Automotive Level Sensor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442850 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Level Sensor Market Size

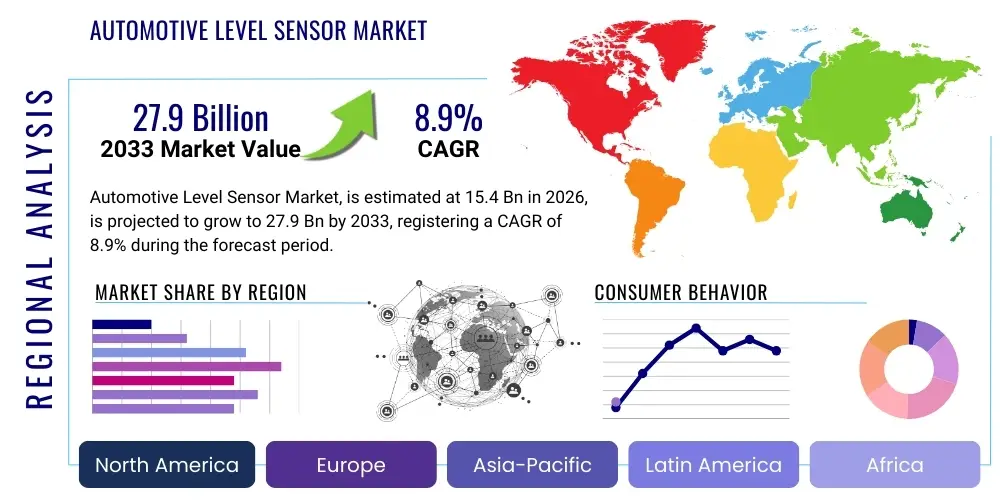

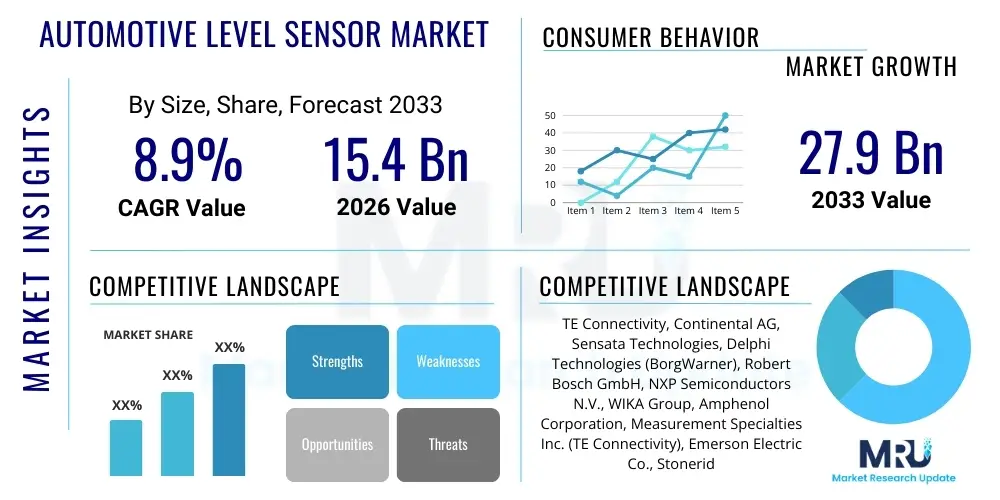

The Automotive Level Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 15.4 Billion in 2026 and is projected to reach USD 27.9 Billion by the end of the forecast period in 2033.

Automotive Level Sensor Market introduction

The Automotive Level Sensor Market encompasses sophisticated devices crucial for monitoring and measuring the levels of various fluids and materials within a vehicle, ensuring optimal performance, safety, and longevity. These sensors are integral components in modern vehicle architectures, responsible for tracking fuel levels, engine oil, brake fluid, coolant, AdBlue (Diesel Exhaust Fluid), and windshield washer fluid. The core function of these sensors is to provide accurate, real-time data to the Engine Control Unit (ECU) and the driver interface, enabling timely maintenance alerts and preventing critical system failures such as engine overheating or brake system malfunction. The increasing complexity of vehicle systems, coupled with stringent emission regulations, particularly those concerning NOx reduction which necessitate reliable AdBlue monitoring, and the rapid adoption of advanced driver-assistance systems (ADAS) requiring perfectly functioning brake systems, has amplified the demand for highly reliable and precise level sensing technologies across all vehicle classes. Furthermore, the push towards electrification necessitates specialized level sensing for complex battery thermal management systems and sophisticated coolant reservoirs, driving substantial technological evolution in this crucial sector. The shift from basic mechanical monitoring towards digital, high-resolution sensing is a defining characteristic of the current market evolution.

Automotive level sensors utilize diverse technological principles, including ultrasonic, capacitive, resistive, magnetic float, and pressure-based methods, each rigorously selected based on the specific fluid properties, operating temperature, viscosity, and required measurement accuracy. For instance, magnetic float sensors are conventionally used for standard fuel level measurement due to their cost-effectiveness and proven robustness in large reservoirs, while capacitive sensors are increasingly favored in high-accuracy and chemically aggressive applications, such as oil quality monitoring or highly reactive fluids like DEF, due to their non-contact nature and ability to withstand harsh chemical environments without degradation. Major applications extend beyond standard passenger vehicles to encompass heavy commercial vehicles, off-highway machinery, agricultural equipment, and specialty vehicles, where large fluid volumes, critical operational dependency, and severe operating conditions demand highly resilient and often redundant sensor solutions. The continuous pursuit of miniaturization of these sensors and their deep integration into complex fluid handling modules are significant ongoing trends, contributing not only to reduced component weight but also to simplified assembly processes and reduced opportunities for leakage or failure for Original Equipment Manufacturers (OEMs).

The primary benefits derived from the deployment of these advanced sensors include enhanced operational safety by ensuring adequate levels of critical fluids like brake fluid and coolant, improved fuel efficiency through granular, accurate consumption monitoring, and optimized maintenance schedules based on real-time fluid status and quality indicators. Key driving factors propelling market growth include the global mandate for vehicle safety standards, such as those governing braking systems and thermal stability, the robust expansion of the automotive sector in emerging economies characterized by rising motorization rates, and the escalating incorporation of sophisticated sensor technology into electric vehicles (EVs) specifically for battery coolant monitoring and leak detection. The intense development of intelligent sensors capable of performing predictive failure analysis, integrating seamlessly into vehicular diagnostic networks, and offering redundancy is expected to dominate the future trajectory of this critical component market, solidifying its essential and expanding role in the evolving, connected automotive landscape.

Automotive Level Sensor Market Executive Summary

The Automotive Level Sensor Market is experiencing robust and systemic growth fueled by non-discretionary regulatory adherence concerning global vehicle emissions and functional safety standards, particularly the requirements for accurate and continuous monitoring of critical operational fluids such as AdBlue and hydraulic brake fluid. Business trends clearly indicate a strong, accelerated shift toward digitalization and the deployment of smart sensing solutions, where established, traditional mechanical sensors are systematically being replaced by highly accurate, solid-state, and non-contact technologies, including advanced capacitive and ultrasonic sensors. This technological transition is principally driven by Original Equipment Manufacturer (OEM) requirements for significantly enhanced reliability, reduced component size and weight, minimized maintenance complexity over the vehicle lifecycle, and seamless digital integration with high-speed vehicle communication protocols, such as CAN bus and Ethernet networks. Furthermore, observable market consolidation activities, including strategic joint ventures, niche technology acquisitions, and formal partnerships between established sensor manufacturing giants and specialized software developers, are actively reshaping the competitive landscape, shifting the focus towards offering holistic, integrated fluid management systems rather than merely supplying standalone measurement components. This integrated approach is crucial for achieving stringent global environmental compliance and improving overall vehicle diagnostic capabilities.

From a regional perspective, the Asia Pacific (APAC) region fundamentally dominates the global consumption landscape, a consequence of the immense scale of vehicle production and subsequent sales volumes originating from key nations like China, India, and South Korea, which are simultaneously witnessing rapid, government-supported adoption of hybrid and pure electric vehicles. Conversely, North America and Europe maintain their global leadership in the realm of technological innovation and high-value deployment, characterized by the early and widespread adoption of the most advanced sensor types, particularly within premium vehicle segments, luxury platforms, and specialized heavy-duty transport. Proposed and pending European regulations, such as the next generation of Euro standards, are expected to necessitate even greater precision, redundancy, and diagnostic capability in sensing systems, thereby compelling significant and continuous investment in advanced sensor research and development activities within the European manufacturing and R&D footprint. Emerging markets across Latin America, the Middle East, and Africa are concurrently demonstrating accelerated growth potential, primarily driven by increasing urbanization rates, rising household incomes enabling higher motorization rates, and the gradual, inevitable introduction of modern vehicle platforms that incorporate sophisticated digital fluid monitoring systems.

Analysis of segment trends highlights the critical and exponential growth observed within the coolant level sensor segment, which is directly and proportionally correlated with the ongoing global proliferation of electric and hybrid vehicles. In these electrified platforms, the efficient and highly precise thermal management of high-voltage battery packs is non-negotiably paramount for ensuring performance, safety, and longevity, making the coolant sensor an essential safety component. By analyzing product technology adoption, non-contact sensors are demonstrably gaining substantial market traction and market share over conventional float sensors, principally due to their inherent enhanced durability, superior measurement accuracy, ability to withstand highly chemical environments, and the complete elimination of mechanical wear points. The application landscape confirms that fuel level sensors, due to the ubiquity of ICE vehicles, still constitute the largest volume segment; however, the fastest growing and highest-value segments pertain to the monitoring of non-conventional and system-critical fluids, such as Diesel Exhaust Fluid (DEF/AdBlue), specialized transmission oil, and dedicated battery cooling fluids. Leading manufacturers are now intensely focused on developing sophisticated multi-functional sensors capable of monitoring both fluid level and complex quality parameters (e.g., contamination, dielectric constant) simultaneously, adding significant complexity, diagnostic capability, and resultant value to the basic sensing unit and the overall vehicle platform.

AI Impact Analysis on Automotive Level Sensor Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Automotive Level Sensor Market revolve primarily around enhancing data interpretation fidelity, enabling sophisticated predictive maintenance protocols, and optimizing sensor calibration in highly dynamic and challenging operational environments. Users are keen to understand precisely how AI algorithms can process vast streams of continuous level and quality data, often combined and correlated with exogenous operational parameters like ambient temperature, engine load, and driving cycle patterns, to predict fluid depletion rates or identify subtle, early signs of contamination or leakage far in advance of standard thresholds being crossed. This shift represents a move far beyond simple low-level alerts, positioning the vehicle for proactive servicing. Concerns frequently focus on the integration complexity—specifically, ensuring that AI-driven diagnostics derived from sensor data are secure, reliable, fully compliant with data privacy regulations, and easily integrated into existing vehicle communication architectures and cloud-based fleet management and diagnostic systems. Expectations center on AI facilitating the immediate transition from reactive, schedule-based maintenance to true predictive fluid management, which promises to significantly improve vehicle uptime, reduce operational costs for large fleet operators, and enhance safety for all road users. This deep integration of AI elevates the level sensor from a basic measuring component to a crucial, intelligent data node within the vehicle's comprehensive diagnostic and telematics ecosystem, unlocking entirely new business models focused on sensor data monetization and advanced digital services.

- AI-Enhanced Predictive Maintenance: Algorithms analyze long-term fluid level trends and correlation with operational data (e.g., temperature, speed, engine load) to forecast component degradation and maintenance requirements before critical system failures occur.

- Optimized Calibration and Accuracy: AI models dynamically adjust and compensate sensor readings in real-time to counteract environmental variables, severe temperature fluctuations, intense vibration, and disruptive vehicle movement effects (fluid sloshing), ensuring substantially higher measurement accuracy.

- Sensor Data Fusion and Diagnostics: AI facilitates the seamless integration and fusion of level sensor data with input from other vehicle sensors (pressure, temperature, flow rate, quality sensors) to provide a comprehensive, holistic assessment of the fluid’s operational condition and structural integrity of the reservoir.

- Automated Fault Detection: Machine learning identifies and flags subtle anomalies, deviations, or erratic behavior in sensor output patterns that are indicative of impending physical sensor failure, system leakage, or contamination, thereby significantly improving system robustness and overall reliability.

- Supply Chain Optimization: AI analyzes global production data, OEM demand forecasts, and geographic adoption rates for various types of level sensors, enabling manufacturers to optimize inventory levels, production scheduling, and overall manufacturing efficiency across the entire supply chain footprint.

DRO & Impact Forces Of Automotive Level Sensor Market

The market is predominantly driven by increasing vehicle production globally, particularly noticeable in rapidly developing economies in Asia and Latin America, combined with the non-negotiable implementation of stringent vehicle safety and emission regulations across all mature markets. Regulators worldwide are consistently raising the bar, mandating sophisticated monitoring systems for fluids critical to operational safety (e.g., ensuring adequate brake fluid volume and monitoring pressure integrity) and environmental compliance (e.g., the accurate metering and monitoring of Diesel Exhaust Fluid (DEF)/AdBlue systems essential for meeting modern NOx reduction targets). The concurrent and rapid expansion of the Electric Vehicle (EV) segment acts as a powerful, distinct catalyst, demanding specialized and highly resilient level sensors for complex battery coolant management systems, which are absolutely vital for maintaining battery longevity, ensuring thermal stability, and guaranteeing vehicle safety during high-load operation. Furthermore, continuous technological advancements leading to the development of highly integrated, miniaturized, and exceptionally accurate sensor solutions, offering ancillary benefits in terms of vehicle weight reduction and improved operational performance metrics, significantly propel market adoption rates among global Original Equipment Manufacturers (OEMs) looking to enhance product quality, comply with evolving standards, and differentiate their vehicle platforms in increasingly competitive global markets.

However, the Automotive Level Sensor Market faces several notable and persistent restraints that challenge sustained profitability and technological migration. A primary and pervasive impediment is the intense price sensitivity endemic within the automotive supply chain; OEMs frequently exert significant pressure on Tier 1 and Tier 2 component suppliers to aggressively reduce unit costs, often leading to severe margin compression for sensor manufacturers, particularly in high-volume, standard applications. The inherent technological complexity associated with successfully integrating new generations of sophisticated non-contact sensor technologies (such as high-frequency radar or advanced capacitive systems) into legacy vehicle platforms or older assembly lines presents a substantial technological and financial hurdle, demanding massive investment in R&D, specialized manufacturing tooling, and rigorous platform standardization efforts. Moreover, the inherent long lifecycle and established reliability of certain traditional mechanical sensors, coupled with the resultant slow transition period required for replacing conventional magnetic float sensors with advanced alternatives in specific high-volume, cost-sensitive vehicle segments (like standard fuel tanks), slows the overall rate of penetration for the most advanced technologies across the broad market spectrum. Furthermore, unresolved concerns regarding ultimate sensor reliability and long-term accuracy when subjected to extreme operating conditions, such as severe vibration, continuous exposure to aggressive chemical contamination, or extreme thermal cycling, necessitate continuous, costly investment in specialized material science and exhaustive durability testing protocols.

Opportunities for exponential growth are vast and strategically centered on the largely untapped potential within specialized vehicle segments, most notably autonomous vehicles, large-scale industrial machinery, and highly customized heavy-duty transport fleets, all of which require exceptional redundancy and ultra-high-precision fluid monitoring systems for safe, fully automated operation. The ongoing and rapid development of multi-functional sensors capable of measuring both fluid level and quality parameters simultaneously represents a significant value addition and opens up substantial new market opportunities, allowing suppliers to capture a higher value share per vehicle. Furthermore, the burgeoning global aftermarket for replacement sensors, consistently driven by the natural aging process of the global vehicle parc and the recurring requirement for post-warranty maintenance and repairs, provides a highly consistent, necessary, and robust revenue stream that is less susceptible to initial OEM volume fluctuations. Strategic geographical expansion, especially targeting rapidly industrializing regions where domestic vehicle production is accelerating and quality standards are simultaneously increasing, offers another lucrative pathway for market participants seeking substantial long-term growth and necessary market share diversification. Finally, the deep convergence of IoT technology and vehicular diagnostics presents a profound opportunity for sensor manufacturers to monetize granular, aggregated sensor data through subscription-based services, offering predictive fleet maintenance and optimizing operational logistics.

Segmentation Analysis

The Automotive Level Sensor Market is comprehensively segmented based on technology, product type, application focus, and the underlying vehicle type to provide an acutely granular understanding of complex market dynamics, current adoption patterns, and future growth trajectories. Segmentation by utilized technology clearly delineates the market into conventional, legacy methods like resistive and magnetic float sensors, and the advanced, high-growth, non-contact methodologies such as capacitive, ultrasonic, and specialized radar-based solutions, directly reflecting the industry-wide, non-reversible shift towards superior measurement accuracy, exceptional reliability, and enhanced durability. Product type segmentation precisely identifies the key component categories, including liquid level sensors dedicated to fluid measurement and bulk level sensors, which often form part of sophisticated module assemblies. Application analysis focuses rigorously on the specific critical fluids being monitored, such as vehicle fuel, engine oil, hydraulic brake fluid, coolant (including specific thermal management fluids for batteries), and Diesel Exhaust Fluid (DEF/AdBlue), with fuel measurement remaining the largest segment by volume and coolant monitoring emerging as the fastest-growing segment driven by electrification. Vehicle type segmentation clearly separates the dynamics of passenger vehicles from commercial vehicles (Light, Medium, Heavy-Duty trucks, and buses) and specialty/off-highway vehicles, recognizing the vastly differing requirements for sensor robustness, chemical resilience, and integration complexity across these distinct categories.

- By Technology:

- Resistive (Traditional mechanical methods)

- Capacitive (High accuracy, non-contact)

- Ultrasonic (Large tank applications, non-contact)

- Magnetic Float (Conventional, cost-effective fuel sensing)

- Pressure (Indirect level measurement)

- Others (Radar, Optical/Infrared)

- By Product Type:

- Liquid Level Sensors (Focus on vehicle fluids)

- Bulk Level Sensors (Often integrated into modules for overall system monitoring)

- By Application:

- Fuel Level Sensing (Largest volume application)

- Engine Oil Level Sensing (High-accuracy requirement)

- Coolant Level Sensing (Critical for engine and battery thermal management systems)

- Brake Fluid Level Sensing (Safety-critical application)

- Diesel Exhaust Fluid (DEF) / AdBlue Sensing (Emission compliance mandated)

- Transmission Oil Level Sensing

- Windshield Washer Fluid Sensing

- By Vehicle Type:

- Passenger Vehicles (Hatchbacks, Sedans, SUVs, Minivans)

- Commercial Vehicles (Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Buses, Coaches)

- Electric and Hybrid Vehicles (Plug-in Hybrid Electric Vehicles (PHEV), Battery Electric Vehicles (BEV))

Value Chain Analysis For Automotive Level Sensor Market

The sophisticated value chain for the Automotive Level Sensor Market initiates with the Upstream Analysis, which meticulously covers the procurement and specialized processing of fundamental raw and intermediary materials. This critical initial stage heavily involves highly specialized suppliers providing essential input components such as sensing elements (e.g., specialized semiconductor wafers, precision piezoelectric crystals, and advanced ceramics for non-contact methods), high-strength magnetic materials utilized in traditional float sensors, and specific formulations of high-temperature, chemical-resistant polymers and metals used for robust sensor housing and encapsulation. Key manufacturing activities at this level include ultra-precision fabrication of sensor chips, stringent encapsulation processes to protect sensitive electronics, and exhaustive material testing protocols designed to ensure absolute compliance with harsh automotive operating specifications, including rigorous resistance to chemical degradation, extreme temperature cycling, and constant vibrational stress. The cost-efficiency and quality assurance of this upstream phase, particularly concerning the reliable supply and consistent quality of semiconductor and specialized magnetic materials, directly and proportionally impact the final product cost structure and the long-term reliability of the sensors, creating critical dependencies on global commodity pricing fluctuations and the operational stability of specialized component manufacturers.

The midstream segment of the value chain is focused intensely on the core activities of design innovation, complex component assembly, rigorous calibration, and thorough end-of-line testing performed by the primary Automotive Level Sensor manufacturers. This phase demands significant investment in intellectual property related to complex signal processing algorithms, advanced miniaturization techniques necessary for module integration, and proprietary communication integration software tailored for vehicle networks. Manufacturers strategically combine the highly specialized sourced raw materials and sophisticated electronic components to construct complete, tested sensor modules, which are often highly customized to interface perfectly with specific OEM fluid reservoir designs, requiring bespoke mounting mechanisms and geometric adherence. Crucial manufacturing processes at this stage include high-density advanced surface mount technology (SMT) for electronic circuits, innovative sealing techniques to ensure ingress protection (IP ratings) against fluid contamination, and extensive, automated quality assurance testing, including environmental simulation. All core manufacturers must rigorously operate under globally recognized automotive quality control frameworks, such as IATF 16949, to ensure component consistency and meet the demanding zero-defect tolerance thresholds set by global vehicle manufacturers. Finished products are subsequently routed through clearly defined direct and indirect distribution channels.

The Downstream Analysis concentrates strategically on the distribution architecture and the crucial end-user utilization of the final sensor products. Distribution is executed predominantly through two foundational major channels: Direct sales achieved through high-volume, long-term contracts with Original Equipment Manufacturers (OEMs) for integration into new vehicle assembly lines (the Tier 1 supply relationship) and highly efficient indirect distribution managed through the global Automotive Aftermarket. The highly demanding OEM channel necessitates exceptionally specialized logistics capabilities, including rigorous adherence to just-in-time (JIT) delivery schedules, and often requires component suppliers to maintain a localized manufacturing or assembly presence strategically positioned near major OEM vehicle assembly plants. The aftermarket channel involves an extensive network of large-scale distributors, specialized automotive wholesalers, and dedicated parts retailers who supply critical replacement sensors to independent repair shops, authorized service centers, and directly to individual consumers. Provision of comprehensive integration services, advanced technical support, and real-time data analytics services provided back to OEMs regarding long-term sensor field performance constitute high-value activities in the advanced stages of the value chain. As modern vehicles become increasingly connected and data-centric, the intrinsic value derived from meticulously analyzing aggregated, real-world sensor data for enabling predictive maintenance protocols (a key downstream service) dramatically increases, fundamentally influencing the profitability and service-oriented business models of leading sensor suppliers.

Automotive Level Sensor Market Potential Customers

The primary and largest volume segment of potential customers for automotive level sensors consists unequivocally of Original Equipment Manufacturers (OEMs) located across the global landscape, encompassing major, high-volume passenger vehicle manufacturers such as Volkswagen Group, Toyota Motor Corporation, Stellantis, General Motors, and Hyundai-Kia, alongside major global heavy-duty truck and commercial vehicle manufacturers like Daimler Truck AG, PACCAR Inc., and Volvo Group. These pivotal customers require massive and continuous volumes of sensors, typically procured through highly competitive, multi-year supply contracts and integrated directly onto complex assembly lines with minimal room for error. Their substantial purchasing decisions are intensely influenced by proven sensor accuracy under all operating conditions, demonstrated reliability over the guaranteed vehicle lifespan, certified compliance with all relevant international safety and quality standards (e.g., ISO certifications and specific regional requirements), and, most critically, the absolute lowest attainable unit cost. For these high-volume OEMs, the supplier's technical capacity for intricate customization—to perfectly fit complex, geometrically challenging fuel tank shapes or seamlessly integrate with proprietary battery thermal management units—is often a pivotal deciding factor in the tendering process. Crucially, the increasing global production and sales velocity of electric vehicles means that both traditional automotive OEMs and specialized EV manufacturers, along with dedicated battery system integrators, are rapidly emerging as the most significant high-growth potential customers, specifically demanding exceptionally robust, chemically inert, and highly accurate coolant and specialized fluid monitoring sensors.

A secondary, yet highly critical and technologically demanding, customer base includes the global ecosystem of Tier 1 automotive suppliers. These influential companies do not directly manufacture the final vehicle but often purchase highly specialized sensing elements, integrated circuit components, and raw sensor structures from level sensor manufacturers. They then rigorously integrate these components into much larger, complex subsystems, such as complete, pre-tested fuel delivery modules, advanced engine management packages, sophisticated transmission systems, or hydraulic brake system packages, before supplying the assembled, tested, and validated unit directly to the final OEM assembly plant. Highly recognized examples include global entities like Robert Bosch, Continental AG, ZF Friedrichshafen, and BorgWarner (Delphi Technologies), which function as essential technological intermediaries. These Tier 1 customers often place additional demands on sensor manufacturers, requiring rigorous performance guarantees, strict adherence to proprietary communication interfaces, and sophisticated compatibility interfaces for the sensors to function flawlessly within their complex, larger systems. These influential Tier 1 customers frequently serve as the primary drivers of innovation in sensor packaging, module integration complexity, and digital communication protocols, requiring suppliers to not only meet stringent OEM specifications but also adhere to their own internal, highly exacting quality control standards and system compatibility requirements before final product acceptance.

The third significant and geographically dispersed customer segment comprises the global Automotive Aftermarket. This market encompasses thousands of independent repair shops, authorized service centers affiliated with dealerships, large-scale parts distributors, specialized wholesalers, and, ultimately, individual vehicle owners requiring replacement components. While the total volume per individual transaction in this channel is substantially lower than OEM bulk orders, the aftermarket provides a continuous, highly predictable demand curve for replacement units necessary due to natural component wear and tear, fluid corrosion, or post-accident repair activities. This segment's purchasing behavior relies heavily on the trifecta of competitive unit pricing, immediate stock availability across diverse geographic locations, and guaranteed compatibility with an exceptionally wide range of older, aging vehicle models and platforms. Distributors catering effectively to the aftermarket prioritize suppliers who offer extensive and deep product catalogs covering virtually all required applications (fuel, oil, coolant, brake fluid) and all major vehicle ages and makes. As the installed vehicle base becomes increasingly digitized, the corresponding demand for replacement sensors that retain OEM-level diagnostic capabilities and standardized communication features is rapidly growing within the professional service and repair industry, creating a high-margin, consistent, and essential revenue stream for sensor manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.4 Billion |

| Market Forecast in 2033 | USD 27.9 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Continental AG, Sensata Technologies, Delphi Technologies (BorgWarner), Robert Bosch GmbH, NXP Semiconductors N.V., WIKA Group, Amphenol Corporation, Measurement Specialties Inc. (TE Connectivity), Emerson Electric Co., Stoneridge Inc., ZF Friedrichshafen AG, Denso Corporation, MTS Systems Corporation, Gill Sensors & Controls, Xylem Inc., First Sensor AG (TE Connectivity), Variohm EuroSensor Ltd., KUS Auto Co. Ltd., Ams-Osram AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Level Sensor Market Key Technology Landscape

The current technology landscape in the automotive level sensor market is characterized by a significant, industry-wide transition away from older mechanical-based sensing solutions, such as magnetic float sensors and simple resistive elements, towards highly advanced, non-contact, and predominantly solid-state methodologies. Capacitive sensing technology is rapidly gaining substantial prominence due to its inherent ability to measure fluid level with exceptional accuracy, often maintaining stability irrespective of variables such as fluid density, temperature variations, or minor pressure fluctuations, making it the preferred choice for critical applications like engine oil monitoring and complex, modern fuel mixtures. Furthermore, capacitive sensors are intrinsically robust, contain zero moving mechanical parts subject to wear, and offer outstanding operational longevity, directly addressing key OEM demands for zero-maintenance components over the vehicle's lifespan. Ultrasonic sensors represent another crucial non-contact technology, predominantly utilized for monitoring large fluid reservoirs such as main fuel tanks and voluminous Diesel Exhaust Fluid (DEF) tanks. These sensors rely on precisely timed sound waves to accurately determine fluid levels, providing consistently robust performance in applications where excessive fluid sloshing or the requirement for chemical inertness is critical, often integrating highly sophisticated signal processing capabilities to efficiently filter out acoustic noise and environmental disturbances for stable, reliable measurement.

The emerging technological focus is intensely centered on enhancing integration capabilities, achieving substantial miniaturization, and enabling pervasive multi-parameter sensing within a single module. High-frequency radar and microwave technology, while historically associated with higher unit costs, are increasingly being rigorously tested and adopted, particularly within high-end and specialized heavy commercial vehicles and off-highway machinery, where their unique ability to provide highly accurate, stable readings regardless of challenging environmental interference like fluid foaming, heavy condensation, or severe internal contamination provides a distinct and often necessary operational advantage. Simultaneously, there is an overarching, strong trend toward the deployment of smart sensors, which are essentially sensing elements deeply embedded with dedicated microprocessors and integrated circuit chips (a process known as System-on-Chip integration). These intelligent sensors perform necessary internal diagnostics, data logging functions, and highly efficient pre-processing of raw measurement data before transmitting the condensed, validated information via standardized digital protocols (ee.g., LIN or CAN bus) directly to the main vehicle control units. This advanced digital integration capability substantially reduces complex vehicle wiring harnesses, significantly improves data integrity and latency, and is the foundational requirement for implementing sophisticated, AI-driven predictive maintenance features across the next generation of vehicle platforms.

Another major technological development focuses critically on the materials science aspect of sensor construction, specifically emphasizing enhanced chemical resistance and guaranteed thermal stability. Level sensors designed explicitly for modern EV battery cooling systems must reliably withstand specialized dielectric cooling fluids and consistently operate across the extreme temperature gradients required for precise thermal management, driving the specialized use of advanced fluoropolymers, high-performance plastics, and specialized ceramic materials in their construction. Conversely, the continuous optimization of traditional magnetic float and resistive technologies for application in the highly cost-sensitive entry-level vehicle markets remains a core focus area, ensuring that these proven, established methods continue to offer cost-effective and reliable solutions for basic, non-critical fluid monitoring tasks. The industry-wide push for global standardization in communication interfaces and uniform module sizes across different vehicle platforms is also a critical technological driver, aiding major manufacturers in achieving significant economies of scale, simplifying inventory management, and effectively reducing overall supply chain complexity for globally deployed vehicle platforms.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market share both in volume and revenue terms, driven primarily by the massive, sustained scale of vehicle manufacturing operations in China, which functions as the world’s largest single market for both Internal Combustion Engine (ICE) and Electric Vehicle (EV) production. Robust and accelerating industrial growth, coupled with rising motorization rates, in India and Southeast Asian nations further propels immense regional demand. The APAC region exhibits particularly high growth in the adoption of advanced, non-contact sensors, specifically driven by the necessity for sophisticated fluid monitoring in the booming Electric Vehicle segment where precise battery thermal management is paramount.

- Europe: Characterized by the world's most stringent vehicle emission standards (e.g., forthcoming Euro 7 standards) and exceptionally high safety mandates, ensuring a mandatory, high uptake of sophisticated, digitally integrated sensors, especially for critical systems like brake fluid, advanced engine oil quality monitoring, and precise Diesel Exhaust Fluid (DEF/AdBlue) systems. Europe maintains its status as a technology and regulatory leader, focusing heavily on integrating complex smart sensors compatible with highly demanding Advanced Driver-Assistance Systems (ADAS) and emerging autonomous vehicle architectures. The established presence of major luxury and premium vehicle manufacturers consistently drives demand for ultra-high-accuracy, long-life, and high-reliability components.

- North America: Represents a highly mature, high-value, and technologically advanced market segment, significantly driven by robust demand for large, specialized heavy commercial vehicles and a strong, early focus on developing and deploying sophisticated fleet management and telematics solutions. Adoption rates are rapidly accelerating, fueled by the aggressive shift towards electric utility trucks and specialized industrial applications requiring resilient sensing. Technological investment is notably high, concentrating on wireless sensor solutions, battery health monitoring, and robust sensing systems engineered to handle the extreme and diverse climate variations common across the continent, from arctic cold to intense desert heat.

- Latin America (LATAM): Exhibits an accelerating pattern of growth due to rapidly increasing motorization rates, expanding industrial activity, and the gradual modernization of domestic vehicle platforms in key markets such as Brazil and Mexico. While the market often trails in the widespread adoption of the most expensive non-contact technologies, it shows consistent and reliable growth in established standard magnetic float and resistive sensors required for essential fluid level monitoring in high-volume, domestically produced economy vehicles. Regulatory convergence with global standards is expected to drive demand for complex sensors in the medium term.

- Middle East and Africa (MEA): This region constitutes a nascent but strategically high-potential market, primarily driven by large-scale oil and gas logistics vehicles, intensive mining operations, and rapidly expanding infrastructure construction projects demanding significant commercial transport fleets. Market growth is heavily concentrated in economically strong countries like Saudi Arabia, the UAE, and South Africa. Sensor demand in this region is uniquely sensitive to the challenges of extreme operating temperatures, intense dust ingress, and harsh chemical exposure, necessitating the deployment of highly durable, specialized, and hermetically sealed sensor designs capable of maintaining functionality under severe stress.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Level Sensor Market.- TE Connectivity

- Continental AG

- Sensata Technologies

- Robert Bosch GmbH

- Delphi Technologies (BorgWarner)

- NXP Semiconductors N.V.

- WIKA Group

- Amphenol Corporation

- Stoneridge Inc.

- ZF Friedrichshafen AG

- Denso Corporation

- MTS Systems Corporation

- Gill Sensors & Controls

- Emerson Electric Co.

- KUS Auto Co. Ltd.

- Variohm EuroSensor Ltd.

- Ams-Osram AG

- Honeywell International Inc.

- TT Electronics plc

- Xylem Inc.

Frequently Asked Questions

Analyze common user questions about the Automotive Level Sensor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological trends are defining the future of automotive level sensors?

The future is defined by the shift towards solid-state, non-contact technologies, primarily capacitive and ultrasonic sensing, due to their superior accuracy and lack of mechanical wear. A key trend is the deep integration of these sensors with sophisticated microprocessors to enable smart functionality, advanced internal diagnostics, and reliable digital communication via vehicle networking interfaces like CAN and LIN protocols. Furthermore, multi-parameter sensing, measuring both fluid level and complex quality parameters simultaneously, is becoming standard for high-performance applications like engine oil and transmission fluids, significantly enhancing advanced predictive maintenance capabilities.

How is the growth of Electric Vehicles (EVs) impacting the demand for level sensors?

The rapid proliferation of EVs is fundamentally reshaping the level sensor market by creating immense, non-discretionary demand for specialized coolant level sensors. These sensors are absolutely vital for continuously monitoring the thermal management systems of high-voltage batteries, ensuring they operate within optimal, narrow temperature ranges, which directly impacts battery life, charge efficiency, and overall safety. Unlike traditional vehicles which primarily monitor fuel, EVs require robust, chemically inert sensors capable of reliably measuring specialized dielectric cooling fluids under dynamic thermal cycling conditions, representing the single fastest-growing and highest-value application segment for sensor manufacturers globally.

Which geographical region holds the largest market share for Automotive Level Sensors?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly due to the unparalleled, sustained scale of vehicle production and massive consumer consumption volumes originating from manufacturing hubs like China, supplemented by rapid industrial growth across economies such as India and South Korea. This volumetric dominance is further cemented by the region's accelerated adoption trajectory for both conventional vehicle platforms and the rapidly expanding electric vehicle market. While APAC leads globally in overall volume, North America and Europe remain the undisputed centers for high-value technology deployment and the early implementation of advanced, regulated sensor applications.

What is the primary difference between resistive and capacitive level sensing technologies?

Resistive level sensors (typically associated with older mechanical components like magnetic float mechanisms) measure the fluid level by physically altering resistance based on the float position along a fixed track, making them highly cost-effective but inherently prone to mechanical wear, friction, and inaccuracies resulting from fluid sloshing during vehicle movement. Capacitive sensors, conversely, are entirely non-contact, measuring the change in electrical capacitance between two dedicated electrodes relative to the fluid level. Capacitive sensors offer significantly higher accuracy, are solid-state (reducing maintenance needs), and are often the preferred choice for safety-critical fluid applications like engine oil and brake fluid where precision, stability, and guaranteed long-term durability are paramount for system integrity.

What role does AI play in improving level sensor performance and vehicle safety?

AI significantly enhances sensor performance by applying advanced machine learning algorithms to compensate dynamically for external noise factors (e.g., severe vibration, rapid temperature changes) and complex operational variables (e.g., dynamic loading), thereby vastly improving measurement accuracy and stability in real-time. Crucially, AI enables the transition to truly advanced predictive maintenance by analyzing complex sensor data patterns over extended periods to reliably forecast potential fluid leaks, component degradation, or impending sensor failure, fundamentally transforming simple level alerts into sophisticated system diagnostics. This transition contributes directly to measurable enhancements in vehicle operational safety, reduced risk of catastrophic failure, and minimized unplanned downtime for large fleet operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager