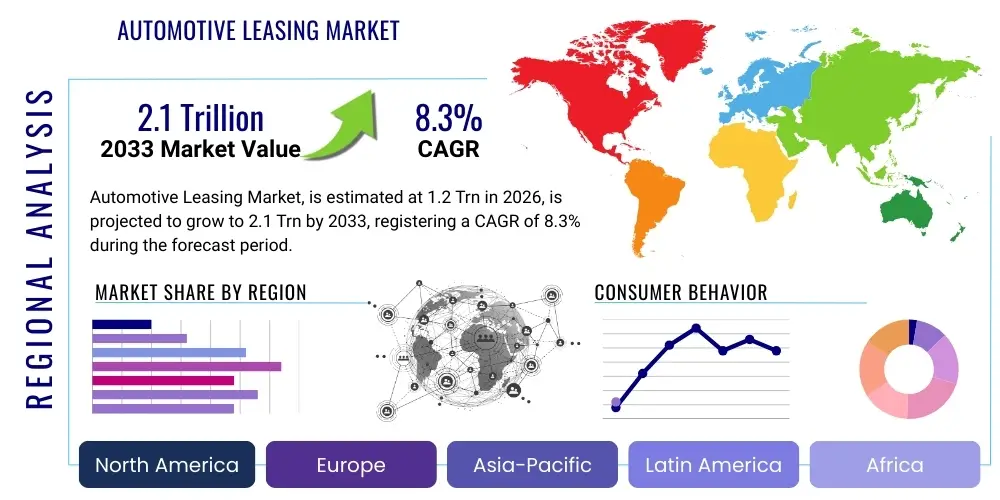

Automotive Leasing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442120 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Leasing Market Size

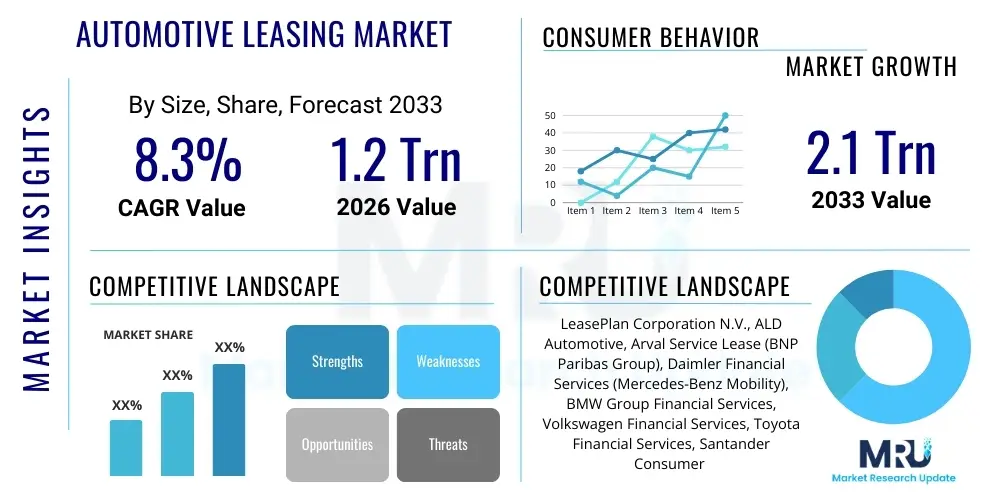

The Automotive Leasing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.3% between 2026 and 2033. The market is estimated at $1.2 Trillion USD in 2026 and is projected to reach $2.1 Trillion USD by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing preference among both corporate fleets and individual consumers for flexible mobility solutions over outright vehicle ownership, driven by economic volatility and the rapid evolution of automotive technology. The leasing model provides predictable monthly costs, minimizes depreciation risk for the user, and facilitates easier access to newer, safer, and more fuel-efficient vehicles, aligning with modern consumer financial planning and environmental considerations.

The market expansion is also underpinned by aggressive penetration strategies adopted by Original Equipment Manufacturers (OEMs) and captive finance arms, who increasingly view leasing as a crucial tool for brand loyalty and managing vehicle lifecycles, particularly in developed economies. Furthermore, the proliferation of electric vehicles (EVs) and hybrid models significantly boosts leasing uptake, as consumers often prefer to lease high-cost, rapidly evolving technology assets to mitigate long-term obsolescence risk. Regulatory shifts promoting fleet electrification and sustainable transportation models in major economic zones further cement the upward trajectory of the automotive leasing sector throughout the forecast period.

Automotive Leasing Market introduction

The Automotive Leasing Market encompasses the provision of vehicles for use over a specified period in exchange for regular payments, offering an alternative to purchasing. This financial service includes operational leasing (rental for a fixed term where the lessor bears the residual risk) and financial leasing (rental leading to ownership or transfer of risk to the lessee). Major applications span corporate fleet management, individual mobility solutions, and short-term rentals, serving a diverse clientele ranging from large multinational corporations seeking tax efficiencies and fleet management simplicity to individual consumers desiring lower upfront costs and access to the latest vehicle models. The primary benefits include reduced capital expenditure, predictable budgeting, simplified maintenance and repair packages, and the avoidance of residual value risk typically associated with ownership. Driving factors for this market are the global economic shift towards usage-based models, advancements in telematics enabling precise residual value estimation, and favorable tax treatments for leased assets in many jurisdictions, coupled with consumer demand for flexibility and technological upgrades.

Automotive Leasing Market Executive Summary

The Automotive Leasing Market demonstrates strong resilience, characterized by a fundamental shift in business trends prioritizing flexible mobility subscription models over traditional fixed-term contracts. Leading lessors are investing heavily in digital platforms to streamline the customer journey, from online vehicle selection to contract signing and end-of-term processes, dramatically improving operational efficiency and customer retention. Regional trends indicate North America and Europe retaining market dominance due to established fleet markets and high adoption rates of corporate leasing, while the Asia Pacific (APAC) region is poised for the fastest expansion, driven by urbanization, rising disposable incomes, and the nascent penetration of structured leasing programs in emerging economies like India and China. Segment-wise, the operational leasing segment continues to hold the largest share, favored by corporations for its off-balance sheet treatment, while the luxury and electric vehicle segments are experiencing exponential growth, reflecting changing consumer priorities toward premium experiences and environmental sustainability.

AI Impact Analysis on Automotive Leasing Market

User queries regarding the impact of Artificial Intelligence (AI) on automotive leasing center around four main themes: accurate residual value prediction, personalized customer service, optimization of fleet maintenance schedules, and the integration of autonomous vehicles into leasing models. Users frequently ask how AI-driven predictive analytics can reduce the financial risk for lessors, especially concerning EV battery degradation, and how AI might transform the customer experience through hyper-personalized contract offers and proactive communication. There is significant interest in the potential for AI to automate complex decision-making processes, such as fraud detection and credit scoring, thereby reducing processing times and operational costs, leading to more competitive pricing for consumers. The overarching expectation is that AI will introduce unprecedented efficiency, tailor services to individual usage patterns, and fundamentally change the lessor's risk management approach, shifting it from generalized actuarial models to precise, vehicle-specific forecasting.

AI is set to revolutionize risk assessment in automotive leasing by utilizing vast datasets encompassing driving behavior, geographical deployment, and external market factors (such as commodity prices and geopolitical events) to calculate precise residual values. Traditional models often rely on generalized historical data, whereas AI/Machine Learning (ML) algorithms can dynamically adjust residual forecasts in real-time, drastically reducing the potential for overestimation or underestimation that affects lessor profitability. This precision is particularly critical in the rapidly evolving EV sector, where battery health monitoring via telematics, processed by AI, becomes a key determinant of the vehicle's long-term worth.

Furthermore, the operational aspects of leasing fleets benefit immensely from AI integration. Predictive maintenance schedules, powered by ML analysis of vehicle diagnostics data, allow lessors to schedule necessary repairs proactively before significant breakdowns occur, minimizing vehicle downtime and ensuring high customer satisfaction. In the customer service domain, AI-driven chatbots and virtual assistants handle routine inquiries, accelerating response times and allowing human agents to focus on complex, high-value interactions, thus streamlining the entire customer lifecycle from initial inquiry to vehicle return and disposal. This technological overhaul enhances the overall perceived value of the leasing proposition.

- AI-driven residual value forecasting improves pricing accuracy, reducing financial risk for lessors.

- Machine Learning algorithms optimize dynamic pricing models based on real-time usage and market demand.

- Predictive maintenance schedules, informed by AI analysis of telematics data, minimize fleet downtime and operational costs.

- AI-powered fraud detection and enhanced credit scoring automate and expedite customer onboarding processes.

- Implementation of AI chatbots and virtual assistants delivers personalized, 24/7 customer support and contract management.

- Optimization of vehicle remarketing strategies using AI to determine optimal disposal timing and channel.

- Integration of Autonomous Vehicle (AV) data management for specialized AV fleet leasing and utilization tracking.

DRO & Impact Forces Of Automotive Leasing Market

The Automotive Leasing Market is driven by factors such as the preference for asset light business models among corporations, the cyclical economic need for predictable budgeting, and continuous technological advancements rendering older vehicle models obsolete quickly, incentivizing consumers to lease newer vehicles. Restraints include high interest rates and economic instability potentially limiting fleet expansion, stringent regulatory compliance regarding consumer protection and emissions standards (which increases operational burden on lessors), and consumer preference for outright ownership in certain emerging markets. Opportunities arise from the rapidly expanding Electric Vehicle (EV) segment, the integration of subscription and flexible mobility services, and market expansion into untapped geographical regions. The key impact forces are the intensifying competition from OEM captive finance companies, the disruptive influence of digital platforms standardizing the leasing process, and the macro trend of mobility-as-a-service (MaaS) which mandates leasing players evolve beyond simple vehicle provision to integrated mobility solutions.

Key drivers center on macroeconomic shifts and evolving consumer behavior. Corporations, particularly large enterprises, are increasingly adopting operational leasing to improve balance sheet efficiency by avoiding capitalization of large assets, thus meeting modern financial reporting standards and freeing up capital for core business investment. Concurrently, the consumer base is migrating away from the emotional commitment of vehicle ownership toward the pragmatic flexibility of usage. This migration is amplified by the rapid launch cycles of automotive technology—especially in safety, connectivity, and electrification—making the commitment to purchasing a five-to-seven-year-old technology significantly less appealing than continuously accessing the newest models through leasing. The perception of leasing as a cost-effective, hassle-free gateway to premium vehicles is a significant propellant.

Conversely, significant restraints hinder market potential. Economic downturns or prolonged periods of high inflation and elevated interest rates directly impact the profitability of leasing companies by increasing the cost of capital required to finance their vehicle purchases, which subsequently translates into higher lease rates, potentially dampening consumer demand. Furthermore, the complexity of residual value forecasting, particularly for novel vehicle types such as high-end EVs whose long-term battery degradation and second-hand market demand are still being established, presents a considerable financial risk. Regulatory fragmentation across international markets regarding taxation, depreciation rules, and consumer contract disclosures also complicates cross-border operations for major global leasing providers.

The primary opportunities lie in the convergence of mobility and digital transformation. The rapid acceleration of EV adoption presents a substantial growth avenue, as the total cost of ownership (TCO) argument favors leasing for expensive, tech-laden vehicles. Lessors capable of providing integrated charging solutions, battery management guarantees, and specialized EV maintenance packages are positioned for market leadership. Furthermore, the development of highly flexible, short-term, subscription-based leasing models, often facilitated by robust digital platforms, addresses the growing demand for personalized mobility solutions that transcend the limitations of traditional 24- to 48-month contracts, appealing directly to younger, urban demographics who prioritize convenience and low commitment.

Segmentation Analysis

The Automotive Leasing Market is segmented based on the type of lease, the vehicle type being leased, the end-user profile, and the regional deployment. Analyzing these segments provides a granular understanding of market dynamics, revealing where specific growth opportunities and competitive pressures exist. Operational leasing dominates the market due to its popularity among corporate fleets seeking off-balance sheet treatment and comprehensive service packages, covering maintenance and insurance. Financial leasing holds a smaller, yet stable, share, primarily catering to businesses or individuals aiming for potential ownership at the end of the term. The market is also heavily influenced by the differentiation between passenger vehicles, which account for the largest volume, and commercial vehicles (vans, trucks), which contribute significantly to the total contract value and require specialized heavy-duty leasing structures. The segmentation analysis is crucial for stakeholders to tailor product offerings and marketing strategies to specific demographic and operational requirements.

- By Lease Type:

- Operational Lease (Service Lease)

- Financial Lease (Capital Lease)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- By End User:

- Corporate/Fleet (Small, Medium, and Large Enterprises)

- Individual/Personal (Retail Customers)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Benelux)

- Asia Pacific (China, Japan, Australia, India)

- Latin America (Brazil, Mexico)

- Middle East and Africa (South Africa, UAE)

Value Chain Analysis For Automotive Leasing Market

The Automotive Leasing Value Chain is complex, involving multiple stakeholders spanning vehicle manufacturing to end-of-life management. Upstream activities begin with Original Equipment Manufacturers (OEMs) and vehicle suppliers, who dictate vehicle availability, pricing, and technology integration. OEMs frequently engage in captive finance, playing a dual role as supplier and lessor, which allows them greater control over the residual values of their own products. Midstream activities involve financing, acquisition, and management, dominated by large independent leasing companies (e.g., LeasePlan, ALD Automotive), captive finance arms (e.g., Mercedes-Benz Financial Services), and banks. These entities handle risk assessment, procurement, lease structuring, insurance provision, and maintenance management. Downstream activities focus on vehicle distribution channels, encompassing direct digital sales, third-party dealer networks, and brokerage houses, which serve as the primary interface with the end consumer. Finally, the value chain concludes with remarketing and disposal, where efficient processes are required for maximizing residual value through auctions, used car sales, or scrap, forming a crucial link to future profitability. The primary flow of assets and services moves through highly organized indirect channels, typically involving dealers or specialized brokers, though direct leasing models via online portals are rapidly gaining traction.

The efficiency of the value chain is increasingly determined by data flow and technological integration. Upstream, strong relationships with OEMs ensure timely supply of new models, particularly low-emission or high-demand EVs, which are critical for maintaining a modern and attractive fleet. Effective procurement strategies, often relying on bulk purchase discounts, are essential for competitive pricing. Midstream, the core competence lies in financial engineering and risk mitigation. Successful lessors leverage sophisticated data analytics to forecast maintenance requirements and residual values precisely, allowing them to offer tightly priced contracts while maintaining margins. Digitization is key here, enabling seamless contract management and automated compliance checking across diverse regulatory landscapes.

The downstream distribution and customer interaction layers are undergoing significant transformation. While traditional physical dealership networks remain important for vehicle handover and local service, the leasing process itself is becoming heavily digitized. Direct-to-consumer online platforms reduce transaction costs and increase transparency, a vital component for retaining retail customers. Furthermore, the final stage—remarketing—is crucial. An effective remarketing strategy, often utilizing digital auction platforms and sophisticated timing models, ensures that vehicles are liquidated at the optimal point in their lifecycle to maximize residual value recovery, which directly subsidizes the initial lease rate offered to the next customer, completing the circular value proposition.

Automotive Leasing Market Potential Customers

Potential customers for the Automotive Leasing Market fall predominantly into two major categories: Corporate/Fleet clients and Individual/Retail consumers, each driven by distinct needs and financial objectives. Corporate customers, ranging from small and medium enterprises (SMEs) to multinational corporations (MNCs), represent the largest segment by value. They primarily seek leasing solutions for optimization of logistics, sales fleets, and executive transport. Their procurement decisions are driven by Total Cost of Ownership (TCO) minimization, tax advantages associated with operational leases, fleet management simplicity (including maintenance, insurance, and road tax bundled into one contract), and the desire to maintain a modern, professional corporate image through regular fleet rotation. Leasing allows these enterprises to conserve capital that would otherwise be tied up in depreciating assets, aligning with asset-light business models.

Individual consumers constitute the fastest-growing segment, particularly in affluent, developed economies and rapidly urbanizing zones. These buyers are typically interested in accessing higher-end vehicles than they might otherwise afford through purchase, lower monthly payments compared to financing vehicle purchases, and the assurance of a short-term commitment (typically 2-4 years). The convenience of having a single monthly payment covering vehicle usage and often maintenance appeals strongly to individuals seeking predictable household budgeting. This segment is highly sensitive to technological obsolescence, making leasing the preferred method for frequently upgrading to vehicles featuring the latest safety features, connectivity, and environmental standards, particularly when adopting Electric Vehicles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Trillion USD |

| Market Forecast in 2033 | $2.1 Trillion USD |

| Growth Rate | 8.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LeasePlan Corporation N.V., ALD Automotive, Arval Service Lease (BNP Paribas Group), Daimler Financial Services (Mercedes-Benz Mobility), BMW Group Financial Services, Volkswagen Financial Services, Toyota Financial Services, Santander Consumer USA, Enterprise Holdings Inc., Avis Budget Group, Sumitomo Mitsui Auto Service Company, Traixle (Crédit Agricole), ORIX Corporation, Hertz Global Holdings, Alphabet (BMW Group), Holman Enterprises, Donlen (Element Fleet Management), General Motors Financial Company, Mitsubishi UFJ Lease & Finance, ICBC Leasing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Leasing Market Key Technology Landscape

The technology landscape in the Automotive Leasing Market is undergoing a rapid evolution, primarily driven by the need for enhanced operational efficiency, superior customer experience, and precise risk management. Central to this transformation is the widespread implementation of IoT-enabled telematics solutions. These systems gather real-time data on vehicle location, usage patterns (mileage, speed, harsh braking), maintenance requirements, and crucial metrics like EV battery health. This granular data feeds into advanced analytical platforms utilizing AI and Machine Learning to refine residual value projections, tailor insurance costs, and implement proactive, condition-based maintenance schedules, moving away from time-based service intervals. Furthermore, the digitization of the entire leasing lifecycle is paramount; online portals and mobile applications facilitate paperless contract signing, digital vehicle inspections, and seamless end-of-lease processes, significantly enhancing transaction speed and consumer transparency. This digital infrastructure is crucial for supporting flexible mobility and subscription models, which demand instant contracting and variable usage tracking.

Blockchain technology is emerging as a critical tool for ensuring transparency and security within the leasing ecosystem. By creating immutable digital records of vehicle history, maintenance logs, ownership changes, and financial transactions, blockchain addresses significant trust issues, particularly during the crucial remarketing phase. This verifiable history drastically reduces fraud risk and increases the confidence of secondary market buyers, thus helping lessors secure higher residual values. Additionally, technologies supporting the integration of autonomous vehicles (AVs) are being developed. Although full AV fleet deployment is nascent, lessors are already focusing on the infrastructure required to track, manage, and monetize self-driving assets, necessitating robust, encrypted communication platforms and complex data management systems capable of handling the massive data streams generated by Level 3 and Level 4 AVs. The ability to integrate these disparate technologies—telematics, AI, blockchain, and AV infrastructure—will define market leaders over the next decade.

The convergence of financing, mobility, and technology is culminating in sophisticated fleet management software systems that provide customers, especially corporate clients, with unparalleled visibility and control over their leased assets. These platforms often include real-time utilization reporting, automated compliance management (e.g., driver license checks, emission zone adherence), and comprehensive fuel/charging card integration. The adoption of these SaaS (Software as a Service) fleet management tools by lessors transforms their offering from a mere finance product into an integrated mobility service solution, differentiating them from pure finance providers. This technological backbone facilitates the shift toward flexible, pay-per-use models that are increasingly demanded by modern businesses prioritizing agility and optimized operational expenditure.

Regional Highlights

The global Automotive Leasing Market exhibits distinct characteristics and growth trajectories across major geographical regions, influenced by economic maturity, regulatory environments, and prevailing consumer preferences regarding vehicle ownership versus usage. North America, specifically the United States, represents a highly mature yet robust market, characterized by strong consumer appetite for new models and a well-established infrastructure for both personal (retail) and commercial leasing. The U.S. market is significantly influenced by incentives offered by captive finance arms of major OEMs, aggressive marketing of low-rate residualized financing, and high average vehicle transaction prices which make leasing an economically attractive alternative to purchasing. The transition toward EV leasing is rapidly accelerating here, driven by federal and state tax credits that lessors can often leverage more efficiently than individual buyers, allowing for highly competitive lease rates on electric models. The U.S. continues to lead in contract volume and total market value.

Europe stands as the epicenter of the global corporate leasing market, primarily driven by stringent tax regulations that favor operational leasing for fleet vehicles across countries like Germany, the UK, France, and the Benelux region. European markets are characterized by a strong focus on Total Cost of Mobility (TCM) rather than just TCO, leading to high demand for bundled service packages that include fuel/charging management, roadside assistance, and fully outsourced fleet administration. Furthermore, European regulatory mandates, such as the ambitious decarbonization targets and strict emission standards (e.g., WLTP), heavily incentivize corporate fleet managers to switch to Ultra Low Emission Vehicles (ULEVs) and Zero Emission Vehicles (ZEVs), fueling the growth of specialized EV leasing solutions. The competitive landscape is dominated by large pan-European independent lessors and bank-affiliated companies, which manage vast, technologically sophisticated fleets operating across multiple jurisdictions.

The Asia Pacific (APAC) region is projected to experience the highest growth CAGR during the forecast period, albeit from a smaller base in many emerging markets. This growth is bifurcated: established markets like Japan and Australia show high maturity, mirroring European fleet management sophistication. However, high-growth economies like China and India are rapidly embracing leasing, primarily fueled by urbanization, the rise of SMEs requiring structured fleet management solutions, and the nascent adoption of personal leasing by the growing middle class who are technologically savvy and willing to embrace flexible consumption models. China, in particular, is witnessing explosive growth in EV leasing, strongly supported by government subsidies and local regulatory backing. Challenges in APAC include regulatory diversity, fragmented insurance markets, and varying infrastructure quality, necessitating highly localized leasing products and risk assessment methodologies.

Latin America and the Middle East & Africa (MEA) represent emerging opportunity markets. In Latin America, economic volatility and high interest rates have traditionally favored shorter-term rental or basic financing, but the corporate sector in Brazil and Mexico is increasingly exploring operational leasing for cost predictability and tax efficiency. The expansion of international lessors into these regions is introducing more structured leasing products. In the MEA region, particularly the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), the market is characterized by a strong luxury vehicle segment and high rotation rates. The leasing model is attractive to both corporate entities managing large oil & gas or construction fleets and expatriate populations seeking flexible, hassle-free mobility without long-term financial commitment. However, political instability and fluctuating currency values remain significant regional risks that lessors must meticulously manage through advanced financial hedging strategies.

- North America: Dominance in personal leasing, rapid EV transition supported by tax incentives, highly competitive market driven by OEM captives.

- Europe: Largest corporate fleet leasing market globally, driven by favorable tax structures, strong regulatory push for ULEV/ZEV adoption, sophisticated TCO management services.

- Asia Pacific (APAC): Highest expected growth rate, fueled by SME expansion in China and India, increasing penetration of individual leasing, and significant government support for EV fleet adoption.

- Latin America: Growth concentrated in corporate fleet leasing (Brazil, Mexico), focusing on operational efficiency despite high economic volatility and fluctuating interest rates.

- Middle East & Africa (MEA): High growth potential in GCC countries driven by luxury vehicle leasing and corporate fleet requirements in energy and construction sectors; requires management of geopolitical and currency risks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Leasing Market.- LeasePlan Corporation N.V. (Part of Ayvens)

- ALD Automotive (Part of Ayvens)

- Arval Service Lease (BNP Paribas Group)

- Daimler Financial Services (Mercedes-Benz Mobility)

- BMW Group Financial Services

- Volkswagen Financial Services

- Toyota Financial Services

- Santander Consumer USA

- Enterprise Holdings Inc.

- Avis Budget Group

- Sumitomo Mitsui Auto Service Company

- Traixle (Crédit Agricole)

- ORIX Corporation

- Hertz Global Holdings

- Alphabet (BMW Group)

- Holman Enterprises

- Donlen (Element Fleet Management)

- General Motors Financial Company

- Mitsubishi UFJ Lease & Finance

- ICBC Leasing

Frequently Asked Questions

Analyze common user questions about the Automotive Leasing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Operational Leasing and Financial Leasing in the Automotive Market?

Operational leasing (or service leasing) typically includes maintenance, insurance, and bears the residual value risk on the lessor, treating the vehicle as an operating expense for the lessee. Financial leasing (or capital leasing) is structured more like a purchase agreement where the lessee often assumes the residual risk, and the asset may appear on the lessee's balance sheet, acting primarily as a financing mechanism.

How is the adoption of Electric Vehicles (EVs) affecting the overall Automotive Leasing Market?

EVs are significantly boosting the leasing market. Due to the high upfront cost and uncertainty regarding long-term battery degradation and technological obsolescence, consumers and corporations prefer leasing EVs to mitigate residual risk. Lessors also efficiently leverage government incentives and tax credits for EVs, offering attractive monthly rates compared to outright purchase financing.

Which geographical region holds the largest market share for Automotive Leasing?

Europe historically maintains the largest market share in terms of structured leasing volume, primarily driven by a highly mature corporate fleet sector and favorable tax legislation supporting operational leasing. North America is also a dominant market, especially in retail leasing, while the Asia Pacific region is projected for the fastest growth.

How do technological advancements like AI and Telematics impact the profitability of leasing companies?

AI and Telematics significantly enhance profitability by enabling highly accurate residual value forecasting, minimizing financial risk associated with vehicle depreciation. They also optimize operational costs through predictive maintenance scheduling and streamline the customer experience via automated digital contract management, leading to improved operational leverage and higher customer retention rates.

What are the major restraints hindering the growth of the Automotive Leasing Market globally?

The major restraints include heightened financial risk due to fluctuating interest rates and macroeconomic instability, which increases the cost of capital for lessors. Additionally, regulatory complexity across diverse international markets and the ongoing challenge of accurately predicting residual values for rapidly evolving vehicle technologies, especially EVs, pose significant hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager