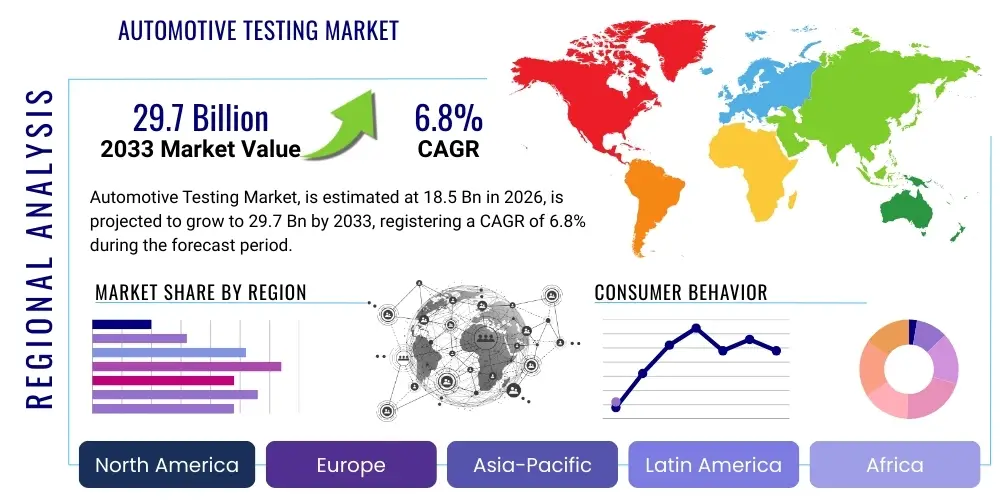

Automotive Testing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443093 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Testing Market Size

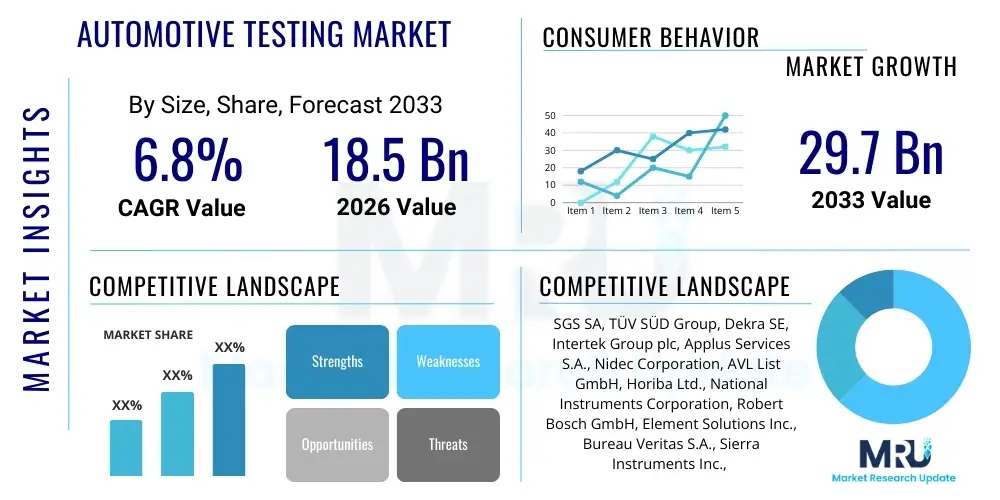

The Automotive Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $29.7 Billion by the end of the forecast period in 2033.

Automotive Testing Market introduction

The Automotive Testing Market encompasses a sophisticated range of services, equipment, and software dedicated to verifying the quality, reliability, safety, and performance of automotive components, systems, and vehicles. This essential market segment addresses rigorous regulatory requirements globally, focusing heavily on reducing emissions, enhancing vehicle safety standards (passive and active), and validating complex electronic architectures related to autonomous and connected vehicle technologies. The scope of testing includes dynamic and static tests, simulation, hardware-in-the-loop (HIL), powertrain testing, durability testing, and electromagnetic compatibility (EMC) testing, ensuring compliance with international standards such as ISO, SAE, and specific regional regulations like those enforced by the EPA and ECE.

Key applications driving market expansion involve the validation of Advanced Driver-Assistance Systems (ADAS), battery and thermal management systems for Electric Vehicles (EVs), and cybersecurity protocols integral to vehicle connectivity. The transition towards electrification and autonomy necessitates significantly more complex and computationally intensive testing procedures compared to traditional internal combustion engine (ICE) vehicles. Benefits derived from robust testing protocols include faster time-to-market for new vehicle models, reduced warranty claims, improved consumer confidence, and, crucially, enhanced occupant safety through verifiable functional integrity of critical systems. Furthermore, market growth is actively driven by global harmonization efforts regarding vehicle safety standards and escalating consumer demand for high-tech, reliable vehicles.

Major driving factors include the rapid global shift toward electric mobility, mandating extensive battery and powertrain performance testing; the implementation of stringent safety norms like NCAP ratings, requiring comprehensive crash and component testing; and the proliferation of software-defined vehicles (SDVs), necessitating continuous validation of software updates and integration across multiple vehicle domains. These trends are forcing manufacturers and third-party testing organizations to invest heavily in advanced testing infrastructure, including specialized laboratories, high-speed data acquisition systems, and sophisticated simulation tools capable of handling vast datasets generated by modern vehicle architectures.

Automotive Testing Market Executive Summary

The Automotive Testing Market is characterized by a significant shift in investment focus from traditional mechanical testing toward digital validation and electrification components testing. Business trends indicate a consolidation among third-party testing, inspection, and certification (TIC) providers, aiming to offer end-to-end solutions that span the entire vehicle lifecycle, from component design validation to end-of-line verification. The escalating complexity of software integration in connected and autonomous vehicles is fueling demand for specialized software testing platforms, leading to greater collaboration between automotive OEMs and technology firms specializing in artificial intelligence and machine learning for simulation validation. Furthermore, sustainability mandates are accelerating the demand for lifecycle analysis and materials testing aimed at reducing the environmental footprint of vehicle manufacturing and operation.

Regionally, the Asia Pacific (APAC) region is poised to dominate market growth, primarily fueled by massive electric vehicle manufacturing scale-up in China and India, coupled with stringent emission regulations adopted across emerging economies. Europe maintains a strong position due to early and strict enforcement of functional safety standards (ISO 26262) and rigorous ADAS testing protocols, necessitating high-precision testing services. North America, while mature, sees significant innovation driven by autonomous vehicle development and the push toward establishing robust cybersecurity testing standards for connected infrastructure. Investment in regional test centers focuses on environmental chambers, crash simulation facilities, and dedicated tracks for autonomous vehicle validation under diverse climatic conditions.

Segmentation trends highlight the increasing prominence of the 'Testing Equipment' segment, driven by the need for advanced dynamometers, battery cyclers, and sophisticated data loggers required for EV testing. In terms of application, 'ADAS and Safety Testing' and 'Powertrain Testing' (specifically EV battery and motor testing) are exhibiting the highest growth rates, reflecting regulatory priorities and industry transition. Service-wise, outsourcing testing to third-party providers is gaining traction as OEMs seek specialized expertise and flexible capacity, particularly for complex and capital-intensive domains such as full-vehicle crash testing and long-duration durability trials.

AI Impact Analysis on Automotive Testing Market

User queries regarding the impact of AI on automotive testing predominantly revolve around how AI can enhance efficiency, reduce physical testing dependency, and handle the exponential increase in data generated by autonomous vehicle development. Key concerns focus on the reliability and trustworthiness of AI-driven simulation results compared to real-world physical testing, the standards required for validating AI models used in test environments, and the necessary skill transformation among testing engineers. Users are particularly interested in AI's role in optimizing test scenarios, predicting component failures before they occur, and automating the classification and analysis of massive volumes of sensor data collected during road testing. The consensus expectation is that AI will move the industry from reactive testing (finding defects) to proactive validation (preventing defects) through predictive modeling and enhanced simulation fidelity, ultimately reducing the cost and time associated with physical prototyping.

- Test Case Optimization: AI algorithms are used to intelligently select and prioritize the most critical and impactful test scenarios, minimizing redundant or low-value testing efforts, particularly in the validation of complex ADAS functionalities and autonomous driving software stacks.

- Simulation Fidelity Enhancement: Machine learning models improve the accuracy and realism of virtual testing environments (HIL and SIL), allowing for the safe and rapid exploration of corner cases and edge scenarios that are too dangerous or costly to replicate physically.

- Predictive Maintenance and Reliability: AI analyzes historical test data and operational field data to predict potential component weaknesses or failure points, shifting the focus from validation of existing design to proactive design optimization.

- Data Annotation and Analysis Automation: Deep learning models accelerate the automated labeling, classification, and analysis of sensor data (LiDAR, radar, cameras) collected during road testing, drastically speeding up the detection and reporting of anomalies or behavioral errors.

- Autonomous System Validation: AI is essential for handling the verification of non-deterministic systems like Level 4 and Level 5 autonomous vehicles, enabling robustness testing against unforeseen environmental variables and complex behavioral interactions.

DRO & Impact Forces Of Automotive Testing Market

The market trajectory is primarily driven by rigorous global regulatory enforcement of safety and environmental mandates, particularly the shift toward zero-emission vehicle standards and enhanced passive and active safety features required by updated NCAP protocols. This regulatory pressure acts as a fundamental driver, forcing OEMs and suppliers to utilize sophisticated testing methods to achieve compliance quickly. Simultaneously, the inherent capital intensity and high operational costs associated with building and maintaining state-of-the-art testing infrastructure, especially for highly specialized areas like battery thermal management or high-speed crash testing, present a significant restraint, often leading smaller players to rely heavily on outsourcing. Opportunities, however, abound in the development and integration of advanced simulation technologies, cyber security testing services for connected vehicles, and specialized expertise in validating software-defined vehicle architectures, creating high-value service niches.

Drivers: The dominant driver is the unprecedented growth in the Electric Vehicle (EV) sector, necessitating comprehensive testing of battery performance, durability, safety, and charging infrastructure compatibility. A secondary but equally potent driver is the mandatory adoption of advanced safety features, including Level 2 and Level 3 ADAS functionalities, which require complex validation against diverse operational conditions and regulatory benchmarks. Furthermore, the global harmonization of testing standards, aiming to reduce divergence between major automotive markets (e.g., EU, US, China), encourages multinational testing providers to standardize offerings and expand geographical reach.

Restraints: The primary restraint involves the substantial investment required for next-generation testing facilities tailored for high-voltage systems and autonomous driving sensors, making the entry barrier high. Another constraint is the critical shortage of highly skilled engineering talent capable of managing complex, integrated testing environments that combine physical systems with virtual modeling (digital twins). The challenge of validating the infinite variability of scenarios encountered by autonomous vehicles in the real world, often requiring billions of miles of simulated or physical testing, also slows development cycles and increases costs significantly.

Opportunity: Significant market opportunities lie in offering specialized cybersecurity testing and compliance services, given the increasing vulnerability of connected vehicles to remote attacks. The development and deployment of cloud-based testing and validation platforms, which allow for distributed collaboration and simulation on a massive scale, represent a major growth area. Moreover, the demand for non-destructive testing (NDT) and advanced material testing services for lighter, stronger, and more sustainable automotive materials presents a niche opportunity for specialized technological providers.

Impact Forces: The impact forces are currently skewed toward regulatory and technological acceleration. Regulatory forces demand immediate compliance and sophisticated verification, pushing market growth (High Impact). Technological forces, specifically the maturity of simulation tools and AI integration, are rapidly transforming the methodology of testing, substituting some physical tests with virtual validation, leading to efficiency gains (Medium to High Impact). Economic factors, such as volatile raw material costs and fluctuating automotive production levels, exert medium-level negative pressure, affecting capital expenditure on new test facilities, though the essential nature of safety testing provides stability.

Segmentation Analysis

The Automotive Testing Market is intricately segmented based on the component being tested, the service type rendered, the type of testing equipment utilized, and the application area targeted. This segmentation reflects the varied technological needs and compliance demands across the automotive value chain. Critical segments include component testing (e.g., engines, brakes, transmission), system-level testing (e.g., ADAS, infotainment), and full vehicle testing (e.g., crash, durability). The division between physical testing and virtual simulation services is increasingly relevant, driven by the shift towards software-defined vehicle validation, where simulation often precedes or supplements real-world verification for cost and efficiency reasons. Understanding these segments is crucial for manufacturers, suppliers, and third-party laboratories to tailor investment strategies and service offerings effectively.

- By Component: Engine and Powertrain, Chassis, Automotive Electronics, Components and Sub-Components, Telematics and Infotainment.

- By Service Type: Inspection, Testing, Certification, Consulting.

- By Application: Safety Testing (Active and Passive), Performance Testing, Durability and Reliability Testing, Noise, Vibration, and Harshness (NVH) Testing, Emission Testing, EMC/EMI Testing, ADAS Testing, Electric Vehicle (EV) Testing (Battery, Motor, Charging).

- By Equipment Type: Diagnostic Tools, Dynamometers (Chassis, Engine), Emission Analyzers, Wheel and Tire Testers, Crash Test Dummies, Battery Testing Equipment, Sensor Testing Equipment.

- By Vehicle Type: Passenger Vehicles, Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles).

Value Chain Analysis For Automotive Testing Market

The value chain for the Automotive Testing Market begins upstream with the providers of highly specialized testing equipment, software, and sensors. These upstream suppliers, including manufacturers of dynamometers, simulation software providers (e.g., hardware-in-the-loop platforms), and advanced data acquisition systems, dictate the technological capacity and throughput of the testing process. Innovation at this stage, particularly in developing high-fidelity simulators and battery cyclers capable of handling high voltage and high-power applications, is critical. The efficiency and accuracy of the entire subsequent testing cycle are highly dependent on the quality and performance of these foundational tools and software platforms, requiring significant R&D investment from upstream participants to maintain market relevance.

Midstream, the value chain involves the testing service providers, encompassing OEM in-house laboratories, Tier 1 supplier testing facilities, and specialized independent third-party testing, inspection, and certification (TIC) organizations. These entities execute the actual physical and virtual testing protocols, adhering strictly to global and regional regulatory mandates. Third-party testing houses play a vital role in providing unbiased certification and verification, often possessing the necessary capital-intensive equipment and accreditation that individual OEMs might not justify for sporadic use. The trend toward outsourcing complex and non-core testing tasks is strengthening the position of these independent TIC providers.

Downstream, the tested and certified components and vehicles are delivered to the final consumers. The distribution channel is predominantly direct or outsourced. Direct channels involve OEMs utilizing their certified components in vehicle assembly. Indirect channels primarily involve the third-party TIC organizations whose certified results enable global market access and regulatory compliance for automotive manufacturers. Crucially, the final step involves the regulatory bodies (e.g., NHTSA, ECE, EPA) which utilize the output of this value chain to enforce standards, making compliance validation the ultimate value delivered by the entire testing ecosystem.

Automotive Testing Market Potential Customers

The primary end-users and buyers in the Automotive Testing Market are the Original Equipment Manufacturers (OEMs). These companies, including major global automotive brands, require extensive testing for every component, system, and vehicle platform they develop to ensure safety, performance, and regulatory compliance before market launch. OEMs typically maintain large in-house testing facilities for core competencies but often outsource specialized, capital-intensive, or non-core testing activities, such as environmental chambers testing, full-scale crash tests, and large-volume emissions certification, to third-party labs, making them dual consumers of both equipment and services.

Tier 1 and Tier 2 automotive suppliers constitute the second major segment of potential customers. As component and subsystem complexity grows—particularly for ADAS sensors, high-voltage battery modules, and complex ECU hardware—suppliers must independently validate their products meet OEM specifications and industry standards (e.g., functional safety standards ISO 26262). These suppliers often lack the large-scale testing infrastructure of OEMs and are heavy users of third-party testing services for both design verification (DV) and production validation (PV) testing stages, driving demand for specialized component testing services like stress, vibration, and thermal cycling tests.

Other key customers include regulatory bodies, governmental agencies, and insurance consortia that conduct independent research or verification testing to inform policy or set safety standards. Furthermore, the burgeoning aftermarket and service industry requires testing services for specialized components, tuning, and repair validation. The emerging electric vehicle charging infrastructure developers also represent a growing customer base, requiring validation services for charging protocols, interoperability, and system safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $29.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGS SA, TÜV SÜD Group, Dekra SE, Intertek Group plc, Applus Services S.A., Nidec Corporation, AVL List GmbH, Horiba Ltd., National Instruments Corporation, Robert Bosch GmbH, Element Solutions Inc., Bureau Veritas S.A., Sierra Instruments Inc., ZF Friedrichshafen AG, Continental AG, KPIT Technologies, HBM Test and Measurement, IAV Automotive Engineering, DNV GL, MISTRAS Group, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Testing Market Key Technology Landscape

The technological evolution in the automotive testing market is centered on enhancing simulation fidelity, handling massive data volumes, and supporting the validation of highly complex, interconnected electronic systems. Hardware-in-the-Loop (HIL) and Software-in-the-Loop (SIL) simulation techniques remain foundational, but they are increasingly being augmented by advanced computational tools like digital twin technology. Digital twins create precise virtual replicas of physical systems or entire vehicles, allowing for thousands of test scenarios to be run simultaneously in a virtual environment before a single physical prototype is built. This technological shift drastically reduces the development lifecycle and the associated costs of physical testing, particularly for new ADAS features and complex powertrain control units (PCUs) in EVs. The industry is rapidly adopting high-speed data acquisition systems (DAQ) capable of handling the terabytes of sensor data generated by Level 4 and Level 5 autonomous test vehicles.

The specialized requirements of Electric Vehicles (EVs) have spurred innovation in battery testing equipment, including sophisticated high-power, multi-channel battery cyclers capable of performing precise performance, safety, and durability assessments under extreme thermal conditions. Furthermore, the integration of 5G and V2X (Vehicle-to-Everything) communication requires specialized Over-the-Air (OTA) testing chambers and sophisticated electromagnetic compatibility (EMC) testing methodologies. The proliferation of vehicle connectivity also demands advanced cybersecurity testing tools, which simulate malicious attacks and vulnerabilities within the vehicle's network architecture (CAN bus, Ethernet) and associated cloud backend systems, moving testing beyond purely functional verification to robust security validation.

Artificial Intelligence and Machine Learning (AI/ML) are pivotal in transforming raw test data into actionable insights. These technologies are applied to automate the design of experiments (DoE), predict failure modes based on historical data patterns, and automatically classify hazardous or critical events captured during road tests, thereby significantly accelerating the validation process. The future landscape includes fully integrated test ecosystems where virtual simulation, physical testing, and real-world data collection continuously feed into and refine AI models, enabling a continuous validation cycle necessary for the rapid deployment and update of software-defined vehicle features.

Regional Highlights

- North America: This region is characterized by high demand for cutting-edge autonomous vehicle (AV) and cybersecurity testing solutions. The emphasis here is on functional safety standards, complex sensor validation (LiDAR, radar fusion), and validation of V2X connectivity protocols. Regulatory pressure from agencies like NHTSA, alongside local initiatives in states like California for AV road testing, drives significant investment in specialized testing tracks and advanced simulation facilities. The mature automotive manufacturing base and the presence of leading technology providers ensure rapid adoption of HIL/SIL and AI-driven validation tools. The rapid expansion of electric vehicle programs and associated battery gigafactories necessitates considerable growth in specialized thermal and performance testing capacity within the region.

- Europe: Europe is a leader in enforcing stringent environmental and safety regulations, particularly concerning vehicle emissions (Euro 7 pending) and functional safety (ISO 26262 compliance). This stringent regulatory environment forces OEMs and suppliers to continuously invest in emission analysis equipment, NVH testing, and high-fidelity crash test facilities. The region's focus on sustainable mobility is accelerating demand for highly accurate EV testing, including battery homologation and range validation under real-world European driving cycles. Germany, in particular, remains a powerhouse for R&D and advanced component testing, fostering a high concentration of leading third-party TIC providers who service the complex validation needs of the premium automotive segment.

- Asia Pacific (APAC): APAC is the fastest-growing market segment, primarily due to the massive scale of vehicle production in China, Japan, South Korea, and emerging markets like India. China's aggressive push into New Energy Vehicles (NEVs) dominates regional growth, creating an unprecedented demand for battery testing, charging infrastructure validation, and regulatory compliance testing tailored to Chinese national standards (GB standards). Japan and South Korea lead in advanced robotics and precision testing equipment manufacturing. Furthermore, increasing regulatory focus in countries like India on improved safety standards (similar to Bharat NCAP) is boosting demand for crash testing and component durability verification services across the sub-continent.

- Latin America: This market exhibits stable growth, driven largely by regulatory modernization and increasing local production volume. The primary focus remains on foundational safety requirements, emission compliance (often following US or European standards with a time lag), and durability testing under diverse road conditions specific to the region. Brazil and Mexico are key markets due to their significant manufacturing footprints, acting as major export hubs. Testing infrastructure development here is often focused on establishing regional centers of excellence for basic vehicle validation and quality control, relying heavily on multinational TIC providers for complex, highly technical tests.

- Middle East and Africa (MEA): Growth in MEA is specialized, driven by localized climate testing requirements, particularly extreme heat and dust durability testing necessary for vehicles operating in desert environments. The market is also seeing increased investment in testing infrastructure linked to emerging local assembly plants, aiming to ensure compliance with Gulf Standards Organization (GSO) regulations. While smaller in volume compared to APAC or Europe, the strategic importance of validating vehicle performance and reliability under severe thermal stress provides unique opportunities for specialized testing chambers and field validation services. Investment in basic vehicle inspection and certification services is also increasing, aiming to improve road safety standards across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Testing Market.- SGS SA

- TÜV SÜD Group

- Dekra SE

- Intertek Group plc

- Applus Services S.A.

- AVL List GmbH

- Horiba Ltd.

- National Instruments Corporation (NI)

- Robert Bosch GmbH

- Element Solutions Inc.

- Bureau Veritas S.A.

- Sierra Instruments Inc.

- Kistler Group

- dSPACE GmbH

- ZF Friedrichshafen AG

- Continental AG

- Keysight Technologies

- Müller-BBM Group

- Wipro Limited (Automotive Testing Services)

- A&D Technology, Inc.

Frequently Asked Questions

Analyze common user questions about the Automotive Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Automotive Testing Market?

The primary drivers include increasingly stringent global safety regulations (like updated NCAP requirements), mandated emissions reductions, the massive shift toward electric vehicle (EV) production requiring advanced battery and powertrain testing, and the complexity introduced by Advanced Driver-Assistance Systems (ADAS) and autonomous driving features.

How is Electric Vehicle (EV) adoption changing automotive testing methodologies?

EV adoption necessitates a fundamental shift toward high-voltage battery testing (thermal management, safety, cycling), e-motor performance validation, and specialized charging infrastructure compliance testing (interoperability and efficiency), moving resources away from traditional ICE powertrain testing.

What role does Artificial Intelligence play in the future of vehicle testing?

AI is crucial for optimizing test scenarios, especially for autonomous systems, by predicting high-risk or critical corner cases in simulations, automating the analysis of vast datasets collected during road testing, and improving the fidelity and efficiency of HIL/SIL environments, thereby reducing reliance on costly physical testing.

Which geographical region holds the highest growth potential for automotive testing?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven primarily by the massive manufacturing scale and rapid adoption of New Energy Vehicles (NEVs) in China, coupled with increasingly stringent localized safety and environmental regulations being implemented across major developing economies like India.

What are the key challenges facing the independent third-party testing organizations (TIC)?

TIC organizations face the challenge of continuously updating and investing in highly capital-intensive equipment (e.g., advanced battery cyclers, dedicated 5G/V2X test beds) to keep pace with rapid technological advancements, along with the difficulty of recruiting specialized engineering talent trained in autonomous and cybersecurity validation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Test Equipment (Automotive Testing Equipments) Market Size Report By Type (Chassis Dynamometer, Engine Dynamometer, Vehicle Emission Test System, Wheel Alignment Tester), By Application (OEM, Aftermarket, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Automotive Testing Equipments Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Chassis Dynamometer, Engine Dynamometer, Wheel Alignment Tester, Vehicle Emission Test System), By Application (Passenger Vehicle, Light Commercial Vehicle, Heavy Commercial Vehicle), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager