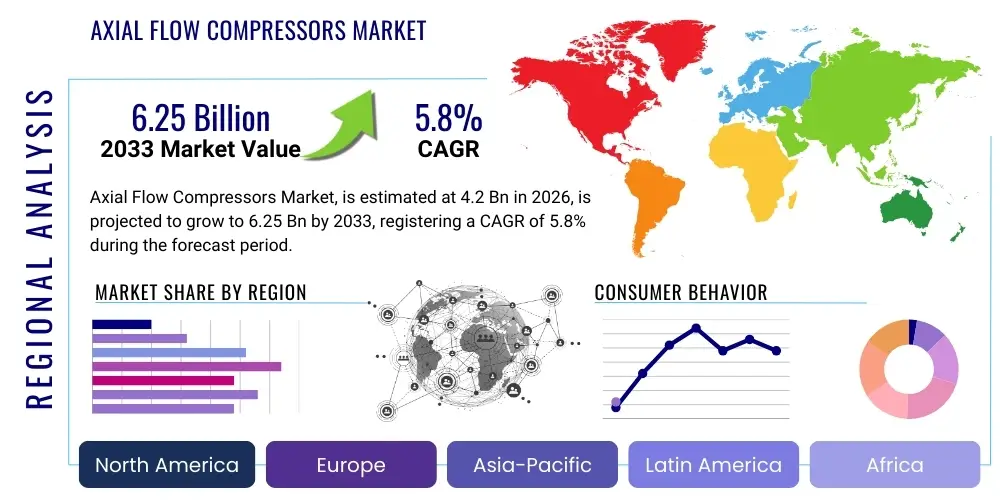

Axial Flow Compressors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443410 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Axial Flow Compressors Market Size

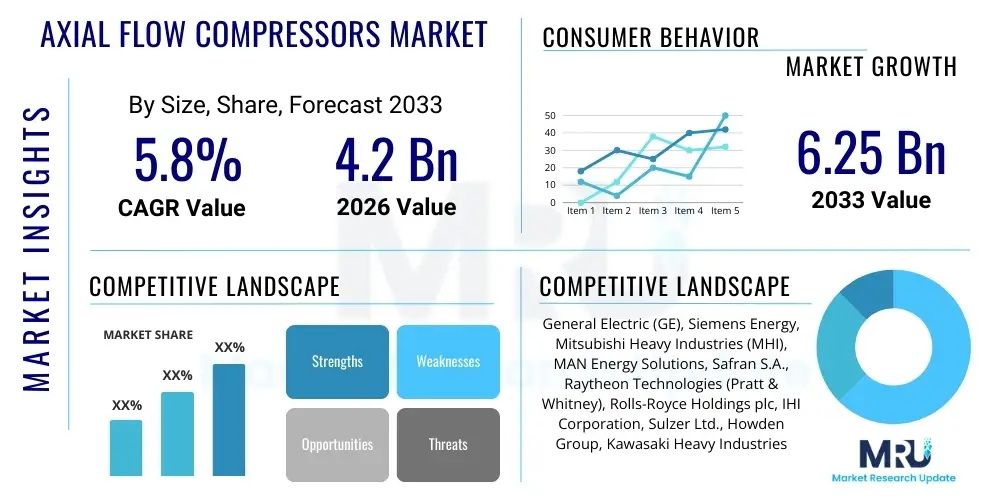

The Axial Flow Compressors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.25 Billion by the end of the forecast period in 2033.

Axial Flow Compressors Market introduction

The Axial Flow Compressors Market encompasses sophisticated aerodynamic machinery fundamentally required for processes demanding high air or gas compression ratios coupled with high mass flow rates, notably in gas turbines used across power generation and aviation sectors. These compressors are distinguished by their operational mechanism, where the fluid flows parallel to the axis of rotation, enabling superior efficiency, particularly at higher pressures, compared to their centrifugal counterparts. The inherent design advantages—specifically, the ability to handle massive volumes of fluid flow and maintain a lightweight structure relative to power output—cement their critical role in high-performance machinery globally. Their primary function involves increasing the pressure of the working fluid before it enters the combustion chamber, directly impacting overall thermal efficiency and specific fuel consumption.

Major applications of axial flow compressors span critical infrastructure and advanced technological industries. In the aerospace domain, they are indispensable components of jet engines, driving propulsion efficiency in commercial airliners and military aircraft alike. For the power generation sector, they are core elements of large industrial gas turbines used in combined cycle power plants, offering crucial support for baseload electricity generation and peak shaving capabilities. Furthermore, the oil and gas industry utilizes high-capacity axial compressors in liquefied natural gas (LNG) production facilities and petrochemical processing plants, where reliability and sustained high throughput are paramount. The benefits derived from these systems include superior pressure ratio capabilities per stage, minimized aerodynamic losses, and excellent performance characteristics under varying operational loads, justifying their substantial deployment costs.

The driving factors propelling the expansion of this market are intrinsically linked to global industrialization and decarbonization efforts. The increasing demand for efficient, reliable electricity generation through natural gas turbines, replacing older coal-fired infrastructure, is a primary driver. Simultaneously, the rapid growth in global air traffic, necessitating the expansion and modernization of commercial aircraft fleets, provides a steady demand stream. Technological advancements in compressor blade design, utilizing complex computational fluid dynamics (CFD) modeling and incorporating advanced materials like nickel-based superalloys and ceramic matrix composites (CMCs), further enhance performance metrics, reduce maintenance intervals, and improve operational longevity, making them crucial investments for energy and mobility providers worldwide.

Axial Flow Compressors Market Executive Summary

The Axial Flow Compressors Market is currently undergoing significant transformation, driven by robust business trends focusing on energy efficiency enhancement, reduction in carbon emissions, and heightened investment in modernization programs, particularly in North America and the Asia Pacific region. Business trends reflect a clear shift toward modular and scalable gas turbine architectures, which rely on highly customized axial compressor stages optimized for specific operational profiles, such as high-altitude performance or extreme temperature stability. Furthermore, intense competition among original equipment manufacturers (OEMs) is fueling rapid innovation in blade cooling technologies and variable stator vane (VSV) actuation systems, aimed at improving overall cycle efficiency and operational flexibility, which is crucial for integrating intermittent renewable energy sources into the grid infrastructure.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by burgeoning economies like China, India, and Southeast Asian nations, is poised to become the most dynamic growth hub, owing to massive ongoing infrastructure projects, expansion of domestic airlines, and significant investment in new natural gas power generation capacity to meet escalating industrial and residential energy demands. Conversely, North America and Europe demonstrate mature market characteristics, where growth is primarily derived from maintenance, repair, and overhaul (MRO) services, technological retrofits, and the introduction of next-generation, ultra-efficient gas turbines designed explicitly for hydrogen blending or sustainable aviation fuel (SAF) compatibility. Regulatory mandates focused on reducing noise pollution and improving energy conversion rates are particularly influential in shaping market strategies within these developed economies, driving demand for advanced aero-engine and power generation systems.

Segment trends highlight the multi-stage compressor design as the dominant configuration across both power generation and aviation applications due to its superior capacity to achieve high overall pressure ratios necessary for modern high-bypass turbofan engines and industrial heavy-duty gas turbines. The aerospace and aviation application segment maintains the largest market share, driven by defense spending and the requirement for continuous upgrades to existing fleets, while the power generation segment shows the fastest growth trajectory, stimulated by the global transition away from coal-fired plants toward efficient gas-based solutions. Investment in research and development is increasingly focused on reducing the material weight of compressor components through additive manufacturing techniques, aiming to decrease rotational inertia and enhance transient response capabilities across all operational segments.

AI Impact Analysis on Axial Flow Compressors Market

User inquiries regarding the impact of Artificial Intelligence on the Axial Flow Compressors Market frequently center on predictive maintenance capabilities, optimization of operational efficiency, and the application of AI in aerodynamic design processes. Key themes revolve around how machine learning algorithms can analyze vast datasets from sensor arrays—monitoring parameters like vibration, temperature, pressure distribution, and surge margins—to predict impending failures with greater accuracy than traditional statistical models. There is significant user interest in leveraging AI for real-time adjustments of variable geometry components (like VSVs) to maintain peak efficiency across fluctuating load conditions, minimizing specific fuel consumption in aero-engines or maximizing power output in gas turbines. Concerns often address the implementation costs, data security related to proprietary operational parameters, and the need for specialized engineering skills to interpret and act upon complex AI-driven diagnostics, alongside expectations that AI will dramatically reduce unplanned downtime and extend component lifespan through optimized operational strategies.

- Enhanced Predictive Maintenance: AI algorithms analyze real-time operational data (vibration, acoustic signatures, thermal stress) to anticipate component degradation and schedule maintenance pre-emptively, drastically reducing unexpected outages and maximizing uptime.

- Optimized Aerodynamic Design: Machine learning accelerates the computational fluid dynamics (CFD) process, exploring millions of potential blade geometries and airfoils far faster than human engineers, leading to compressors with higher efficiency and wider stable operating ranges.

- Real-Time Performance Tuning: AI models dynamically adjust variable compressor geometry (Variable Stator Vanes or VSVs) in response to instantaneous changes in ambient temperature, load demand, or altitude, ensuring the compressor operates at maximum thermodynamic efficiency continually.

- Fault Isolation and Diagnostics: Neural networks process complex sensor inputs to isolate the precise location and cause of operational anomalies, speeding up troubleshooting and lowering MRO costs significantly.

- Supply Chain Optimization: AI optimizes the inventory management and logistics for critical compressor spares, forecasting demand based on predicted maintenance schedules and operational profiles across the global fleet.

- Digital Twin Creation: AI facilitates the development and calibration of highly accurate digital twins of axial compressors, enabling risk-free testing of operational scenarios and control logic updates before deployment on physical assets.

DRO & Impact Forces Of Axial Flow Compressors Market

The dynamics of the Axial Flow Compressors Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), amplified by profound Impact Forces stemming from technological and regulatory landscapes. Strong market drivers include the irreversible global trend toward high-efficiency energy solutions, exemplified by the retirement of older, less efficient industrial gas turbines and the relentless pursuit of fuel economy improvements in commercial aviation. However, this growth is substantially restrained by the extremely high initial capital expenditure associated with purchasing and installing heavy-duty compressors, coupled with stringent certification requirements—especially in aerospace—which create high barriers to entry for new competitors. Opportunities are emerging through the adoption of innovative materials, such as lightweight composite structures and advanced ceramic matrix composites (CMCs), which promise reduced operational weight and increased tolerance to high temperatures, thereby enabling higher compression ratios and thermal efficiencies, particularly relevant for next-generation engines.

Impact forces currently shaping the market include strict international emissions standards (like ICAO’s CO2 standards for aircraft and EU directives on industrial emissions), which mandate continuous technological improvement to reduce the environmental footprint of gas turbine operations. Furthermore, geopolitical instability significantly impacts the defense and oil & gas sectors, leading to volatile but potentially high-value procurement cycles for military jet engines and LNG infrastructure. The shift towards decentralized power generation and the increasing integration of hydrogen combustion technologies in industrial turbines represent pivotal technological impact forces, compelling manufacturers to invest heavily in redesigning compressor flow paths and materials compatible with alternative fuels. This environment demands that manufacturers not only focus on raw efficiency but also on component durability, operational flexibility, and long-term sustainability to remain competitive.

The inherent sensitivity of axial flow compressors to aerodynamic stability, often characterized by the narrow operational margins before surge or stall events, acts as a continuous engineering constraint and operational risk. Addressing this requires sophisticated control systems and advanced monitoring, which adds to complexity and cost. Yet, the push for supercritical CO2 (sCO2) power cycles in small modular reactors (SMRs) and concentrated solar power (CSP) offers a unique niche opportunity for compact, high-speed axial compressors tailored for specialized thermodynamic cycles. Ultimately, the market trajectory is determined by the successful mitigation of high development costs through streamlined manufacturing processes, like advanced five-axis machining and additive manufacturing, counterbalancing the restrictive nature of long design and certification lead times inherent in mission-critical applications.

Segmentation Analysis

The Axial Flow Compressors Market is systematically segmented based on technological characteristics, physical configuration, and primary application domains, providing a granular view of demand distribution and technological focus areas. Key segmentation criteria include the number of compression stages (single-stage vs. multi-stage), the dominant material used in fabrication (metals vs. composites), and critically, the final application area, such as aerospace, power generation, or petrochemical processing. Understanding these segments is vital for market participants to tailor their research and development efforts and investment strategies. The distinction between single-stage units, often used where moderate pressure rise is required with maximum flow rate (e.g., small industrial air separation), and multi-stage designs, which are essential for achieving the extremely high pressure ratios necessary for modern jet engines and large industrial gas turbines, drives manufacturing specialization and component supply chains.

Segmentation by end-use highlights distinct requirements concerning operational lifespan, maintenance scheduling, and performance metrics. For example, military applications prioritize robustness, instantaneous response, and high-temperature capability, often leading to proprietary designs, whereas commercial power generation demands maximum thermal efficiency, extended maintenance intervals, and cost-effective operation over a 25+ year lifespan. Furthermore, geographic segmentation is crucial, as environmental regulations (e.g., NOx and CO2 emissions limits) and the availability of natural gas feedstock significantly influence the type and scale of compressors deployed across regions like North America, Europe, and emerging APAC economies. This detailed segmentation allows stakeholders to analyze market penetration rates and identify unsaturated demand pockets, particularly within industrial sectors transitioning toward cleaner energy sources or requiring upgrades to comply with new regulatory standards regarding noise and efficiency.

- By Stage:

- Single-Stage

- Multi-Stage

- By Material:

- Metal Alloys (e.g., Titanium, Nickel-based Superalloys)

- Composites and Ceramics (e.g., CMCs)

- By Application:

- Aerospace and Aviation (Commercial, Military, Space)

- Power Generation (Industrial Gas Turbines, Combined Cycle Plants)

- Oil & Gas (LNG Production, Gas Compression Stations, Processing)

- Chemical and Petrochemical Processing

- Industrial Manufacturing (HVAC, Air Separation Units)

- By End-Use:

- Commercial Operators

- Industrial Users (Energy, Processing)

- Government and Defense

Value Chain Analysis For Axial Flow Compressors Market

The value chain for the Axial Flow Compressors Market is complex, involving highly specialized upstream material suppliers, sophisticated component manufacturers, highly integrated OEMs, and extensive downstream service providers. The upstream segment is dominated by specialized metallurgical firms that supply high-grade, temperature-resistant materials—such as single-crystal nickel superalloys for blades and vanes, and advanced titanium alloys for discs—which undergo stringent quality control due to the critical nature of their function within rotating machinery. These materials dictate the overall performance envelope and cost structure of the final product. Component manufacturing involves highly precise processes like five-axis CNC machining, forging, and specialized coating applications (e.g., thermal barrier coatings), where intellectual property related to design tolerances and manufacturing precision provides significant competitive advantages. The efficiency of this upstream phase directly impacts the lead time and reliability of the final compressor unit.

The manufacturing and assembly stage is controlled primarily by major Original Equipment Manufacturers (OEMs), who integrate these components into complete gas turbine packages or jet engines. These OEMs possess deep domain expertise in thermodynamics, rotor dynamics, and system integration, acting as the primary point of contact for large-scale procurement. Distribution channels vary significantly based on the application: for aerospace, distribution is typically direct from the OEM to the aircraft manufacturer (e.g., Airbus or Boeing) or military procurement agencies. For power generation and oil & gas, distribution can involve direct sales for large turnkey projects or reliance on specialized engineering, procurement, and construction (EPC) firms that handle system integration. Post-sales, the downstream segment, encompassing MRO (Maintenance, Repair, and Overhaul) services, becomes critical, often representing a significant revenue stream for OEMs and specialized independent service providers (ISPs), driven by long-term service agreements (LTSAs).

The nature of distribution involves both direct and indirect pathways. Direct sales characterize high-value, custom-engineered solutions where the OEM works closely with the end-user (e.g., a power plant operator or major airline) from the conceptual design phase through commissioning. Indirect channels are more prevalent for smaller industrial compressors or standardized replacement parts, often utilizing a network of authorized distributors, certified service centers, or system integrators who can provide local support and manage complex installation logistics. Given the substantial cost and critical function of axial flow compressors, control over the MRO distribution network ensures customer retention and guarantees the use of certified replacement parts, maintaining the integrity and efficiency of the installed base over its multi-decade operational life.

Axial Flow Compressors Market Potential Customers

Potential customers for axial flow compressors are predominantly large industrial conglomerates, national government bodies, and global commercial service providers operating mission-critical, high-energy-density machinery. The primary end-user segment is the aerospace and aviation industry, including commercial airlines (like Delta, Emirates, Lufthansa) and airframe manufacturers, which procure compressors integrated into high-bypass turbofan engines for passenger and cargo transport. Simultaneously, defense ministries and national air forces represent major purchasers for military aircraft, demanding robust, high-performance axial compressors designed for extreme maneuverability and harsh operating conditions. These customers prioritize specific thrust-to-weight ratios and component reliability, driving continuous R&D investment by engine manufacturers.

Another crucial end-user vertical is the power generation sector, comprising utility companies, independent power producers (IPPs), and state-owned enterprises that operate gas-fired power plants. These entities require large-scale, heavy-duty axial compressors integrated into industrial gas turbines (IGTs) for reliable electricity production, emphasizing long operating cycles and high thermal efficiency to maximize profitability and meet grid demands. The ongoing shift towards combined cycle power plants (CCPP) further solidifies this demand. Additionally, the oil and gas industry represents a significant buying segment, specifically companies involved in natural gas processing, transmission pipeline operations, and particularly the rapidly expanding liquefied natural gas (LNG) market, where axial compressors are essential for large-scale refrigeration and gasification processes, demanding continuous, high-volume flow under fluctuating environmental conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.25 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric (GE), Siemens Energy, Mitsubishi Heavy Industries (MHI), MAN Energy Solutions, Safran S.A., Raytheon Technologies (Pratt & Whitney), Rolls-Royce Holdings plc, IHI Corporation, Sulzer Ltd., Howden Group, Kawasaki Heavy Industries, Capstone Green Energy, Elliott Group, Wartsila Corporation, Bharat Heavy Electricals Ltd (BHEL), Honeywell International, Kirloskar Pneumatic Co. Ltd., Ingersoll Rand, Atlas Copco, Baker Hughes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Axial Flow Compressors Market Key Technology Landscape

The technology landscape governing the Axial Flow Compressors Market is highly sophisticated, driven by continuous innovation aimed at increasing aerodynamic efficiency, reducing weight, and enhancing operational durability under extreme thermal and mechanical loads. A critical area of advancement involves Variable Stator Vane (VSV) technology, which allows the angle of the compressor blades to be adjusted dynamically in flight or during operation to optimize airflow, prevent surge, and maintain maximum efficiency across a broad range of operating points. Advanced control systems, often leveraging high-speed microprocessors and complex control algorithms, are required to manage these VSV systems precisely. Furthermore, the development of sophisticated cooling technologies, including intricate internal cooling passages within rotor blades and advanced film cooling, is paramount, especially in the high-pressure stages of gas turbines where temperatures can exceed the melting point of the blade material.

Material science is another pivotal technology domain, with a strong focus on utilizing lighter, stronger, and more heat-resistant materials. The transition from heavy nickel-based superalloys towards advanced composites and ceramic matrix composites (CMCs) is a significant trend, particularly in the fan and low-pressure compressor stages where weight reduction offers substantial fuel economy benefits for aviation. CMCs, in particular, offer superior temperature resistance and creep strength, allowing the compressor to operate at higher firing temperatures in the adjacent turbine section, thereby significantly boosting the overall thermal cycle efficiency. Complementary to materials, surface engineering—involving specialized coatings for erosion and corrosion protection—is essential for maintaining the aerodynamic profiles of airfoils over the long term, especially when operating in harsh environments or using less refined fuels.

Digital technologies are rapidly integrating into the core design and operational life cycle of axial flow compressors. Computational Fluid Dynamics (CFD) has moved beyond basic simulation to include high-fidelity transient flow analysis, enabling engineers to model complex phenomena like rotating stall and surge with unprecedented accuracy, leading to enhanced stability margins. Furthermore, the advent of digital twins, which are high-fidelity virtual models of the physical compressor, allows operators to monitor performance in real-time and predict component life under specific operational conditions. This predictive capability, powered by integrated sensor arrays and machine learning algorithms, transforms maintenance strategies from time-based to condition-based, optimizing asset utilization and minimizing costly unplanned downtime, thereby securing a strong technological foundation for future generations of compressor systems.

Regional Highlights

The Axial Flow Compressors Market demonstrates distinct geographical market maturity levels and growth trajectories influenced by regional energy policies, defense spending cycles, and infrastructure investment levels across the globe.

- North America: A mature and technologically advanced market, dominating innovation in aerospace and high-efficiency industrial gas turbines (IGTs). Growth is driven primarily by fleet modernization (both commercial and military aviation) and significant investment in natural gas infrastructure expansion and modernization. The United States remains the largest single market globally, characterized by high demand for MRO services and advanced compressor retrofits aimed at meeting stringent EPA regulations.

- Europe: Characterized by stringent environmental regulations and a strong focus on energy transition. The market emphasizes high-efficiency solutions and R&D into hydrogen-compatible gas turbines, driving demand for innovative compressor materials and designs. Key demand centers are the UK, Germany, and France, with significant activity in both aerospace (Airbus, Rolls-Royce) and industrial power sectors.

- Asia Pacific (APAC): The fastest-growing regional market, propelled by rapid industrialization, massive investments in new power generation capacity (especially in China, India, and Southeast Asia), and the explosive growth of commercial air travel. Infrastructure development, including LNG terminals and petrochemical complexes, creates substantial demand for large industrial axial compressors. The region offers significant opportunity for new installations rather than just upgrades.

- Middle East and Africa (MEA): Growth is primarily linked to the oil and gas sector, particularly large-scale LNG projects and pipeline compressor stations requiring heavy-duty units for gas extraction and transportation. Government investments in regional aviation hubs and defense modernization programs further contribute to market stability, focusing on rugged and reliable operational profiles due to harsh climate conditions.

- Latin America: A developing market characterized by fluctuating investments driven by regional economic stability and domestic energy policies. Demand is predominantly concentrated in Brazil and Mexico, focusing on replacing older infrastructure in the power generation and domestic petrochemical sectors, often reliant on competitive imports from global OEMs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Axial Flow Compressors Market.- General Electric (GE)

- Siemens Energy

- Mitsubishi Heavy Industries (MHI)

- MAN Energy Solutions

- Safran S.A.

- Raytheon Technologies (Pratt & Whitney)

- Rolls-Royce Holdings plc

- IHI Corporation

- Sulzer Ltd.

- Howden Group

- Kawasaki Heavy Industries

- Capstone Green Energy

- Elliott Group

- Wartsila Corporation

- Bharat Heavy Electricals Ltd (BHEL)

- Honeywell International

- Kirloskar Pneumatic Co. Ltd.

- Ingersoll Rand

- Atlas Copco

- Baker Hughes

Frequently Asked Questions

Analyze common user questions about the Axial Flow Compressors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of an axial flow compressor over a centrifugal compressor?

Axial flow compressors excel at handling significantly higher mass flow rates and achieving superior thermal efficiency and pressure ratios across multiple stages, making them mandatory for high-power applications like jet engines and large industrial gas turbines.

How is the market influenced by the transition to hydrogen and sustainable fuels?

The transition necessitates substantial redesigns of compressor aerodynamics and material selection to handle the different combustion characteristics and volumetric flow requirements of hydrogen or Sustainable Aviation Fuels (SAF), creating demand for specialized, next-generation units and retrofit solutions.

Which application segment holds the largest share in the Axial Flow Compressors Market?

The Aerospace and Aviation segment currently commands the largest market share, driven by the consistently high demand for new, efficient turbofan engines for commercial and military aircraft and the substantial MRO requirements for the global installed fleet.

What is the role of Variable Stator Vanes (VSVs) in axial compressor performance?

VSVs allow dynamic adjustment of the angle of attack of the compressor blades, optimizing airflow to maintain peak aerodynamic efficiency, prevent operational instabilities like surge or stall, and ensure consistent performance across diverse engine speeds and loads.

What are the main regional growth drivers for axial flow compressors?

The Asia Pacific region is the key growth driver, stimulated by massive investments in new power generation infrastructure (gas turbines) and rapid fleet expansion in commercial aviation, coupled with significant industrialization demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager