Automotive Exhaust Heat Recovery (EHR) System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441234 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Exhaust Heat Recovery (EHR) System Market Size

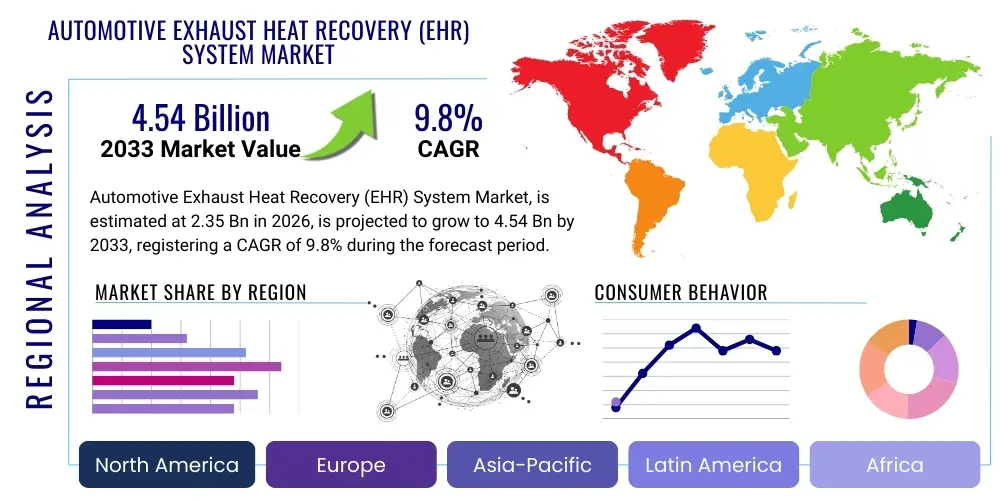

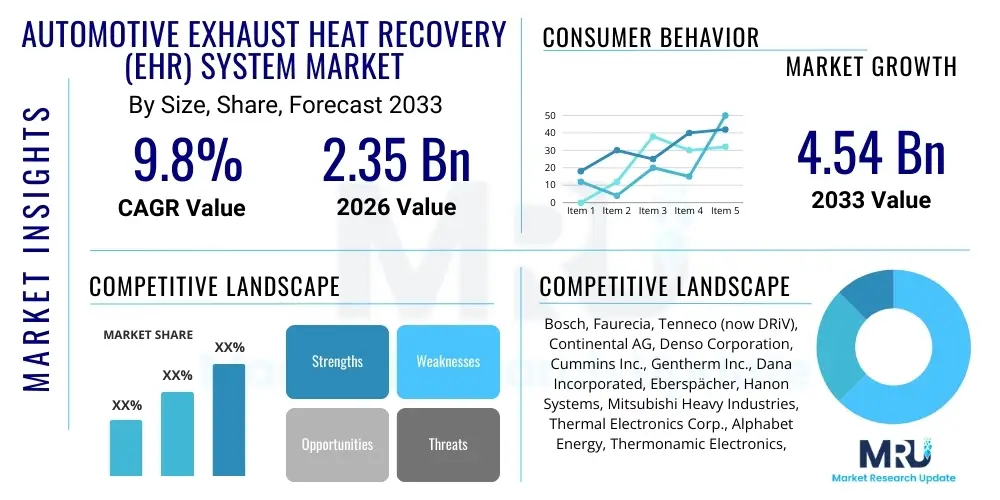

The Automotive Exhaust Heat Recovery (EHR) System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 2.35 Billion in 2026 and is projected to reach USD 4.54 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for enhanced fuel efficiency in internal combustion engine (ICE) vehicles and mandatory reductions in vehicular greenhouse gas emissions, particularly in major automotive markets like Europe, China, and North America. The technology offers a viable pathway for OEMs to comply with increasingly stringent regulatory benchmarks without necessitating immediate, full-scale powertrain electrification.

The valuation reflects the increasing commercialization of both Thermoelectric Generator (TEG) and Organic Rankine Cycle (ORC) systems across various vehicle platforms, including passenger cars, heavy-duty trucks, and hybrid electric vehicles. While initial adoption was concentrated in premium and high-performance segments due to the high component cost and system integration complexity, falling manufacturing costs and technological refinement are democratizing EHR adoption. The projected growth is also underpinned by strategic investments in robust, lightweight, and efficient heat exchanger materials capable of withstanding extreme thermal cycling and corrosive exhaust environments, ensuring long-term system reliability.

Automotive Exhaust Heat Recovery (EHR) System Market introduction

The Automotive Exhaust Heat Recovery (EHR) System market encompasses technologies designed to capture waste thermal energy from the vehicle's exhaust gases and convert it into usable forms of power, primarily mechanical or electrical energy, thereby improving overall vehicle efficiency. EHR systems, such as the Organic Rankine Cycle (ORC) waste heat recovery systems and Thermoelectric Generators (TEGs), operate on thermodynamic principles to reclaim energy that would otherwise be dissipated into the atmosphere. The fundamental product objective is to minimize the energy penalty associated with internal combustion, leading directly to reduced fuel consumption and lower carbon dioxide emissions, a crucial consideration for modern powertrain design and regulatory compliance globally.

Major applications of EHR systems span across the entire automotive sector, finding particular relevance in heavy-duty commercial vehicles and long-haul transportation, where sustained high exhaust temperatures maximize the energy recovery potential. In passenger vehicles, EHR often supplements the auxiliary power unit (APU) requirements or provides localized thermal management, particularly in hybrid configurations where managing cold start emissions and rapid cabin heating is critical. Benefits include documented fuel economy improvements ranging from 3% to 10% depending on the driving cycle and system efficiency, prolonged range for hybrid and conventional vehicles, and reduced strain on the alternator, freeing up engine power for traction.

The market is predominantly driven by powerful macro-environmental factors, including stringent government regulations like the Euro 7 emissions standards and the Corporate Average Fuel Economy (CAFE) standards in the US, which necessitate continuous improvements in powertrain efficiency. Furthermore, the rising global price volatility of fossil fuels incentivizes the adoption of efficiency-enhancing technologies like EHR. The push towards electrification also acts as a driving factor, as EHR systems can be effectively integrated into complex hybrid architectures to manage thermal loads and charge high-voltage batteries, bridging the efficiency gap between traditional ICE vehicles and fully electric powertrains.

Automotive Exhaust Heat Recovery (EHR) System Market Executive Summary

The Automotive Exhaust Heat Recovery (EHR) System market is characterized by robust investment in proprietary thermal management solutions, driven predominantly by regulatory pressure and the need for differentiation in the competitive automotive manufacturing landscape. Current business trends indicate a strong focus on strategic collaborations between Tier 1 suppliers, specializing in thermal systems, and semiconductor manufacturers to enhance the efficiency and scalability of Thermoelectric Generator (TEG) modules. Furthermore, the trend of downsizing and turbocharging internal combustion engines, which results in higher peak exhaust temperatures but also fluctuating thermal loads, fuels the need for adaptive and highly responsive EHR systems, leading companies to prioritize modular designs and standardized interfaces for easier OEM integration across diverse platforms.

Regionally, Asia Pacific, specifically China and Japan, dominates the market share due to high production volumes of hybrid and small-to-mid-sized passenger vehicles, coupled with aggressive governmental support for green technologies and domestic manufacturing capabilities. Europe follows closely, driven by the immediate requirement to meet aggressive CO2 reduction targets, pushing for high-efficiency ORC systems primarily in high-mileage fleet and commercial applications. North America is showing accelerating adoption, particularly in the heavy-duty truck segment, where even marginal fuel economy gains yield significant operational cost savings over the vehicle lifecycle, emphasizing robust, low-maintenance designs for long-haul operations.

Segmentation trends highlight the technological divergence based on application. The Organic Rankine Cycle (ORC) segment maintains the majority revenue share due to its established efficiency gains and potential for higher power output, making it ideal for large displacement commercial engines. Conversely, the Thermoelectric Generator (TEG) segment, while currently smaller, is projected to exhibit the fastest growth rate, fueled by advancements in material science (like skutterudites and silicides) that promise higher conversion efficiencies and lighter system footprints, making TEGs increasingly viable for compact passenger vehicle integration where packaging space is a critical constraint.

AI Impact Analysis on Automotive Exhaust Heat Recovery (EHR) System Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Automotive Exhaust Heat Recovery (EHR) System Market frequently center on how machine learning can optimize the dynamic operation and design of these complex thermal systems. Common questions address the application of predictive models for varying driving cycles, the use of generative design for heat exchanger architecture, and the capacity of AI-driven control units to maximize energy harvesting in real-time under fluctuating temperature and flow conditions. The key theme emerging from user expectations is the shift from pre-calibrated, static EHR systems to intelligent, adaptive solutions that utilize deep learning algorithms to predict and adjust to dynamic thermal loads, thereby significantly improving system reliability, maintaining peak efficiency, and minimizing parasitic losses across all operating modes, especially critical during transient conditions like acceleration and deceleration.

- AI optimizes system control by predicting exhaust temperature and flow rate changes based on real-time vehicle data (speed, load, road grade), ensuring the EHR system operates at its maximum thermodynamic efficiency point (e.g., controlling ORC working fluid mass flow).

- Machine learning models accelerate the R&D cycle by simulating millions of permutations for heat exchanger geometry and thermoelectric material compositions, leading to superior, lighter, and more compact EHR component designs through generative design processes.

- Predictive maintenance algorithms analyze sensor data from the EHR system (pressure, temperature, vibration) to detect incipient component failures (e.g., fluid leaks, crystallization in TEG modules) well before operational degradation occurs, drastically reducing unexpected downtime for commercial fleet operators.

- AI enhances thermal management by integrating the EHR function with other vehicle thermal loops (cabin heating, battery cooling), allowing for synergistic operation that recovers waste heat while simultaneously satisfying vehicle thermal comfort and battery conditioning requirements, especially crucial for hybrid vehicles.

DRO & Impact Forces Of Automotive Exhaust Heat Recovery (EHR) System Market

The Automotive Exhaust Heat Recovery (EHR) System market dynamics are fundamentally shaped by the interaction of stringent environmental regulations, substantial technological hurdles, and the emerging threat and opportunity presented by electric mobility. Drivers include global regulatory targets requiring continuous improvements in fleet fuel economy and mandated CO2 reduction limits, pushing OEMs to adopt every available efficiency-enhancing technology. Restraints primarily involve the high upfront cost of specialized materials (e.g., rare-earth elements for TEGs, exotic alloys for heat exchangers), the complexity of integrating these substantial systems into existing vehicle architectures, and the significant engineering challenge of ensuring durability under extreme, cyclic thermal loads. Opportunities lie in the hybridization trend, where EHR systems provide critical electrical boosting, and in the heavy-duty segment's need for marginal fuel gains, while the paramount impact force remains the sustained global commitment to decarbonization, compelling manufacturers to invest heavily in efficient energy utilization.

Segmentation Analysis

The segmentation of the Automotive Exhaust Heat Recovery (EHR) System market provides a granular view of technological preferences and market adoption patterns across various vehicle types and product configurations. The market is primarily bifurcated based on the technology type—Thermoelectric Generator (TEG) systems and Organic Rankine Cycle (ORC) systems—each offering distinct advantages and limitations regarding efficiency, weight, and complexity. Further differentiation is applied based on the vehicle type, distinguishing between high-volume passenger vehicles, where packaging constraints and cost minimization are crucial, and commercial vehicles, where robustness, power generation capacity, and long-term operating efficiency take precedence.

Analyzing these segments reveals that while ORC systems currently dominate revenue due to their capacity for higher power output suitable for larger engines, the TEG segment is poised for rapid expansion, driven by continuous material science breakthroughs improving the dimensionless figure of merit (ZT) and reducing reliance on expensive, scarce materials. Furthermore, the hybrid vehicle segment is emerging as the fastest-growing application area, recognizing that EHR systems provide invaluable supplemental electrical power, extending the range and reducing the strain on the conventional engine during regenerative periods, thereby enhancing the overall performance characteristics of plug-in and mild hybrid vehicles in preparation for fully autonomous or electric futures.

- By Technology

- Organic Rankine Cycle (ORC)

- Thermoelectric Generator (TEG)

- Thermal Electric Heating (TEH)

- Phase Change Material (PCM) Systems

- By Component

- Heat Exchanger/Evaporator

- Expander/Turbine (for ORC)

- Generator/Alternator

- Thermoelectric Modules (P-type and N-type semiconductors)

- Pumps and Valves

- By Vehicle Type

- Passenger Vehicles (Sedans, SUVs, Compacts)

- Commercial Vehicles (Heavy-Duty Trucks, Light Commercial Vehicles, Buses)

- By Fuel Type

- Diesel

- Gasoline

- Hybrid Vehicles

- By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Automotive Exhaust Heat Recovery (EHR) System Market

The value chain for the Automotive Exhaust Heat Recovery (EHR) System market is complex and highly specialized, beginning with the upstream sourcing of exotic materials essential for high-temperature and high-efficiency operation. Upstream analysis focuses on material science innovation, particularly in specialized metal alloys (for heat exchangers capable of 600°C+) and advanced semiconductor materials like Skutterudites, Bismuth Telluride, and Silicon Germanium used in TEG modules. Raw material suppliers and specialized chemical processing companies hold significant leverage here due to the proprietary nature and scarcity of these high-performance materials. Manufacturing involves highly technical processes, often requiring cleanroom environments for semiconductor module production and advanced welding techniques for ORC loop components, tasks typically performed by specialized Tier 2 component manufacturers.

Midstream activities are dominated by Tier 1 automotive suppliers who integrate these specialized components into fully functional EHR systems. These suppliers manage the thermal design, fluid dynamics, and electronic control unit (ECU) calibration necessary for system-wide operation. Their role is crucial in adapting the generic EHR technology package to meet the specific volumetric, weight, and performance requirements of different OEM platforms. Downstream analysis focuses on the distribution channels, overwhelmingly dominated by the Original Equipment Manufacturer (OEM) channel, as EHR systems are highly integrated into the vehicle powertrain architecture and rarely fitted in the aftermarket due to complexity and voiding of warranties. Direct sales from Tier 1 suppliers to major automotive manufacturers (like Daimler, Ford, Toyota) form the bulk of the market revenue.

The indirect channel, comprising specialized performance tuning firms or niche commercial fleet refitters, holds a minimal share but is growing for certain heavy-duty applications where customization is necessary. Overall, the value chain emphasizes strong collaboration between material developers, system integrators (Tier 1), and vehicle manufacturers (OEMs). Cost containment and quality control throughout the chain are critical, given that EHR efficiency directly impacts vehicle performance metrics that are regulated globally, demanding precision manufacturing and rigorous testing standards throughout the supply lifecycle.

Automotive Exhaust Heat Recovery (EHR) System Market Potential Customers

Potential customers and end-users of the Automotive Exhaust Heat Recovery (EHR) System market primarily comprise large-scale vehicle manufacturers (OEMs) who are mandated or incentivized to integrate advanced efficiency technologies into their mass-produced vehicle platforms. These OEMs, including global leaders in passenger car manufacturing (e.g., Volkswagen Group, Toyota, Hyundai-Kia) and commercial vehicle production (e.g., Volvo Trucks, Daimler Truck AG, PACCAR), serve as the primary direct buyers. Their purchasing decisions are driven by the need to achieve stringent fuel economy targets (e.g., CAFE standards), reduce fleet-wide CO2 emissions, and gain a competitive edge by offering highly efficient powertrain options, especially within the increasingly popular mild and plug-in hybrid vehicle segments.

A significant customer segment also includes major operators of commercial fleets, such as long-haul logistics companies and public transit authorities. While they typically purchase vehicles through OEMs, their influence drives demand for robust, efficient, and low-maintenance EHR systems, particularly for heavy-duty trucks and buses, where operational cost savings resulting from fuel efficiency gains (even a modest 3-5%) translate into millions of dollars annually across large fleets. These customers prioritize reliability and total cost of ownership (TCO) over cutting-edge technology, favoring proven ORC systems for their higher power generation capability and established durability in continuous operation. The key buyer criteria revolve around system efficiency verification, integration complexity, and the lifecycle cost of the EHR solution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.35 Billion |

| Market Forecast in 2033 | USD 4.54 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Faurecia, Tenneco (now DRiV), Continental AG, Denso Corporation, Cummins Inc., Gentherm Inc., Dana Incorporated, Eberspächer, Hanon Systems, Mitsubishi Heavy Industries, Thermal Electronics Corp., Alphabet Energy, Thermonamic Electronics, O-Flex Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Exhaust Heat Recovery (EHR) System Market Key Technology Landscape

The technological landscape of the Automotive Exhaust Heat Recovery (EHR) System market is fundamentally bifurcated into two dominant, yet distinct, approaches: the Organic Rankine Cycle (ORC) systems and Thermoelectric Generator (TEG) systems. ORC technology involves a closed thermodynamic loop utilizing an organic working fluid with a lower boiling point than water, allowing it to vaporize using exhaust heat. This high-pressure vapor then drives a piston expander or turbine, generating mechanical work that is converted into electrical power. Key advancements in ORC systems focus on developing optimized expander designs (scroll or screw types) to maximize efficiency under fluctuating engine loads, alongside the search for environmentally friendly working fluids that offer superior thermal stability and high cycle efficiency at moderate temperatures, ensuring robust performance without thermal decomposition.

Conversely, TEG systems utilize the Seebeck effect, converting thermal gradients directly into electrical voltage through semiconductor materials. The primary technological challenge and focus area for TEGs is improving the dimensionless figure of merit (ZT), which dictates conversion efficiency. Research is heavily invested in advanced materials such as skutterudites, half-Heusler alloys, and complex Bismuth Telluride compounds that can operate efficiently at the high-temperature differential between the exhaust stream and the cooling plate. Innovations also focus on improving the thermal and mechanical contacts between the exhaust manifold and the TEG modules, ensuring durability and consistent heat transfer efficiency in the harsh automotive environment, while simultaneously striving to reduce the cost and weight associated with these often rare-earth-dependent materials to enable mass-market adoption.

Furthermore, emerging technologies, including advanced phase change materials (PCM) for thermal energy storage and thermal electric heating (TEH) for rapid engine and catalytic converter warm-up, complement the primary EHR systems. PCM systems offer a passive means to store temporary excess heat, which can be released later to maintain optimal engine or cabin temperature, particularly useful during stop-start driving cycles. The overall technology trajectory is moving towards integrated thermal management platforms, where AI-controlled software dynamically manages the interplay between ORC/TEG recovery, waste heat storage, and conventional cooling loops, thereby maximizing the total thermal efficiency gain across all driving conditions and ensuring full compliance with upcoming stringent cold-start and greenhouse gas regulations.

Regional Highlights

Regional dynamics play a crucial role in shaping the deployment and technological focus within the Automotive Exhaust Heat Recovery (EHR) System market, reflecting varied regulatory environments, market maturity levels, and specific consumer demand patterns for different vehicle classes.

- Asia Pacific (APAC): APAC, particularly China, Japan, and South Korea, is the leading market for EHR systems, driven by massive vehicle production volumes, strong governmental push for energy efficiency standards (e.g., China's stringent fuel consumption mandates), and rapid adoption of hybrid electric vehicles. Japan pioneered early adoption, focusing on small-scale, highly integrated TEG systems for passenger cars, while China's market is rapidly expanding across both passenger and heavy-duty electric vehicle sectors, where EHR can supplement battery charging and thermal management. The region benefits from established semiconductor manufacturing capabilities critical for TEG production.

- Europe: Europe represents a high-value market segment characterized by the world’s most demanding CO2 reduction targets, such as the Euro 7 standards, forcing OEMs to seek efficiency gains across all powertrains. EHR adoption here is driven primarily by its application in premium and diesel-powered commercial vehicles (trucks and buses), where ORC systems are favored for their high efficiency and power generation capacity over extended operational periods. Regulatory timelines compel rapid technology deployment, sustaining high R&D investment within the region.

- North America: North America presents a significant opportunity, mainly within the heavy-duty truck segment, propelled by the need to meet rigorous EPA and CAFE standards for commercial vehicles. Given the vast distances covered, the focus is on robust, durable, and highly efficient systems (often ORC) that offer substantial fuel savings for fleet operators. Passenger vehicle adoption is slower than in Europe or Japan but is gaining momentum with the increasing sales of full-sized hybrid trucks and SUVs.

- Latin America, Middle East, and Africa (LAMEA): This region is an emerging market, currently dominated by the OEM sales channel for imported vehicles. Growth is expected to accelerate in localized manufacturing hubs like Brazil, driven by long-term mandates focusing on renewable fuels and efficiency. The market tends to follow the technology introduction cycles of North America and Europe, focusing initially on proven, low-maintenance ORC systems for bus and fleet applications in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Exhaust Heat Recovery (EHR) System Market.- Bosch (Robert Bosch GmbH)

- Faurecia (now Forvia)

- Tenneco (now DRiV Incorporated)

- Continental AG

- Denso Corporation

- Cummins Inc.

- Gentherm Inc.

- Dana Incorporated

- Eberspächer Group

- Hanon Systems

- Mitsubishi Heavy Industries, Ltd.

- Thermal Electronics Corp.

- Alphabet Energy, Inc.

- Thermonamic Electronics (Jiangxi) Corp. Ltd.

- O-Flex Industries

- Exhaust Heat Recovery Technologies (EHRC)

- Wabco (part of ZF Friedrichshafen)

- Visteon Corporation

- Mahle GmbH

Frequently Asked Questions

Analyze common user questions about the Automotive Exhaust Heat Recovery (EHR) System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of installing an Automotive Exhaust Heat Recovery (EHR) System?

The primary benefit of an EHR system is the significant enhancement of vehicle fuel economy, typically ranging from 3% to 10%, achieved by converting previously wasted thermal energy into usable electrical or mechanical power, thereby reducing the engine's required workload and lowering CO2 emissions.

What are the main types of EHR technology used in vehicles?

The two main types are the Organic Rankine Cycle (ORC) systems, which use a closed fluid loop to drive a turbine/expander for higher power output, and Thermoelectric Generator (TEG) systems, which use semiconductor modules (Seebeck effect) to convert heat directly into electricity, favored for their compactness.

How do stringent emission regulations affect the EHR market?

Strict global emission regulations, such as Euro 7 and CAFE standards, act as the most significant market driver. These regulations necessitate substantial improvements in powertrain efficiency, making EHR systems a crucial technology for OEMs seeking compliance and avoiding heavy regulatory penalties.

Is the high cost of EHR systems justified by the fuel savings?

For high-mileage commercial vehicles (heavy-duty trucks and buses), the substantial cumulative fuel savings and operational cost reduction over the vehicle's lifespan far outweigh the initial high system cost, leading to a strong positive return on investment (ROI). For mass-market passenger vehicles, ongoing cost reduction in TEG materials is making the justification increasingly favorable.

What is the future role of EHR systems in hybrid and electric vehicles?

In hybrid vehicles, EHR systems are essential for supplemental battery charging and rapid thermal management (e.g., quick cabin heating, optimal battery conditioning). While purely battery electric vehicles (BEVs) lack a high-temperature exhaust source, EHR principles transition into optimizing thermal loops for battery temperature control and minimizing range loss from HVAC demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager