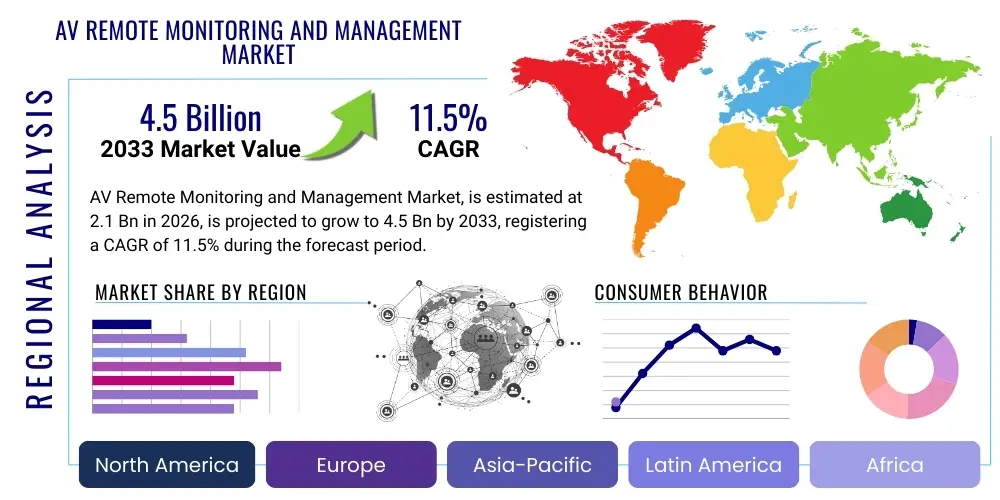

AV Remote Monitoring and Management Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443289 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

AV Remote Monitoring and Management Market Size

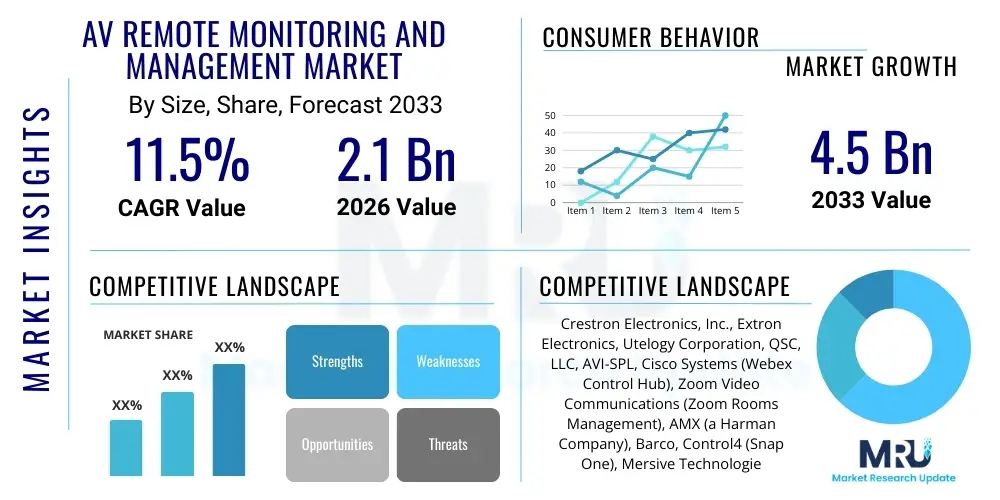

The AV Remote Monitoring and Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating complexity of enterprise AV infrastructure, necessitating sophisticated tools for maintenance, diagnostics, and performance optimization across diverse geographic locations. Organizations are increasingly recognizing that manual management of dispersed AV assets leads to unacceptable downtime, higher operational expenditures, and reduced productivity in crucial communication and collaboration environments. The shift towards unified communications and collaboration (UCC) platforms, coupled with the proliferation of sensor-enabled AV endpoints, further solidifies the need for integrated RMM solutions that offer real-time health checks and automated troubleshooting capabilities.

AV Remote Monitoring and Management Market introduction

The AV Remote Monitoring and Management (RMM) Market encompasses software solutions and services designed to remotely monitor, manage, and maintain Audio Visual equipment and systems deployed across various commercial, educational, and governmental settings. These systems include, but are not limited to, video conferencing hardware, digital signage networks, classroom projectors, sound systems, and integrated control platforms. The core function of AV RMM is to provide centralized visibility into the operational status, performance metrics, and diagnostic data of these devices, allowing IT and AV technicians to proactively identify and resolve issues before they escalate into disruptive failures, thereby ensuring maximum uptime and optimal user experience. Key benefits include enhanced service reliability, reduced operational costs associated with on-site technician deployment, and streamlined asset lifecycle management.

Major applications for AV RMM span corporate boardrooms and collaboration spaces, educational technology environments (e-learning systems), healthcare facilities (telemedicine and patient education screens), and hospitality sectors (integrated room control and digital guest services). The evolution of hybrid work models has dramatically increased the reliance on high-quality, reliable remote collaboration tools, making the continuous performance of AV systems critical to business continuity. RMM tools facilitate preventative maintenance scheduling, firmware updates, configuration management, and the generation of detailed usage reports, offering indispensable value to organizations managing large and distributed AV estates.

The market's robust growth trajectory is primarily fueled by several powerful driving factors, including the pervasive digital transformation initiatives sweeping across industries, demanding seamless AV integration and interoperability. The increasing adoption of IoT devices within AV ecosystems, which generate vast amounts of performance data, necessitates advanced RMM platforms capable of sophisticated data analytics and anomaly detection. Furthermore, the growing awareness among end-users regarding the total cost of ownership (TCO) associated with managing complex AV technology manually is accelerating the shift toward subscription-based, cloud-native RMM solutions that promise greater efficiency and scalability.

AV Remote Monitoring and Management Market Executive Summary

The AV Remote Monitoring and Management Market is characterized by intense technological innovation centered on integrating predictive analytics and robust cybersecurity features within RMM platforms. Business trends highlight a strong preference for cloud-based RMM solutions over traditional on-premise deployments, driven by the need for scalability, simplified deployment, and lower capital expenditure. Strategic partnerships between hardware manufacturers (OEMs) and software providers are becoming increasingly common, aiming to offer deeply integrated, vendor-specific monitoring tools that enhance diagnostic accuracy and automation levels. Furthermore, the convergence of IT Service Management (ITSM) and AV RMM frameworks is enabling businesses to manage their technology infrastructure holistically, moving AV systems from niche maintenance areas into core IT operations.

Regional trends indicate North America currently holds the largest market share, attributable to the early adoption of advanced collaboration technologies, the presence of major technology vendors, and significant investment in smart corporate infrastructure. Asia Pacific (APAC) is projected to exhibit the highest CAGR during the forecast period, fueled by rapid urbanization, massive investments in educational and commercial infrastructure development, and the increasing demand for advanced digital signage and conference room technology in emerging economies like China and India. Europe maintains a steady growth trajectory, driven by stringent regulatory requirements for data privacy, prompting the development of GDPR-compliant RMM solutions, particularly within the government and healthcare sectors.

Segmentation trends reveal that the Services segment, encompassing managed services, implementation, and consulting, is growing faster than the Software segment, reflecting the complexity of integrating RMM into existing enterprise IT environments and the desire for outsourced management expertise. Among application types, Corporate and Government sectors remain the dominant end-users due to their sheer volume of AV assets and critical reliance on continuous operation for internal and external communications. Cloud deployment models are rapidly outpacing on-premise solutions due to superior flexibility and rapid updates, fundamentally reshaping how RMM capabilities are delivered and consumed globally.

AI Impact Analysis on AV Remote Monitoring and Management Market

User inquiries regarding Artificial Intelligence (AI) in AV RMM frequently center on its ability to transition maintenance from reactive to truly predictive, minimizing human intervention. Common questions include: "How accurately can AI algorithms predict AV equipment failure based on historical performance data?" "What are the security implications of autonomous RMM systems utilizing machine learning?" and "Will AI integration drastically reduce the need for skilled AV technicians?" These questions reflect a collective expectation that AI will deliver sophisticated anomaly detection, highly accurate root cause analysis (RCA), and automated remediation workflows. Users anticipate AI will not only monitor device health but also analyze user behavior and environmental factors (like room acoustics or lighting conditions) to proactively optimize performance and calibrate systems autonomously, ultimately leading to unparalleled operational efficiency and resource optimization.

The core theme emerging from these inquiries is the expectation of hyper-automation. Businesses are keen to leverage AI and Machine Learning (ML) to process the massive streams of telemetry data generated by modern AV systems—a task impossible for human analysts alone. This drive towards data-driven operations extends beyond simple fault detection; it includes optimizing energy consumption of devices, ensuring compliance with internal security policies through automated scanning, and providing personalized troubleshooting recommendations directly to end-users via AI-powered chatbots or virtual assistants integrated into the RMM platform interface. This shift is critical for managing the exponential growth of networked AV endpoints.

Furthermore, concerns about the initial investment required for AI infrastructure, data governance, and algorithmic bias are also prevalent among market participants. While the promise of enhanced operational capabilities is high, organizations are carefully evaluating the scalability and trustworthiness of AI models in mission-critical environments. Successful market adoption hinges on vendors demonstrating clear ROI through reduction in false positives, measurable improvement in first-time fix rates, and seamless integration of these advanced capabilities within existing AV management dashboards and IT workflows without adding significant operational complexity.

- AI enables predictive maintenance by analyzing operational telemetry for early signs of component degradation.

- Machine Learning algorithms enhance root cause analysis, drastically reducing diagnostic time for complex system failures.

- Automation of routine tasks (e.g., firmware updates, configuration audits) via AI-driven workflows improves technician productivity.

- AI optimizes system performance dynamically by adapting settings based on real-time usage and environmental conditions.

- AI-powered natural language processing (NLP) improves user self-service troubleshooting and ticketing system efficiency.

- Advanced anomaly detection identifies sophisticated security threats or unauthorized configuration changes in networked AV gear.

DRO & Impact Forces Of AV Remote Monitoring and Management Market

The AV Remote Monitoring and Management market is propelled by significant drivers (D), countered by technological and systemic restraints (R), and offers substantial opportunities (O), all subjected to various impact forces. The primary driver is the accelerating trend of unified collaboration, demanding fault-tolerant AV systems critical for hybrid workforces and digital classrooms. This demand is reinforced by the cost-effectiveness RMM provides by minimizing expensive, time-consuming truck rolls for routine maintenance and diagnostics. However, a major restraint is the persistent security vulnerability associated with networking potentially proprietary AV devices, often requiring specialized patch management and facing resistance due to perceived complexity and integration challenges with legacy systems. The market opportunity lies prominently in developing hyper-personalized, vertically-specific RMM solutions leveraging IoT integration and edge computing for ultra-low latency monitoring, especially in mission-critical environments like command centers and surgical suites. The resulting impact forces are shaping the competitive landscape through consolidation and mandatory standardization efforts.

Key drivers also include the sheer volume and diversity of AV devices now deployed across enterprises, making manual management virtually impossible and exponentially increasing the risk of Shadow IT practices when dedicated management tools are absent. This proliferation necessitates sophisticated asset management capabilities inherent in RMM platforms, providing real-time inventory and lifecycle tracking. Moreover, the increasing regulatory pressure in sectors like finance and government concerning data transmission and system uptime further compels organizations to adopt robust, auditable RMM solutions. These systems not only ensure operational compliance but also provide the necessary documentation trails required during internal and external audits, establishing RMM as a governance tool rather than merely a maintenance utility.

Conversely, significant restraints hinder growth, including the high initial implementation cost, particularly for large-scale enterprise deployments requiring integration across disparate existing IT infrastructures and vendor platforms. The lack of standardized protocols across different AV manufacturers creates integration hurdles, forcing RMM providers to develop complex, custom integrations rather than scalable, universal connectors. Opportunities are abundant, especially in the development of subscription-based, Software as a Service (SaaS) models that lower the entry barrier for Small and Medium-sized Enterprises (SMEs). Furthermore, the burgeoning demand for environmentally sustainable operations presents an opportunity for RMM systems to offer advanced power management and energy consumption optimization features for AV assets, aligning with corporate sustainability goals and potentially generating operational cost savings beyond just maintenance efficiency.

Segmentation Analysis

The AV Remote Monitoring and Management market is comprehensively segmented based on its component structure, deployment model, organizational size, end-user industry, and key capabilities offered. Understanding these segmentations is critical for stakeholders to tailor product development and market penetration strategies, as different segments exhibit unique spending patterns and technological maturity levels. The primary segmentation dimensions reveal a strong preference shift towards cloud-based architectures, driven by enterprise requirements for elasticity, rapid deployment, and reduced dependence on internal IT hardware investment. Furthermore, the segmentation by organizational size highlights the increasing accessibility of RMM tools to SMEs, thanks to scalable SaaS offerings, moving beyond a market traditionally dominated by large enterprises. This granular analysis provides insights into the localized competitive dynamics and untapped market potentials within specific verticals.

Segmentation by component distinguishes between the foundational software platform, which provides the dashboard, analytics, and control logic, and the associated services, which are crucial for successful implementation, system integration, ongoing managed support, and technical consulting. While the software segment captures the intellectual property and core technological innovation, the services segment often represents a higher recurring revenue stream and is critical for ensuring high customer satisfaction and long-term contract renewal. The end-user analysis demonstrates the dominant role of the corporate sector, which relies heavily on seamless video conferencing and collaboration infrastructure, followed closely by the educational sector, which demands robust and easily managed classroom AV technology to support blended learning environments.

Further segmentation by capability, such as predictive diagnostics versus reactive alerting, or asset management versus network health monitoring, allows vendors to position specialized products. For instance, advanced segments focusing on deep network telemetry and security auditing appeal heavily to governmental and financial institutions with stringent compliance requirements, while simpler, focused remote control applications might target retail digital signage networks. This multilayered segmentation confirms the market’s maturity and specialization, requiring vendors to provide modular and customizable RMM suites that can adapt to highly specific operational needs and budgetary constraints across the global economy.

- By Component:

- Software (Platform and Applications)

- Services (Managed Services, Professional Services, Implementation & Integration)

- By Deployment Model:

- Cloud-Based

- On-Premise

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-User Industry:

- Corporate Sector (Boardrooms, Huddle Spaces, Training Facilities)

- Education (K-12, Higher Education)

- Government & Defense

- Healthcare (Telemedicine, Patient Education)

- Retail & Hospitality (Digital Signage, Integrated Guest Systems)

- Media & Entertainment

Value Chain Analysis For AV Remote Monitoring and Management Market

The Value Chain for the AV Remote Monitoring and Management market begins with upstream activities dominated by hardware component manufacturers (sensors, processors, network interfaces) and core software developers specializing in data telemetry protocols and cloud infrastructure services. These foundational entities provide the essential building blocks—reliable endpoints and secure, scalable data processing capabilities—necessary for RMM functionality. Midstream, the value shifts to RMM platform providers who integrate these foundational technologies, developing proprietary algorithms for diagnostics, creating intuitive user interfaces (dashboards), and establishing robust connectivity protocols to disparate AV hardware from various OEMs. Strategic differentiation at this stage involves platform openness, API availability for third-party integrations, and the sophistication of predictive analytics modules.

Downstream analysis focuses heavily on distribution and service delivery. Distribution channels are typically a mix of direct sales to large enterprises, particularly for highly customized or integrated solutions, and indirect channels relying on authorized AV integrators, Managed Service Providers (MSPs), and Value-Added Resellers (VARs). These indirect partners play a crucial role, often handling the initial deployment, configuration, and ongoing first-level support for end-users, especially SMEs who lack dedicated in-house AV IT teams. The relationship between RMM vendors and these integrators is symbiotic, as the integrators provide market reach and crucial last-mile service expertise.

Direct engagement occurs primarily with major global accounts seeking centralized management across international deployments, where the RMM vendor provides the platform directly and may offer professional services for global rollout standardization. Indirect channels, however, dominate the local and regional markets, where integrators package RMM solutions alongside hardware installations, positioning RMM as a necessary enhancement to system reliability and a recurrent revenue stream. Successful companies in this market leverage robust partnerships with diverse channel partners, providing comprehensive training and support to ensure consistent deployment quality and maximizing market coverage across various vertical segments.

AV Remote Monitoring and Management Market Potential Customers

Potential customers for AV Remote Monitoring and Management solutions encompass a wide spectrum of organizations that rely on complex, interconnected Audio Visual technology for mission-critical operations, communication, or customer engagement. The primary target demographic includes IT Directors and Facilities Managers in large corporations who are responsible for maintaining seamless collaboration environments across multiple offices or global campuses. These buyers prioritize solutions that offer centralized control, compliance reporting, and predictive fault isolation, directly impacting corporate productivity and meeting efficiency. The purchasing decision often involves a cross-functional team including IT security, procurement, and the specific business units most reliant on the AV systems, such as marketing (for digital signage) or training departments.

A rapidly growing segment of potential customers includes educational institutions, ranging from large universities managing hundreds of smart classrooms and lecture halls to K-12 districts overseeing technology in distance learning initiatives. For educational buyers, ease of use, ability to manage disparate device types (projectors, interactive displays, recording systems), and cost-efficiency are paramount, making SaaS-based RMM solutions highly attractive. Similarly, the healthcare industry—specifically hospital networks utilizing telemedicine carts, patient information displays, and operating room integration systems—represents a high-value customer base demanding stringent security, guaranteed uptime, and rapid diagnostics to comply with patient care standards and regulations like HIPAA.

Furthermore, government agencies, particularly those dealing with defense, emergency response, and public service, are crucial buyers. These entities require RMM systems that adhere to the highest standards of network security, data sovereignty, and system redundancy for command and control centers or critical communication infrastructure. For all customer segments, the underlying motivation for adoption is shifting from simply fixing broken devices to leveraging RMM data for strategic decision-making, such as optimizing room utilization, standardizing equipment purchasing based on reliability metrics, and justifying AV technology investments through demonstrated uptime and reduced TCO.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Crestron Electronics, Inc., Extron Electronics, Utelogy Corporation, QSC, LLC, AVI-SPL, Cisco Systems (Webex Control Hub), Zoom Video Communications (Zoom Rooms Management), AMX (a Harman Company), Barco, Control4 (Snap One), Mersive Technologies, Domotz, Kramer Electronics, Biamp Systems, Atlona (a Panduit Company), Logitech, Savant Systems, Inc., Xyte. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AV Remote Monitoring and Management Market Key Technology Landscape

The technological backbone of the AV RMM market is defined by several converging technologies, primarily focusing on robust network connectivity, sophisticated data ingestion capabilities, and advanced analytics. Central to RMM functionality is the reliance on Internet of Things (IoT) principles, where AV devices are treated as smart endpoints generating real-time telemetry data regarding temperature, uptime, connection quality, and usage statistics. This requires RMM platforms to support diverse connectivity protocols—including IP, SNMP, and proprietary APIs—to effectively communicate with a heterogeneous array of manufacturer devices. The shift towards cloud-native architectures (utilizing AWS, Azure, or Google Cloud) is fundamental, enabling scalability and reliable data warehousing necessary to handle massive data volumes and facilitate rapid deployment updates without extensive client-side infrastructure changes. Security is an intrinsic technological concern, necessitating the use of encryption (SSL/TLS), secure authentication mechanisms (e.g., OAuth 2.0), and continuous vulnerability scanning tailored specifically for AV network environments.

A critical component is the integration of Artificial Intelligence and Machine Learning (AI/ML). Advanced RMM platforms utilize ML models for trend analysis and pattern recognition, moving beyond simple threshold alerting to true predictive failure forecasting. For instance, an ML model might analyze subtle fluctuations in network latency or fan speed correlation over time to predict component burnout weeks in advance. Edge computing capabilities are also gaining traction, particularly for latency-sensitive applications or environments with intermittent network access. Edge devices deployed locally can perform preliminary data aggregation, filtering, and local decision-making (e.g., rebooting a frozen display) before transmitting only critical, processed data to the central cloud platform, reducing bandwidth consumption and improving response times for immediate operational issues.

Furthermore, the technology landscape emphasizes interoperability and a unified user experience. Modern RMM solutions are increasingly expected to integrate seamlessly with adjacent enterprise systems, such as IT Service Management (ITSM) platforms (e.g., ServiceNow, Zendesk) for automated ticketing, Customer Relationship Management (CRM) tools for service history, and existing network monitoring systems. This integration minimizes operational silos and provides a single pane of glass for both AV and traditional IT teams. The use of standardized APIs (RESTful interfaces) and open communication standards is essential to facilitate this ecosystem convergence, ensuring that RMM is treated not as a standalone tool but as a foundational layer of the broader enterprise digital infrastructure management strategy, continually driving product evolution towards comprehensive IT/AV alignment.

Regional Highlights

- North America (NA): Dominates the global AV RMM market due to high technological maturity, the early adoption of unified communications technologies, and the strong presence of major technology providers and large multinational corporations that operate extensive, complex AV estates. The demand is heavily concentrated in the Corporate and Higher Education sectors, driven by sophisticated requirements for guaranteed uptime, standardized deployment protocols, and advanced security features. Significant R&D investment in AI-driven diagnostics and IoT integration originates primarily from this region.

- Europe: Characterized by steady growth, particularly in Western European nations like the UK, Germany, and France. Growth is stimulated by the expansion of smart office concepts and strict regulatory frameworks, such as GDPR, which necessitate RMM solutions with robust data governance and secure monitoring capabilities. The emphasis here is often on high-quality, reliable systems in professional AV applications (e.g., broadcast, government, finance).

- Asia Pacific (APAC): Expected to be the fastest-growing region, propelled by massive infrastructure development in emerging economies (China, India, Southeast Asia). Rapid urbanization, coupled with significant government spending on digital transformation initiatives in education and public safety, is fueling the adoption of networked AV systems and, consequently, RMM tools. The market in APAC is price-sensitive but highly receptive to scalable, cloud-based solutions tailored for managing large, geographically dispersed digital signage and collaboration networks.

- Latin America (LATAM): Exhibits moderate growth, primarily focused on large metropolitan areas and expanding corporate centers. Adoption is driven by the need for remote management capabilities to overcome geographical distances and reduce travel costs for technical support. The market prefers flexible, subscription-based models due to varying economic conditions and limited initial capital expenditure budgets.

- Middle East and Africa (MEA): Growth is strong, particularly in the Gulf Cooperation Council (GCC) countries, driven by mega-projects in hospitality, retail, and government infrastructure (e.g., smart city initiatives). RMM solutions are critical for managing the sophisticated AV installations within world-class convention centers, hotels, and futuristic corporate headquarters, focusing on system integration robustness and long-term service contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AV Remote Monitoring and Management Market.- Crestron Electronics, Inc.

- Extron Electronics

- Utelogy Corporation

- QSC, LLC

- AVI-SPL

- Cisco Systems (Webex Control Hub)

- Zoom Video Communications (Zoom Rooms Management)

- AMX (a Harman Company)

- Barco

- Control4 (Snap One)

- Mersive Technologies

- Domotz

- Kramer Electronics

- Biamp Systems

- Atlona (a Panduit Company)

- Logitech

- Savant Systems, Inc.

- Xyte

- Aurora Multimedia

- Black Box Corporation

Frequently Asked Questions

Analyze common user questions about the AV Remote Monitoring and Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is AV Remote Monitoring and Management (RMM) and why is it crucial now?

AV RMM is a suite of tools that allows centralized, proactive oversight and maintenance of Audio Visual devices over a network. It is crucial due to the rapid expansion of complex, integrated AV infrastructure (especially in hybrid work environments), which necessitates automation to minimize downtime, ensure service quality, and reduce operational costs associated with manual, on-site diagnostics.

How does AI contribute to the efficiency of AV RMM systems?

AI significantly enhances AV RMM efficiency by enabling predictive maintenance. Machine Learning algorithms analyze vast telemetry data to forecast potential component failures, automate root cause analysis, and dynamically optimize system configurations, transforming maintenance from reactive repairs into proactive, data-driven system management.

What are the primary differences between cloud-based and on-premise RMM deployment models?

Cloud-based RMM offers superior scalability, lower capital expenditure, and automatic updates, making it ideal for distributed organizations and SMEs. On-premise deployment provides maximum control over data security and network topology, often preferred by highly regulated sectors such as government and finance, though it requires greater internal IT resource investment.

Which industry vertical is driving the highest demand for AV RMM solutions?

The Corporate Sector, particularly large enterprises managing extensive meeting rooms, collaboration spaces, and global offices, is currently the largest driver of demand. These organizations require guaranteed, reliable AV systems to support critical internal and external communications, making RMM essential for business continuity and productivity maximization.

What is the greatest restraint facing the widespread adoption of AV RMM?

The primary restraint is the persistent challenge of interoperability and standardization across the highly fragmented AV hardware landscape. Different manufacturers utilize disparate protocols, forcing RMM providers to develop complex, customized integrations, which increases implementation complexity and initial deployment costs for end-users.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager