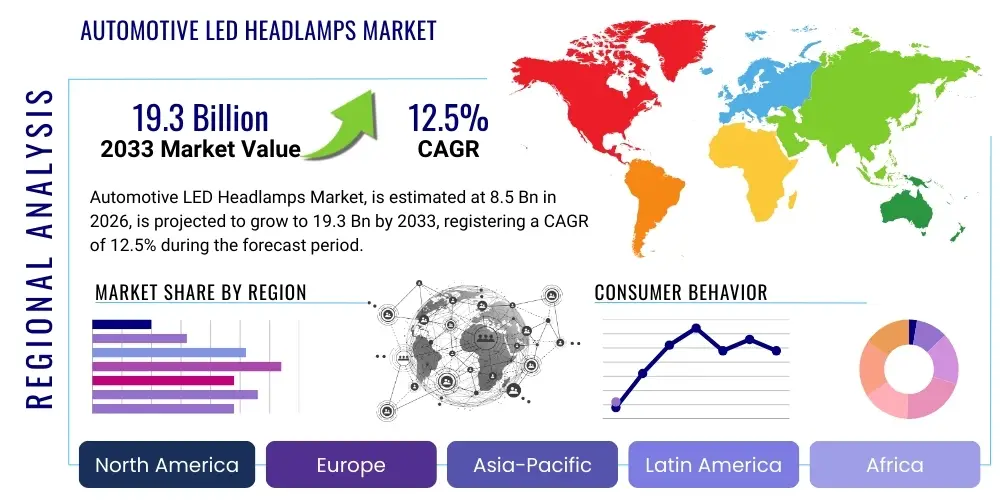

Automotive LED Headlamps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442013 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automotive LED Headlamps Market Size

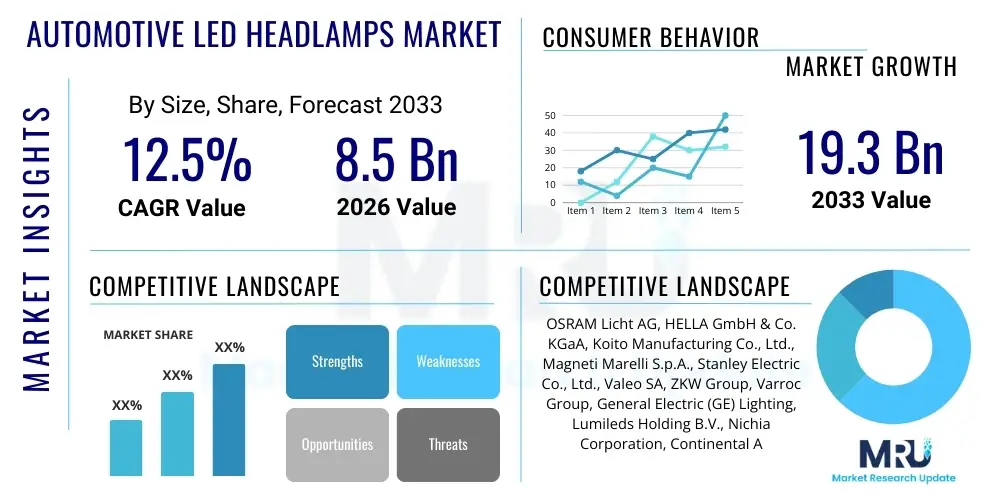

The Automotive LED Headlamps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 19.3 Billion by the end of the forecast period in 2033.

Automotive LED Headlamps Market introduction

The Automotive LED Headlamps Market encompasses the design, manufacture, and integration of Light Emitting Diode (LED) based lighting systems used for vehicle forward illumination. These systems represent a significant technological evolution from traditional halogen and even high-intensity discharge (HID) lamps, offering superior performance characterized by greater luminous efficiency, reduced power consumption, and extended lifespan. LED headlamps are increasingly becoming standard equipment across various vehicle segments, particularly due to their aesthetic appeal—allowing for highly stylized and unique vehicle front-end designs—and their operational benefits, which include instant illumination response critical for safety functions. The core product includes the LED light source, associated heat sinks, electronic drivers, and sophisticated optical systems necessary to shape the light beam according to regulatory standards and adaptive functionality requirements.

Major applications of LED headlamp technology span across Passenger Vehicles (PVs)—including sedans, SUVs, and luxury cars—and Commercial Vehicles (CVs), though PVs remain the dominant application segment due to higher consumer demand for advanced features and design. The fundamental benefits driving this market transition include improved nighttime visibility, which directly enhances driver safety by reducing eye strain and increasing reaction time; energy efficiency, which is particularly vital for Electric Vehicles (EVs) where every watt saved contributes to extended battery range; and durability, as LED units typically last the lifetime of the vehicle, reducing maintenance costs. Furthermore, the compact nature of LED technology facilitates the integration of advanced features such as adaptive driving beam (ADB) and matrix lighting, which dynamically adjust the light pattern based on driving conditions and surrounding traffic, maximizing illumination without causing glare to oncoming drivers.

Driving factors fueling the rapid adoption of LED headlamps are multifaceted, rooted primarily in stringent global vehicle safety regulations necessitating improved lighting performance and the accelerating electrification trend within the automotive sector. Regulatory bodies in key markets, such as the European Union and North America, are increasingly permitting and promoting adaptive lighting solutions, which are predominantly based on LED or advanced laser technology. Simultaneously, the growing consumer preference for premium, high-tech vehicle features, coupled with the decreasing manufacturing costs of high-performance LED components due to mass production scale, solidify the market's upward trajectory. OEM strategies prioritizing vehicle differentiation through innovative lighting designs also play a crucial role, positioning LED technology as an essential element of modern automotive identity and competitive advantage.

Automotive LED Headlamps Market Executive Summary

The Automotive LED Headlamps Market is poised for robust expansion, driven primarily by favorable business trends centered around sustainability and premiumization. Manufacturers are observing a significant shift in the supply chain towards integrating advanced semiconductor technologies necessary for sophisticated control electronics, indicating a maturation of the LED ecosystem beyond simple illumination components. Key business strategies involve vertical integration by major Tier 1 suppliers to secure high-quality LED chips and driver electronics, ensuring reliable supply for high-volume automotive production lines. Furthermore, the increasing collaboration between automotive lighting specialists and software providers is a major trend, aiming to unlock the full potential of adaptive and smart lighting systems, aligning the market growth with the overarching trend of connected and autonomous vehicles.

Regionally, the market dynamics show distinct patterns. Asia Pacific (APAC) currently dominates the market in terms of volume, largely propelled by high vehicle production rates in China, India, and Japan, alongside rapidly increasing consumer demand for premium features in emerging middle-class demographics. Europe maintains its leadership in technology adoption, particularly due to stringent safety regulations and early implementation of advanced technologies like Matrix LED systems. North America is experiencing steady growth, supported by regulatory harmonization efforts—specifically concerning adaptive driving beam standards—which are expected to open up new revenue streams for sophisticated LED lighting systems in the US market. The Middle East and Africa (MEA) and Latin America segments are anticipated to demonstrate high CAGRs, primarily driven by growing vehicle fleet sizes and increasing foreign investment in automotive assembly operations.

Segment trends highlight the critical importance of the OEM segment over the aftermarket, as LED technology is complex and highly integrated into vehicle electrical architectures from the factory. Within product segmentation, Adaptive LED Headlamps are experiencing the fastest growth, moving beyond niche applications into mid-range vehicles as costs decline. The vehicle type segment confirms the dominance of Passenger Vehicles, though the Commercial Vehicle segment is gradually integrating LED technology, particularly in heavy-duty trucks and buses, where the benefits of durability and reduced maintenance cycles provide substantial operational savings. The market is consolidating around a few major Tier 1 suppliers who possess the necessary intellectual property for complex optical and electronic designs, creating a high barrier to entry for smaller competitors.

AI Impact Analysis on Automotive LED Headlamps Market

Analysis of common user questions reveals significant interest concerning how Artificial Intelligence (AI) will transform vehicle lighting from a reactive safety component into a proactive, intelligent system. Users frequently inquire about the feasibility of AI-driven adaptive headlights, asking if systems can truly predict hazards, optimize energy usage in real-time, and personalize light distribution based on driver behavior and external factors like micro-weather conditions. Concerns often revolve around the reliability of complex sensor fusion involving cameras and LiDAR integrated with AI algorithms, and the regulatory challenges associated with deploying highly dynamic, AI-controlled lighting patterns in diverse road environments. The key expectation is that AI will move lighting beyond simple dimming and brightening to a state of predictive optimization, enhancing safety and overall vehicle intelligence.

AI's primary influence centers on enabling highly sophisticated Adaptive Driving Beam (ADB) functionality, transforming current matrix LED systems. AI algorithms process real-time input from multiple vehicle sensors—including forward-facing cameras, GPS data, and even V2X (Vehicle-to-Everything) communication signals—to create an instantaneous digital model of the road environment. This enables the headlamps to project light beams with pinpoint accuracy, selectively illuminating critical areas, such as pedestrians or road signs, while simultaneously generating precise blackout zones to prevent glaring other drivers. This level of algorithmic control far exceeds the capabilities of rule-based logic systems, optimizing light output dynamically based on predicted trajectories of other vehicles and vulnerable road users, thereby maximizing the safety envelope of the vehicle.

Beyond adaptive lighting control, AI is significantly impacting the manufacturing and maintenance of LED headlamp modules. In production, AI is utilized for automated quality control inspections, analyzing complex light patterns and color consistency far faster and more accurately than human operators, ensuring high quality and consistency across high-volume production lines. Operationally, AI contributes to predictive maintenance by monitoring the health and thermal performance of individual LED clusters and driver electronics. By analyzing subtle variations in power draw or heat dissipation, AI systems can forecast potential component failures, alerting maintenance systems before a total headlamp failure occurs, thus enhancing reliability and reducing warranty costs for OEMs. This application of AI optimizes the lifespan and operational effectiveness of highly complex and expensive LED assemblies.

- Enables predictive, real-time optimization of light distribution using sensor fusion data.

- Drives sophisticated Adaptive Driving Beam (ADB) functionality by creating precise blackout zones.

- Improves manufacturing efficiency through AI-powered automated quality control and pattern verification.

- Facilitates predictive maintenance of LED modules by monitoring thermal and electrical anomalies.

- Integrates vehicle lighting systems with autonomous driving stacks for enhanced environmental awareness.

DRO & Impact Forces Of Automotive LED Headlamps Market

The dynamics of the Automotive LED Headlamps market are shaped by powerful Drivers (D) such as increasing global focus on vehicle safety regulations and the sustained growth of the Electric Vehicle (EV) sector, where energy efficiency is paramount. Restraints (R) primarily revolve around the high initial capital investment required for high-definition (HD) LED modules and the thermal management challenges inherent in packing high-power LEDs into compact headlamp units. Opportunities (O) are concentrated in the rapid development of Digital Light Processing (DLP) technology and the expansion into the commercial vehicle and heavy-duty aftermarket sectors. These forces create significant impact vectors (Impact Forces) across the entire value chain, influencing OEM adoption timelines, supplier R&D expenditure, and consumer willingness to pay a premium for advanced lighting features, collectively pushing the industry towards increasingly intelligent and energy-efficient lighting solutions.

A primary driver is the accelerating trend of vehicle premiumization and consumer demand for superior visibility. Consumers now perceive advanced lighting features not just as safety enhancements but as integral components of vehicle aesthetics and technology status. Regulatory shifts, particularly the move towards legalizing and encouraging dynamic lighting systems such as ADB, remove technical hurdles that previously restrained market growth in key regions like North America. However, the market faces notable restraints, most significantly the relatively high unit cost of advanced LED assemblies compared to traditional lighting solutions. This cost factor impacts the penetration rate in cost-sensitive, entry-level vehicle segments, despite the long-term total cost of ownership benefits offered by LEDs. Furthermore, the technical complexity of thermal management—dissipating the significant heat generated by powerful LEDs without compromising their performance or lifespan—remains a persistent engineering challenge for lighting manufacturers.

The most compelling opportunities for market growth lie in continuous technological innovation, especially the commercialization of Micro-LED and DLP projection systems. These technologies allow for unprecedented levels of light control and the projection of safety information directly onto the road, suchating a pathway toward sophisticated augmented reality integration within headlamps. Impact forces, therefore, include the intense competitive pressure among Tier 1 suppliers to reduce the manufacturing cost of advanced components while simultaneously investing heavily in software development to manage complex lighting algorithms. The adoption curve is also impacted by external factors, such as volatile raw material costs (e.g., rare earth elements used in phosphors and aluminum for heat sinks) and the overall health of the global automotive manufacturing sector. The market's future growth hinges on the industry's ability to lower the cost barrier and standardize the regulatory framework for these intelligent lighting solutions.

Segmentation Analysis

The Automotive LED Headlamps Market is segmented across several critical dimensions, primarily defined by product type, vehicle type, and distribution channel. Product segmentation distinguishes between basic Low-Beam/High-Beam LED solutions and highly complex Adaptive LED systems, which incorporate matrix or pixelated technology for dynamic light shaping. Vehicle type segmentation clearly highlights the dominance of Passenger Vehicles, though the rise of electric buses and heavy-duty commercial vehicles is creating specialized demand for durable, energy-efficient lighting optimized for extended operational hours. Analyzing the distribution channel is vital, showing a clear distinction between the high-volume, original equipment manufacturer (OEM) channel—which dictates initial installation—and the smaller, but growing, aftermarket segment focused on replacements, upgrades, and customization.

Deep analysis of segmentation reveals that the Adaptive LED segment is the primary growth engine, shifting the market focus from static illumination to smart interaction with the driving environment. These systems require complex integration of electronics, optics, and software, leading to higher average selling prices (ASPs) and greater revenue generation for specialized component manufacturers. Geographically, segmentation aligns strongly with regulatory maturity, where regions with progressive laws regarding dynamic lighting (like Europe) see rapid uptake of advanced Matrix LED solutions, while high-volume production centers (like APAC) drive growth in standardized, cost-optimized LED units for entry-level vehicles. Understanding these segments is crucial for manufacturers to tailor their R&D and manufacturing strategies, determining whether to focus on high-margin, technically demanding premium products or volume-driven, standardized solutions.

- By Product Type:

- Low Beam/High Beam LED Headlamps

- Adaptive LED Headlamps (Matrix/Pixel LED)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Automotive LED Headlamps Market

The value chain for automotive LED headlamps is intricate, starting with the upstream supply of fundamental components, progressing through complex manufacturing and integration, and concluding with downstream distribution to OEMs and the aftermarket. Upstream analysis focuses on the sourcing of semiconductor materials (Gallium Nitride for LEDs), phosphors, and specialized thermal management materials (high-grade aluminum and copper alloys). Key upstream players include LED chip manufacturers and specialized electronic component suppliers that provide driver ICs and microcontrollers necessary for controlling complex adaptive light patterns. The high cost and specialized nature of these raw materials and components necessitate strong, long-term relationships between Tier 2 suppliers and the major automotive lighting companies to ensure supply stability and component quality.

The midstream stage involves the highly specialized manufacturing and assembly of the entire headlamp module, dominated by Tier 1 automotive suppliers. This stage requires significant investment in precision optics, thermal modeling, and electronics integration capabilities. These Tier 1 suppliers consolidate components, design proprietary light guides and reflectors, and integrate the complex control software required for adaptive functions, effectively transforming raw components into integrated, safety-critical vehicle parts. The downstream segment involves direct distribution to Original Equipment Manufacturers (OEMs), which represents the vast majority of sales. Distribution to OEMs is typically managed through long-term contracts and highly synchronized logistics networks (Just-In-Time delivery), driven by vehicle assembly schedules.

The distribution channels highlight a strong dichotomy: Direct sales to OEMs form the core business, characterized by high volume, low margin sensitivity per unit (relative to complexity), and rigorous quality control standards dictated by vehicle manufacturers. The indirect channel, serving the aftermarket, includes independent distributors, authorized service centers, and specialized repair shops. While the aftermarket is smaller, it offers higher potential margins for replacement units and performance upgrades, though sales volumes are significantly lower than the OEM channel. The shift towards complex, integrated LED systems makes aftermarket replacement increasingly difficult, often requiring dealer programming, reinforcing the critical role of OEM partnerships across the entire product lifecycle.

Automotive LED Headlamps Market Potential Customers

The primary customers for automotive LED headlamps are Original Equipment Manufacturers (OEMs) across the global automotive industry, serving both the passenger and commercial vehicle segments. Within the PV segment, luxury and premium vehicle manufacturers were the early adopters, driving innovation in technologies like Matrix LED and personalization features, as these systems align with their high-performance and technological differentiation strategies. However, market expansion now targets mid-range vehicle manufacturers, particularly those focusing on new safety ratings and fuel efficiency, viewing LED adoption as a standard competitive necessity rather than a premium optional extra. The integration of LED technology is now a critical design consideration for nearly all new vehicle platforms, defining the visual signature and technological profile of modern automobiles.

A rapidly expanding customer base is found within the Electric Vehicle (EV) manufacturing segment, encompassing both established automotive giants transitioning to electric platforms and emerging pure-play EV startups. For EVs, the inherent low power consumption of LED headlamps is a crucial selling point, directly impacting vehicle range and reducing strain on the battery pack. Consequently, EV manufacturers prioritize the most energy-efficient and lightweight LED solutions available. Beyond initial vehicle production, the aftermarket sector represents the second-largest customer segment, comprising vehicle owners seeking high-performance replacement units, customization solutions, or upgrades from older halogen/HID systems, primarily driven by safety concerns and aesthetic enhancements, though the technical complexity of modern LED systems limits the scope of DIY or independent upgrades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 19.3 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OSRAM Licht AG, HELLA GmbH & Co. KGaA, Koito Manufacturing Co., Ltd., Magneti Marelli S.p.A., Stanley Electric Co., Ltd., Valeo SA, ZKW Group, Varroc Group, General Electric (GE) Lighting, Lumileds Holding B.V., Nichia Corporation, Continental AG, Denso Corporation, Continental Automotive GmbH, Delphi Technologies, Robert Bosch GmbH, Aptiv PLC, NXP Semiconductors, Texas Instruments, Infineon Technologies AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive LED Headlamps Market Key Technology Landscape

The current technology landscape in the Automotive LED Headlamps market is characterized by a rapid transition from basic full-LED systems to sophisticated digital and adaptive lighting solutions, demanding high precision and integration of microelectronics. The cornerstone of this innovation is the Matrix LED technology, which uses an array of individually controllable LEDs (or pixels) coupled with intelligent software algorithms. This allows the headlamp beam pattern to be dynamically adjusted in real-time, switching off or dimming specific pixels that would otherwise cause glare to oncoming vehicles or vehicles ahead, while maintaining high beam illumination in all other areas. Further advancement includes high-definition (HD) matrix systems that utilize hundreds or even thousands of micromirrors or tiny LEDs to achieve ultra-fine light shaping, dramatically improving nighttime visibility and safety.

The next frontier is the deployment of Digital Light Processing (DLP) technology, originally developed for projectors, which is now being adapted for automotive use. DLP headlamps use a chip containing millions of microscopic mirrors, enabling light patterns to be projected with unprecedented resolution and complexity. This technology goes beyond simply preventing glare; it allows for the projection of symbols, warnings, or guidance lines directly onto the road surface, essentially creating augmented reality indicators for the driver. For instance, the system can project the actual width of the vehicle in narrow construction zones or highlight icy patches on the road, significantly enhancing driver assistance capabilities. The implementation of DLP requires robust processing power and thermal management systems to handle the heat generated by the high-power LED light sources necessary for projection.

Further integral technologies include advanced sensor integration and sophisticated electronic control units (ECUs). Modern LED headlamp systems are heavily reliant on data collected from external sensors (cameras, LiDAR, radar) already present in the vehicle’s Advanced Driver-Assistance Systems (ADAS) suite. This sensor fusion is managed by dedicated ECUs running complex algorithms that dictate the adaptive beam patterns based on speed, steering angle, weather conditions, and surrounding traffic. The ongoing development of Micro-LED technology promises even greater energy efficiency and miniaturization, potentially leading to thinner, more aesthetically flexible headlamp designs, which is crucial for maximizing vehicle aerodynamic efficiency and meeting the stringent design demands of the electric vehicle segment.

Regional Highlights

- Europe: Europe stands as the global technology leader in the Automotive LED Headlamps Market, driven by pioneering regulatory standards and high consumer uptake of premium vehicles. Countries like Germany, France, and the UK were early adopters of adaptive and Matrix LED technology due to progressive road safety mandates and high market penetration of luxury brands. The regional emphasis is strongly placed on energy efficiency, aligning with the EU's strict emissions targets and the widespread adoption of EVs. The presence of major Tier 1 suppliers and significant R&D centers ensures continuous innovation, maintaining the region's position at the forefront of digital lighting solutions and their integration into sophisticated ADAS architecture.

- Asia Pacific (APAC): APAC represents the largest market in terms of volume and is the fastest-growing region, fueled by massive vehicle production capacity, particularly in China and India. The market growth is two-pronged: volume adoption of basic full-LED systems in entry-level and mid-range vehicles, driven by cost reduction and aesthetic appeal; and high-end technological adoption in countries like Japan and South Korea, mirroring European trends. Government initiatives supporting new energy vehicles (NEVs) in China further accelerate the adoption of energy-efficient LED technology, making it a critical hub for both manufacturing and consumption.

- North America (NA): Historically constrained by slower regulatory approval for advanced adaptive lighting technologies, North America is experiencing a rapid transformation following the legalization of Adaptive Driving Beam (ADB) systems. This regulatory shift is expected to unlock significant market potential, leading to high-value upgrades across new model lineups in the US and Canada. The region is characterized by a strong consumer preference for large SUVs and trucks, necessitating robust, powerful LED headlamp units. Furthermore, the high concentration of technology-focused EV manufacturers is driving demand for advanced, integrated lighting systems that optimize energy use.

- Latin America (LATAM): The LATAM market is currently characterized by slower, but steady, growth, focused predominantly on the OEM installation of standardized LED headlamps in mid-segment vehicles. Brazil and Mexico, as key manufacturing hubs, are driving regional demand. Market adoption is primarily influenced by global platform standardization efforts by multinational OEMs rather than specific localized regulatory pressures. The focus remains on cost-effective, durable LED solutions suitable for varying infrastructure and road conditions.

- Middle East and Africa (MEA): The MEA region is a smaller but emerging market, heavily reliant on vehicle imports. Growth is anticipated due to increasing per capita income and infrastructural development in key GCC countries. The extreme temperature variations in this region place a premium on robust thermal management systems within LED assemblies. Market penetration of LED headlamps is primarily confined to premium imported vehicles, though local assembly efforts and governmental focus on road safety are expected to gradually widen adoption rates across all vehicle segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive LED Headlamps Market.- OSRAM Licht AG

- HELLA GmbH & Co. KGaA

- Koito Manufacturing Co., Ltd.

- Magneti Marelli S.p.A.

- Stanley Electric Co., Ltd.

- Valeo SA

- ZKW Group

- Varroc Group

- Lumileds Holding B.V.

- Nichia Corporation

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- Aptiv PLC

- NXP Semiconductors

- Texas Instruments

- Infineon Technologies AG

- LG Innotek

- 3M Company

- Everlight Electronics Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive LED Headlamps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption rate of Automotive LED Headlamps?

The primary driver is the mandated push for enhanced vehicle safety features globally, coupled with the rising consumer demand for energy-efficient, long-lasting, and aesthetically superior lighting solutions, particularly within the rapidly expanding Electric Vehicle (EV) segment.

How do Adaptive Driving Beam (ADB) systems enhance vehicle safety?

ADB systems utilize matrix LED technology and advanced sensors to dynamically adjust the light pattern in real-time, maximizing illumination of the road ahead while simultaneously creating precise dark zones around other vehicles, effectively providing constant high-beam visibility without causing glare to other drivers.

What challenges does the Automotive LED Headlamps market currently face?

Major challenges include the high upfront cost of advanced LED and digital projection headlamp modules, complex thermal management requirements due to high power density, and fragmentation in global regulatory standards concerning the use and deployment of fully adaptive lighting technologies.

What is the significance of Digital Light Processing (DLP) technology in headlamps?

DLP technology enables high-definition, pixel-level control of the light beam, allowing for advanced features such as projecting guidance symbols, warning indicators, and complex graphical messages onto the road surface, thus integrating the headlamp into the vehicle's augmented reality and ADAS suite.

Which geographical region dominates the Automotive LED Headlamps Market?

Asia Pacific (APAC) currently dominates the market in terms of manufacturing volume and consumption due to high vehicle production rates in China and India, while Europe leads in the adoption and implementation of cutting-edge adaptive and digital lighting technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager