Aviation Warning Lights Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442769 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Aviation Warning Lights Market Size

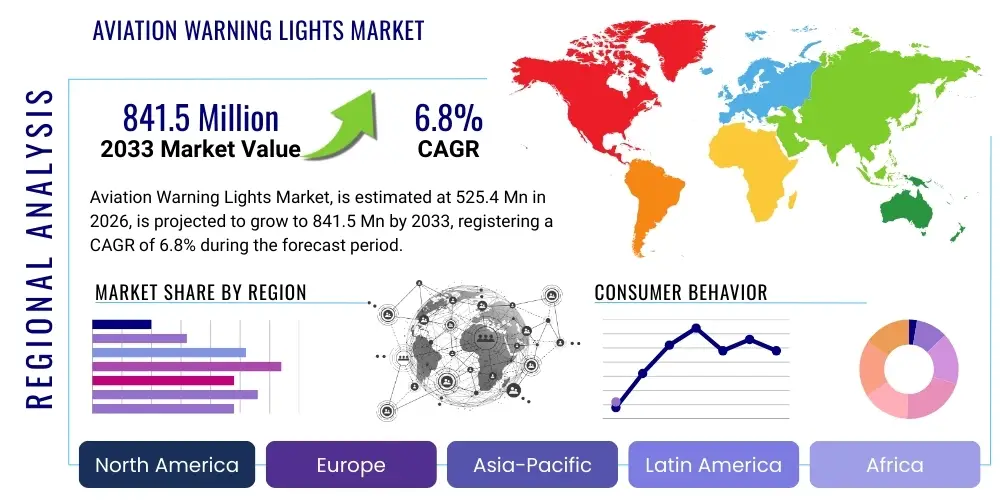

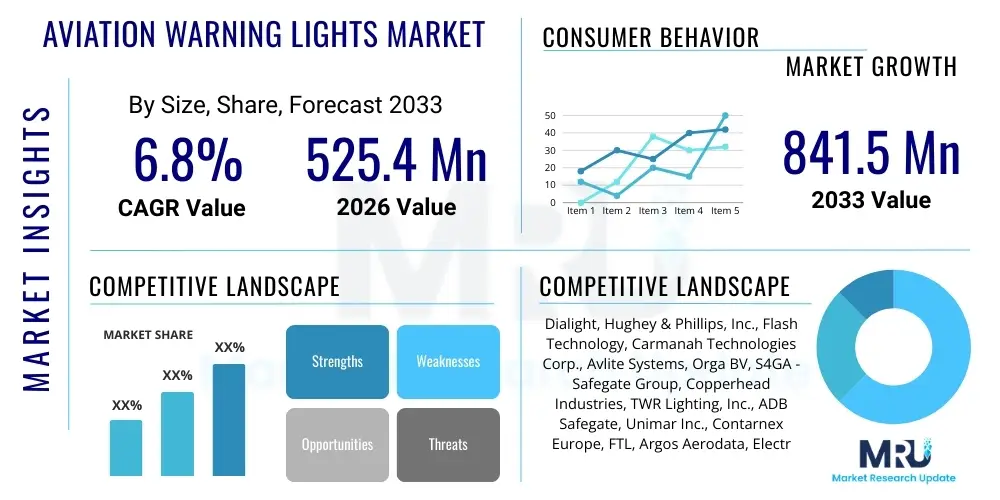

The Aviation Warning Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 525.4 Million in 2026 and is projected to reach USD 841.5 Million by the end of the forecast period in 2033.

The consistent growth trajectory of the Aviation Warning Lights (AWL) market is intrinsically linked to global regulatory mandates requiring the marking of tall structures and potential aerial hazards. This includes telecommunication towers, skyscrapers, wind turbines, bridges, and industrial chimneys. The increasing focus on aviation safety, coupled with stringent enforcement by international bodies such as the International Civil Aviation Organization (ICAO) and national authorities like the Federal Aviation Administration (FAA), ensures sustained demand for compliant obstruction lighting systems. Furthermore, the rapid global expansion of urban infrastructure and large-scale renewable energy projects, particularly extensive wind farms, necessitate continuous installation and upgrade cycles for these critical safety systems, contributing significantly to market value appreciation.

Technological transformation within the market, specifically the wholesale shift from traditional incandescent and Xenon flash systems to highly efficient Light Emitting Diode (LED) technology, is a primary driver of revenue growth. LED-based systems offer substantial advantages, including drastically reduced energy consumption, extended operational lifecycles, and minimized maintenance requirements, which translate to lower total cost of ownership (TCO) for end-users. The continuous evolution of these LED systems, incorporating features like remote monitoring capabilities, GPS synchronization, and adaptive intensity controls (often referred to as 'Smart Lighting'), commands premium pricing and accelerates the replacement market, further solidifying the projected market valuation for 2033.

Aviation Warning Lights Market introduction

The Aviation Warning Lights Market encompasses the design, manufacturing, installation, and servicing of specialized illumination systems mandated for marking obstacles that pose a hazard to air navigation. These systems, critical for ensuring aviation safety, include high-intensity, medium-intensity, and low-intensity lights, primarily utilized on communication towers, high-rise buildings, power transmission lines, and major construction projects. The core product categories are defined by intensity levels and flash patterns dictated by regulatory bodies such as ICAO (Annex 14) and FAA (AC 70/7460). Major applications span civil aviation infrastructure, military installations, telecommunications, and the burgeoning renewable energy sector, especially wind power generation. Key benefits include hazard mitigation, regulatory compliance assurance, reduced risk of aircraft collisions, and improved visibility during adverse weather conditions. The market growth is fundamentally driven by global infrastructure development, stricter regulatory enforcement regarding obstruction marking, and ongoing technological adoption of energy-efficient LED and intelligent monitoring systems.

Aviation Warning Lights Market Executive Summary

The Aviation Warning Lights Market exhibits robust business trends characterized by the consolidation of advanced LED technologies and the widespread integration of remote monitoring capabilities, transitioning the industry toward smart, connected obstruction lighting. Segment trends indicate the medium-intensity lighting category, particularly utilized in wind farms and mid-level structures, experiencing the fastest growth due to the global push for renewable energy. Technologically, the shift toward infrared (IR) and GPS-synchronized flashing for enhanced visibility and coordination is prominent. Regionally, the Asia Pacific (APAC) market is poised for exceptional expansion, fueled by massive infrastructural investments in countries like China and India, rapid urbanization, and significant airport modernization programs. North America and Europe maintain dominance in terms of adopting cutting-edge compliance technologies and sophisticated monitoring software, while regulatory harmonization, specifically related to drone operation safety zones, presents emerging opportunities across all major geographic regions.

AI Impact Analysis on Aviation Warning Lights Market

User inquiries regarding AI's impact on Aviation Warning Lights primarily revolve around predictive maintenance capabilities, autonomous compliance verification, and integrating lighting systems with broader Air Traffic Management (ATM) frameworks. Users are keenly interested in how machine learning algorithms can analyze performance data (such as ambient light, system health, and weather patterns) to forecast potential component failures before they occur, thus moving from scheduled maintenance to predictive maintenance models. Concerns also center on the role of AI in dynamically adjusting light intensity based on real-time flight paths or drone activity (Dynamic Obstruction Lighting), and whether AI-driven systems can automatically generate compliance reports for regulatory bodies, minimizing human intervention and audit risks. The core expectation is that AI will enhance system reliability, reduce operational costs, and enable higher levels of dynamic adaptation for enhanced aviation safety.

- AI-driven predictive maintenance modeling reduces system downtime by analyzing sensor data to anticipate component failures in LED arrays and power supplies.

- Integration of machine learning for optimized intensity control, dynamically adjusting light output based on real-time visibility conditions and air traffic patterns (Dynamic Obstruction Lighting).

- Autonomous compliance reporting mechanisms utilizing AI to verify operational status, flash patterns, and synchronization against ICAO/FAA standards automatically.

- Enhanced remote diagnostics and fault isolation through neural networks that quickly identify the precise location and nature of system malfunctions across geographically dispersed assets (e.g., wind farms).

- Integration of AWL data into Unmanned Traffic Management (UTM) and ATM systems to provide real-time obstruction hazard mapping for autonomous aircraft and drones.

- AI-powered visual anomaly detection systems utilizing cameras integrated within the lighting apparatus to monitor for external damage or environmental obstructions (e.g., ice accumulation).

DRO & Impact Forces Of Aviation Warning Lights Market

The Aviation Warning Lights market is significantly driven by mandatory regulatory compliance and the global proliferation of tall structures, including telecommunications infrastructure, high-rise urban development, and expansive renewable energy projects, particularly wind farms that require extensive marking. However, market expansion is restrained by the high initial capital expenditure associated with installing complex, intelligent lighting systems, and challenges related to power infrastructure and reliable connectivity in remote locations. Significant opportunities arise from the increasing adoption of solar-powered and GPS-synchronized LED systems, alongside the specialized demand driven by the emerging urban air mobility (UAM) and drone industries which require lower-altitude, smaller-scale obstruction markers. The market is subject to intense impact forces from stringent ICAO/FAA regulations (compelling force), rapid technological obsolescence of legacy systems (pull factor), volatility in raw material pricing for LED components (restraining factor), and the highly competitive nature of specialized component manufacturing.

One major driver remains the necessity of regulatory adherence. Aviation authorities worldwide mandate that any structure exceeding a specified height threshold must be marked with appropriate lighting systems to ensure visibility from the air, minimizing the risk of collision. Non-compliance results in severe financial penalties and operational restrictions, making the procurement of certified AWL systems a non-negotiable requirement for construction and infrastructure operators. This continuous regulatory pressure provides a resilient foundation for consistent market demand, irrespective of short-term economic fluctuations in the construction sector.

Conversely, complexity in standard harmonization poses a notable restraint. Although ICAO provides global guidelines, individual national aviation authorities (NAAs) often implement localized variations or additional requirements regarding light intensity, color, and flash rates, which complicate the supply chain and manufacturing processes for global vendors. Furthermore, the integration of new smart features, such as remote diagnostics and dimming capabilities, requires specialized technical expertise for installation and maintenance, often increasing labor costs and limiting the pool of qualified service providers, thereby slowing adoption in less developed regions.

The most compelling opportunity lies in the expanding niche market of specialized marking requirements for emerging technologies. The rapid deployment of drone delivery networks and the eventual launch of UAM services require extensive low-altitude demarcation of obstacles, helipads, and restricted airspace zones. Developing AWL systems that are smaller, lighter, compliant with UAM specific regulations, and capable of seamless integration with drone traffic management systems represents a high-growth pathway for manufacturers focusing on innovation.

Segmentation Analysis

The Aviation Warning Lights Market is segmented based on product type (defining intensity levels), technology used (LED, Xenon, Incandescent), power source (AC-powered, DC-powered, Solar-powered), and application (structures marked). Product intensity segmentation is the most crucial, as it directly correlates with the height of the structure and the required visibility range, thus influencing pricing and deployment complexity. The dominance of LED technology across all product types reflects the industry's commitment to energy efficiency and extended system longevity. Application segmentation highlights the increasing demand from renewable energy sectors and telecommunications, while the growing adoption of solar-powered systems addresses the critical need for reliable lighting in remote, off-grid installations.

- By Product Type:

- High-Intensity Aviation Warning Lights (Type A, Type B)

- Medium-Intensity Aviation Warning Lights (Type A, Type B, Type C)

- Low-Intensity Aviation Warning Lights (Type A, Type B, Type C)

- By Technology:

- LED (Light Emitting Diode)

- Xenon Flash

- Incandescent (Declining Segment)

- By Power Source:

- AC-Powered Systems

- DC-Powered Systems

- Solar-Powered Systems

- By Application/End-User Structure:

- Telecommunication Towers and Masts

- Wind Turbines/Wind Farms

- High-Rise Buildings and Bridges

- Chimneys and Industrial Stacks

- Power Transmission Lines

- Airport Infrastructure (Runway Approaches, Perimeter)

- By Intensity Regulation:

- FAA Compliant Systems

- ICAO Compliant Systems

- Custom Regional Compliance Systems

Value Chain Analysis For Aviation Warning Lights Market

The value chain for the Aviation Warning Lights Market commences with upstream activities involving raw material procurement, focusing heavily on specialized components such as high-output LEDs, durable UV-resistant polycarbonate lenses, specialized optics, microprocessors for control circuits, and robust casing materials like marine-grade aluminum. Key upstream suppliers include LED manufacturers (e.g., Cree, Osram) and specialized electronics producers. The manufacturing stage involves assembling these components into certified lighting units, integrating proprietary control software, and rigorous testing for environmental resilience and photometric compliance (ensuring proper intensity and color). This phase is highly specialized and subject to strict quality control to meet aviation safety standards.

Midstream activities involve distribution, where the supply chain diverges. Direct sales channels are frequently employed for large, specialized governmental contracts (e.g., military, large airport projects) or major industrial clients (large wind farm developers). This approach allows manufacturers to provide direct engineering consultation and custom solution integration. Indirect distribution, however, relies heavily on specialized aviation and electrical distributors, system integrators, and value-added resellers (VARs) who handle inventory, regional compliance adjustments, and provide local installation support for smaller projects and general construction sectors. These distributors often maintain stock of medium and low-intensity lights.

The downstream segment centers on installation, commissioning, maintenance, and certification. Due to the high-stakes nature of aviation safety, installation must be performed by certified professionals, often requiring specialized access equipment for tall structures. Maintenance contracts, particularly predictive and routine checks, constitute a crucial recurring revenue stream. The final end-users are primarily asset owners—telecom companies, renewable energy developers, property management firms, and governmental infrastructure agencies—who purchase the systems primarily to satisfy regulatory obligations and ensure operational continuity.

Aviation Warning Lights Market Potential Customers

Potential customers for Aviation Warning Lights are predominantly asset owners and operators whose infrastructure penetrates regulated airspace, requiring mandatory marking to prevent aviation hazards. The largest segments include telecommunications companies investing heavily in 5G network expansion, necessitating thousands of new towers requiring medium-intensity lighting, and the burgeoning renewable energy sector, where major wind farm developers procure thousands of units for turbine marking. Additionally, governmental bodies overseeing infrastructure development, military installations requiring secure air navigation aids, and major construction firms building skyscrapers or bridges represent significant, high-value end-users. The continuous cycle of infrastructure maintenance and regulatory updates ensures that both new installations and replacement/upgrade contracts form the basis of the customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 525.4 Million |

| Market Forecast in 2033 | USD 841.5 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dialight, Hughey & Phillips, Inc., Flash Technology, Carmanah Technologies Corp., Avlite Systems, Orga BV, S4GA - Safegate Group, Copperhead Industries, TWR Lighting, Inc., ADB Safegate, Unimar Inc., Contarnex Europe, FTL, Argos Aerodata, Electrocube |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aviation Warning Lights Market Key Technology Landscape

The technology landscape of the Aviation Warning Lights Market is undergoing a rapid evolution, primarily driven by the migration to solid-state lighting. Light Emitting Diode (LED) technology dominates new installations due to its exceptional energy efficiency, superior durability, and significantly extended service life compared to older incandescent or Xenon systems. Modern LED obstruction lights often incorporate sophisticated optics to ensure precise beam focus and light distribution required by ICAO and FAA standards, maximizing visibility while minimizing light pollution. Furthermore, the integration of specialized microprocessors enables precise flash rate control and automated self-diagnostics, allowing systems to report operational status and potential faults remotely, adhering to increasingly stringent compliance monitoring requirements.

A critical technological advancement is the widespread adoption of GPS synchronization (sometimes referred to as Synched Flash Technology). This technology uses integrated GPS receivers to ensure that multiple warning lights across a large geographic area (such as a sprawling wind farm or a line of transmission towers) flash simultaneously, thereby enhancing pilot perception of the hazard perimeter and overall safety. This synchronized operation is mandated in many jurisdictions for specific types of high- and medium-intensity lighting installations. Concurrently, the rise of remote monitoring systems utilizing Cellular, Satellite, or IoT connectivity allows maintenance teams to access real-time system health reports, diagnostic data, and performance logs from a central location, drastically reducing the need for costly and time-consuming site visits, especially in remote or difficult-to-access locations.

Emerging technology focuses on adaptive and intelligent lighting solutions. Dynamic Obstruction Lighting (DOL) systems are being developed that utilize radar or advanced sensors to monitor the presence and proximity of aircraft or drones. These intelligent systems can adjust the light intensity automatically—dimming or switching off the lights when no aircraft are detected in the vicinity—to reduce light pollution and energy consumption while maintaining full compliance and safety when needed. Furthermore, the inclusion of infrared (IR) lighting components is becoming standard, ensuring visibility for pilots utilizing night vision goggles (NVGs), particularly relevant for military operations and specialized helicopter emergency services (HEMS), marking a clear technological pathway toward enhanced operational security across various aerial mission profiles.

Regional Highlights

- North America (NA): Dominates the market value due to stringent FAA regulations, high maturity in adopting GPS-synchronized LED technology, and extensive existing infrastructure (telecom towers, skyscrapers). The region is a pioneer in implementing advanced remote monitoring and control systems and leads innovation in integrating AWL data into NextGen air traffic management systems.

- Europe: Characterized by high environmental sensitivity, leading to rapid uptake of low-power, energy-efficient LED systems. Strong market performance driven by massive offshore and onshore wind farm developments, where ICAO and national CAAs strictly enforce obstruction lighting mandates, particularly favoring medium-intensity Type C lights.

- Asia Pacific (APAC): Exhibits the highest growth potential, fueled by unprecedented rates of urbanization, infrastructure modernization (e.g., airport expansion in China, India, and Southeast Asia), and rapid deployment of telecom and power infrastructure across emerging economies. Regulatory enforcement is strengthening, leading to mandatory upgrades of older, non-compliant systems.

- Middle East and Africa (MEA): Growth is primarily driven by large-scale infrastructural mega-projects (e.g., new city construction, major industrial complexes) and significant investments in airport and air navigation facilities in the Gulf Cooperation Council (GCC) countries. There is a high preference for robust, heat-resistant, and solar-powered systems to cope with harsh desert climates and often limited grid access.

- Latin America (LATAM): Market expansion is steady, largely tied to mineral extraction infrastructure and expanding power transmission networks. The market shows a strong demand for cost-effective, durable medium and low-intensity lighting solutions, often prioritizing solar-powered models for remote, mountainous installations where grid power access is inconsistent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aviation Warning Lights Market.- Dialight

- Hughey & Phillips, Inc.

- Flash Technology

- Carmanah Technologies Corp.

- Avlite Systems

- Orga BV

- S4GA - Safegate Group

- Copperhead Industries

- TWR Lighting, Inc.

- ADB Safegate

- Unimar Inc.

- Contarnex Europe

- FTL (Flight Light Inc.)

- Argos Aerodata

- Electrocube

- Qualite Corporation

- Technostrobe Inc.

- Delta Obstruction Lighting

- Point Lighting Corp.

- Holland Aviation

Frequently Asked Questions

Analyze common user questions about the Aviation Warning Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory standards governing Aviation Warning Lights?

The Aviation Warning Lights market is primarily governed by the International Civil Aviation Organization (ICAO) Annex 14, which sets global standards for obstruction lighting intensity and color. In the United States, the Federal Aviation Administration (FAA) Advisory Circular (AC) 70/7460 dictates specific requirements for marking and lighting tall structures, which are typically adopted by industry players worldwide for compliance assurance.

Why is LED technology dominating the Aviation Warning Lights market?

LED technology dominates due to its superior efficiency, which drastically reduces power consumption, crucial for remote or solar-powered installations. Furthermore, LEDs offer a significantly longer operational lifespan, robust resistance to environmental factors, and precise control over beam intensity and flash patterns, leading to reduced maintenance costs and enhanced regulatory compliance.

How does GPS synchronization improve the effectiveness of obstruction lighting?

GPS synchronization ensures that multiple obstruction lighting units installed across a large area, such as a wind farm or long power line, flash simultaneously. This coordinated timing prevents confusion and helps pilots accurately perceive the entire structure's perimeter, which is critical for safety and is often a mandatory requirement for medium and high-intensity lighting systems.

What is Dynamic Obstruction Lighting (DOL) and its main advantage?

Dynamic Obstruction Lighting (DOL) refers to intelligent systems that use sensors or radar data to automatically adjust light intensity or turn the lights on/off based on the real-time presence or proximity of aircraft. The main advantage of DOL is minimizing light pollution and reducing energy consumption while maintaining maximum safety compliance only when an aerial threat is detected in the vicinity.

Which application segment is driving the fastest growth in the market?

The wind energy sector, specifically the installation of expansive onshore and offshore wind farms, is currently driving the fastest growth. Each turbine requires compliant medium-intensity lighting systems, often necessitating solar power and GPS synchronization due to remote locations, creating substantial and recurring demand for certified obstruction lighting solutions globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager