a key element of perceived quality in premium vehicles. The technology aims to eliminate play between the door and the pillar, not just when the door is closed, but also during dynamic vehicle operation. This contrasts sharply with older, fixed rubber bumpers, providing a dynamically superior solution. Furthermore, the integration of lightweighting technologies, including multi-material construction (combining lightweight magnesium or aluminum components with engineering plastics), is paramount to support the automotive industry’s drive toward fuel efficiency and extended EV range without compromising structural integrity or dampening capability.

Looking ahead, the market is witnessing the emergence of smart and active stabilization technologies. While still niche, these systems incorporate micro-sensors, such as accelerometers or pressure sensors, to monitor the physical gap and vibration levels in real-time. In highly advanced conceptual designs, these sensors could potentially feed data back to a small actuator within the stabilizer, allowing for dynamic adjustments of the component’s tension or damping fluid viscosity. Although full commercialization of truly active systems is constrained by cost and complexity, the foundational technology is being leveraged for advanced quality control and diagnostics. This includes embedding passive RFID tags or simple monitoring elements within the stabilizers to facilitate automated quality checks during assembly and track performance data throughout the vehicle's lifespan, enabling suppliers to offer superior warranty and performance guarantees based on quantifiable data analysis.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in both production and consumption of automotive door stabilizers, driven by China, Japan, and South Korea, which collectively represent the highest volume of vehicle manufacturing worldwide. The region's dominance is underpinned by robust demand for high-quality components, accelerating technological adoption in domestic production, and a rapidly expanding middle class that demands features historically reserved for premium segments. Japan and South Korea, home to major global automotive innovators, focus heavily on precision engineering and advanced materials for stabilizer development, catering both to domestic high-end manufacturing and global supply chains. China’s vast manufacturing base and intense competition among local and international automakers ensure continuous, high-volume demand, especially as the country aggressively leads the global transition to New Energy Vehicles (NEVs), demanding specialized NVH solutions.

- Europe: The European market is characterized by a high emphasis on performance, safety, and acoustic luxury, driven by manufacturers in Germany, Italy, and France. European regulations concerning crash safety and pedestrian protection are among the strictest globally, necessitating the use of high-integrity door stabilization components. The region is a hotbed for innovation in advanced polymer and mechanical stabilizer systems, often utilizing sophisticated designs to reduce vibration in high-speed driving conditions typical of the region. The high penetration of premium and luxury brands ensures sustained demand for high-specification, custom-engineered stabilizers that contribute significantly to the perceived quality and quietness of the cabin experience.

- North America: North America presents a substantial market opportunity, particularly in the SUV, light truck, and crossover segments, which account for a majority of vehicle sales. These larger vehicles often experience greater body flex and vibration over varying road surfaces, making effective door stabilization critical for maintaining structural rigidity and reducing cabin noise. The market is driven by consumer expectations for durability and comfort. Furthermore, the significant investment in localized EV manufacturing by major American OEMs is rapidly accelerating the demand for lightweight, high-damping stabilizers specifically engineered for battery-electric platforms, supporting the localized supply chain growth for these specialized components.

- Latin America and Middle East & Africa (MEA): While currently smaller in market share, these regions are emerging as high-growth potential areas. Latin America, particularly Brazil and Mexico, benefits from established regional manufacturing hubs that are increasingly integrating globally standardized components to meet export requirements and rising domestic quality benchmarks. MEA growth is primarily linked to increasing vehicle imports and gradual expansion of local assembly operations. The demand is generally focused on cost-effective, durable stabilizers suitable for challenging road conditions, offering opportunities for suppliers specializing in robust, basic components before shifting to more advanced systems as economic development accelerates and consumer disposable income rises, enabling a transition towards feature-rich vehicle models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Door Stabilizer Market.- Mitsui Kinzoku Act Corporation

- Trelleborg AB

- F.C.C. Co., Ltd.

- Magna International Inc.

- Aisin Seiki Co., Ltd.

- Continental AG

- Hutchinson SA

- Vibracoustic GmbH

- ZF Friedrichshafen AG

- Hi-Lex Corporation

- Kiekert AG

- U-Shin Ltd. (MinebeaMitsumi Group)

- SMR Automotive Mirrors UK Ltd.

- Sango Co., Ltd.

- Stabilus S.A.

- Schaeffler AG

- Faurecia SE

- Inteva Products

- Huf Hülsbeck & Fürst GmbH & Co. KG

- Adient plc.

Frequently Asked Questions

Analyze common user questions about the Automotive Door Stabilizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and benefit of an Automotive Door Stabilizer?

The primary function of an automotive door stabilizer is to minimize the clearance between the vehicle door and the chassis frame when the door is closed, using mechanical or elastomeric components. This enhances structural rigidity, significantly reduces vibration and rattles (improving NVH), and contributes to a quieter, more solid cabin feel, particularly critical for modern electric vehicles.

How does the demand for electric vehicles (EVs) specifically influence the Door Stabilizer Market?

The quiet nature of EV powertrains exposes subtle road noise and structural vibrations, including door rattles, which are masked in internal combustion engine vehicles. This heightened sensitivity drives higher demand for advanced, precision-engineered door stabilizers and damping elements that provide superior acoustic isolation and rigidity, making them essential NVH countermeasures for EV manufacturers.

Are door stabilizers standard equipment or performance upgrades?

High-quality door stabilizers are increasingly becoming standard Original Equipment Manufacturer (OEM) features in premium and luxury vehicles due to stringent NVH and quality standards. However, aftermarket options are widely available, serving as popular performance upgrades or replacements for vehicle owners seeking to enhance their car’s structural feel and reduce unwanted cabin noise.

Which geographic region dominates the Automotive Door Stabilizer Market?

The Asia Pacific (APAC) region currently dominates the market, largely attributable to the high volume of vehicle production and sales in major economies like China, Japan, and South Korea. APAC’s rapid adoption of advanced automotive technologies and growing consumer expectations for vehicle quality further solidify its market leadership in both manufacturing and consumption.

What technological advancements are expected to impact the future of door stabilization?

Future developments are focused on smart stabilization, including the integration of specialized, high-damping materials (e.g., advanced polymers) and the potential introduction of active stabilization systems. These active systems use sensors and micro-actuators to dynamically adjust door fitment in real-time, optimizing chassis stiffness and NVH performance based on driving conditions, driven by AI and data analytics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager