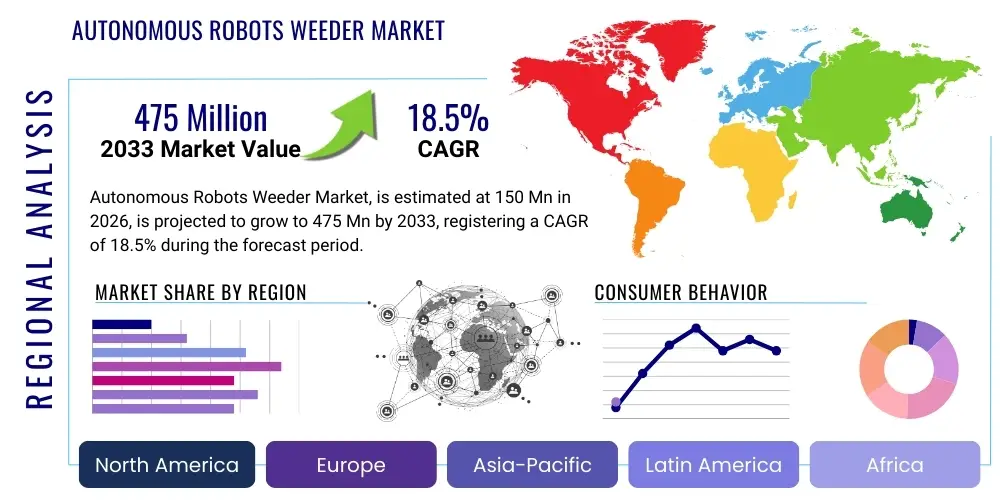

Autonomous Robots Weeder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443215 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Autonomous Robots Weeder Market Size

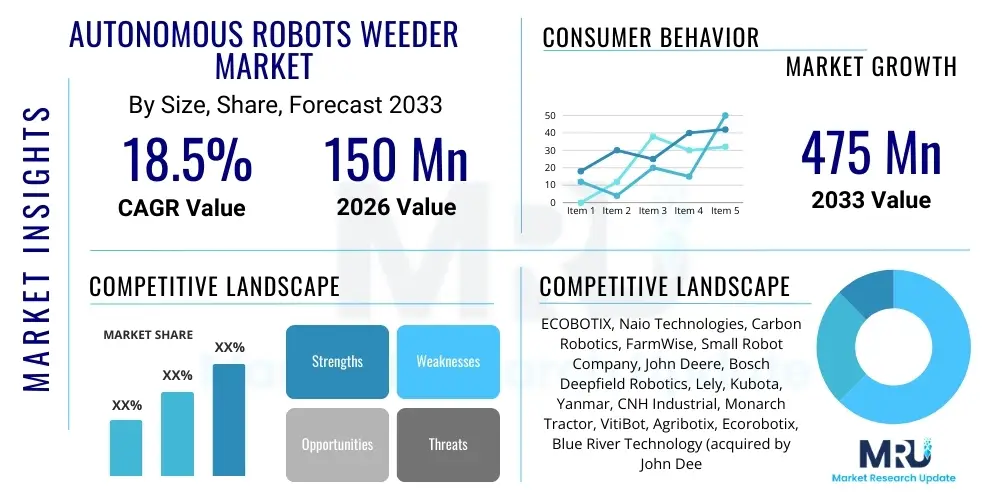

The Autonomous Robots Weeder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 475 Million by the end of the forecast period in 2033.

This substantial growth trajectory is underpinned by the increasing necessity for sustainable and efficient weed management solutions in the agricultural sector globally. Traditional weeding methods are resource-intensive, rely heavily on manual labor, which is becoming scarce and costly, and often involve the heavy application of chemical herbicides, leading to environmental degradation and resistance development in weeds. Autonomous robots weeder technology offers a precise, non-chemical, and labor-saving alternative, directly addressing these critical challenges faced by modern farming operations.

Market expansion is further accelerated by advancements in computer vision, machine learning, and GPS technology, which enhance the accuracy and reliability of autonomous weeding systems. As input costs for farmers rise, the long-term return on investment (ROI) offered by automated machinery, particularly in reducing herbicide expenditure and optimizing crop yields, drives significant adoption across various farm sizes and crop types. Government initiatives promoting smart agriculture and precision farming methods also play a crucial role in stimulating demand and reducing technological barriers to entry for growers.

Autonomous Robots Weeder Market introduction

The Autonomous Robots Weeder Market encompasses the development, manufacturing, and deployment of robotic systems designed to detect and eliminate unwanted vegetation (weeds) in agricultural fields without human intervention during operation. These systems integrate sophisticated sensing technologies, real-time data processing, and highly precise mechanical or thermal weeding mechanisms. The primary goal of these robots is to improve agricultural sustainability by minimizing chemical use, reducing soil disruption, and optimizing labor efficiency, thereby contributing significantly to the paradigm shift towards precision agriculture.

Autonomous robot weeders typically consist of a mobile chassis, high-resolution cameras or LiDAR sensors for plant recognition, and an AI-driven navigation and decision-making unit. Once a weed is identified, the robot employs targeted methods such as micro-spraying, mechanical removal (tillage, cutting), or thermal/electrical treatment. Major applications span high-value specialty crops (vegetables, fruits, grapes) where weed control is critical for quality, as well as large-scale row crops (corn, soybeans) where efficiency and scale are paramount. These systems offer unparalleled accuracy, often operating at the individual plant level, distinguishing weeds from crops even in dense environments.

The fundamental benefits of adopting autonomous weeding robots include significant reduction in herbicide costs (up to 90% in some cases), mitigation of labor shortages, substantial improvement in crop yield quality due to reduced competition and plant stress, and enhanced environmental stewardship through decreased chemical runoff. Driving factors fueling this market include stringent environmental regulations limiting chemical usage, increasing global demand for organic and sustainably produced food, continuous technological refinement leading to lower hardware costs, and the pressing need for optimized resource management in response to climate change impacts on farming practices globally. The convergence of robotics and deep learning capabilities is rapidly making these autonomous solutions indispensable tools for future farm management.

Autonomous Robots Weeder Market Executive Summary

The Autonomous Robots Weeder Market is currently characterized by rapid technological innovation and strong investment, positioning it as a pivotal segment within the broader AgTech ecosystem. Business trends highlight a shift from large, multi-purpose robotic platforms to smaller, specialized, and swarming autonomous units, optimized for specific crop types and terrain challenges. Key market players are increasingly forming strategic partnerships with AI firms and traditional agricultural machinery manufacturers to integrate advanced computer vision models and reliable mechanical actuators. Furthermore, the market is moving towards 'Robotics-as-a-Service' (RaaS) models, lowering the initial capital expenditure barrier for small and medium-sized farms and accelerating overall market penetration, particularly in regions with high labor costs.

Regionally, North America and Europe currently dominate the market, primarily driven by high adoption rates of precision agriculture techniques, strong governmental support for sustainable farming, and acute labor scarcity. However, the Asia Pacific region, particularly countries like China and India, is emerging as the fastest-growing market segment. This growth is spurred by massive agricultural acreage, rapid modernization efforts, and a growing recognition of the environmental and economic benefits of reducing traditional herbicide dependency. Regulatory harmonization regarding the use of autonomous machinery in fields will be critical for seamless global expansion, influencing regional market velocities.

Segment trends reveal that the Vision-Based autonomous weeding robots segment is achieving the highest growth rate, attributed to the superior accuracy and adaptability offered by deep learning algorithms in identifying weeds under varying field conditions. Application-wise, specialty crops and vineyards remain the primary early adopters due to the high value and meticulous requirements of these crops. In terms of farm size, while large commercial farms were the initial target, advancements in affordability and smaller form factors are now enabling significant uptake in the medium-sized farm segment, indicating a broadening customer base and successful diversification of product offerings across the market landscape. The confluence of these trends ensures robust and sustained market expansion through 2033.

AI Impact Analysis on Autonomous Robots Weeder Market

Common user questions regarding AI's impact on autonomous weeding focus heavily on system reliability, identification accuracy, and cost-effectiveness compared to traditional methods. Users frequently ask: "How accurately can AI distinguish between complex weeds and cash crops?" "What happens when field conditions (light, soil type, crop density) change drastically?" and "Will AI-driven robots be affordable for small farms?" This highlights key user concerns centered around the precision of deep learning models, the robustness of decision-making under real-world variability, and the economic accessibility of the technology. Users expect AI to deliver near-perfect classification, reduce the need for constant human supervision, and ultimately lower overall operational expenditure compared to conventional farming practices, serving as the central value proposition for adoption.

The core influence of Artificial Intelligence, particularly machine learning and computer vision, is transformative, moving autonomous weeders beyond simple row following to sophisticated, plant-level management systems. AI algorithms are essential for real-time image processing, enabling robots to instantaneously classify thousands of plant species, differentiate crops from weeds, assess plant health, and determine the optimal weeding mechanism (mechanical, thermal, or micro-dose chemical) to apply. This level of granular decision-making ensures minimal crop damage and maximum weed eradication efficiency, something impossible with purely programmed or manual systems. Furthermore, AI facilitates predictive maintenance and optimizes robot path planning across complex field layouts, drastically improving operational uptime and energy efficiency, which directly impacts the return on investment for farmers.

Beyond visual recognition, AI is crucial for the learning capabilities of these robots. Through continuous data ingestion from numerous operational hours across diverse agricultural environments, AI models refine their accuracy over time, adapting to new weed varieties and environmental conditions without explicit reprogramming. This perpetual learning capability ensures the longevity and increasing effectiveness of the robotic fleet. Moreover, integrating AI with geospatial data (GPS, drone imagery) allows for precision mapping of weed pressure zones, enabling a highly targeted approach that conserves resources. This integration elevates autonomous weeders from simple machines to intelligent, data-gathering systems that inform broader farm management strategies, driving productivity gains and fostering truly sustainable agricultural practices.

- Enhanced plant classification accuracy through deep learning models.

- Real-time decision-making for precise, individualized weed treatment.

- Optimization of robot navigation and path planning in complex fields.

- Predictive identification of weed outbreaks and resistance development.

- Automated system calibration and self-correction based on environmental feedback.

- Integration with farm management software for holistic data analysis.

- Continuous model improvement through iterative data collection and learning.

DRO & Impact Forces Of Autonomous Robots Weeder Market

The Autonomous Robots Weeder Market is propelled by powerful socioeconomic and environmental drivers, moderated by specific technological restraints, and shaped by emerging opportunities related to sustainable farming mandates. Key drivers include the severe global shortage and increasing cost of agricultural labor, which makes automation a necessity rather than a luxury. Secondly, the escalating regulatory pressure globally, particularly in Europe, to curb the use of broad-spectrum herbicides due to environmental and public health concerns, necessitates non-chemical weeding alternatives. Opportunities are vast, focused primarily on developing multi-functional robotic platforms capable of seeding, fertilizing, and harvesting in addition to weeding, maximizing the utility and ROI for farmers. However, restraints such as the high initial capital investment required for these sophisticated machines and farmer skepticism regarding reliability and interoperability currently pose significant adoption barriers, especially for small-scale operations.

The core impact force dictating the market's trajectory is the balance between technological maturity and economic accessibility. As computer vision and navigation technologies become cheaper and more robust, the total cost of ownership (TCO) for autonomous weeders decreases, shifting the economic viability threshold favorably. The impact forces also include the widespread issue of herbicide resistance; as more weeds become immune to chemical treatments, farmers are forced to seek mechanical and robotic alternatives, directly accelerating demand for autonomous solutions. Furthermore, the push towards organic farming, which strictly prohibits synthetic herbicides, creates an essential, high-growth niche where autonomous robotic weeders are the only scalable solution for weed control, driving targeted innovation and investment in advanced non-chemical removal mechanisms.

Specific restraints also include challenges related to operating in diverse, real-world farm environments, such as unpredictable weather conditions, highly variable soil textures, and the need for robust power management solutions to ensure long operational shifts. Technological improvements focused on all-weather operability and standardized communication protocols (interoperability with existing farm equipment) are necessary to overcome these hurdles. The impact of these forces suggests a future where adoption is dictated less by farm size and more by the region's labor dynamics and its regulatory stance on chemical usage, creating divergent growth rates globally but ensuring overall robust market expansion driven by efficiency and sustainability mandates.

Segmentation Analysis

The Autonomous Robots Weeder Market is segmented primarily across several dimensions, including the underlying technology used for weed identification and navigation, the mode of operation (level of autonomy), the specific application area (crop type), and the size of the farm utilizing the technology. Understanding these segments is crucial for manufacturers to tailor their product offerings and for investors to identify high-growth potential niches. The technology segmentation, particularly the distinction between 2D/3D Vision-Based systems and GPS/RTK-Guided systems, defines the accuracy and complexity level of the robot, directly influencing its cost and applicability across different field conditions and crop densities.

The application segmentation is particularly revealing, differentiating between the specialized needs of high-density specialty crops, which require smaller, extremely precise robots, and large-scale row crops, which demand speed and resilience across vast acreage. The differentiation by farm size also reflects evolving pricing strategies, where smaller, subscription-based models or RaaS offerings are increasingly targeting the previously underserved small and medium farm segments. This structured segmentation analysis provides a roadmap for market penetration, highlighting the critical trade-offs between precision (vision systems) and coverage area (GPS systems) that define competitive positioning within the autonomous weeding landscape.

- By Technology:

- Vision-Based Systems (2D/3D Imaging)

- GPS/RTK Guided Systems

- Hybrid Systems (Integrating vision and positioning)

- By Operation Mode:

- Fully Autonomous Weeding Robots

- Semi-Autonomous/Operator-Assisted Systems

- By Application:

- Row Crops (e.g., Corn, Soybeans, Wheat)

- Specialty Crops (e.g., Vegetables, Berries)

- Vineyards and Orchards

- Turf and Ornamental Weeding

- By Farm Size:

- Small Farms (Less than 100 Hectares)

- Medium Farms (100 to 500 Hectares)

- Large Farms (Above 500 Hectares)

Value Chain Analysis For Autonomous Robots Weeder Market

The value chain for the Autonomous Robots Weeder Market begins with the upstream suppliers of critical components, predominantly encompassing specialized sensor manufacturers (high-resolution cameras, LiDAR, ultrasonic sensors), sophisticated computing hardware providers (GPUs, embedded systems for edge computing), and precision mechanical component suppliers (actuators, precision motors, chassis materials). This upstream segment is characterized by high technological specialization and is crucial for determining the final cost and capability of the robot. Key dynamics here include maintaining strategic sourcing agreements to ensure a stable supply of high-performance microprocessors necessary for running complex AI algorithms in real-time under harsh environmental conditions. The quality and reliability of these upstream components directly impact the robot's Mean Time Between Failures (MTBF) and overall accuracy in the field, making supply chain resilience a significant competitive differentiator for robot manufacturers.

The midstream of the value chain involves the core processes of robot manufacturing, system integration, and software development, which is typically managed by the Original Equipment Manufacturers (OEMs) of the autonomous weeders. This stage focuses heavily on integrating the diverse hardware components with proprietary software, particularly the development and refinement of computer vision algorithms and field navigation software. R&D investment is paramount in this midstream segment, driving continuous improvement in weed identification accuracy and operational autonomy. Successful OEMs not only assemble the physical robot but also develop comprehensive data analytics platforms that allow farmers to track performance, map weed pressure, and receive actionable insights, thereby transforming the robot from a machine into a sophisticated data tool.

The downstream analysis focuses on market delivery, distribution channels, and post-sale support. Distribution channels are multifaceted, ranging from direct sales models, particularly for large-scale, customized robotic fleets, to established agricultural equipment dealerships and the emerging model of Robotics-as-a-Service (RaaS) providers. The RaaS model, often leveraging indirect distribution channels through regional service providers, is becoming increasingly popular as it offers small and medium-sized farms access to the technology without the prohibitive upfront capital cost. Post-sale services, including software updates, predictive maintenance, and calibration support, are critical in maintaining long-term customer satisfaction and ensuring high uptime, creating a recurring revenue stream and strengthening the relationship between the manufacturer and the end-user farmer.

Autonomous Robots Weeder Market Potential Customers

Potential customers for the Autonomous Robots Weeder Market span a diverse range of agricultural entities, with a core focus on large commercial farming operations specializing in high-value, intensively managed crops. The primary end-users or buyers are large-scale row crop farmers in North America and Europe who are motivated by labor cost reduction, the need for enhanced efficiency across thousands of acres, and compliance with sustainability mandates requiring reduced chemical inputs. These customers possess the necessary capital for significant technology investment and have sophisticated internal systems capable of integrating robotic data into existing farm management platforms. They prioritize high operational speed, robustness, and proven ROI through reduced herbicide spending and maximized yield preservation, often favoring large, fully autonomous fleet solutions.

A rapidly growing segment of potential customers includes operators of specialty crop farms, such as vineyards, orchards, and producers of organic vegetables and berries. For these growers, precision is paramount, as accidental crop damage results in high financial losses. Since organic farming explicitly bans synthetic herbicides, autonomous weeders using mechanical or thermal removal are often the only scalable method of weed control, making these robots indispensable tools. These customers typically require smaller, highly maneuverable robots capable of operating in dense, non-uniform crop environments and are often more receptive to RaaS models, which align capital expenditure with seasonal operational needs, thus accelerating their adoption cycle. Furthermore, agricultural research institutions and governmental experimental farms represent niche, yet influential, customers who purchase these systems for research, testing, and demonstration purposes, influencing broader market acceptance and technological standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 475 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ECOBOTIX, Naio Technologies, Carbon Robotics, FarmWise, Small Robot Company, John Deere, Bosch Deepfield Robotics, Lely, Kubota, Yanmar, CNH Industrial, Monarch Tractor, VitiBot, Agribotix, Ecorobotix, Blue River Technology (acquired by John Deere), Precision Hawk, Trimble, CLAAS, AGCO Corporation, Raven Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autonomous Robots Weeder Market Key Technology Landscape

The technological landscape of the Autonomous Robots Weeder Market is defined by the convergence of four critical domains: highly accurate Global Navigation Satellite Systems (GNSS, often utilizing Real-Time Kinematic or RTK correction), advanced computer vision systems powered by deep learning, precision mechanical and actuation systems, and robust power management solutions. RTK-GPS provides centimeter-level positioning accuracy, essential for ensuring the robot follows the exact rows and avoids damaging crops. However, relying solely on GPS is insufficient; hence, the vision system, often incorporating stereoscopic or 3D cameras and LiDAR, performs the vital task of plant identification and localization within the row. These systems rely on neural networks trained on vast agricultural datasets to instantly differentiate minute weed seedlings from target crops, irrespective of growth stage or environmental variability.

The processing power required for real-time operation is typically provided by high-performance embedded systems, often utilizing specialized GPUs for edge computing, which allows the robot to make instantaneous decisions in the field without relying on cloud connectivity. This 'intelligence at the edge' is crucial for maintaining operational autonomy and reliability. Furthermore, the weeding mechanism itself represents a key technological differentiation point. While some robots use precise micro-dosing spray nozzles to apply tiny amounts of targeted herbicide (often only 2% of the conventional application), others utilize purely non-chemical methods such as high-powered lasers (as employed by Carbon Robotics), targeted mechanical cultivators (used by FarmWise), or focused electrical pulses or thermal energy, catering directly to the organic farming segment. The choice of weeding mechanism is dictated by the crop type, target weed, and regional regulatory requirements.

A developing area of technological focus involves swarm robotics and enhanced energy efficiency. Swarm technology involves deploying multiple small, cooperating robots that distribute the workload, offering redundancy and scalability superior to a single large machine. This shift requires sophisticated inter-robot communication and centralized task allocation algorithms. Concurrently, battery technology, particularly the utilization of high-density lithium-ion batteries and sophisticated power management systems, is being continuously optimized to extend operational range and duration, reducing charging downtime. Furthermore, integration capabilities—the robot’s ability to communicate seamlessly with other farm management software (e.g., ISO-BUS standards) and data collection platforms—is increasingly seen as a fundamental requirement, facilitating the robot's role as a core component of the holistic digital farming infrastructure.

Regional Highlights

- North America: This region is a market leader, characterized by early adoption of precision agriculture, large farm sizes that necessitate high efficiency and scale, and significant investments in AgTech startups. The U.S. and Canada face acute agricultural labor shortages and possess strong governmental incentives supporting smart farming technologies. Adoption is particularly high among large-scale row crop farmers (corn, soybeans) and high-value specialty crop producers (California, Washington). The presence of major agricultural machinery manufacturers and technology giants (e.g., John Deere/Blue River Technology) drives innovation and market availability. The focus here is on high throughput and integration into existing heavy machinery fleets, requiring robust, fast, and highly reliable autonomous systems capable of covering expansive areas.

- Europe: Europe represents a high-growth, highly regulated market. The strict environmental legislation, particularly the EU's Farm to Fork strategy emphasizing pesticide reduction, serves as a powerful catalyst for autonomous non-chemical weeding solutions. Countries like France, Germany, and the Netherlands lead in adoption, specifically in the vineyard, orchard, and vegetable segments where organic and sustainable practices are mandated or preferred by consumers. European players often focus on smaller, highly precise robots optimized for varying field sizes and complex terrains. The emphasis is predominantly on mechanical and thermal weeding methods to meet stringent chemical reduction targets, making technology providers specializing in non-herbicide solutions particularly competitive.

- Asia Pacific (APAC): APAC is expected to exhibit the highest CAGR during the forecast period. While historically reliant on manual labor, rising labor costs, government initiatives promoting agricultural modernization (e.g., in China and India), and the sheer scale of the agricultural land base are driving rapid automation. Currently, market penetration is lower than in the West, but the demand for scalable, affordable technology is immense. The challenge lies in developing robots suitable for smaller, fragmented land holdings and diverse crop environments, demanding versatile, potentially smaller, and lower-cost units. Investment in localized R&D for region-specific crop recognition models is critical for successful market entry.

- Latin America (LATAM): This region offers significant potential, driven by vast acreage dedicated to staple crops (soybeans, sugar cane, corn) and high initial labor costs in countries like Brazil and Argentina. Adoption is currently slower, constrained by infrastructure challenges and lower capital availability compared to North America. However, large corporate farms operating in cash crops are increasingly piloting autonomous systems to secure cost efficiencies and optimize pesticide use. Future growth hinges on improving accessibility through favorable financing and RaaS models tailored to the region's unique economic structure and operational scale.

- Middle East and Africa (MEA): The MEA market is nascent but growing, driven by food security concerns, resource scarcity (especially water), and the need for high-efficiency farming techniques in arid environments. Autonomous weeders, particularly those minimizing soil disruption and maximizing water efficiency, appeal to countries focused on agricultural self-sufficiency. Adoption is concentrated in technologically advanced agricultural projects and large corporate farms in the UAE, Saudi Arabia, and South Africa, which can afford the necessary capital investment. The environmental benefits associated with precise application and data collection serve as crucial adoption drivers in this highly resource-sensitive environment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autonomous Robots Weeder Market.- ECOBOTIX

- Naio Technologies

- Carbon Robotics

- FarmWise

- Small Robot Company

- John Deere (Blue River Technology)

- Bosch Deepfield Robotics

- Lely

- Kubota

- Yanmar

- CNH Industrial

- Monarch Tractor

- VitiBot

- Agribotix

- Ecorobotix

- Precision Hawk

- Trimble

- CLAAS

- AGCO Corporation

- Raven Industries

Frequently Asked Questions

Analyze common user questions about the Autonomous Robots Weeder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary economic benefit of adopting autonomous robots weeder technology?

The primary economic benefit is the substantial reduction in operational costs, achieved through minimizing reliance on increasingly expensive manual labor and significantly decreasing the consumption of chemical herbicides due to hyper-targeted, precision application or non-chemical removal methods. This leads to a strong long-term Return on Investment (ROI).

How reliable are vision-based autonomous weeders in variable field conditions, such as different lighting or dense foliage?

Modern vision-based autonomous weeders, leveraging deep learning and AI, demonstrate high reliability. They use sophisticated neural networks trained on vast datasets to adapt to varying light, soil types, and crop densities, ensuring high accuracy in distinguishing crops from weeds even in complex, real-world agricultural environments.

Are autonomous weeding robots suitable for organic farming operations?

Yes, autonomous weeding robots are highly suitable for organic farming, representing a crucial enabling technology. Many systems utilize non-chemical methods, such as mechanical cultivation, laser ablation, or thermal treatment, fulfilling the strict requirements of organic certification while providing scalable, efficient weed control.

What are the main segments driving technological development in the Autonomous Robots Weeder Market?

The key technological drivers are advancements in high-precision GNSS/RTK navigation, enabling centimeter-level accuracy; the continuous improvement of computer vision and deep learning models for accurate plant classification; and innovations in energy efficiency and power systems to maximize field operating time.

Is the Robotics-as-a-Service (RaaS) model becoming common in this market?

Yes, RaaS is a rapidly accelerating trend. It lowers the prohibitive initial capital expenditure for farmers, making autonomous weeding technology accessible to small and medium-sized farms. RaaS providers manage maintenance, updates, and operational logistics, offering farmers a subscription-based, efficient service model.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager