Avalanche Victim Detector Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441250 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Avalanche Victim Detector Market Size

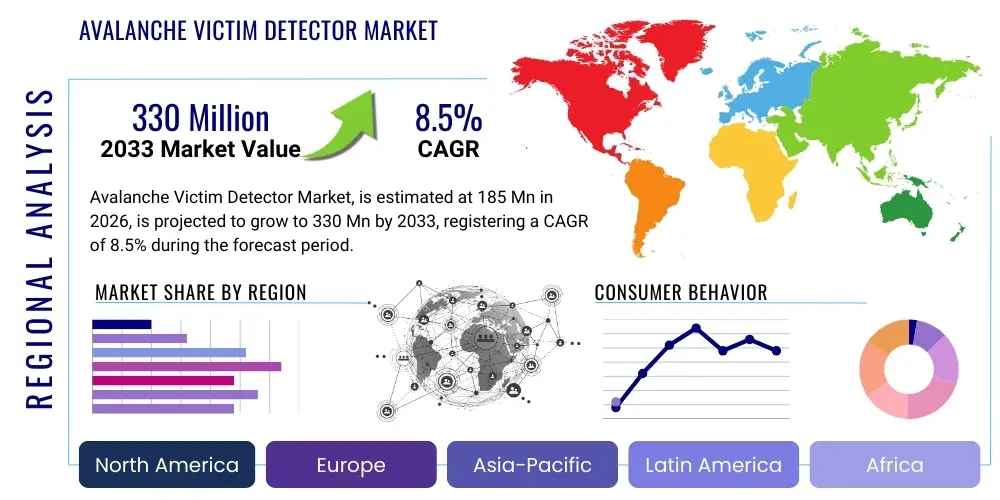

The Avalanche Victim Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $185 Million in 2026 and is projected to reach $330 Million by the end of the forecast period in 2033.

Avalanche Victim Detector Market introduction

The Avalanche Victim Detector Market encompasses essential safety equipment designed to locate individuals buried under avalanche debris. The primary product in this category is the avalanche transceiver, also known as a beacon, which operates on the standardized international frequency of 457 kHz. These devices function by transmitting a pulsed radio signal when set to transmit mode and receiving signals when switched to search mode, allowing rescuers to pinpoint the location of a buried victim. Modern detectors, predominantly digital, incorporate multiple antennas (typically three) and sophisticated microprocessors to provide visual and audible directional guidance, significantly speeding up the rescue process, which is critical given the narrow survival window in an avalanche event. The product landscape also includes supplementary tools like RECCO reflectors, which are passive transponders integrated into clothing or gear, and sophisticated probe and shovel kits used in conjunction with the transceiver signal for final pinpointing.

Major applications for avalanche victim detectors span across various high-risk snow environments, including recreational backcountry skiing, snowboarding, snowmobiling, mountaineering, and professional activities such as ski patrolling, search and rescue operations, and mountain guiding. The core benefit provided by these devices is the drastic reduction in search time, directly correlating with improved survival rates. Given that the majority of avalanche victims do not survive more than 30 minutes under the snow due to asphyxia or trauma, rapid location is paramount. Effective utilization of these detectors requires specialized training, making user education a crucial component of market development. The increasing popularity of off-piste and sidecountry skiing, driven by advancements in gear technology making access easier, is a primary factor fueling market demand.

Driving factors for sustained market growth include stringent safety regulations imposed in major ski regions globally, mandatory equipment requirements for guided tours in high-risk zones, and heightened consumer awareness regarding mountain safety, often fueled by educational initiatives from organizations like avalanche centers and industry associations. Furthermore, continuous technological innovation aimed at enhancing search effectiveness, improving battery life, and integrating GPS capabilities into high-end detectors are maintaining momentum. However, market penetration is often constrained by the high initial cost of quality equipment and the lack of comprehensive mandatory usage laws outside of strictly regulated professional environments. Despite these challenges, the fundamental necessity of these life-saving tools ensures steady expansion in regions characterized by significant snowfall and active winter tourism.

Avalanche Victim Detector Market Executive Summary

The global Avalanche Victim Detector Market is characterized by a mature regulatory environment in key geographical zones, driving steady technological progression and adoption. Current business trends indicate a strong shift toward digital, multi-antenna transceivers (3-antenna systems) offering superior accuracy and range compared to older analog models. Manufacturers are heavily investing in user interface simplification and advanced signal processing algorithms to enhance effectiveness, particularly in challenging scenarios involving multiple burials or deep burials. A notable business trend is the increasing collaboration between equipment manufacturers and educational safety providers, aiming to incorporate device training into certified avalanche safety courses (e.g., AIARE or regional equivalents), thereby boosting replacement cycles and new user adoption. Furthermore, the convergence of consumer electronics expertise with specialized rescue technology is leading to detectors with integrated Bluetooth connectivity for firmware updates and personalized settings management, appealing to tech-savvy younger demographics entering the backcountry scene.

Regionally, Europe, particularly the Alpine nations, commands the largest market share due to long-standing cultural engagement with mountain sports, high population density near major ski resorts, and strict national safety policies mandating specific gear in designated areas. North America follows closely, demonstrating rapid growth fueled by the expansion of resort boundaries into sidecountry terrain and exponential increases in snowmobile and splitboarding usage in remote areas. Asia Pacific, while currently smaller, is emerging as a critical growth region, driven primarily by investments in world-class ski infrastructure in countries like Japan and China, coupled with rising disposable incomes supporting specialized outdoor gear purchases. The demand dynamics across these regions are primarily sensitive to winter precipitation patterns, global climate variability affecting snow stability, and corresponding public perception of avalanche risk.

Segment trends reveal that the professional segment (ski patrols, military, SAR teams) demands premium, robust devices with maximum range and specialized functions like marking capabilities, justifying higher price points. Conversely, the recreational segment prioritizes ease of use, intuitive displays, and balanced features at a moderate price. The technology segment is strongly favoring digital transceivers, nearly phasing out analog-only units due to inherent limitations in directing search efforts. Moreover, passive detection technologies like RECCO continue to experience growth, not as primary detectors, but as supplementary safety nets embedded across a wider range of outdoor apparel and equipment, creating a duality in the safety gear ecosystem where active transceivers are mandatory and passive reflectors offer redundancy, influencing purchasing patterns across all end-user categories.

AI Impact Analysis on Avalanche Victim Detector Market

Common user questions regarding AI integration often revolve around whether artificial intelligence can automate the search process entirely, reduce the dependency on human expertise, or provide real-time predictive avalanche risk assessments directly through the detector. Users are concerned about the reliability of AI-driven tools in harsh, chaotic environments and whether these complex systems introduce points of failure. The fundamental expectation is that AI should enhance the speed and accuracy of traditional search techniques, especially in complex multiple burial scenarios where signal overlap often confuses human operators. Users anticipate AI algorithms could filter out noise, optimize search patterns, and perhaps integrate with drone or remote sensing technologies to cover vast areas more efficiently than current methods allow.

AI is poised to revolutionize the avalanche detection and rescue ecosystem primarily through advanced data processing and predictive analytics, moving beyond simple signal interpretation. In the near term, AI is being integrated into detector firmware to run sophisticated algorithms capable of distinguishing primary signals from signal artifacts or noise, significantly improving accuracy in scenarios with high electromagnetic interference or closely spaced multiple buried victims. Furthermore, machine learning models, trained on extensive datasets of past avalanche events, terrain features, and weather patterns, can contribute to superior risk assessment tools used by professionals. These AI-enhanced risk models, while not currently integrated directly into handheld detectors for public use, influence the operational decisions of patrol teams, potentially leading to earlier closure of dangerous slopes.

Looking ahead, the most transformative impact of AI will likely involve optimizing the search process post-avalanche. AI could power autonomous or semi-autonomous search drones equipped with specialized sensors (e.g., ground-penetrating radar integrated with transceiver signal detection). These drones could use AI to dynamically adjust flight paths based on real-time signal strength and terrain mapping, maximizing search coverage and minimizing time. For conventional handheld detectors, AI could analyze the user’s movement and the signal output to suggest optimal search corridors, effectively compensating for human error or fatigue during prolonged rescue operations. This transition enhances the 'smart' capabilities of the hardware, ensuring the device provides actionable, data-driven instructions, thus augmenting, rather than replacing, the rescuer's capabilities.

- AI algorithms enhance signal processing to isolate and identify distinct transceiver signals in multiple burial situations.

- Machine learning models aid in predictive risk analysis by processing meteorological, topographical, and snowpack data for professional safety teams.

- Integration of AI with drone technology enables autonomous or optimized aerial search patterns over large, difficult-to-access avalanche zones.

- AI-driven firmware updates allow detectors to dynamically adjust search parameters based on ambient noise and signal complexity, improving pinpoint accuracy.

- Predictive analytics can inform detector manufacturers on potential mechanical or battery failures, leading to safer device design and maintenance protocols.

DRO & Impact Forces Of Avalanche Victim Detector Market

The Avalanche Victim Detector Market is fundamentally driven by the escalating engagement in backcountry winter sports, particularly skiing and snowboarding outside controlled resort boundaries, a trend amplified by improving gear and easier accessibility to remote terrain. Concurrently, strict adherence to safety protocols mandated by organized guiding services and professional mountain operations necessitates the adoption of certified detection equipment, establishing a mandatory baseline demand. Counterbalancing these drivers are significant restraints, primarily the high cost associated with advanced digital three-antenna transceivers and the requirement for continuous, specialized training to ensure effective use. A device is only as effective as the user's proficiency, and poor technique can nullify the benefit, leading to reluctance in investment by occasional users. Opportunities for growth lie in the integration of these devices into the broader Internet of Things (IoT) ecosystem, enabling features such as geo-location data sharing among rescue teams and automated system checks via smartphone applications.

The structural dynamics of the market are influenced by key impact forces derived from technology evolution, regulatory scrutiny, and environmental factors. Technological obsolescence is a constant pressure, as older analog and basic two-antenna digital units are continuously replaced by high-performance three-antenna models that offer critical features like marking functions and better directional guidance. This rapid cycle of innovation forces consumers to upgrade, sustaining market vitality. Regulatory forces, particularly the enforcement of mandatory transceiver use in European Union avalanche risk areas and certain US National Forest zones, create non-negotiable demand floors. Furthermore, climate change, leading to more erratic and potentially more unstable snowpacks, paradoxically increases the perceived risk associated with winter sports, thereby reinforcing the imperative for reliable safety gear.

A crucial restraint impacting market penetration in developing regions is the general lack of formalized avalanche education infrastructure and the high dependence on imported, premium-priced Western equipment, making these life-saving tools inaccessible to local enthusiasts or small guiding operations. This creates a significant disparity in safety standards globally. However, the opportunity presented by emerging markets, such as the rapidly expanding winter sports economies in Asia (e.g., South Korea, China), coupled with the potential for governments to subsidize safety training and equipment, offers substantial long-term growth prospects. Manufacturers are strategically addressing the cost restraint by developing robust entry-level digital models that maintain core safety functions while reducing reliance on premium features, aiming to broaden the consumer base and maximize the overall volume of equipped individuals in high-risk zones.

Segmentation Analysis

The Avalanche Victim Detector Market is comprehensively segmented across technology, application (end-user), and distribution channel, reflecting the diverse needs of both recreational enthusiasts and professional rescue organizations. Technology segmentation remains pivotal, distinguishing between outdated analog transceivers and the currently dominant digital multi-antenna systems, which have set the industry standard for efficiency and ease of use in search operations. The application segments clearly delineate requirements, with professionals demanding maximum durability, complex features like marking multiple victims, and extended battery life, contrasting with recreational users who prioritize simplicity and affordability. Understanding these segmentation nuances is crucial for manufacturers, as product development strategies must cater specifically to the distinct performance expectations and price sensitivities inherent in each segment.

- By Technology:

- Analog Transceivers

- Digital Transceivers (Two-Antenna)

- Digital Transceivers (Three-Antenna)

- Passive Reflectors (e.g., RECCO)

- By End-User Application:

- Recreational Backcountry Users

- Professional Rescue and Safety Teams (Ski Patrol, Mountain Guides, Military)

- Educational and Rental Services

- By Distribution Channel:

- Offline Retail (Specialty Outdoor Stores, Chain Stores)

- Online Retail (E-commerce Platforms, Brand Websites)

- Rental Services and Institutional Sales

Value Chain Analysis For Avalanche Victim Detector Market

The value chain for the Avalanche Victim Detector Market begins with highly specialized upstream activities centered around the sourcing of miniaturized electronic components, sophisticated microprocessors, and specialized antennas designed for high reliability in extreme cold environments. Manufacturing involves precision engineering to ensure devices meet rigorous electromagnetic compatibility standards and waterproof durability requirements. Due to the life-saving nature of the equipment, quality control and testing—including extensive field tests and regulatory certifications (e.g., CE, FCC)—are integrated deeply into the manufacturing phase, often requiring significant capital investment in highly automated assembly lines that maintain consistency and resilience across production batches. This complexity in both component sourcing and assembly limits the number of manufacturers capable of producing certified, reliable devices, maintaining a concentrated upstream market structure dominated by a few specialized electronic component suppliers.

Midstream activities involve sophisticated branding, marketing, and the crucial element of user education. Marketing must emphasize reliability and the life-saving potential, often utilizing endorsements from professional athletes and mountain rescue teams to build trust. Distribution channels are highly specialized. Direct channels often involve institutional sales to professional organizations (ski resorts, military units) where volume procurement and specific technical support agreements are central. Indirect channels predominantly rely on specialized outdoor retailers who offer expert advice, fitting, and often incorporate the sale of transceivers with mandatory user training or package deals including probes and shovels, leveraging their position as authorities in mountain safety equipment. This expertise-driven retail environment ensures that consumers receive appropriate guidance on usage and maintenance.

Downstream activities focus heavily on after-sales support, servicing, and mandatory firmware updates. Since avalanche transceivers are safety-critical devices, periodic checks and updates are essential to maintain performance standards. The longevity of the product, although robust, is often limited by technological advancements; hence, manufacturers and distributors manage the end-of-life cycle by promoting educational trade-in programs or incentivizing upgrades to newer, more compliant technology. Furthermore, the downstream interaction involves educational bodies that integrate the correct use of these detectors into their curriculum. This symbiotic relationship between the sales infrastructure and the safety training ecosystem reinforces market demand and ensures that the deployed technology is utilized proficiently, maximizing the overall public safety benefit derived from the equipment.

Avalanche Victim Detector Market Potential Customers

The end-user base for avalanche victim detectors is diverse but centrally characterized by individuals and organizations operating in environments where the risk of avalanche entanglement is significant. The largest consumer segment consists of recreational backcountry enthusiasts, including skiers, snowboarders, and snowmobilers who venture beyond the patrolled boundaries of ski resorts. This segment is driven by a desire for self-sufficiency and compliance with informal community safety standards, often purchasing mid-range, intuitive digital devices that offer a favorable balance of price and performance. Their purchasing decisions are highly influenced by perceived risk, peer recommendations, and the mandates set forth by guiding services they employ, making them sensitive to both price and the ease of integration with other specialized outdoor gear.

The professional sector constitutes the second major segment and demands the highest quality, most reliable equipment, often purchasing in bulk. This includes official ski patrol units responsible for slope safety and rescue within resort boundaries, professional mountain guides who lead commercial tours, and specialized search and rescue (SAR) organizations, including military units operating in mountainous terrain. For these institutional buyers, total cost of ownership, including ruggedness, reliable marking features for multiple burials, extensive range, and consistent regulatory compliance, overrides initial purchase price concerns. Procurement often involves tenders and long-term service contracts directly negotiated with manufacturers or institutional distributors, emphasizing durability and specialized maintenance services.

A rapidly growing segment of potential customers comprises institutional buyers managing rental fleets, specifically ski resorts and specialized outdoor gear rental shops located near mountain access points. These customers require robust, simple-to-use detectors that can withstand frequent handling and diverse user skill levels, offering devices primarily for individuals taking certified courses or those taking one-off guided tours. Additionally, academic and non-profit avalanche safety education providers represent a niche but important customer group, purchasing equipment for training purposes, often seeking bulk discounts for educational packs. These various customer types underscore the market's stability, as demand is anchored in both mandatory professional requirements and voluntary recreational safety adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million |

| Market Forecast in 2033 | $330 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mammut Sports Group AG, Black Diamond Equipment, Ortovox Sportartikel GmbH, ARVA Equipment, BCA (Backcountry Access), Pieps GmbH, Kohla Sport, TrekSta, Skitrab, K2 Sports, Liberty Mountain, Mountain Safety Research (MSR), Grivel, Edelrid, Petzl, Backcountry Access (BCA), G3 (Genuine Guide Gear), Rocky Mountain Underground (RMU), Scott Sports, ABS Avalanche Airbag Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Avalanche Victim Detector Market Key Technology Landscape

The technological landscape of the Avalanche Victim Detector Market is predominantly defined by the transition from older analog signal processing to highly advanced digital multi-antenna systems, which forms the current foundation of industry best practices. Digital transceivers utilize microprocessors to interpret the magnetic flux lines emitted by a buried transmitting beacon, converting complex analog signals into simplified, directional visual and audible cues for the rescuer. The critical innovation has been the adoption of three-antenna systems (X, Y, and Z axes), which allow for extremely precise distance and direction readings, crucial during the final pinpointing phase. This three-axis capability dramatically reduces the "spiking" effect common in older two-antenna models, providing a smooth, continuous trajectory toward the signal source, thereby enhancing the speed and effectiveness of the search, especially in deep burial situations or complex snow conditions that scatter the signal.

Further technological advancements focus on connectivity and interoperability. Many modern high-end detectors now incorporate Bluetooth Low Energy (BLE) technology, primarily for simplified configuration, software updates, and battery management when paired with a smartphone application. This facilitates easy maintenance and ensures that devices are running the latest firmware, which often includes updated search algorithms or bug fixes, directly addressing a key safety concern regarding device obsolescence. Another significant technology area is the integration of advanced features such as group check modes, which allow professional teams to quickly verify that all members’ transceivers are transmitting correctly before entering the field. Furthermore, advanced digital filtering techniques are continuously being developed to address interference from cell phones, power lines, and other electronic devices, ensuring signal integrity during a critical rescue operation.

The concept of "Smart Detectors" is emerging, where device capabilities extend beyond simple signal detection. This involves incorporating motion sensors and tilt sensors to identify whether a rescuer is actively searching or stationary, which can be critical for optimizing battery life or initiating emergency protocols. While full GPS integration for tracking purposes is limited by regulatory concerns (as the primary function must remain the standardized 457 kHz transmission), manufacturers are exploring complementary geo-referencing through linked smartphone devices. Additionally, passive detection, primarily through the established RECCO system, continues to be technologically refined. Although RECCO requires specialized active search radar used by professional teams, the technology's widespread integration into apparel acts as a crucial safety layer, complementing the active transceiver market and ensuring that victims without a transmitting beacon still have a chance of being located by equipped professional teams.

Regional Highlights

- Europe (The Alpine Region): Europe, particularly the expansive Alpine ranges spanning France, Switzerland, Austria, Italy, and Germany, represents the largest and most established market for Avalanche Victim Detectors. This dominance is driven by a deep-rooted culture of mountain sports and highly stringent regulatory frameworks. Mandatory safety equipment policies are common in many European ski resorts and national parks, often requiring transceivers, probes, and shovels for access to specific off-piste areas. The market here is characterized by high penetration rates and a preference for premium, technologically advanced three-antenna digital devices, often procured from European heritage brands. Furthermore, the extensive network of organized mountain rescue services (e.g., Swiss Air-Rescue Rega, regional ski patrols) necessitates continuous procurement of the latest, most reliable professional-grade equipment, cementing Europe's leadership in both technological demand and market volume. Educational infrastructure, such as national avalanche warning services, is also highly developed, promoting responsible adoption and ensuring high replacement rates for older technology.

- North America (The Rocky Mountains and Pacific Coast Ranges): North America is the second-largest market and is characterized by rapid growth, largely stemming from the expanding popularity of unguided backcountry access, catalyzed by lightweight, high-performance gear suitable for touring. The Rocky Mountains (Colorado, Utah) and the Pacific Northwest (Washington, British Columbia) are key hubs, driving demand among recreationalists. While regulatory mandates are generally less strict than in Europe, strong advocacy from avalanche centers (e.g., AIARE, Avalanche Canada) and peer pressure within the backcountry community ensure high voluntary adoption. The market trend focuses on balancing high performance with user-friendliness, catering to a user base that may receive less formal, continuous training than their European counterparts. Growth is also significantly influenced by the rapid increase in specialized guided touring operations and the professionalization of US and Canadian ski patrol teams who adhere strictly to global safety standards.

- Asia Pacific (APAC): The APAC market, while smaller, is experiencing the fastest growth rate, fueled primarily by emerging winter sports destinations, notably Japan, China, and South Korea. Japan's Hokkaido region, famous for deep powder, sees high demand from international ski tourists who bring established safety expectations, driving demand for rental services and local sales. China represents a significant long-term opportunity, driven by government investment in winter infrastructure and rising middle-class interest in recreational sports following major international events. However, market development in APAC faces challenges related to the nascent stage of formal avalanche education and the need to adapt marketing and distribution strategies to local retail preferences. The initial demand often focuses on foundational, reliable digital equipment, with a high volume of institutional purchases expected as government and private resort safety programs mature.

- Latin America, Middle East, and Africa (LAMEA): This region constitutes a relatively small but important niche market, concentrated in specific high-altitude zones. In Latin America, the Andes mountain range (Chile and Argentina) supports seasonal ski industries and mountaineering, creating periodic demand for professional and recreational detectors, heavily influenced by Northern Hemisphere seasonal trends. The Middle East and Africa have minimal requirements for detectors, limited primarily to high-altitude military or specialized scientific expeditions. Market penetration is low, relying mostly on imported high-end equipment through specialized expedition outfitters. Future growth here is closely tied to investment in infrastructure and the development of sustainable, accessible winter tourism, which remains geographically limited.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Avalanche Victim Detector Market.- Mammut Sports Group AG

- Black Diamond Equipment

- Ortovox Sportartikel GmbH

- ARVA Equipment

- BCA (Backcountry Access)

- Pieps GmbH (Subsidiary of Black Diamond Equipment)

- Kohla Sport

- TrekSta

- Skitrab

- K2 Sports

- Liberty Mountain

- Mountain Safety Research (MSR)

- Grivel

- Edelrid

- Petzl

- G3 (Genuine Guide Gear)

- Scott Sports

- ABS Avalanche Airbag Systems

- Voile Manufacturing

- Dynafit

Frequently Asked Questions

Analyze common user questions about the Avalanche Victim Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor influencing the effectiveness of an avalanche victim detector?

The most critical factor is user proficiency, specifically the training level of the rescuer. Even the most advanced detector requires rapid, accurate search execution and practiced technique to maximize the chance of survival for the buried victim within the narrow critical time window of 15 to 30 minutes.

Should I purchase an analog or a digital avalanche transceiver in the current market?

It is strongly recommended to purchase a modern digital three-antenna transceiver. Digital units offer superior processing, visual directional guidance, and automated functions that drastically simplify the search process compared to older analog models, which require expert interpretation of audio signals.

How often should avalanche detectors be replaced or serviced?

While detectors do not have a fixed lifespan, they should be serviced or checked professionally every few years, especially if used frequently or stored improperly. Replacement is recommended every five to ten years due to rapid technological advancements (e.g., transition from two-antenna to three-antenna systems) that significantly enhance rescue speed and reliability.

What is the difference between an avalanche transceiver and a RECCO reflector?

An avalanche transceiver is an active battery-powered device that both transmits and receives on the 457 kHz frequency, allowing companions to conduct a rapid rescue. A RECCO reflector is a passive transponder integrated into gear, requiring a specialized RECCO search radar unit utilized exclusively by professional rescue teams, acting as a valuable secondary safety measure.

Is artificial intelligence currently being used in avalanche victim detectors?

Yes, AI and advanced algorithms are increasingly utilized in the latest digital detector firmware, primarily to enhance signal processing, filter out electronic interference, and optimize complex search patterns, particularly in challenging multi-burial scenarios, thereby improving overall accuracy and search efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager