Automotive Wipes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441227 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Automotive Wipes Market Size

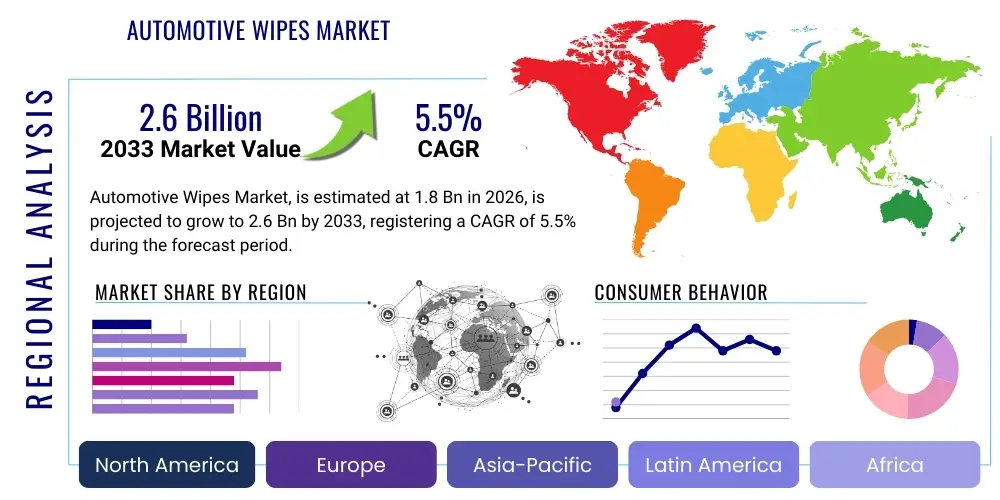

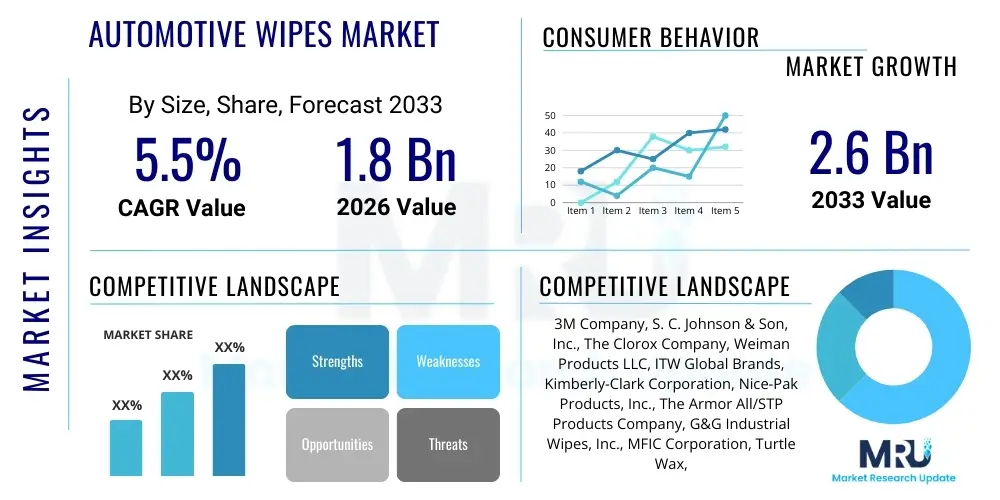

The Automotive Wipes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033.

Automotive Wipes Market introduction

The Automotive Wipes Market encompasses a wide range of disposable, pre-moistened or dry cleaning cloths designed specifically for vehicle maintenance, detailing, and interior/exterior cleaning. These products offer convenience, efficiency, and specific formulations tailored to different automotive surfaces, such as leather, vinyl, glass, paint, and wheels. The primary product description centers around materials like non-woven fabrics (spunlace, airlaid, or meltblown) saturated with specialized chemical solutions—including polishes, disinfectants, degreasers, and protectants—to safely and effectively remove dirt, grime, dust, and residues without scratching or damaging delicate finishes. The market addresses both professional detailers and the rapidly expanding segment of DIY (Do-It-Yourself) automotive consumers.

Major applications of automotive wipes span across interior cleaning (dashboard, upholstery, consoles), exterior detailing (headlights, paint spot cleaning, trim), and specialized tasks such as oil removal, tire shining, and bug/tar cleanup. The core benefits driving adoption include ease of use, water conservation compared to traditional washing methods, portability, and precise dosage control of cleaning chemicals, which minimizes waste. Furthermore, formulations are increasingly focused on environmental compatibility, utilizing biodegradable materials and VOC-compliant solvents, aligning with modern consumer preferences for sustainable maintenance solutions. This shift towards specialized and eco-friendly products reinforces market stability and growth.

The market is significantly driven by several macroeconomic factors, notably the steady increase in global vehicle production and ownership, particularly in emerging economies, coupled with growing consumer awareness regarding vehicle hygiene and maintenance. Rapid urbanization and the resultant need for convenient, time-saving cleaning solutions further bolster demand. Technological advancements in wipe materials, such as microfiber blends and advanced substrate designs that enhance scrubbing power while remaining scratch-free, also serve as critical driving factors. The convenience factor inherent in wipes positions them as an essential tool for quick fixes and regular upkeep, fueling consistent expenditure in both consumer retail and professional fleet maintenance sectors.

Automotive Wipes Market Executive Summary

The Automotive Wipes Market is characterized by robust growth, propelled primarily by increasing vehicle parc globally and a strong consumer preference for convenient, specialized cleaning solutions. Current business trends indicate a significant focus on product differentiation, particularly through the introduction of premium wipes infused with ceramic coatings, UV protectants, and antimicrobial agents, catering to high-end vehicle owners and professional detailers seeking enhanced longevity and protection. Key manufacturers are investing heavily in sustainable manufacturing, transitioning toward recycled or plant-based substrates and solvent-free formulations to meet stringent regulatory requirements and growing eco-consciousness among buyers. Merger and acquisition activities remain steady, consolidating smaller, niche players specializing in specific chemical formulations or eco-friendly materials under the umbrella of large consumer packaged goods and chemical companies, thereby streamlining distribution channels and expanding market reach across diverse geographies.

Regional trends reveal distinct patterns of consumption and market maturity. North America and Europe currently represent the largest revenue bases, driven by high disposable incomes, mature aftermarket service industries, and a deeply entrenched DIY culture. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by soaring vehicle sales, especially in China and India, and the nascent adoption of professional car wash and detailing services. Within APAC, the demand is shifting from basic interior cleaning wipes to specialized exterior and wheel cleaning wipes. Conversely, in regions like Latin America and the Middle East & Africa (MEA), growth remains tied to regulatory reforms concerning water usage in vehicle washing and the formalization of the automotive aftermarket supply chain, creating specific opportunities for waterless cleaning wipe alternatives.

Segment trends highlight the dominance of the Interior Wipes segment, attributed to frequent usage for hygiene and aesthetic maintenance of cabins, dashboard, and seating surfaces. Within the Material segment, non-woven spunlace technology retains the largest share due to its superior absorption and durability. The distribution channel analysis shows hypermarkets and supermarkets, alongside e-commerce platforms, as the primary sales avenues, benefiting from visibility and convenience. E-commerce, in particular, is experiencing accelerated growth, leveraging subscription models and direct-to-consumer relationships to capture routine purchases. Furthermore, the rising proliferation of shared mobility and commercial fleets necessitates durable, industrial-grade wipes for quick sanitation and maintenance turnaround times, driving demand within the commercial end-user segment.

AI Impact Analysis on Automotive Wipes Market

User queries regarding AI's influence on the Automotive Wipes Market primarily revolve around how machine learning can optimize product formulations, predict consumer demand patterns with greater accuracy, and enhance the logistical efficiency of supply chains for fast-moving consumer goods (FMCG). Users are keen to understand if AI can analyze environmental data (like regional air quality or road conditions) to recommend hyper-specialized wipe types (e.g., for intense industrial fallout) or if AI-powered computer vision systems in automated car washes could integrate wipe-based finishing touches. A significant concern is the potential for AI-driven manufacturing to personalize wipe material composition and chemical saturation levels on a batch-by-batch basis, improving quality control and reducing material waste, thereby accelerating the shift towards premium, customized automotive care products and impacting raw material procurement and inventory management.

- AI-driven Demand Forecasting: Machine learning models optimize production schedules by accurately predicting spikes in seasonal or regional demand for specific wipe types (e.g., winter salt removal wipes vs. summer bug wipes).

- Optimized Chemical Formulation: AI algorithms analyze substrate compatibility and cleaning efficacy data to fine-tune chemical saturation ratios, enhancing performance while minimizing reliance on expensive or environmentally harsh ingredients.

- Supply Chain Resilience: Predictive analytics identify potential logistical bottlenecks or raw material shortages (e.g., non-woven fabric precursors), allowing manufacturers to proactively adjust sourcing and distribution strategies.

- Quality Control Automation: AI-powered visual inspection systems monitor the non-woven web production line, detecting defects in material consistency or saturation levels with high precision, reducing manufacturing rejects.

- Personalized Consumer Recommendations: E-commerce platforms utilize AI to suggest specific wipe kits or subscription tiers based on the user's vehicle type, driving habits, and regional environmental needs, boosting conversion rates.

- Autonomous Vehicle Interior Sanitation: Development of specialized wipes and dispensing systems designed for automated cleaning within shared autonomous vehicle fleets, managed and deployed via integrated fleet management software.

DRO & Impact Forces Of Automotive Wipes Market

The market dynamics are defined by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the market's growth trajectory and inherent risks. The foremost driver is the convenience factor associated with ready-to-use wipes, saving time and simplifying maintenance for the average vehicle owner, directly addressing the fast-paced urban lifestyle prevalent globally. This convenience is coupled with the rising adoption of specialized detailing practices, where high-quality wipes ensure a streak-free, professional finish without the risk of cross-contamination often associated with reusable cloths. Additionally, heightened health and hygiene awareness post-pandemic, particularly concerning vehicle interiors (shared rides, personal cars), has dramatically increased demand for disinfectant and antibacterial automotive wipes, further solidifying their market necessity and growth rate.

However, the market faces significant restraints, primarily revolving around environmental concerns and cost. Many traditional automotive wipes utilize non-biodegradable synthetic fibers and often come in plastic packaging, contributing to landfill waste, which draws scrutiny from environmental regulatory bodies and eco-conscious consumer groups. Although biodegradable alternatives are emerging, they often come at a premium price point, which can deter mass adoption, particularly in price-sensitive markets. Another restraint is the perception among some professional detailers that wipes lack the intensive cleaning power or material quality required for heavy-duty contamination compared to traditional wash and polish systems. Furthermore, market saturation in developed regions necessitates constant innovation to maintain consumer interest and avoid commoditization, pressuring manufacturers to absorb high research and development costs for novel formulations and substrates.

Opportunities for expansion are abundant, particularly in emerging markets where water scarcity regulations are tightening, making waterless cleaning solutions, such as specialized exterior wash wipes, highly attractive substitutes. The rapid electrification of the global vehicle fleet (EVs) presents a specific niche opportunity, as these vehicles often require specialized interior materials and finishes (e.g., lighter-colored sustainable fabrics) that necessitate gentle, dedicated cleaning products. Furthermore, strategic partnerships with Original Equipment Manufacturers (OEMs) to supply co-branded maintenance kits at the point of sale, or integrating specialized wipes into professional car wash subscription services, offer new high-volume revenue streams. The continuous innovation in substrate technology, yielding stronger, more absorbent, and fully compostable wipe materials, promises to mitigate current environmental restraints and unlock vast untapped potential across consumer and commercial applications.

Segmentation Analysis

The Automotive Wipes Market is segmented based on rigorous criteria including Product Type, Material, Application, End-User, and Distribution Channel, reflecting the diverse requirements of vehicle maintenance. This layered segmentation allows manufacturers to tailor product offerings precisely, addressing specific consumer pain points—such as glass clarity, leather conditioning, or heavy degreasing. The core of the segmentation analysis rests on understanding the chemical compatibility and substrate performance required for different vehicle surfaces, ranging from sensitive clear coats to rugged wheel alloys. Analyzing these segments provides strategic clarity for market entry, product development pipeline decisions, and targeted marketing campaigns aimed at maximizing conversion across the automotive ecosystem, from fleet operators to individual owners.

- By Product Type:

- Interior Cleaning Wipes (Dashboard, Vinyl, Leather)

- Exterior Cleaning Wipes (Paint, Headlight, Bug & Tar Removal)

- Glass Wipes

- Wheel & Tire Wipes

- Specialty Wipes (Oil & Grease Removal, Polish & Wax Application)

- By Material:

- Non-Woven (Spunlace, Airlaid, Meltblown)

- Microfiber

- Blends and Composites

- By Application:

- Car Detailing

- General Cleaning & Maintenance

- Sanitation & Disinfection

- By End-User:

- Individual Vehicle Owners (DIY)

- Commercial (Fleet Operators, Car Washes, Detail Shops, Auto Repair Garages)

- By Distribution Channel:

- Offline (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Automotive Wipes Market

The value chain for the Automotive Wipes Market commences with upstream activities involving the procurement of raw materials, primarily non-woven fabric substrates (derived from synthetic fibers like polyester, polypropylene, or natural fibers such as rayon and pulp) and specialized cleaning chemicals (surfactants, solvents, conditioners, and antimicrobial agents). Key upstream relationships involve securing long-term contracts with polymer manufacturers and chemical suppliers to ensure a stable supply of high-quality, price-competitive inputs. Innovations in this stage focus on developing sustainable and biodegradable substrates and utilizing green chemistry principles to formulate effective yet environmentally safe cleaning agents, significantly influencing the final product's cost structure and market positioning.

The midstream stage involves the core manufacturing processes: converting the bulk non-woven material, impregnating the material with the specialized chemical solutions (saturation), cutting and folding the wipes, and finally, packaging them into airtight dispensers or canisters to maintain moisture content and shelf life. Operational efficiency in this stage is critical, requiring advanced high-speed machinery capable of handling various substrates and chemical viscosities, ensuring precise saturation levels and minimizing material waste. Quality control checks are rigorous here, ensuring compliance with automotive surface safety standards (e.g., pH neutrality, scratch resistance) and regulatory guidelines regarding chemical use and labeling across different target markets.

Downstream activities focus on distribution and final sales. Distribution channels are categorized into direct and indirect routes. Direct distribution involves supplying commercial clients (fleet maintenance companies, large detail chains) or utilizing proprietary e-commerce platforms. Indirect distribution relies heavily on partnerships with hypermarkets, supermarkets, automotive specialty retailers (like AutoZone or Pep Boys), and major online marketplaces (Amazon, eBay). The rise of digital commerce has decentralized sales, making AEO and efficient logistics for bulky, low-cost items paramount. Marketing efforts emphasize convenience, specialized application (e.g., ceramic-infused wipes), and brand trust, influencing end-user purchasing decisions at the retail shelf or online point of sale.

Automotive Wipes Market Potential Customers

Potential customers for the Automotive Wipes Market are broadly categorized into two major segments: Individual Vehicle Owners and Commercial End-Users. Individual Vehicle Owners constitute the largest volume segment, driven by the desire for quick, convenient, and effective interior and exterior maintenance solutions without the time commitment required for traditional washing methods. This demographic includes daily commuters, families, and car enthusiasts who prioritize maintaining the aesthetic value and resale potential of their vehicles. Their purchasing decisions are highly influenced by brand reputation, ease of use, packaging design, and targeted benefits such as UV protection or streak-free glass cleaning, generally purchasing through retail and e-commerce channels.

The Commercial End-User segment represents the high-volume, professional application sector, demanding industrial-grade performance, bulk packaging, and specialized formulations (e.g., heavy-duty degreasers, sanitation wipes). This segment includes professional car detailing shops that require scratch-free, high-performance products for premium services; fleet operators (trucking, ride-sharing, rental car agencies) focused on rapid turnaround and hygiene standards; and auto repair garages needing quick cleanup solutions for oil, grease, and shop grime. For these customers, factors such as cost-effectiveness per use, regulatory compliance (especially for disinfectants), and material durability under rigorous conditions are the critical purchasing criteria, often procured through direct supply agreements or specialized distributor networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, S. C. Johnson & Son, Inc., The Clorox Company, Weiman Products LLC, ITW Global Brands, Kimberly-Clark Corporation, Nice-Pak Products, Inc., The Armor All/STP Products Company, G&G Industrial Wipes, Inc., MFIC Corporation, Turtle Wax, Inc., P&G (Procter & Gamble), The Viking Car Care, Auto-Chem, Stoner Inc., Meguiar’s (3M Subsidiary), Kärcher SE & Co. KG, Sontara (PGI), Tork (Essity), Scott Wipers (Kimberly-Clark Professional) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Wipes Market Key Technology Landscape

The technological evolution within the Automotive Wipes Market is primarily centered on enhancing the efficacy and sustainability of the two core components: the substrate material and the chemical formulation. In substrate technology, the transition from traditional dry woven cloths to advanced non-woven materials, particularly spunlace and hydroentangled fabrics, has been pivotal. Spunlace technology offers superior strength, softness, and absorbency, allowing the wipes to effectively trap dirt particles without scratching high-gloss finishes. Recent innovations include developing highly structured 3D embossed patterns on the non-woven surface, which increases the surface area for dirt pickup and improves scrubbing efficiency, essential for applications like wheel cleaning or heavy bug and tar removal. Furthermore, the push towards eco-friendly alternatives mandates utilizing materials like bamboo, recycled polyester (rPET), or wood pulp composites that are biodegradable or compostable, addressing critical environmental challenges.

In terms of chemical formulations, the key technological advancements focus on creating multifunctional, non-toxic, and high-performance solutions. The shift is towards water-based, solvent-free, and VOC-compliant chemistries to meet stringent health and safety regulations, particularly in Europe and North America. Premium product lines now incorporate advanced protectants, such as carnauba wax blends, silicone emulsions, and even nanotechnology-based ceramic polymers. These integrated protectants allow the wipe to clean the surface and simultaneously leave behind a protective layer that repels water, dust, and UV radiation, extending the time between cleanings. The integration of specialized surface tension modifiers ensures quick evaporation, resulting in streak-free performance, particularly crucial for glass and high-gloss interior plastics.

Packaging technology also plays a crucial, though often overlooked, role. Innovations are focused on optimizing dispensing mechanisms to prevent premature drying of the wipes, ensuring the last wipe in the canister maintains the same moisture content and efficacy as the first. This involves utilizing advanced sealing technologies, redesigned canister lids (like one-hand dispensing systems), and barrier films with superior moisture vapor transmission rate (MVTR) resistance. The integration of smart manufacturing technologies, including IoT sensors within production lines, allows for real-time monitoring of saturation levels and environmental controls, ensuring consistent product quality across massive production volumes, thereby reinforcing the overall technological competitiveness of leading manufacturers.

Regional Highlights

- North America: This region holds a dominant market share, driven by a mature aftermarket industry, high average disposable income facilitating premium product purchasing, and a pervasive DIY culture regarding car maintenance. The high density of vehicle ownership and the presence of major retail chains (e.g., Walmart, Amazon, AutoZone) specializing in automotive consumer goods ensure robust sales volume. Specific demand is high for specialized products like leather conditioning wipes and ceramic coating maintenance wipes.

- Europe: Characterized by stringent environmental regulations (especially regarding VOCs and plastic waste), Europe is a leader in adopting sustainable and biodegradable wipe solutions. Germany, the UK, and France are the largest markets, driven by the professional detailing sector and a strong preference for high-quality, vehicle-specific cleaning products. The emphasis here is on premium, eco-certified formulations.

- Asia Pacific (APAC): APAC is the fastest-growing region due to soaring new vehicle registrations, rapid urbanization, and increasing consumer awareness regarding vehicle hygiene. Countries like China, India, and Japan are key growth hubs. The demand is currently shifting from basic cleaning wipes towards specialized exterior and disinfectant wipes, particularly in commercial fleet and ride-sharing services that require quick sanitation turnaround.

- Latin America (LATAM): Growth in LATAM is moderately high, largely stimulated by water scarcity issues in major urban centers, making waterless car cleaning wipes highly desirable. Brazil and Mexico are primary markets where economic development and expanding middle classes are increasing the affordability and adoption of convenient automotive care products, often prioritizing cost-effective bulk purchases.

- Middle East and Africa (MEA): This region exhibits niche growth driven by specific environmental challenges such as sand, dust, and extreme heat, requiring specialized exterior and glass cleaning formulations. The adoption rate is steadily increasing, particularly in the Gulf Cooperation Council (GCC) countries, supported by expanding luxury car segments that demand high-end detailing and maintenance products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Wipes Market.- 3M Company

- S. C. Johnson & Son, Inc.

- The Clorox Company

- Weiman Products LLC

- ITW Global Brands (including brands like Permatex)

- Kimberly-Clark Corporation

- Nice-Pak Products, Inc.

- The Armor All/STP Products Company (Energizer Holdings)

- G&G Industrial Wipes, Inc.

- MFIC Corporation

- Turtle Wax, Inc.

- P&G (Procter & Gamble)

- The Viking Car Care

- Auto-Chem

- Stoner Inc.

- Meguiar’s (A 3M Subsidiary)

- Kärcher SE & Co. KG

- Sontara (PGI)

- Tork (Essity)

- Scott Wipers (Kimberly-Clark Professional)

Frequently Asked Questions

Analyze common user questions about the Automotive Wipes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Automotive Wipes Market?

The primary factor driving market growth is the overwhelming consumer demand for convenience and time efficiency in vehicle maintenance. Automotive wipes offer a quick, mess-free, and precise application solution for cleaning and detailing vehicle surfaces without the need for water or multiple cleaning agents, appealing strongly to both individual owners and commercial fleet operators.

Are most automotive wipes safe for use on all vehicle surfaces, including clear coats and sensitive interiors?

High-quality automotive wipes are formulated to be surface-specific; glass wipes prevent streaks, leather wipes contain conditioners, and exterior wipes are pH-neutral and non-abrasive to protect clear coats. Consumers must verify the intended application, as specialized formulations are essential to avoid damage to sensitive automotive finishes.

How is sustainability impacting the manufacturing and sales of automotive wipes?

Sustainability is a major trend, pushing manufacturers toward biodegradable non-woven substrates (like bamboo or recycled materials) and water-based, VOC-compliant chemical solutions. Consumers increasingly seek eco-friendly packaging and products, particularly in developed markets, influencing product innovation and procurement strategies.

Which regional market is expected to show the fastest growth rate for automotive wipes?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily fueled by the rapid expansion of vehicle ownership, increasing adoption of professional detailing services, and rising consumer disposable incomes in major economies like China and India, leading to greater acceptance of specialized car care products.

What is the key technological innovation currently defining the automotive wipes product landscape?

The key technological innovation is the integration of advanced protective agents, such as ceramic polymer technology and nanotechnology-based sealants, directly into the wipe formulation. This allows users to not only clean but also apply a protective, long-lasting hydrophobic layer in a single, convenient step, enhancing product value significantly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager