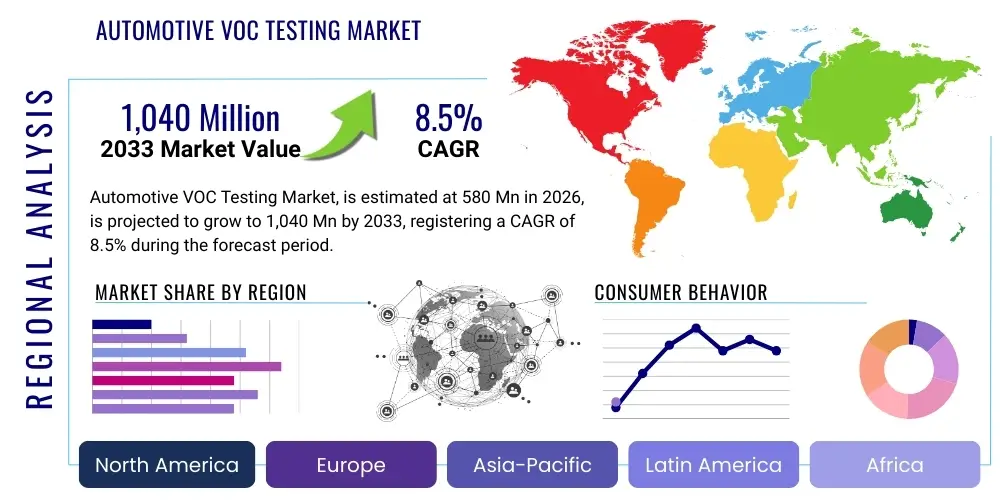

Automotive VOC Testing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442116 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Automotive VOC Testing Market Size

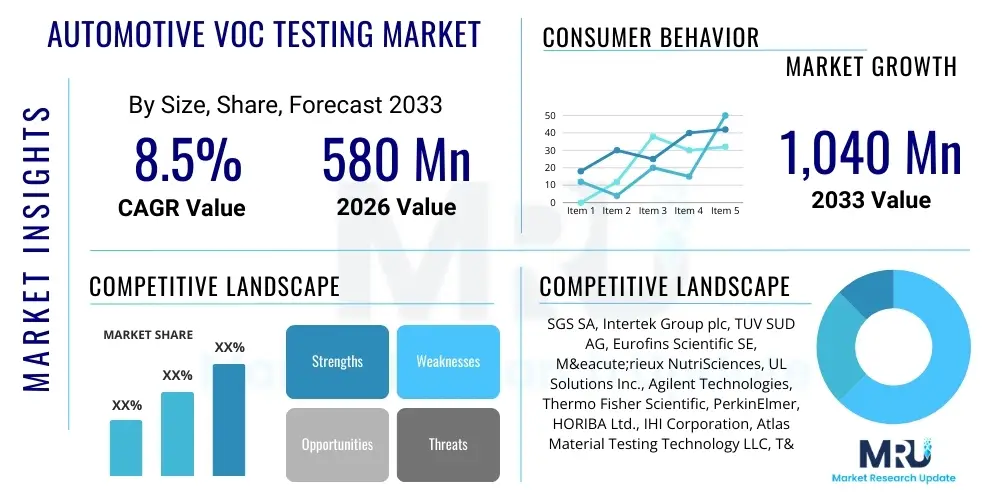

The Automotive VOC Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. This robust expansion is fueled primarily by increasingly stringent global regulations concerning interior air quality (IAQ) and heightened consumer awareness regarding the health impacts associated with exposure to Volatile Organic Compounds (VOCs) originating from vehicle cabin materials. The market is estimated at $580 Million in 2026, driven by continuous innovation in testing methodologies and the mandatory certification requirements imposed on original equipment manufacturers (OEMs) and Tier 1 suppliers worldwide. The integration of advanced testing protocols, including thermal desorption and sophisticated chromatographic techniques, ensures compliance with evolving international standards such as VDA 278 and China's GB/T 27630.

The imperative for reducing cabin emissions, particularly in newly manufactured vehicles, positions VOC testing as a critical, non-negotiable step in the automotive production lifecycle. Furthermore, the rapid global shift toward electric vehicles (EVs) is inadvertently boosting this market, as the quieter cabin environment of EVs makes consumers more sensitive to material-off gassing odors and chemical presence, thereby necessitating even stricter internal air quality controls during material selection and vehicle assembly. This regulatory and consumer pressure guarantees sustained investment in advanced testing infrastructure and specialized laboratory services.

Consequently, the Automotive VOC Testing Market is projected to reach $1,040 Million by the end of the forecast period in 2033. This significant growth trajectory is supported by the adoption of high-throughput testing systems, the proliferation of localized testing centers in major automotive manufacturing hubs, particularly across Asia Pacific, and the rising demand for real-time monitoring solutions integrated into vehicle production lines. The focus remains on identifying and quantifying substances like formaldehyde, acetaldehyde, benzene, toluene, and xylene, which are commonly found in vehicle interiors and contribute substantially to poor indoor air quality.

Automotive VOC Testing Market introduction

The Automotive VOC Testing Market encompasses the specialized services, equipment, and methodologies utilized to measure, identify, and quantify Volatile Organic Compounds (VOCs) released from materials used within vehicle interiors. These compounds, often off-gassed from plastics, adhesives, leather, fabrics, and carpets, can significantly degrade the interior air quality (IAQ), posing potential health risks to occupants and contributing to unpleasant odors. The core objective of this testing market is to ensure that automotive manufacturers comply with mandatory global regulatory standards and internal quality requirements designed to limit chemical exposure within confined vehicle spaces. Key applications include raw material assessment, component-level testing (such as dashboards, seating, and headliners), and full vehicle chamber testing.

The primary benefit derived from stringent VOC testing is enhanced occupant health and safety, directly addressing consumer concerns related to "new car smell," which is often indicative of high VOC concentrations. Furthermore, proactive testing minimizes the risk of expensive product recalls, bolsters brand reputation through demonstrable commitment to quality and safety, and facilitates smoother access to international markets where compliance with regional IAQ directives (e.g., those mandated by the European Union, China, and the U.S.) is essential. The process typically involves methods like micro-chamber testing for small samples, bag testing, and sophisticated full-vehicle climatic chamber testing using advanced analytical instruments like Gas Chromatography–Mass Spectrometry (GC-MS).

Driving factors for the market’s accelerated expansion include the increasing harmonization of global IAQ standards, which pushes OEMs toward universal testing protocols; rapid technological advancements leading to more sensitive, faster, and cost-effective testing equipment; and rising consumer litigation risks associated with indoor air quality issues. Moreover, the trend towards lightweight and sustainable materials in modern vehicles, which often introduces new chemical complexities and potential VOC sources, continually necessitates rigorous testing throughout the supply chain to validate material safety and performance under various environmental conditions.

Automotive VOC Testing Market Executive Summary

The Automotive VOC Testing Market is characterized by robust business trends centered on regulatory convergence, digitalization of testing protocols, and expansion into emerging markets. Financially, the sector exhibits resilience, driven by non-discretionary testing requirements mandated by leading automotive nations, particularly China and Germany. Business strategies focus heavily on providing integrated service packages that combine initial material screening with final vehicle certification, offering end-to-end solutions to complex OEM supply chains. Key trends include the transition from simple screening tests to comprehensive, quantitative analyses, and the increasing demand for portable, on-site testing solutions to accelerate material validation cycles, thereby reducing time-to-market for new vehicle models.

Regionally, Asia Pacific (APAC) stands out as the paramount growth engine, primarily due to the concentration of global automotive manufacturing in countries like China, India, Japan, and South Korea, coupled with the imposition of some of the world's most stringent VOC emission standards (e.g., China's GB/T 27630). Europe maintains a significant market share, focusing intensely on standards such as VDA 278, which govern materials testing in the German automotive sector, prioritizing quality assurance and high-fidelity measurements. North America, influenced heavily by the Environmental Protection Agency (EPA) and state-specific regulations like those in California, shows steady growth, particularly in the adoption of automated and high-throughput testing systems designed to handle the large volume of testing required by major domestic manufacturers.

Segmentation trends highlight the dominance of the testing services segment over equipment sales, reflecting the reliance of OEMs and Tier 1 suppliers on specialized, accredited laboratories for accurate and unbiased results. Among testing methods, Gas Chromatography–Mass Spectrometry (GC-MS) remains the gold standard due to its high accuracy and capability for detailed component analysis. Furthermore, the material-based segmentation sees a surging demand for testing upholstery, plastics, and adhesives, which are primary sources of off-gassing. Future segment growth is expected in real-time monitoring systems and simulation software, facilitating predictive compliance assessments early in the vehicle design phase.

AI Impact Analysis on Automotive VOC Testing Market

Common user questions regarding AI's influence on the Automotive VOC Testing Market frequently revolve around efficiency gains, data interpretation reliability, and the potential for predictive modeling. Users are keen to understand how AI can reduce the labor intensity of traditional testing protocols, specifically inquiring about automated data processing, spectral library matching, and faster identification of unknown VOCs. Concerns often center on the validation of AI-driven results versus established human-validated methods, and the initial investment required for integrating sophisticated machine learning models into existing laboratory infrastructure. Expectations are high concerning AI's capability to analyze massive datasets generated by high-throughput screening, enabling faster failure prediction and correlation of material composition with VOC emission profiles.

AI is beginning to revolutionize the VOC testing landscape primarily by optimizing the analytical phase. Machine learning algorithms are being deployed to enhance the accuracy and speed of interpreting complex chromatographic and spectrometric data, automatically identifying and quantifying VOC peaks that might be challenging for traditional software. This capability significantly reduces the required turnaround time for testing results, which is crucial in the fast-paced automotive development cycle. Furthermore, AI systems can be trained on extensive historical datasets, allowing them to predict the VOC emission characteristics of new, untested materials based on their chemical structure, temperature profiles, and aging simulations, moving the industry toward preventative material selection rather than reactive compliance testing.

The use of artificial intelligence also extends to operational efficiency within testing laboratories. AI can manage and optimize chamber testing scheduling, control environmental parameters with higher precision, and automate quality control checks on instrument calibration. For example, AI-powered image analysis combined with sensor data can flag anomalies during the thermal desorption process, ensuring data integrity. This level of automation addresses the market restraint related to the high operational costs and human expertise required for specialized analytical chemistry, making compliance testing more scalable and accessible across the entire automotive supply chain ecosystem.

- AI-driven spectral analysis accelerates the identification and quantification of complex VOC mixtures.

- Machine learning algorithms enable predictive modeling of VOC emission profiles for new or prototype materials, reducing physical testing iterations.

- Automated data validation and quality control improve the reliability and reproducibility of testing results in high-throughput labs.

- AI optimizes climatic chamber operations, enhancing efficiency in temperature and humidity control during full-vehicle testing.

- Integration with Digital Twins allows for virtual simulation of off-gassing under varied environmental and operational conditions.

DRO & Impact Forces Of Automotive VOC Testing Market

The dynamics of the Automotive VOC Testing Market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces (IF) emanating from regulatory bodies and technological shifts. The primary driver is the global tightening of interior air quality standards, such as those promulgated by the European Union, the Chinese government (GB/T standards), and US state regulators, compelling mandatory and continuous testing throughout the automotive value chain. Opportunities arise significantly from the rapid adoption of electric vehicles (EVs), which intensifies the focus on interior material quality due to the absence of engine noise masking potential chemical odors, alongside technological opportunities in advanced, portable sensor development for on-line monitoring. These forces collectively shape the market's direction, demanding higher sensitivity and faster throughput from testing providers.

Major restraints challenge the market's growth, most notably the high capital expenditure required for establishing advanced testing facilities, particularly climatic chambers and sophisticated analytical instruments like GC-MS and HPLC. Furthermore, the lack of complete global standardization presents a challenge; variations in testing protocols (e.g., sample preparation, extraction methods, and defined VOC thresholds) across different regions necessitate repeated testing or complex protocol reconciliation, increasing costs and lead times for manufacturers operating internationally. The need for highly skilled analytical chemists and technicians also acts as an operational restraint, given the specialized nature of trace chemical analysis.

Impact forces, primarily regulatory and technological, exert strong pressure on market participants. Regulatory mandates enforce compliance, creating an inelastic demand for testing services regardless of economic cycles. Technologically, the shift towards miniaturized sensors and non-destructive testing methods acts as a transformative force, potentially reducing the reliance on large, expensive laboratory chambers over the long term and democratizing access to preliminary screening tests. Strategic alliances between testing equipment manufacturers and accredited testing service providers are common, aimed at standardizing methodologies and accelerating the adoption of new, efficient testing technologies globally.

Segmentation Analysis

The Automotive VOC Testing Market is meticulously segmented based on the type of test, the component material being analyzed, the analytical method employed, and the end-user seeking the service. This segmentation allows stakeholders, including OEMs, material suppliers, and independent laboratories, to tailor services and products to specific regulatory or internal compliance needs. The market is primarily bifurcated into Equipment and Services, with the latter dominating due to the need for third-party validation and the high capital cost associated with owning and operating complex analytical equipment. Material segmentation focuses on identifying primary VOC contributors such as polymers, textiles, and adhesives, helping manufacturers prioritize replacement or refinement efforts. Geographic segmentation emphasizes the difference in regulatory severity and manufacturing concentration across regions like APAC, North America, and Europe.

The analytical method segment is crucial, distinguishing between high-precision techniques necessary for certification (e.g., GC-MS, HPLC) and rapid screening methods used for quality control during production (e.g., portable sensor arrays). While GC-MS is essential for quantifying specific chemical components down to trace levels, sensor-based systems offer cost-effective, real-time feedback, supporting different stages of the product lifecycle. The segmentation by test type—including material testing, component testing, and full vehicle testing—reflects the layered approach required by most regulatory bodies, ensuring VOC emission controls are maintained from raw material sourcing through to final assembly.

Understanding these granular segments is vital for market positioning. For instance, companies specializing in adhesives or interior trim materials require frequent material-level testing using thermal desorption techniques, whereas OEMs prioritize comprehensive full-vehicle chamber testing to meet final type approval standards. The ongoing push for sustainability also drives demand for testing bio-based or recycled materials, creating a niche market for specialized methods capable of characterizing novel VOC profiles associated with these new-generation substances.

- By Type:

- Equipment (Climatic Chambers, GC-MS Systems, Thermal Desorbers)

- Services (Accredited Laboratory Testing, Consulting, Certification)

- By Test Type:

- Material Testing

- Component Testing (Seats, Dashboard, Carpet, Headliners)

- Full Vehicle Testing

- By Analytical Method:

- Gas Chromatography–Mass Spectrometry (GC-MS)

- High-Performance Liquid Chromatography (HPLC)

- Thermal Desorption Units (TD)

- Photoionization Detectors (PIDs) and Sensor Arrays

- By Material/Source:

- Plastics and Polymers

- Adhesives and Sealants

- Textiles and Leather

- Paints and Coatings

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Automotive VOC Testing Market

The value chain of the Automotive VOC Testing Market begins with the upstream suppliers and extends through the service providers to the final customers—the automotive manufacturers and their Tier 1 partners. Upstream analysis focuses on the manufacturers of sophisticated analytical instrumentation (e.g., Agilent, Thermo Fisher Scientific), specialized testing chambers, and consumables like sorbent tubes and certified reference materials. These entities invest heavily in R&D to enhance detection limits, speed, and automation capabilities of their equipment. The reliability and accuracy of the final VOC testing results are fundamentally dependent on the quality and calibration of these upstream technologies.

The central core of the value chain is the testing service provider segment, which includes independent, internationally accredited testing laboratories (e.g., SGS, Intertek, TUV SUD) and captive OEM testing facilities. These providers acquire the necessary equipment and employ specialized personnel to execute complex regulatory tests (such as VDA 278, GB/T 27630, and internal OEM standards). They add value through expertise in sample preparation, adherence to stringent quality assurance protocols, data interpretation, and providing necessary certification documentation. Distribution channels for these services are predominantly direct, involving long-term contracts and consultative relationships with automotive clients, ensuring ongoing compliance throughout the product development lifecycle.

Downstream, the key recipients of these services are the automotive Original Equipment Manufacturers (OEMs), who mandate VOC testing to ensure vehicle type approval, and Tier 1 and Tier 2 suppliers, who must certify their specific components (e.g., seating systems, injection-molded parts) meet performance specifications before delivery to the assembler. Direct distribution refers to testing services provided directly to the OEM or Tier 1 supplier by the accredited lab. Indirect influence exists through regulatory bodies and industry consortiums (like AIAG or VDA) which define the mandatory standards, effectively dictating the demand and required specificity of the services provided throughout the entire automotive production process.

Automotive VOC Testing Market Potential Customers

The primary consumers and end-users of automotive VOC testing services and equipment are entities within the automotive manufacturing and supply ecosystem who bear regulatory responsibility for product compliance and safety. Original Equipment Manufacturers (OEMs) constitute the largest customer segment, as they hold the ultimate legal liability for the overall vehicle's Interior Air Quality (IAQ) and must obtain final type approval before market launch. OEMs utilize full vehicle chamber testing and component screening to validate their design choices and material selections, often maintaining internal testing facilities alongside outsourcing specialized compliance work.

The next critical segment comprises Tier 1 and Tier 2 suppliers. These companies specialize in manufacturing specific, high-value components such as complete dashboard assemblies, seating systems, door panels, and HVAC units. Since VOCs typically originate from these individual components, suppliers must provide certified proof that their materials and components adhere to the emission limits set by the OEM and global standards. This segment drives significant demand for material and component-level micro-chamber testing and routine quality control checks to ensure consistency in batches.

Furthermore, independent, accredited third-party testing laboratories (3rd party labs) are both service providers and occasionally customers, acquiring the necessary equipment to serve the wider market. Other potential buyers include regulatory agencies and research institutes that perform comparative studies or develop new standards. Finally, suppliers of raw materials, such as chemical manufacturers providing plastics, adhesives, or specialized coatings, often require preliminary VOC screening services to optimize their formulations before they enter the automotive supply chain, positioning them as key early-stage customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $1,040 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGS SA, Intertek Group plc, TUV SUD AG, Eurofins Scientific SE, Mérieux NutriSciences, UL Solutions Inc., Agilent Technologies, Thermo Fisher Scientific, PerkinElmer, HORIBA Ltd., IHI Corporation, Atlas Material Testing Technology LLC, TÜV Rheinland, Element Solutions Inc, Applus Services S.A., 3M Company (Materials Testing Division), Shimadzu Corporation, VDL Groep, CSA Group, and Dekra SE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive VOC Testing Market Key Technology Landscape

The core technological foundation of the Automotive VOC Testing Market relies on advanced analytical chemistry techniques capable of separating, identifying, and quantifying VOCs at parts per billion (ppb) levels. Gas Chromatography-Mass Spectrometry (GC-MS) remains the pivotal technology, offering unparalleled sensitivity and selectivity. GC-MS systems are utilized after sampling preparation—typically involving thermal desorption (TD) units or solvent extraction—to analyze the complex mixture of organic compounds released from interior materials. Recent technological advancements in GC-MS focus on miniaturization, faster temperature ramping, and enhanced spectral libraries combined with AI for automated data matching, significantly improving throughput while maintaining high accuracy required for regulatory compliance.

Thermal Desorption (TD) is another fundamental technology, essential for concentrating VOCs released from solid samples prior to GC-MS analysis. TD technology has evolved to include automated sample changers and multi-stage focusing capabilities, allowing for the analysis of multiple samples sequentially and reducing the overall lab effort. Furthermore, High-Performance Liquid Chromatography (HPLC) plays a crucial role, particularly for analyzing semi-volatile organic compounds (SVOCs) like phthalates and formaldehyde, which require different separation methods. The combination of TD-GC-MS and HPLC ensures comprehensive coverage of the broad range of harmful compounds potentially present in vehicle interiors.

Emerging technologies focus heavily on rapid screening and on-site monitoring. Portable VOC sensors, based on metal oxide semiconductor (MOS) technology or photoionization detectors (PIDs), are increasingly being adopted by Tier 1 suppliers for quick, inexpensive checks during production lines to flag major deviations in material quality before expensive certification testing is required. While these sensors do not offer the quantitative precision of laboratory instruments, their integration facilitates continuous quality control and reduces batch failure rates. Additionally, the development of specialized climatic chambers with highly controlled environments and low background contamination is critical, ensuring testing results accurately reflect real-world vehicle conditions.

Regional Highlights

The global Automotive VOC Testing Market exhibits distinct regional dynamics driven by varying regulatory landscapes, manufacturing footprints, and consumer sensitivity to environmental quality. Asia Pacific (APAC) currently holds the dominant position and is projected to experience the fastest growth over the forecast period. This dominance is directly attributable to the region’s status as the largest global hub for automotive manufacturing, particularly in China, Japan, and South Korea. China's GB/T 27630 standard is particularly stringent and widely enforced, creating massive, consistent demand for localized testing services and associated equipment to certify the millions of vehicles produced annually.

Europe represents a mature and technologically advanced market segment, characterized by high-quality standards and comprehensive regulatory frameworks. Germany, home to several major premium OEMs, dictates much of the European market practice through standards like VDA 278, which is often adopted globally as a benchmark for material off-gassing assessment. European regulations emphasize detailed, long-term emission assessments and low-level detection, favoring the deployment of high-end analytical equipment and highly specialized, accredited laboratories. The focus here is on achieving superior interior air quality that goes beyond minimum legal requirements.

North America maintains a stable and significant market share, driven primarily by federal safety mandates and powerful regional regulators like the California Air Resources Board (CARB). Testing demand is robust, often focusing on compliance with specific VOC limits and odor evaluation, particularly for vehicles sold in states with stricter environmental standards. The region is a key early adopter of automation and high-throughput screening technologies, seeking efficiency gains in testing protocols to manage the vast scale of production and multiple vehicle platforms developed by domestic manufacturers.

- Asia Pacific (APAC): Dominant market share and highest growth rate; driven by massive production volumes and stringent standards like China's GB/T 27630 and Japan's JAPIA guidance.

- Europe: High demand for specialized services adhering to VDA 278 and internal premium OEM specifications; focus on R&D for advanced material testing and low-emission vehicles.

- North America: Stable growth fueled by federal regulatory adherence and California's environmental standards; strong adoption of automated, large-scale testing systems for major domestic brands.

- Latin America (LATAM): Emerging market with growing domestic production, slowly adopting international IAQ standards; primarily reliant on exported testing services or compliance with standards of importing regions.

- Middle East and Africa (MEA): Nascent market, driven mainly by luxury vehicle imports and compliance with global standards; increasing domestic manufacturing activity in countries like South Africa is spurring local testing capabilities development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive VOC Testing Market, encompassing analytical equipment manufacturers and global testing, inspection, and certification (TIC) service providers.- SGS SA

- Intertek Group plc

- TUV SUD AG

- Eurofins Scientific SE

- Mérieux NutriSciences

- UL Solutions Inc.

- Agilent Technologies

- Thermo Fisher Scientific

- PerkinElmer Inc.

- HORIBA Ltd.

- IHI Corporation

- Atlas Material Testing Technology LLC

- TÜV Rheinland

- Element Solutions Inc

- Applus Services S.A.

- Shimadzu Corporation

- Bruker Corporation

- LECO Corporation

- VDL Groep

- CSA Group

- Dekra SE

Frequently Asked Questions

Analyze common user questions about the Automotive VOC Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Automotive VOC Testing and why is it mandatory?

Automotive VOC Testing measures Volatile Organic Compounds off-gassed from interior materials (plastics, fabrics, adhesives) to assess and quantify the quality of cabin air. It is mandatory because regulatory bodies worldwide (e.g., China's GB/T 27630, Europe's VDA 278) impose strict limits on these compounds to protect occupant health and ensure consumer safety, necessitating certified compliance for market entry.

Which analytical methods are most commonly used in automotive VOC compliance?

The primary analytical technique is Gas Chromatography–Mass Spectrometry (GC-MS), often coupled with Thermal Desorption (TD), as it provides the highest accuracy and sensitivity required to identify and quantify specific VOCs at trace levels (parts per billion). High-Performance Liquid Chromatography (HPLC) is used specifically for analyzing formaldehyde and acetaldehyde.

How does the shift to Electric Vehicles (EVs) affect the VOC Testing Market?

The shift to EVs increases demand for more stringent VOC testing. Since EVs operate silently, occupants are more sensitive to odors and chemical off-gassing. This heightened consumer expectation compels OEMs to focus intensely on low-emission materials, driving up the frequency and complexity of IAQ testing services.

What are the key differences between material testing and full vehicle testing?

Material testing involves analyzing small samples (e.g., plastics, textiles) in micro-chambers to screen individual components early in development. Full vehicle testing involves placing an assembled car in a large climatic chamber for an extended period to measure the cumulative VOC emissions under simulated environmental conditions, mandatory for final regulatory certification.

Which region dominates the Automotive VOC Testing market in terms of demand?

The Asia Pacific (APAC) region, specifically China, dominates the market due to its position as the largest global automotive manufacturing base and its implementation of one of the world's strictest Interior Air Quality (IAQ) regulatory standards, GB/T 27630, which mandates comprehensive testing for all vehicles sold domestically.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager