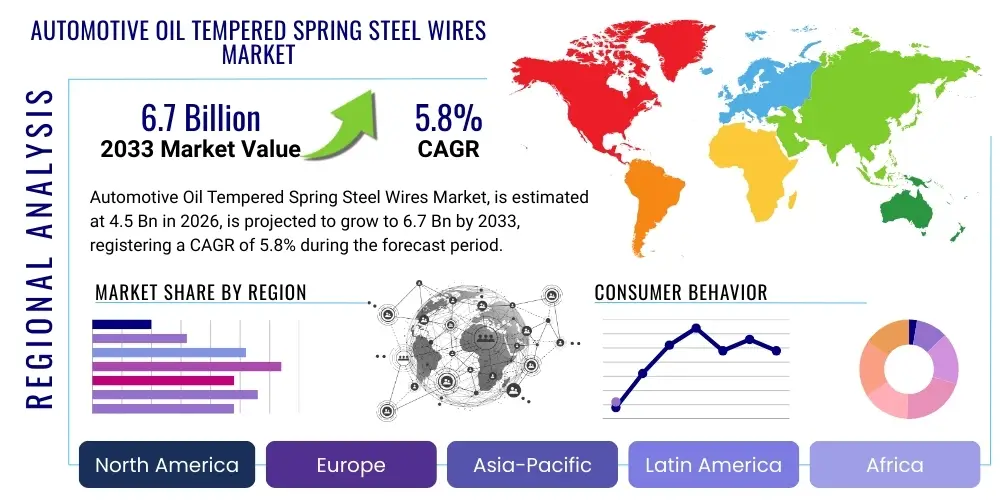

Automotive Oil Tempered Spring Steel Wires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441232 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Automotive Oil Tempered Spring Steel Wires Market Size

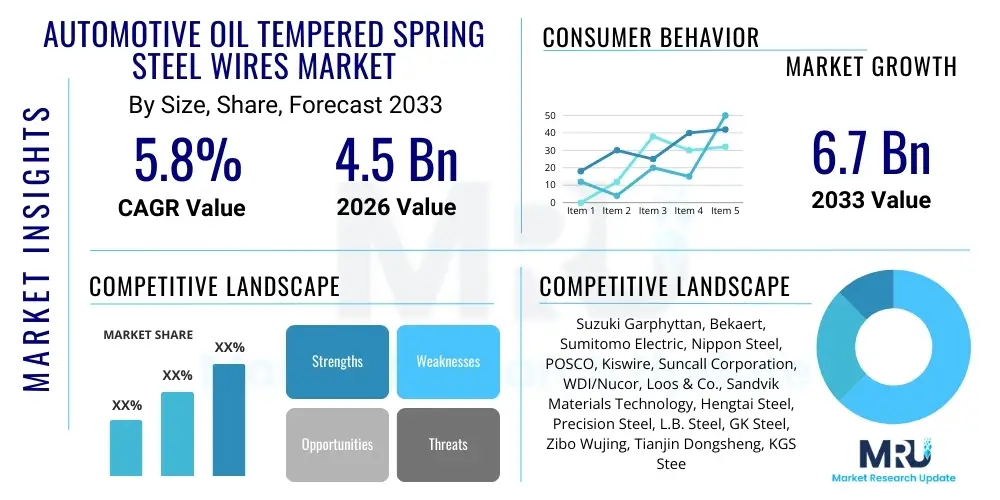

The Automotive Oil Tempered Spring Steel Wires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Automotive Oil Tempered Spring Steel Wires Market introduction

The Automotive Oil Tempered Spring Steel Wires Market encompasses the production and supply of high-performance steel wires specifically designed for use in critical automotive spring applications. These wires undergo a specialized thermal treatment process, involving quenching in oil followed by tempering, to achieve superior tensile strength, fatigue resistance, and durability necessary for demanding environments such as suspension and transmission systems. This specialized steel is crucial for manufacturing coil springs, stabilizer bars, clutch springs, and various other elastic components that manage dynamic loads and vibrations within vehicles. The core product description revolves around wires fabricated from high-carbon or alloy steel that meet stringent performance criteria defined by automotive original equipment manufacturers (OEMs).

Major applications for oil tempered spring steel wires include chassis components, engine valve springs, brake systems, and crucial safety mechanisms like seatbelt retractors. The wires are selected based on factors such as required stress amplitude, operating temperature, and required lifetime cycles. The primary benefits derived from using these specialized wires include enhanced vehicle stability, improved ride comfort, reduced noise, vibration, and harshness (NVH) levels, and extended component lifespan. Their high strength-to-weight ratio allows for the design of lighter components, contributing directly to vehicle fuel efficiency and overall performance metrics, a critical factor driving adoption in modern vehicle architectures.

The market is predominantly driven by sustained global automotive production volumes, particularly in emerging economies where vehicle ownership is rapidly increasing. Furthermore, the relentless pursuit of vehicle light weighting to comply with increasingly strict emission regulations (such as CAFE standards and Euro 7) mandates the use of high-strength, durable materials like oil tempered spring steel wires. Technological advancements in wire drawing and tempering processes, aimed at minimizing surface defects and maximizing fatigue life, are also fueling market expansion. The shift towards complex multi-link suspension systems in premium and performance vehicles further solidifies the demand for these high-specification materials, ensuring market resilience despite cyclical fluctuations in the broader automotive sector.

Automotive Oil Tempered Spring Steel Wires Market Executive Summary

The Automotive Oil Tempered Spring Steel Wires Market is poised for stable growth, fueled primarily by technological advancements in vehicle safety and performance requirements, alongside robust automotive production volumes in Asia Pacific. Business trends indicate a strong focus on strategic partnerships between wire manufacturers and Tier 1 automotive suppliers to co-develop custom materials optimized for electric vehicle (EV) applications, which often require specific stiffness and fatigue properties under demanding battery weight loads. The transition towards high-strength, chrome-silicon alloy steels is a major product trend, reflecting the need for superior heat resistance and cyclic durability in modern powertrains and suspension systems. Consolidation among major players is observed as companies seek economies of scale and control over the vertically integrated supply chain, from raw material sourcing (high-quality steel billets) to finished wire product delivery.

Regionally, Asia Pacific (APAC), particularly China and India, dominates the market share due to unparalleled scale in automotive manufacturing and rapid infrastructural development requiring reliable commercial vehicle fleets. Europe maintains a strong presence driven by stringent safety standards and the high concentration of premium and luxury vehicle manufacturers, which utilize high-specification wires for complex suspension systems. North America demonstrates stable demand, largely influenced by the heavy-duty truck segment and the accelerating shift toward electric light trucks and SUVs. Regional trends are also shaped by localized raw material sourcing agreements, designed to mitigate geopolitical supply chain risks and volatile steel price fluctuations.

Segment trends highlight the dominance of the Suspension Systems application, which accounts for the largest revenue share, reflecting the widespread use of coil springs in all vehicle types. The Alloy Steel segment is projected to experience the fastest growth rate, surpassing high-carbon steel in performance-critical applications, driven by its superior mechanical properties under elevated stresses. Within the Vehicle Type segmentation, the Electric Vehicle (EV) segment is emerging as a critical growth vector, requiring specially designed wires to manage the increased unsprung mass associated with battery packs, demanding higher tensile strength and corrosion resistance than traditional components. The OEM sales channel continues to be the primary revenue generator, emphasizing the need for long-term supply contracts and adherence to original equipment quality specifications.

AI Impact Analysis on Automotive Oil Tempered Spring Steel Wires Market

Common user questions regarding AI's impact in this sector center on how AI can enhance the metallurgical consistency and quality control of the oil tempering process, how predictive analytics can optimize production schedules based on volatile OEM demand, and the potential for AI-driven inspection systems to detect microscopic defects that compromise fatigue life. Users are keenly interested in reducing material waste and energy consumption during high-temperature treatments. The key themes summarized across user inquiries focus on AI's ability to transition from reactive quality assurance to proactive process optimization. Expectations are high that AI will lead to the development of 'smart' manufacturing lines capable of self-adjusting parameters (temperature, speed, quenching time) in real-time, significantly improving material uniformity, reducing deviations, and ultimately ensuring that every batch meets the increasingly narrow tolerance bands required for modern automotive components, particularly in safety-critical applications like suspension springs and valve springs.

- AI-driven optimization of the oil tempering process parameters to achieve superior microstructural homogeneity and consistency.

- Predictive maintenance analytics applied to wire drawing and heat treatment machinery, minimizing unscheduled downtime and improving operational efficiency.

- Automated visual inspection systems (computer vision) for non-destructive testing (NDT) to identify surface defects, seams, or decarburization with higher accuracy and speed than manual methods.

- Supply chain risk management using AI algorithms to predict raw material (steel billet) price volatility and optimize sourcing decisions globally.

- Enhanced inventory management and demand forecasting by integrating OEM production schedules and market trends to minimize buffer stock requirements.

- Simulation and modeling using machine learning to rapidly design new alloy compositions or wire geometries optimized for specific electric vehicle load requirements.

DRO & Impact Forces Of Automotive Oil Tempered Spring Steel Wires Market

The market is fundamentally shaped by powerful interconnected dynamics. Key drivers include the mandatory integration of high-performance suspension components necessary for vehicle safety and handling, the increasing demand for light weighting materials to enhance fuel efficiency and accommodate EV battery mass, and the continuous growth of the global vehicle parc necessitating constant aftermarket supply. Restraints predominantly involve the extreme volatility of raw material costs, specifically high-grade steel and alloying elements like chromium and silicon, alongside the high capital investment required for specialized wire drawing, cleaning, and oil tempering facilities. Opportunities arise from the rapidly expanding electric vehicle segment, which requires custom-engineered springs for managing heavy battery loads, and the potential for developing ultra-high-strength, lighter-weight wire variants using advanced nanostructured steels. These external forces converge to create intense pressure on manufacturers to maintain strict quality standards while simultaneously optimizing cost structures and embracing sustainable production methods.

The primary driving force remains the increasing global emphasis on occupant safety and vehicle performance, compelling OEMs to specify materials with superior fatigue resistance and long-term reliability. Regulatory pressures regarding environmental performance translate directly into demand for lighter steel wires, as every kilogram saved contributes to reduced CO2 emissions or increased EV range. Furthermore, the globalization of automotive platforms necessitates a standardized, high-quality material supply chain, favoring large-scale manufacturers with established global footprints. However, these positive drivers are constantly challenged by macroeconomic instability, which affects consumer purchasing power and, consequently, vehicle production targets, leading to cyclical demand patterns within the spring wire industry.

Impact forces are determined by the synergy between material innovation and manufacturing efficiency. The need for faster processing speeds and lower energy consumption during heat treatment pushes technological boundaries. Competitive intensity is high, driven by differentiation based on surface quality (crucial for fatigue life), metallurgical cleanliness, and consistent mechanical properties. The regulatory force, particularly relating to material traceability and compliance in safety-critical parts, acts as a significant barrier to entry for smaller or non-specialized producers. Ultimately, the market trajectory is dictated by the ability of wire manufacturers to sustainably supply cost-effective, high-reliability materials that align with the automotive industry’s dual mandate of safety enhancement and emission reduction, especially within the complex demands posed by the rapidly evolving electric vehicle architecture.

Segmentation Analysis

The Automotive Oil Tempered Spring Steel Wires market is meticulously segmented to provide clear insights into market dynamics and consumer preferences across various product specifications, end-use applications, and geographical regions. Segmentation by type differentiates between High Carbon Steel (which offers cost efficiency and adequate performance for standard applications) and Alloy Steel (such as Chromium-Vanadium and Chromium-Silicon, tailored for high-stress, high-temperature, or extreme fatigue applications). The application segmentation is crucial, distinguishing the massive requirements of suspension systems from the precision needs of engine and transmission components. Furthermore, segmenting by vehicle type, specifically differentiating between traditional Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs), allows for tracking the significant shifts in material specifications driven by electrification trends and battery mass challenges.

- By Type

- High Carbon Steel (e.g., SWOSC-V)

- Alloy Steel (e.g., Chrome-Silicon, Chrome-Vanadium)

- By Application

- Suspension Systems (Coil Springs, Torsion Bars)

- Engine Components (Valve Springs)

- Transmission Systems (Clutch Springs, Gears)

- Brake Systems

- Other Mechanisms (Seating, Actuators)

- By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles (LCVs, HCVs)

- Electric Vehicles (BEV, PHEV)

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Oil Tempered Spring Steel Wires Market

The value chain for automotive oil tempered spring steel wires commences with upstream activities centered on raw material procurement, specifically high-quality steel billets or rods, typically sourced from integrated steel mills. This stage requires rigorous quality control concerning chemical composition, inclusion content, and surface integrity, as defects at this initial stage severely impact the final spring performance. The midstream processing involves highly specialized steps: hot rolling the billets into wire rods, followed by cold drawing to achieve the specified diameter, and finally, the critical oil tempering and patenting processes, which impart the necessary high tensile strength and ductility. Manufacturers in this segment focus heavily on process control, surface treatment (e.g., shot peening), and non-destructive testing to ensure compliance with demanding automotive standards. Efficiency and consistency in this stage are paramount for defining the component's fatigue life.

Moving downstream, the specialized spring steel wires are sold either directly to Tier 1 automotive component suppliers or, less frequently, to the automotive OEMs themselves. Tier 1 suppliers, such as spring manufacturers, take the wire and form, coil, and finish the specific spring components (e.g., suspension coils, valve springs) before supplying them to vehicle assembly plants. The distribution channel is predominantly direct, characterized by long-term contracts and stringent quality audits, reflecting the safety-critical nature of the final product. Indirect sales occur primarily through distributors serving the automotive aftermarket, providing replacement springs and components. The close collaboration between the wire manufacturer, the spring coiler (Tier 1), and the OEM is essential for optimizing spring design relative to material capabilities and achieving targeted vehicle performance and cost objectives.

The profitability across the value chain is concentrated in the specialized midstream wire manufacturing phase due to the high technological barriers to entry and the required capital expenditure for sophisticated heat treatment lines. Upstream steel producers operate on commodity markets, while downstream spring manufacturers rely on efficient forming processes and strong contractual relationships with OEMs. The shift towards electric vehicles is influencing the value chain by increasing demand for materials that offer both superior strength and reduced weight, thereby placing greater pressure on midstream producers to innovate material compositions and surface treatments. This complexity emphasizes the strategic importance of vertical integration, allowing dominant market players to control quality from the melting stage of the steel to the final drawing and tempering process, mitigating risks associated with external sourcing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Suzuki Garphyttan, Bekaert, Sumitomo Electric, Nippon Steel, POSCO, Kiswire, Suncall Corporation, WDI/Nucor, Loos & Co., Sandvik Materials Technology, Hengtai Steel, Precision Steel, L.B. Steel, GK Steel, Zibo Wujing, Tianjin Dongsheng, KGS Steel, Zhejiang Huzhou, Taiyo Wire, Shanghai Metal Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Oil Tempered Spring Steel Wires Market Key Technology Landscape

The technological landscape of the Automotive Oil Tempered Spring Steel Wires market is defined by continuous process refinements aimed at maximizing material purity, minimizing surface defects, and enhancing fatigue endurance. A primary focus is on advanced heat treatment methodologies, specifically optimizing the oil quenching medium and subsequent tempering cycles. This includes using specialized furnace atmospheres and precise temperature controls to achieve a uniform sorbitic microstructure throughout the wire cross-section, which is directly correlated with superior mechanical properties. Modern production lines utilize continuous in-line patenting and tempering equipment, ensuring highly consistent mechanical properties across massive production batches. Furthermore, non-contact measurement systems, often employing laser or eddy current technology, are crucial for real-time monitoring of wire diameter and surface quality, immediately flagging deviations before material waste occurs.

Material innovation centers on developing next-generation alloy steels that can withstand increasingly demanding conditions, such as higher stress amplitudes and elevated operating temperatures in downsized turbo engines. This includes the proliferation of ultra-high tensile strength (UHTS) wires, often achieved through specialized additions of elements like Niobium or Molybdenum and refined grain structure control. Another key technological area is surface engineering. Since fatigue failures typically initiate at the surface, technologies like intensified shot peening (where micro-pellets are forcefully impacted onto the surface) and specialized coating applications (for corrosion and wear resistance) are vital. These surface treatments induce beneficial compressive residual stresses, significantly extending the service life of safety-critical springs, particularly those used in automotive suspension systems.

Digitalization and automation are increasingly integrated into the wire manufacturing process, forming the backbone of Industry 4.0 initiatives within this sector. This includes sophisticated control systems for wire drawing machines, integrating data from numerous sensors to optimize draft schedules and lubrication systems, thereby reducing friction and maintaining surface integrity. Moreover, advanced simulation software (Finite Element Analysis) is now commonly used during the material and component design phase, allowing manufacturers to predict stress distribution and fatigue life under specific vehicle load cases, accelerating the time-to-market for new wire specifications required by OEMs for novel platforms, especially those supporting electric vehicle battery architecture. This technological convergence ensures that the final product meets the extreme quality and durability expectations of the global automotive sector while optimizing energy efficiency during manufacturing.

Regional Highlights

The regional analysis reveals significant variations in growth trajectories and demand drivers, heavily influenced by localized automotive production capacity, regulatory environments, and the speed of electric vehicle adoption.

- Asia Pacific (APAC): APAC is the global powerhouse for the Automotive Oil Tempered Spring Steel Wires Market, driven overwhelmingly by China, Japan, South Korea, and increasingly India. China’s vast domestic automotive market, coupled with its dominance in global EV manufacturing, ensures sustained high demand for spring steel wires. The region benefits from lower manufacturing costs and substantial investment in high-quality steel production capacity. Japan and South Korea lead in technological adoption and supply specialized, high-performance wires to their globally recognized OEM bases.

- Europe: Europe represents a mature market characterized by stringent quality demands and a rapid transition towards electrification. The focus here is less on volume growth and more on high-specification, premium wires suitable for luxury and high-performance vehicle suspension systems (using complex alloy steels). Regulatory mandates favoring vehicle light weighting and safety drive continuous innovation in material properties. Germany, France, and Italy are central to demand, underpinned by their status as major vehicle exporters.

- North America: The North American market is stable, supported by strong demand from the light truck, SUV, and heavy-duty commercial vehicle segments. The accelerating shift toward electric pickup trucks and SUVs necessitates specialized wires to handle higher payload requirements and increased sprung mass. Manufacturers focus on compliance with FMVSS safety standards and reliable supply chains, often engaging in domestic production to mitigate logistics risks.

- Latin America (LATAM): LATAM, centered around Brazil and Mexico, serves as a crucial manufacturing hub for vehicles destined for North and South American markets. Demand is moderately growing, linked closely to local economic stability and vehicle export volumes. The market typically prioritizes cost-effective, standard high-carbon steel wires for mass-market vehicles, although specifications are slowly improving.

- Middle East and Africa (MEA): This region is currently the smallest consumer, relying heavily on imported vehicles and components. Market growth is primarily linked to localized assembly operations and the development of transportation infrastructure, particularly in countries like South Africa and Saudi Arabia. Demand is generally focused on replacement components and standard specification wires for locally assembled basic vehicle models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Oil Tempered Spring Steel Wires Market.- Suzuki Garphyttan

- Bekaert

- Sumitomo Electric Industries, Ltd.

- Nippon Steel Corporation

- POSCO

- Kiswire Ltd.

- Suncall Corporation

- Wire Drawing Industries (WDI)/Nucor

- Loos & Co., Inc.

- Sandvik Materials Technology

- Hengtai Steel Co., Ltd.

- Precision Steel & Wire

- L.B. Steel

- GK Steel Corporation

- Zibo Wujing Wire and Cable Co., Ltd.

- Tianjin Dongsheng Steel Wire Rope Co., Ltd.

- KGS Steel Corporation

- Zhejiang Huzhou Spring Co., Ltd.

- Taiyo Wire & Cable Co., Ltd.

- Shanghai Metal Corporation

Frequently Asked Questions

Analyze common user questions about the Automotive Oil Tempered Spring Steel Wires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for oil tempered spring steel wires?

The increasing global emphasis on vehicle safety, performance, and light weighting regulations drives the demand for oil tempered wires, which offer the superior tensile strength and fatigue resistance required for critical suspension and engine components, especially in high-stress environments.

How does the shift to Electric Vehicles (EVs) impact spring wire requirements?

EVs generally require specialized spring steel wires with higher yield strength and corrosion resistance due to the increased unsprung mass from heavy battery packs. This demands robust, durable materials capable of handling greater sustained static and dynamic loads compared to ICE counterparts.

What is the difference between High Carbon Steel and Alloy Steel in this market?

High Carbon Steel wires are typically used for standard, cost-sensitive applications, offering good performance. Alloy Steel wires (like Chrome-Silicon or Chrome-Vanadium) are reserved for premium, high-stress, high-temperature components, such as valve springs or high-performance suspension systems, offering superior fatigue life.

Which geographical region holds the largest market share for these wires?

Asia Pacific (APAC), particularly driven by the massive automotive and EV production bases in China, Japan, and South Korea, currently accounts for the largest share of the Automotive Oil Tempered Spring Steel Wires Market volume and value.

What key technological innovation is currently affecting the manufacturing process?

The primary technological focus is on advanced surface engineering techniques, such as intensified shot peening and specialized coatings, which are crucial for inducing compressive residual stresses on the wire surface, thus significantly extending the fatigue life of the final spring component.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager