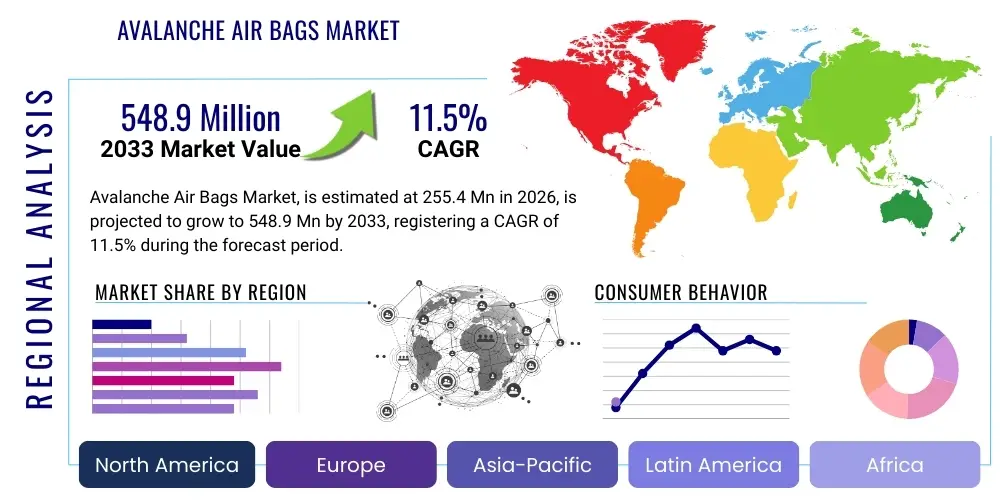

Avalanche Air Bags Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442378 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Avalanche Air Bags Market Size

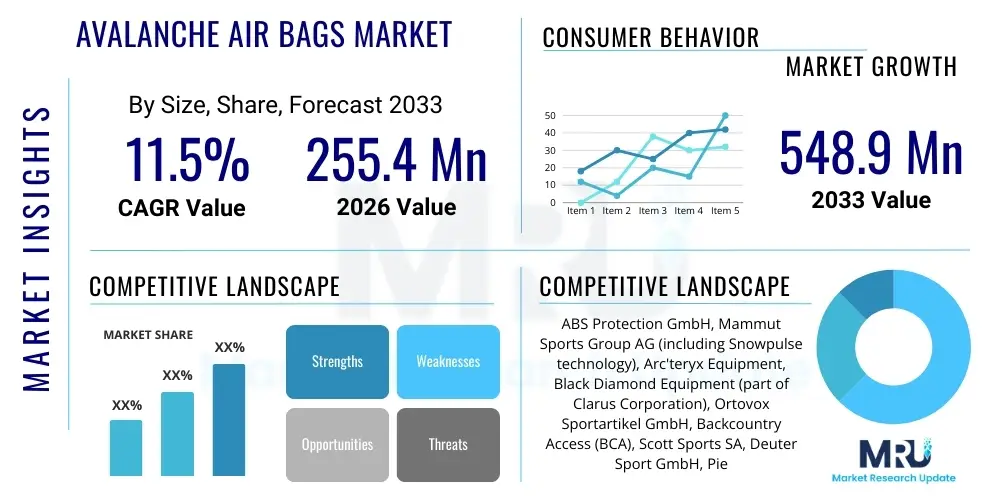

The Avalanche Air Bags Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 255.4 Million in 2026 and is projected to reach USD 548.9 Million by the end of the forecast period in 2033. This robust expansion is reflective of increasing global participation in high-risk backcountry winter sports and corresponding improvements in consumer safety education and regulatory mandates across primary geographic markets.

Avalanche Air Bags Market introduction

The Avalanche Air Bags Market encompasses the specialized industry dedicated to the development, manufacturing, and global distribution of sophisticated safety systems integral to the mitigation of fatality risk in avalanche events. These systems, meticulously designed and typically integrated within functional backpacks, operate on the core physical principle of inverse segregation, often colloquially termed the "Brazil Nut Effect." By rapidly inflating a high-volume, tear-resistant air bladder upon user activation, the system significantly increases the body's volume relative to the surrounding snow matrix. This volumetric enhancement minimizes the density disparity, thereby forcing the individual toward the moving debris's surface, dramatically increasing the probability of survival by preventing deep or complete burial, which is the overwhelmingly primary cause of mortality in snow slides.

The technological evolution within this sector has been characterized by a critical shift from reliance solely on compressed gas cartridges—using nitrogen or argon—to the widespread adoption of high-efficiency, battery-powered electric fan systems. This transition addresses core user concerns related to weight, the ability for multiple practice deployments, and overcoming stringent air travel regulations imposed on pressurized gas cylinders. Major applications of avalanche air bag systems span recreational off-piste skiing and snowboarding, high-altitude mountaineering expeditions, professional mountain guiding, and critical search and rescue (SAR) operations. The product’s core benefit lies in its preventative capability, offering a proactive layer of safety that complements, but does not replace, traditional rescue tools such as transceivers, probes, and shovels, cementing its status as essential equipment for operations in uncontrolled snow environments.

Market expansion is fundamentally driven by several macro factors, including the surging global popularity of backcountry and adventure tourism, which pushes enthusiasts into previously inaccessible and inherently riskier mountain terrains. Concurrently, heightened public and regulatory emphasis on snow safety protocols, spurred by organizations such as the European Avalanche Warning Services and the American Avalanche Association, reinforces the necessity of adopting certified safety apparatus. Furthermore, aggressive product development focusing on miniaturization, enhanced ergonomics, and improved integration of systems (e.g., combining inflation with advanced GPS or communication capabilities) makes these life-saving devices more appealing and accessible to a broader consumer demographic, sustaining robust market penetration across established winter sports geographies.

Avalanche Air Bags Market Executive Summary

The global Avalanche Air Bags market exhibits significant momentum, propelled by demographic trends indicating increasing high-risk recreational participation alongside continuous technological refinement. Key business trends underscore a competitive environment where differentiation is achieved through maximizing system reliability, optimizing weight-to-performance ratios, and integrating smart electronics. Manufacturers are strategically engaging in vertical integration to control critical supply chains, particularly those related to specialized textiles and battery technology, thereby ensuring quality control and supply consistency. Furthermore, strategic alliances are frequently forged between air bag producers and major outdoor equipment retailers and training organizations to enhance consumer education and expand retail reach. Investment in sustainable manufacturing practices, appealing to the environmentally conscious outdoor community, also represents a growing competitive differentiator and a key business trend.

Geographically, market dominance remains concentrated in North America and Europe, which together account for the substantial majority of global revenue. Europe, specifically the Alps, represents a mature market characterized by high user adoption and replacement demand, where regulatory requirements often drive product updates and innovation cycles. North America shows accelerated growth, driven by an expanding consumer base willing to invest in premium safety gear and influenced by strong media coverage of backcountry activities. Crucially, the Asia Pacific (APAC) region stands out as the primary growth engine for the forecast period. Countries such as Japan, renowned for its consistent snow conditions, and emerging markets like China, with massive government investments in ski tourism infrastructure, are poised to rapidly increase their demand profile, requiring tailored distribution strategies and localized product offerings.

Analysis of segmentation trends reveals a definitive market preference shift toward Fan-based Electric Systems over traditional Compressed Air Cartridge Systems, primarily due to their operational convenience, lower long-term cost of ownership, and ease of airline transportation. The Recreational End-Use segment maintains its quantitative lead, yet the Professional and Commercial sectors, including Search and Rescue and certified guiding operations, drive demand for specialized, highly durable, and multi-deployment models, commanding a premium price point. E-commerce platforms are increasingly challenging the hegemony of traditional specialty retail channels by offering extensive product comparisons and direct-to-consumer advantages, especially for users seeking system components or upgrades, thus necessitating omnichannel strategies for leading brands to maintain market share relevance.

AI Impact Analysis on Avalanche Air Bags Market

The convergence of Artificial Intelligence (AI) and the Avalanche Air Bags Market is generating widespread inquiry among end-users and safety professionals, centering on the potential for autonomous system enhancement and predictive safety integration. Users are keen to understand how AI can transition safety systems from reactive (post-trigger) to truly proactive mechanisms. Common user questions reflect a demand for sophisticated sensors and machine learning models capable of analyzing micro-environmental conditions—such as snow density gradients, slope angle changes, and real-time human movement metrics—to provide instantaneous, highly localized risk assessments, potentially overriding manual input in catastrophic scenarios. The industry expectation is that AI will be leveraged to optimize the precise timing and volumetric intensity of air bag deployment, moving beyond simple mechanical activation to a nuanced response calibrated to the physics of the specific avalanche event, thus maximizing the probability of remaining on the surface. Furthermore, the incorporation of AI into associated rescue hardware, particularly advanced transceivers and drone-based search algorithms, promises a significant reduction in critical search times post-burial, forming a seamless digital integration across the entire mountain safety infrastructure.

- AI-enhanced Sensor Fusion: Utilizing machine learning algorithms to aggregate and interpret data from multiple integrated sensors (GPS, inertial measurement units, barometers) to provide highly accurate, immediate danger ratings.

- Predictive Deployment Optimization: Employing AI to analyze the dynamics of the user during the initial moments of an avalanche to determine the optimal inflation rate and pressure required for maximum buoyancy effect.

- Automated System Diagnostics and Maintenance: AI platforms continuously monitoring the health status of the battery, fans, and specialized fabrics, proactively alerting users to potential technical faults before deployment failure occurs.

- Smart Fabric Wear Assessment: Using computer vision or integrated micro-sensors to detect structural fatigue or micro-tears in the air bag material, extending product reliability and informing necessary preemptive repairs.

- Integration with Digital Twins: Creating digital representations of complex snowpacks and terrain for simulation, allowing AI to refine risk assessment models based on vast amounts of historical and real-time environmental data.

- AI-driven Search Grid Optimization: Leveraging AI to process signals from multiple transceivers or integrated GPS beacons, dramatically accelerating the definition and execution of search patterns for rescue teams in complex terrain.

DRO & Impact Forces Of Avalanche Air Bags Market

The market's robust trajectory is primarily fueled by powerful Drivers, including the escalating global participation in remote and challenging backcountry winter activities. This is significantly amplified by the development of ultra-lightweight and highly reliable fan-based air bag systems, which have lowered the entry barrier for recreational users previously deterred by the bulk and weight of older cartridge technology. Mandates for the use of avalanche safety gear in specific high-risk commercial operations (e.g., heli-skiing) and increasing consumer willingness to invest in premium, life-saving equipment following high-profile incidents further cement market growth. Educational initiatives led by global safety organizations, effectively communicating the high efficacy rate of modern air bag technology, also play a crucial role in transforming safety awareness into tangible market demand across demographics.

However, the market expansion faces tangible Restraints, chiefly centered on the substantial initial capital outlay required for high-end systems, which can exceed hundreds of US dollars, making them prohibitively expensive for budget-conscious or occasional backcountry users. Furthermore, despite the advent of fan systems, logistical challenges persist, particularly concerning the necessary maintenance and specialized handling of compressed gas cartridges still utilized by many systems, especially when crossing international borders due to varied IATA and regional aviation safety regulations. An additional constraint is the perception, particularly among highly experienced users, that the air bag provides a false sense of security, potentially leading to increased risk-taking behavior (risk compensation), requiring continuous educational efforts to emphasize the need for combined safety protocols.

Opportunities for profound market expansion reside in the continuous integration of multi-functional safety features. The development of next-generation hybrid systems, combining the reliability of compressed gas deployment initiation with the multi-deployment capability of fan technology, promises superior performance characteristics. Significant untapped potential exists in expanding market penetration into rapidly developing high-altitude tourism areas, notably in Central Asia and newly developing mountain resorts across Eastern Europe and South America, requiring localized distribution networks. The commercial opportunity also extends to specialized rental programs offered through resorts and guiding services, enabling wide access to certified equipment without requiring a full purchase, which simultaneously serves as a crucial awareness and product trial mechanism for future sales conversion.

Segmentation Analysis

Segmentation analysis is foundational to understanding the dynamic structure of the Avalanche Air Bags market, categorized fundamentally by the underlying inflation technology, the system’s configuration, the specific end-user application, and the established pathways to market. Technology segmentation is pivotal, reflecting the market’s transition away from purely mechanical systems toward electro-mechanical fan-based technology, which has significantly impacted product design and pricing strategies. Understanding the preference shifts within these segments allows manufacturers to allocate R&D resources effectively, focusing on enhancing battery longevity and fan motor performance in the electric segment, while optimizing weight reduction and cartridge reliability in the compressed air segment.

The end-use segmentation dictates product features, where recreational users prioritize lightweight, ergonomic designs suitable for long tours, whereas professional users demand systems offering superior durability, higher pack volumes for rescue gear, and certified features for heavy-duty operational environments. Analyzing the distribution channel segmentation reveals the enduring importance of specialized brick-and-mortar retailers, which act as vital educational hubs for complex safety equipment, juxtaposed against the rising efficiency and price transparency offered by global e-commerce platforms, forcing a sophisticated omnichannel engagement strategy from market leaders to capture both experiential and transactional customers.

- By Technology:

- Compressed Air Cartridge Systems: Utilize non-flammable compressed gas (nitrogen or argon) for instantaneous inflation; established, reliable technology but restricted by travel regulations.

- Fan-based Electric Systems (Battery-powered): Employs high-powered, rechargeable electric fans for multiple deployments and easier travel; dominates new product development focusing on battery optimization.

- Hybrid Systems (Combining elements of both): Emerging niche combining rapid gas activation with sustained fan inflation for redundancy and optimal deployment efficiency.

- By Air Bag Type:

- Single Bag Systems (Monobag): Standard configuration, often offering maximum volume deployment, prioritized for simplicity and weight reduction.

- Double Bag Systems (Twinbag): Offers increased redundancy and greater surface area coverage for enhanced lift and stability during the slide event.

- V-shaped/U-shaped Configurations: Designed to protect the head, neck, and upper torso from trauma while maximizing surface buoyancy.

- By End-Use:

- Recreational Users (Backcountry Skiing, Snowboarding, Snowmobiling): Largest volume segment, prioritizing convenience, weight, and ease of use.

- Commercial and Professional (Heli-Ski Guides, Mountain Patrol, Film Crews): Requires high-durability, standardized systems with large storage capacity and high reliability in demanding environments.

- Search & Rescue Operations (SAR Teams, Military Applications): Demands specialized, certified gear with integration points for tactical communication and rescue equipment.

- By Distribution Channel:

- Offline Channels (Specialty Retail Stores, Outdoor Equipment Shops): Crucial for product demonstration, expert consultation, and fitting; maintain relevance through experiential retail.

- Online Channels (E-commerce Websites, Direct-to-Consumer Platforms): Growing segment driving price competition and offering convenience for replacement parts and repeat purchases.

- By Capacity/Volume:

- 20 Liters and Below (Minimalist/Touring): Designed for day trips where minimal gear is required, focusing entirely on weight minimization.

- 20 Liters to 40 Liters (Standard Multi-day): Versatile systems suitable for most multi-day tours and standard guiding operations.

- Above 40 Liters (Expedition/High Capacity): Specialized for lengthy expeditions or operations requiring extensive survival and technical equipment.

Value Chain Analysis For Avalanche Air Bags Market

The rigorous value chain commences with the Upstream analysis, focusing intensely on the procurement of mission-critical raw materials necessary for ensuring deployment success under extreme conditions. This involves sourcing specialized, low-temperature resistant polymer textiles for the air bags, advanced metallurgy for precise valve and cartridge components, and high-energy-density, cold-tolerant battery cells for fan systems. Suppliers must adhere to exceptionally stringent quality assurance protocols, often necessitating certification specific to aerospace or extreme sports environments. Due to the precision manufacturing required, intellectual property related to inflation dynamics and high-speed valve actuation remains a fiercely guarded component of upstream competitive advantage, contributing substantially to the final product cost structure and ensuring the system's operational integrity.

Midstream activities involve sophisticated design, integration, and assembly. Manufacturers integrate the inflation mechanism—whether it is a pyro-mechanical trigger unit or a complex battery management system and fan assembly—into a specifically designed backpack structure, ensuring proper load distribution and rapid accessibility of the trigger handle. The critical nature of the product mandates multi-stage quality control checks, including cold chamber testing and rigorous deployment simulation, often surpassing statutory minimum requirements. Operations must be highly lean and seasonal, scaling rapidly during the pre-winter production cycle. Leading companies often invest heavily in robotic assembly for uniformity and precision, differentiating themselves through proprietary backpack ergonomics that appeal to professional users requiring optimal performance during strenuous physical activity.

Downstream analysis highlights the crucial role of distribution channels in product accessibility and end-user safety. Direct channels, primarily e-commerce, allow manufacturers to manage brand perception and customer relationships while offering efficient mechanisms for warranty claims and system registration. However, Indirect channels, dominated by specialty outdoor and mountain sports retailers, are essential for initial customer engagement. These retailers provide indispensable, expert consultation on system sizing, fitting, and mandatory maintenance, significantly influencing consumer choice based on perceived reliability and ease of use in the field. Training organizations and certified guides also form an influential downstream force, often acting as key opinion leaders (KOLs) whose preferences and endorsements substantially sway market purchasing decisions within the critical professional segment, driving loyalty to brands proven under extreme conditions.

Avalanche Air Bags Market Potential Customers

The core segment of potential customers consists of recreational backcountry users who engage in activities such as ski touring, split boarding, and high-speed snowmobiling outside the boundaries of patrolled ski resorts. This demographic is characterized by a high propensity for investing in safety technology due to heightened awareness of the inherent risks associated with off-piste travel, often spurred by social media exposure and educational courses. Their purchasing motivations are centered on lightweight, aesthetically pleasing systems that seamlessly integrate with other gear and offer the convenience of rechargeable fan systems. Marketing efforts successfully target this group by emphasizing technological innovation, reduction in touring weight, and positive testimonials from adventure athletes, driving high unit volume sales primarily through online and large specialized retail outlets.

A second, highly influential segment comprises the Commercial and Professional cohort, which includes certified international mountain guides (UIAGM/IFMGA), avalanche forecasters, ski patrol staff, and specialized remote industrial workers (e.g., dam inspectors, forestry workers in high-altitude zones). These customers prioritize equipment reliability, extreme durability capable of resisting abrasive snow debris, and features that support high operational tempo, such as easy servicing and high-capacity pack volumes. Their procurement decisions are often standardized and fleet-based, driven by organizational safety mandates and contractual requirements for regulatory compliance. Manufacturers engage this segment through direct sales teams, specialized professional pricing programs, and providing robust technical support and certified training services, securing long-term, high-value contracts.

The third significant market segment includes government and institutional entities, notably national Search and Rescue (SAR) organizations, specialized military mountain units, and certain scientific expeditions. These potential customers require custom-built or highly reinforced systems that meet rigorous tactical specifications, including resilience to extreme environmental factors and seamless integration with proprietary communication and navigation hardware. Procurement processes for this segment are lengthy, governed by detailed technical specifications, competitive bidding, and mandatory compliance with government-level safety standards. Penetration into this segment relies heavily on demonstrated product superiority in stress testing, providing customized logistic support, and achieving relevant defense or public safety certifications, representing the most demanding subset of the market in terms of performance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 255.4 Million |

| Market Forecast in 2033 | USD 548.9 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABS Protection GmbH, Mammut Sports Group AG (including Snowpulse technology), Arc'teryx Equipment, Black Diamond Equipment (part of Clarus Corporation), Ortovox Sportartikel GmbH, Backcountry Access (BCA), Scott Sports SA, Deuter Sport GmbH, Pieps GmbH (part of Black Diamond Equipment), Klim (owned by Polaris Industries), Dynafit, Salewa, Head NV (Tyrolia), Thule Group, Liberty Mountain, K2 Sports, Teton Gravity Research, Voile, Transceiver Plus Systems, JetForce Technology (Cooperative technology platform). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Avalanche Air Bags Market Key Technology Landscape

The technology landscape is presently defined by intense competition and rapid innovation between the two established core inflation platforms. Compressed Air Cartridge Systems, while representing legacy technology, continue to hold market share due to their proven reliability, instantaneous deployment speed, and simplicity of design, appealing particularly to budget-sensitive users and those favoring mechanical robustness over electronic complexity. Recent advancements in this domain have centered on engineering ultralight cylinders utilizing aerospace-grade carbon fiber composites to dramatically reduce carried weight, coupled with the development of more ergonomic, easily resettable trigger mechanisms. However, the inherent limitations posed by IATA regulations concerning pressurized gas transport internationally continue to compel the industry toward alternative, more travel-friendly solutions.

The Fan-based Electric Systems, exemplified by technology platforms such as JetForce, dominate the R&D investment pipeline and are rapidly gaining market share across all end-use segments. These systems leverage advanced brushless DC motors and proprietary impeller designs to draw in ambient air, achieving full inflation volumes comparable to cartridge systems but offering the critical advantages of multiple practice deployments, simplified servicing, and unrestricted airline travel. Technological focus areas include dramatically improving the performance envelope of lithium-ion batteries in extreme cold environments to ensure consistent power output at temperatures far below zero, enhancing the electronic trigger system reliability to eliminate failure points, and integrating advanced diagnostic feedback loops that communicate system readiness status directly to the user via integrated LEDs or smartphone applications.

Future technological differentiation will be driven by the adoption of smart systems integration, moving the avalanche air bag into a comprehensive digital safety ecosystem. This includes the implementation of hybrid inflation mechanisms designed to leverage the best of both worlds, offering rapid gas ignition coupled with sustained fan pressure maintenance. Furthermore, the integration of advanced sensors and micro-processors for automatic, context-aware deployment—where the system deploys only when specific, catastrophic forces and orientations are detected—is nearing commercialization. Seamless connectivity with standard safety devices (transceivers, GPS watches) via proprietary low-power protocols is becoming standard, enabling data logging, automated rescue beacon activation, and enhanced coordination capabilities for professional teams operating in dynamic, remote environments, thereby significantly enhancing the overall effectiveness of mountain risk management strategies.

Regional Highlights

- North America: This region maintains a position of significant influence and high growth potential, propelled by the vast, accessible backcountry areas throughout the Western United States and Canada. The market here is characterized by high demand for premium, technologically advanced products, specifically the electronic fan-based systems, reflecting the high disposable income of the target demographic and a strong consumer culture valuing state-of-the-art safety gear. Strict educational mandates and high liability concerns among commercial operators ensure consistent professional adoption, while leading domestic brands leverage strong marketing through prominent outdoor media outlets and professional athlete endorsements to drive retail sales.

- Europe: Europe represents the historical nucleus of the avalanche safety market, underpinned by centuries of mountain culture and highly formalized regulatory frameworks, particularly within the Alpine nations. This region is a mature, high-volume market where replacement cycles and technological upgrades, often mandated by evolving CE standards or regional guiding association requirements, drive continuous revenue. Competition is intense, focusing heavily on brand heritage, collaboration with rescue services, and deep segmentation to cater to specific sub-markets, from casual ski tourers to high-altitude expeditionary mountaineers, ensuring high saturation but steady growth through innovation.

- Asia Pacific (APAC): Positioned as the most dynamically growing regional market, APAC's expansion is intrinsically linked to rising standards of living and aggressive investment in ski tourism infrastructure, particularly in countries like Japan, where the high snow volume (Japow) attracts international enthusiasts, and China, where domestic participation is surging. While adoption rates remain lower than in the West, the rapid growth trajectory indicates significant future potential. Challenges include managing diverse regulatory import requirements and localizing user education to ensure proper usage of complex safety equipment among newly emerging consumer bases.

- Latin America (LATAM): Market presence in LATAM is concentrated primarily in the Andean regions (Chile, Argentina), serving professional sectors such as mining, scientific research, and limited professional mountain guiding. Consumer-level recreational adoption is significantly lower due to economic barriers and less developed backcountry infrastructure. Demand focuses on robust, field-tested systems where reliability under extreme high-altitude conditions takes precedence over lightweight design or electronic complexity. Growth here is primarily driven by industrial safety mandates and governmental procurement cycles rather than general consumer purchasing.

- Middle East and Africa (MEA): MEA remains the smallest and most fragmented market, with negligible recreational demand outside of niche locations like the Atlas Mountains in Morocco. Sales are almost exclusively limited to governmental or specialized organizational purchasing, including military units and international aid organizations operating in high-mountain border zones. The market is highly opportunistic, relying on large-scale tenders for specialized, durable equipment rather than sustaining a continuous consumer retail flow.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Avalanche Air Bags Market.- ABS Protection GmbH

- Mammut Sports Group AG (including Snowpulse technology)

- Arc'teryx Equipment (owned by Amer Sports)

- Black Diamond Equipment (part of Clarus Corporation)

- Ortovox Sportartikel GmbH

- Backcountry Access (BCA)

- Scott Sports SA

- Deuter Sport GmbH

- Pieps GmbH (part of Black Diamond Equipment)

- Klim (owned by Polaris Industries)

- Dynafit

- Salewa

- Head NV (Tyrolia)

- Thule Group

- Liberty Mountain

- K2 Sports

- Teton Gravity Research (Content and Influence)

- Voile

- Transceiver Plus Systems

- JetForce Technology (Cooperative technology platform)

Frequently Asked Questions

Analyze common user questions about the Avalanche Air Bags market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism by which an avalanche air bag increases survival rates?

The primary mechanism is the utilization of the physical principle of inverse segregation, often referred to as the Brazil Nut Effect. The rapid inflation of the air bag significantly increases the victim's volume relative to the moving snow debris, causing the individual to float toward the surface of the slide, dramatically reducing the risk of fatal complete burial and subsequent asphyxiation.

What are the main differences between compressed air and fan-based avalanche systems?

Compressed air systems offer instantaneous, highly reliable deployment but are single-use per cartridge, heavier, and face significant restrictions on air travel due to IATA regulations concerning pressurized gas. Fan-based systems are lighter, rechargeable, permit multiple practice deployments, and are generally exempt from airline hazardous material restrictions, representing the current technological preference due to increased user convenience.

Are avalanche air bags a replacement for other safety gear like transceivers and probes?

Absolutely not; the avalanche air bag is designed to prevent burial, but it is not a locator device. It must be employed as a crucial component of a comprehensive safety ensemble that mandates the concurrent use of an operational avalanche transceiver, a probe pole, and a shovel (the essential safety trio) to ensure timely location and efficient extraction if a partial burial still occurs.

How often should a user service or check their avalanche air bag system?

System functionality checks are mandatory before every single backcountry excursion, including verifying battery charge levels, running electronic self-diagnostics, and inspecting the air bag material for wear. A full functional test deployment and professional inspection, including seal and cartridge verification (for gas systems), is strongly recommended annually before the start of the winter season to ensure peak operational readiness.

Which geographic regions exhibit the highest demand for professional avalanche air bags?

The highest sustained demand for professional-grade avalanche air bags is observed in the European Alpine region (Switzerland, Austria, France) and across North America (Rocky Mountains, Pacific Coast Range). This demand is driven by extensive commercial guiding operations, highly active search and rescue organizations, and stringent organizational safety mandates requiring certified, high-durability systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager