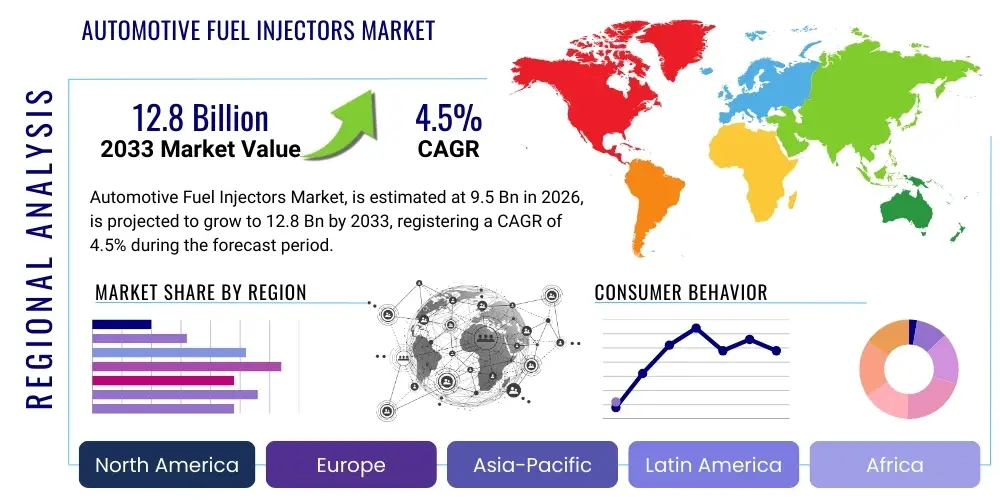

Automotive Fuel Injectors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441800 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Automotive Fuel Injectors Market Size

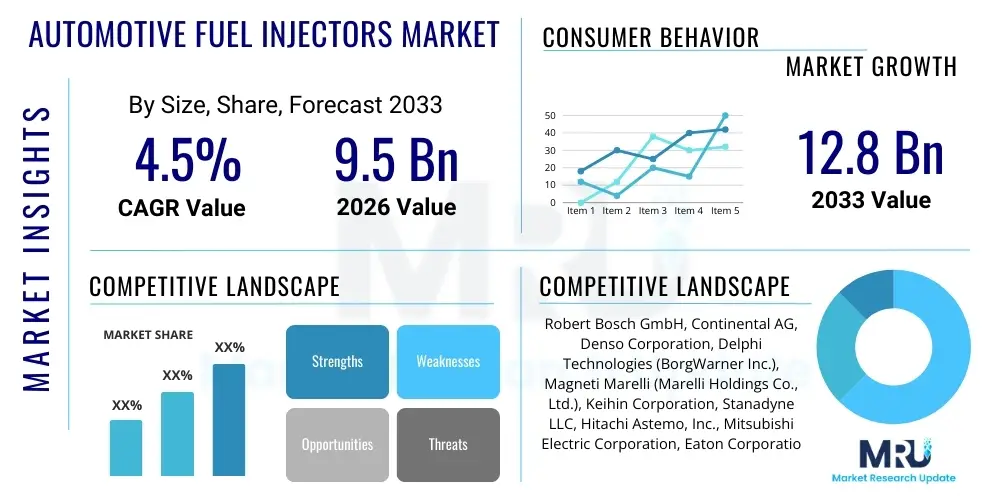

The Automotive Fuel Injectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033.

Automotive Fuel Injectors Market introduction

The Automotive Fuel Injectors Market encompasses the design, manufacturing, and distribution of components critical for introducing fuel into an internal combustion engine (ICE). Fuel injectors are electromagnetic valves that precisely meter and atomize fuel, ensuring optimal combustion efficiency, reducing harmful emissions, and enhancing engine performance. The primary product categories include Port Fuel Injection (PFI) injectors, Gasoline Direct Injection (GDI) injectors, and injectors designed for diesel and alternative fuels. Despite the growing trend toward vehicle electrification, the necessity for high-efficiency ICE vehicles, particularly in developing economies and heavy-duty transport sectors, sustains the demand for advanced fuel injection systems capable of meeting stringent global emission standards like Euro 7 and CAFE regulations. Major applications span passenger cars, commercial vehicles (trucks and buses), and off-highway machinery, with technological innovation focusing heavily on higher injection pressures and multi-hole nozzle designs to achieve finer fuel spray characteristics.

Key benefits derived from modern fuel injector technology include significant improvements in fuel economy, enhanced power output through precise fuel-air mixture control, and substantial reduction in particulate matter and NOx emissions. The adoption of GDI systems, in particular, has been a significant market driver due to its superior efficiency compared to traditional PFI systems, although it introduces challenges such as particulate emissions that require further technological mitigation. The market is characterized by intensive research and development activities aimed at increasing the reliability and longevity of injectors, especially under high-pressure, high-temperature operating conditions required by modern turbocharged engines. Furthermore, the integration of electronic control units (ECUs) and sophisticated sensors allows for dynamic adjustment of injection timing and volume, leading to continuous optimization of the combustion cycle in real-time.

The driving factors for market growth are multifaceted, primarily centered around escalating global demands for better fuel efficiency and continuous tightening of regulatory frameworks concerning vehicle emissions across North America, Europe, and Asia Pacific. Specifically, the rising sales of hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs), which still rely on optimized ICE units, provide a stable and growing niche for high-performance fuel injectors. Investment in advanced manufacturing techniques, such as precision machining and micro-electromechanical systems (MEMS) technology for solenoid or piezoelectric actuations, further enables the development of next-generation injectors that are smaller, faster, and more accurate, ensuring market vitality despite long-term transition towards fully battery electric vehicles (BEVs).

Automotive Fuel Injectors Market Executive Summary

The global Automotive Fuel Injectors Market exhibits sustained growth driven by the continuous demand for high-efficiency internal combustion engines (ICEs), particularly within the hybrid vehicle segment and commercial transport sectors globally. Business trends indicate a strong shift towards Gasoline Direct Injection (GDI) systems, displacing traditional Port Fuel Injection (PFI) due to GDI's superior thermal efficiency and resultant lower CO2 emissions. Key market players are investing heavily in piezoelectric technology and advanced materials to withstand ultra-high injection pressures (exceeding 350 bar), crucial for optimizing performance in highly downsized and turbocharged engines. Consolidation among Tier 1 suppliers and Original Equipment Manufacturers (OEMs) is also notable, focused on integrating smart injection technologies and advanced diagnostics into engine management systems, thereby streamlining supply chains and improving product competitiveness.

Regionally, Asia Pacific (APAC), particularly China and India, dominates both in production volume and consumption, spurred by rapid urbanization, increasing vehicle parc, and the adoption of modern emission standards (e.g., China 6, Bharat Stage VI). While Europe leads in the adoption of stringent emission regulations (e.g., Euro 7 proposals), driving innovation in both diesel and gasoline injector precision, North America maintains strong demand driven by larger engine formats and sustained preference for light trucks and SUVs utilizing high-pressure GDI systems. The long-term regional outlook suggests that APAC will remain the primary growth engine for volume, whereas European and North American markets will drive value through the adoption of premium, technologically advanced injection solutions designed for hybrid powertrains and performance vehicles.

Segmentation trends highlight the dominance of gasoline fuel types, primarily due to the vast global volume of gasoline-powered passenger vehicles and the rapid penetration of GDI technology. Within the injector type segment, GDI systems are expected to capture the largest market share growth, driven by their necessity in modern engine downsizing strategies. Vehicle type segmentation confirms that passenger vehicles represent the bulk of the market, although the commercial vehicle segment, particularly heavy-duty trucks requiring robust diesel common rail injection (CRI) systems, contributes significantly to market value. The persistent need for cleaner commercial transport ensures a steady, high-value demand for advanced diesel injectors despite environmental pressures.

AI Impact Analysis on Automotive Fuel Injectors Market

Common user questions regarding AI's impact on the fuel injectors market center on how AI can enhance manufacturing precision, optimize fuel efficiency in real-time, and predict maintenance needs. Users are keenly interested in the integration of machine learning (ML) models into Engine Control Units (ECUs) to dynamically adjust injection parameters based on environmental conditions, fuel quality variations, and driving patterns. Key themes emerging from these queries include the potential for AI to dramatically reduce emissions through hyper-precise control, the deployment of predictive maintenance algorithms to prevent injector failure, and the optimization of factory floor operations using industrial AI for quality control. Concerns often revolve around the security of these integrated systems and the complexity of developing and calibrating highly accurate AI models for combustion diagnostics, especially given the rapid cycle times required in engine operation.

AI’s primary influence lies in transforming both the manufacturing process and the operational performance of fuel injectors. In manufacturing, AI-powered vision systems and anomaly detection algorithms ensure micron-level precision during nozzle drilling and assembly, minimizing defects that could compromise spray patterns and performance. Operationally, Machine Learning models integrated within the vehicle's engine management system (EMS) can analyze massive streams of sensor data—including oxygen levels, temperature, and pressure—to calculate the exact, optimized injection duration and timing for every combustion cycle. This dynamic, adaptive injection strategy surpasses static calibration maps, leading to measurable gains in fuel efficiency and significant reductions in transient emissions, directly addressing modern regulatory requirements.

Furthermore, AI facilitates advanced diagnostics and predictive maintenance. By continuously monitoring the electrical and mechanical signatures of the injector solenoids or piezo stacks, ML models can identify subtle deviations that precede failure. This allows for proactive servicing, maximizing vehicle uptime and extending the lifespan of the engine components. The integration of AI tools also aids in the design phase, running millions of computational fluid dynamics (CFD) simulations to rapidly prototype and validate new nozzle geometries and spray characteristics, accelerating the development cycle for next-generation, high-pressure injectors necessary for efficient hybrid powertrains.

- AI enhances manufacturing quality control via real-time vision systems for micron-level precision in nozzle production.

- Machine Learning algorithms enable dynamic, real-time optimization of injection timing and duration based on engine load and ambient conditions.

- Predictive maintenance models utilize sensor data to forecast potential injector failures, improving reliability and reducing vehicle downtime.

- AI optimizes fuel efficiency and reduces transient emissions beyond static engine mapping capabilities.

- Computational AI accelerates R&D by simulating complex fuel spray dynamics and new injector designs more rapidly than physical testing.

DRO & Impact Forces Of Automotive Fuel Injectors Market

The dynamics of the Automotive Fuel Injectors Market are shaped by powerful opposing forces: the immediate need for enhanced ICE efficiency (Drivers and Opportunities) versus the long-term structural shift towards electrification (Restraints). Drivers include the relentless tightening of global emission standards, which necessitates sophisticated injection systems like GDI and advanced common rail, ensuring that even residual ICE production must be hyper-efficient. Opportunities arise from the robust growth in the hybrid vehicle sector (HEVs and PHEVs), which requires highly reliable and precisely controlled injectors optimized for start-stop and variable load operations. These forces compel manufacturers to continuously innovate, focusing on increasing injection pressures (over 500 bar) and developing flexible fuel capabilities to meet diverse regional regulatory landscapes.

Conversely, the dominant restraint is the accelerating global transition towards Battery Electric Vehicles (BEVs), particularly in mature markets like Western Europe and parts of North America, where governmental mandates and consumer preferences favor zero-emission transport. This foundational shift creates significant long-term uncertainty regarding volume forecasts for ICE components after 2035. However, the sheer scale of the global vehicle fleet ensures that the aftermarket and replacement segment remains robust for decades. Impact forces, therefore, revolve around the necessity for innovation within a constrained environment: firms must develop high-value, premium components for specialized, high-performance, and hybrid applications to offset volume losses in the standard ICE segment.

The primary impact force governing this market is technological substitution. Fuel injector manufacturers are responding by diversifying their product portfolios, focusing on components for alternative fuels (CNG/LPG), hydrogen internal combustion engines (H2-ICE), and sophisticated systems for high-efficiency hybrid vehicles. The focus has shifted from maximizing production volume to maximizing component value and performance. Opportunities are particularly strong in emerging markets where ICE dominance is projected to continue well past 2040, providing a significant, sustained market for current and near-future generation fuel injectors, particularly those suited for reliable, cost-effective diesel applications in commercial transport.

Segmentation Analysis

The Automotive Fuel Injectors Market is primarily segmented based on the technology utilized (PFI vs. GDI/CRI), the type of fuel (Gasoline, Diesel, Alternative Fuels), and the specific vehicle application (Passenger Car, Commercial Vehicle). This granular segmentation helps stakeholders understand the diverse demands across different vehicular platforms and regulatory environments. Gasoline Direct Injection (GDI) technology, which offers superior thermal efficiency and allows for engine downsizing, dominates the technological landscape in the passenger car segment. Conversely, high-pressure Common Rail Injection (CRI) systems remain indispensable in the diesel segment, particularly for commercial and heavy-duty vehicles, due to their requirement for high torque and durability.

The breakdown by fuel type reveals that gasoline injectors hold the majority volume share, reflecting the global dominance of gasoline passenger vehicles. However, diesel injectors, particularly advanced CRI systems, command a higher value share due to their complex design, requiring extremely high-pressure tolerance and precision components to manage soot and NOx emissions. The emerging segment of alternative fuel injectors, including those for Compressed Natural Gas (CNG), Liquefied Petroleum Gas (LPG), and hydrogen-based ICEs, is small but growing, driven by specific regional mandates (like India and China) promoting cleaner, readily available gaseous fuels for urban transport fleets.

The commercial vehicle segment, encompassing light, medium, and heavy-duty trucks, demands robust, long-lasting injectors designed to operate reliably over long haul distances and under sustained heavy load. Innovation in this segment is centered on reducing the complexity of aftertreatment systems by improving in-cylinder combustion quality through ultra-precise multi-pulse injection strategies. Understanding these distinct segments is crucial for manufacturers to tailor R&D investments, balancing the immediate need for high-volume PFI/GDI replacement parts with the high-value opportunity presented by next-generation hybrid and commercial vehicle injection systems.

- By Technology:

- Port Fuel Injection (PFI)

- Gasoline Direct Injection (GDI)

- Common Rail Injection (CRI) / Diesel Direct Injection (DDI)

- By Fuel Type:

- Gasoline

- Diesel

- Alternative Fuels (CNG/LPG/Hydrogen)

- By Component:

- Solenoid Injectors

- Piezoelectric Injectors

- By Vehicle Type:

- Passenger Cars (PC)

- Commercial Vehicles (CV)

Value Chain Analysis For Automotive Fuel Injectors Market

The value chain for the Automotive Fuel Injectors Market starts with upstream suppliers providing critical raw materials and highly specialized components. This includes advanced high-strength steels and alloys for injector bodies, precision ceramics and plastics for internal seals, and specialized magnetic or piezoelectric materials for actuators. Upstream suppliers are characterized by stringent quality controls, as the materials must withstand high pressures (up to 2,500 bar in diesel systems) and high temperatures. Key activities in the upstream phase focus on material science innovation to reduce friction, enhance durability, and minimize thermal expansion, all critical factors affecting injector lifespan and precision, requiring strong partnerships between Tier 2 suppliers and material producers.

The midstream phase involves the core manufacturing process, dominated by Tier 1 suppliers like Bosch, Continental, and Denso. This stage requires significant capital investment in highly precise machinery for nozzle hole drilling (often using laser or micro-EDM techniques), assembly, and rigorous end-of-line testing and calibration. The complexity lies in integrating the mechanical components with the electronic control units (ECUs) and solenoids/piezo stacks to ensure extremely tight tolerances for fuel metering. The direct channel of distribution is overwhelmingly dominant in this market, as OEMs integrate these components directly into newly manufactured engines, necessitating a highly synchronized just-in-time (JIT) delivery system tailored to OEM production schedules.

Downstream analysis covers both the OEM channel (Direct) and the aftermarket/replacement channel (Indirect). The direct channel involves supplying injectors to engine manufacturers (OEMs) for new vehicle assembly, representing the highest volume and technical complexity. The indirect channel involves independent service repair shops, distributors, and spare parts retailers, addressing the maintenance and repair needs of the existing global vehicle fleet. This aftermarket segment, while lower in volume than the direct channel, often provides higher margins and stability, especially as global vehicle ages increase. Strategic management of this indirect distribution network, ensuring authenticity and quality control of replacement parts, is crucial for maintaining brand reputation and customer safety.

Automotive Fuel Injectors Market Potential Customers

The primary potential customers and buyers of automotive fuel injectors fall into two major categories: Original Equipment Manufacturers (OEMs) and the Aftermarket Repair & Service sector. OEMs, including global giants like Toyota, Volkswagen Group, Ford, and various commercial vehicle manufacturers such as Daimler Trucks and Volvo Group, constitute the highest volume segment. These customers require millions of units annually, demanding customized specifications, rigorous adherence to proprietary engine designs, and compliance with the latest emission certification protocols. Procurement decisions at the OEM level are driven by reliability, mass production capacity, technological sophistication (e.g., capability to supply 500-bar GDI systems), and strong long-term supply agreements that guarantee stable pricing and delivery.

The second major group is the Aftermarket, which includes independent garages, franchise repair shops, fleet operators, and large parts distributors (e.g., Autozone, O’Reilly). These buyers procure fuel injectors for maintenance, repair, and replacement purposes for vehicles that have completed their warranty period. For this customer base, factors such as product availability, competitive pricing, brand reputation for longevity, and ease of installation are paramount. Given the technical complexity of modern injectors, the aftermarket is increasingly reliant on suppliers providing comprehensive diagnostic tools and technical support alongside the replacement parts, making service integration a key buying consideration.

A specialized, growing customer segment includes manufacturers of niche applications, such as high-performance racing teams, marine engine producers, and off-highway machinery manufacturers (e.g., construction and agriculture). These customers require extremely durable, often bespoke, fuel injectors capable of operating under punishing conditions or delivering maximal power output. While these volumes are significantly smaller, the high technical barriers and specialization involved mean they often represent a high-margin business opportunity for dedicated Tier 1 suppliers. Focus in this area involves developing injectors resistant to extreme vibrations, varied fuel quality, and extended duty cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Technologies (BorgWarner Inc.), Magneti Marelli (Marelli Holdings Co., Ltd.), Keihin Corporation, Stanadyne LLC, Hitachi Astemo, Inc., Mitsubishi Electric Corporation, Eaton Corporation plc, Cummins Inc., Schaeffler AG, Vitesco Technologies Group AG, Yanmar Co., Ltd., Weichai Power Co., Ltd., ASCO Numatics, Carter Fuel Systems, LLC, Infineon Technologies AG, Westport Fuel Systems Inc., Zhejiang Xichuan Shock Absorber Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Fuel Injectors Market Key Technology Landscape

The technological landscape of automotive fuel injectors is undergoing rapid evolution, driven primarily by the pursuit of ultra-lean combustion and reduced particulate emissions. The dominant technologies are Gasoline Direct Injection (GDI) and high-pressure Common Rail Injection (CRI). GDI systems are characterized by injecting fuel directly into the combustion chamber at very high pressures (currently ranging from 200 bar up to 350 bar in production vehicles, with 500 bar systems in development). This high-pressure injection facilitates better atomization and allows for precise stratification of the fuel-air mixture, leading to improved fuel efficiency and torque compared to older Port Fuel Injection (PFI) systems. The shift from solenoid-actuated GDI to faster, more precise piezoelectric-actuated GDI injectors represents a critical advancement, enabling multiple injection events per combustion cycle for optimal control.

In the diesel segment, Common Rail Injection (CRI) remains the standard, utilizing a common pressure accumulator (the rail) to feed injectors that operate at extremely high pressures, often exceeding 2,200 bar for passenger vehicles and 2,500 bar for heavy-duty commercial applications. Key technology enhancements in CRI focus on advanced control mechanisms, such as seven or eight-hole nozzle geometries and rapid multi-pulse capability, which allows for pilot, main, and post-injections. These sophisticated injection strategies are vital for controlling the combustion noise, mitigating the formation of nitrogen oxides (NOx) and soot (particulate matter), thus allowing engines to meet the increasingly strict Euro 6d and upcoming Euro 7 standards without sacrificing power or efficiency.

Emerging technologies also include injectors specifically designed for alternative fuels and hydrogen. For Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG) engines, injectors must handle gaseous fuel delivery, which requires unique materials and sealing strategies to prevent leaks and ensure stable flow characteristics across a wide temperature range. Furthermore, research into high-speed solenoid and piezoelectric injectors for Hydrogen Internal Combustion Engines (H2-ICE) is gaining traction. The integration of advanced diagnostics and AI-powered Electronic Control Units (ECUs) is now considered part of the core technology landscape, enabling "smart injectors" that can adjust performance based on learned engine characteristics and real-time environmental data, ensuring the optimal performance and longevity of the entire powertrain system.

Regional Highlights

Regional dynamics significantly influence the Automotive Fuel Injectors Market, reflecting local regulatory environments, consumer preferences, and manufacturing concentration.

- Asia Pacific (APAC): This region dominates the market in terms of production and volume consumption, led by China, India, and Japan. The primary driver is the sheer size of the manufacturing base and rapid growth in vehicle sales, coupled with the mandatory adoption of stricter emission norms (e.g., China 6 and BS-VI). APAC is a critical market for high-volume, reliable PFI and GDI systems in passenger vehicles, and a substantial user of high-durability common rail diesel systems for its expanding commercial fleet.

- Europe: Europe is characterized by stringent emission regulations (Euro standards), making it the primary driver of technological innovation and high-value product adoption. The region shows a strong preference for sophisticated GDI and high-pressure diesel injectors, essential for downsizing engines and meeting CO2 targets. However, the accelerating shift toward BEVs in Western European nations means the market focus is increasingly placed on premium injectors for high-efficiency PHEVs and specialized commercial vehicles.

- North America: The market is dominated by large passenger vehicles, SUVs, and light trucks, resulting in a high demand for powerful, reliable GDI systems. While emission standards are robust, the market volume is gradually being impacted by BEV adoption, especially in coastal states. Demand for premium, high-flow injectors remains strong, particularly in the high-performance and heavy-duty truck sectors, where diesel engines continue to require advanced common rail technology for compliance with EPA standards.

- Latin America (LATAM), Middle East, and Africa (MEA): These regions represent growth opportunities, especially in the aftermarket and replacement segments. Reliance on older ICE technology and often lower fuel quality necessitates robust and reliable PFI and entry-level GDI systems. Market growth is stable, driven by increasing vehicle ownership, with less immediate pressure from mass BEV adoption compared to Europe or North America, ensuring sustained demand for essential engine components for the foreseeable future.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Fuel Injectors Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Delphi Technologies (BorgWarner Inc.)

- Magneti Marelli (Marelli Holdings Co., Ltd.)

- Keihin Corporation

- Stanadyne LLC

- Hitachi Astemo, Inc.

- Mitsubishi Electric Corporation

- Eaton Corporation plc

- Cummins Inc.

- Schaeffler AG

- Vitesco Technologies Group AG

- Weichai Power Co., Ltd.

- ASCO Numatics

- Westport Fuel Systems Inc.

- Hella GmbH & Co. KGaA

- Aisan Industry Co., Ltd.

- TI Fluid Systems plc

- Pierburg GmbH (Rheinmetall Automotive)

Frequently Asked Questions

Analyze common user questions about the Automotive Fuel Injectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Gasoline Direct Injection (GDI) technology?

The adoption of GDI is primarily driven by global regulatory mandates requiring enhanced fuel efficiency and lower CO2 emissions. GDI systems offer superior thermal efficiency compared to traditional Port Fuel Injection (PFI), enabling engine downsizing without compromising performance, which is crucial for meeting modern environmental standards.

How does the increasing trend of electric vehicles (EVs) impact the fuel injector market?

The rise of fully battery electric vehicles (BEVs) acts as a long-term volume restraint. However, the short-to-medium term impact is mitigated by strong growth in hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs), which require highly optimized, technologically advanced fuel injectors designed for frequent start-stop and variable load operation, sustaining market value.

What role does piezoelectric technology play in modern fuel injectors?

Piezoelectric actuators are integral to high-performance GDI and Common Rail Injectors because they enable extremely rapid opening and closing times. This speed allows for highly precise, multiple injection events (multi-pulse) within a single combustion cycle, essential for fine-tuning combustion, reducing noise, and lowering particulate emissions effectively.

Which geographical region represents the largest growth opportunity for fuel injector manufacturers?

Asia Pacific (APAC), particularly China and India, represents the largest growth opportunity. This is due to rapidly increasing vehicle production volumes, sustained reliance on ICEs in the immediate future, and the continuous upgrade of local emission regulations, driving the demand for modern GDI and CRI systems.

What is the difference between a Solenoid Injector and a Piezoelectric Injector in terms of performance?

Solenoid injectors are robust and cost-effective, providing reliable performance. Piezoelectric injectors are significantly faster, allowing for finer control over fuel quantity and timing, supporting more complex, multi-pulse injection strategies necessary for achieving ultra-low emissions and optimal efficiency in premium and high-performance engines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager