Automotive Performance Engine Bearings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441790 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Performance Engine Bearings Market Size

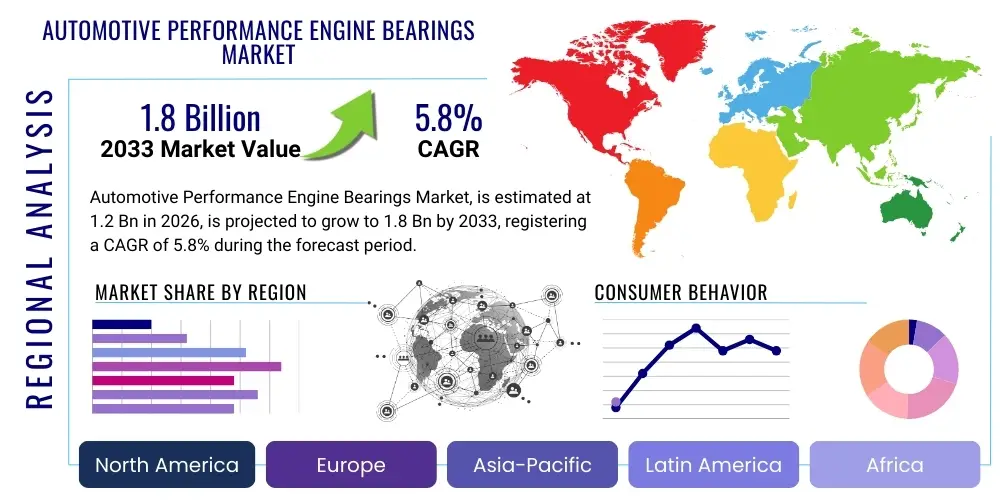

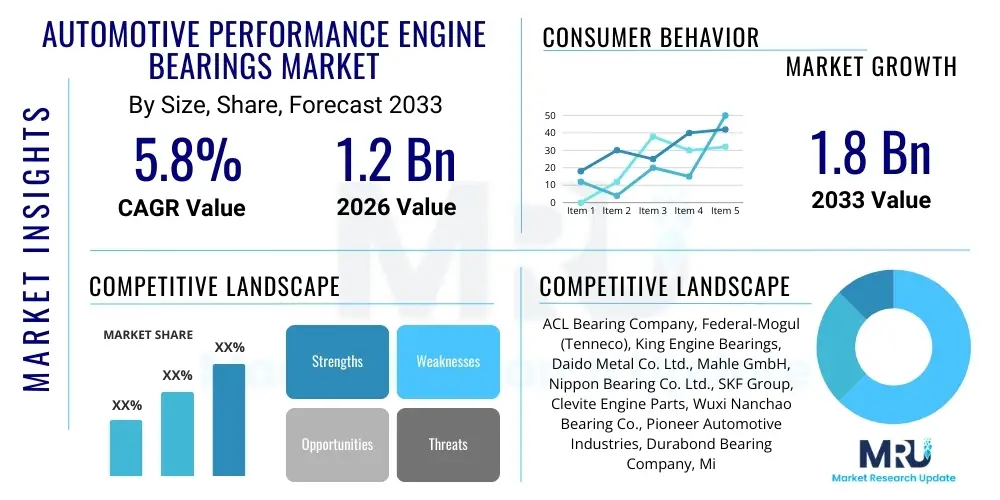

The Automotive Performance Engine Bearings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the global rise in motorsports activities, the increasing demand for high-performance luxury vehicles, and continuous technological advancements in engine design requiring superior bearing materials capable of withstanding extreme operational pressures and temperatures. The performance segment, distinct from standard OEM bearings, focuses on enhanced durability, reduced friction, and optimized load distribution necessary for high revolutions per minute (RPM) environments, driving premium pricing and specialized manufacturing processes within this niche.

Automotive Performance Engine Bearings Market introduction

The Automotive Performance Engine Bearings Market encompasses specialized components critical for the efficient and reliable operation of internal combustion engines operating under high stress, high temperature, and high RPM conditions, typically found in racing vehicles, modified consumer cars, and high-end sports cars. These bearings, including main bearings, connecting rod bearings, and thrust bearings, function to reduce friction between moving parts like the crankshaft and connecting rods, ensuring smooth power transfer and preventing catastrophic engine failure. Unlike conventional OEM bearings designed for standard operating conditions, performance bearings utilize advanced material compositions, such as tri-metal alloys, copper-lead blends, and sophisticated aluminum formulations, often incorporating proprietary coatings like polymide or lead-free alternatives to enhance fatigue resistance and seizure protection under peak loads.

The product description centers on precision-engineered components offering superior hydrodynamic lubrication films and high geometric accuracy. Major applications span professional motorsports (Formula 1, NASCAR, endurance racing), street performance upgrades, and niche manufacturing of exotic vehicles. The key benefits derived from adopting these performance bearings include significantly increased engine longevity, ability to handle higher boost pressures and compression ratios, reduced parasitic power loss due to lower friction, and improved overall reliability during aggressive driving or competitive racing events. Driving factors fueling this market growth include the rising disposable incomes globally enabling increased participation in expensive hobbyist racing and tuning, strict regulation adherence in professional racing demanding maximum engine reliability, and continuous innovation in bearing design to accommodate smaller, yet more powerful turbocharged engine architectures.

Automotive Performance Engine Bearings Market Executive Summary

The Automotive Performance Engine Bearings Market is characterized by robust business trends focusing on material science innovation, particularly the shift towards lead-free and high-strength aluminum alloys, necessitated by environmental regulations and demands for improved fatigue life. Key business activities revolve around strategic partnerships between specialized bearing manufacturers and high-performance engine builders or aftermarket tuners to co-develop custom bearing solutions optimized for specific engine platforms. Market fragmentation remains high at the regional level, though consolidation efforts are observable among major established players seeking to capture lucrative motorsport supply contracts. Furthermore, digital engagement and direct-to-consumer sales channels are gaining prominence, allowing manufacturers to cater directly to the enthusiast and tuning community with highly specialized products.

Regional trends indicate that North America and Europe currently dominate the market share, driven by a deeply ingrained racing culture, high concentration of aftermarket tuning shops, and the presence of globally recognized high-performance vehicle manufacturers. However, the Asia Pacific (APAC) region, particularly China and Japan, is emerging as the fastest-growing market, propelled by rapid expansion in its domestic motorsports scene, increasing affluence leading to higher purchases of luxury performance vehicles, and liberalization of vehicle modification laws in some jurisdictions. Segment trends highlight that the Connecting Rod Bearings segment remains the largest revenue contributor due to their extreme load requirements, while the Tri-metal Material segment, despite higher cost, maintains dominance in extreme professional applications due to its proven resilience and load-carrying capacity. The shift towards sustainable performance materials, like specialized polymers and advanced aluminum composites, represents a critical emerging segment trend.

AI Impact Analysis on Automotive Performance Engine Bearings Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Automotive Performance Engine Bearings Market frequently center on themes such as predictive failure analysis, optimization of manufacturing processes, and accelerated material discovery for next-generation alloys. Users are particularly interested in how AI and Machine Learning (ML) algorithms can utilize vast datasets generated during dynamometer testing and real-world racing events to predict bearing wear rates, thereby allowing for highly optimized maintenance schedules and preventing catastrophic engine failures in high-stakes environments. Key concerns include the accessibility of proprietary engine data necessary to train robust AI models and the standardization required across different engine platforms for broad applicability. Expectations are high regarding AI’s ability to drastically shorten the product development cycle by simulating millions of operational hours under varied stress conditions, leading to faster deployment of superior bearing technology.

The implementation of AI/ML technologies promises revolutionary changes across the entire value chain, from raw material procurement to post-sale monitoring. In manufacturing, AI-driven quality control systems can utilize high-speed imaging and sensor data to detect microscopic imperfections in surface finishes or geometric tolerances that would be invisible to traditional inspection methods, ensuring every bearing meets the stringent quality requirements of the performance segment. Furthermore, computational fluid dynamics (CFD) enhanced by AI allows engineers to model the complex hydrodynamic film behavior under extreme oscillatory motion with greater accuracy, leading to designs that minimize friction while maximizing load capacity. This enhanced simulation capability significantly reduces the need for expensive and time-consuming physical prototyping, accelerating innovation cycles necessary to keep pace with rapid engine technological evolution, especially in hybrid and highly boosted internal combustion powerplants.

- AI-driven predictive maintenance modeling minimizes unexpected engine bearing failures in motorsport applications.

- Machine Learning optimizes bearing geometry and clearance parameters based on real-time engine telemetry data.

- AI accelerates material science research, aiding in the discovery and validation of novel, lead-free, high-fatigue resistant bearing alloys.

- Automated visual inspection using deep learning enhances quality control, detecting micro-surface defects in manufacturing.

- Supply chain resilience is improved through AI algorithms forecasting demand shifts for specialized performance materials.

DRO & Impact Forces Of Automotive Performance Engine Bearings Market

The market dynamics of Automotive Performance Engine Bearings are shaped by powerful impact forces stemming from increasing performance expectations, regulatory mandates, and material innovation challenges. Key drivers include the ever-increasing specific power output (horsepower per liter) of modern engines, necessitating components capable of handling significantly higher internal stresses and thermal loads, particularly in turbocharged applications. This demand is amplified by the growing popularity and professionalism of global motorsports, which serve as crucial testing grounds for extreme component reliability. Conversely, the market faces significant restraints, primarily the stringent global phase-out of traditional lead and cadmium-based bearing materials due to environmental concerns, forcing manufacturers to invest heavily in finding suitable, high-performance, and cost-effective alternatives. Furthermore, the specialized nature of the performance segment means lower production volumes compared to OEM markets, leading to higher manufacturing complexity and costs, which can restrict broader market adoption.

Opportunities in this sector are abundant, centered around the development of advanced sputter bearing technologies and Physical Vapor Deposition (PVD) coatings, which offer superior wear resistance and fatigue strength, especially when used in combination with modern engine oils. The trend towards lightweighting in engine components also presents an avenue for growth, pushing development towards high-strength aluminum alloys that reduce reciprocating mass without compromising durability. The main impact forces involve the competitive environment within motorsports driving constant iterative improvements, the supply chain volatility for specialized raw materials (e.g., copper, tin, proprietary polymers), and the rapid pace of engine design evolution (e.g., downsizing and turbocharging) that constantly resets performance thresholds for bearing specifications. Balancing the need for extreme durability with environmental sustainability remains the most significant long-term impact force guiding strategic investments in R&D.

Segmentation Analysis

The Automotive Performance Engine Bearings Market is primarily segmented based on material type, product type, vehicle type, and distribution channel, reflecting the highly specialized nature and diverse end-user applications within the performance tuning and racing industries. Material segmentation is crucial as it dictates the bearing’s load-carrying capacity, friction coefficient, and compatibility with various crank shaft materials. The evolution in material science is continuously challenging traditional tri-metal structures with advanced aluminum and specialized polymer composites, each offering a distinct balance of performance and environmental compliance. Furthermore, product type segmentation distinguishes the main bearings, which support the crankshaft, from the connecting rod bearings, which handle explosive combustion forces, and the thrust bearings, which manage axial movement, with each type requiring highly specific design criteria and tolerances tailored for high-performance operation.

Vehicle type segmentation separates the requirements of professional motorsports, which demand uncompromising reliability under transient extreme conditions, from high-performance street vehicles, which prioritize long-term durability and noise reduction alongside enhanced load capacity. The distribution channel breakdown reflects how these specialized products reach the end-user, differentiating between direct supply agreements with engine builders and the extensive aftermarket network that services the tuning community. Understanding these granular segmentations is vital for manufacturers to effectively target their product offerings, whether it is high-precision, lead-free tri-metal bearings for top-tier racing teams or durable, cost-effective aluminum performance bearings for the mass aftermarket tuning segment. This strategic focus ensures that product development aligns directly with the specific, demanding needs of diverse high-performance engine applications globally.

- Material Type

- Tri-metal (Copper-lead or Bronze substrates with specialized overlays)

- Bi-metal (Aluminum-based Alloys)

- Polymer Coated Bearings (Including advanced PTFE and PEEK coatings)

- Product Type

- Main Bearings

- Connecting Rod Bearings (Rod Bearings)

- Thrust Bearings

- Vehicle Type

- Motorsport Vehicles (F1, NASCAR, Rally, Drag Racing)

- High-Performance Street Vehicles (Luxury Sports Cars, Tuner Cars)

- Marine and Aviation Performance Engines (Niche Applications)

- Distribution Channel

- Original Equipment Manufacturers (OEMs/OES)

- Aftermarket (Specialty Distributors, E-commerce, Performance Shops)

Value Chain Analysis For Automotive Performance Engine Bearings Market

The value chain for Automotive Performance Engine Bearings begins with upstream analysis, focusing heavily on the procurement of high-purity, specialized raw materials, including copper, tin, lead (where still permitted), aluminum alloys, and proprietary polymer coatings. Raw material quality is paramount, as even minute inconsistencies can compromise the structural integrity and performance longevity of the finished bearing under high stress. Key activities at this stage involve smelting, casting, and precision rolling of the base alloy strip, often requiring highly specialized metallurgical processes controlled by a limited number of global suppliers. The integration of high-precision sensors and testing equipment during raw material preparation ensures the stringent quality standards demanded by performance applications are met before reaching the manufacturing stage, representing a critical, high-value component of the upstream segment.

Midstream activities involve sophisticated manufacturing processes, including stamping, complex machining (turning and boring), and specialized surface treatments such as electroplating, sputtering, or PVD coating application. These processes require extremely high dimensional accuracy (measured in microns) and strict adherence to geometric tolerances to maintain the required oil clearance and hydrodynamic efficiency. The downstream analysis focuses on distribution channels, which are typically bifurcated. Direct channels involve exclusive supply relationships with high-performance engine builders, professional race teams, and niche vehicle manufacturers, where product customization and technical support are paramount. Indirect channels rely on a network of specialized aftermarket distributors, performance tuning shops, and increasingly, specialized e-commerce platforms that cater directly to the global tuning and enthusiast community, providing rapid access to a wide range of standard and oversized performance bearing sets.

Automotive Performance Engine Bearings Market Potential Customers

The primary customer base for Automotive Performance Engine Bearings is highly specialized and demanding, requiring components that offer superior reliability and optimized friction characteristics over standard OEM parts. The most prominent end-users are professional motorsports teams and organizations, including Formula racing circuits, touring car championships, and specialized endurance racing teams. These customers purchase in large volumes directly from manufacturers, often demanding custom specifications, specific material composites, and accelerated delivery schedules to meet strict racing season timelines. The reliability of these bearings is directly linked to competitive success, making them a high-priority procurement item where cost secondary to performance integrity.

A second major customer group includes aftermarket performance tuning shops and independent engine builders. These businesses specialize in upgrading and modifying consumer vehicles for enhanced power and durability, catering to street racers, drag racers, and automotive enthusiasts. They require a diverse inventory of performance bearings compatible with various popular engine platforms (e.g., specific Japanese, American, or German engine families) and typically source components through authorized aftermarket distributors. Finally, niche Original Equipment Manufacturers (OEMs) specializing in limited-production, high-end luxury sports cars and exotic vehicles also constitute a high-value customer segment, incorporating these advanced bearings directly into their factory engines to support warranted high-output specifications and maintain their brand reputation for extreme performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ACL Bearing Company, Federal-Mogul (Tenneco), King Engine Bearings, Daido Metal Co. Ltd., Mahle GmbH, Nippon Bearing Co. Ltd., SKF Group, Clevite Engine Parts, Wuxi Nanchao Bearing Co., Pioneer Automotive Industries, Durabond Bearing Company, Miba AG, Kolbenschmidt Pierburg AG, Trelleborg AB, Metavation (Dana Inc.) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Performance Engine Bearings Market Key Technology Landscape

The technological landscape of the Automotive Performance Engine Bearings Market is characterized by continuous refinement in material science and manufacturing precision, aimed at achieving higher fatigue strength, improved seizure resistance, and reduced friction. A paramount technological trend is the evolution of bearing overlays. While traditional electroplated overlays are still utilized, advanced techniques like Physical Vapor Deposition (PVD) and sputtering are gaining prominence. Sputtered bearings involve depositing a very thin, dense, and highly wear-resistant layer onto the bearing substrate, often incorporating nickel, chromium, or proprietary carbide blends. This process significantly enhances the load-carrying capacity and wear resistance, making them ideal for the most extreme pressure environments found in modern turbocharged diesel and gasoline engines operating at peak power, thereby extending engine reliability under aggressive conditions.

Another crucial technological advancement involves the development and increasing adoption of lead-free bearing materials, driven by global environmental mandates such as the European Union’s End-of-Life Vehicle (ELV) directive. Manufacturers are heavily investing in high-strength aluminum alloys (e.g., AlSn20Cu) coupled with innovative micro-additions of elements like silicon or strontium to achieve fatigue characteristics comparable to traditional copper-lead alloys. Furthermore, the use of advanced polymer coatings, particularly PTFE (polytetrafluoroethylene) or specialized polymer/metallic composites, applied over bi-metal substrates, offers superior embeddability for handling debris and improved conformability, which is essential for engines that experience slight shaft misalignment or temporary loss of oil film under transient loads. These polymer coatings not only reduce friction but also provide a crucial layer of protection against metal-to-metal contact during startup or oil starvation events, ensuring engine survival when lubrication is momentarily compromised.

The manufacturing technology itself continues to advance, leveraging ultra-precision CNC machinery and sophisticated metrology systems to ensure geometric consistency and tight dimensional control. The bearing wall thickness and crush height must be maintained with micron-level accuracy to guarantee proper interference fit and optimal oil film thickness under dynamic conditions. Furthermore, computational modeling, including Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD), is now standard practice, allowing engineers to simulate thermal expansion, dynamic loading, and fluid behavior across the bearing interface before physical prototyping. This digital simulation capability significantly optimizes the groove design, oil hole placement, and bearing eccentricity profile, which are crucial factors in minimizing cavitation and ensuring stable hydrodynamic operation at elevated RPMs, solidifying the role of digital engineering in modern performance bearing development.

Regional Highlights

The global Automotive Performance Engine Bearings Market displays distinct regional consumption and manufacturing patterns, heavily influenced by motorsport regulations, local economies, and cultural engagement with high-performance automotive tuning. North America (NA), encompassing the United States and Canada, holds a dominant market share due to its established and highly commercialized racing industries (NASCAR, NHRA, IndyCar), a large and affluent population of automotive enthusiasts, and a robust aftermarket tuning sector. The demand here is characterized by a strong preference for durable, high-load tri-metal bearings tailored for V8 and turbocharged import engines, supported by an extensive network of specialist distributors and performance parts retailers. Regulatory environments, while strict on emissions, generally allow for a vibrant aftermarket modification industry.

Europe, driven by nations such as Germany, the UK, and Italy, represents the second largest market, characterized by intense focus on sophisticated engineering, high-end luxury performance vehicles (e.g., Porsche, Ferrari, BMW M), and premier global racing series (Formula 1, WEC). European demand leans towards technologically advanced, lead-free solutions, including sputter-coated and PVD bearings, often supplied directly to prestige engine manufacturers and elite racing teams. The emphasis is on lightweight materials and friction reduction to meet highly competitive efficiency and performance targets. Meanwhile, the Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, is the fastest-growing market segment. This growth is fueled by increasing disposable income, rapid adoption of motorsports (particularly regional GT and Touring Car championships), and a burgeoning enthusiasm for customized performance vehicles. While Japan remains a leader in technology adoption, China’s sheer market volume and accelerating shift towards sophisticated tuning culture provide immense future growth potential.

- North America: Market dominance due to deep-rooted motorsports culture (NASCAR, Drag Racing) and a massive aftermarket tuning industry, demanding high durability and proven reliability.

- Europe: High demand for technologically advanced, often custom-engineered, lead-free performance bearings, driven by premium vehicle manufacturers and top-tier global racing series (F1, WEC).

- Asia Pacific (APAC): Fastest growing region, propelled by rising affluence in emerging economies, expanding local motorsports activities, and the increasing market presence of high-performance tuning companies in countries like China and South Korea.

- Latin America (LATAM): Growth concentrated in Brazil and Mexico, linked to regional racing circuits and a growing, albeit volatile, demand for engine reliability upgrades in challenging operating conditions.

- Middle East & Africa (MEA): Niche market focused primarily on high-end luxury and supercar performance upgrades, driven by localized affluence and extreme climate operation requiring enhanced thermal stability in bearings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Performance Engine Bearings Market.- ACL Bearing Company

- Federal-Mogul (Tenneco)

- King Engine Bearings

- Daido Metal Co. Ltd.

- Mahle GmbH

- Nippon Bearing Co. Ltd.

- SKF Group

- Clevite Engine Parts

- Wuxi Nanchao Bearing Co.

- Pioneer Automotive Industries

- Durabond Bearing Company

- Miba AG

- Kolbenschmidt Pierburg AG

- Trelleborg AB

- Metavation (Dana Inc.)

- NTN Corporation

- Jingye Machinery Manufacturing Co., Ltd.

- Taiho Kogyo Co., Ltd.

- Shaanxi Automotive Industry Co., Ltd.

- Donghua Chain Group

Frequently Asked Questions

Analyze common user questions about the Automotive Performance Engine Bearings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes performance engine bearings from standard OEM bearings?

Performance bearings are engineered using advanced materials (e.g., tri-metal alloys, sputtered overlays) and tighter tolerances to withstand significantly higher loads, temperatures, and dynamic stresses common in racing or highly modified engines, offering superior fatigue life and seizure resistance compared to standard OEM components designed for typical street use.

Which material type currently dominates the high-performance segment?

The Tri-metal material type, typically consisting of a steel backing, a copper or bronze intermediate layer, and a thin, often electroplated or sputtered overlay, dominates the high-performance segment. This structure provides the best combination of high fatigue strength and excellent surface characteristics for hydrodynamic lubrication under extreme pressure.

How are environmental regulations impacting performance bearing manufacturing?

Environmental regulations, particularly those banning lead and cadmium (e.g., EU ELV directive), are forcing manufacturers to rapidly transition toward lead-free alternatives, primarily high-strength aluminum-based alloys and proprietary polymer coatings, which must be rigorously tested to match or exceed the performance characteristics of older, restricted materials.

What is the role of sputtering and PVD in advanced bearing technology?

Sputtering and Physical Vapor Deposition (PVD) are vacuum coating technologies used to deposit extremely thin, dense, and hard metallic or ceramic layers (like specialized nickel or chromium composites) onto the bearing surface. This significantly enhances wear resistance, prevents material transfer, and improves surface hardness, essential for extreme transient loading conditions in racing engines.

What are the primary challenges facing the aftermarket performance bearing sector?

The main challenges include managing supply chain complexity for specialized materials, maintaining consistent quality control across lower volume production batches, and ensuring product compatibility and availability for the vast diversity of engine platforms modified by the global tuning community, complicated by counterfeit components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager