Automotive Rubber Seal Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440976 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Automotive Rubber Seal Market Size

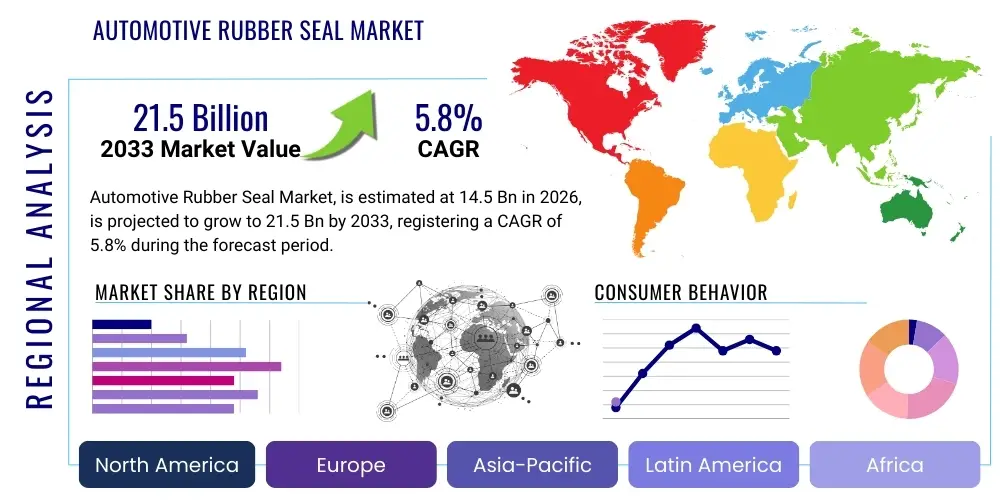

The Automotive Rubber Seal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $21.5 Billion by the end of the forecast period in 2033.

Automotive Rubber Seal Market introduction

The Automotive Rubber Seal Market encompasses the manufacturing and supply of various sealing components crucial for vehicle safety, performance, and comfort. These seals—including weatherstrips, gaskets, O-rings, and molded seals—are essential for preventing the ingress of dust, moisture, and noise, while also containing fluids and gases within mechanical systems like the engine and transmission. The primary function of these products is to maintain structural integrity and optimize vehicle aerodynamics and thermal management, directly impacting fuel efficiency and the lifespan of critical components. Seals are deployed extensively across the vehicle, ranging from dynamic applications in rotating assemblies to static applications in body closures and window channels.

The market is defined by stringent regulatory environments, particularly concerning vehicle emissions and noise reduction, compelling manufacturers to utilize high-performance elastomers such as EPDM (Ethylene Propylene Diene Monomer), silicone, and HNBR (Hydrogenated Nitrile Butadiene Rubber). Product innovation is focused on developing lighter, more durable materials that can withstand extreme temperature variations, chemical exposure, and ozone degradation, especially within the demanding electric vehicle (EV) battery and thermal management systems. The adoption of new vehicle architectures, lightweighting mandates, and increased reliance on sophisticated electronics necessitates seals with enhanced dimensional stability and excellent dielectric properties, driving continuous material science advancements in the sector.

Key drivers underpinning the market's robust growth trajectory include the accelerating global production of vehicles, particularly in emerging economies like China and India, alongside the mandated replacement cycles in the aftermarket sector. Furthermore, the global shift towards premium and luxury vehicle segments, which utilize a higher volume and quality of sealing components for superior acoustic dampening and cabin refinement, significantly contributes to market expansion. The increasing complexity of modern vehicles, featuring advanced driver-assistance systems (ADAS) and sophisticated thermal regulation systems, requires a greater number of specialized seals to ensure the operational reliability and safety standards demanded by original equipment manufacturers (OEMs).

Automotive Rubber Seal Market Executive Summary

The Automotive Rubber Seal Market is experiencing dynamic shifts characterized by heightened integration into EV manufacturing supply chains and a strong emphasis on sustainability in material sourcing. Business trends indicate a movement towards strategic partnerships between material suppliers and Tier 1 component manufacturers to co-develop custom elastomer compounds optimized for specific automotive subsystems, such as battery pack housing and thermal runway mitigation systems. Consolidation among major players is also notable, driven by the need to acquire specialized technological expertise in areas like advanced extrusion and injection molding processes, ensuring global capacity to meet increasingly large and complex OEM contracts. Leading companies are strategically investing in digitalization to optimize production efficiency and enhance supply chain visibility across diverse global operations.

Regionally, Asia Pacific maintains its dominance, fueled by massive vehicle production volumes in China and the rapid urbanization and infrastructure expansion in Southeast Asian nations, leading to high demand for both new seals and aftermarket replacements. North America and Europe demonstrate mature market characteristics, focusing intensely on regulatory compliance related to volatile organic compounds (VOCs) and material recyclability, thus driving innovation toward bio-based and non-leaching sealants. The increasing adoption of self-driving and connected vehicle technologies further amplifies regional demand for seals that protect sensitive electronic sensors and wiring harnesses from environmental damage, necessitating high-specification, electromagnetically compatible (EMC) elastomers capable of maintaining performance stability over extended periods and under diverse operational stresses.

Segment trends reveal a rapid proliferation of EPDM rubber in exterior applications due to its superior UV and ozone resistance, contrasting with the rising penetration of specialized materials like Fluoroelastomers (FKM) and HNBR in performance-critical areas such as powertrain components requiring exceptional heat and oil resistance. The Passenger Vehicle segment retains the largest market share globally, yet the Heavy Commercial Vehicle (HCV) sector shows strong growth potential due to increased freight movement and the need for robust, long-lasting seals in demanding commercial operating environments. Furthermore, within the application segmentation, the Body & Chassis category, driven by sophisticated weatherstripping and acoustic management requirements, continues to lead in value contribution, though the powertrain segment commands the highest price per component due to its stringent performance requirements and material complexity.

AI Impact Analysis on Automotive Rubber Seal Market

User inquiries regarding AI's influence typically revolve around how artificial intelligence and machine learning (ML) can optimize complex manufacturing processes, enhance material quality control, and predict seal failure rates under variable operational conditions. Key themes center on achieving 'zero-defect' production through automated visual inspection systems powered by deep learning algorithms, which can identify minute surface imperfections undetectable by human operators and ensure tight adherence to geometric tolerances, crucial for high-performance fluid sealing. Users are also keen on understanding how predictive analytics, utilizing sensor data from connected vehicles (IoT integration), can extend the useful life of seals and optimize maintenance schedules, moving the industry towards condition-based monitoring rather than time-based replacement, especially for mission-critical seals in EV battery enclosures where accessibility is limited and failure consequences are severe.

The integration of AI also addresses critical material science challenges. ML models are being employed to rapidly simulate and test the compatibility of new elastomer formulations with aggressive fluids (e.g., advanced coolants and oils) and extreme thermal cycling, significantly reducing R&D timelines and costs associated with traditional physical prototyping. This computational approach allows researchers to quickly iterate on compound composition—varying filler type, curative agents, and plasticizers—to achieve optimized properties like low compression set, enhanced abrasion resistance, and specific dielectric constants required for emerging automotive applications. Furthermore, supply chain optimization represents a major area of inquiry, where AI-driven forecasting tools are used to anticipate raw material price fluctuations and optimize inventory management for highly variable SKU portfolios, ensuring resilience against geopolitical and logistical disruptions common in the global automotive supply chain, particularly for specialized, single-source materials like fluoropolymers.

User expectations focus heavily on improved customization and efficiency. AI enables manufacturers to analyze specific vehicle design constraints and environmental factors (e.g., regional climate differences, road quality) to suggest optimal seal profiles and material compositions, moving beyond standardized components. This level of customization, facilitated by generative design algorithms, promises seals that are lighter, stronger, and more cost-effective to produce, ultimately providing a significant competitive advantage to Tier 1 suppliers that successfully implement these smart manufacturing and design methodologies. The long-term vision involves fully autonomous quality loops, where machines adjust vulcanization parameters in real-time based on AI feedback from integrated sensors, minimizing waste and optimizing energy consumption during the curing process.

- AI-enhanced Quality Control: Implementation of computer vision and deep learning for automated, high-speed inspection of seal defects during extrusion and molding, ensuring precise geometrical compliance.

- Predictive Maintenance Optimization: Utilizing ML to analyze sensor data from vehicles to forecast seal degradation and schedule timely replacements, particularly in critical powertrain and battery seals before failure occurs.

- Material Science Acceleration: Employing generative AI and ML simulations to expedite the development and testing of novel high-performance, heat-resistant, and dielectric elastomer compounds for EV applications.

- Supply Chain Resiliency: AI-driven demand forecasting and inventory management optimization to mitigate risks associated with volatile raw material procurement (e.g., synthetic rubber, specialty fillers) and logistics bottlenecks.

- Process Parameter Optimization: Using prescriptive analytics to fine-tune injection molding and curing cycles, minimizing material waste, optimizing energy use, and maximizing throughput efficiency in large-scale production facilities.

DRO & Impact Forces Of Automotive Rubber Seal Market

The market is primarily propelled by strict regulatory mandates related to vehicle safety, noise reduction (NVH), and fuel efficiency, driving demand for advanced sealing solutions that minimize air leakage and dampen vibrations. This regulatory pressure, particularly in developed regions, necessitates the adoption of superior rubber compounds and sophisticated seal designs. However, the industry faces significant constraints, chiefly volatility in the pricing and supply of synthetic rubber raw materials, such as butadiene and isoprene, which directly impacts production costs and profitability, often leading to margin pressure in long-term OEM contracts. The lengthy and rigorous process of new material qualification by OEMs also acts as a structural restraint, delaying the introduction of advanced, potentially cost-saving, elastomer solutions into the market.

Opportunities lie squarely within the burgeoning electric vehicle sector, where demand for seals capable of managing high voltage, aggressive battery coolants, and specific electromagnetic shielding requirements creates lucrative, high-value component markets. This shift requires expertise in developing seals that are flame retardant and exhibit exceptional chemical resistance, creating a technology gap that specialized suppliers can capitalize on. Furthermore, expansion in the aftermarket segment, fueled by the growing average age of the global vehicle fleet, presents stable revenue opportunities for replacement parts, which often utilize standardized but durable rubber formulations designed for ease of installation and long service life.

These drivers, restraints, and opportunities converge to form substantial impact forces, including intense pricing pressure from OEMs—who frequently demand year-over-year cost reductions—and the necessity for continuous capital investment in specialized manufacturing equipment for highly precise, complex seal geometries, such as automated multi-component molding lines. The market is also heavily impacted by the global movement towards sustainability, forcing suppliers to invest in research for bio-based polymers and advanced recycling techniques for end-of-life seals, balancing performance against environmental mandates. The need for global standardization and high-volume consistency further exerts pressure on operations and quality management systems.

- Drivers: Stringent NVH (Noise, Vibration, Harshness) reduction regulations globally; increasing global vehicle production, especially across EV and premium segments; high demand for durable aftermarket replacements; increasing complexity in modern vehicle body architecture requiring sophisticated weatherstripping.

- Restraints: Volatile prices and supply chain dependence on petrochemical-derived raw materials; substitution risk from high-performance TPEs and engineering plastics in less demanding applications; demanding OEM qualification processes extending time-to-market; high initial capital expenditure for advanced molding machinery and R&D.

- Opportunity: Exponential growth in the EV and hybrid vehicle segment driving demand for high-specification sealing; development of specialized seals for battery thermal management and electromagnetic compatibility (EMC); geographical expansion into emerging automotive manufacturing hubs in Southeast Asia and Latin America; focusing on niche high-performance sealing materials (e.g., FKM, FFKM).

- Impact Forces: Intense OEM cost optimization mandates leading to fierce competition; necessity for developing and maintaining a resilient global manufacturing footprint; strong regulatory push towards sustainable and low-VOC material solutions; rapid technological shifts in bonding and vulcanization processes requiring continuous expertise upgrades.

Segmentation Analysis

The Automotive Rubber Seal Market is comprehensively segmented based on product type, the material used, the specific vehicle type, and the final application within the vehicle. This granular segmentation is essential for understanding the diverse performance requirements and value propositions across the industry. Product segmentation distinguishes between high-volume, standard components like weatherstrips used in body closures, and highly engineered, technical components such as dynamic seals and high-pressure gaskets used in critical powertrain and braking systems. Material segmentation highlights the shift towards synthetic elastomers optimized for severe duty cycles, extreme temperatures, and chemical resistance, particularly driven by EV requirements, where fire safety and thermal stability are paramount considerations.

Further analysis by vehicle type reveals differing market dynamics; the Passenger Vehicle segment prioritizes NVH reduction, cabin aesthetics, and lightweighting, demanding precision-fit, low-friction seals often incorporating complex co-extruded foam structures. Conversely, the Commercial Vehicle segment emphasizes rugged durability, load-bearing capacity, and resistance to wear and tear in challenging operating conditions, requiring heavier gauge and highly robust rubber compounds, especially for engine mounting and structural vibration isolation. This segmentation clearly dictates material purchasing strategies and manufacturing tolerances across the supply base.

Application segmentation provides insight into where the highest component value is concentrated, with powertrain seals (e.g., crankshaft and valve stem seals) commanding high prices due to their critical, non-negotiable role in engine and transmission function under high heat and chemical load. This contrasts sharply with the volume-driven Body & Chassis segment, which relies on cost-effective, high-volume extrusion capabilities. Understanding these segmentation nuances is vital for suppliers seeking to allocate resources effectively between high-volume, low-margin products and high-performance, high-margin specialties.

- By Product Type: Weatherstrips, Gaskets, O-Rings, Hoses, Profile Seals, Molded Seals.

- By Material: EPDM (Ethylene Propylene Diene Monomer), Silicone, Natural Rubber, Polyurethane, HNBR (Hydrogenated Nitrile Butadiene Rubber), Fluoroelastomers (FKM/FFKM).

- By Vehicle Type: Passenger Vehicles (PV), Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV).

- By Application: Body & Chassis, Powertrain, HVAC (Heating, Ventilation, and Air Conditioning), Interiors.

Value Chain Analysis For Automotive Rubber Seal Market

The value chain begins significantly upstream with the suppliers of primary raw materials, primarily synthetic rubbers (such as EPDM, NBR, SBR, and specialized polymers) derived from petrochemical feedstocks, alongside carbon black, vulcanizing agents, and high-performance additives (e.g., plasticizers, anti-ozonants). The performance, pricing volatility, and sustainability profile of the final seal component are highly dependent on the quality and price stability of these upstream inputs. Tier 2 suppliers then perform the critical step of material compounding, often blending proprietary mixes of elastomers and fillers optimized for specific automotive requirements like heat resistance, compression set, or low-temperature flexibility, creating customized pre-compounds ready for precision manufacturing.

The core manufacturing stage is dominated by Tier 1 automotive suppliers who execute highly technical processes. This includes advanced extrusion for complex multi-hollow weatherstrip profiles, compression molding for large gaskets, and high-speed injection molding for intricate O-rings and dynamic shaft seals. Value is added here through precision tooling design, rigorous quality control using optical inspection, and specialized post-curing and surface treatment processes. These manufacturers require substantial capital investment and deep technical expertise in rubber chemistry and process engineering. Distribution to OEMs is highly controlled, utilizing direct distribution channels involving massive volumes delivered Just-In-Time (JIT) directly to assembly lines globally, demanding exceptional logistical efficiency, precise inventory management, and zero-defect quality adherence.

The indirect channel caters primarily to the global aftermarket, involving independent regional distributors, large retail auto parts chains, and wholesale parts dealers. This segment requires different logistical approaches, including specialized packaging, branding geared toward the end-user, and the maintenance of extensive catalogs of parts for older vehicle models, ensuring continued revenue generation throughout the product lifecycle. Downstream analysis concludes with the final installation at OEM facilities or repair garages. Crucially, performance feedback from these end-users, especially regarding premature seal failures or warranty claims, is channeled back through the value chain to Tier 1 and Tier 2 suppliers to drive continuous material and design improvement and ensure long-term product reliability across diverse global operating conditions.

Automotive Rubber Seal Market Potential Customers

The primary customers for the Automotive Rubber Seal Market are Original Equipment Manufacturers (OEMs) of passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs) globally. These customers represent the highest volume demand, purchasing seals integrated into their proprietary vehicle platforms to meet strict performance metrics regarding NVH, fluid containment, and durability. OEM procurement strategies are characterized by long-term strategic contracts, stringent quality audits, global supply capability, and a demand for high technological collaboration, especially concerning new EV architectures and ADAS protection systems.

A secondary, yet rapidly expanding, customer base includes Tier 1 and Tier 2 automotive component manufacturers who purchase specialized seals for integration into larger sub-assemblies before delivery to the OEM. Examples include brake system suppliers requiring high-pressure piston seals, thermal management system providers needing specific coolant hose connections, and steering system manufacturers requiring robust power steering seals. These customers value technical collaboration, material expertise, and certification excellence, as the seal's performance critically determines the reliability and safety of their entire modular component.

Finally, the large and fragmented aftermarket segment represents a substantial customer base, comprising wholesale distributors, large retail auto parts chains, and thousands of independent service garages worldwide. This customer group drives demand for standardized, reliable replacement components, prioritizing cost-effectiveness, extensive catalog breadth, and rapid local fulfillment. While unit prices are generally lower than OEM contracts, the aftermarket segment offers stable, recession-resistant revenue streams and is less susceptible to fluctuations in new vehicle production cycles, serving as a vital stabilizer for the industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $21.5 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freudenberg Group, Continental AG, Trelleborg AB, Cooper-Standard Holdings Inc., Sumitomo Riko Co., Ltd., Hutchinson SA, Nichirin Co. Ltd., Federal-Mogul LLC (Tenneco), Dana Incorporated, NOK Corporation, Parker Hannifin Corporation, SKF AB, Wacker Chemie AG, BASF SE, Chem-Trend, Rubber World Industries, Mishimoto, Hi-Bond, Metroseal, Fuzhou Fuding. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Rubber Seal Market Key Technology Landscape

The technological landscape of the Automotive Rubber Seal Market is continuously evolving, driven primarily by the pursuit of higher precision, material reduction, and multi-functionality. Key manufacturing technologies include advanced injection molding, which allows for the rapid, high-volume production of complex, three-dimensional seal geometries with extremely tight tolerances, essential for modern engine and transmission applications. This technology minimizes flash and material waste while ensuring consistent quality across billions of parts. Liquid Silicone Rubber (LSR) molding is also gaining prominence, particularly for seals requiring high thermal stability, flexibility, and resistance to cold, making them ideal for sensitive electronic enclosures and external lighting components where long-term durability is paramount.

Extrusion technology has seen significant upgrades, moving towards continuous vulcanization (CV) lines that integrate microwave or salt bath curing and finishing processes, dramatically improving production speed and surface quality for high-volume weatherstripping and long-run profile seals. Furthermore, the development of Co-Extrusion and Tri-Extrusion techniques enables the simultaneous production of seals combining materials with distinct properties—such as a dense core for structural stability, a softer cellular foam for compression and sealing, and a decorative, low-friction skin—significantly enhancing NVH characteristics and minimizing closing effort on vehicle doors. This multi-material approach is crucial for achieving specialized seals that integrate metal or plastic carriers for structural support directly during the molding process, known as over-molding or insert molding.

Material science innovation centers on developing next-generation elastomers that can meet the stringent requirements of electric vehicles, specifically regarding thermal management, flame retardancy, and electromagnetic shielding (EMI/RFI). Suppliers are leveraging nanotechnology to incorporate conductive fillers (like carbon nanotubes or specialty metal flakes) into rubber compounds, creating seals that simultaneously provide environmental protection and electromagnetic compatibility, shielding sensitive ADAS sensors and battery control units from interference. Moreover, precision surface treatments, such as plasma functionalization and specialty coatings (e.g., polyurethane or Teflon-based), are increasingly used to reduce friction and improve the "slip-stick" behavior of seals, enhancing user experience in dynamic body closure applications and extending overall component life by resisting abrasion and ozone attack.

Regional Highlights

Regional dynamics are critical in defining the growth trajectory of the Automotive Rubber Seal Market, reflecting variations in production capacity, regulatory frameworks, and vehicle penetration rates. Asia Pacific (APAC) stands as the largest and fastest-growing regional market, primarily due to the colossal manufacturing base in China, the expanding automotive industry in India, and the significant presence of major Japanese and South Korean OEMs. The high volume of vehicle production and robust demand for new commercial vehicles in these rapidly industrializing economies fuels the market. This region is currently characterized by a strong focus on balancing quality and cost for high-volume weatherstrips and basic gaskets, though demand for high-performance seals for locally manufactured premium and electric vehicles is rising rapidly, driving local investment in advanced material processing capabilities.

Europe represents a mature market focused heavily on premiumization, advanced safety features, and strict environmental standards (e.g., Euro 7 emissions and stringent material recyclability targets). European demand is driven by high-specification seals for luxury vehicles emphasizing superior acoustic performance, advanced fluid containment in complex engine systems (even in hybrid models), and lightweight construction materials to meet carbon emission reduction mandates. Innovation here is centered on high-durability, low-VOC (Volatile Organic Compounds) materials that contribute to interior air quality and sustainability goals, prompting major investment in specialized FKM, HNBR, and high-purity silicone elastomer production to serve the sophisticated domestic manufacturing base.

North America showcases a robust demand structure across both the OEM and aftermarket segments, particularly driven by strong sales of large SUVs and pickup trucks, which utilize extensive and heavy-duty sealing systems for noise mitigation and structural integrity. The market is increasingly adopting new-generation seals specifically designed to withstand the harsh climate extremes prevalent across the continent, alongside significant investments geared towards supporting the rapid transition to electric vehicle manufacturing hubs in the US and Mexico. Latin America and the Middle East & Africa (MEA) offer growth potential, largely dependent on improving economic stability, infrastructure development, and local vehicle assembly initiatives, with MEA specifically growing due to increased heavy commercial vehicle demand for logistics, mining, and agricultural operations requiring extremely rugged and weather-resistant sealing solutions.

- Asia Pacific (APAC): Market leader driven by high volume production in China and India; focus on cost-efficient and durable seals for high-volume PVs and HCVs; significant investment in EV component manufacturing and domestic supply chains; highest expected CAGR.

- Europe: High focus on premiumization, superior NVH reduction, and rigorous regulatory compliance (low VOCs, recyclability); strong demand for specialized seals for luxury brands and high-performance hybrid systems; rapid adoption of advanced, non-leaching elastomer formulations.

- North America: Stable demand across large passenger vehicles and light trucks; substantial and growing adoption of advanced sealing solutions for EV battery packs and high-performance aftermarket segment; regulatory focus on vehicle longevity, safety standards, and regional climate resilience.

- Latin America and MEA: Emerging markets with growing vehicle fleet and increasing need for replacement parts; demand tied to economic stability and commercial fleet modernization programs; focus on robust, cost-effective seals capable of handling diverse environmental conditions and fuel quality variations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Rubber Seal Market.- Freudenberg Group

- Continental AG

- Trelleborg AB

- Cooper-Standard Holdings Inc.

- Sumitomo Riko Co., Ltd.

- Hutchinson SA

- Nichirin Co. Ltd.

- Federal-Mogul LLC (Tenneco)

- Dana Incorporated

- NOK Corporation

- Parker Hannifin Corporation

- SKF AB

- Wacker Chemie AG

- BASF SE

- Chem-Trend

- Rubber World Industries

- Mishimoto

- Hi-Bond

- Metroseal

- Fuzhou Fuding

Frequently Asked Questions

Analyze common user questions about the Automotive Rubber Seal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of automotive rubber seals?

The primary functions include ensuring Noise, Vibration, and Harshness (NVH) reduction for cabin comfort, preventing the ingress of dust, water, and air (weatherstripping), and containing fluids and gases within critical systems like engines, transmissions, and cooling circuits (gaskets and O-rings) to prevent leakage and ensure system functionality.

How is the growth of Electric Vehicles (EVs) impacting seal material selection?

EVs are driving demand for specialized materials like silicone and HNBR that offer excellent thermal resistance for battery packs and cooling lines, superior dielectric properties to manage high voltage, and often require materials with integrated electromagnetic shielding capabilities (EMI/RFI protection) critical for sensor reliability.

Which material segment holds the largest share in the Automotive Rubber Seal Market?

EPDM (Ethylene Propylene Diene Monomer) generally holds the largest market share due to its excellent resistance to weathering, ozone, and heat, making it the preferred and most cost-effective material for high-volume exterior applications such as weatherstrips and complex profile seals.

What are the main technological challenges facing automotive seal manufacturers?

Key challenges involve mastering multi-material integration (bonding rubber to plastic/metal carriers), achieving extremely strict dimensional tolerances in complex geometries, reducing dynamic friction without compromising sealing integrity, and meeting global sustainability mandates requiring low-VOC and bio-based compounds.

Which geographical region exhibits the highest market growth rate?

Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by robust new vehicle production volumes, rapid industrial expansion, and increasing localized manufacturing of electric and high-specification vehicles, particularly in countries with high domestic consumption like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager