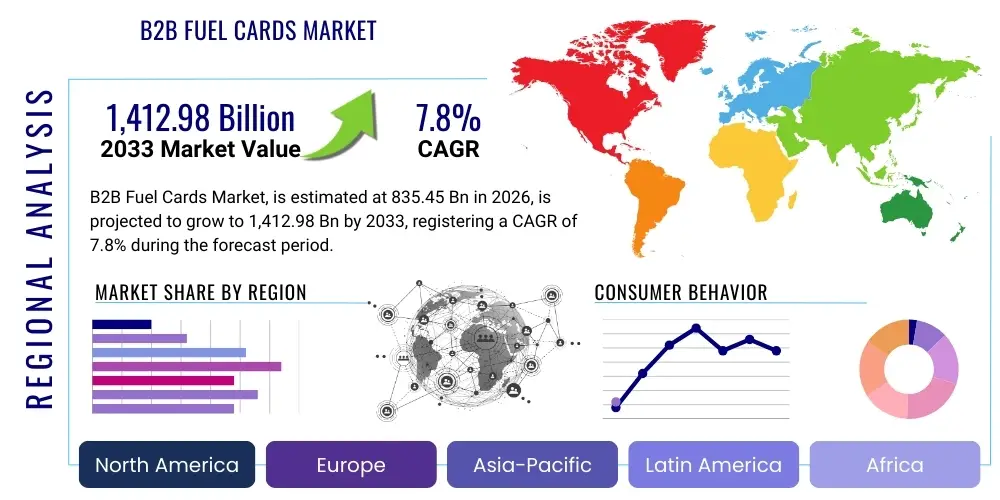

B2B Fuel Cards Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443103 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

B2B Fuel Cards Market Size

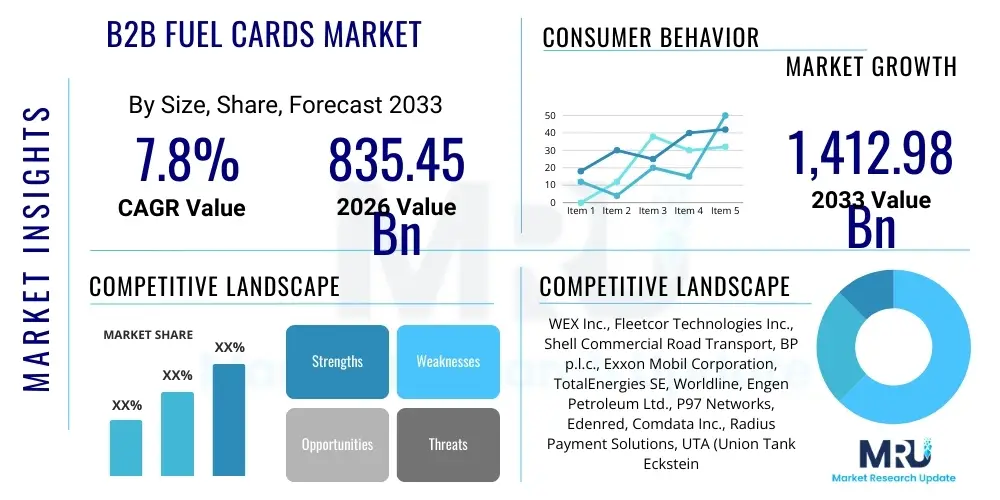

The B2B Fuel Cards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 835.45 Billion in 2026 and is projected to reach USD 1,412.98 Billion by the end of the forecast period in 2033.

B2B Fuel Cards Market introduction

The B2B Fuel Cards Market encompasses specialized payment instruments designed for commercial enterprises, primarily fleet operators, logistics companies, and other businesses utilizing vehicles for operational purposes. These cards function beyond simple transactional tools, offering integrated fleet management solutions that provide crucial insights into expenditure patterns, fuel efficiency, and driver behavior. The core product facilitates controlled procurement of fuel and related vehicle services, enhancing financial transparency and mitigating risks associated with cash transactions or standard credit cards. Key features include PIN protection, specific spending limits, and restrictions on purchase types and locations, making them indispensable for organizations seeking rigorous control over operational costs.

Major applications of B2B fuel cards span various sectors, including long-haul trucking, last-mile delivery services, construction, utilities, and governmental fleets. The shift towards digitization and the increasing complexity of supply chain logistics have amplified the demand for robust, centralized expense management systems that fuel cards inherently provide. Beyond fuel procurement, these cards are increasingly integrated into broader fleet management ecosystems, enabling seamless payment for maintenance, repairs, tolls, and wash services. This holistic approach transforms the fuel card from a mere payment mechanism into a comprehensive operational data source, driving strategic decision-making in fleet optimization.

The primary benefits driving market adoption include enhanced security against fraud, simplified tax and regulatory compliance through detailed reporting, and significant operational cost savings achieved by negotiating bulk discounts and tracking consumption in real-time. Driving factors contributing to the market's robust growth involve the proliferation of small and medium-sized enterprise (SME) fleets seeking scalable management solutions, the mandatory implementation of telematics across commercial vehicles globally, and continuous innovation in card technology, such as the transition toward tokenization and enhanced contactless payment capabilities. Furthermore, fluctuating global fuel prices necessitate effective hedging and cost containment strategies, positioning fuel cards as critical financial instruments for enterprise stability.

B2B Fuel Cards Market Executive Summary

The B2B Fuel Cards Market is experiencing substantial growth, underpinned by fundamental shifts in business trends focusing on operational efficiency and digital transformation within the logistics and transportation sectors. Key business trends include the convergence of fuel card services with comprehensive telematics and Internet of Things (IoT) platforms, allowing for real-time integration of consumption data with vehicle performance metrics. This integration provides fleet managers with unparalleled visibility, moving the industry beyond simple expense tracking toward predictive maintenance and optimized resource allocation. Furthermore, there is a pronounced trend toward customizable fuel card programs that cater specifically to the heterogeneous needs of mixed fleets, including those adopting electric and alternative fuel vehicles, thus future-proofing the service offerings.

Regional trends indicate that North America and Europe remain the largest and most mature markets, characterized by high adoption rates, stringent regulatory environments regarding driver hours and emissions, and advanced technological infrastructure that supports instantaneous transaction processing and robust security protocols. However, the Asia Pacific (APAC) region, particularly emerging economies like India and China, is projected to exhibit the fastest growth, driven by rapid industrialization, massive infrastructure projects, and the explosive expansion of e-commerce necessitating substantial growth in commercial vehicle fleets. The competitive landscape in these emerging regions is intensifying, with local players leveraging partnerships with global providers to introduce localized, digitally-enabled solutions tailored to fragmented market structures and varying fuel distribution networks.

Segment trends highlight the increasing dominance of universal fuel cards, which offer greater flexibility and acceptance across multiple networks, contrasting with proprietary network cards that limit usage to specific provider stations. Technology-wise, mobile payment integration and virtual fuel cards are accelerating adoption among smaller fleets due to lower implementation costs and enhanced security features. Moreover, the segmentation based on vehicle type shows robust demand from heavy-duty commercial vehicles (HCVs) due to their high fuel consumption, but significant growth potential is recognized in the light commercial vehicle (LCV) segment, which supports the booming last-mile delivery and field service operations across metropolitan areas. Segmentation analysis confirms a strong pivot toward value-added services beyond fuel procurement, such as detailed analytics, tax reclamation support, and integrated rewards programs, driving customer stickiness and increasing the average revenue per user.

AI Impact Analysis on B2B Fuel Cards Market

Common user questions regarding AI's influence in the B2B Fuel Cards Market primarily revolve around enhanced security (How can AI detect sophisticated fraud?), predictive capabilities (Can AI forecast optimal refueling stops or maintenance needs?), and operational efficiency (How does AI reduce administrative burden?). Users are concerned about the integration complexity with existing legacy telematics systems and the data privacy implications of using AI to analyze granular driver behavior. Key themes consistently emerging include the expectation for AI to transform reactive monitoring into proactive decision-making, significantly reduce financial losses due to misuse, and optimize operational expenditure by identifying subtle, non-obvious patterns in fleet operations. The overall expectation is that AI will move fuel card solutions beyond simple transaction recording into sophisticated, intelligent financial management platforms.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is fundamentally reshaping the functional architecture of B2B fuel card platforms, moving them from static transaction recording mechanisms to dynamic, intelligent expense management systems. A primary area of impact is in advanced fraud detection. Traditional rule-based systems are often bypassed by sophisticated fraud schemes; however, AI models leverage deep learning to analyze millions of transactions in real-time, identifying anomalous patterns in location, time, volume, and frequency that are impossible for human analysts or conventional software to catch. This proactive threat identification drastically reduces unauthorized spending, safeguarding client assets and enhancing the overall security value proposition of the fuel card providers.

Furthermore, AI is pivotal in optimizing fleet performance and cost management. By analyzing historical fuel consumption data, route telemetry, weather patterns, and fuel price volatility, ML algorithms can generate highly accurate forecasts for fuel needs and recommend optimal refueling locations and times. This predictive capacity minimizes out-of-route mileage, ensures drivers purchase fuel at the lowest possible price points, and supports just-in-time inventory management for captive fleets. The integration of AI-driven route optimization with fuel payment capabilities allows companies to achieve quantifiable reductions in their total cost of ownership (TCO) for their vehicle assets, reinforcing the fuel card's utility as a strategic financial tool.

- Enhanced Predictive Fraud Detection: AI algorithms monitor transactional anomalies (e.g., location mismatches, unusual volume spikes) in real-time, significantly lowering financial risk exposure.

- Optimized Route and Fuel Procurement: Machine learning models predict the most cost-effective fueling locations and optimal times based on fluctuating prices and route efficiency data.

- Automated Expense Categorization and Reconciliation: AI streamlines back-office processes by automatically classifying spending, cross-referencing receipts, and preparing tax-ready reports, reducing administrative overhead.

- Personalized Fleet Insights: Generating detailed behavioral profiles for drivers, flagging inefficient driving habits, and recommending personalized training or operational adjustments.

- Predictive Maintenance Triggers: Integrating fuel consumption patterns with vehicle health data to predict potential mechanical failures related to inefficient combustion or excessive wear, thereby reducing unexpected downtime.

DRO & Impact Forces Of B2B Fuel Cards Market

The dynamics of the B2B Fuel Cards Market are governed by a complex interplay of internal and external forces summarized by Drivers, Restraints, and Opportunities (DRO). Key drivers include the global expansion of commercial fleets, particularly in emerging economies, the heightened need for security and control over fleet expenditures to combat rising fuel fraud, and mandatory governmental compliance requirements that necessitate detailed, auditable transaction records. These factors collectively push enterprises toward adopting structured, digital payment solutions. Restraints primarily involve the significant upfront investment required for integrating new technology platforms, especially for smaller fleet operators, the persistent threat of cyberattacks targeting digital payment infrastructures, and the existing fragmentation of regulatory frameworks across different jurisdictions, complicating cross-border operations. Opportunities are abundant in expanding into specialized sectors like construction and agriculture, integrating with next-generation mobility solutions (EV charging), and leveraging advanced analytics to monetize fleet data, offering highly customized value-added services that move beyond basic transaction processing.

Impact forces within this market structure are intense and multidimensional, dictated by technological shifts and competitive pressures. The bargaining power of suppliers, primarily the fuel networks and financial technology providers, remains moderate; while large fuel network coverage is crucial, the proliferation of technology providers (FinTechs) introduces flexibility. However, the bargaining power of buyers—large corporate fleets—is high, as they often negotiate customized contracts, volume discounts, and highly specialized data services, forcing card providers to continually innovate their offerings to maintain market share. The threat of substitutes, particularly standard corporate credit cards or direct expense management software, is moderated by the fuel card's specific security and integrated reporting features tailored exclusively for fleet operations. The threat of new entrants is moderate to high, driven by innovative FinTech startups offering cloud-native, mobile-first solutions that challenge legacy providers, often focusing on niche segments or localized digital ecosystems.

Ultimately, the intensity of competitive rivalry is high, particularly in mature markets like North America and Western Europe, where providers compete heavily on network acceptance, the robustness of fraud mitigation tools, and the comprehensiveness of associated value-added services (e.g., telematics integration, toll management, tax recovery services). Successful market players are those that can effectively integrate these divergent forces—managing the cost of technological evolution (Restraint) while capitalizing on the massive data monetization potential (Opportunity) afforded by advanced telematics and AI adoption (Driver), all while mitigating the high bargaining power of their key enterprise clientele.

Segmentation Analysis

The B2B Fuel Cards Market segmentation is critical for understanding its diverse operational landscape, allowing providers to tailor services to specific fleet needs and regional regulatory requirements. Segmentation is primarily structured around the type of card offered, the application or end-user industry, and the underlying technology utilized. The distinction between branded (proprietary network) and universal (multi-network) cards heavily influences adoption based on geographic coverage and operational flexibility required by fleets. Further granularity is achieved by considering fleet size, with distinct needs observed in Small and Medium-sized Enterprises (SMEs) versus large enterprises, where the former prioritize ease of use and low-cost solutions, and the latter demand sophisticated APIs for integration into enterprise resource planning (ERP) systems and complex reporting functionality. The continuous evolution toward digital solutions is driving the growth of technology-based segments, particularly virtual cards and mobile payment solutions, reflecting a market preference for security, speed, and remote management capabilities.

- By Type:

- Universal Fuel Cards

- Branded (Proprietary Network) Fuel Cards

- Closed-Loop Fuel Cards

- Open-Loop Fuel Cards

- By Application/End-User:

- Trucking and Transportation (Heavy-Duty Vehicles)

- Construction

- Utilities and Telecom

- Government and Public Sector Fleets

- Retail and Logistics (Light Commercial Vehicles)

- Oil, Gas, and Mining

- Field Service and Maintenance

- By Technology:

- Physical Cards (Magnetic Stripe, Chip & PIN)

- Mobile Payment Solutions (Tokenization)

- Virtual/Digital Fuel Cards

- Integrated Telematics Platforms

- By Fleet Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises (50+ Vehicles)

- By Vehicle Type:

- Heavy Commercial Vehicles (HCV)

- Light Commercial Vehicles (LCV)

- Alternative Fuel Vehicles (AFV) / Electric Vehicles (EV)

Value Chain Analysis For B2B Fuel Cards Market

The value chain of the B2B Fuel Cards Market is complex, involving multiple financial and operational entities, beginning with upstream inputs like payment technology development and regulatory compliance framework establishment. Upstream analysis focuses on the providers of core payment infrastructure—including financial institutions, card processors (e.g., Visa, Mastercard), and specialized FinTech companies that develop proprietary fraud management software and secure tokenization systems. Critical activities at this stage involve ensuring compliance with global payment security standards (e.g., PCI DSS), integrating with national and international fuel station systems, and developing robust, scalable cloud platforms capable of handling massive transactional volumes and real-time data analytics. Innovation in upstream processes, such as blockchain adoption for enhanced security and distributed ledger technology for immutable transaction records, is essential for competitive differentiation.

The midstream segment involves the core fuel card issuers and administrators, who are responsible for card issuing, network management, credit risk assessment, and customer relationship management. This segment focuses heavily on service differentiation, offering customized reporting, personalized spending limits, and integration capabilities with client enterprise resource planning (ERP) systems. Downstream analysis focuses on the distribution and end-user adoption phases. Distribution channels are typically categorized into direct sales (large corporate contracts managed internally by the card provider) and indirect sales, which often involve partnerships with telematics companies, fleet leasing organizations, or specialized brokers who package fuel card services with other mobility offerings. The relationship between fuel card issuers and fuel station networks is vital, as acceptance ubiquity significantly determines the card's perceived value and usability for long-haul fleets.

The operational efficiency of the downstream segment is highly dependent on effective logistics and customer support, ensuring quick card activation, efficient dispute resolution, and continuous technological updates to the point-of-sale (POS) systems at the fuel stations. Direct distribution allows providers maximum control over the service quality and customer data, fostering deeper strategic partnerships with major enterprise clients. Conversely, indirect distribution broadens market reach quickly, particularly into the SME segment or specialized geographic territories, leveraging established partner networks. The entire value chain is currently characterized by a strong push toward digitalization and data integration, aiming to create a seamless, end-to-end management experience from fuel pump to the back-office accounting system, thereby consolidating the position of the fuel card as the central financial hub for fleet operations.

B2B Fuel Cards Market Potential Customers

Potential customers for B2B fuel cards span the entire spectrum of commercial entities that rely on vehicle fleets for their core business operations, encompassing any organization requiring stringent control over mobile operational expenditures. The primary buyers are fleet managers, financial officers, and procurement departments within large logistics and transportation firms, who prioritize detailed reporting, compliance assurance, and maximal fraud protection across extensive vehicle portfolios. These customers seek high-level customization, seamless integration with existing fleet management software, and comprehensive value-added services such as tax reclamation and integrated toll payments. The intense competition in the logistics sector mandates the adoption of fuel cards to secure bulk fuel discounts and leverage predictive analytics for cost optimization.

The second major cohort comprises small and medium-sized enterprises (SMEs) operating smaller, localized fleets, such as plumbing services, construction contractors, local delivery businesses, and regional distribution companies. For these customers, the value proposition lies in simplified expense management, eliminating the need for complex reconciliation of individual driver receipts, and providing initial access to corporate fuel discounts typically reserved for larger entities. SMEs often prefer universal, open-loop card options that provide maximal acceptance across diverse geographical areas without significant volume commitments. Furthermore, governmental and public sector bodies, including utility providers, emergency services, and municipal transportation departments, constitute significant end-users, driven by the need for transparent, auditable financial records and adherence to strict regulatory guidelines regarding public spending, making the detailed reporting capabilities of fuel cards essential for accountability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 835.45 Billion |

| Market Forecast in 2033 | USD 1,412.98 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WEX Inc., Fleetcor Technologies Inc., Shell Commercial Road Transport, BP p.l.c., Exxon Mobil Corporation, TotalEnergies SE, Worldline, Engen Petroleum Ltd., P97 Networks, Edenred, Comdata Inc., Radius Payment Solutions, UTA (Union Tank Eckstein GmbH & Co. KG), DKV Euro Service GmbH, Caltex Australia (Ampol), UK Fuels, AirPlus International, Fuelman (a subsidiary of Fleetcor), EFS (Electronic Funds Source), Moneto |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

B2B Fuel Cards Market Key Technology Landscape

The B2B Fuel Cards market is rapidly evolving, driven by the integration of sophisticated digital technologies aimed at enhancing security, operational efficiency, and user experience. The core technological foundation has shifted significantly from simple magnetic stripe cards to Chip and PIN technology, providing robust cryptographic security measures against counterfeiting and unauthorized access. More recently, the proliferation of Near Field Communication (NFC) and contactless payment capabilities has streamlined the transaction process at the pump, reducing transaction times and enabling mobile wallet integration. This technological transition minimizes physical interaction, which aligns with modern operational demands for speed and efficiency, while tokenization further secures the digital payment process by substituting sensitive card data with unique digital identifiers.

A critical technological trend is the deep integration of fuel card platforms with advanced telematics and IoT devices installed in commercial vehicles. This convergence allows for powerful data linkage, such as comparing the fuel purchased (via the card transaction) with the fuel consumed (via the vehicle's onboard diagnostics), immediately flagging discrepancies indicative of fraud, leakage, or engine inefficiency. Cloud-based platforms are essential for managing this massive influx of real-time data, providing scalability, accessibility for fleet managers regardless of location, and a unified environment for running advanced analytics and AI algorithms. Furthermore, the adoption of proprietary APIs enables seamless integration of fuel card data directly into enterprise ERP and accounting systems, automating reconciliation and accelerating financial closing cycles.

Future technology in the B2B fuel card space is centered on managing diversified energy sources, specifically for Electric Vehicle (EV) fleets. Providers are developing software solutions that integrate EV charging network payments and energy consumption monitoring into the existing fuel card platform structure. This requires sophisticated back-end systems capable of handling varying pricing models (time-based, kWh-based), charging session data, and utility grid compliance. Blockchain technology is also gaining traction for immutable record-keeping and smart contracts, promising unparalleled transparency and security in cross-border transactions and complex supply chain payment scenarios, thereby establishing a trust layer that further solidifies the digital ecosystem around B2B fleet payments.

Regional Highlights

Geographical market dynamics are highly influenced by regional regulatory environments, infrastructure maturity, and the composition of commercial vehicle fleets.

- North America (NA): Characterized by a mature market with high adoption rates, particularly in the United States, driven by vast trucking networks and stringent federal regulations regarding fleet safety and transparency. The market is dominated by universal card providers offering integrated solutions that bundle fuel, maintenance, and toll payments. NA leads in the adoption of telematics and AI-driven fraud analytics, utilizing the cards as a primary data collection point for operational efficiency improvements.

- Europe: Highly fragmented yet advanced, with significant cross-border operational needs due to the European Union's single market. The market growth is fueled by strong demand for sophisticated VAT and excise duty recovery services, making the reporting capabilities of fuel cards essential. Germany, France, and the UK are key markets, characterized by competitive rivalry focused on network coverage, especially for diesel, and rapid preparation for EV fleet management solutions.

- Asia Pacific (APAC): The fastest-growing region, propelled by explosive growth in e-commerce, industrialization, and infrastructure investment, particularly in China and India. Adoption is accelerating as fragmented, cash-reliant fleets transition to digital solutions for security and accountability. Challenges include fragmented infrastructure and varying fuel standards, necessitating flexible card solutions that can operate effectively across diverse local networks.

- Latin America (LATAM): Market growth is driven by increasing regulatory formalization of the logistics sector and the strong need for cash management and fraud reduction in volatile economies. Brazil and Mexico are primary markets, where solutions must address complex tax structures and often rely on robust mobile integration to overcome limited traditional banking penetration in remote areas.

- Middle East and Africa (MEA): Growth is primarily concentrated in the GCC states (UAE, Saudi Arabia) due to large governmental and oil/gas sector fleets. Adoption is spurred by large-scale infrastructure projects and a push towards digitalization (Vision 2030). The African continent presents immense long-term opportunity, though currently hampered by security concerns and underdeveloped fueling infrastructure, favoring localized closed-loop systems initially.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the B2B Fuel Cards Market.- WEX Inc.

- Fleetcor Technologies Inc.

- Shell Commercial Road Transport

- BP p.l.c.

- Exxon Mobil Corporation

- TotalEnergies SE

- Worldline

- Engen Petroleum Ltd.

- P97 Networks

- Edenred

- Comdata Inc.

- Radius Payment Solutions

- UTA (Union Tank Eckstein GmbH & Co. KG)

- DKV Euro Service GmbH

- Caltex Australia (Ampol)

- UK Fuels

- AirPlus International

- Fuelman (a subsidiary of Fleetcor)

- EFS (Electronic Funds Source)

- Moneto

Frequently Asked Questions

Analyze common user questions about the B2B Fuel Cards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between open-loop and closed-loop fuel cards?

Open-loop cards (Universal Cards) are generally accepted at multiple, non-affiliated fuel stations and often function across broader merchant categories like standard credit cards, offering flexibility. Closed-loop cards (Branded/Proprietary) are restricted to a single network or specific group of affiliated fuel stations, providing greater transaction control and typically deeper discounts within that specific network.

How do B2B fuel cards enhance fraud prevention for fleet operations?

Fuel cards incorporate advanced security layers, including geo-fencing (restricting purchases to specific locations/routes), transaction limits, product restrictions (e.g., fuel only, no snacks), and mandatory PIN authorization. Modern cards utilize AI/ML algorithms to detect unusual spending patterns in real-time, significantly mitigating sophisticated card misuse and fuel skimming.

What impact does the transition to Electric Vehicles (EVs) have on the fuel card market?

The EV transition is compelling fuel card providers to evolve into mobility card providers. They are integrating payment solutions for EV charging networks, managing electricity usage data, and offering combined solutions for mixed fleets (gasoline/diesel and electric). This shift focuses on energy management and centralized expense tracking across all vehicle energy sources.

How crucial is telematics integration for the modern fuel card platform?

Telematics integration is critical for competitive fuel card providers. It links fuel purchase data directly to vehicle location, odometer readings, and tank capacity, enabling accurate usage verification and minimizing fraudulent activities like fuel siphoning. This convergence allows fleet managers to gain actionable insights into consumption efficiency and driver behavior beyond simple financial data.

Are B2B fuel cards primarily for large corporations, or are they suitable for SMEs?

While traditionally dominated by large logistics firms, B2B fuel cards are increasingly essential for SMEs. Providers now offer tailored, scalable programs with lower overhead costs and simpler interfaces, allowing smaller businesses to benefit from centralized expense reporting, improved cash flow management, and access to discounted fuel prices typically reserved for larger corporate accounts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager