Automotive SaaS Cloud Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440939 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Automotive SaaS Cloud Service Market Size

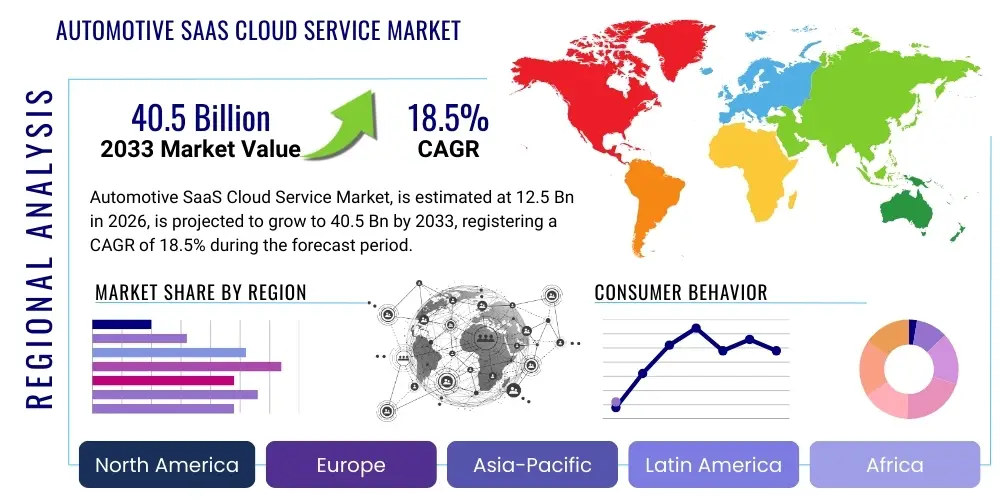

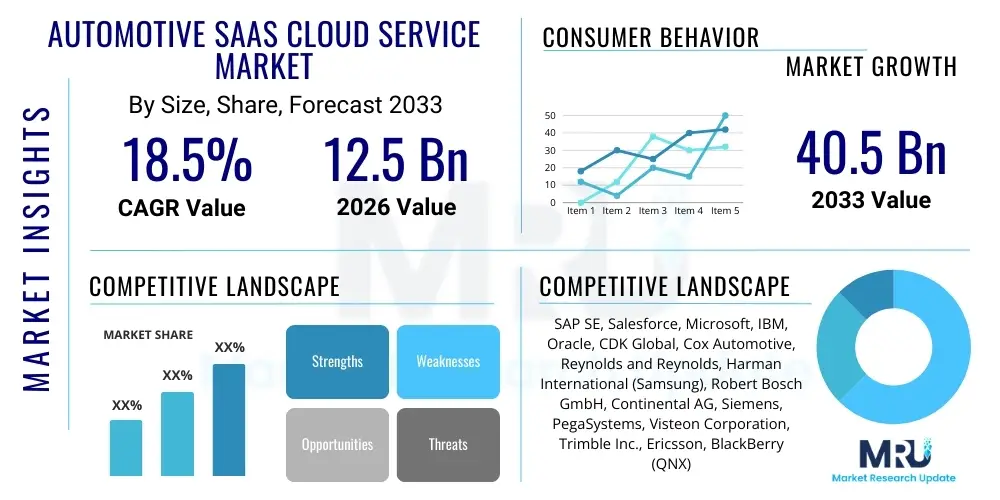

The Automotive SaaS Cloud Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $12.5 Billion USD in 2026 and is projected to reach $40.5 Billion USD by the end of the forecast period in 2033. This robust expansion is fueled primarily by the accelerated digitalization across the automotive ecosystem, driven by the proliferation of connected vehicles, the necessity for enhanced supply chain optimization, and the increasing complexity of regulatory compliance which demands flexible, scalable cloud-based solutions.

Automotive SaaS Cloud Service Market introduction

The Automotive SaaS Cloud Service Market encompasses a suite of software applications delivered via the cloud specifically tailored for the automotive industry, covering areas from manufacturing, dealer management, retail, fleet operations, supply chain logistics, and connected vehicle services. These solutions, delivered on a subscription basis, include applications for enterprise resource planning (ERP), customer relationship management (CRM), vehicle diagnostics, predictive maintenance, and sophisticated telematics platforms. Major applications span across original equipment manufacturers (OEMs), automotive suppliers (Tier 1 and Tier 2), dealerships, and mobility service providers, offering benefits such as reduced IT infrastructure costs, enhanced operational agility, rapid deployment capabilities, and improved data-driven decision-making. Key driving factors include the global shift toward electric vehicles (EVs) necessitating new manufacturing software, the high demand for over-the-air (OTA) update capabilities in connected cars, and the essential requirement for scalable data management tools to handle massive volumes of sensor data generated by modern vehicles.

Automotive SaaS Cloud Service Market Executive Summary

The Automotive SaaS Cloud Service market is experiencing significant upward momentum, underpinned by major business trends such as the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) into maintenance and diagnostic platforms, leading to predictive service models. Regional trends indicate North America and Europe currently hold the largest market shares due to high rates of digital transformation maturity and established infrastructures for connected car services, while the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily fueled by massive automotive production capacity in countries like China and India and increasing adoption of fleet management SaaS solutions. Segment trends show that the telematics and connected vehicle services segment, encompassing diagnostic and remote monitoring capabilities, remains the dominant revenue generator, although the Dealer Management System (DMS) segment is witnessing substantial technological upgrades and growth driven by the need for seamless omnichannel retail experiences. The shift towards Subscription-as-a-Service models for vehicle features further reinforces the necessity for robust cloud infrastructure and SaaS backend solutions.

AI Impact Analysis on Automotive SaaS Cloud Service Market

User inquiries regarding the impact of AI on the Automotive SaaS Cloud Service Market frequently revolve around optimizing maintenance schedules, enhancing autonomous driving capabilities, and ensuring data security and privacy within vast cloud ecosystems. Common user concerns focus on the integration complexity of large language models (LLMs) for customer service applications (e.g., virtual assistants), the ethical implications of using deep learning for driver behavior analysis, and the required computational power and cost associated with deploying sophisticated AI algorithms across globally distributed vehicle fleets. Users are keen to understand how AI-driven predictive maintenance can move from reactive to truly proactive service, minimizing vehicle downtime and maximizing asset utilization, while also seeking assurances regarding the scalability of AI solutions provided by SaaS vendors to handle exabytes of operational data.

The convergence of AI with automotive SaaS platforms is fundamentally reshaping service delivery, operational efficiency, and customer experience management. AI algorithms are increasingly embedded within cloud solutions to process real-time telematics data, identifying anomalies indicative of potential mechanical failures long before traditional systems could detect them. This transition empowers OEMs and fleet operators to significantly reduce warranty claims and operational costs by scheduling targeted, just-in-time repairs. Furthermore, AI is critical for optimizing manufacturing supply chains, predicting demand fluctuations with greater accuracy, and automating complex logistics planning, making the SaaS platform the centralized hub for intelligence distribution across the entire automotive value chain.

Key themes emerging from user expectations include the necessity for hyper-personalized driver and passenger experiences, driven by AI interpreting user preferences and contextually adjusting in-car settings or offering relevant subscription services. The reliance on AI for enhancing cybersecurity, particularly in protecting OTA update mechanisms and sensitive driver data stored in the cloud, is another critical expectation. Overall, users anticipate that AI will transition the automotive SaaS market from being merely a system of record to a dynamic, intelligent system of prediction and action, creating new revenue streams based on data insights and continuous functional improvement.

- AI-driven Predictive Maintenance: Transforms traditional diagnostic tools into proactive service platforms, reducing vehicle downtime and increasing operational lifespan.

- Enhanced Data Analytics and Telematics: Utilizes machine learning to process massive volumes of sensor data, yielding superior insights into vehicle performance, usage patterns, and safety metrics.

- Autonomous Vehicle Data Management: Provides scalable cloud infrastructure necessary for storing, annotating, and training AI models crucial for L4 and L5 autonomous systems development.

- Optimized Supply Chain Logistics: AI algorithms improve demand forecasting, inventory management, and route optimization for parts delivery, integrating seamlessly with SaaS ERP solutions.

- Personalized Customer Experience (CX): Implementation of conversational AI and recommendation engines within CRM SaaS solutions to offer tailored in-vehicle services and marketing communications.

- Cybersecurity and Threat Detection: Leverages AI to identify and mitigate cyber threats in real time across connected vehicle networks and cloud infrastructure, ensuring data integrity and compliance.

- Automated Software Development and Testing: Uses AI/ML tools to accelerate the development, testing, and secure deployment of new software features via OTA updates, a core SaaS function.

DRO & Impact Forces Of Automotive SaaS Cloud Service Market

The Automotive SaaS Cloud Service Market is propelled by powerful growth drivers, most notably the escalating trend of vehicle connectivity, mandatory government regulations favoring digital documentation and emissions monitoring, and the inherent cost-efficiency and scalability offered by subscription-based cloud models compared to legacy on-premise software. Simultaneously, the market faces significant restraints, including stringent data privacy and regulatory compliance hurdles, particularly GDPR and CCPA, which necessitate robust data sovereignty controls, coupled with persistent concerns regarding cloud infrastructure security vulnerabilities and the inherent difficulty of integrating new SaaS solutions with highly customized, outdated OEM legacy systems. These challenges create opportunities for vendors specializing in hybrid cloud architectures, certified security protocols, and offering solutions tailored specifically for the electric vehicle (EV) supply chain, alongside expanding into emerging markets where digitalization is accelerating.

Impact forces on this market are characterized by a high degree of technological substitution risk, driven by rapid advancements in edge computing and 5G network integration, which could shift some processing capabilities away from centralized cloud infrastructure, thereby requiring SaaS providers to adopt more decentralized and distributed cloud architectures. Furthermore, the competitive intensity is increasing dramatically, with hyperscalers (AWS, Azure, GCP) directly entering the automotive vertical and partnering heavily with traditional automotive software firms, pressuring margins and forcing specialized SaaS providers to demonstrate deep domain expertise. The bargaining power of buyers, particularly large OEMs, remains moderately high as they seek customized, long-term contractual agreements, compelling vendors to focus heavily on platform interoperability and API standardization to secure large-scale contracts and maintain market relevance.

A crucial factor influencing market dynamics is the capital expenditure required for developing comprehensive, industry-specific SaaS suites. While entry barriers related to infrastructure have been lowered by utilizing public clouds, the necessity for specialized automotive knowledge—covering complex domains like functional safety (ISO 26262), real-time vehicle data interpretation, and global regulatory variation—remains a significant barrier to entry for generalized software companies. This specialized knowledge requirement sustains the influence of established automotive software vendors who successfully pivot their offerings to a cloud-native SaaS model, ensuring that the market continues to evolve through strategic partnerships and targeted mergers and acquisitions aimed at consolidating expertise and expanding geographical reach.

Drivers:

- Increased Penetration of Connected Vehicles (V2X): Exponential growth in data generation from connected cars necessitates scalable, cloud-based data storage, processing, and application delivery.

- Shift Towards Subscription-Based Services (Mobility as a Service - MaaS): OEMs are transitioning revenue models toward recurring services (e.g., feature upgrades, advanced navigation), requiring robust SaaS backend infrastructure.

- Demand for Operational Efficiency and Cost Reduction: Cloud SaaS models offer lower Total Cost of Ownership (TCO) compared to traditional on-premise IT deployments, appealing strongly to budget-conscious enterprises.

- Accelerated Digital Transformation in Dealerships: Need for modern Dealer Management Systems (DMS) and Customer Relationship Management (CRM) tools to support omnichannel sales and service models.

- Adoption of Over-The-Air (OTA) Updates: SaaS platforms are essential for managing the secure and scalable deployment of software patches and feature upgrades across global vehicle fleets.

- Regulatory Compliance and Emissions Monitoring: SaaS solutions facilitate real-time monitoring, reporting, and management necessary to adhere to strict global emissions standards and safety mandates.

Restraints:

- Data Security and Privacy Concerns: High risk associated with storing sensitive telematics, vehicle performance, and customer personal data in the cloud, demanding stringent security certifications.

- Integration Challenges with Legacy Systems: Difficulty in migrating entrenched, customized, and often proprietary on-premise IT systems used by older OEMs and Tier 1 suppliers to modern cloud-native architecture.

- Regulatory Complexity and Data Sovereignty: Varying international laws (e.g., GDPR, China's Cybersecurity Law) mandate where and how vehicle and consumer data must be stored and processed, complicating global deployment.

- High Initial Investment in Cloud Migration: Although TCO is lower long-term, the upfront costs and complexities associated with migrating large, mission-critical systems to the cloud can be prohibitive for smaller automotive companies.

Opportunity:

- Focus on Electric Vehicle (EV) Ecosystem Solutions: Developing specialized SaaS tools for EV battery management, charging infrastructure optimization, and energy consumption diagnostics presents a high-growth niche.

- Expansion into Emerging Markets (APAC and MEA): Rapid vehicle production growth and increasing digital adoption in these regions offer significant opportunities for scalable SaaS deployment.

- Integration of Edge Computing and 5G: Opportunity to develop hybrid cloud SaaS models that leverage low-latency edge processing for critical in-vehicle functions while using the cloud for complex analytics.

- Development of Specialized Cybersecurity SaaS: Offering advanced, AI-powered threat detection and intrusion prevention systems specifically designed for connected car environments.

Segmentation Analysis

The Automotive SaaS Cloud Service Market is comprehensively segmented based on application type, deployment model, organization size, and end-user vertical, reflecting the diverse requirements across the automotive industry lifecycle. Segmentation by application type, such as Supply Chain Management (SCM) and Enterprise Resource Planning (ERP), addresses fundamental operational needs, while segmentation by service type, like Telematics and Infotainment, captures the high-growth connected vehicle sector. The deployment model split between public, private, and hybrid clouds is critical, as it defines security postures and regulatory compliance capabilities, with hybrid models often favored by large OEMs seeking to retain control over highly sensitive intellectual property. Finally, end-user segmentation clearly distinguishes the needs of Original Equipment Manufacturers (OEMs), large Tier 1 suppliers, and independent dealerships, enabling vendors to tailor highly specific feature sets and service level agreements (SLAs).

Further analysis of the segmentation reveals that large enterprises remain the primary consumers of high-value, comprehensive SaaS suites, particularly for complex SCM and manufacturing operations, leveraging custom private cloud deployments to ensure performance and security. Conversely, Small and Medium-sized Enterprises (SMEs), particularly independent dealerships and smaller parts distributors, are rapidly adopting public cloud, off-the-shelf solutions for basic CRM and inventory management, valuing rapid deployment and low maintenance overhead. The Telematics segment is highly dynamic, driven by the shift towards consumption-based pricing models for software features and sophisticated predictive diagnostics, representing the future direction of value creation within the mobility sector, linking vehicle performance directly to cloud-based analytical intelligence.

The strategic importance of segmentation lies in identifying underserved niches. For example, specialized SaaS solutions focusing solely on regulatory compliance for global vehicle certification (e.g., safety, emissions) or specific applications within the rapidly expanding electric vehicle battery lifecycle management offer high margins and less intense competition than generalized DMS or ERP systems. Understanding these micro-segments allows providers to optimize product development and go-to-market strategies, ensuring that their solutions directly address critical pain points within specific subsets of the complex automotive ecosystem, leading to faster customer acquisition and higher retention rates.

- By Application Type:

- Enterprise Resource Planning (ERP)

- Customer Relationship Management (CRM)

- Supply Chain Management (SCM)

- Manufacturing Execution Systems (MES)

- Product Lifecycle Management (PLM)

- Vehicle Diagnostics and Maintenance Management

- Telematics and Infotainment Systems

- Dealer Management Systems (DMS)

- By Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud (Often preferred by OEMs for core IP)

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End User:

- Original Equipment Manufacturers (OEMs)

- Automotive Component Manufacturers (Tier 1 & Tier 2 Suppliers)

- Automotive Dealerships and Retailers

- Fleet Operators and Logistics Providers

- Mobility Service Providers (MaaS)

Value Chain Analysis For Automotive SaaS Cloud Service Market

The value chain for Automotive SaaS Cloud Services commences with the upstream segment, dominated by foundational technology providers, primarily cloud infrastructure hyperscalers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These providers supply the necessary IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) components, including scalable compute, storage, networking, and foundational AI/ML tools, which form the bedrock upon which specialized automotive software is built. Further upstream involvement includes specialized data providers supplying mapping data, real-time traffic information, and standardized vehicle operational data protocols, essential inputs for telematics and diagnostic SaaS applications. The efficiency of this upstream segment is highly dependent on the strategic partnerships forged between SaaS developers and these foundational cloud and data providers, influencing both cost structure and the innovation pace of the final product.

The core midstream segment involves the Automotive SaaS vendors themselves, the firms responsible for developing, customizing, integrating, and delivering the specialized software applications. This crucial stage includes product development (coding specific automotive logic, ensuring functional safety compliance), system integration services (linking the SaaS platform to existing OEM manufacturing systems or dealership databases), and ongoing platform maintenance and security updates. This segment requires deep vertical expertise, transforming generic cloud capabilities into industry-specific solutions like connected vehicle diagnostics, advanced production scheduling, or highly compliant DMS solutions. Successful companies in this stage excel not only in software engineering but also in understanding and rapidly adapting to evolving automotive industry standards and regulatory changes.

The downstream segment focuses on distribution channels and direct engagement with the end-users. Distribution is multifaceted: Direct channels involve SaaS vendors selling and implementing solutions directly to large OEMs or Tier 1 suppliers, characterized by lengthy sales cycles and high contract values requiring extensive customization and support. Indirect channels involve partnerships with system integrators, value-added resellers (VARs), and industry-specific consultants who facilitate the sale and deployment of SaaS solutions, particularly to SMEs and dealerships. The final interaction point is customer support and ongoing managed services, crucial for maintaining high customer retention rates, especially considering the mission-critical nature of applications like manufacturing MES or vehicle OTA update platforms, where continuous availability and reliability are paramount.

Automotive SaaS Cloud Service Market Potential Customers

The primary customers for Automotive SaaS Cloud Services span the entire vehicle lifecycle, beginning with Original Equipment Manufacturers (OEMs) who are major consumers of complex solutions like PLM, SCM, and manufacturing optimization software, leveraging these tools to manage global production lines, new product introductions, and ensure the quality control of millions of vehicles. Tier 1 and Tier 2 suppliers form another vital customer base, utilizing SaaS for managing highly complex global logistics, component traceability, quality management systems (QMS), and regulatory compliance documentation, all critical components of the modern interconnected supply chain. These large enterprise customers require robust, private, or hybrid cloud deployments capable of handling sensitive operational data and integrating with diverse global IT infrastructures.

Beyond manufacturing and supply chain, the service and retail sectors represent a rapidly growing customer segment. Automotive dealerships and dealer groups rely heavily on cloud-based Dealer Management Systems (DMS) and CRM platforms to manage sales processes, service bay scheduling, inventory, financing documentation, and customer retention programs. The shift towards online vehicle purchasing and digital service booking is driving rapid adoption of highly responsive, scalable SaaS platforms in this sector. Furthermore, independent service garages and aftermarket parts distributors increasingly utilize specialized SaaS tools for diagnostic support, repair history tracking, and inventory sourcing, seeking affordable, pay-as-you-go solutions.

An emerging, yet highly influential, customer segment includes massive global fleet operators (e.g., trucking, logistics, rental companies) and new mobility service providers (e.g., ride-sharing companies, autonomous shuttle providers). These entities are intensely data-driven, relying on sophisticated telematics, asset tracking, and predictive maintenance SaaS applications to minimize operating expenses, optimize utilization rates, and manage compliance with stringent safety and environmental regulations. For these customers, the value proposition of SaaS is directly linked to real-time operational intelligence and measurable improvements in logistical efficiency, leading to higher investments in advanced subscription services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion USD |

| Market Forecast in 2033 | $40.5 Billion USD |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Salesforce, Microsoft, IBM, Oracle, CDK Global, Cox Automotive, Reynolds and Reynolds, Harman International (Samsung), Robert Bosch GmbH, Continental AG, Siemens, PegaSystems, Visteon Corporation, Trimble Inc., Ericsson, BlackBerry (QNX), Aptiv PLC, Altair Engineering, Tech Mahindra. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive SaaS Cloud Service Market Key Technology Landscape

The technological underpinnings of the Automotive SaaS Cloud Service Market are heavily reliant on highly scalable, containerized microservices architectures, which facilitate rapid deployment, modularity, and independent scaling of various automotive applications. Key technologies include the use of Kubernetes and Docker for efficient management of workloads across multi-cloud environments, ensuring that applications such as real-time diagnostic processors or global inventory trackers can be scaled instantaneously based on demand fluctuations. Furthermore, the increasing reliance on serverless computing models, particularly for event-driven functions like processing individual telematics data packets, reduces operational overhead and improves vendor agility, enabling faster deployment of patches and feature updates without necessitating downtime for large vehicle fleets or manufacturing sites.

A central technological focus is the seamless integration of IoT (Internet of Things) platforms with the core SaaS infrastructure. The immense volume of data generated by in-vehicle sensors requires specialized IoT gateways and protocols (like MQTT) to efficiently transmit information to the cloud environment. SaaS providers are therefore integrating advanced data lakes and data warehousing solutions built on technologies like Apache Hadoop and Apache Spark to handle petabytes of structured and unstructured vehicle data, enabling complex analytics and feeding predictive models. The architecture must prioritize low latency for safety-critical applications while ensuring high throughput for general performance data, often achieved through strategic deployment of Edge Computing nodes within the vehicle or at regional network access points.

The cybersecurity domain forms a critical pillar of the technology landscape. Modern automotive SaaS solutions must incorporate zero-trust security models, advanced encryption standards (e.g., end-to-end encryption for OTA communications), and API security management tools to protect against unauthorized access and tampering. Blockchain technology is emerging as a critical tool, specifically utilized in supply chain traceability SaaS applications to provide an immutable ledger for component provenance and recall management, enhancing both transparency and regulatory compliance. Moreover, the implementation of comprehensive DevOps and DevSecOps practices is becoming standard, ensuring that security is continuously integrated throughout the development pipeline of all cloud-native automotive services.

Regional Highlights

North America: North America represents the most mature and dominant market for Automotive SaaS Cloud Services, characterized by high adoption rates among major domestic and international OEMs, an advanced ecosystem of connected vehicle technology, and sophisticated dealer groups eager to implement cutting-edge DMS solutions. The region benefits from substantial investment in cloud infrastructure and a regulatory environment that, while strict regarding data privacy, fosters innovation in mobility services and autonomous driving development. The high concentration of technology innovation hubs, particularly in California and the Midwest, drives early adoption of AI-infused SaaS platforms for predictive maintenance and advanced driver assistance system (ADAS) data processing. Market growth here is primarily fueled by the replacement of legacy IT systems with cloud-native solutions and the expansion of subscription-based in-vehicle services.

- Dominant Market Share: Highest revenue contribution due to early adoption of cloud computing and mature connected vehicle infrastructure.

- High Investment in Telematics: Strong focus on optimizing commercial fleet operations and integrating V2X technologies.

- Key Drivers: Stringent compliance requirements and rapid development of autonomous vehicle technology requiring massive data processing capabilities.

Europe: Europe holds a significant market share, driven by strong regulatory mandates focused on vehicle safety (e.g., eCall requirements) and strict environmental standards, which necessitate robust, cloud-based data monitoring and reporting SaaS applications. The region is a hotbed for automotive manufacturing innovation, particularly in Germany, France, and the UK, leading to high demand for PLM and MES SaaS solutions to manage complex, multi-national production environments. However, the market faces unique challenges due to stringent GDPR regulations concerning data sovereignty and cross-border data transfer, necessitating that SaaS vendors offer highly localized and certified private cloud deployments to comply with regional legal requirements.

- Strong Regulatory Influence: GDPR mandates drive demand for localized and highly secure hybrid cloud solutions.

- Manufacturing Excellence: High adoption of SCM and MES SaaS among leading European OEMs and Tier 1 suppliers.

- Focus Areas: Sustainable mobility solutions, electric vehicle battery lifecycle management SaaS, and integration with regional smart city initiatives.

Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market globally, primarily fueled by massive automotive production output in countries like China, Japan, and South Korea, coupled with rapidly increasing vehicle sales in emerging economies like India and Southeast Asia. The market expansion is characterized by greenfield adoption, where new players and expanding operations bypass legacy systems and implement cloud-native SaaS solutions directly. China, in particular, demonstrates immense potential, driven by state-backed digitalization initiatives and high consumer demand for sophisticated in-vehicle infotainment and connectivity services, though geopolitical factors and local data restrictions impose unique requirements on international vendors.

- Highest Growth Rate: Fueled by large-scale production volume and rising middle-class consumer demand for connectivity.

- Greenfield Opportunities: Emerging markets bypass legacy systems, opting directly for public cloud SaaS deployments.

- Key Segments: Fleet management services, telematics, and localized infotainment systems due to diverse language and regional preferences.

Latin America and Middle East & Africa (MEA): These regions represent emerging but rapidly developing markets. Latin America is characterized by increasing foreign investment and a rising necessity for efficient logistics and fleet management SaaS solutions to navigate complex operational environments. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in smart city initiatives and digital infrastructure, driving demand for advanced mobility and dealership management SaaS platforms. Growth in both regions is contingent on continued improvement in internet connectivity infrastructure and the stabilization of economic conditions, but the high growth potential in commercial fleet operations and digital retailing makes them crucial expansion targets for global SaaS providers.

- MEA Focus: Smart city integration and demand for premium retail and DMS solutions in high-wealth nations.

- LATAM Focus: High growth in fleet management and supply chain optimization due to logistical complexity.

- Common Challenge: Infrastructure stability and limited access to localized, high-security cloud facilities often necessitate hybrid or satellite-enabled solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive SaaS Cloud Service Market.- SAP SE

- Salesforce

- Microsoft

- IBM

- Oracle

- CDK Global

- Cox Automotive

- Reynolds and Reynolds

- Harman International (Samsung)

- Robert Bosch GmbH

- Continental AG

- Siemens

- PegaSystems

- Visteon Corporation

- Trimble Inc.

- Ericsson

- BlackBerry (QNX)

- Aptiv PLC

- Altair Engineering

- Tech Mahindra

- CGI Inc.

- Dassault Systemes SE

- General Motors (GM) - Software Services Arm

- Zoho Corporation

- T-Systems International GmbH

Frequently Asked Questions

Analyze common user questions about the Automotive SaaS Cloud Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Automotive SaaS solutions by OEMs?

The primary driver is the necessity for scalable, flexible platforms to manage massive data volumes generated by connected vehicles, support Over-The-Air (OTA) software updates, and facilitate the transition towards subscription-based feature monetization models.

How does the shift to electric vehicles (EVs) impact the Automotive SaaS market demand?

The EV shift dramatically increases demand for specialized SaaS tools focused on battery health monitoring, charging infrastructure optimization, energy consumption analytics, and compliant data management for battery lifecycle traceability.

What are the main security concerns associated with cloud services in the automotive industry?

The main concerns revolve around data sovereignty, securing sensitive vehicle telematics and customer PII (Personally Identifiable Information) against cyberattacks, and ensuring the integrity of critical OTA update pipelines against external threats, necessitating robust encryption and zero-trust architectures.

Which geographical region exhibits the fastest growth potential in this market?

The Asia Pacific (APAC) region, driven by accelerated vehicle production, increased digitalization in emerging economies, and high consumer demand for in-vehicle connectivity features, is projected to experience the highest Compound Annual Growth Rate (CAGR).

What role does Artificial Intelligence (AI) play within Automotive SaaS Cloud Services?

AI is crucial for transforming reactive systems into predictive platforms, enabling advanced predictive maintenance, optimizing complex supply chain logistics, enhancing personalized in-vehicle customer experiences, and bolstering real-time cybersecurity threat detection.

How do Dealer Management Systems (DMS) SaaS platforms enhance automotive retail operations?

DMS SaaS platforms consolidate sales, service, inventory, and financing data into a unified cloud interface, enabling dealerships to provide seamless omnichannel customer experiences, optimize operational workflow efficiency, and improve targeted marketing efforts.

What is the distinction between Public, Private, and Hybrid Cloud deployment models in this sector?

Public cloud offers scalability and cost-efficiency for non-critical apps; Private cloud offers high security and control, often used for core manufacturing IP; Hybrid cloud combines both, allowing OEMs to manage sensitive workloads internally while leveraging public resources for flexibility and large-scale data processing.

Are smaller automotive enterprises actively adopting SaaS solutions?

Yes, Small and Medium-sized Enterprises (SMEs), particularly independent suppliers and dealerships, are rapidly adopting public cloud SaaS models due to lower upfront costs, ease of deployment, and the ability to scale specialized services without significant internal IT investment.

What is the significance of the Value Chain Analysis for SaaS vendors?

The Value Chain Analysis helps vendors identify cost drivers in the upstream segment (hyperscaler fees) and optimize distribution strategies in the downstream segment (direct sales vs. reseller partnerships) to maximize margin and market reach.

How do regulatory changes, such as emissions standards, influence SaaS development?

Regulatory changes necessitate specialized SaaS applications for real-time monitoring, data aggregation, and standardized reporting of vehicle performance and emissions data, ensuring global compliance and minimizing potential fines for OEMs.

What are the primary challenges in integrating new SaaS systems with existing OEM infrastructure?

Challenges include the proprietary nature and high customization of decades-old OEM legacy systems (often on-premise), data mapping complexity, and ensuring zero interruption to mission-critical operations during the necessary data migration and system synchronization processes.

Which specific technology provides the foundational architecture for modern Automotive SaaS?

Containerization technologies, specifically Docker and Kubernetes, alongside microservices architecture, provide the necessary modularity, resilience, and highly scalable environment required to manage diverse and demanding automotive cloud workloads.

Do automotive SaaS providers typically offer customization options for large clients?

Yes, large Original Equipment Manufacturers (OEMs) typically require significant customization, deep integration with their specialized manufacturing systems, and tailored service level agreements (SLAs), making highly flexible platforms a prerequisite for high-value contracts.

What is MaaS and how does it relate to the Automotive SaaS market?

MaaS (Mobility as a Service) refers to the shift from vehicle ownership to consumption-based mobility solutions. It relies entirely on robust Automotive SaaS backends for trip planning, payment processing, fleet scheduling, and real-time vehicle status tracking.

How is blockchain technology being utilized in automotive SaaS?

Blockchain is primarily used in Supply Chain Management (SCM) SaaS for ensuring immutable traceability of critical components, managing digital identities for vehicles, and streamlining intellectual property protection in collaborative R&D environments.

What is the primary focus of the European automotive SaaS market regarding compliance?

The primary focus is compliance with GDPR (General Data Protection Regulation), requiring strict data sovereignty controls, transparent data processing agreements, and localized cloud infrastructure to handle EU citizen data legally.

How do SaaS solutions support autonomous driving development?

SaaS platforms provide the massive, scalable cloud storage, high-throughput data pipelines, and AI/ML processing capabilities necessary for training, testing, and safely deploying the complex algorithms that underpin autonomous vehicle systems (ADAS/AD).

What role do hyperscalers play in the Automotive SaaS value chain?

Hyperscalers (AWS, Azure, GCP) form the upstream foundation, supplying the IaaS and PaaS upon which nearly all automotive SaaS applications are built, offering scalable computing power, storage, and networking resources essential for market operation.

What specific benefits do fleet operators gain from specialized SaaS applications?

Fleet operators benefit from real-time asset tracking, route optimization, driver behavior monitoring, fuel efficiency reporting, and AI-driven predictive maintenance scheduling, all contributing to reduced operational costs and improved regulatory compliance.

Is the market moving more towards Public or Hybrid cloud deployments?

While Public cloud is favored by SMEs, the trend for large OEMs handling sensitive data and core operational systems is overwhelmingly towards Hybrid Cloud models, offering a balance of security, control, and scalable public cloud flexibility.

What defines the Telematics and Infotainment segment within Automotive SaaS?

This segment includes cloud services that manage in-vehicle communication, navigation, media content delivery, remote vehicle diagnostics, and emergency service integration, often operating on a pay-per-use or subscription model directly to the consumer.

How does the implementation of 5G technology affect Automotive SaaS offerings?

5G enables low-latency, high-bandwidth connectivity, critical for real-time sensor data transmission and OTA updates, prompting SaaS vendors to develop solutions that leverage distributed Edge Computing capabilities closer to the vehicle for faster processing.

What are the key differences between ERP and SCM SaaS in the automotive context?

ERP SaaS focuses on internal resource management (finance, HR, core manufacturing planning), while SCM SaaS focuses externally on managing the flow of goods, logistics, supplier relationships, component traceability, and inventory optimization across the entire global supply chain network.

Why is the ability to handle unstructured data critical for modern Automotive SaaS?

Unstructured data, such as video feeds from ADAS sensors, customer feedback logs, and free-form diagnostic notes, constitutes a large percentage of vehicle data; the SaaS platform must efficiently store, process, and analyze this data using AI/ML to extract meaningful operational insights.

What is the projected long-term impact of digitalization on dealership operations?

Digitalization, facilitated by advanced SaaS DMS and CRM, leads to fully integrated omnichannel retailing, personalized customer service delivery, highly efficient service bay scheduling, and significant reductions in administrative overhead.

What factor causes the high bargaining power of large OEMs?

The high bargaining power stems from the substantial volume of systems required, the necessity for deep customization, and the long-term, high-value nature of the contracts, allowing OEMs to demand stringent performance guarantees and specialized pricing models.

How are SaaS providers addressing the restraint of integrating with legacy systems?

SaaS providers are increasingly utilizing sophisticated API layers, standardized data connectors, and microservices architecture to create flexible integration pathways, minimizing the need for radical overhaul of highly customized, but essential, legacy OEM platforms.

Why is North America considered the most mature automotive SaaS market?

North America is mature due to early, widespread adoption of enterprise cloud solutions across major automotive players, high digital transformation readiness, and established infrastructure supporting the complex technological requirements of connected and autonomous vehicle development.

Which specific functional safety standard is highly relevant for automotive SaaS developers?

ISO 26262 (Road vehicles – Functional safety) is highly relevant, requiring that SaaS solutions involved in critical functions (like OTA updates for safety features) adhere to strict development and testing protocols to ensure system reliability and safety integrity levels (ASIL).

What is the significance of the shift towards serverless computing in this market?

Serverless computing reduces operational costs for vendors by eliminating idle infrastructure costs and allows for rapid, event-driven scaling, essential for efficiently processing sporadic bursts of telematics data or managing high-volume, asynchronous service requests.

How are profitability and recurring revenue structured for Automotive SaaS vendors?

Profitability is driven by high customer retention rates and the recurring nature of subscription revenue (MRR/ARR), often supplemented by high-margin professional services for implementation, customization, and ongoing managed support services.

What are the key characteristics of greenfield adoption in the APAC market?

Greenfield adoption in APAC means new manufacturing plants or growing enterprises adopt cloud-native SaaS directly, bypassing the long and complex migration processes associated with replacing older, entrenched on-premise IT systems common in Western markets.

How do SaaS solutions improve component traceability in the supply chain?

SCM SaaS platforms, often enhanced with blockchain, provide end-to-end digital tracking of parts from Tier 2 manufacturing to final vehicle assembly, which is critical for rapid recall management and ensuring compliance with quality standards.

What competitive forces are challenging specialized automotive SaaS vendors?

The primary competitive challenge comes from large hyperscalers (AWS, Microsoft) who are aggressively entering the vertical by offering specialized automotive cloud platforms and forming partnerships, creating intense pressure on pricing and innovation speed for smaller, dedicated vendors.

What are the primary applications of CRM SaaS within the automotive sector?

CRM SaaS applications manage lead generation, track customer communication across various touchpoints (online, dealership), coordinate marketing campaigns, schedule service appointments, and manage customer loyalty and retention programs throughout the vehicle ownership lifecycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager