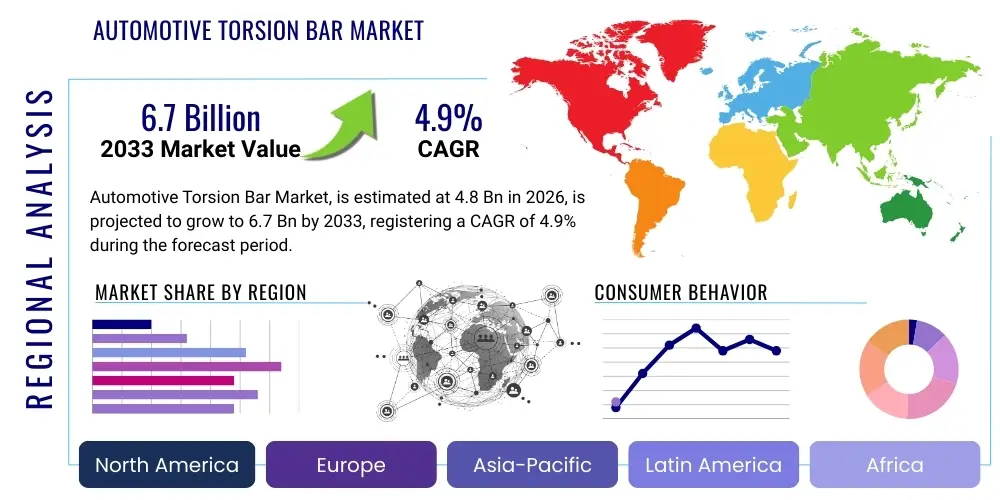

Automotive Torsion Bar Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443032 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Torsion Bar Market Size

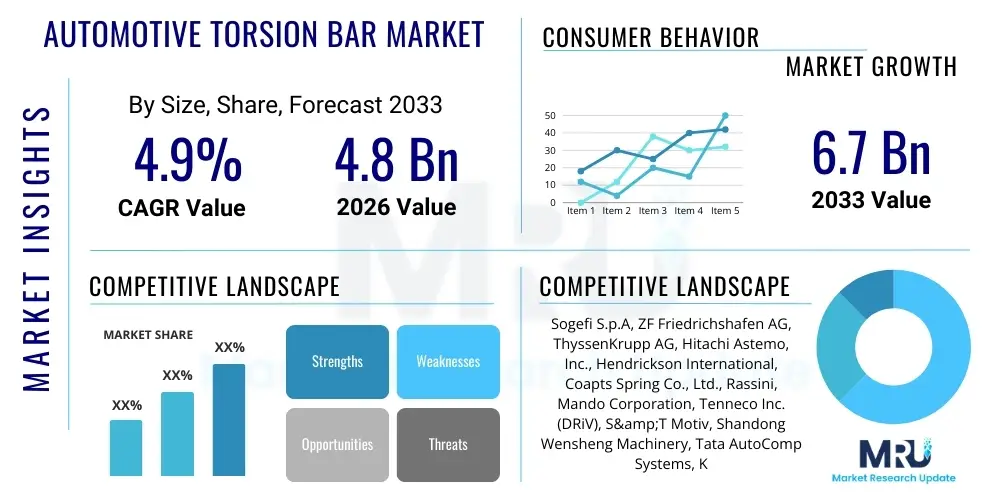

The Automotive Torsion Bar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.9% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This steady growth trajectory is primarily driven by the consistent global production of light commercial vehicles (LCVs) and heavy-duty vehicles (HDVs), where torsion bars remain a cost-effective and robust solution for suspension systems, offering high durability and load-carrying capacity essential for demanding operational environments.

The market expansion is closely tied to infrastructure development globally, particularly in emerging economies of Asia Pacific and Latin America, which spurs demand for commercial vehicles. Torsion bars, due to their simplicity and reliability compared to complex air or coil spring setups in certain applications, maintain a strong market presence, especially in pickup trucks, SUVs, and specialized military or off-road vehicles. Furthermore, ongoing innovation in material science, focusing on high-strength alloy steels and composites, aims to reduce the weight of these components without compromising structural integrity or performance, aligning with stringent automotive emissions and fuel efficiency targets.

While the transition towards Battery Electric Vehicles (BEVs) initially posed a challenge due to differing chassis designs, torsion bars continue to find applications in specific EV platforms, particularly those designed for utility or commercial use requiring robust load management. The replacement market, fueled by the long lifespan of commercial vehicles and the necessity for periodic maintenance of critical suspension components, also contributes significantly to the overall market valuation. Regulatory mandates concerning vehicle safety, requiring stable and predictable handling under various load conditions, further solidify the foundational demand for reliable suspension elements like torsion bars.

Automotive Torsion Bar Market introduction

The Automotive Torsion Bar Market encompasses the manufacturing, distribution, and utilization of high-strength elastic elements designed primarily for vehicle suspension systems, though they also serve roles in steering mechanisms and anti-roll stabilization. A torsion bar functions by utilizing the stiffness of a piece of metal, typically specialized alloy steel, against twisting; one end is fixed to the vehicle chassis, while the other is connected to the suspension arm. When a wheel encounters a bump, the suspension arm rotates, twisting the bar, which then resists this motion, effectively absorbing and returning energy to dampen vibrations and maintain vehicle ride height and stability. The key applications are concentrated in light commercial vehicles, heavy trucks, and high-performance passenger vehicles where precise load leveling and durability are paramount, offering benefits such as compactness, variable stiffness adjustment, and superior reliability under continuous heavy stress, thereby driving consistent market demand.

The product, essentially a long straight piece of spring steel, provides a simple yet highly effective means of suspension, eliminating the need for bulky conventional springs. Its inherent linearity and ease of tuning make it a preferred choice for manufacturers prioritizing durability and operational simplicity, particularly in vehicles subjected to harsh terrains or high payloads, such as off-road utility vehicles and medium-duty trucks. The main driving factors for the market include increasing global vehicle production, especially in the commercial sector, technological advancements leading to lighter and stronger materials (e.g., micro-alloyed steel), and the persistent requirement for enhanced vehicle safety and handling performance mandated by global regulatory bodies, ensuring the sustained relevance of this specialized component.

Automotive Torsion Bar Market Executive Summary

The Automotive Torsion Bar Market is characterized by moderate but stable growth, anchored predominantly by the robust demand within the commercial vehicle segment globally, coupled with strategic material innovations aimed at weight reduction. Current business trends indicate a strong focus among manufacturers on integrating advanced finite element analysis (FEA) into the design process to optimize component geometry and maximize fatigue life, enhancing product competitiveness against alternative suspension solutions. Regionally, the Asia Pacific (APAC) market leads in volume due to high automotive manufacturing output and burgeoning commercial fleets, while North America remains a crucial market valuing high load-carrying capacity in its ubiquitous pickup truck and SUV segments. Segment trends highlight the dominance of steel-based torsion bars, though specialized, higher-margin segments are exploring composite materials for high-performance or niche military applications, indicating a gradual, selective shift towards lightweighting technologies.

The competitive landscape is consolidated, dominated by major Tier 1 suppliers specializing in precision metal forging and spring manufacturing, who leverage global supply chains and established relationships with Original Equipment Manufacturers (OEMs). Strategic imperatives include localized manufacturing to mitigate logistical risks and geopolitical trade tensions, alongside vertical integration to control the quality of specialized alloy inputs. Financial performance in this market is generally stable, supported by long-term contracts and the essential nature of the product, although profitability is highly sensitive to fluctuations in raw material costs, particularly nickel and molybdenum used in high-grade spring steel. Overall, the market remains foundational to the heavy-duty vehicle sector, ensuring predictable, sustained revenue generation despite the disruptive shift occurring in passenger vehicle suspension design towards adaptive and air-based systems.

AI Impact Analysis on Automotive Torsion Bar Market

User inquiries regarding the impact of AI on the Automotive Torsion Bar Market commonly revolve around three core themes: optimization of manufacturing and material selection, integration into smart suspension systems, and the role of AI in predictive maintenance for critical suspension components. Users are keen to understand how AI-driven simulation and generative design could lead to lighter, more efficient torsion bar geometries that maximize strength-to-weight ratios, thereby addressing major design constraints. Furthermore, there is significant interest in how real-time data from vehicle sensors, processed by AI algorithms, might inform the optimal performance characteristics required for torsion bars in future autonomous and connected vehicles, moving the focus from passive components to data-informed design inputs. The primary expectation is that AI will revolutionize the upfront engineering and quality control phases, drastically reducing design cycle times and material waste while ensuring ultra-high reliability standards.

- AI-driven topology optimization for lightweight design, resulting in highly efficient torsion bar geometries.

- Predictive modeling of material fatigue and fracture mechanics, enhancing the reliability and lifespan of components.

- Integration of machine learning algorithms for real-time quality control during the forging and heat treatment processes.

- Optimization of supply chain and inventory management based on AI forecasting of vehicle production schedules.

- Use of sensor data and AI analysis to inform design requirements for next-generation, high-performance suspension systems.

DRO & Impact Forces Of Automotive Torsion Bar Market

The Automotive Torsion Bar Market is influenced by a dynamic interplay of factors encompassing strong regulatory push for commercial vehicle safety (Driver), intense competition from newer, more adaptable suspension technologies like air springs in premium segments (Restraint), and the significant opportunity presented by expanding heavy-duty and utility vehicle fleets in rapidly industrializing nations (Opportunity). The primary driver is the unparalleled reliability, low maintenance requirement, and cost-effectiveness of torsion bars in high-load applications where complex electronics are undesirable. However, this is heavily restrained by the rising adoption of alternative suspension systems in electric vehicles and high-end SUVs, where weight and adaptability are prioritized over sheer durability. The opportunity lies in the burgeoning aftermarket and replacement segment, particularly as average fleet ages increase, requiring robust and readily available replacement parts, alongside the development of composite torsion bars that mitigate the traditional weight penalty associated with steel components.

Impact forces currently shaping the market are centered around regulatory changes and material costs. Stringent vehicle safety standards globally, requiring predictable handling and stability, fundamentally necessitate reliable suspension elements, thereby exerting a high positive impact force. Conversely, volatility in the pricing of key raw materials, specifically high-grade specialty steels, introduces significant pressure on manufacturer margins, acting as a moderate to high restraining force. The ongoing global shift towards electrification, categorized as an external disruptive force, marginally constrains future growth primarily within the conventional passenger vehicle application, yet its impact on the commercial vehicle segment remains moderated as torsion bars are frequently retained in rugged electric utility platforms due to their fundamental structural advantages in managing battery weight and payload variance.

Ultimately, the market demonstrates resilience due to its entrenched position in specific high-demand vehicle categories. While substitution risk is present in luxury and specialized light-duty markets, the sheer volume and operational requirements of global commercial and utility fleets ensure that the demand for rugged, reliable, and standardized suspension components, such as torsion bars, remains robust. Manufacturers must focus on mitigating cost pressures through operational efficiency and material innovation to capitalize on the sustained expansion of utility and light truck sales worldwide.

Segmentation Analysis

The Automotive Torsion Bar Market is systematically segmented based on key functional and application parameters, allowing for detailed market assessment across diverse vehicle platforms and operational requirements. Primary segmentation revolves around Vehicle Type, distinguishing between Passenger Vehicles (P.V.) and Commercial Vehicles (C.V.), with C.V. historically dominating the market share due to the component’s strength and utility in load management. Further differentiation occurs by Material Type, predominantly encompassing Alloy Steel and gradually exploring High-Performance Composites, driven by the push for vehicle lightweighting. Additionally, Application segmentation (Suspension System, Steering System, and Stabilizer Bars) clarifies the functional diversity, demonstrating that while suspension is the largest application, torsion elements are crucial in stabilizer bars (anti-roll bars) for managing lateral vehicle dynamics and enhancing stability.

Understanding these segments is crucial for strategic market entry and product development. For instance, the Alloy Steel segment is volume-driven, focusing on maximizing cost-efficiency and durability for high-volume commercial vehicle OEMs, whereas the nascent Composite segment targets high-end performance applications or military vehicles where weight reduction justifies higher material costs. Regional segmentation confirms that market growth is closely tied to regional industrial output and regulatory frameworks; for example, North America’s emphasis on heavy pickup trucks ensures a consistently high demand for robust torsion bar specifications, while European regulations often prioritize advanced materials that contribute to enhanced fuel efficiency and emissions reduction across all vehicle types.

- By Vehicle Type:

- Passenger Vehicles (P.V.)

- Light Commercial Vehicles (L.C.V.)

- Heavy Commercial Vehicles (H.C.V.)

- By Material Type:

- Alloy Steel (e.g., Chromium-Vanadium Steel)

- Specialty High-Strength Steel

- Composites and Other Materials

- By Application:

- Suspension Systems (Front and Rear)

- Stabilizer Bars (Anti-Roll Bars)

- Steering Components (Limited Use)

- By End-Use Market:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Replacement and Upgrades)

Value Chain Analysis For Automotive Torsion Bar Market

The value chain for the Automotive Torsion Bar Market begins upstream with the procurement of specialized raw materials, primarily high-grade spring alloy steels (such as 5160, 6150, or similar Cr-V alloys) crucial for achieving the necessary strength and fatigue resistance. This upstream phase involves close coordination with specialized metallurgical suppliers and steel mills to ensure material consistency and compliance with stringent automotive quality standards, often requiring custom forging stock. Midstream activities involve precision manufacturing processes, including hot rolling or cold drawing, specialized heat treatment (quenching and tempering), surface preparation (such as shot peening to enhance fatigue resistance), and precise machining of splined ends. This phase is capital-intensive and requires high technical expertise in metallurgy and mechanical engineering to achieve the exact torque-deflection characteristics required by the OEM.

The distribution channel is predominantly an indirect model, characteristic of the Tier 1 automotive supply structure. Manufacturers (Tier 1 suppliers) typically sell directly to Original Equipment Manufacturers (OEMs) under long-term contracts, delivering components for assembly line integration (the direct path). A significant, though secondary, channel is the aftermarket, where distribution is handled by authorized distributors, wholesalers, and specialized parts retailers who service maintenance and repair operations (MRO). Downstream analysis focuses on the end-users: primarily vehicle manufacturers who integrate the bars into chassis assemblies, and subsequently, fleet operators and individual vehicle owners who require replacement parts. Efficiency in this chain is highly dependent on managing material costs and optimizing the high-precision manufacturing steps to maintain competitive pricing, given the standardized nature of the product.

Optimization of the value chain increasingly involves digital integration, where component design data is seamlessly shared between the OEM, the Tier 1 supplier, and sometimes even the raw material producer. This collaboration ensures rapid prototype development and allows for immediate adjustments based on real-world testing or simulations. The critical challenge in the downstream segment remains combating counterfeit parts in the aftermarket, necessitating strict quality assurance and branding for genuine OEM-supplied components. As vehicle production globalizes, the logistical complexity of delivering heavy, specialized components efficiently to diverse assembly plants across continents also becomes a significant factor influencing total landed costs and supply chain robustness, demanding strategically located manufacturing hubs.

Automotive Torsion Bar Market Potential Customers

The primary potential customers and buyers within the Automotive Torsion Bar Market are Original Equipment Manufacturers (OEMs) across the global automotive industry, including specialized manufacturers of light trucks, heavy commercial vehicles, buses, and utility vehicles. These major buyers integrate the torsion bars as foundational components into their chassis and suspension assemblies during the initial vehicle production phase, requiring high-volume supply, rigorous quality certification, and adherence to specific design tolerances unique to each vehicle platform. Secondary customers include large governmental agencies, such as military and defense organizations, that utilize heavy-duty, off-road, or specialized armored vehicles which rely heavily on robust torsion bar suspension systems for extreme operating conditions and high payload capacity, often necessitating highly customized or hardened materials.

A third, rapidly growing customer base is the global automotive aftermarket, encompassing independent repair shops, certified maintenance service centers, and specialized performance tuning companies. These customers purchase torsion bars for replacement purposes, either due to wear and tear over the vehicle’s lifecycle, or as part of performance upgrades where higher stiffness or adjustable systems are required for motorsport or heavy hauling applications. Furthermore, fleet operators—companies managing large logistics, construction, or mining vehicle fleets—represent significant recurring customers, as they prioritize component durability, minimal downtime, and the long-term total cost of ownership (TCO), making reliable, easily replaceable torsion bars an attractive maintenance solution compared to more complex, electronic suspension alternatives.

Therefore, successful market penetration requires manufacturers to establish robust relationships with Tier 1 and Tier 2 OEMs through proven reliability and competitive pricing, while simultaneously cultivating a wide, accessible distribution network to serve the high-volume, fragmented needs of the global aftermarket. Targeted marketing efforts should address the distinct needs of each customer segment: high-precision engineering and just-in-time delivery for OEMs, and superior longevity and readily available stock for the aftermarket and fleet maintenance buyers. The evolution of the customer base towards electric utility vehicles also presents a specialized opportunity, as the high weight of battery packs often necessitates stronger or redesigned suspension components capable of managing significantly increased unsprung mass while maintaining dynamic stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 4.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sogefi S.p.A, ZF Friedrichshafen AG, ThyssenKrupp AG, Hitachi Astemo, Inc., Hendrickson International, Coapts Spring Co., Ltd., Rassini, Mando Corporation, Tenneco Inc. (DRiV), S&T Motiv, Shandong Wensheng Machinery, Tata AutoComp Systems, Kilen Springs (Lesjofors AB), NHK Spring Co., Ltd., Muhr und Bender KG (MUBEA), Gestamp Automoción S.A., Sanluis Rassini, Wanxiang Qianchao Co., Ltd., Sogefi Rejna, Benteler International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Torsion Bar Market Key Technology Landscape

The technological landscape of the Automotive Torsion Bar Market is primarily characterized by advancements in material science, manufacturing precision, and computational modeling, rather than dramatic electronic integration typical of other automotive sectors. Key technology focuses on developing high-strength, low-alloy (HSLA) steels, often micro-alloyed with elements like Vanadium and Molybdenum, which allow for lighter bars capable of handling higher stress cycles and providing superior fatigue life. Advanced heat treatment technologies, such as controlled atmosphere hardening and induction tempering, are crucial for achieving the desired metallurgical structure and surface hardness, directly impacting the component's durability and overall performance within the suspension system. Furthermore, surface treatment techniques, notably advanced shot peening processes, are vital for introducing compressive residual stress on the surface, which is the primary method used to prevent crack initiation and significantly extend the component’s operational life under dynamic loading.

Another significant technological thrust involves the application of sophisticated Computer-Aided Engineering (CAE) tools, particularly Finite Element Analysis (FEA) and fatigue analysis software. These tools enable manufacturers to simulate complex road loads and environmental stresses with high accuracy, allowing engineers to iteratively optimize the bar's geometry (including diameter, taper, and spline design) to minimize material usage while meeting specific stiffness and strength requirements. This computational approach drastically reduces the physical prototyping cycle and ensures compliance with ever-tightening weight restrictions imposed by emissions standards. Furthermore, there is ongoing research and development into non-metallic solutions, specifically composite materials utilizing carbon or glass fibers, aiming to achieve substantial weight savings, although these technologies are currently constrained by high cost and manufacturing complexities, limiting their application primarily to high-performance racing or niche military sectors.

Manufacturing process control is a core technological competency. Modern production lines utilize non-destructive testing methods, such as magnetic particle inspection and ultrasonic testing, to ensure that the finished product is free of internal defects that could compromise safety or performance. Automation, often utilizing robotic handling and precision measuring systems, guarantees extremely tight dimensional tolerances for the splined ends, ensuring a perfect fit with the vehicle's chassis and suspension arms. The integration of sensors into suspension systems, while not directly part of the torsion bar itself, is influencing design by providing real-time data on load and stress, which feeds back into the development of future, data-informed torsion bar specifications, potentially leading to 'smart' passive components optimized for specific operating profiles.

Regional Highlights

The Automotive Torsion Bar Market exhibits distinct consumption and production characteristics across major global regions, influenced primarily by regional vehicle type preferences, manufacturing capabilities, and regulatory environments.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, driven by high-volume automotive production, particularly in China, India, Japan, and South Korea. The strong demand for light commercial vehicles (LCVs) and utility vehicles in emerging markets for infrastructure development and logistics heavily utilizes robust torsion bar suspension systems. Furthermore, APAC is a key manufacturing hub, hosting major steel producers and Tier 1 automotive component suppliers, making it a critical region for both consumption and export.

- North America: This region is characterized by high demand for heavy-duty pickup trucks and large SUVs, segments where torsion bars are often integral for managing high payload capacities and ensuring stability during towing. The market is mature, emphasizing durability, high performance, and aftermarket demand driven by customization and replacement needs associated with rigorous use cycles. Regulatory frameworks promoting vehicle safety and handling maintain a stable demand for high-quality, certified components.

- Europe: The European market displays moderate growth, focusing heavily on precision engineering and vehicle lightweighting, aligning with stringent EU emission standards. While passenger vehicle adoption of torsion bars is lower than in the commercial sector, their use in light trucks and specialized utility vehicles is stable. The region is a leader in specialty steel and advanced manufacturing techniques, fostering innovation in material science for both standard and high-performance applications.

- Latin America (LATAM): LATAM is an emerging market with increasing demand linked to the expansion of regional economies and associated commercial vehicle fleet growth. The need for durable, low-maintenance suspension systems capable of operating reliably on varied road conditions makes the torsion bar a highly suitable and cost-effective solution, driving significant growth opportunities, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Demand in MEA is specialized, concentrated primarily in military, mining, and oil/gas sector vehicles, which require extreme durability and off-road capability. High temperature and harsh operational environments necessitate robust, highly reliable components, ensuring sustained niche demand for heavy-duty torsion bars and related suspension systems within this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Torsion Bar Market.- Sogefi S.p.A

- ZF Friedrichshafen AG

- ThyssenKrupp AG

- Hitachi Astemo, Inc.

- Hendrickson International

- Coapts Spring Co., Ltd.

- Rassini

- Mando Corporation

- Tenneco Inc. (DRiV)

- S&T Motiv

- Shandong Wensheng Machinery

- Tata AutoComp Systems

- Kilen Springs (Lesjofors AB)

- NHK Spring Co., Ltd.

- Muhr und Bender KG (MUBEA)

- Gestamp Automoción S.A.

- Sanluis Rassini

- Wanxiang Qianchao Co., Ltd.

- Sogefi Rejna

- Benteler International

Frequently Asked Questions

Analyze common user questions about the Automotive Torsion Bar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of torsion bar suspension over coil springs?

Torsion bar suspension systems offer superior adjustability, compactness, and high durability, particularly beneficial for heavy-duty and commercial vehicles where managing significant and variable payloads is essential. They also allow for easier ride height adjustment and provide excellent long-term reliability with minimal maintenance compared to conventional coil or leaf spring setups in high-stress applications.

How is the adoption of Electric Vehicles (EVs) affecting the demand for traditional torsion bars?

While many passenger EVs utilize integrated battery structure and air suspension, torsion bars maintain strong relevance in electric Light Commercial Vehicles (eLCVs) and utility trucks. This is because the high weight of EV battery packs requires robust, high-strength suspension components, making torsion bars a reliable choice for managing the increased load and maintaining vehicle stability, particularly in last-mile delivery and rugged electric platforms.

Which geographical region dominates the Automotive Torsion Bar Market?

The Asia Pacific (APAC) region dominates the Automotive Torsion Bar Market in terms of volume. This is driven by extensive commercial vehicle production, rapid infrastructure development, and high adoption of utility vehicles and pickup trucks in major economies like China and India, making APAC both the largest producer and consumer globally.

What key material innovations are shaping the future of torsion bar manufacturing?

The future of torsion bar manufacturing is being shaped by advanced material science, primarily focusing on High-Strength Low-Alloy (HSLA) steels for fatigue resistance and ongoing research into Carbon Fiber Reinforced Polymer (CFRP) composites. These innovations aim to significantly reduce component weight without sacrificing critical strength and load-bearing capabilities, addressing modern fuel efficiency and performance requirements.

Who are the main buyers in the aftermarket segment for automotive torsion bars?

The main buyers in the aftermarket segment include independent repair shops, authorized maintenance service centers, and specialized fleet operators. These entities purchase replacement torsion bars due to natural wear and tear, or high-performance versions for vehicle customization and upgrading specific off-road or heavy-hauling capabilities of existing vehicles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager