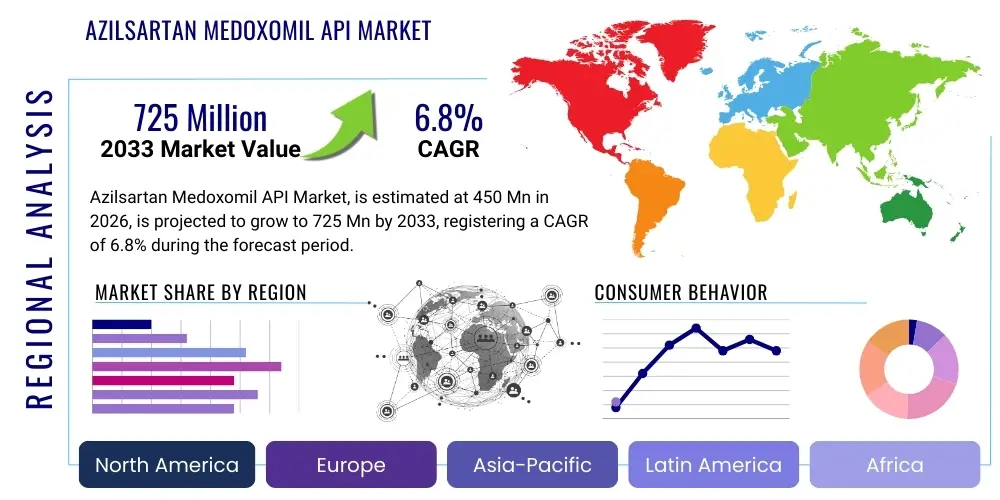

Azilsartan Medoxomil API Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442151 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Azilsartan Medoxomil API Market Size

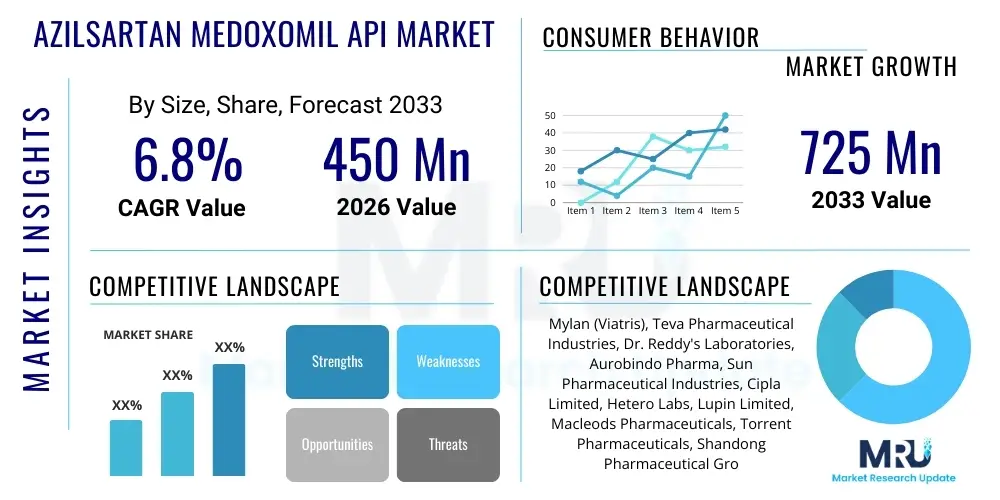

The Azilsartan Medoxomil API Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 725 Million by the end of the forecast period in 2033.

Azilsartan Medoxomil API Market introduction

The Azilsartan Medoxomil API market encompasses the segment dedicated to the manufacture and distribution of the active pharmaceutical ingredient used in the formulation of anti-hypertensive drugs. Azilsartan Medoxomil is a potent angiotensin II receptor blocker (ARB) utilized primarily for the treatment of hypertension (high blood pressure). Its mechanism of action involves selectively blocking the binding of angiotensin II to the AT1 receptors in vascular smooth muscle, thereby leading to vasodilation and reduced blood pressure. The product is valued for its sustained efficacy and favorable tolerability profile compared to earlier generations of ARBs, which drives consistent demand across global therapeutic markets. Major applications include the monotherapy or combination therapy for essential hypertension, and increasingly, its potential role in managing secondary complications like chronic kidney disease and cardiovascular risk reduction associated with elevated blood pressure. Key benefits include superior 24-hour blood pressure control and reduced risk of stroke or myocardial infarction in hypertensive patients. The market growth is principally driven by the global increase in hypertension prevalence, the expanding elderly population sensitive to cardiovascular complications, the expiration of key brand patents leading to greater generic competition, and continuous regulatory approval processes stabilizing the supply chain for API manufacturers worldwide. Furthermore, the trend toward fixed-dose combination therapies incorporating Azilsartan Medoxomil also provides significant impetus to market expansion.

Azilsartan Medoxomil API Market Executive Summary

The Azilsartan Medoxomil API market is characterized by intense competition among generic manufacturers following the patent cliff, coupled with stringent regulatory oversight from agencies such as the FDA and EMA concerning impurity profiles and manufacturing standards. Business trends indicate a strong movement towards vertical integration, where large pharmaceutical companies and established Contract Development and Manufacturing Organizations (CDMOs) are securing captive supply chains to maintain competitive pricing and ensure regulatory compliance, particularly regarding polymorphic forms and chiral purity crucial for ARBs. Regional trends show that Asia Pacific (APAC), specifically India and China, remains the dominant manufacturing hub, leveraging lower operational costs and established chemical synthesis expertise to supply global generic drug markets, while North America and Europe continue to be the primary consumption centers due to high healthcare expenditure and established prescription patterns. Segment trends emphasize the increasing demand for high-purity, standardized Azilsartan Medoxomil API compliant with international pharmacopeia standards (USP/EP/JP), driven largely by the proliferation of generic formulations and the need for bioequivalence demonstration. The market is also witnessing greater focus on specialized grade APIs tailored for advanced formulations, including complex fixed-dose combinations, requiring enhanced stability and optimized particle size distribution, reflecting a maturing and sophisticated API supply landscape focused on quality and cost-efficiency simultaneously.

AI Impact Analysis on Azilsartan Medoxomil API Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Azilsartan Medoxomil API market predominantly revolve around optimizing complex chemical synthesis routes, predicting potential raw material supply chain disruptions, and enhancing quality control systems to meet increasingly stringent global regulatory standards for impurity detection. Users are keenly interested in how machine learning algorithms can accelerate the identification of novel, cost-effective catalysts or reagents for the multistep synthesis of Azilsartan Medoxomil, thereby reducing production time and environmental footprint (green chemistry). Furthermore, a significant cluster of questions addresses the use of AI in predictive modeling for ensuring consistency in polymorphic forms of the API, which is critical for drug efficacy and regulatory approval. Expectations are high that AI will significantly streamline the validation and verification processes required for API manufacturing plants, moving towards a proactive, real-time quality assurance model rather than traditional batch testing, thus minimizing risks associated with product recalls and batch failures inherent in complex chemical manufacturing. The overall thematic concerns center on the initial investment required for AI infrastructure integration versus the long-term cost savings realized through maximized yield, reduced waste, and automated compliance tracking throughout the pharmaceutical supply chain.

The integration of AI into Azilsartan Medoxomil API manufacturing is fundamentally restructuring operational efficiency and quality management paradigms. By leveraging predictive analytics, manufacturers can now model the kinetic behavior of different reaction steps, optimizing parameters such as temperature, pressure, and catalyst loading to achieve maximum conversion rates and desired product purity profiles. This application of AI-driven process optimization minimizes waste and reduces energy consumption, aligning with contemporary sustainability goals while substantially lowering the overall cost of goods sold (COGS). The shift from traditional laboratory optimization, which is often trial-and-error based, to AI-guided methodologies allows for faster scale-up from pilot to commercial batches, accelerating time-to-market, particularly critical for competitive generic molecules like Azilsartan Medoxomil. Furthermore, AI systems are instrumental in managing the vast datasets generated by process analytical technology (PAT) tools integrated into modern API production lines. These systems continuously monitor critical process parameters (CPPs) and critical quality attributes (CQAs) in real-time, instantly flagging deviations that might compromise API quality, ensuring unparalleled batch consistency and fulfilling the requirements of Quality by Design (QbD) principles mandated by global health authorities.

Another profound area of AI influence pertains to supply chain resilience and inventory management, particularly crucial given the global sourcing of intermediates and raw materials required for Azilsartan Medoxomil synthesis. AI algorithms can analyze geopolitical risks, supplier performance metrics, logistical constraints, and historical price volatility to forecast potential supply bottlenecks months in advance, allowing manufacturers to proactively adjust procurement strategies or identify alternative qualified vendors. This preemptive risk management capability substantially mitigates the chance of production delays, which are costly in the high-stakes generic pharmaceutical market. Beyond manufacturing and supply, AI is also being deployed in advanced regulatory affairs, utilizing natural language processing (NLP) to swiftly analyze complex regulatory documents and ensure the Azilsartan Medoxomil API dossiers submitted adhere perfectly to regional specifications (e.g., EU GMP, US cGMP, Schedule M in India). This automated compliance checking reduces human error, speeds up the filing process, and enhances the likelihood of first-pass regulatory approval, solidifying AI’s role as a critical enabler of operational excellence and global market access for this essential antihypertensive API.

- AI-driven optimization of multi-step chemical synthesis pathways to maximize yield and purity.

- Predictive maintenance using sensor data in reactors and processing equipment to reduce unplanned downtime.

- Advanced quality control (AQC) utilizing machine vision and spectroscopy for real-time impurity detection and polymorph stability verification.

- Supply chain risk forecasting and resilience planning against geopolitical and logistical disruptions using machine learning models.

- Accelerated regulatory document analysis and automated compliance verification (NLP implementation).

- Modeling of solubility and bioavailability characteristics of the final drug product utilizing API data.

DRO & Impact Forces Of Azilsartan Medoxomil API Market

The dynamics of the Azilsartan Medoxomil API market are governed by a robust interplay of driving forces centered on demographic shifts and therapeutic needs, balanced against stringent regulatory and competitive constraints inherent in the pharmaceutical sector, while significant opportunities arise from geographic expansion and innovation in drug delivery. Key drivers include the escalating global burden of hypertension, particularly in rapidly aging populations across developed and developing nations, which creates persistent demand for effective blood pressure management solutions. The relatively recent transition of Azilsartan Medoxomil from a brand-protected entity to a generic molecule has dramatically opened the market, inviting intensive competition, which subsequently lowers API costs and increases accessibility, further boosting adoption rates worldwide. Restraints primarily involve the rigorous and time-consuming compliance requirements imposed by international health agencies on API manufacturing, demanding high capital investment in cGMP facilities and comprehensive validation protocols to ensure purity and stability. Opportunities lie primarily in leveraging the underserved therapeutic areas, such as developing combination therapies that integrate Azilsartan Medoxomil with diuretics or calcium channel blockers for optimized patient outcomes, and aggressively penetrating emerging markets in Southeast Asia, Latin America, and Africa where hypertension treatment rates are rapidly accelerating yet often rely on cost-effective generic alternatives. The overall impact forces compel manufacturers to prioritize process efficiency, supply chain security, and unwavering adherence to quality standards to maintain relevance in this highly competitive, mature API segment.

A detailed examination of the market drivers reveals that the epidemiological factors surrounding cardiovascular disease are paramount. Hypertension affects nearly one billion people globally, and the consistent need for chronic, lifelong treatment ensures a sustained baseline demand for Azilsartan Medoxomil API. Furthermore, healthcare reforms in numerous countries aimed at improving access to essential medicines favor the adoption of effective, affordable generic versions of established drugs, directly benefitting the API providers for this molecule. The clinical efficacy profile of Azilsartan Medoxomil, often cited for its superior pharmacokinetic properties compared to older ARBs, translates into physician preference, bolstering prescription volume even within a competitive therapeutic class. This inherent clinical advantage acts as a strong pull factor for manufacturers to focus capital expenditure on scalable, reliable synthesis routes. The successful implementation of government-backed universal healthcare programs in large nations, focusing on prevention and chronic disease management, further solidifies the long-term growth trajectory for the API market. The shift towards generic adoption following patent expiration fundamentally transforms the market structure, moving the competitive focus from marketing prowess to manufacturing scale and cost leadership, directly fueling increased API production capacities globally, particularly in cost-advantageous regions.

Conversely, the market faces significant headwinds from regulatory complexity and technological hurdles. Ensuring batch-to-batch consistency and strict control over specific impurities, especially nitrosamines which have recently come under intense scrutiny, requires continuous investment in analytical technology and process validation, presenting a high operational barrier for new entrants. Furthermore, the inherent complexity of the multi-step chemical synthesis required for Azilsartan Medoxomil, often involving specialized reagents and chiral resolution techniques, elevates production costs and requires highly skilled technical personnel, limiting the number of qualified global suppliers. The opportunity landscape is equally dynamic, characterized by the potential of developing enhanced drug delivery systems utilizing the API. This includes developing novel formulations, such as orally disintegrating tablets (ODTs) or modified-release capsules, which require specialized API grades and manufacturing techniques, thereby creating niche, high-value segments within the broader market. Moreover, strategic regional partnerships between Western pharmaceutical companies and established Asian API producers represent a crucial mechanism for capitalizing on the manufacturing efficiencies of the East while ensuring compliance and quality standards required for the highly regulated Western markets, effectively mitigating risks and accelerating global market penetration for the API.

Segmentation Analysis

The Azilsartan Medoxomil API market is segmented based on critical differentiators including Product Grade, End-User application, and Geographic region, each influencing market penetration strategies and pricing dynamics. Product grade segmentation reflects the necessity for varying levels of purity and specific physical characteristics (e.g., particle size distribution) demanded by different final formulation types and regulatory jurisdictions, with high-purity grades fetching premium prices. Application segmentation highlights the primary therapeutic uses, predominantly hypertension management, which constitutes the largest volume segment, alongside niche applications in cardiovascular risk reduction and nephropathy management, guiding targeted marketing and R&D efforts. End-user analysis distinguishes between major pharmaceutical companies that require large volumes for captive consumption, specialized generic manufacturers seeking cost-efficient sourcing, and academic or contract research organizations involved in early-stage development and impurity profiling, thereby defining the typical transactional volumes and relationship structures within the market ecosystem.

- By Product Grade:

- High Purity Grade

- Standard Grade (Pharmacopeial Grade)

- By Application:

- Hypertension Treatment (Monotherapy and Combination Therapy)

- Chronic Kidney Disease Management

- Cardiovascular Risk Reduction

- By End-User:

- Pharmaceutical & Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs) & CDMOs

- Research Institutions and Academic Laboratories

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Azilsartan Medoxomil API Market

The Azilsartan Medoxomil API value chain begins with the complex upstream sourcing of specialized chemical intermediates and raw materials, often involving complex organic synthesis steps requiring niche expertise and proprietary processes. The stability and cost-effectiveness of this upstream segment are highly dependent on global petrochemical prices and geopolitical stability, given that many key intermediates are sourced from specialized chemical industries primarily located in China and India. Efficient management of intermediate sourcing, focusing on secure, dual-source strategies and rigorous qualification of suppliers, is paramount to mitigating regulatory risks, especially concerning elemental impurities and potential residual solvents. The central stage involves the core API manufacturing process itself, characterized by stringent adherence to cGMP standards, multi-stage synthesis, purification, crystallization, and drying processes. This stage demands significant capital investment in compliant reactor infrastructure and advanced analytical laboratories capable of real-time monitoring of critical quality attributes (CQAs) to ensure the final product meets specified purity levels, polymorphic consistency, and particle size distribution required by end-users for optimal formulation stability and bioavailability.

The downstream segment of the value chain focuses on distribution and integration into the final drug product manufacturing process. Distribution channels are highly regulated and specialized, primarily involving direct sales models from the API manufacturer to large pharmaceutical formulation companies or through specialized pharmaceutical distributors who handle regulatory documentation, customs clearance, and cold chain logistics, where applicable. Direct channels are typically utilized for large volume contracts with key generic players, allowing for better price control and deeper technical collaboration on quality specifications. Indirect channels, through distributors, are more common for supplying smaller formulation units or reaching diverse geographical regions that lack established direct sales infrastructure. Technical support and regulatory compliance documentation (e.g., Drug Master Files or DMFs) are integral components of this downstream phase, as the API manufacturer must provide exhaustive data to support the final drug product's regulatory submission, a critical gatekeeping function determining market access.

The efficiency of the entire value chain is increasingly being evaluated based on sustainable practices and integrated quality management systems. Upstream analysis focuses on green chemistry principles, minimizing solvent use and waste generation during intermediate synthesis. Downstream analysis emphasizes logistical optimization, aiming to reduce lead times and inventory costs for formulation customers. The prevailing structure favors API manufacturers who demonstrate robust backward integration—controlling the production of key complex intermediates—as this allows for superior cost control, reduced reliance on third-party suppliers, and enhanced regulatory transparency, ultimately creating a more resilient and profitable offering in the highly competitive Azilsartan Medoxomil API market. Manufacturers who fail to invest in rigorous quality assurance and secure, verified supply chain sourcing face considerable risks related to product rejection, regulatory sanctions, and potential exclusion from major purchasing tenders.

Azilsartan Medoxomil API Market Potential Customers

The primary consumers and end-users of Azilsartan Medoxomil API are the large-scale global pharmaceutical and biopharmaceutical companies, encompassing both originator brand manufacturers (though their reliance decreases post-patent expiry) and, predominantly, generic drug manufacturers. These companies constitute the bulk volume purchasers, requiring significant quantities of API for mass production of finished dosage forms (FDFs) distributed across global markets. Their purchasing criteria are exceptionally stringent, focusing equally on unit cost competitiveness, long-term supply assurance, proven regulatory compliance (cGMP documentation, DMF status), and the specific technical attributes of the API, such as crystal habit and particle size distribution (PSD), which directly impact the manufacturing efficiency and bioequivalence of the final tablet product. Maintaining robust relationships with these key pharmaceutical buyers necessitates not only competitive pricing but also continuous technical support and proactive compliance updates regarding evolving international standards, especially those concerning impurity thresholds.

A rapidly growing segment of potential customers includes Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). These organizations purchase Azilsartan Medoxomil API either on behalf of their pharmaceutical clients or as part of their integrated service offerings to produce FDFs for smaller companies, virtual pharmaceutical entities, or those seeking outsourcing solutions. CMOs and CDMOs prioritize flexibility, rapid scalability, and integrated services, often preferring suppliers who can manage smaller, specialized batches required for clinical trials or niche markets alongside large commercial quantities. Their purchasing power is significant because they aggregate demand from multiple client sources, acting as major consolidators in the API procurement landscape. Suppliers targeting this segment must demonstrate highly flexible logistics capabilities and robust confidentiality frameworks to protect the intellectual property and commercial interests of the CMO’s diverse clientele.

A smaller, yet strategically important, customer segment includes specialized research institutions, academic laboratories, and smaller biotechnology firms. These entities typically require R&D or clinical trial quantities of Azilsartan Medoxomil API, often in highly pure or custom-synthesized forms for early-stage formulation studies, preclinical toxicology testing, or comparative efficacy research. While the volume purchased by this group is minimal compared to large generic manufacturers, they often pay premium prices for specialized grades and comprehensive analytical reports. Successfully serving this segment helps API manufacturers maintain an edge in technical innovation, allowing them to test and validate new synthesis processes or unique API polymorphs before scaling them up for commercial use. Consequently, the optimal market strategy involves a tiered approach: securing high-volume, cost-sensitive contracts with generic manufacturers, fostering strong partnerships with agile CMOs, and maintaining a specialized offering for the premium R&D customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 725 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mylan (Viatris), Teva Pharmaceutical Industries, Dr. Reddy's Laboratories, Aurobindo Pharma, Sun Pharmaceutical Industries, Cipla Limited, Hetero Labs, Lupin Limited, Macleods Pharmaceuticals, Torrent Pharmaceuticals, Shandong Pharmaceutical Group, Zhejiang Huahai Pharmaceutical, Hubei Tianrui Chemical, Glenmark Pharma, Alkem Laboratories, Granules India, Unichem Laboratories, Zydus Lifesciences, Suven Pharma. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Azilsartan Medoxomil API Market Key Technology Landscape

The technological landscape underpinning the Azilsartan Medoxomil API market is dominated by advancements in chemical synthesis methods aimed at improving efficiency, purity, and environmental sustainability, reflecting the core industry shift toward green chemistry and Quality by Design (QbD) principles. Traditionally, the synthesis of Azilsartan Medoxomil involves multi-step processes prone to generating various impurities, requiring substantial chromatographic purification which increases costs and solvent consumption. Modern API manufacturers are increasingly adopting advanced catalytic systems, including organocatalysis and transition metal catalysis, to facilitate cleaner and more selective reactions, drastically improving reaction yields and reducing the overall environmental footprint. Furthermore, the focus on solid-state chemistry is paramount, specifically controlling the crystal form (polymorph) of Azilsartan Medoxomil. Sophisticated crystallization and isolation techniques, often guided by high-throughput screening and computational chemistry, are employed to ensure the API consistently exhibits the most stable and bioavailable crystalline form, which is a non-negotiable requirement for regulatory submission and product performance.

A critical emerging technology impacting this market is Continuous Flow Manufacturing (CFM), which is gradually replacing traditional batch processing. CFM offers several advantages for Azilsartan Medoxomil production: it provides superior control over reaction kinetics and heat transfer, reducing the risk of side reactions and improving safety, particularly when dealing with hazardous or exothermic synthesis steps. By integrating sophisticated Process Analytical Technology (PAT) tools, such as in-line spectroscopy (e.g., Raman or NIR), into the continuous flow stream, manufacturers can monitor and adjust critical process parameters in real-time. This level of automation and precision ensures consistent quality, minimizes batch variations, and allows for rapid scale-up or scale-down capabilities, making the manufacturing process significantly more agile and cost-effective, a crucial differentiator in the generic API landscape. The investment in these high-precision, automated systems is significant but yields long-term returns through reduced labor costs, minimized off-specification material, and expedited regulatory clearance due to robust quality evidence.

Beyond synthesis and flow chemistry, the utilization of sophisticated analytical tools forms a fundamental part of the technology ecosystem. High-resolution mass spectrometry and advanced liquid chromatography techniques are essential for the highly sensitive detection and quantification of low-level process and degradation impurities, including the recently highlighted nitrosamine contaminants, ensuring compliance with the latest ICH and regional guidelines. Furthermore, manufacturers are leveraging particle engineering technologies, such as micronization and nanosuspension techniques, to precisely control the particle size distribution (PSD) of the Azilsartan Medoxomil API. This control is vital as the PSD directly influences the dissolution rate and subsequent bioavailability of the final oral dosage form. The continuous adoption of integrated informatics platforms that manage all quality, analytical, and manufacturing data, often powered by AI (as previously discussed), serves as the backbone connecting these disparate technologies, ensuring full traceability and maintaining the integrity of the critical data required for global market acceptance and sustaining a high standard of pharmaceutical manufacturing excellence in the highly competitive anti-hypertensive API segment.

Regional Highlights

- North America (United States and Canada): This region represents a mature, high-value market characterized by high consumer awareness, robust healthcare spending, and stringent regulatory standards (FDA compliance). Although the API manufacturing base here is smaller due to high labor and operational costs, the U.S. remains the largest consumer market by revenue, driven by high prescription rates and the established use of Azilsartan Medoxomil-based therapies. Demand focuses overwhelmingly on premium, high-purity API grades sourced from qualified suppliers with impeccable regulatory track records (e.g., DMF Type II submissions). The primary market dynamic is driven by securing cost-effective supply agreements for generic formulations while maintaining complex intellectual property vigilance.

- Europe (Germany, UK, France, Italy, Spain): Europe is a significant consumer and manufacturer hub, especially within the generic segment, governed by the European Medicines Agency (EMA) and national health technology assessment bodies. The market is highly price-sensitive, placing substantial pressure on API costs. Western European formulation companies often rely on strategic partnerships with specialized Eastern European or Indian/Chinese API manufacturers to balance cost optimization with strict EU GMP requirements. Focus areas include ensuring adherence to pharmacopeial monographs (EP) and navigating complex national reimbursement systems which favor cost-effective generic alternatives.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is simultaneously the fastest-growing consumption market and the dominant global manufacturing base for Azilsartan Medoxomil API. India and China possess vast manufacturing capacities, leveraging lower production costs and strong chemical synthesis expertise to supply over 70% of the global generic API market volume. Japan and South Korea, however, represent sophisticated, high-value markets with regulatory demands similar to the West. The growth in APAC is fueled by expanding middle-class populations, increased access to healthcare, rising hypertension prevalence, and strong government initiatives supporting local generic drug production, particularly in India (bulk drug parks).

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets characterized by significant untapped potential and relatively lower regulatory entry barriers compared to North America and Europe. Demand is almost entirely focused on highly cost-competitive generic formulations, making the affordability of the Azilsartan Medoxomil API a primary factor in market penetration. Market entry strategies often involve local distribution partnerships and navigating fluctuating economic conditions and diverse national regulatory systems, with a strong focus on basic pharmacopeial standards to address prevalent health conditions efficiently and affordably.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Azilsartan Medoxomil API Market.- Teva Pharmaceutical Industries

- Mylan (Viatris)

- Dr. Reddy's Laboratories

- Aurobindo Pharma

- Sun Pharmaceutical Industries

- Cipla Limited

- Hetero Labs Limited

- Lupin Limited

- Macleods Pharmaceuticals

- Torrent Pharmaceuticals

- Shandong Pharmaceutical Group

- Zhejiang Huahai Pharmaceutical Co., Ltd.

- Hubei Tianrui Chemical Co., Ltd.

- Glenmark Pharma

- Alkem Laboratories

- Granules India Limited

- Unichem Laboratories

- Zydus Lifesciences

- Novartis AG (through generics division)

- Kyowa Kirin Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Azilsartan Medoxomil API market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Azilsartan Medoxomil API market?

The primary driver is the accelerating global prevalence of hypertension, particularly within aging populations worldwide, necessitating sustained and effective chronic treatment solutions. Furthermore, the generic availability following patent expirations has significantly reduced costs, boosting accessibility and adoption rates.

How does the Azilsartan Medoxomil API market ensure regulatory compliance and high quality?

Compliance is ensured through rigorous adherence to global Current Good Manufacturing Practices (cGMP) standards established by agencies like the FDA and EMA. Manufacturers must maintain comprehensive Drug Master Files (DMFs) detailing synthesis, analytical testing, and stability data, with increasing reliance on Process Analytical Technology (PAT) and automated quality control to monitor critical quality attributes in real-time.

Which geographical region dominates the manufacturing of Azilsartan Medoxomil API?

Asia Pacific (APAC), specifically India and China, currently dominates the global manufacturing landscape for Azilsartan Medoxomil API. This dominance is attributed to cost advantages, established chemical expertise, and large-scale production capacities necessary to serve the expansive global generic pharmaceutical market.

What technological advancements are critical for competitive advantage in API synthesis?

Key technological advancements include the adoption of Continuous Flow Manufacturing (CFM) for enhanced efficiency and control, the implementation of advanced catalytic methods (green chemistry) to improve yield and reduce waste, and the use of particle engineering techniques to optimize API stability and bioavailability in final formulations.

What are the main risks associated with the supply chain for Azilsartan Medoxomil API?

The main risks include price volatility of specialized raw materials, geopolitical instability affecting key manufacturing hubs (like China/India), and increasing regulatory scrutiny on trace impurities, particularly nitrosamines, which necessitates constant analytical vigilance and process adjustments to prevent costly recalls or market suspensions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager