Automotive Power Folding Mirror Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442731 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Power Folding Mirror Systems Market Size

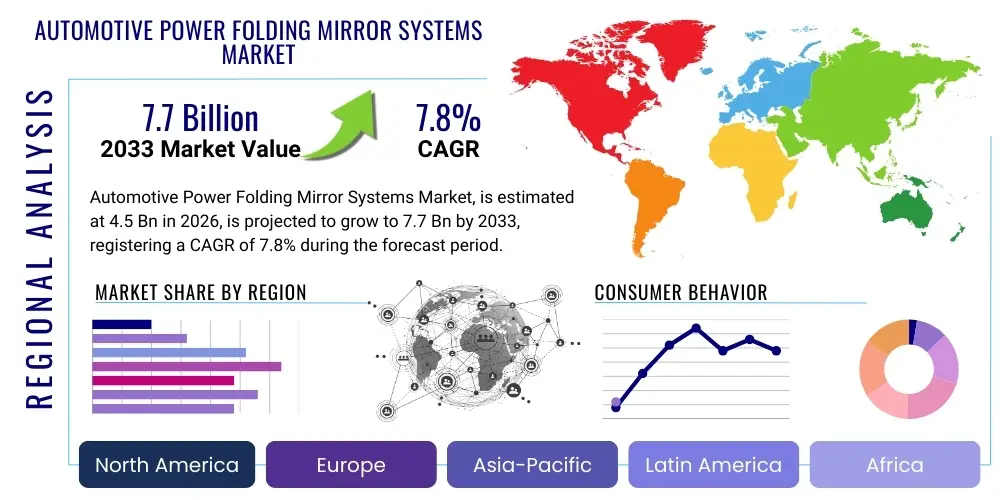

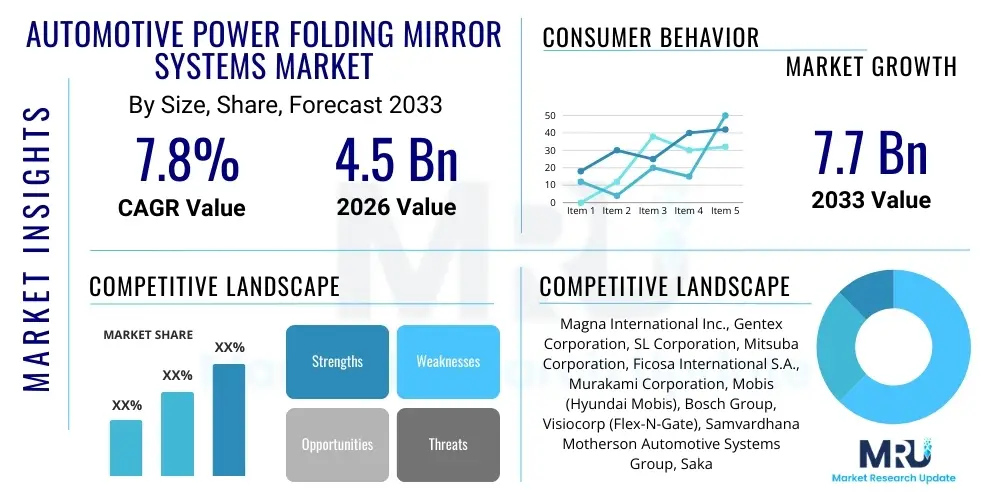

The Automotive Power Folding Mirror Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Automotive Power Folding Mirror Systems Market introduction

The Automotive Power Folding Mirror Systems Market encompasses the manufacturing, distribution, and integration of electronically controlled side view mirrors designed with actuators that allow them to fold inward against the vehicle chassis. This critical feature is predominantly driven by demands for enhanced vehicle protection in narrow spaces, improved pedestrian safety standards, and increasing convenience features within modern automotive architecture. The product, fundamentally an electromechanical assembly, consists of a mirror glass, housing, motor unit, gearbox, and electronic control unit (ECU) which communicates via the vehicle's onboard network (often CAN or LIN bus). Major applications span across passenger vehicles, including high-volume segments like Sedans, Sports Utility Vehicles (SUVs), and Premium/Luxury vehicles, where the feature is often standard or bundled into advanced convenience packages. The primary benefits include preventing accidental damage in tight parking lots or automated car washes, improved aerodynamic efficiency when folded, and compliance with stringent urban driving regulations globally. The market's foundational growth is strongly influenced by rising global vehicle production, particularly in emerging economies where vehicle density is increasing, alongside the consumer trend prioritizing comfort and integrated safety features in vehicle selection.

The complexity of these systems has risen significantly due to the necessity of integrating multiple functionalities into the mirror assembly. Beyond simple folding mechanisms, modern power folding mirrors often incorporate heating elements for defrosting, blind-spot detection (BSD) indicators, auto-dimming features, integrated turn signals (puddle lamps), and sophisticated position memory functions linked to individual driver profiles. This multifunctional integration requires robust, miniaturized electronic components and reliable electromechanical actuators, driving innovation in component design and material science, particularly focusing on lightweighting and durability under harsh environmental conditions. The power folding capability transitions the mirror from a passive, fixed component to an active, regulated system integral to the vehicle's electrical domain. Furthermore, the standardization of power folding mirrors, especially in European and North American markets, is increasingly being observed in mid-segment vehicles, moving the technology beyond just the premium segment and positioning it as a fundamental expectation for contemporary vehicles, thus widening the market penetration and accelerating volume growth.

A significant driving factor for market expansion is the continuous evolution of global vehicle safety standards and consumer expectations regarding vehicle automation and convenience. The perception of vehicle quality is now intrinsically linked to the level of electronic integration and intelligent features offered. Power folding mirrors mitigate insurance risks associated with external damage and contribute to overall vehicle longevity, appealing directly to both manufacturers seeking differentiation and end-consumers valuing practical utility. As original equipment manufacturers (OEMs) look to streamline vehicle platforms globally, standardizing power folding mirror systems across different models reduces manufacturing complexity in the long run, even if the initial component cost is higher than fixed mirror systems. This strategic standardization by major automotive groups reinforces the market's long-term stability and projected growth trajectory.

Automotive Power Folding Mirror Systems Market Executive Summary

The Automotive Power Folding Mirror Systems Market is characterized by robust growth, primarily propelled by global regulatory pressures focusing on enhanced vehicle safety and the escalating consumer demand for premium features and convenience across all vehicle segments. Business trends indicate a strong push towards miniaturization of motor assemblies and increased electronic integration capabilities, supporting complex features like integration with surround-view camera systems and automatic actuation based on GPS location (e.g., when approaching a home garage). Key market players, predominantly Tier 1 suppliers, are heavily investing in developing modular mirror systems that can be easily customized for various OEM specifications while maintaining high performance and reliability standards, aiming for economies of scale in component production. The market dynamics also reflect a strategic shift towards suppliers capable of managing global supply chains and offering sophisticated software integration expertise, moving the competition from mere hardware provision to system integration partnership.

Regional trends reveal Asia Pacific (APAC), particularly China and India, as the fastest-growing market due to explosive growth in local vehicle production, rising disposable incomes, and the rapid adoption of electronic features in mid-segment vehicles. Europe maintains a strong foothold, driven by stringent pedestrian protection norms and the high density of urban traffic, necessitating anti-damage features like power folding. North America represents a mature market focusing heavily on premium SUVs and light trucks, where folding systems often include robust features like towing visibility settings and advanced heating capabilities suitable for severe weather conditions. Segment trends show that the OEM segment dominates the market as power folding mirrors are standard fitments, contrasting the smaller, though stable, aftermarket segment primarily catering to repairs, replacements, and luxury upgrades of older vehicle models. Furthermore, the motor type segmentation is witnessing a gradual preference shift towards brushless DC (BLDC) motors due to their extended lifespan, efficiency, and quieter operation compared to traditional brushed DC motors, aligning with the luxury and electric vehicle market demands for reduced noise, vibration, and harshness (NVH) levels.

In summary, the market trajectory is decisively upward, underscored by technological convergence where the mirror assembly is transforming from a simple reflecting device into a complex electronic sensor housing unit. This evolution ensures continued revenue opportunities for specialized component manufacturers and system integrators. The focus on sustainability is also emerging as a trend, with manufacturers exploring lighter, recyclable materials for mirror housings to reduce overall vehicle weight and improve fuel efficiency or electric range. The competitive landscape is fragmented but led by a few dominant global Tier 1 entities that control the majority of OEM supply contracts, setting high barriers to entry for new competitors who lack the necessary integration expertise and proven reliability history required by major automotive clients globally.

AI Impact Analysis on Automotive Power Folding Mirror Systems Market

User queries regarding AI's impact on automotive mirror systems primarily revolve around enhanced functionality, predictive maintenance capabilities, and the seamless integration of digital mirrors (Camera Monitoring Systems - CMS). Common concerns include the reliability of AI-driven actuation (e.g., automatic folding based on proximity sensors or navigation data), the security of data generated by integrated cameras and sensors, and the potential obsolescence of purely mechanical folding systems as vehicles transition towards full autonomy. Users anticipate that AI will personalize mirror settings based on biometric or habitual driving patterns, optimize mirror usage to reduce power consumption, and proactively diagnose motor or sensor failures before they occur. There is a strong expectation that AI will facilitate the final leap from sophisticated electromechanical mirrors to fully intelligent CMS units, where the folding mechanism itself might become part of a larger, software-defined control system that manages all external visualization needs based on real-time driving conditions and vehicle state.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast motor wear, gearbox misalignment, or electronic failure in the folding mechanism, scheduling maintenance preemptively.

- Contextual Automatic Folding: AI algorithms process geo-location, vehicle speed, parking sensor data, and road type to determine the optimal moment to fold or unfold mirrors automatically, minimizing risk of damage.

- Personalized Driver Profiles: AI learns individual driver preferences for mirror angle, heating intensity, and automatic folding triggers, linked through cloud services or in-vehicle ECUs.

- Integration with Autonomous Driving (AD): AI manages the transition from physical mirrors to CMS views based on the operational level of autonomy (e.g., folding physical mirrors when the vehicle is in high-level self-driving mode and relies solely on cameras).

- Optimized Power Management: AI controls the precise motor torque and duty cycle required for folding, ensuring minimal electrical load on the vehicle's battery, particularly critical in Electric Vehicles (EVs).

- Enhanced Manufacturing Quality: Applying machine learning to monitor assembly lines for micro-defects in motor winding or gear train alignment, improving the consistency and reliability of the final product.

DRO & Impact Forces Of Automotive Power Folding Mirror Systems Market

The market is predominantly driven by increasing global safety regulations, especially those mandated in the European Union and specific Asian countries, which require mirrors to withstand impact and minimize injury to pedestrians in case of collision, often necessitating collapsible or folding designs. The continuous technological advancements, including the incorporation of ADAS components like blind-spot monitors and cameras into the mirror housing, exponentially increase the perceived value and necessity of the entire assembly, pushing OEMs to adopt these systems standardly. Conversely, the market faces significant restraints, primarily stemming from the substantially higher manufacturing cost and the increased complexity associated with designing, producing, and integrating electromechanical folding systems compared to static mirrors. Moreover, the reliability challenge related to electronic components exposed to severe environmental factors (vibration, moisture, extreme temperature fluctuations) poses a continuous engineering hurdle that suppliers must overcome to meet OEM durability standards. Opportunities lie heavily in the burgeoning Electric Vehicle (EV) sector, where lighter, more aerodynamic, and digitally integrated folding systems are crucial for maximizing driving range and supporting next-generation connectivity features, paving the way for sophisticated, high-value components.

Impact forces influencing the market are multifaceted, combining economic, technological, and regulatory pressures. Economically, fluctuations in raw material prices, particularly for specialized plastics, copper wiring, and rare earth magnets used in motor construction, directly affect Tier 1 supplier profitability and subsequent pricing to OEMs. Technologically, the rapid evolution towards Camera Monitoring Systems (CMS) presents a potential disruptive force; while CMS does not eliminate the need for an external assembly housing, it fundamentally changes the function, potentially shifting investment away from complex mechanical folding mechanisms towards digital processing units, although regulatory acceptance of CMS as a full replacement for physical mirrors is still progressing globally. Regulatory impact is high, with mandates on pedestrian safety shaping design requirements. Furthermore, geopolitical tensions and trade barriers significantly influence the global automotive supply chain, forcing manufacturers to regionalize production and seek robust, multi-source supply strategies to mitigate risks of delays or cost surges, impacting the standardization and global implementation timelines of new mirror system designs across multinational automotive groups.

The overall market trajectory is defined by a balance between the undeniable consumer desire for convenience and safety integration (drivers) and the inherent manufacturing cost and complexity (restraints). Strategic emphasis on lightweighting materials, such as specific aluminum alloys and high-performance composites for mirror bases and actuators, represents a significant focus area, attempting to mitigate the cost barrier while simultaneously addressing the increasing demand for fuel efficiency and EV range optimization. The transition period where power folding mirrors co-exist with increasingly sophisticated ADAS features ensures market stability, but the long-term vision clearly points towards fully smart, digital systems. Consequently, companies that can successfully manage the transition from electromechanical excellence to integrated digital system architecture will secure dominant market positions, leveraging opportunities created by urbanization and the subsequent requirement for damage mitigation in densely populated driving environments, reinforcing the value proposition of power folding capability.

Segmentation Analysis

The Automotive Power Folding Mirror Systems Market is extensively segmented based on several technical and commercial parameters, providing a granular view of market dynamics and adoption trends across different vehicle classes and technological implementations. Key segmentation criteria include the type of motor mechanism (Brushed DC vs. Brushless DC), the component type (Actuator/Motor Assembly, Mirror Housing, and Electronic Control Unit/ECU), the vehicle type (Passenger Cars vs. Commercial Vehicles), the sales channel (OEM vs. Aftermarket), and the level of integration (Basic Folding vs. Advanced Integrated Systems featuring heating, BSD, and memory functions). This complex segmentation helps stakeholders—from component manufacturers to final vehicle assemblers—to tailor their product development strategies and marketing efforts toward the most lucrative and rapidly evolving sub-sectors. The segmentation based on integration level is particularly crucial, as it reflects the premiumization trend, where systems incorporating multiple electronic features command higher prices and represent a significant portion of the total market value, especially in North America and European luxury vehicle segments, driving higher R&D investment into integration challenges.

- By Component:

- Actuator/Motor Assembly

- Mirror Housing & Glass

- Electronic Control Unit (ECU) & Wiring Harness

- By Motor Type:

- Brushed DC Motor

- Brushless DC (BLDC) Motor

- By Vehicle Type:

- Passenger Cars (Sedans, Hatchbacks, SUVs)

- Commercial Vehicles (LCVs, HCVs)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement & Upgrade)

- By System Integration:

- Basic Power Folding System

- Advanced Integrated Systems (with Heating, Blind Spot Detection, Auto-Dimming, Camera Integration)

- By Material Type (Housing):

- Plastics (ABS, Polycarbonate)

- Metals and Alloys (Aluminum)

Value Chain Analysis For Automotive Power Folding Mirror Systems Market

The value chain for Automotive Power Folding Mirror Systems is intricate and highly dependent on specialized Tier 2 and Tier 3 component suppliers. Upstream analysis involves the procurement of highly specific raw materials, including high-grade engineering plastics for mirror housings and frames (requiring UV resistance and impact tolerance), rare earth magnets and copper wire for the electric motors, and specialized electronic components (microcontrollers, sensors, communication chips) for the ECUs. The quality and stable supply of these upstream materials are critical, as they directly influence the durability, performance, and cost of the final assembly. Tier 2 suppliers focus on manufacturing precision components, such as gear sets for the folding mechanism, specialized motors, and custom PCBs. These suppliers operate under stringent quality control standards mandated by Tier 1 integrators. Efficient sourcing and robust logistics management at this stage are vital for maintaining competitive pricing and ensuring timely delivery for mass vehicle production schedules.

Midstream activities are dominated by Tier 1 suppliers (e.g., Magna, Gentex, Bosch) who manage the complex integration, assembly, and rigorous testing of the complete mirror system. Tier 1 suppliers design the overall architecture, optimize the electromechanical interface, and integrate all required functionalities (folding, heating, BSD, cameras) into a single, cohesive unit that meets specific OEM platform requirements. This stage involves sophisticated assembly processes, including precise calibration of the folding mechanism and programming of the ECU to communicate seamlessly with the vehicle's central bus system (CAN/LIN). Testing procedures are extremely detailed, encompassing endurance testing for millions of folding cycles, environmental stress testing, and electromagnetic compatibility (EMC) verification, ensuring the mirror system functions flawlessly throughout the vehicle's lifespan. Downstream activities involve the direct supply of these finished, validated mirror systems to Original Equipment Manufacturers (OEMs) for integration onto the vehicle assembly line. This supply is characterized by "Just-in-Time" (JIT) delivery protocols, requiring extreme efficiency and reliability from the Tier 1 suppliers to avoid production bottlenecks for the OEM.

The distribution channel is overwhelmingly dominated by the direct channel, where Tier 1 suppliers contract directly with OEMs for large-volume, long-term supply agreements spanning entire vehicle model generations. The aftermarket distribution (indirect channel), while smaller in volume, focuses on replacement parts and occasional upgrades, relying on independent distributors, certified repair shops, and online platforms. The direct channel dictates technological development, quality standards, and pricing benchmarks across the entire value chain. Strategic partnerships between OEMs and Tier 1 suppliers, often involving co-development projects for next-generation vehicle platforms, further solidify the dominance of the direct route. The trend towards global platform standardization by major OEMs necessitates Tier 1 suppliers with a robust, globally distributed manufacturing footprint capable of supporting production in North America, Europe, and Asia Pacific simultaneously, further concentrating market power among a select few global players capable of meeting these extensive logistic and quality requirements.

Automotive Power Folding Mirror Systems Market Potential Customers

The primary and largest potential customers for Automotive Power Folding Mirror Systems are global Original Equipment Manufacturers (OEMs) who integrate these components directly into newly manufactured vehicles across various segments. This includes multinational automotive groups such as Volkswagen Group, Toyota Motor Corporation, General Motors, Ford Motor Company, Hyundai Motor Group, and Stellantis, encompassing their diverse brands from budget-friendly hatchbacks to high-end luxury vehicles. The increasing adoption rate of power folding mirrors, driven by standardization in high-volume segments like compact SUVs and mid-size sedans, ensures that virtually every major OEM purchasing manager is a key target customer for Tier 1 suppliers. These OEM buyers focus heavily on total cost of ownership, system reliability (measured in folding cycles), compliance with international safety and electromagnetic standards, and the ability of the supplier to integrate complex ADAS features (e.g., cameras, sensors) within the mirror housing without compromising aesthetic design or aerodynamic performance. The procurement cycle for OEMs is long, involving intensive validation phases and multi-year contracts, making reliable partnership history a crucial factor in securing business.

A secondary, yet significant, customer base resides in the aftermarket segment. This segment comprises authorized and independent repair garages, specialized automotive parts distributors, insurance companies managing repair networks, and individual vehicle owners seeking replacement parts following accidental damage or component failure. While the volume per transaction is lower than OEM contracts, the aftermarket often offers higher profit margins on replacement units, especially for proprietary designs or specialized components required for premium vehicles. The demand in the aftermarket is intrinsically linked to the size of the global installed vehicle base equipped with these systems and the typical lifecycle failure rate of electromechanical components. Furthermore, niche potential customers include custom vehicle modifiers and specialty manufacturers (e.g., armored vehicles, specialized utility trucks) who require tailored mirror solutions incorporating additional robustness or unique functionality. For the aftermarket, availability, speed of delivery, and ensuring compatibility with specific vehicle models are the paramount purchasing criteria, driving the need for efficient logistics and distribution networks managed by aftermarket focused suppliers and resellers.

The shift towards Electric Vehicles (EVs) introduces a specific subset of potential customers: emerging EV manufacturers (e.g., Tesla, Rivian, and numerous Chinese EV startups) who prioritize highly aerodynamic, lightweight designs and deep digital integration. These customers often demand specialized mirror systems that either incorporate full CMS technology or feature ultra-slim profiles with advanced power management capabilities. Suppliers targeting the EV market must demonstrate advanced capabilities in material science for lightweighting and expertise in sophisticated thermal and electronic management to support the high degree of automation and sensor integration typical of next-generation electric platforms. Additionally, fleet operators, especially those managing urban ride-sharing or logistics fleets, represent a growing customer segment. They require durable, easy-to-maintain power folding mirrors to reduce vehicle downtime caused by damage in congested urban environments, focusing purchasing decisions on durability, rapid repairability, and competitive unit pricing for high-volume fleet orders. This evolving customer matrix highlights the necessity for suppliers to maintain flexible manufacturing capabilities catering to both high-volume standardized production and specialized, technology-forward EV and fleet needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magna International Inc., Gentex Corporation, SL Corporation, Mitsuba Corporation, Ficosa International S.A., Murakami Corporation, Mobis (Hyundai Mobis), Bosch Group, Visiocorp (Flex-N-Gate), Samvardhana Motherson Automotive Systems Group, Sakae Riken Kogyo Co., Ltd., Continental AG, Stoneridge Inc., ZKW Group, Ichikoh Industries, Ltd., LUKAS Electric, SMR Automotive Mirror Technology Germany GmbH, Jiangsu Beichen Auto Parts Co., Ltd., Zhejiang Asia Pacific Mechanical & Electronic Co., Ltd., Ningbo Tianlong Electronic Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Power Folding Mirror Systems Market Key Technology Landscape

The technology landscape of the Automotive Power Folding Mirror Systems Market is characterized by a relentless drive towards increased integration, intelligence, and reliability, necessitating advanced electromechanical and electronic solutions. Central to current advancements is the adoption of robust communication protocols, primarily the Controller Area Network (CAN) and Local Interconnect Network (LIN) buses, which allow the mirror ECU to receive commands and transmit status updates seamlessly across the vehicle’s electrical architecture. LIN is frequently used for simpler functionalities due to its lower cost and bandwidth, while CAN or even Ethernet is becoming standard for transmitting high-bandwidth data required for integrated cameras and advanced ADAS features housed within the mirror assembly. Modern designs focus on precision motor control using miniaturized, high-torque BLDC motors, which offer superior durability, efficiency, and reduced operational noise (NVH) compared to older brushed motors, enhancing the premium feel of the vehicle. Furthermore, the integration of temperature management systems (heating elements) and sophisticated optical sensors (auto-dimming glass using electrochromic technology) continues to define the high-end segment, demanding complex wiring and thermal dissipation designs within constrained spatial envelopes.

The foremost technological innovation currently shaping the future of this market is the evolution toward Camera Monitoring Systems (CMS), often referred to as digital mirrors. While not eliminating the external housing, CMS replaces traditional reflective glass with high-definition cameras and internal displays, significantly reducing the size of the external assembly, improving aerodynamics, and theoretically eliminating the need for complex mechanical folding mechanisms, although some physical housing protection mechanisms may still be required. The development of advanced algorithms for image processing, low-light compensation, and rapid display latency management is crucial for CMS adoption. Concurrently, efforts in material science focus on lightweighting, utilizing high-strength, low-density plastic composites and tailored aluminum alloys for the structure. Reducing the mass of the mirror assembly not only aids in vehicle weight reduction (benefiting fuel economy and EV range) but also reduces the torque requirements for the folding motor, potentially allowing for smaller, lighter, and more efficient actuators. The increasing complexity mandates stringent cyber-security protocols, especially for CMS and connected mirrors, to protect against unauthorized access or manipulation of the visual data stream, pushing cybersecurity to the forefront of design specifications.

Another area of concentrated technological investment involves the enhancement of sensor fusion capabilities within the mirror unit. The mirror housing is becoming a strategic location for integrating various ADAS sensors, including radar and ultrasonic sensors for Blind Spot Detection (BSD), Rear Cross Traffic Alert (RCTA), and even parking assist systems. This transformation mandates a more complex ECU design capable of handling multiple data inputs, performing local processing, and maintaining high reliability despite exposure to external elements. The trend is moving towards modular designs, enabling OEMs to select and integrate different ADAS features depending on the vehicle trim level and regional requirements without necessitating a complete redesign of the core folding mechanism. This modularity streamlines manufacturing processes and lowers long-term tooling costs for suppliers. Overall, the technology trajectory underscores a shift from simple mechanical motion control to sophisticated electronic system management, where the power folding function is just one integrated feature in a complex, multi-sensory external vehicle module that is integral to advanced safety and driving automation functions.

Regional Highlights

- Asia Pacific (APAC): APAC, led by manufacturing hubs in China, Japan, South Korea, and India, represents the largest and fastest-growing market globally. This growth is fueled by robust domestic vehicle production, especially in the mid-range and SUV segments, where power folding mirrors are rapidly becoming a standardized feature rather than an exclusive luxury. Rising disposable incomes and increasing consumer awareness regarding vehicle safety and convenience drive high adoption rates. China, in particular, dominates consumption and local production, often prioritizing advanced features and rapid integration of new technology, including early adoption of CMS in high-end electric vehicles. Government policies focused on automotive modernization and safety also contribute significantly to market expansion.

- Europe: Europe is characterized by stringent pedestrian safety regulations (UN/ECE Regulation 46), which strongly favor external components that minimize injury upon impact, inherently boosting demand for flexible, collapsible, or folding mirror designs. This regulatory environment, combined with high vehicle density in urban areas leading to frequent damage risks, makes power folding systems highly valued. Western European countries exhibit high penetration rates across passenger cars, driven by a mature market focused on premium features, efficiency, and the integration of advanced ADAS technology within the mirror unit. Germany, France, and the UK are key markets, focusing on quality, durability, and sophisticated integration via CAN bus systems.

- North America: The North American market, centered around the US and Canada, is defined by a strong preference for large vehicles, including SUVs, light trucks, and heavy-duty vehicles, where power folding mirrors are crucial for navigating tight parking structures and managing towing visibility. The market is mature, and high-end integration—including specialized features like integrated memory functions and robust heating/defrosting capabilities to handle severe weather—is standard. Demand is closely tied to the cycles of premium vehicle sales. Regulatory focus is primarily on enhancing driver visibility and safety, ensuring systems are reliable under extreme usage conditions.

- Latin America (LATAM): LATAM remains a nascent but rapidly developing market. Adoption rates are increasing in major economies like Brazil and Mexico, driven by the localization of global vehicle platforms and a gradual shift in consumer preference towards convenience features previously exclusive to premium segments. Economic stability and localized manufacturing capabilities are key factors influencing growth, with systems often imported or locally assembled using standardized components to control costs for the price-sensitive mainstream market.

- Middle East and Africa (MEA): The MEA market is highly fragmented, with strong demand centers in the GCC (Gulf Cooperation Council) countries due to high per capita income and a preference for luxury SUVs and high-end imports, ensuring high penetration of integrated power folding systems. Growth in the African region is slower, primarily focused on basic functionality and aftermarket replacement, though urbanization trends and increasing foreign investment in localized automotive assembly plants are expected to boost OEM demand for standardized systems in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Power Folding Mirror Systems Market.- Magna International Inc.

- Gentex Corporation

- SL Corporation

- Mitsuba Corporation

- Ficosa International S.A.

- Murakami Corporation

- Mobis (Hyundai Mobis)

- Bosch Group

- Visiocorp (Flex-N-Gate)

- Samvardhana Motherson Automotive Systems Group

- Sakae Riken Kogyo Co., Ltd.

- Continental AG

- Stoneridge Inc.

- ZKW Group

- Ichikoh Industries, Ltd.

- LUKAS Electric

- SMR Automotive Mirror Technology Germany GmbH

- Jiangsu Beichen Auto Parts Co., Ltd.

- Zhejiang Asia Pacific Mechanical & Electronic Co., Ltd.

- Ningbo Tianlong Electronic Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Power Folding Mirror Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and benefit of automotive power folding mirror systems?

The primary function is to electronically fold the side mirrors inward, protecting them from damage in tight spaces, such as car washes or parking garages. Key benefits include convenience, reduced repair costs, and enhanced vehicle safety by allowing the mirror to collapse upon impact, adhering to pedestrian protection standards.

How do power folding mirrors integrate with modern vehicle electronic systems?

They integrate via the vehicle's communication networks, typically the CAN or LIN bus. The system's ECU receives commands from the driver controls, door module, or centralized body control module, allowing the folding mechanism to operate based on ignition status, locking status, or driver profile memory settings.

What is the role of ADAS components in the power folding mirror assembly?

The mirror housing is increasingly utilized as a strategically located platform for integrating ADAS sensors, such as blind-spot detection (BSD) radar, side-view cameras, and proximity sensors. This integration requires a robust folding mechanism that maintains sensor calibration and functionality even after repeated folding cycles.

Which geographical region exhibits the fastest growth in the power folding mirror market?

The Asia Pacific (APAC) region, driven by high automotive production volume in China and India and the rising standardization of convenience features in mass-market vehicles, currently demonstrates the fastest growth rate and highest volume demand for power folding mirror systems.

Are Camera Monitoring Systems (CMS) expected to replace traditional power folding mirrors?

While CMS (digital mirrors) are a significant technological shift that removes the need for large reflective glass, they are currently transitioning into the market, primarily in premium and EV segments. Full global replacement depends on regulatory acceptance and cost parity, suggesting a co-existence phase for the foreseeable future, where CMS systems will still require protected housing mechanisms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager