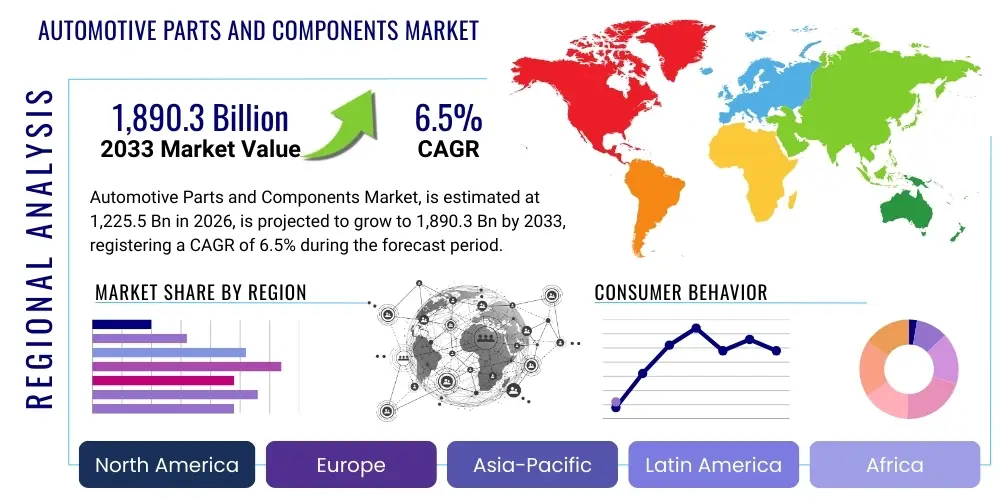

Automotive Parts and Components Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440699 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Parts and Components Market Size

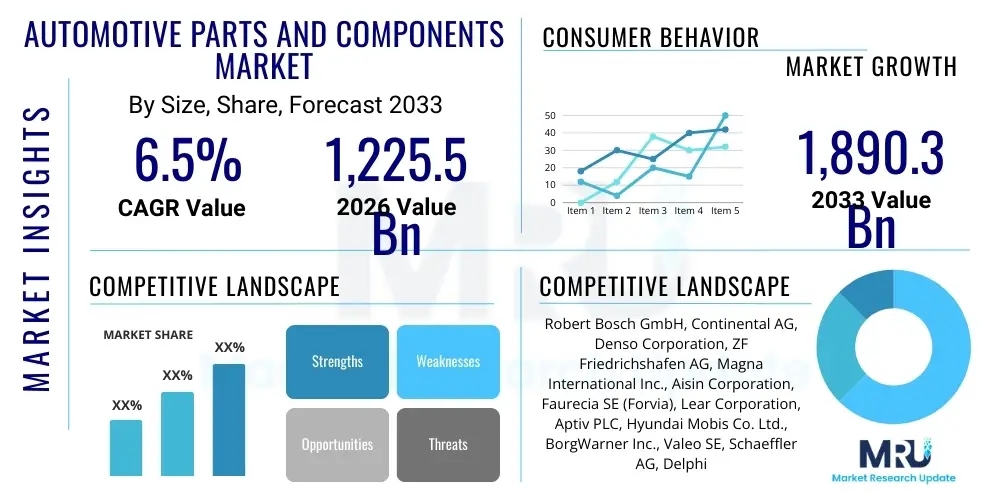

The Automotive Parts and Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1,225.5 Billion in 2026 and is projected to reach USD 1,890.3 Billion by the end of the forecast period in 2033.

Automotive Parts and Components Market introduction

The Automotive Parts and Components Market encompasses a vast array of systems and individual parts essential for the manufacturing, operation, maintenance, and repair of all types of vehicles. This includes everything from fundamental engine and transmission components, chassis systems, braking and steering mechanisms, to sophisticated electronic modules, interior and exterior trim, lighting systems, and tires. These components are supplied to original equipment manufacturers (OEMs) for new vehicle assembly and to the aftermarket for repairs, upgrades, and personalization, forming the backbone of the global automotive industry. The continuous evolution of vehicle technology, driven by consumer demand for enhanced safety, comfort, performance, and environmental efficiency, directly fuels innovation and growth within this critical sector. The intricate supply chain involves raw material suppliers, specialized component manufacturers, and a complex network of distributors.

The major applications of automotive parts and components span across passenger vehicles, commercial vehicles (trucks, buses), off-road vehicles, and even two-wheelers. Their benefits are multifaceted, ensuring vehicle functionality, safety, fuel efficiency, emission reduction, and overall driver experience. Modern advancements in automotive engineering mean components are increasingly integrated with smart technologies, offering features like advanced driver-assistance systems (ADAS), infotainment, and connectivity. Driving factors for market growth include the steady increase in global vehicle production, particularly in emerging economies, coupled with a robust aftermarket demand stemming from an aging vehicle parc and the necessity for routine maintenance and repair. Furthermore, the accelerating shift towards electric vehicles (EVs), autonomous driving, and connected car technologies is fundamentally reshaping the component landscape, necessitating the development of new materials, power electronics, sensors, and software-driven systems.

Automotive Parts and Components Market Executive Summary

The Automotive Parts and Components Market is experiencing transformative shifts driven by global megatrends, primarily the electrification of powertrains, the pursuit of autonomous driving capabilities, and the pervasive integration of connectivity. Business trends indicate a strong focus on strategic partnerships, mergers, and acquisitions among Tier-1 and Tier-2 suppliers to consolidate capabilities, share R&D costs, and broaden technological portfolios, particularly in software and electronics. Suppliers are investing heavily in retooling their manufacturing processes to accommodate new materials and production techniques required for electric vehicle components and lightweight structures. Furthermore, the industry is grappling with supply chain resilience post-pandemic, leading to diversified sourcing strategies and increased regionalization of production to mitigate future disruptions, while also facing intense pressure on pricing and profitability due to fluctuating raw material costs and increased R&D expenditure for next-generation technologies. Sustainability and circular economy principles are also gaining traction, influencing material selection and end-of-life component management.

Regional trends reveal Asia Pacific, particularly China and India, as the dominant hub for both production and consumption, characterized by rapid industrialization and increasing disposable incomes driving new vehicle sales. Europe is leading in stringent emission regulations and the rapid adoption of electric vehicles, pushing component manufacturers towards advanced battery systems, power electronics, and sophisticated ADAS solutions. North America demonstrates strong demand for SUVs and light trucks, alongside significant investments in autonomous vehicle technology and infrastructure, which translates into demand for specialized sensors, computing platforms, and high-strength materials. Latin America and the Middle East & Africa present emerging opportunities, with growing vehicle fleets and a rising need for affordable, durable aftermarket components. These regions are also seeing an influx of investments for local manufacturing, although they remain susceptible to global economic fluctuations and geopolitical instabilities.

Segment trends highlight the rapid expansion of the electronics and electrical components segment, driven by the proliferation of sensors, ECUs, infotainment systems, and battery management units integral to modern vehicles. The powertrain segment is undergoing a fundamental transformation, with internal combustion engine (ICE) component suppliers diversifying into electric motor, inverter, and charging system components. Chassis, braking, and steering systems are evolving towards steer-by-wire and brake-by-wire technologies to support autonomous driving functionalities. Interior components are focusing on advanced human-machine interfaces (HMI), smart surfaces, and customizable comfort features, while exterior components prioritize lightweighting through advanced materials and aerodynamic designs. The aftermarket segment continues its steady growth, propelled by the increasing average age of vehicles and the demand for routine maintenance, repair, and genuine or quality alternative spare parts, further boosted by e-commerce platforms simplifying part procurement.

AI Impact Analysis on Automotive Parts and Components Market

User inquiries concerning AI's impact on the Automotive Parts and Components Market frequently revolve around its potential to revolutionize every stage of the product lifecycle, from design and manufacturing to supply chain management and predictive maintenance. Common questions explore how AI can accelerate product development cycles, enhance manufacturing efficiency and quality control, optimize complex global supply chains, and enable predictive analytics for component failure, thereby extending product lifespan and improving safety. There's significant interest in AI's role in developing next-generation components for autonomous vehicles, such as advanced sensor fusion algorithms and decision-making systems, as well as its application in creating personalized in-cabin experiences. Users are also concerned about the cybersecurity implications of AI-driven systems and the workforce transformation required to adapt to these new technologies, highlighting a balance between optimistic innovation and practical challenges.

- AI-driven generative design and simulation accelerates component development, optimizing weight, strength, and thermal performance for new materials and complex geometries.

- Predictive maintenance analytics, powered by AI, monitors component health in real-time, forecasting potential failures and enabling proactive servicing to minimize downtime and enhance vehicle reliability.

- Enhanced quality control through AI-powered visual inspection systems, detecting microscopic defects in manufacturing lines with greater accuracy and speed than human inspection.

- Optimized supply chain management using AI algorithms for demand forecasting, inventory management, and logistics routing, improving efficiency and resilience against disruptions.

- Development of advanced sensor fusion and perception systems for autonomous vehicles, where AI processes vast amounts of data from multiple sensors to create a comprehensive understanding of the vehicle's surroundings.

- AI integration into manufacturing processes, enabling adaptive robotics and smart factories that can self-optimize for efficiency, reduce waste, and improve operational flexibility.

- Personalized in-car experiences through AI, adjusting climate control, infotainment, and seating preferences based on driver habits and passenger needs, requiring new smart interior components.

- Improved cybersecurity for connected components and vehicle systems, with AI detecting and responding to anomalies and potential threats in real-time, protecting critical vehicle functions and data.

- AI facilitates the development of intelligent battery management systems (BMS) for EVs, optimizing battery performance, extending lifespan, and ensuring safety through sophisticated algorithms.

- Reduced warranty costs and improved customer satisfaction by using AI to analyze field data and identify common component issues, leading to faster design iterations and defect resolution.

DRO & Impact Forces Of Automotive Parts and Components Market

The Automotive Parts and Components Market is profoundly shaped by a confluence of driving forces, inherent restraints, and burgeoning opportunities that exert significant impact. Key drivers include the consistent growth in global vehicle production, particularly in emerging economies where vehicle ownership is on the rise, coupled with the perpetual demand from the aftermarket for maintenance and repair of a continuously growing global vehicle parc. Furthermore, technological advancements, especially in electrification, autonomous driving, and connectivity, necessitate the development and integration of new, sophisticated components. The increasing emphasis on vehicle safety, driven by evolving regulatory standards and consumer expectations, also compels manufacturers to innovate and incorporate advanced braking systems, airbags, and ADAS components. Economic stability and disposable income levels directly influence new vehicle sales and the propensity for aftermarket upgrades, acting as fundamental market accelerators.

However, the market faces notable restraints that temper its growth trajectory. These include volatility in raw material prices, such as steel, aluminum, and rare earth minerals, which directly impacts production costs and profit margins for component manufacturers. Geopolitical tensions and trade disputes can disrupt global supply chains, leading to manufacturing delays and increased logistics expenses, as evidenced by recent events. Stringent environmental regulations, while driving innovation, also impose significant compliance costs and necessitate substantial R&D investments, particularly for traditional ICE component manufacturers transitioning to EV components. Intense competition among suppliers, coupled with pressure from OEMs to reduce costs, can compress profit margins across the value chain. Furthermore, the complexity and high capital expenditure required for developing advanced technologies, especially in rapidly evolving fields like autonomous driving, pose significant barriers to entry and expansion for many players, leading to consolidation.

Amidst these challenges, substantial opportunities are emerging that promise to redefine the market landscape. The accelerating shift towards electric vehicles (EVs) creates entirely new segments for battery systems, electric motors, power electronics, and charging infrastructure components, offering a fertile ground for innovation and investment. The increasing adoption of Advanced Driver-Assistance Systems (ADAS) and the eventual rollout of fully autonomous vehicles generate immense demand for sensors, cameras, radar, lidar, and sophisticated computing platforms. The drive for lightweighting in vehicles, aimed at improving fuel efficiency and extending EV range, fuels opportunities for advanced materials like composites, high-strength steels, and aluminum alloys. Expanding internet connectivity within vehicles also opens avenues for smart components, infotainment systems, and over-the-air (OTA) update capabilities. Moreover, the growth of the e-commerce platform for aftermarket parts distribution is enhancing accessibility and streamlining procurement for both individual consumers and workshops, creating new distribution models and market reach. These forces collectively shape a dynamic and evolving industry.

- Drivers: Growing global vehicle production and sales; increasing average age of vehicles supporting aftermarket demand; rapid technological advancements in EVs, ADAS, and connectivity; rising demand for vehicle safety and performance features; urbanization and economic growth in emerging markets.

- Restraints: Volatility in raw material prices; supply chain disruptions and geopolitical risks; stringent environmental regulations and compliance costs; intense competition and pricing pressure from OEMs; high R&D investments and capital expenditure for new technologies.

- Opportunities: Proliferation of electric vehicles (EVs) and hybrid vehicles; increasing adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies; demand for lightweight materials for improved fuel efficiency and range; growth of connected car technologies and telematics; expansion of e-commerce platforms for aftermarket parts.

- Impact Forces: Technological shifts towards electrification and autonomy; economic cycles influencing consumer spending and vehicle sales; evolving regulatory landscape impacting design and production; supply chain resilience and globalization vs. regionalization trends; environmental sustainability initiatives shaping material and manufacturing choices.

Segmentation Analysis

The Automotive Parts and Components Market is characterized by diverse segmentation, allowing for a detailed understanding of its complex structure and dynamics. These segments help analyze market trends, identify growth opportunities, and understand competitive landscapes across various product types, vehicle applications, end-uses, and material compositions. The primary product categories dissect the vehicle into major systems, reflecting the specialized manufacturing and technological expertise required for each. Vehicle type segmentation distinguishes between the unique demands and component specifications for passenger cars versus heavy-duty commercial vehicles, recognizing their differing operational environments and regulatory requirements. End-use segmentation provides insight into the distribution channels and purchasing behaviors of original equipment manufacturers versus the aftermarket, each representing distinct business models and customer needs. Furthermore, the material segmentation underscores the ongoing innovation in lightweighting and durability, crucial for enhancing vehicle performance and efficiency.

- By Product Type:

- Powertrain & Drivetrain (Engines, Transmissions, Axles, Drive Shafts, Differential Systems, Turbochargers, Electric Motors, Inverters, Battery Management Systems)

- Chassis Systems (Suspension Systems, Steering Systems, Braking Systems, Wheels & Tires)

- Electrical & Electronics (Batteries, Wiring Harnesses, ECUs, Sensors, Lighting Systems, Infotainment Systems, ADAS Components, Telematics Units)

- Interior Components (Seats, Dashboard & Consoles, Airbags, Steering Wheels, Interior Trim, HVAC Systems)

- Exterior Components (Body Panels, Bumpers, Grilles, Mirrors, Windows & Windshields, Exterior Lighting, Aerodynamic Parts)

- Body & Structural Components (Frame, Body-in-white, Doors, Hoods, Trunks)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks, MPVs)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles, Buses, Coaches)

- By End-Use:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement Parts, Accessories, Performance Parts)

- By Material Type:

- Metals (Steel, Aluminum, Magnesium, Copper)

- Plastics & Polymers (Polypropylene, Polyurethane, ABS)

- Composites (Carbon Fiber, Glass Fiber)

- Rubber

- Glass

Value Chain Analysis For Automotive Parts and Components Market

The value chain of the Automotive Parts and Components Market is a complex and highly integrated ecosystem, beginning with upstream raw material extraction and extending through manufacturing, assembly, and distribution to end-users. The upstream segment involves the sourcing of primary raw materials such as various metals (steel, aluminum, copper), plastics, rubber, glass, and specialized chemicals from mining companies, petrochemical industries, and other basic material suppliers. These raw materials undergo initial processing by Tier 3 suppliers, who then provide semi-finished goods or basic components to Tier 2 suppliers. Tier 2 suppliers further process and assemble these into more specialized sub-components like castings, forgings, electronic chips, and wiring harnesses, which are then supplied to Tier 1 manufacturers. This intricate upstream network emphasizes global sourcing strategies to optimize cost, quality, and supply continuity, often making the industry susceptible to raw material price fluctuations and geopolitical disruptions.

Moving downstream, Tier 1 suppliers, which are often large, globally diversified corporations, integrate sub-components and perform complex assembly to produce major automotive systems such such as complete engine assemblies, transmission systems, advanced braking modules, ADAS units, and full interior cockpits. These finished components and modules are then supplied directly to Original Equipment Manufacturers (OEMs) for integration into new vehicle production lines. The relationship between Tier 1 suppliers and OEMs is often collaborative and long-term, involving co-development and stringent quality control. The distribution channel for the aftermarket is more fragmented, encompassing direct sales from component manufacturers to large distributors, wholesalers, independent retailers, authorized service centers, and increasingly, online e-commerce platforms. This multi-channel approach caters to varying customer needs, from bulk purchases by workshops to individual part procurement by consumers. Both direct sales to OEMs and indirect channels to the aftermarket play crucial roles in ensuring market reach and maximizing sales volumes, with increasing focus on optimizing logistics and inventory management for both segments.

Automotive Parts and Components Market Potential Customers

The Automotive Parts and Components Market caters to a diverse range of potential customers, primarily segmented into Original Equipment Manufacturers (OEMs) and various entities within the aftermarket. OEMs represent the largest customer base, comprising global automotive brands that require a vast array of components for the assembly of new vehicles. These relationships are often long-term, contractual, and involve significant collaboration in design, engineering, and quality assurance. OEMs demand high-volume production, stringent quality control, and timely delivery to maintain their production schedules and vehicle launch timelines. The shift towards electrification and autonomous driving is also driving OEMs to seek out suppliers with expertise in new technologies such as battery systems, power electronics, and advanced sensor suites, expanding the scope of their supplier partnerships.

Beyond new vehicle production, the aftermarket constitutes a robust and steadily growing customer segment. This includes independent automotive workshops and service centers that perform maintenance and repair work on existing vehicles, requiring a constant supply of replacement parts. Large retail chains specializing in automotive parts, both physical and online, serve as key distributors to these workshops and direct to end-consumers. Fleet operators, managing large numbers of commercial or passenger vehicles, also represent significant buyers for maintenance parts and specialized components. Finally, individual vehicle owners themselves are direct consumers of aftermarket parts, either for DIY repairs, vehicle upgrades, or personalization, often through retail channels or specialized performance shops. The diverse needs of these end-users, from cost-effective standard replacements to high-performance upgrades, create a multifaceted demand landscape for automotive parts and components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,225.5 Billion |

| Market Forecast in 2033 | USD 1,890.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Magna International Inc., Aisin Corporation, Faurecia SE (Forvia), Lear Corporation, Aptiv PLC, Hyundai Mobis Co. Ltd., BorgWarner Inc., Valeo SE, Schaeffler AG, Delphi Technologies (BorgWarner), Autoliv Inc., Garrett Motion Inc., Tenneco Inc., Visteon Corporation, Hella GmbH & Co. KGaA, Pirelli & C. S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Parts and Components Market Key Technology Landscape

The Automotive Parts and Components Market is undergoing a profound technological transformation, driven by an accelerating shift towards electrification, autonomous driving, connectivity, and smart manufacturing. Advanced material science plays a crucial role, with an emphasis on lightweighting through the adoption of high-strength steels, aluminum alloys, magnesium, and carbon fiber composites to improve fuel efficiency in ICE vehicles and extend range in electric vehicles. In the powertrain domain, innovations focus on efficient electric motors, advanced battery chemistries and management systems (BMS), power electronics (inverters, converters), and sophisticated charging technologies. For traditional internal combustion engines, technological advancements include hybridization, more efficient turbochargers, and emission reduction systems that comply with increasingly stringent global standards. These technologies aim to enhance performance while minimizing environmental impact, requiring significant R&D investment from component suppliers.

The rise of Advanced Driver-Assistance Systems (ADAS) and autonomous driving capabilities necessitates a robust technological landscape in sensor technology, including radar, lidar, ultrasonic sensors, and high-resolution cameras, all integrated with powerful electronic control units (ECUs) and sophisticated AI-driven software algorithms for data processing and decision-making. Vehicle connectivity relies on advanced telematics units, 5G communication modules, and secure cybersecurity protocols to enable seamless communication between vehicles (V2V), with infrastructure (V2I), and with the cloud (V2X), facilitating real-time data exchange for navigation, infotainment, and over-the-air (OTA) updates. Manufacturing processes are also evolving with the adoption of Industry 4.0 principles, including additive manufacturing (3D printing) for prototyping and specialized components, advanced robotics for automated assembly, and big data analytics for predictive maintenance and quality control in smart factories. This integrated technological ecosystem underpins the next generation of automotive components, fundamentally reshaping vehicle design and functionality.

Regional Highlights

- North America: A leader in automotive technology adoption, particularly in ADAS and emerging autonomous driving solutions. Strong demand for SUVs and light trucks fuels market growth. Significant investments in EV charging infrastructure and battery manufacturing are driving local component production. The region boasts a robust aftermarket supported by an aging vehicle fleet and a culture of vehicle customization and repair.

- Europe: Characterized by stringent emission regulations and a rapid transition towards electric vehicles, driving innovation in powertrain electrification, lightweight materials, and advanced safety systems. Germany, France, and the UK are key markets with established automotive industries and a strong focus on premium and luxury vehicle components. Regional growth is influenced by the EU's Green Deal initiatives and circular economy principles.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily due to high vehicle production volumes in China, Japan, South Korea, and India. Rapid urbanization, rising disposable incomes, and expanding middle-class populations are driving new vehicle sales. The region is a global manufacturing hub for a vast array of automotive components, with significant investments in EV battery production and smart mobility solutions.

- Latin America: An emerging market with growing vehicle fleets and increasing demand for affordable and durable aftermarket components. Brazil and Mexico are key players, with substantial automotive manufacturing bases serving both domestic and export markets. The region faces economic volatility but presents long-term growth potential as vehicle ownership rates rise.

- Middle East and Africa (MEA): Characterized by significant potential for market expansion, particularly in GCC countries due to oil wealth driving luxury car demand, and in South Africa with its established automotive industry. Increasing infrastructure development and economic diversification efforts are supporting vehicle sales and demand for both OEM and aftermarket parts. Challenges include political instability and varying regulatory frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Parts and Components Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Magna International Inc.

- Aisin Corporation

- Faurecia SE (Forvia)

- Lear Corporation

- Aptiv PLC

- Hyundai Mobis Co. Ltd.

- BorgWarner Inc.

- Valeo SE

- Schaeffler AG

- Delphi Technologies (BorgWarner)

- Autoliv Inc.

- Garrett Motion Inc.

- Tenneco Inc.

- Visteon Corporation

- Hella GmbH & Co. KGaA

- Pirelli & C. S.p.A.

Frequently Asked Questions

What are the primary factors driving growth in the Automotive Parts and Components Market?

The market's growth is primarily driven by increasing global vehicle production, consistent aftermarket demand from an aging vehicle parc, rapid technological advancements in electric vehicles (EVs) and autonomous driving systems (ADAS), and a global focus on enhanced vehicle safety and performance standards. Economic growth and urbanization in emerging markets also significantly contribute to this expansion.

How is the rise of electric vehicles (EVs) impacting the automotive components industry?

The proliferation of EVs is profoundly reshaping the industry by creating entirely new demand for electric motors, battery systems, power electronics (inverters, converters), and charging components. Simultaneously, it necessitates a significant re-evaluation and transformation for traditional internal combustion engine (ICE) component manufacturers, many of whom are diversifying their product portfolios towards EV-specific technologies.

What are the key challenges faced by manufacturers in this market?

Manufacturers encounter challenges such as volatile raw material prices, disruptions in global supply chains, stringent environmental regulations requiring substantial R&D investments, intense competition leading to pricing pressures, and the high capital expenditure necessary for developing advanced, rapidly evolving technologies like autonomous driving systems.

What role does technology play in the evolution of automotive parts and components?

Technology is central to the industry's evolution, driving innovations in lightweight materials, advanced manufacturing processes (e.g., additive manufacturing, robotics), sophisticated electronic control units (ECUs), sensor technologies for ADAS, and AI-driven software for autonomous functions and connectivity. These advancements are crucial for meeting demands for safety, efficiency, and enhanced driver experience.

Which geographical regions are expected to show the most significant growth?

Asia Pacific, particularly China and India, is anticipated to exhibit the most significant growth due to high vehicle production volumes, rising disposable incomes, and increasing vehicle ownership rates. Europe and North America will also demonstrate substantial growth, driven by technological adoption, EV transition, and robust aftermarket demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager