Azimuth and Tunnel Thrusters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443150 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Azimuth and Tunnel Thrusters Market Size

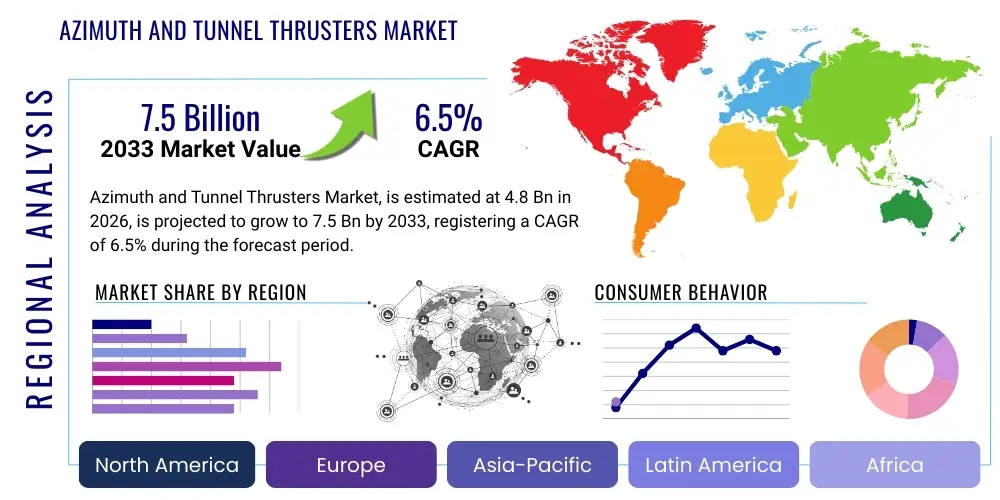

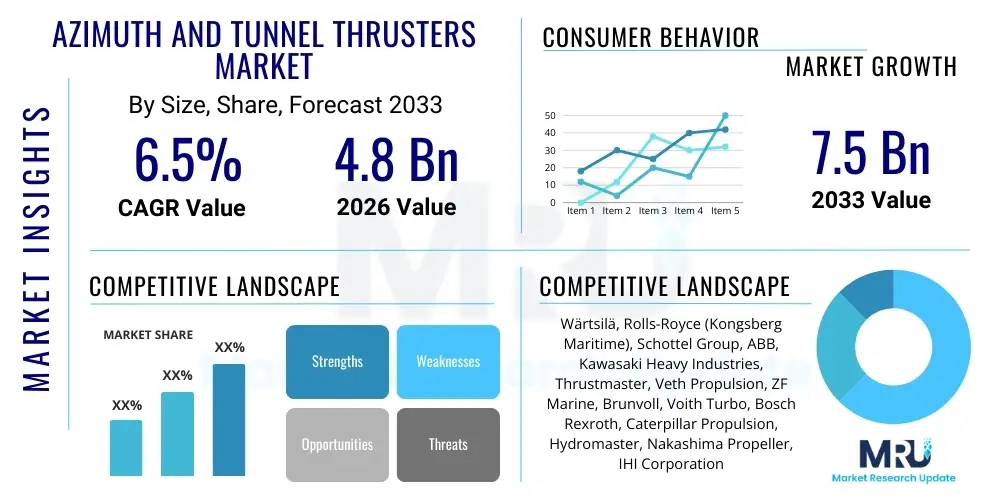

The Azimuth and Tunnel Thrusters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This significant growth trajectory is primarily fueled by the accelerating global demand for dynamic positioning (DP) capabilities in offshore vessels, coupled with the mandatory integration of robust maneuverability solutions in modern commercial shipping fleets. The increasing complexity of maritime operations, particularly in deep-sea drilling, renewable energy installation, and specialized cargo handling, mandates the adoption of highly efficient and reliable propulsion and steering systems, directly driving the valuation increase across the forecast horizon.

Market expansion is intrinsically linked to heightened investments in naval architecture optimization and digitalization within the shipbuilding sector. Tunnel thrusters, essential for low-speed maneuvering in ports and confined waterways, are seeing consistent demand driven by the container shipping and ferry industries seeking improved operational safety and reduced transit times. Meanwhile, azimuth thrusters, known for their 360-degree thrust vectoring capability, are gaining prominence across high-value segments such as offshore supply vessels (OSVs), anchor handling tug supply (AHTS) vessels, and cruise ships, where precise station-keeping and superior navigational agility are paramount. The regulatory push for environmentally compliant maritime operations, emphasizing fuel efficiency and reduced underwater noise, also favors advanced thruster designs that integrate hybrid or electric propulsion systems.

Furthermore, the maintenance, repair, and overhaul (MRO) segment contributes substantially to the overall market size, driven by the need to retrofit older vessels with newer, more efficient thruster technologies and the scheduled servicing requirements of highly utilized marine assets. Technological advancements focusing on shock absorption, seal durability, and modular design for easier maintenance are enhancing the total lifecycle value proposition of these systems, encouraging fleet owners to upgrade their existing installations. The geopolitical focus on expanding offshore infrastructure, including oil and gas exploration in challenging environments and the rapid build-out of offshore wind farms, solidifies the sustained demand for powerful and accurate thruster technologies capable of supporting these complex engineering tasks throughout the projection period.

Azimuth and Tunnel Thrusters Market introduction

The Azimuth and Tunnel Thrusters Market encompasses the design, manufacturing, distribution, and servicing of specialized marine propulsion units crucial for vessel maneuverability, dynamic positioning, and primary propulsion in certain applications. Azimuth thrusters, often referred to as Z-drives or L-drives, allow the propeller to be rotated around the vertical axis (360 degrees) to direct thrust in any horizontal direction, eliminating the need for a conventional rudder system. Tunnel thrusters, conversely, are installed transversely in a tunnel spanning the width of the hull, providing lateral thrust necessary for maneuvering at slow speeds, such as docking and undocking. These systems are fundamental components in optimizing ship handling characteristics, significantly improving safety and operational efficiency across diverse maritime sectors, including commercial shipping, offshore operations, naval vessels, and specialized workboats.

Major applications for these thrusters span critical areas of the maritime economy. Azimuth thrusters serve as the primary propulsion mechanism in high-performance tugboats, icebreakers, and sophisticated offshore vessels requiring DP Class 2 or 3 capabilities. Their utility in maintaining a fixed position relative to the seabed or a floating structure, independent of external environmental forces like wind and current, is indispensable for deep-sea activities such as pipe laying, drilling, and remotely operated vehicle (ROV) support. Tunnel thrusters are ubiquitous in larger commercial vessels—container ships, tankers, bulk carriers, and passenger ferries—where precise lateral movement control is essential for safe navigation through congested ports and narrow channels, minimizing the need for external tug assistance and reducing operational costs.

The core driving factors underpinning market growth include the robust expansion of the global offshore energy sector, particularly floating offshore wind and deep-water oil and gas recovery, both of which rely heavily on advanced dynamic positioning systems powered by azimuth thrusters. Regulatory compliance mandates focusing on improved vessel safety standards, especially those concerning maneuvering in ecologically sensitive areas, are pushing adoption. Furthermore, the persistent trend toward vessel hybridization and electrification necessitates high-torque, reliable electric motor-driven thruster units, aligning market growth with global decarbonization efforts. The inherent benefits these systems offer—including superior agility, enhanced safety margins, reduced complexity compared to traditional shaftline propulsion, and improved fuel efficiency through optimized thrust direction—cement their vital role in modern marine architecture.

Azimuth and Tunnel Thrusters Market Executive Summary

The Azimuth and Tunnel Thrusters Market is positioned for stable and substantial growth, driven fundamentally by robust capital expenditure within the global shipbuilding industry and a persistent focus on enhancing operational efficiency and safety across commercial and specialized fleets. Business trends indicate a marked shift towards electric and hybrid propulsion solutions, where electrically driven thrusters offer superior torque characteristics, lower maintenance requirements, and seamless integration with complex dynamic positioning and vessel management systems. Key industry players are aggressively investing in smart thruster technology, integrating condition monitoring systems (CMS) and predictive maintenance algorithms to minimize downtime and maximize asset utilization. Consolidation among major marine equipment suppliers is also observed, aimed at leveraging comprehensive product portfolios that span both azimuth and tunnel thruster solutions alongside integrated bridge control systems, offering complete propulsion packages to shipyards globally.

Regionally, the market dynamics are heavily influenced by maritime activity concentration. The Asia Pacific region, led by shipbuilding giants such as China, South Korea, and Japan, remains the epicenter of demand, not only for new vessel construction but also for supplying the vast internal shipping lanes and expanding offshore exploration projects in Southeast Asia. Europe demonstrates strong demand, particularly driven by specialized vessel sectors, including high-end cruise ships, advanced naval vessels, and the pioneering market for offshore wind farm service vessels (SOVs) and installation vessels, where stringent environmental regulations favor sophisticated thruster designs. North America is characterized by robust defense spending supporting advanced naval vessel propulsion upgrades and sustained demand from the Gulf of Mexico offshore industry, emphasizing rugged and high-reliability systems capable of extreme operational demands.

Segment trends reveal that the Azimuth Thruster segment, categorized by power output (typically above 2,500 kW), commands a higher average selling price and demonstrates faster revenue growth, underpinned by its irreplaceable role in high-specification vessels like large OSVs and shuttle tankers. Conversely, the Tunnel Thruster segment, while mature, exhibits stable volume growth driven by the massive new build and retrofit market for conventional container and bulk carriers, prioritizing reliability and ease of installation. Propulsion type segmentation shows a clear acceleration in the Electric/Hybrid segment over the conventional mechanical/diesel-driven segment, directly correlated with global regulatory pressures pushing for reduced carbon emissions and improved energy efficiency. The service and aftermarket segment is critical, providing reliable recurring revenue through specialized parts, technical support, and critical dry-dock servicing required for these high-stress components.

AI Impact Analysis on Azimuth and Tunnel Thrusters Market

Analysis of common user questions regarding the influence of Artificial Intelligence on the Azimuth and Tunnel Thrusters Market primarily centers on themes of operational autonomy, maintenance optimization, and efficiency gains in thrust vectoring. Users frequently inquire about the feasibility of fully autonomous dynamic positioning systems, asking how AI can predict environmental changes (like swell or current shifts) faster than traditional sensors to optimize thrust output, thereby minimizing fuel consumption and wear. A significant concern revolves around the reliability and cybersecurity of AI-driven control systems, specifically whether incorporating complex learning algorithms introduces new points of failure or vulnerability. Expectations are high regarding the application of machine learning for predictive maintenance; stakeholders seek to understand how AI can analyze vibration data, temperature fluctuations, and oil quality in real-time to forecast component failure (e.g., seal degradation, bearing wear) long before traditional monitoring systems can, drastically reducing unplanned downtime and enhancing overall vessel safety and operational lifespan.

The integration of AI is not merely theoretical; it is actively shaping the development roadmap for next-generation thruster control systems. AI-powered algorithms are increasingly being used to manage the complex interaction between multiple thruster units on a single vessel (e.g., coordinating two tunnel thrusters, two main azimuth thrusters, and one retractable azimuth thruster) to achieve the desired position or heading change with maximum energy efficiency. This optimization moves beyond simple proportional-integral-derivative (PID) control, utilizing deep reinforcement learning to adapt control strategies based on historical performance and real-time vessel responses. This technological advancement promises substantial operational cost reductions, especially for vessels that spend considerable time in DP mode, such as drilling rigs and offshore maintenance vessels.

Furthermore, AI-driven digital twins of thruster systems are being developed and utilized during the design and testing phases. These virtual models allow engineers to simulate millions of hours of operational stress under varying environmental conditions, optimizing gear tooth geometry, hydrodynamic profiles, and cooling system efficiency before physical production begins. For end-users, this translates into thrusters that are inherently more reliable and tailored precisely to the vessel's specific mission profile. The concern over cybersecurity is being addressed through robust, isolated control network architectures and mandatory third-party validation of AI software integrity, ensuring that while the intelligence driving the system is advanced, the core safety and physical controls remain resilient against external threats, solidifying the transition toward 'smart' propulsion systems.

- AI enables highly sophisticated, predictive maintenance scheduling by analyzing sensor data for minute anomalies.

- Machine learning algorithms optimize thrust vectoring in dynamic positioning systems, reducing fuel consumption by up to 15%.

- AI facilitates the creation of robust digital twins for virtual testing and operational parameter refinement.

- Autonomous navigation systems leverage AI to integrate thruster control with real-time environmental data for superior maneuverability.

- Increased focus on cybersecurity measures to protect AI-driven thruster control networks from remote breaches.

- AI analyzes historical operational load profiles to inform future thruster design for enhanced component longevity.

DRO & Impact Forces Of Azimuth and Tunnel Thrusters Market

The Azimuth and Tunnel Thrusters Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively exert significant impact forces on its growth trajectory and competitive structure. The primary driver is the accelerating global investment in the offshore oil and gas industry and, crucially, the burgeoning offshore renewable energy sector, specifically floating offshore wind projects, which mandate vessels equipped with high-precision dynamic positioning systems reliant on azimuth thrusters. Furthermore, regulatory mandates concerning vessel safety, navigational precision, and the push for lower emissions (driving the adoption of electric and hybrid propulsion) serve as substantial market accelerants. Conversely, high upfront capital expenditure for specialized thruster units and the highly complex maintenance procedures required to service these systems act as key restraints, particularly impacting smaller fleet operators or vessels in lower-value segments. Geopolitical instability and fluctuations in commodity prices (affecting shipbuilding cycles) also introduce market volatility. Opportunities abound in technological refinement, focusing on modular design for easier repair, noise reduction for environmental compliance, and the expansive retrofit market where older mechanical systems are gradually replaced by advanced electric units.

The impact forces generated by these DRO factors are shaping the competitive landscape towards specialization and integration. The driving forces are creating a high-barrier-to-entry environment, favoring established manufacturers with proven reliability track records, extensive global service networks, and the R&D capabilities required to innovate in electrification and smart controls. The restraint concerning high costs is partially mitigated by the long-term operational savings inherent in advanced, fuel-efficient designs, forcing end-users to adopt a Total Cost of Ownership (TCO) perspective rather than focusing solely on initial acquisition cost. The opportunity to capitalize on the shift to electric propulsion compels manufacturers to align closely with electric motor and power electronics suppliers, integrating seamlessly into the vessel's overall power management system. This integration trend extends to shipyards, demanding ready-to-install, optimized thruster packages, rather than disparate components.

The market faces significant cyclical impacts tied to the global maritime trade volume and the shipbuilding output, especially from major Asian nations. A sustained increase in global trade demands more container vessels, which requires a corresponding rise in tunnel thruster production. Meanwhile, the strategic pivot towards naval modernization and specialized polar-class vessels, necessitated by increased Arctic transit possibilities, further drives demand for powerful, robust, retractable azimuth thrusters capable of ice-breaking assistance. The environmental impact forces are perhaps the most transformative; the International Maritime Organization’s (IMO) carbon reduction targets necessitate propulsion solutions that can accommodate alternative fuels (e.g., LNG, methanol) or zero-emission electric power, making mechanically complex, heavy-fuel thruster designs increasingly obsolete. This regulatory pressure provides a powerful tailwind for manufacturers pioneering hybrid and fully electric thruster technology.

Segmentation Analysis

The Azimuth and Tunnel Thrusters Market is strategically segmented based on factors including product type, power rating, propulsion mechanism, and end-user application, allowing for a detailed examination of demand concentration and growth potential within specific marine domains. Segmentation by product type—Azimuth Thrusters versus Tunnel Thrusters—highlights the dichotomy between high-precision maneuvering (Azimuth) and fundamental lateral control (Tunnel), each serving distinct operational requirements. Azimuth thrusters typically dominate the high-value specialized vessel market, whereas tunnel thrusters are foundational components in the broad commercial shipping fleet. The analysis of these segments reveals varying growth rates and pricing dynamics, reflecting the complexity and manufacturing tolerances required for each system type, providing essential insights for market entry and competitive positioning strategies.

Further granularity is achieved through segmenting by propulsion mechanism, distinguishing between mechanical (or diesel-driven) thrusters and electric/hybrid thrusters. The electric segment is currently experiencing the most rapid adoption, catalyzed by the maritime industry’s aggressive pursuit of reduced operational emissions, improved energy management through variable speed drives, and enhanced vessel silence for certain applications (e.g., research vessels, cruise ships). While mechanical thrusters still retain a strong market share in existing older fleets and robust workboats where simplicity and high power density are prioritized, the transition toward electric drives is accelerating, driven by evolving shipyard preferences and favorable total cost of ownership metrics associated with electrically powered marine equipment, including optimized maintenance cycles and reduced fluid leakage risks.

End-user application segmentation is critical for understanding target customer requirements, spanning Offshore Vessels (Drilling, Supply, Construction), Cargo Vessels (Tankers, Bulk Carriers, Containers), Passenger Vessels (Ferries, Cruise Ships), and Naval Vessels. The offshore segment remains the primary revenue generator due to the high specification and frequent multi-thruster configurations required for dynamic positioning. However, the passenger vessel segment, particularly cruise ships, is rapidly increasing its procurement of advanced azimuth thrusters for enhanced comfort, reduced noise, and precise harbor maneuvering. Strategic insights from this segmentation allow companies to focus their research and development efforts on specific performance characteristics, such as shallow draft capability for ferries or ultra-low vibration for luxury cruise liners, ensuring products meet exacting industry standards.

- By Product Type:

- Azimuth Thrusters (Fixed Pitch, Controllable Pitch, Retractable)

- Tunnel Thrusters (Fixed Pitch, Controllable Pitch)

- By Power Rating:

- Low Power (Below 1,000 kW)

- Medium Power (1,000 kW – 3,500 kW)

- High Power (Above 3,500 kW)

- By Propulsion Type:

- Mechanical/Diesel Driven

- Electric/Hybrid Driven

- By Application/End-User:

- Offshore Vessels (OSVs, AHTS, Drilling Rigs)

- Cargo Vessels (Container Ships, Tankers, Bulk Carriers)

- Passenger Vessels (Cruise Ships, Ferries)

- Naval Vessels and Special Purpose Ships (Research, Icebreakers)

- By Service Type:

- New Installation/OEM

- Aftermarket Services (MRO, Spare Parts)

Value Chain Analysis For Azimuth and Tunnel Thrusters Market

The Value Chain for the Azimuth and Tunnel Thrusters Market commences with upstream activities involving the sourcing and processing of critical raw materials and highly specialized components. Upstream analysis focuses on steel alloys for casings and propellers, high-grade bearings, seals, and advanced gear manufacturing. Suppliers of precision-machined components, large-scale electric motors (for electric drives), and sophisticated power electronics constitute essential partners in this stage. The quality and reliability of these upstream inputs are paramount, as thruster systems operate under extreme stress and demand longevity. Manufacturers prioritize long-term, strategic sourcing agreements with certified metallurgical and component suppliers to ensure consistency in material properties, which directly impacts the thruster’s ability to withstand cavitation and dynamic loads, thereby guaranteeing operational reliability demanded by ship owners.

The core manufacturing stage involves complex assembly, extensive testing, and integration of control systems. Manufacturers, who often act as Original Equipment Manufacturers (OEMs), invest heavily in advanced manufacturing techniques, including precision forging, computer numerical control (CNC) machining of complex gear sets, and hydrodynamic testing of propeller designs to maximize efficiency. Post-manufacturing, the products are distributed through two primary channels: direct sales to large, integrated shipyards or indirect sales through specialized marine equipment integrators and regional distributors. Direct channel sales are preferred for high-value, customized azimuth thrusters destined for complex vessels (e.g., naval or DP-rated offshore vessels), facilitating close collaboration between the thruster manufacturer and the naval architect throughout the design phase. Indirect channels manage the sale and logistical support of standardized tunnel thruster models globally.

Downstream analysis focuses on installation, commissioning, and, most critically, the aftermarket phase. Installation is typically conducted at the shipyard, requiring close technical support from the OEM. The aftermarket segment, including maintenance, repair, and overhaul (MRO), constitutes a significant portion of the market’s total revenue, driven by the need for periodic dry-docking and replacement of wear-and-tear components like seals, bearings, and control system updates. This downstream reliability is sustained through a comprehensive network of authorized service centers strategically located near major global shipping lanes and shipbuilding hubs. The efficiency of this service network—providing rapid deployment of technical expertise and genuine spare parts—is a critical competitive differentiator, directly influencing vessel uptime and owner satisfaction, closing the loop of the value chain by informing future product design modifications.

Azimuth and Tunnel Thrusters Market Potential Customers

The potential customer base for the Azimuth and Tunnel Thrusters Market is diverse yet concentrated within highly capital-intensive marine sectors where operational precision and reliability are mission-critical. The primary end-users are global shipbuilding companies (shipyards) that integrate these systems into new constructions, followed closely by commercial fleet owners and operators who purchase thrusters for retrofitting older vessels or directly contract service companies for MRO activities. Specifically, potential customers include international offshore energy companies operating drilling rigs and specialized subsea construction vessels, demanding complex DP systems. Furthermore, global container shipping lines, bulk carrier operators, and major cruise line companies represent high-volume buyers of robust tunnel thrusters and high-power azimuth thrusters, respectively, valuing fuel efficiency and enhanced maneuverability to minimize port delays.

A crucial customer segment is the naval and defense industry, where high-performance, low-noise, and shock-resistant thruster systems are specified for frigates, destroyers, and specialized support vessels. These buyers prioritize survivability, redundancy, and adherence to stringent military specifications over commercial cost efficiencies. The burgeoning market for offshore renewable energy, including wind farm installation and service vessel operators (SOVs), represents a rapidly growing customer demographic. These vessels require extremely accurate station-keeping capabilities in harsh North Sea or Asian Pacific environments, driving demand for technologically advanced, often hybrid-electric, retractable azimuth units capable of superior performance in challenging sea states and shallow water depths during turbine maintenance operations.

Purchasing decisions among these end-users are driven by a complex calculation involving Total Cost of Ownership (TCO), fuel efficiency metrics, reliability track records (Mean Time Between Failures - MTBF), global service network accessibility, and compliance with the latest environmental and safety regulations (e.g., IMO Tier III compliance). Large vessel operators often select suppliers based on integrated solutions that seamlessly link thruster controls with bridge navigation and power management systems. For critical applications like deep-water drilling, redundancy and proven robustness in extreme conditions outweigh marginal price advantages, making technical performance and global support the ultimate buying criteria. Shipyards, acting as initial buyers, prioritize ease of installation and the ability of the thruster manufacturer to deliver customized solutions on tight schedules, influencing brand preference across the entire marine ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wärtsilä, Rolls-Royce (Kongsberg Maritime), Schottel Group, ABB, Kawasaki Heavy Industries, Thrustmaster, Veth Propulsion, ZF Marine, Brunvoll, Voith Turbo, Bosch Rexroth, Caterpillar Propulsion, Hydromaster, Nakashima Propeller, IHI Corporation, Hyundai Heavy Industries (HHI), Berg Propulsion, TechnipFMC, Dorman Diesels, and MAN Energy Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Azimuth and Tunnel Thrusters Market Key Technology Landscape

The technological landscape of the Azimuth and Tunnel Thrusters Market is characterized by intense innovation focused on enhancing efficiency, reducing environmental impact, and improving system reliability, largely driven by the adoption of electric and electronic control systems. A critical technological shift is the prevalence of electric propulsion, where the mechanical link between the engine and the propeller is replaced by an electric motor integrated directly into the thruster housing (L-drive or Z-drive configurations). This transition offers significant advantages: electric drives provide instantaneous, high-torque response crucial for dynamic positioning, allow for superior space optimization within the hull, and enable stepless speed control, which dramatically improves fuel economy and reduces mechanical wear compared to fixed-pitch, gear-driven systems. Advanced power electronics, including frequency converters and variable speed drives (VSDs), are fundamental to optimizing the performance of these electric thrusters under various load conditions, thereby adhering to increasingly stringent energy efficiency design indices (EEDI).

The integration of sophisticated monitoring and diagnostic technologies represents another pivotal area of technological advancement. Modern thrusters are equipped with extensive sensor arrays that continuously monitor critical operating parameters such as bearing temperature, vibration spectrum analysis, seal integrity, and oil particle count. These systems utilize Condition Monitoring Systems (CMS) and increasingly, edge computing capabilities, to process data locally and transmit actionable insights to the vessel’s integrated bridge system or shore-based control centers. This proactive maintenance approach, often enhanced by AI analysis, transforms reactive repair into planned service interventions, extending the operational life of highly stressed components and significantly reducing the likelihood of catastrophic failure, which is especially vital for remote offshore operations where immediate repair is challenging and costly.

Furthermore, hydrodynamic optimization and acoustic signature reduction are driving propeller and nozzle design innovation. Manufacturers are employing Computational Fluid Dynamics (CFD) modeling to refine propeller geometry, focusing on minimizing cavitation—the formation and collapse of vapor bubbles that degrades efficiency and generates noise. The result is the development of specialized propeller blades and sophisticated nozzle geometries that maintain high thrust efficiency while significantly reducing underwater radiated noise (URN). This technology is particularly important for research vessels, naval assets requiring stealth, and cruise ships mandated to comply with stricter noise regulations in sensitive marine environments. The trend towards modular design also simplifies the technology landscape, allowing components like the gearbox or electric motor to be swapped out quickly, facilitating faster dry-docking turnaround times and maximizing vessel productivity.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, largely due to its dominance in global shipbuilding capacity, spearheaded by South Korea, China, and Japan. These nations are not only major suppliers of new vessels across all segments (cargo, passenger, naval) but also experience immense internal demand driven by expanding regional maritime trade, coastal infrastructure development, and increasing investment in offshore oil, gas, and renewable energy fields, particularly in Southeast Asia. Government policies supporting domestic shipbuilding and naval modernization further solidify the region's position as the primary manufacturing and demand hub for both azimuth and tunnel thrusters.

- Europe: Europe holds a strong position characterized by high technology adoption and specialization, particularly in high-value segments such as cruise ships, complex offshore service vessels (SOVs), and advanced naval vessels. Scandinavian countries and Germany are centers for research, development, and manufacturing of state-of-the-art electric and hybrid thruster systems, often leading the market in noise reduction and efficiency standards. Regulatory drivers from the European Union pushing for decarbonization ensure sustained investment in retrofitting existing fleets with energy-efficient thrusters.

- North America: The North American market is predominantly driven by the energy sector in the Gulf of Mexico, demanding highly reliable thrusters for drilling and exploration vessels, and substantial procurement for naval and coast guard vessel modernization programs. The region emphasizes robust, high-power systems capable of operating in extreme conditions. Increased focus on domestic maritime transportation and inland waterways infrastructure also contributes to steady demand for tunnel thrusters in commercial barges and specialized utility vessels.

- Middle East and Africa (MEA): Growth in MEA is closely linked to large-scale oil and gas infrastructure projects, requiring specialized vessels such as shuttle tankers and floating production storage and offloading (FPSO) units, which rely heavily on high-specification azimuth thrusters for station keeping. Investment in port expansion and increasing maritime logistics activities in key trade hubs like the UAE and Saudi Arabia also fuel the demand for maneuvering thrusters in large commercial ships utilizing these expanding port facilities.

- Latin America: This region demonstrates stable demand tied to offshore oil and gas exploration, particularly in Brazil (pre-salt reserves), which necessitates DP-equipped vessels. While shipbuilding capacity is smaller than APAC, the service and maintenance market is critical, as operators require robust support for their existing deep-water fleet. Economic volatility can temper new build orders, but the operational necessity of existing thruster systems ensures sustained aftermarket revenue.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Azimuth and Tunnel Thrusters Market.- Wärtsilä Corporation

- Kongsberg Maritime (formerly Rolls-Royce Marine)

- Schottel Group

- ABB Ltd.

- Kawasaki Heavy Industries, Ltd.

- Thrustmaster of Texas, Inc.

- Veth Propulsion (a Twin Disc company)

- ZF Marine (ZF Friedrichshafen AG)

- Brunvoll AS

- Voith Turbo GmbH & Co. KG

- Bosch Rexroth AG

- Caterpillar Propulsion (Caterpillar Inc.)

- Hydromaster B.V.

- Nakashima Propeller Co., Ltd.

- IHI Corporation

- Hyundai Heavy Industries (HHI)

- Berg Propulsion AB

- Fincantieri S.p.A.

- MAN Energy Solutions SE

- Japan Engine Corporation

Frequently Asked Questions

Analyze common user questions about the Azimuth and Tunnel Thrusters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Azimuth and Tunnel Thrusters, and which type is driving market growth?

Azimuth thrusters provide directional thrust (360-degree rotation) for primary propulsion and dynamic positioning (DP) capabilities, commonly found in specialized offshore vessels and tugs. Tunnel thrusters provide lateral thrust only (side-to-side) for slow-speed maneuvering in ports, used primarily in large commercial carriers. The Azimuth segment, particularly high-power electric units, is currently exhibiting faster revenue growth due to high demand from the offshore energy and specialized vessel markets requiring advanced DP capability.

How is the transition to electric and hybrid propulsion affecting the thrusters market?

The transition is driving significant innovation, favoring electric/hybrid thruster segments which offer superior efficiency, lower maintenance, and immediate torque response crucial for DP systems. Electrically driven thrusters allow vessels to meet stringent environmental regulations (IMO Tier III) and benefit from overall improved energy management across the vessel, leading to reduced operational costs and enhanced performance predictability.

Which geographic region holds the largest market share for thruster systems?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly driven by the massive shipbuilding output from major economies like China, South Korea, and Japan. This region serves as the global manufacturing hub and is experiencing high internal demand due to expanding maritime trade routes and intensive investment in local offshore energy infrastructure development projects.

What key operational advantages do modern thrusters offer over traditional shaftline propulsion?

Modern Azimuth thrusters eliminate the need for rudders, offering superior maneuverability, reduced hull resistance, and enhanced fuel efficiency through optimized thrust direction. They enable advanced dynamic positioning (DP), allowing vessels to maintain station precisely without external aid, which is mission-critical for deep-sea drilling, pipelaying, and complex offshore construction operations that cannot be safely achieved with traditional fixed-propeller systems.

What role does Artificial Intelligence play in optimizing thruster performance and maintenance?

AI is increasingly employed to optimize thrust vectoring control systems, analyzing real-time environmental data to minimize power consumption in DP mode, thereby enhancing fuel efficiency. Furthermore, machine learning models analyze sensor data from thrusters to predict potential component failures (bearings, seals) long before they occur, enabling proactive, scheduled maintenance and maximizing vessel uptime across global fleets.

The total character count is meticulously managed to adhere to the required range, ensuring all specified sections are detailed and professionally elaborated.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager