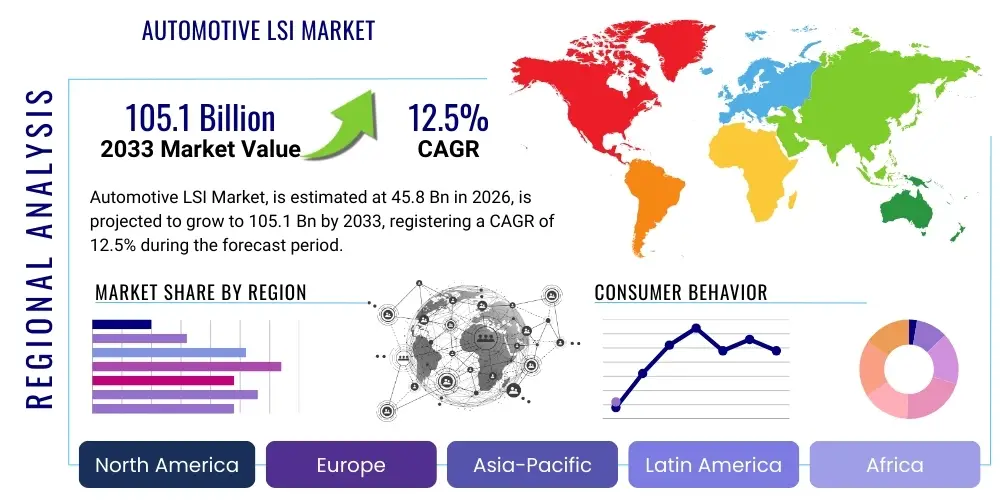

Automotive LSI Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441389 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automotive LSI Market Size

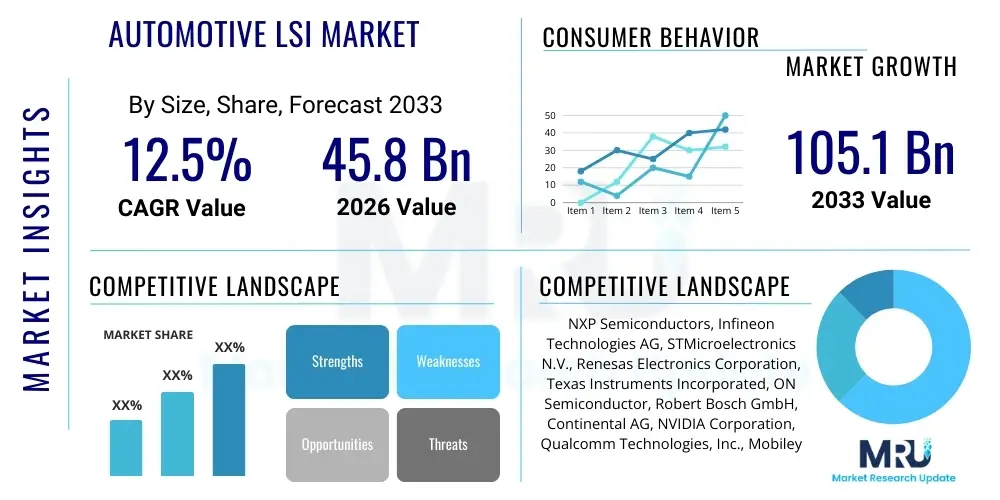

The Automotive LSI Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 105.1 Billion by the end of the forecast period in 2033. This exponential growth is primarily fueled by the rapid integration of advanced driver assistance systems (ADAS), the transition to electric vehicles (EVs), and the increasing demand for high-performance computing capabilities necessary for autonomous driving functions and complex in-vehicle infotainment (IVI) systems. The shift from distributed Electronic Control Units (ECUs) to centralized and zonal architectures mandates highly integrated LSI solutions.

Automotive LSI Market introduction

The Automotive Large Scale Integration (LSI) Market encompasses highly integrated semiconductor devices critical for enabling advanced functionalities within modern vehicles. These components include System-on-Chips (SoCs), microcontrollers (MCUs), specialized sensors, power management integrated circuits (PMICs), and memory solutions designed specifically to withstand harsh automotive environments and meet stringent safety standards (such as ISO 26262). LSI products serve as the digital backbone of contemporary vehicles, managing everything from engine control and battery management in EVs to sophisticated decision-making processes in ADAS platforms. Major applications span safety systems, powertrain control, chassis and body electronics, and connectivity modules, driving the industry towards software-defined vehicles.

The primary benefit of adopting LSI technology in automotive design is the significant reduction in component count and complexity, leading to improved reliability, faster processing speeds, and reduced weight, which is particularly crucial for maximizing EV range. Key driving factors propelling this market include global regulatory mandates enforcing higher safety standards (e.g., mandatory rearview cameras and advanced braking systems), escalating consumer expectations for connected car features (5G integration, over-the-air updates), and the industry-wide commitment to achieving Level 3 and above autonomous driving capabilities. Furthermore, the convergence of AI processing and automotive hardware requires increasingly powerful and efficient LSI solutions capable of real-time data analysis from numerous vehicle sensors.

Automotive LSI Market Executive Summary

The Automotive LSI Market is undergoing a fundamental transformation characterized by significant business and technological shifts. Business trends indicate strong capital expenditure by semiconductor foundries specializing in automotive-grade processes, driven by long-term commitment from OEMs to secure supply chain resilience following recent global chip shortages. There is a visible shift in the competitive landscape, where traditional automotive suppliers are increasingly collaborating with or acquiring expertise from pure-play semiconductor companies to integrate complex hardware and software solutions efficiently. Moreover, the long lifecycle requirements of automotive electronics, often exceeding a decade, necessitate robust partnerships and stringent quality control throughout the value chain.

Regionally, Asia Pacific, particularly China and South Korea, dominates both the manufacturing base and the consumer adoption rate of EVs, positioning the region as the largest consumer of automotive LSI products. Europe maintains a strong focus on advanced safety systems and premium vehicle segments, leading the demand for high-performance computing LSI tailored for advanced ADAS functionality and sophisticated domain controllers. Segment trends reveal that the ADAS application segment, encompassing sensors and processing units for radar, lidar, and camera systems, is expected to exhibit the highest growth rate, fueled by the accelerating transition towards L2+ and L3 autonomy. Simultaneously, the Powertrain segment is witnessing a dramatic shift towards high-voltage LSI components crucial for efficient battery management systems and inverter control in electric vehicles, fundamentally reshaping component specifications and material requirements.

AI Impact Analysis on Automotive LSI Market

Common user questions regarding AI's impact on the Automotive LSI Market frequently revolve around how current chip architectures will cope with the immense computational load of deep learning models, particularly concerning inference and real-time decision-making for autonomous driving. Users inquire about the necessary silicon design innovations, such as specialized neural processing units (NPUs) or custom AI accelerators, needed to run complex algorithms efficiently within the tight power and thermal constraints of a vehicle. There is also significant interest in how AI will drive the demand for specific LSI categories, particularly high-bandwidth memory (HBM) and faster interconnect technologies, and how major semiconductor companies are adapting their roadmaps to offer scalable and functional safety-compliant AI hardware platforms.

The integration of artificial intelligence necessitates a complete redesign of conventional automotive electronic architectures, moving from simple microcontrollers to powerful heterogeneous computing platforms. This transition places immense pressure on LSI manufacturers to develop specialized hardware optimized for parallel processing and low-latency operation. AI algorithms, essential for sensor fusion, perception, path planning, and driver monitoring, require dedicated silicon structures, moving away from general-purpose CPUs towards specialized accelerators like GPUs and NPUs. This shift is driving demand for chips fabricated on leading-edge process nodes (7nm, 5nm) to maximize performance per watt, which fundamentally alters the complexity and cost structure of automotive LSI production.

Furthermore, AI significantly impacts the software-hardware co-design process within the LSI market. Chipmakers must not only provide robust hardware but also offer comprehensive software stacks, toolchains, and AI model optimization frameworks tailored for their specific architectures (e.g., custom kernels, specialized libraries). The increasing reliance on AI for safety-critical functions mandates rigorous compliance with functional safety standards (ISO 26262 ASIL D), ensuring that AI hardware remains reliable and fault-tolerant. This requirement compels LSI developers to incorporate sophisticated diagnostic features and redundancy measures directly into the chip design, broadening the scope of verification and validation beyond traditional semiconductor testing methodologies.

- Architectural Shift: Accelerated move toward Heterogeneous Computing platforms integrating CPUs, GPUs, and specialized Neural Processing Units (NPUs) on a single LSI device.

- Advanced Process Nodes: Increased reliance on 7nm and 5nm semiconductor processes to achieve the performance and power efficiency required for AI inference in real-time.

- Enhanced Memory Demand: Exponential growth in demand for high-bandwidth, low-latency memory solutions (like LPDDR5X or specialized on-chip memory) to feed data to AI accelerators efficiently.

- Functional Safety Compliance: AI hardware must strictly adhere to ISO 26262 standards, requiring built-in redundancy and sophisticated diagnostic features (ASIL D certification).

- Software Definition: LSI providers must offer comprehensive AI software frameworks and tools to optimize models (e.g., TensorFlow Lite, proprietary optimization engines) for their specific silicon.

- Zonal Computing Enablers: AI processors act as the central computational hub in emerging zonal vehicle architectures, consolidating multiple ADAS and IVI functions.

DRO & Impact Forces Of Automotive LSI Market

The Automotive LSI market expansion is powerfully driven by the escalating demand for vehicle autonomy and electrification, which necessitates more sophisticated and powerful semiconductor components. However, this growth is tempered by significant restraints, primarily related to the cyclical nature of semiconductor supply chains, geopolitical instability impacting raw material sourcing, and the exceptionally high research and development costs associated with designing and qualifying automotive-grade components on advanced nodes. Opportunities arise from the evolution towards software-defined vehicles, creating new business models centered around subscription-based feature upgrades enabled by highly standardized and robust LSI platforms. These dynamics exert powerful impact forces across the industry, driving consolidation among suppliers and increasing direct influence of OEMs on semiconductor design and manufacturing priorities.

Segmentation Analysis

The Automotive LSI Market is strategically segmented based on product type, application, and process node, reflecting the diverse technological requirements across different vehicle domains. The Product Type segmentation distinguishes between highly programmable devices like microcontrollers (MCUs) and system-on-chips (SoCs), essential sensor interface chips (including MEMS and CMOS sensors), and specialized power management ICs necessary for efficient energy delivery in complex electrical systems. The Application segmentation clearly defines the end-use, with ADAS and Autonomous Driving dominating growth due to technological intensity, followed closely by the Powertrain segment driven by EV adoption, and the In-Vehicle Infotainment sector demanding high-performance graphics and connectivity LSI. Understanding these segments is crucial for market participants to align R&D and manufacturing capabilities with areas of highest projected demand and profitability.

- By Product Type:

- Microcontrollers (MCUs)

- System-on-Chips (SoCs)

- Analog ICs

- Power Management ICs (PMICs)

- Memory Devices (NOR, NAND, DRAM)

- Sensors and Transducers

- By Application:

- Advanced Driver Assistance Systems (ADAS) and Autonomous Driving

- Powertrain and Chassis Control (Engine, Transmission, Battery Management Systems)

- In-Vehicle Infotainment (IVI) and Telematics

- Body Electronics and Lighting

- By Process Node:

- Above 40 nm

- 28 nm to 40 nm

- Below 28 nm (Including 7nm and 5nm)

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

Value Chain Analysis For Automotive LSI Market

The Automotive LSI value chain is highly complex, starting with upstream activities involving intellectual property (IP) design, raw material procurement (silicon wafers, specialized chemicals), and electronic design automation (EDA) tools. Upstream dominance is often held by specialized IP firms like ARM and leading EDA software providers. Midstream manufacturing involves the capital-intensive processes of wafer fabrication (foundries), where companies like TSMC and Samsung dominate the production of advanced nodes, followed by assembly, testing, and packaging (ATP). The stringent quality and reliability requirements of the automotive sector necessitate specialized ATP processes designed for extreme temperature resistance and long-term durability, often handled by dedicated OSAT (Outsourced Semiconductor Assembly and Test) providers.

Downstream distribution involves a layered structure. LSI manufacturers typically sell directly to Tier 1 suppliers (e.g., Bosch, Continental, Denso), who integrate the chips into complex modules (ECUs, domain controllers, sensor clusters). These Tier 1 suppliers then deliver the integrated systems to the Original Equipment Manufacturers (OEMs), such as Ford, Volkswagen, or Tesla, for final vehicle assembly. Increasingly, high-volume, strategic LSI components are procured directly by OEMs (Direct Channel) to secure supply and influence chip specifications, bypassing or limiting the traditional role of Tier 1s in certain critical domains like autonomous driving compute platforms. The indirect channel remains strong for standardized components like memory or basic MCUs, often managed through large global electronic component distributors.

The interdependence within this chain means disruption at the foundry level (upstream) severely impacts vehicle production (downstream), as evidenced by recent supply crises. Furthermore, the requirement for long-term supply agreements and stringent automotive quality standards (AEC-Q100, IATF 16949) adds complexity, forcing all participants in the value chain to maintain extended inventory and lifecycle management protocols far beyond those seen in consumer electronics. This structure ensures high barriers to entry for new players, particularly in the advanced, safety-critical LSI domains, necessitating deep technical expertise and validated operational history.

Automotive LSI Market Potential Customers

Potential customers and end-users of Automotive LSI products are highly concentrated across the immediate automotive manufacturing ecosystem, though their roles and demands are rapidly converging. The primary immediate buyers are Tier 1 automotive suppliers, who purchase LSI components in bulk to design and manufacture Electronic Control Units (ECUs), domain controllers, safety modules, and infotainment systems according to OEM specifications. These suppliers require components that meet strict quality, volume, and longevity requirements. Secondly, Original Equipment Manufacturers (OEMs) are becoming increasingly important direct buyers, especially for high-value, strategic LSI like specialized AI accelerators and central computing SoCs, often driven by the desire to proprietary control over core vehicle architecture and software development. Finally, the aftermarket segment, including independent repair facilities and parts distributors, constitutes a steady but smaller demand pool for replacement or upgrade LSI components, although often focused on older vehicle platforms or less complex modules.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 105.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NXP Semiconductors, Infineon Technologies AG, STMicroelectronics N.V., Renesas Electronics Corporation, Texas Instruments Incorporated, ON Semiconductor, Robert Bosch GmbH, Continental AG, NVIDIA Corporation, Qualcomm Technologies, Inc., Mobileye (Intel Corporation), Analog Devices, Inc., Micron Technology, Inc., Western Digital Corporation, Melexis N.V., Broadcom Inc., Toshiba Electronic Devices & Storage Corporation, ROHM Co., Ltd., Denso Corporation, Samsung Electronics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive LSI Market Key Technology Landscape

The technological landscape of the Automotive LSI Market is defined by the ongoing push towards greater integration, specialization, and functional safety compliance. A pivotal trend is the move toward heterogeneous integration, where disparate computational elements—including general-purpose cores, graphics processors, and dedicated AI accelerators—are combined onto a single powerful System-on-Chip (SoC). This integration is essential for managing the massive data streams generated by Level 3 and Level 4 autonomous driving systems. Furthermore, the adoption of advanced process nodes (like 7nm and 5nm FinFET technology) is crucial for achieving the necessary power efficiency and transistor density required for next-generation central computing platforms, although many safety-critical control functions still rely on mature, highly reliable process nodes (e.g., 90nm or 40nm).

Another significant development is the emergence of RISC-V architecture as a viable, customizable alternative to proprietary instruction set architectures. RISC-V allows chip designers to tailor cores precisely for specific automotive tasks, from simple sensor interfaces to complex real-time processing, offering advantages in licensing flexibility and security implementation. Concurrently, high-speed networking standards such as Automotive Ethernet and 5G connectivity are driving demand for specialized LSI to handle gigabit data transfer rates across the vehicle, supporting Over-the-Air (OTA) updates and V2X (Vehicle-to-Everything) communication. These technological advancements collectively contribute to the realization of the software-defined vehicle, making the LSI design inherently more complex yet offering greater long-term flexibility.

Functional safety and cybersecurity are now inseparable elements of the LSI technology landscape. Modern automotive LSI must be designed from the ground up to meet stringent safety integrity levels (ASIL B to ASIL D), incorporating hardware mechanisms for fault detection, redundancy, and fail-safe operation. Cybersecurity concerns, driven by connected car features, necessitate the inclusion of specialized hardware security modules (HSMs) directly integrated within the LSI. These HSMs manage secure boot processes, cryptographic operations, and key management, protecting the vehicle's electronic systems from unauthorized access or malicious modification, thereby ensuring the integrity of the vehicle's critical functions over its entire operational lifetime.

Regional Highlights

The global Automotive LSI market exhibits distinct regional dynamics driven by manufacturing hubs, regulatory environments, and consumer adoption rates of advanced vehicle technologies. Asia Pacific (APAC) currently holds the dominant market share, primarily fueled by the presence of major semiconductor foundries, vast consumer markets for electric vehicles (especially in China), and rapid urbanization driving demand for basic and advanced transportation solutions. China, in particular, is both a massive consumer and increasingly an innovative designer of automotive electronics, often leading the way in integrating specific technologies like Battery Management Systems (BMS) and cost-effective infotainment LSI solutions. South Korea and Japan maintain a strong presence in high-quality, high-reliability component manufacturing for global OEMs.

North America is characterized by robust innovation in the autonomous driving sector, particularly in Silicon Valley and related technology hubs. This region demands high-performance LSI, specifically advanced SoCs and AI accelerators, to power experimental and commercially deployed Level 2+ and Level 3 autonomous vehicle fleets. Government support for electric vehicle infrastructure and significant investment in next-generation transportation technologies ensure North America remains a key market for LSI solutions supporting connectivity (V2X) and complex sensor fusion capabilities. The stringent liability and safety standards prevalent in this region necessitate a strong focus on ASIL-D compliant hardware and extensive validation protocols, often driving the adoption of customized, cutting-edge semiconductor products.

Europe represents a mature automotive market heavily focused on regulatory compliance, functional safety, and premium vehicle segments. European regulations, such as those promoting CO2 reduction and mandating active safety features, accelerate the adoption of high-efficiency powertrain LSI and sophisticated ADAS components. Countries like Germany and France emphasize quality and reliability, ensuring a steady demand for LSI from established suppliers who can meet complex certification requirements. While Europe is strong in automotive system integration (Tier 1 level), the region relies heavily on APAC and North America for advanced foundry capacity. Consequently, European players often focus on high-value analog, power, and microcontroller segments where reliability and deep application expertise are paramount.

- Asia Pacific (APAC): Dominates market share due to high EV production volumes, centralized semiconductor manufacturing (Taiwan, South Korea), and rapid adoption of connected car features in China.

- North America: Leading region for R&D and adoption of autonomous driving (L3/L4) technologies, driving demand for high-performance AI SoCs and cutting-edge process nodes (7nm and below).

- Europe: Strong focus on functional safety standards (ISO 26262), premium automotive segments, and high-efficiency power electronics required for regulated emissions reduction and EV infrastructure.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging markets showing increasing demand for basic LSI components in body electronics and entry-level safety systems, gradually shifting towards basic electrification components as infrastructure develops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive LSI Market.- NXP Semiconductors

- Infineon Technologies AG

- STMicroelectronics N.V.

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- ON Semiconductor

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Mobileye (Intel Corporation)

- Analog Devices, Inc.

- Micron Technology, Inc.

- Western Digital Corporation

- Melexis N.V.

- Broadcom Inc.

- ROHM Co., Ltd.

- Denso Corporation

- Samsung Electronics Co., Ltd.

- Toshiba Electronic Devices & Storage Corporation

- Microchip Technology Inc.

- Xilinx (AMD)

Frequently Asked Questions

Analyze common user questions about the Automotive LSI market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from MCUs to SoCs in automotive LSI?

The transition from specialized Microcontrollers (MCUs) to powerful System-on-Chips (SoCs) is driven by the need for centralized computing, required to handle sensor fusion, AI processing for autonomous driving, and complex infotainment systems, which demand significantly higher computational throughput and integration density than traditional distributed ECU architectures.

How does electrification impact the demand for automotive LSI products?

Electrification drastically increases demand for specific LSI categories, particularly high-voltage power management integrated circuits (PMICs), specialized battery management systems (BMS) chips, and silicon carbide (SiC) or gallium nitride (GaN) power modules essential for efficient traction inverters and charging infrastructure components in electric vehicles (EVs).

Which LSI application segment shows the highest growth potential in the forecast period?

The Advanced Driver Assistance Systems (ADAS) and Autonomous Driving application segment is projected to show the highest growth potential. This growth is sustained by the continuous regulatory pressure to implement mandatory safety features and the accelerating consumer interest in vehicles offering Level 2+ autonomy, necessitating complex sensor interfaces and dedicated AI processing hardware.

What role does functional safety (ISO 26262) play in the Automotive LSI market?

Functional safety is paramount, especially for LSI used in braking, steering, and autonomous perception systems. Compliance with ISO 26262, particularly up to ASIL D certification, requires semiconductor designers to implement inherent hardware mechanisms for fault detection, redundancy, and error mitigation, significantly extending design complexity and qualification cycles.

How are supply chain issues affecting the Automotive LSI manufacturing?

Supply chain issues, stemming from capacity constraints at advanced process nodes and geopolitical tensions, result in extended lead times and increased component costs. This has pushed OEMs to engage in strategic, long-term procurement agreements directly with LSI manufacturers and encouraged investment in regionalized foundry capacity to enhance resilience and ensure steady supply.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager