Automotive Lithium-ion Batteries Carbon Black Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442473 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Lithium-ion Batteries Carbon Black Market Size

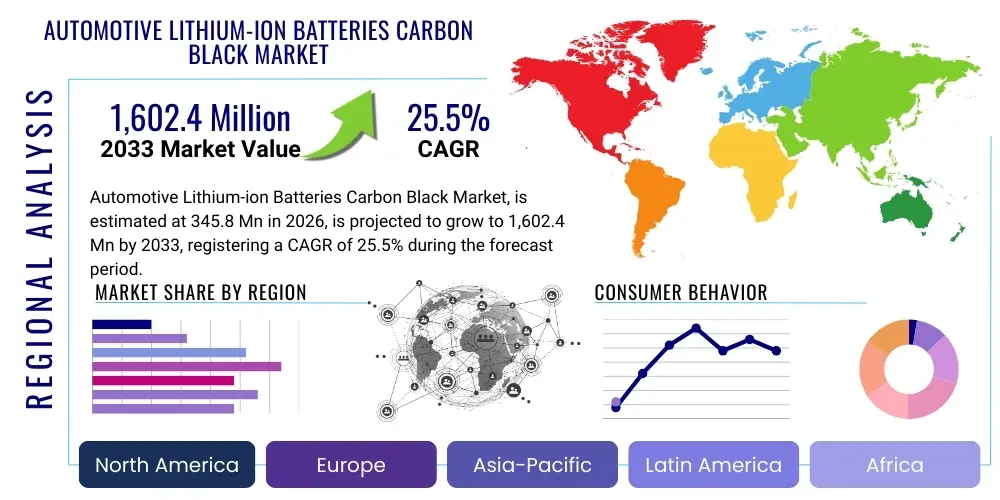

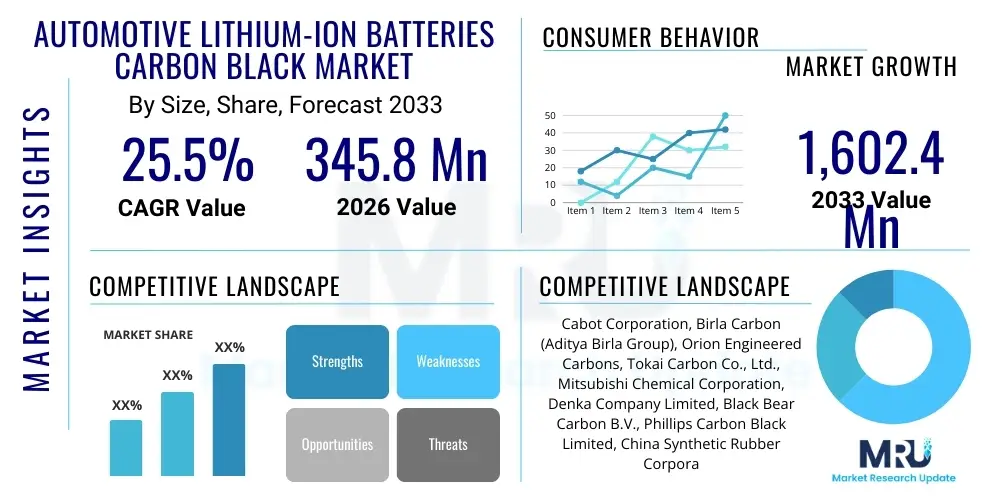

The Automotive Lithium-ion Batteries Carbon Black Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,450 Million by the end of the forecast period in 2033.

Automotive Lithium-ion Batteries Carbon Black Market introduction

The Automotive Lithium-ion Batteries Carbon Black Market encompasses the production, distribution, and utilization of specialized carbon black grades designed exclusively for use as conductive additives within cathodes and anodes of Li-ion batteries powering electric vehicles (EVs) and hybrid electric vehicles (HEVs). Carbon black, typically manufactured through the incomplete combustion or thermal decomposition of heavy petroleum products, is critical for enhancing the electron conductivity network within the electrode structure, significantly impacting the battery’s capacity, charging speed, and overall lifecycle performance. The unique morphological structure and surface chemistry of high-performance carbon black grades, such as Super P and acetylene black, are essential for achieving the high current rates required for reliable automotive applications, ensuring efficient electron flow between active material particles and the current collector.

The primary application of carbon black in automotive lithium-ion batteries is to establish robust electronic pathways across the active material particles, which include lithium metal oxides (in cathodes) and graphite (in anodes). Its addition mitigates internal resistance, ensures uniform current distribution, and improves the utilization rate of the active materials, thereby boosting the energy efficiency and instantaneous power output of the battery cell, crucial factors for acceleration and regeneration in EVs. Beyond conductivity enhancement, specialized carbon black also contributes structurally by acting as a spacer, helping to maintain the physical integrity of the electrode during repeated intercalation and de-intercalation cycles of lithium ions, which is vital for the longevity of the high-mileage EV batteries, preventing mechanical degradation and capacity fade over thousands of cycles.

The market is fundamentally driven by the accelerating global transition towards electric mobility, supported by stringent emission regulations (e.g., Euro 7, CAFE standards) and significant governmental subsidies and infrastructure investments in major automotive markets across Asia-Pacific, Europe, and North America. Key benefits of utilizing high-grade carbon black include substantial improvements in battery power density, significantly reduced charge times achieved through enhanced ion and electron transport kinetics, and an improved safety profile resulting from better thermal management due to uniform heat distribution within the cell. However, the industry is increasingly exploring advanced carbon allotropes, such as Carbon Nanotubes (CNTs) and Graphene, which pose a competitive pressure, pushing carbon black manufacturers to innovate specialized nano-structured variants optimized for specific high-energy density electrode chemistries, such as high-nickel Nickel Manganese Cobalt (NMC) and cost-effective Lithium Iron Phosphate (LFP) formulations.

Automotive Lithium-ion Batteries Carbon Black Market Executive Summary

The Automotive Lithium-ion Batteries Carbon Black Market is experiencing robust and accelerated expansion, fundamentally fueled by the explosive growth trajectory of the global electric vehicle sector and the corresponding build-out of giga-scale battery manufacturing capacity worldwide. Business trends indicate a strategic pivot among major carbon black producers toward developing ultra-pure, high-structure, and low-resistivity grades tailored specifically for high-performance battery applications, necessitating massive R&D investment in particle morphology control. Consolidation efforts, strategic joint ventures, and long-term supply agreements between carbon black suppliers and large-scale battery gigafactories are becoming the market norm, emphasizing security of supply, stringent quality consistency (measured in parts per million of contaminants), and geographical proximity to major production hubs. Furthermore, sustainability concerns are leading to increased exploration and piloting of circular economy models for carbon production, particularly involving recovered carbon black (rCB) derived from tire pyrolysis, though achieving the requisite battery-grade purity remains the central technical hurdle for mass adoption in premium EV cells.

Regionally, the Asia Pacific (APAC) market, spearheaded primarily by manufacturing powerhouses like China, South Korea, and Japan, dominates the current consumption landscape, predominantly due to the concentration of global battery cell manufacturing capabilities and the region housing the world’s largest and most rapidly expanding EV market. Conversely, Europe and North America are projected to exhibit the highest Compound Annual Growth Rates (CAGRs) during the forecast period, driven by ambitious regional regulatory targets for mandatory EV penetration and the proactive establishment of localized, self-sufficient battery supply chains ("onshoring" and "friend-shoring" initiatives). This substantial geographical shift, underpinned by legislative frameworks such as the European Green Deal and the US Inflation Reduction Act (IRA), mandates substantial and rapid expansion of local carbon black production capacity in these regions to minimize logistical vulnerabilities, mitigate geopolitical risks, and satisfy increasingly strict localized content requirements for government incentives.

In terms of segmentation analysis, the market reveals that specialized high-purity grades such as acetylene black and proprietary conductive carbon black (SCCB) grades command the highest revenue per unit volume, often preferred in cathode formulations where maximizing volumetric energy density and minimizing internal impedance are critical objectives. However, ongoing advancements in nano-carbon structures are rapidly influencing the market, leading to increased adoption of hybrid solutions, specifically blends of traditional carbon black with Carbon Nanotubes (CNTs) to achieve superior electronic networks with extremely low loading levels. This strategy frees up valuable electrode volume for active materials, thereby boosting overall energy density. Simultaneously, the Lithium Iron Phosphate (LFP) chemistry segment is witnessing substantial growth, particularly in commercial vehicle and entry-level passenger EV applications, further diversifying the demand for different grades of conductive additives optimized for high-volume, cost-effective, and thermally stable battery production.

AI Impact Analysis on Automotive Lithium-ion Batteries Carbon Black Market

User inquiries regarding AI's influence on this niche market typically revolve around critical operational efficiency questions, such as how artificial intelligence can optimize the highly complex and energy-intensive manufacturing process of carbon black (e.g., real-time reactor control, yield maximization, energy efficiency), predict material performance characteristics based on instantaneous morphological sensor data, and ultimately integrate into sophisticated battery management systems (BMS) to optimize electrode life and thermal runaway prevention. Key concerns center on the substantial capital expenditure required for implementing advanced AI-driven control systems across legacy manufacturing infrastructure and the essential need for high-quality, continuous, multi-modal data streams from industrial sensors to effectively train reliable predictive models. Users also express high expectations that AI will significantly accelerate the discovery, formulation, and validation of novel carbon additives, enabling a faster industrial transition to higher energy density battery chemistries, thereby allowing carbon black to maintain its competitive edge against emerging alternative materials like high-purity graphene and advanced CNTs.

The deployment of sophisticated machine learning algorithms and digital twin technology is poised to revolutionize the highly specialized production phase of automotive-grade carbon black. AI models possess the capability to analyze complex, high-dimensional reaction kinetics within carbon black furnaces in real-time, instantaneously adjusting crucial variables such as feedstock flow rate, oxygen-to-fuel ratio, precise temperature profiles, and quenching rates to ensure optimal particle size uniformity, aggregation structure, and surface area distribution. This unprecedented level of dynamic precision, unattainable through traditional statistical process control (SPC), leads directly to materially higher yields of the required premium battery-grade material, significantly reduced specific energy consumption per unit of carbon black, and superior batch-to-batch consistency—a non-negotiable requirement for high-reliability EV battery production lines. The strategic integration of AI into the quality control chain ensures that only highly uniform and ultra-pure carbon black is utilized, proactively minimizing performance variability and potential defects in the expensive final battery product.

Furthermore, AI plays an increasingly vital and expansive role in the accelerated Research and Development pipeline for new carbon black variants optimized for future battery chemistries. Deep learning networks can swiftly correlate input raw material properties, detailed processing parameters, and post-treatment specifications with extensive electrochemical performance data (e.g., rate capability, impedance growth, long-term cycling stability) derived from prototype cells and pilot lines. This predictive modeling dramatically accelerates the formulation optimization process, shortening the time-to-market for specialized conductive carbon blacks tailored specifically for challenging new battery architectures, such as next-generation semi-solid state electrolytes or high-capacity silicon-anode rich chemistries. In the battery manufacturing process itself, predictive maintenance algorithms utilizing AI analyze input material quality profiles (including carbon black purity and structure) against real-time operating conditions to forecast potential defects or long-term performance degradation, optimizing the material loading process and minimizing expensive scrap rates at the gigafactory scale.

- Enhanced Manufacturing Precision: AI-driven control systems optimize furnace conditions in real-time for superior structure, purity, and energy efficiency.

- Accelerated R&D and Formulation: Machine learning models predict electrochemical performance characteristics of novel carbon black variants based on material inputs and processing pathways, drastically reducing experimental cycles.

- Supply Chain Optimization: Predictive analytics forecasts localized demand fluctuations from battery manufacturers, ensuring timely, efficient, and risk-mitigated supply of certified materials to gigafactories globally.

- Quality Assurance Automation: Computer vision and advanced data analytics verify the consistency of nanostructure and dispersion properties post-production, enhancing product reliability.

- Thermal Management Integration: AI feedback loops incorporated within the Battery Management System (BMS) analyze performance data to potentially adjust charging and discharge protocols based partly on the known characteristics of the electrode conductive additives, impacting safety and longevity.

DRO & Impact Forces Of Automotive Lithium-ion Batteries Carbon Black Market

The market dynamics for automotive lithium-ion batteries carbon black are shaped by a powerful confluence of global regulatory support for electromobility and continuous technological pressure for performance improvement, counterbalanced by inherent supply chain vulnerabilities, high energy consumption in production, and the sustained emergence of competing conductive additives. Major market Drivers include aggressive global electric vehicle adoption targets across all major economies, fueled by governmental mandates, and the imperative requirement for consistently higher energy density and faster charging speeds in batteries, which necessitate highly efficient, low-impedance conductive networks. Restraints largely center on the volatile pricing and supply chain concentration of petrochemical feedstocks (oil and gas residues), the high energy intensity and associated carbon footprint of traditional carbon black manufacturing, alongside the complex technical challenge of achieving uniform, defect-free dispersion of carbon additives within high-solids-content electrode slurries. Opportunity arises from developing niche, ultra-high-value carbon black grades specifically optimized for revolutionary battery architectures, such as all-solid-state electrolytes or highly sensitive silicon-based anodes, and strategically leveraging sustainable production methods like high-purity recovered carbon black (rCB) to meet growing ESG mandates and regional content requirements.

The primary impact forces critically driving this market include technological substitution pressure and stringent environmental compliance mandates, which collectively determine long-term viability and competitive intensity. The persistent threat of substitution, particularly from next-generation conductive materials like advanced Carbon Nanotubes (CNTs) and highly conductive Graphene, which offer significantly superior aspect ratios and conductivity at much lower loading levels, forces traditional carbon black manufacturers to innovate aggressively, often leading to proprietary hybrid materials (e.g., Carbon Black-CNT composite blends) to defend their market share. Conversely, increasing pressure for environmental compliance, driven by EU regulations (such as the Carbon Border Adjustment Mechanism (CBAM)) and increasingly influential consumer and investor demand for sustainability, compels manufacturers to invest heavily in modernizing facilities to reduce their carbon footprint, address particulate emissions, and ultimately move away from the high energy intensity traditionally associated with classic furnace black production methods. The balance between maintaining a competitive price point and achieving these stringent performance and sustainability criteria is paramount.

Specific market pressures also emanate significantly from the consolidated, highly specialized nature of high-performance battery carbon black production and the non-negotiable quality demands of the automotive sector. While overall market demand is accelerating exponentially (linked directly to the geometric growth of gigafactory capacity), capacity additions for specialized, ultra-pure carbon black require multi-year lead times and substantial capital investment, leading to potential supply bottlenecks and price inflation if EV adoption continues to outpace localized material manufacturing capability expansion in key geographic clusters (Europe and North America). Geopolitical tensions impacting global petrochemical supply chains further amplify the market risk profile. Therefore, strategic partnerships focusing on localized, highly resilient supply chains, diversification of feedstock sources (including sustainable alternatives), and stringent quality control protocols are absolutely crucial survival strategies for market participants navigating these complex and rapidly evolving impact forces.

Segmentation Analysis

The Automotive Lithium-ion Batteries Carbon Black Market is comprehensively segmented based on various technical and application criteria, enabling manufacturers to tailor product specifications, optimize production, and implement targeted market penetration strategies. Key segments include classification by product type (Acetylene Black, Super P Carbon Black, specialized Conductive Carbon Black (SCCB), etc.), which relates directly to the proprietary manufacturing process and the resulting critical morphological properties like structure, particle size, and surface area distribution. Further classification is defined by application, primarily focusing on its utilization within either the cathode or anode electrode, as the fundamental requirements for conductivity enhancement, material interaction, and long-term stability differ significantly between the two electrochemical components. A critical segmentation dimension is also derived from the specific type of battery chemistry (e.g., NMC, LFP, NCA), reflecting the distinct conductivity and stability needs of high-power cells versus high-energy density cells in commercial operation.

The Product Type segment is paramount, as the required performance specifications for conductive additives in automotive cells are intensely specialized and non-interchangeable. For instance, Acetylene Black is often favored for its exceptional purity, high structure, and relatively low surface area, offering superior bulk conductivity and excellent rheological properties during slurry mixing, thus being a staple in various high-power cathode formulations. Conversely, Super P and other similar proprietary nano-structured grades are highly valued for their extremely small particle size and exceptionally large active surface area, optimizing the physical interface with active material particles and facilitating swift lithium ion transport, which is vital for high-rate capability and low internal resistance. The ongoing technological distinction between standard conductive carbon black and advanced, surface-treated nano-structured carbon black highlights the continuous trend toward materials engineered at the nanoscale to minimize additive loading while maximizing electronic percolation and electrochemical performance, directly responding to the critical market demand for increased energy density batteries where minimized non-active material volume is essential.

Application-wise, the cathode market segment typically demands the highest levels of purity, exceptional dispersion stability, and tailored structure, as cathode materials (like NMC or LFP) are intrinsically less conductive than common anode materials (like graphite), making the role of the carbon black significantly more critical in establishing a functional electron pathway. The surging global demand for long-range and extreme fast-charging EVs continuously drives rapid innovation in conductive additives for high-nickel cathode systems, requiring materials that offer mechanical stability and chemical inertness under high voltage operation. Conversely, the anode segment, particularly with the introduction of silicon-based alloying additives to boost capacity, requires specialized carbon black grades that can effectively accommodate the significant volume expansion associated with silicon cycling, often acting as flexible conductive and structural buffers to maintain cell integrity, conductivity, and cycling performance over thousands of charging cycles.

- By Product Type:

- Acetylene Black (High purity, high structure)

- Super P Carbon Black (Proprietary nano-structured grades)

- Specialized Conductive Carbon Black (SCCB)

- High Structure Furnace Black Grades (Specialty automotive)

- By Battery Component:

- Cathode (Highest purity requirements, critical conductivity role)

- Anode (Growing demand, crucial for Si-based additive integration)

- By Battery Chemistry:

- NMC (Nickel Manganese Cobalt)

- LFP (Lithium Iron Phosphate)

- NCA (Nickel Cobalt Aluminum)

- Others (e.g., Silicon Anodes, Solid-state prototypes)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Automotive Lithium-ion Batteries Carbon Black Market

The value chain for automotive lithium-ion batteries carbon black is highly specialized, capital-intensive, and spans from the extraction of refined petrochemical feedstocks to the meticulous integration of the final product into highly sophisticated battery cells within multi-billion dollar gigafactories. Upstream analysis reveals a critical dependence on consistent, high-quality heavy petrochemical residues, such as specific grades of residual oil, coal tar, or natural gas streams, which are processed into the primary feedstock for the thermal decomposition reaction. The stringent purity and chemical consistency of these incoming feedstocks significantly influence the final quality, structure, and grade of the carbon black, particularly the concentration of harmful metallic impurities, making secure, long-term sourcing from reliable, audited petrochemical suppliers a highly critical factor for maintaining battery quality standards. Midstream activities involve the highly controlled, energy-intensive thermal decomposition processes (furnace method), followed by meticulous post-treatment steps like de-agglomeration, high-purity pelletization, and specialized surface modification to achieve the required battery-grade specifications, including ultra-low (<10 ppm total) metallic contaminants.

Downstream activities involve the highly regulated supply of the specialized carbon black product to either large-scale battery material manufacturers (e.g., cathode precursor powder producers or composite anode material suppliers) or, most commonly, directly to Tier 1 battery cell manufacturers (gigafactories). The distribution channel is crucial, often requiring specialized, airtight packaging and logistics protocols to handle ultra-fine powders and ensure absolute minimal moisture ingress or cross-contamination during transport and storage, vital for maintaining cell integrity. Direct distribution, characterized by long-term strategic contracts, often lasting 5 to 10 years, between the global carbon black producers and major battery manufacturers (e.g., CATL, LG Energy Solution, Samsung SDI, Northvolt), is the predominant model. These deep, direct relationships facilitate joint development efforts, allowing suppliers to co-develop custom carbon black grades precisely tailored for proprietary, high-performance electrode formulations, ensuring optimal compatibility and performance across mass production scales.

Indirect distribution, involving regional chemical distributors or specialized battery component traders, exists but is increasingly rare for high-volume, mission-critical premium automotive grades due to the extremely stringent quality control, extensive technical support, and strict supply chain certification requirements imposed by large automotive OEMs and their Tier 1 battery suppliers. The accelerating global trend towards vertically integrated and regionally localized battery supply chains (e.g., establishing production bases in North America and Europe) necessitates localized production and distribution hubs for battery-grade carbon black to minimize geopolitical risk, significantly reduce lead times, and meet mandatory requirements for local content sourcing, as dictated by policies like the IRA. This regionalization tightens the linkage between the energy-intensive midstream carbon processing stage and the highly controlled, high-volume end-use battery assembly stage, requiring massive capital investment in localized production capacity by carbon black majors.

Automotive Lithium-ion Batteries Carbon Black Market Potential Customers

The primary and most significant customers for specialized automotive lithium-ion batteries carbon black are concentrated exclusively in the modern lithium-ion battery manufacturing ecosystem, particularly within organizations focused on high-performance, high-capacity cell production specifically for electric vehicle and commercial transport applications. These crucial customers include the operators of large-scale battery gigafactories, such as those operated by the major Asian battery giants, established European entities, and emerging American domestic players, who integrate the carbon black material directly into their electrode manufacturing lines during the highly sensitive slurry mixing process. These end-users represent the cornerstone of market demand, demanding unprecedented levels of ultra-high purity, precise and repeatable morphological characteristics (structure and particle size), and guaranteed consistency across vast, multi-ton production volumes. Procurement decisions at this level are heavily influenced by extensive electrochemical testing results, demonstrated scalability of the supplier's process, certification history, and the supplier's geopolitical ability to maintain a secure, certified, and cost-competitive global or regional supply chain.

Secondary, yet highly influential, customer segments include advanced battery materials companies that specialize in producing pre-mixed, ready-to-use cathode and anode active materials. These companies purchase the specialized carbon black in large quantities and often blend it with materials like NMC precursors, LFP powder, or specialized synthetic graphite before supplying the formulated, highly proprietary product to smaller or more specialized battery assemblers, who may lack the in-house capabilities for precise slurry formulation. Research institutions, specialized battery testing laboratories, and automotive original equipment manufacturers (OEMs) deeply involved in proprietary advanced battery development also represent an important, though lower-volume, customer segment. Their purchasing power is disproportionately high in driving innovation and standardization, as they test and validate next-generation carbon additives for future vehicle platforms and new electrochemical configurations, often defining the specifications that Tier 1 suppliers must eventually meet.

The rapidly shifting global landscape towards greater vertical integration within the EV supply chain means that some major automotive OEMs, particularly those investing directly in their own cell production capabilities or establishing critical joint ventures with cell manufacturers, are becoming direct purchasers or, at the very least, significant influencers in the downstream procurement process of carbon black. Their primary focus shifts toward ensuring materials that enhance long-term battery longevity, maximize volumetric energy density, and enable extreme fast-charging capabilities, ensuring the performance characteristics meet stringent, multi-year warranty requirements for high-mileage electric vehicle fleets. Ultimately, the end-user consumer (the EV owner) indirectly drives the entire demand, as their expectation for optimal vehicle range, charging speed, rapid depreciation mitigation, and durability translates directly into the specific, high-stakes material specifications handed down the automotive manufacturing value chain, making material quality a crucial element of brand reputation and market success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,450 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cabot Corporation, Orion Engineered Carbons S.A., Birla Carbon (Aditya Birla Group), Phillips 66 Company, Mitsubishi Chemical Corporation, Tokai Carbon Co. Ltd., Sid Richardson Carbon & Energy Co., Continental Carbon Company, Jiangxi Black Cat Carbon Black Co., Ltd., HEG Ltd., Imerys S.A., Lion Specialty Chemicals Co., Ltd., OCI Company Ltd., Ralson Carbon Black, D&W Carbon Co., Ltd., Asbury Carbons, Shandong Jinnan Chemical Co., Ltd., China Synthetic Rubber Corporation (CSRC), Showa Denko K.K. (Resonac). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Lithium-ion Batteries Carbon Black Market Key Technology Landscape

The technology landscape for automotive-grade lithium-ion battery carbon black is characterized by intense focus on particle morphology engineering and rigorous surface modification to achieve optimal electrochemical performance under severe operating conditions. Traditional furnace black technology is continuously refined through process control advancements and computational fluid dynamics simulations, primarily aimed at achieving the ultra-high structure (high aggregation level) and tightly controlled surface area required for superior conductivity while maintaining extremely low levels of process contaminants, especially transition metals, which can significantly accelerate electrolyte decomposition and prematurely reduce cell life. Specialized technologies, such as the use of proprietary high-temperature reactors, precise quenching methods, and advanced post-treatment processes (e.g., thermal treatment in controlled, inert atmospheres), are essential for mass-producing materials like Super P and proprietary acetylene blacks that consistently meet the highly stringent Tier 1 battery industry standards. Continuous innovation in this segment focuses on developing carbon black with meticulously tailored pore structures and controlled particle size distribution to maximize both ionic and electronic conductivity simultaneously, which is especially crucial for facilitating rapid charge transport in newly adopted, high-capacity thick electrode architectures designed to increase energy density.

A significant technological paradigm shift involves the increasing integration of advanced nano-carbon materials, which leads directly to the development of sophisticated hybrid conductive additives. While pure carbon black remains a foundational material due to its cost-efficiency, scalability, and robust conductive path formation, leading global suppliers are increasingly blending or chemically coating carbon black particles with materials like highly graphitized Carbon Nanotubes (CNTs) or specialized Graphene Oxide derivatives. This advanced hybridization strategically leverages the volumetric efficiency and cost-effectiveness of carbon black while exploiting the significantly superior long-range electrical connectivity and mechanical robustness offered by CNTs and Graphene structures. The resulting composite materials demonstrate powerful synergistic effects, providing a superior balance between electrical conductivity, optimal electrode slurry rheology (processability), and overall material cost compared to utilizing either material in isolation, thereby optimizing electrode design for demanding high-power applications like extreme fast charging (XFC). Research efforts are also heavily invested in understanding and mitigating the impact of these high-structure additives on electrode slurry viscosity and dispersion quality, ensuring smooth, high-speed coating during large-scale gigafactory manufacturing processes without problematic aggregation issues.

Furthermore, technology related to sustainability is gaining unprecedented prominence across the industry, particularly the highly complex purification and activation techniques required for recovered carbon black (rCB). Although the vast majority of automotive battery carbon black still originates from virgin petrochemical sources, technologies that can economically and effectively upgrade rCB—derived from the pyrolysis of end-of-life tires—to achieve genuine battery-grade purity levels (specifically requiring the near-total removal of residual sulfur, zinc, and heavy metals, which act as electrochemical poisons) are currently under aggressive development and pilot scaling. Success in this technical area would dramatically alter the supply chain dynamics, offering a significant ESG advantage and reducing the industry's dependency on volatile virgin petroleum feedstocks, aligning strongly with circular economy mandates championed by major regulatory bodies in Europe and North America. Advancements in proprietary dispersion technology, including specialized solvent systems, high-shear mixing equipment, and continuous wet-jet milling techniques, are also critically important for ensuring the uniform distribution and complete de-agglomeration of these fine conductive powders within viscous electrode slurries, which directly dictates the final electrochemical performance, structural homogeneity, and manufacturing yield in high-volume battery production.

Regional Highlights

Asia Pacific (APAC) stands as the undisputed geographical leader in the Automotive Lithium-ion Batteries Carbon Black Market, fundamentally driven by its massive installed capacity for global EV battery manufacturing. Countries like China, South Korea, and Japan host the majority of the world’s largest and most technologically advanced battery producers (e.g., CATL, LG Energy Solution, Samsung SDI, Panasonic), which collectively account for the vast bulk of global Li-ion cell production, thereby creating an enormous and highly localized demand base for high-purity conductive additives. China, specifically, not only dominates global EV production and consumer penetration but also possesses robust, often state-backed, domestic carbon black manufacturing capabilities, supplying the majority of the regional requirement efficiently. The strategic focus for suppliers in APAC is intensely centered on securing large volume, cost-effective, and long-term supply agreements, optimizing highly complex just-in-time logistics to serve rapidly expanding gigafactories, and maintaining absolute cost competitiveness in this high-volume, performance-driven environment.

Europe represents the fastest-growing major market segment and is projected to exhibit the highest Compound Annual Growth Rate during the forecast period. This rapid and transformative expansion is spurred by the European Union’s ambitious climate neutrality targets and the introduction of mandatory CO2 reduction schemes, leading to colossal, policy-backed investments in domestic EV manufacturing and the establishment of numerous domestic and joint-venture battery gigafactories (e.g., Northvolt, Automotive Cells Company (ACC), and localized expansions by established Asian players). Policy initiatives, notably the forthcoming Batteries Regulation, aimed at fostering regional battery independence and supply chain security, mean that the demand for localized, compliant carbon black production is surging exponentially. European battery manufacturers are highly focused not only on maximizing cell performance but also on stringent sustainability criteria and detailed supply chain traceability, leading to a strong preference for suppliers demonstrating low-carbon manufacturing processes, robust environmental compliance, and ethical sourcing, making ESG credentials a significant competitive differentiator in this region.

North America is also poised for explosive, government-mandated growth, largely catalyzed by the US Inflation Reduction Act (IRA) and associated policy mechanisms, which mandate strict local content requirements for EV tax credits and critical battery component sourcing. This pivotal legislation is triggering unprecedented, multi-billion dollar investment in establishing massive domestic battery manufacturing capacity across the US, Canada, and Mexico, primarily through crucial joint ventures between Asian battery leaders and domestic automotive OEMs (e.g., GM, Ford, Stellantis). Carbon black suppliers are responding aggressively to this strategic mandate by either constructing new or significantly expanding existing production facilities within North America to ensure full compliance with regional sourcing rules and to capitalize on the guaranteed, long-term, high-volume demand generated by major domestic EV producers. The North American market prioritizes material consistency, high technical support for complex, cutting-edge electrode development (such as new high-capacity silicon-anode systems), and guaranteed resilience against external international supply chain disruptions, viewing localized carbon black supply as a critical strategic asset for national energy security and manufacturing reliability in the EV age.

- Asia Pacific (APAC): Dominates the current market size and volume due to the highest global concentration of battery manufacturing and EV production capacity. Characterized by high-volume, competitive pricing, and focus on securing stable supply for gigafactories.

- Europe: Exhibits the highest CAGR, driven by aggressive EU regulatory mandates, massive regional investments in gigafactories, and a strong market emphasis on sustainability, low-carbon footprint materials, and regional supply chain independence.

- North America: Experiencing accelerated, policy-driven growth (IRA-catalyzed), leading to extensive onshoring of battery and material production. High demand for specialized carbon grades to support next-generation battery technologies (e.g., silicon anodes) and robust supply chain resilience.

- Latin America & MEA: Nascent markets currently reliant predominantly on imports, with anticipated growth directly tied to future localized EV assembly, energy storage projects, and the establishment of regional battery pack integration facilities, particularly in economies with favorable raw material resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Lithium-ion Batteries Carbon Black Market.- Cabot Corporation

- Orion Engineered Carbons S.A.

- Birla Carbon (Aditya Birla Group)

- Phillips 66 Company

- Mitsubishi Chemical Corporation

- Tokai Carbon Co. Ltd.

- Sid Richardson Carbon & Energy Co.

- Continental Carbon Company

- Jiangxi Black Cat Carbon Black Co., Ltd.

- HEG Ltd.

- Imerys S.A.

- Lion Specialty Chemicals Co., Ltd.

- OCI Company Ltd.

- Ralson Carbon Black

- D&W Carbon Co., Ltd.

- Asbury Carbons

- Shandong Jinnan Chemical Co., Ltd.

- China Synthetic Rubber Corporation (CSRC)

- Showa Denko K.K. (Resonac)

- Aerosil (Evonik Industries AG)

Frequently Asked Questions

Analyze common user questions about the Automotive Lithium-ion Batteries Carbon Black market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of carbon black in automotive lithium-ion batteries?

Carbon black serves as the essential conductive additive, constructing an efficient, highly interconnected electron conduction network throughout the cathode and anode materials. This functionality drastically enhances the battery’s power density, minimizes internal ohmic resistance, and facilitates superior high-rate charging and discharging capabilities, which are fundamental requirements for modern electric vehicle performance and range.

How does the type of carbon black (e.g., Acetylene Black vs. Super P) impact battery performance?

The impact is based on morphology: Acetylene Black is often prized for its exceptional purity and stable high structure, optimizing bulk electrode conductivity. Super P and proprietary nano-structured grades offer minimal particle size and superior active surface area, optimizing the critical interface with active materials, which is vital for long-cycle stability and maximizing high-rate energy transfer capability.

Which geographic region currently dominates the demand for Automotive Li-ion Batteries Carbon Black?

The Asia Pacific (APAC) region, spearheaded by manufacturing hubs like China, South Korea, and Japan, commands the largest global consumption share. This dominance is due to the highest concentration of global Li-ion battery manufacturing gigafactories and its leading position in the electric vehicle production market landscape.

What are the primary alternatives to carbon black used as conductive additives in EV batteries?

The main alternatives gaining significant technological traction are multi-walled and single-walled Carbon Nanotubes (CNTs) and specialty Graphene derivatives. These materials offer highly superior aspect ratios and connectivity at remarkably lower loading levels, and are often strategically blended with traditional carbon black to create high-performance, synergistic hybrid conductive materials.

What role does sustainability and recovered carbon black (rCB) play in the future market supply?

Recovered Carbon Black (rCB), sourced from end-of-life tire pyrolysis, provides a critical pathway for sustainable sourcing and circular economy goals. While significant technical challenges persist in achieving ultra-high battery-grade purity (especially concerning metallic contaminants), technological advancements in purification are positioning compliant rCB as a vital material for meeting future ESG mandates and securing localized, sustainable supply chains, particularly in Europe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager