Automotive Hose Turbocharger Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443007 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Automotive Hose Turbocharger Market Size

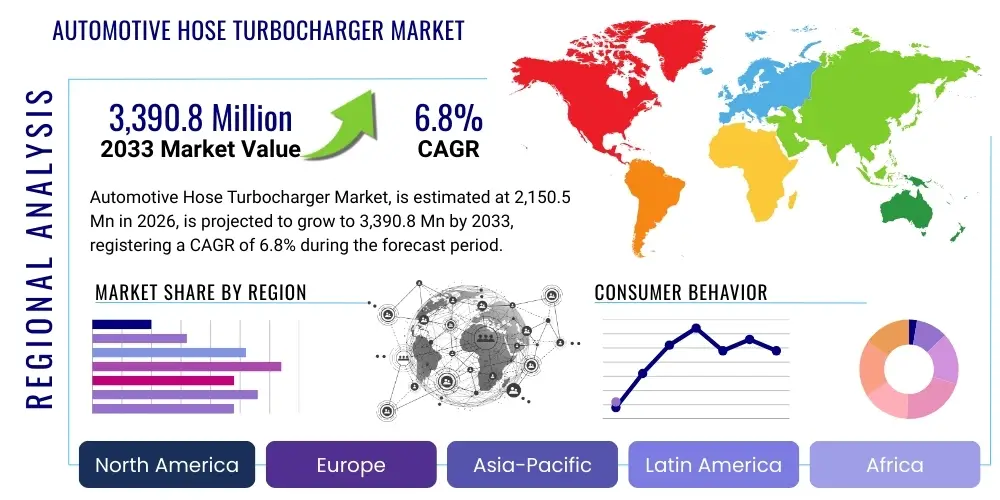

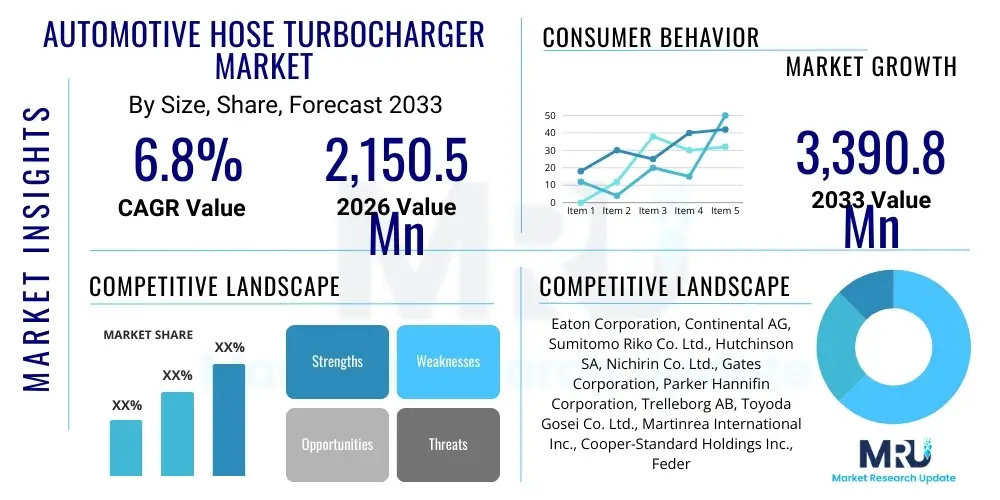

The Automotive Hose Turbocharger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2,150.5 Million in 2026 and is projected to reach $3,390.8 Million by the end of the forecast period in 2033.

Automotive Hose Turbocharger Market introduction

The Automotive Hose Turbocharger Market encompasses the manufacturing, distribution, and utilization of specialized flexible conduits designed to manage high-temperature and high-pressure airflow within turbocharged internal combustion engines. These hoses are critical components that connect the turbocharger compressor outlet to the intercooler, and subsequently the intercooler to the engine intake manifold, ensuring efficient transmission of compressed air. Given the extreme operating conditions—including temperatures often exceeding 200°C and pressures significantly higher than atmospheric pressure—these hoses require advanced material construction, typically involving silicone, fluorosilicone, or synthetic rubber reinforced with aramid fibers or high-tensile fabrics, to maintain structural integrity and prevent leakage or premature failure. The fundamental purpose of these hoses is to maximize engine efficiency and power output while minimizing fuel consumption and emissions.

The increasing global demand for fuel-efficient vehicles, coupled with stringent emission regulations such as Euro 7 and CAFE standards, is fundamentally driving the adoption of turbochargers, consequently bolstering the market for associated hose systems. Turbochargers allow smaller engines to produce power comparable to naturally aspirated larger engines, a phenomenon known as 'engine downsizing.' This technological shift necessitates robust hose systems capable of handling increased thermal and mechanical stress inherent in smaller, higher-performing turbocharged units. Furthermore, the market is characterized by continuous innovation aimed at developing lighter-weight, durable, and highly flexible hose solutions that contribute positively to the overall weight reduction targets of modern vehicles, crucial for both performance and overall energy efficiency, particularly in hybrid configurations.

Major applications for automotive hose turbochargers span across passenger vehicles (PVs), light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). These components are essential in diesel engines, where turbocharging is nearly ubiquitous, and are rapidly gaining traction in gasoline direct injection (GDI) engines for enhanced performance and efficiency. Key benefits derived from high-quality turbocharger hoses include improved engine response, extended service life of the air intake system, precise maintenance of boost pressure, and minimization of thermal degradation, which directly translates into enhanced driving experience and compliance with environmental standards. The geographical landscape is dominated by regions with high automotive production volumes and early adoption of stringent emission norms, particularly Europe and Asia Pacific, where engine downsizing trends and regulatory mandates are most pronounced.

Automotive Hose Turbocharger Market Executive Summary

The Automotive Hose Turbocharger Market is experiencing dynamic growth driven primarily by the global shift towards engine downsizing and the mandatory implementation of stringent emission control regulations across major economies. Business trends indicate a strong focus among manufacturers on material science innovation, specifically leveraging advanced silicones and fluoropolymers to create hoses that offer superior heat resistance, chemical stability, and longevity, thereby meeting the demanding specifications of high-performance turbocharged engines. Furthermore, strategic collaborations between hose manufacturers and original equipment manufacturers (OEMs) are crucial for early integration of customized hose designs tailored to specific engine architectures, optimizing performance and reducing assembly complexity, often through the supply of integrated hose-connector modules. The push for modular engine designs and the increasing use of forced induction systems, even in hybrid electric vehicles (HEVs), are sustaining robust demand and investment in high-throughput manufacturing.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to escalating automotive production in China, India, and Southeast Asian nations, coupled with the rapid urbanization and rising disposable incomes driving new vehicle purchases. Regulatory convergence with Western emission standards accelerates the adoption of turbochargers across all vehicle segments in this region. Europe, however, currently maintains the largest market share, characterized by its long-standing stringent regulatory environment promoting high turbocharger penetration rates, especially in diesel passenger cars and commercial vehicles. North America shows steady growth, influenced by the increasing market acceptance of turbocharged gasoline engines in PVs and light trucks, alongside sustained demand from the performance aftermarket seeking upgrade solutions.

Segmentation trends highlight the dominance of the silicone material segment due to its excellent thermal resilience and flexibility, making it the preferred choice for high-pressure turbo air ducts in premium and high-stress applications. In terms of vehicle type, passenger cars account for the largest volume share, reflecting the sheer volume of global production and the widespread adoption of downsizing strategies. The aftermarket segment is also demonstrating significant expansion, driven by the need for replacement parts that match or exceed OEM specifications, particularly in regions with aging vehicle fleets or high levels of vehicle tuning. Suppliers must increasingly invest in automated quality assurance processes and advanced non-destructive testing (NDT) to meet OEM reliability metrics and maintain competitive advantage in a highly quality-sensitive market.

AI Impact Analysis on Automotive Hose Turbocharger Market

User queries regarding the impact of Artificial Intelligence (AI) on the Automotive Hose Turbocharger Market often revolve around optimizing material composition, predicting hose failure, enhancing manufacturing quality control, and streamlining supply chain logistics. Key themes emerging from these questions concern how AI-driven predictive maintenance models can reduce unexpected vehicle breakdowns caused by hose failure by analyzing sensor data for minute degradation patterns. Users are also keen to understand whether machine learning algorithms can accelerate the discovery of novel composite materials offering improved thermal and mechanical properties necessary for future high-efficiency, high-temperature engines. The core expectation is that AI will shift production from reactive testing to proactive, predictive material selection and process optimization, significantly improving product durability and overall engine system reliability while reducing warranty liabilities for component manufacturers.

AI's influence is primarily felt in the design optimization, quality assurance, and predictive maintenance phases of the automotive component lifecycle. In the design stage, generative AI algorithms can simulate thousands of material combinations and complex routing geometries under extreme thermal cycling and pressure fluctuations, identifying optimal hose designs that minimize pressure drop and maximize resilience far faster than traditional human-led iterative simulation methods. This capability accelerates the time-to-market for specialized hose assemblies required for new, highly compact, and thermally demanding engine platforms. On the manufacturing floor, AI-powered vision systems are employed for non-destructive testing (NDT) and sophisticated pattern recognition, identifying minute surface imperfections, wall thickness inconsistencies, and reinforcement layer misalignment in real-time, drastically reducing the defect rate associated with manual or conventional automated inspection methods, thereby guaranteeing stringent OEM quality standards.

Furthermore, AI plays a crucial role in enhancing the operational lifespan and reliability of the end product in the field. Predictive maintenance platforms leverage sensor data streamed from the vehicle (including real-time temperature, boost pressure, and vibration profiles) to monitor the degradation profile of the turbocharger hose assembly. Machine learning models analyze this continuous data against historical failure patterns to accurately predict the remaining useful life (RUL) of the hose, signaling the driver or fleet manager when preventative replacement is necessary. This shift from simple time-based replacement schedules to highly accurate, condition-based maintenance minimizes vehicle downtime for commercial fleet operators and ensures optimal engine performance throughout the vehicle's operational cycle, offering a substantial competitive advantage to hose suppliers capable of integrating smart monitoring solutions into their core product offering, pushing the envelope of component digitalization.

- AI-driven Generative Design: Optimization of hose geometry and material stacking/composition for maximum flow efficiency and superior structural durability under high operational stress.

- Predictive Quality Control (PQC): Utilization of machine vision and deep learning for real-time, high-speed defect detection during manufacturing, including analysis of vulcanization uniformity and internal structural integrity, ensuring near zero-defect output.

- Predictive Maintenance Integration: Development of ML models using engine telemetry data to forecast hose degradation and impending catastrophic failure, enabling proactive, condition-based replacement strategies, especially critical for heavy commercial vehicle fleets.

- Supply Chain Optimization: ML algorithms improving raw material sourcing, predictive inventory management, and logistics planning for specialized, high-cost polymers and reinforcement fibers, stabilizing production costs and lead times.

- Accelerated Material Discovery: AI simulation tools identifying new composite elastomeric materials with dramatically enhanced thermal, chemical, and pressure resistance properties suitable for future, high-power density engines operating beyond current thermal limits.

- Automated Testing & Validation: Robotics and AI systems performing accelerated stress testing and fatigue analysis under simulated engine conditions, significantly shortening the development and validation cycle for new turbocharger hose products while ensuring regulatory compliance.

- Manufacturing Process Optimization: Use of reinforcement learning to fine-tune curing temperatures and pressures in vulcanization processes, minimizing material waste and maximizing throughput consistency.

DRO & Impact Forces Of Automotive Hose Turbocharger Market

The Automotive Hose Turbocharger Market is fundamentally shaped by a confluence of driving factors related to technological mandates, regulatory pressures, and consumer preferences, balanced against significant operational restraints and emerging technological opportunities. The primary driver remains the pervasive global commitment to engine downsizing and the subsequent necessity of turbocharging to meet stringent fuel economy and emissions standards, effectively cementing the turbocharger assembly, including its crucial hose systems, as a non-negotiable component in modern ICE and hybrid powertrains. Regulatory environments across Asia Pacific and Europe continuously tighten, forcing manufacturers to adopt ever more efficient forced induction systems. This sustained regulatory push acts as a powerful, non-cyclical demand stimulus for high-quality, reliable turbocharger hose systems capable of long-term high-performance operation.

Restraints largely center around the material and operational challenges associated with extreme performance demands. Specifically, this includes the high cost and complexity of sourcing and processing specialized elastomers, such as high-grade fluorosilicone, necessary for handling continuous high temperatures (up to 250°C) and aggressive chemical exposures (oil, solvents). Furthermore, the long-term strategic restraint is the accelerating global shift towards Battery Electric Vehicles (BEVs), which completely eliminates the need for turbocharger components. While this substitution threat is tempered by the robust growth of the hybrid vehicle segment, which still utilizes turbochargers, manufacturers must manage the risk of market contraction in the ICE-only segment beyond the forecast period. Maintaining profitability requires strategic focus on high-margin, high-specification hybrid and performance applications.

Impact forces in the market are significant, primarily manifesting through the intense bargaining power of Tier 1 suppliers and OEMs who demand robust quality control, competitive pricing, and integrated modular solutions. The high threat of potential technical failure, where a minor hose failure can lead to catastrophic engine damage, compels buyers to prioritize reliability and quality assurance over marginal cost savings, favoring established suppliers with proven track records. A crucial opportunity lies in the lightweighting trend; developing hoses that significantly reduce mass (e.g., through advanced multi-layered thin-wall construction or integration with lightweight composite connectors) offers a strong competitive edge, supporting OEM efforts to improve vehicle efficiency. Additionally, the growing performance aftermarket provides an opportunity for suppliers to introduce premium, high-durability upgrade kits, often commanding higher margins than standard OEM supply.

Segmentation Analysis

The Automotive Hose Turbocharger Market is comprehensively segmented across several dimensions, including Material Type, Product Type, Vehicle Type, Distribution Channel, and operational region, allowing for granular analysis of market dynamics and opportunity mapping. This segmentation reflects the diverse requirements of the global automotive industry, where different vehicle classes and engine types necessitate highly specific hose characteristics concerning pressure resistance, thermal resilience, and flexibility. Material composition, specifically the choice between silicone, fluorosilicone, EPDM, and aramid-reinforced options, forms the foundational segmentation, directly influencing the hose's performance envelope, durability, and total manufacturing cost, catering to specific engine thermal and chemical operational environments.

The market structure is heavily influenced by the vehicle type segmentation, with Passenger Cars representing the largest volume segment globally, driven by the mass adoption of small, turbocharged gasoline engines in alignment with fuel efficiency goals. The commercial vehicle segment (including light and heavy-duty trucks) exhibits robust growth rates, primarily due to the mandatory use of rugged turbochargers in diesel engines for cargo transport and logistics, which demand extremely durable and high-specification hoses capable of enduring continuous heavy-duty cycles, high vibrations, and prolonged operational hours. Analyzing these segments is essential for stakeholders to tailor their product offerings, focusing on high-volume standard hoses for PVs or high-performance, complex assemblies for demanding HCV and off-highway applications.

Furthermore, the distribution channel segmentation, dividing the market into OEM (Original Equipment Manufacturer) and Aftermarket sales, is critical for understanding revenue streams and profitability dynamics. The OEM channel dominates in terms of overall unit volume and total value, driven by long-term supply agreements and rigorous initial component integration into new vehicle models. However, the Aftermarket segment, dedicated to replacement, repair, and performance upgrades, provides consistently higher profit margins and steady demand driven by vehicle aging and modification trends, especially in developed economies with substantial installed bases of turbocharged vehicles. Optimizing logistical capabilities and ensuring broad product availability across diverse global distribution networks are keys to maximizing revenue across both these essential channels.

- By Material Type:

- Silicone Rubber Hoses (Dominant for high-temperature and performance applications)

- Fluorosilicone Rubber Hoses (Specialized for extreme oil/chemical resistance)

- EPDM Rubber Hoses (Cost-effective for lower-temperature segments)

- Aramid Reinforced Hoses (Utilized for high burst pressure requirements)

- Others (FKM, HNBR, Fluoroelastomers)

- By Product Type:

- Coolant Hoses (Interconnecting engine cooling systems)

- Charge Air Hoses (Connecting compressor to intercooler and intercooler to manifold)

- Vacuum Hoses (Used in wastegate/blow-off valve control systems)

- Bypass Hoses

- Intercooler Connectors (Integrated assemblies)

- By Vehicle Type:

- Passenger Vehicles (PVs) (Largest volume segment, driven by downsizing)

- Light Commercial Vehicles (LCVs) (Strong growth due to logistics demand)

- Heavy Commercial Vehicles (HCVs) (High durability and specification requirements)

- Off-Highway Vehicles (Specialized duty cycles)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement, Tuning, and Performance Upgrades)

Value Chain Analysis For Automotive Hose Turbocharger Market

The Value Chain for the Automotive Hose Turbocharger Market is initiated in the Upstream Segment, which is concentrated on the sourcing and formulation of highly specialized raw materials. This critical stage involves procuring performance elastomers (silicone, fluorosilicone), high-tensile reinforcement fibers (aramid, polyester), and complex chemical additives (stabilizers, curing agents). Given the non-standard nature and proprietary formulation of these high-specification materials required to withstand continuous thermal and chemical stress, the polymer and chemical suppliers in this segment hold significant influence. Establishing secure, long-term supply contracts and managing quality consistency are essential upstream activities to mitigate supply risks and ensure the foundational quality of the final product.

The Midstream component encompasses the core manufacturing, converting raw materials into finished hose assemblies. This stage involves sophisticated processes such as compounding, extrusion, precision winding of reinforcement layers, complex molding (for shaped hoses), and high-pressure vulcanization (curing). Manufacturing is highly capital-intensive, requiring specialized, automated machinery to ensure dimensional accuracy, structural integrity, and defect-free bonding of multiple material layers. Tier 1 hose manufacturers focus heavily on achieving operational efficiency and minimizing material waste through lean manufacturing and high levels of process automation. The ability to produce geometrically complex, custom-shaped hoses with internal baffling or integrated connectors is a key midstream differentiator, aligning with modern engine bay consolidation efforts.

The Downstream segment involves distribution, sales, and end-user engagement, bifurcated distinctly between OEM and Aftermarket channels. Direct sales to OEMs necessitate just-in-time (JIT) delivery, rigorous inventory management integrated directly with vehicle assembly schedules, and continuous quality audits. The indirect Aftermarket channel relies on extensive global distributor networks, wholesalers, and online performance retailers to manage replacement and upgrade demand. Success downstream requires strong logistical capabilities, effective inventory forecasting based on regional vehicle fleet age, and comprehensive technical support documentation. The end-users—vehicle manufacturers (OEMs) and repair/tuning shops (Aftermarket)—demand both competitive pricing and absolute assurance of reliability, driven by the critical function of the component within the engine's operation.

Automotive Hose Turbocharger Market Potential Customers

The primary and most dominant segment of potential customers for Automotive Hose Turbocharger products comprises Original Equipment Manufacturers (OEMs) of passenger vehicles and commercial vehicles globally. These entities represent the largest volume purchasers, integrating the hoses directly into new vehicle assembly lines across various platforms, including gasoline, diesel, and hybrid powertrains. Key factors driving OEM procurement decisions include stringent regulatory compliance (emission reduction targets mandate high-efficiency turbo systems), guaranteed reliability over the vehicle's lifespan, and the ability of the supplier to integrate complex hose assemblies into modular engine systems. OEMs prioritize suppliers offering deep technical expertise, robust R&D capabilities, and adherence to global quality certifications (e.g., IATF 16949).

The secondary yet highly profitable customer segment is the Aftermarket, which includes independent automotive repair shops, specialized tuning and performance modification garages, authorized service dealers, and large automotive parts retailers. Demand from the aftermarket is driven by the necessity for replacement parts due to wear-and-tear failure, which is accelerated by high mileage accumulation and continuous thermal cycling inherent in turbocharged engines. This segment often shows a strong preference for high-durability or performance-oriented products, providing significant market opportunities for manufacturers to offer upgraded silicone or aramid-reinforced hoses that surpass standard OEM specifications in terms of thermal and pressure tolerance. Effective marketing and extensive stock keeping are crucial for servicing this geographically fragmented but highly reactive customer base.

Furthermore, specialized industrial and off-highway equipment manufacturers constitute a crucial niche customer base. This includes producers of large agricultural machinery, high-duty construction equipment, and marine propulsion systems, which heavily rely on robust, turbocharged diesel powerplants for continuous high torque output. These specialized applications impose exceptionally harsh operating conditions—including high levels of vibration, extreme temperature gradients, and exposure to dirt and contaminants—demanding hoses that are engineered for exceptional ruggedness and durability far exceeding standard passenger vehicle requirements. Catering to this diverse group of customers necessitates a flexible manufacturing strategy capable of delivering both mass-produced components and highly specific, low-volume custom assemblies with extended warranty periods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2,150.5 Million |

| Market Forecast in 2033 | $3,390.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Continental AG, Sumitomo Riko Co. Ltd., Hutchinson SA, Nichirin Co. Ltd., Gates Corporation, Parker Hannifin Corporation, Trelleborg AB, Toyoda Gosei Co. Ltd., Martinrea International Inc., Cooper-Standard Holdings Inc., Federal-Mogul LLC (Tenneco), HPS Silicone Hoses, Mishimoto Automotive, Samco Sport, Flexfab LLC, VOSS Automotive GmbH, Manuli Rubber Industries S.p.A., Unigawa, Delphi Technologies (BorgWarner). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Hose Turbocharger Market Key Technology Landscape

The technological landscape of the Automotive Hose Turbocharger Market is profoundly shaped by continuous advancements in specialized material science and precision manufacturing, driven by the increasing demands for thermal management and high-pressure resilience in compact, high-output engines. A foundational technology involves the sophisticated use of high-performance elastomers, predominantly multi-layered silicone and fluorosilicone compounds. These materials are systematically reinforced with high-tensile fabrics, such as aramid fibers or polyester, often involving complex winding patterns to ensure the hose resists both expansion under high positive boost pressure and collapse under vacuum conditions (a critical failure mode during turbo lag or deceleration). The incorporation of specialized inner liners, particularly fluorocarbon materials, is essential technology to protect the hose structure from aggressive oil mist and chemical additives inherent in modern engine oil systems, extending component longevity.

Significant innovation is also concentrated in manufacturing processes, specifically moving towards highly automated precision molding, extrusion, and advanced vulcanization techniques necessary to produce complex, custom-shaped hose geometries required for tightly packaged modern engine bays. A key technological trend is the development and adoption of integrated, modular hose assemblies featuring quick-connect coupling systems, often utilizing lightweight thermoplastic or composite connectors. These integrated designs simplify vehicle assembly on the OEM line, reduce potential leakage points compared to traditional clamp-and-fit systems, and contribute to the overall vehicle lightweighting objectives. Furthermore, computational fluid dynamics (CFD) modeling has become an indispensable tool in the design phase, allowing engineers to optimize the hose’s internal contour to minimize pressure drop and airflow turbulence, thereby maximizing the overall efficiency of the turbocharger system.

Looking towards future technological integration, research is underway regarding 'smart hose' solutions, which involve embedding micro-sensors within the composite structure to continuously monitor operational parameters like internal pressure, temperature, and material strain. This integration capability supports sophisticated, real-time data feedback to the engine control unit (ECU), enabling highly granular engine management and facilitating the implementation of advanced predictive maintenance protocols. The focus remains heavily on developing ultra-lightweight, high-temperature resistance (HTR) hoses capable of reliably operating above 250°C, a necessary requirement as performance densities in hybrid and compact ICE engines continue to climb. The utilization of robotic systems for precise material handling and automated non-destructive testing (NDT) further secures the high quality and zero-defect rate required by Tier 1 automotive suppliers.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, driven by the immense manufacturing volumes in China and India and the rapid adoption of international emission standards (e.g., China VI, BS-VI). The market demands highly durable, cost-effective, and high-volume solutions for the booming passenger vehicle and LCV segments, making this region the primary focus for new manufacturing investment and capacity expansion among global suppliers.

- Europe: This region maintains the highest value share due to the early and sustained adoption of stringent emission regulations that propelled engine downsizing, particularly in the premium and diesel segments. While facing transition pressure from electrification, Europe exhibits sustained demand for highly technical, high-specification hoses required for complex hybrid powertrains and high-performance vehicles, where quality and thermal stability are non-negotiable.

- North America: Demonstrates stable and substantial market relevance, driven by the continuous integration of turbocharged GDI engines into popular light truck and SUV segments to meet increasing fuel economy mandates. The aftermarket in North America is particularly robust, supporting a large installed base of turbocharged vehicles and a strong cultural affinity for performance upgrades, favoring suppliers who offer premium, high-burst pressure hose kits.

- Latin America (LATAM): Expected to show moderate yet consistent growth, tied closely to economic recovery and the modernization of vehicle fleets in major economies like Brazil and Mexico. The market requires durable solutions designed to withstand challenging regional road conditions and variable fuel quality, placing a premium on chemical and abrasion resistance in addition to thermal stability.

- Middle East and Africa (MEA): This region offers niche demand, primarily influenced by high commercial vehicle utilization and large-scale infrastructure projects. Extreme ambient temperatures necessitate specialized heat-resistant and UV-stable elastomer compounds for turbocharger hoses, ensuring components do not prematurely degrade under intense solar radiation and high operating loads.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Hose Turbocharger Market.- Eaton Corporation

- Continental AG

- Sumitomo Riko Co. Ltd.

- Hutchinson SA

- Nichirin Co. Ltd.

- Gates Corporation

- Parker Hannifin Corporation

- Trelleborg AB

- Toyoda Gosei Co. Ltd.

- Martinrea International Inc.

- Cooper-Standard Holdings Inc.

- Federal-Mogul LLC (Tenneco)

- HPS Silicone Hoses

- Mishimoto Automotive

- Samco Sport

- Flexfab LLC

- VOSS Automotive GmbH

- Manuli Rubber Industries S.p.A.

- Unigawa

- Delphi Technologies (BorgWarner)

Frequently Asked Questions

Analyze common user questions about the Automotive Hose Turbocharger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for high-performance automotive turbocharger hoses?

The primary driver is the pervasive trend of engine downsizing coupled with stringent global emission standards (e.g., Euro 7, CAFE). Smaller, turbocharged engines operate at significantly higher temperatures and boost pressures, necessitating highly durable, advanced elastomeric hoses (like fluorosilicone or aramid-reinforced silicone) to prevent leaks, collapse, or thermal degradation, thereby ensuring optimal engine efficiency and compliance.

How are electric vehicles (EVs) impacting the long-term forecast of the turbocharger hose market?

While pure Battery Electric Vehicles (BEVs) eliminate the need for turbocharger hoses, the market benefits significantly from the rapid growth of Hybrid Electric Vehicles (HEVs). HEVs still utilize highly stressed, turbocharged ICEs that demand specialized hose assemblies designed to withstand intense, intermittent thermal cycling, ensuring that demand remains robust throughout the transition period.

What are the key material innovations addressing extreme temperature resistance in turbocharger hoses?

Key material innovations focus on enhanced multi-layer silicone compounds, often utilizing fluorosilicone liners to resist aggressive oil mist and chemical exposure, and high-tenacity reinforcement layers made of aramid fibers. These advanced materials enable hoses to reliably operate at sustained temperatures exceeding 200°C, crucial for modern, high-output turbocharged systems and extending service life under severe operational duress.

Which geographical region represents the largest growth opportunity for hose manufacturers?

Asia Pacific (APAC), specifically the markets of China and India, offers the largest growth opportunity. This is driven by massive volume increases in vehicle production, rapid regulatory upgrades demanding widespread turbo technology adoption, and increasing consumer demand for efficient, high-performance passenger vehicles across the emerging economies in the region.

How is AI being utilized to improve the manufacturing and reliability of turbocharger hose products?

AI is employed in generative design to optimize hose geometries for airflow efficiency and in production for predictive quality control (PQC), where machine vision systems detect microscopic defects in real-time before vulcanization. This significantly reduces failure rates and enhances the overall reliability and lifespan of the components supplied to both OEM and performance aftermarket segments.

In addition to the aforementioned segments, specialized R&D efforts are heavily concentrated on producing ultra-lightweight hose assemblies. The industry is actively moving away from heavy metallic pipes in specific applications by substituting them with high-strength, reinforced polymer or composite materials for the air charge system. This technological migration aims to contribute to overall vehicle mass reduction, which is a constant objective for manufacturers striving to meet increasingly stringent corporate average fuel economy (CAFE) standards globally. The optimization of internal surface smoothness and reduced turbulence within the hoses, often achieved through computer simulation (CFD), is another critical area where manufacturers are seeking marginal gains in engine efficiency, further differentiating high-end products from standard offerings. Continuous pressure testing and thermal degradation analysis remain core aspects of the technological landscape, ensuring that new products meet the rigorous lifetime demands of modern engines, often projecting operational lifespans exceeding 150,000 miles under severe conditions, a necessary guarantee for OEM partners.

The pursuit of integration technology, where the hose assembly is combined with other components like sensors, valves, or plastic ducts into a single, modular unit, represents a significant process innovation. This not only simplifies vehicle assembly but also reduces the number of potential leakage points, enhancing the system's overall reliability under dynamic load conditions. Suppliers capable of providing complex, pre-assembled modules rather than individual components are gaining significant favor with OEMs, securing long-term contracts based on system expertise. Material recycling and sustainability also drive innovation; manufacturers are exploring thermoplastic elastomers (TPEs) and other recyclable compounds that could potentially replace traditional thermoset rubbers in lower-temperature applications, aligning with global environmental compliance goals and reducing the long-term ecological footprint of vehicle manufacturing. The continuous cycle of material science and process optimization is essential for maintaining competitiveness in a market characterized by high technical barriers to entry and extremely demanding performance specifications from the end users.

Crucially, the rise of specialized performance vehicle segments, including sports cars and dedicated racing applications, drives demand for extremely high-specification hoses that must endure sustained maximum boost pressure and thermal cycling far exceeding standard commercial vehicle requirements. This niche segment often utilizes exotic materials, such as high-purity fluorocarbon elastomers (FKM), coupled with complex spiral reinforcement techniques to achieve superior burst pressure resistance and minimal material creep over time. Serving this market requires specialized, low-volume manufacturing capabilities and extensive performance testing. The knowledge gained from these high-performance applications often trickles down into mass-market OEM product development, driving incremental improvements in standard hose durability and heat resistance, demonstrating the interconnectedness of different segments within the technological development sphere and establishing new benchmarks for material performance.

The stringent quality requirements for turbocharger hoses necessitate advanced testing protocols that go beyond simple pressure tests. These include impulse testing (simulating rapid pressure cycling), aggressive oil resistance testing at elevated temperatures, and ozone resistance testing mandated by regulatory bodies. Manufacturers are investing heavily in sophisticated, custom-built testing rigs that simulate years of engine operation in a matter of weeks, ensuring that new product designs meet or exceed OEM service life expectations under the most aggressive environmental conditions. This rigorous validation process, often supported by AI-driven analysis of test results, is a non-negotiable component of the key technology landscape, securing supplier accreditation and long-term market access for these highly critical engine components where failure is catastrophic.

Moreover, the global automotive supply chain resilience, post-pandemic, has pushed technology focus toward localized and regionalized manufacturing capabilities. Utilizing modular and agile production lines that can quickly adapt to material supply constraints or sudden shifts in regional demand is becoming a core technological competency. The implementation of Industry 4.0 principles, including comprehensive real-time data monitoring, cloud-based supply chain management, and predictive maintenance of manufacturing equipment, ensures operational efficiency and mitigates production delays, ultimately supporting the reliable, high-volume delivery required by global automotive platforms. This operational technological focus is just as important as the material science breakthroughs in maintaining market competitiveness and meeting stringent Just-in-Time delivery timelines required by assembly plants worldwide.

The material complexity often extends to proprietary coatings and internal treatments designed to reduce friction and improve air density by minimizing heat transfer across the hose wall. For instance, some premium hoses incorporate heat-reflective external layers to mitigate radiant heat from adjacent exhaust components, thereby protecting the structural integrity of the elastomer over extended periods. Internally, specialized anti-static compounds are sometimes incorporated, especially in air intake systems, to manage static charge buildup, which can potentially affect sensitive sensor readings and overall system performance. These subtle but technologically impactful details demonstrate the high degree of specialized engineering required in the automotive hose turbocharger domain, moving far beyond simple rubber tubes to highly engineered, integrated fluid dynamic components essential for optimal engine control.

Looking ahead, the long-term technological trajectory involves further integration with powertrain controls. Future generations of smart hoses might not only communicate degradation data but also incorporate active elements, such as electronically controlled bypass or pressure relief valves integrated seamlessly into the hose body, allowing the ECU to dynamically adjust boost delivery with greater precision and speed. While this level of mechatronic integration is currently complex and costly, it represents the leading edge of turbocharger system optimization, promising enhanced responsiveness, fuel economy gains, and real-time fault detection capabilities. Such advancements will require deep cross-disciplinary collaboration between material scientists, electronics engineers, and powertrain control specialists, solidifying the market's reliance on cutting-edge, integrated system technology and advanced component design.

The competition among raw material suppliers is also driving down the effective cost and improving the performance envelope of specialized compounds. For instance, the development of lower-cost, high-performance EPDM alternatives with demonstrably enhanced heat and oil resistance is challenging the historical dominance of silicone in certain mid-range and less thermally stressed applications. Manufacturers are constantly evaluating the cost-benefit ratio of different materials, leveraging new compounding techniques to achieve near-silicone performance at a reduced input cost. This relentless search for optimal material-cost performance ratios is a key technological feature of the market, ensuring that turbocharging remains an economically viable solution across various vehicle price points and segments globally, maintaining the market's foundational momentum despite the long-term electric transition.

Furthermore, sophisticated simulation and modeling techniques are crucial in mitigating the engineering and financial risk associated with new product development. Finite Element Analysis (FEA) is extensively used to predict stress distribution, fatigue life, and deformation under dynamic loads and temperature cycling, ensuring the hose design can withstand mounting constraints, thermal expansion, and engine vibrations throughout the vehicle's mandated service life. This upfront investment in virtual validation significantly reduces the necessity for expensive and time-consuming physical prototyping cycles, accelerating product development and customization for specific OEM platforms. The sophistication of these digital engineering tools directly impacts the competitive ability of Tier 1 suppliers in securing future design wins for upcoming engine architectures, making high-fidelity simulation and analysis capabilities a prerequisite for market leadership in this technically demanding sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager