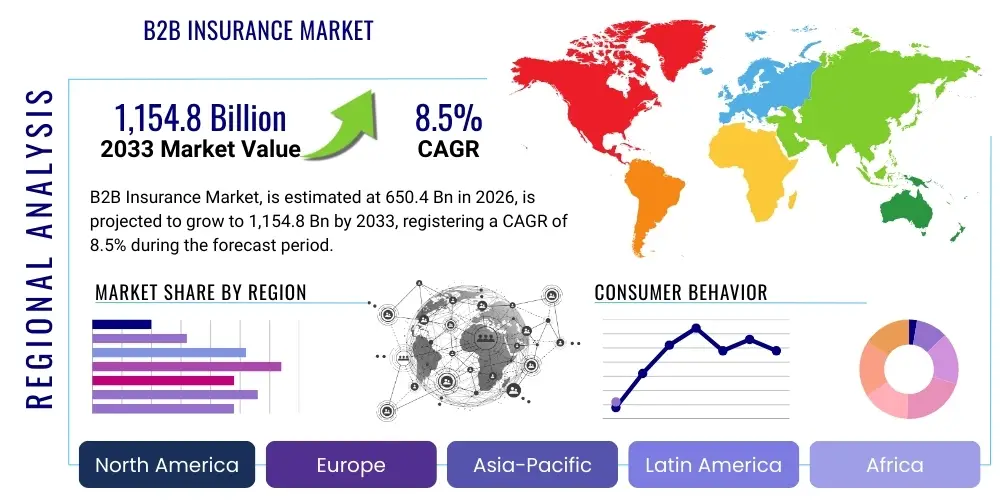

B2B Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442584 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

B2B Insurance Market Size

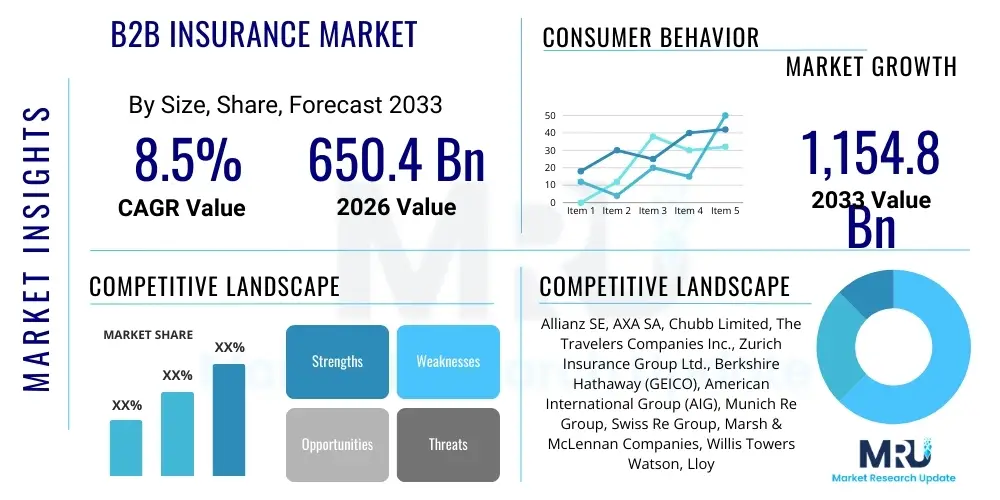

The B2B Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 650.4 Billion in 2026 and is projected to reach USD 1,154.8 Billion by the end of the forecast period in 2033.

B2B Insurance Market introduction

The B2B insurance market encompasses all insurance products and services tailored for business entities, ranging from small and medium enterprises (SMEs) to large multinational corporations (MNCs). This comprehensive sector is fundamentally driven by the inherent necessity for sophisticated risk mitigation against a widening spectrum of exposures, including tangible assets like commercial property, intangible liabilities such as professional negligence and regulatory non-compliance, employee welfare through workers' compensation schemes, and increasingly critical, complex cyber threats. Unlike the relatively standardized structure of consumer insurance, B2B offerings are intrinsically complex, demand high degrees of customization based on industry and jurisdictional requirements, and are heavily regulated, necessitating specialized underwriting expertise capable of accurately quantifying low-frequency, high-severity risks. The market’s resilience stems from its essential role in maintaining global economic stability, providing the financial backbone for businesses to operate and innovate without existential fear of catastrophic losses. Core commercial products, including general liability insurance, property damage coverage, professional indemnity, and Directors and Officers (D&O) liability, are mandated or highly recommended across virtually all industrial sectors globally.

The profound digital transformation sweeping across global commerce serves as a complex, dual-faceted force—acting as both a major driver of new risk and a catalyst for innovation within the B2B insurance domain. As businesses increasingly rely on interconnected supply chains, massive data storage via cloud services, and automation, they expose themselves to systemic vulnerabilities, notably data breaches, system failures, and intellectual property theft. Concurrently, this digital shift empowers insurers with unprecedented access to real-time data streams, utilizing tools like telematics, sophisticated Internet of Things (IoT) devices embedded in industrial assets, and advanced computational data analytics. These technologies enable a paradigm shift from historical loss analysis to predictive risk modeling, leading to improved risk selection, more dynamic and precise pricing, and the ability to offer proactive loss prevention services. Major applications of B2B insurance are pervasive across key global industries, including the high-stakes manufacturing sector, heavily regulated healthcare and life sciences, the volatile financial services industry, and the rapidly scaling technology and telecommunications sectors, each demanding highly bespoke risk portfolios that account for their unique operational complexities and regulatory burdens.

Driving factors propelling sustained market expansion are inextricably linked to macro-economic trends and legislative rigor. Firstly, the global trend toward tightening regulatory environments consistently introduces new compliance obligations, mandating higher levels of specific coverage (e.g., environmental liability or data protection insurance). Secondly, the documented increase in the frequency and severity of natural catastrophic events (cat events) necessitates larger insured limits and advanced reinsurance solutions for commercial properties and infrastructure. Furthermore, the burgeoning global trade volume fuels specialized demand for complex marine, cargo, and trade credit insurance, safeguarding international transactions. Crucially, there is a rising financial literacy and risk awareness among small and medium enterprises (SMEs) regarding liability risks previously neglected, leading to significant market penetration in this historically underserved segment. The continuous evolution of modern business models, embracing platform economics, robotics, and highly specialized technical services, constantly generates novel and unquantified risk profiles, ensuring that demand for innovative, scalable B2B insurance solutions remains robust throughout the forecast period and beyond, compelling carriers to invest heavily in continuous product innovation and underwriting talent.

B2B Insurance Market Executive Summary

The global B2B Insurance Market is undergoing a fundamental structural reconfiguration driven by accelerated technological adoption, shifting regulatory expectations, and the increasing volatility of global risks. Current business trends illustrate a decisive shift away from the traditional, purely indemnificatory role of insurance towards integrated, proactive risk mitigation and advisory services, often embedded as value-added components within standard insurance contracts. Insurtech companies, leveraging agile development and deep technological expertise, continue to disrupt established value chains, pressing incumbent carriers to prioritize digital transformation. This push focuses intensely on streamlining inefficient legacy processes, enhancing the distribution experience through user-friendly digital portals, and dramatically improving claims handling efficiency via Artificial Intelligence (AI). Strategic collaborations and inorganic growth through mergers and acquisitions are defining features of the competitive environment, as major global carriers seek to acquire specialized expertise, diversify risk pools, and achieve greater scale necessary to underwrite large, multi-jurisdictional risks. Furthermore, the integration of Environmental, Social, and Governance (ESG) factors into underwriting decisions is emerging as a critical trend, influencing both risk assessment and capital allocation across the industry.

Geographically, market performance reflects significant disparities in economic and regulatory maturity. North America sustains its market leadership, underpinned by high corporate insurance penetration, sophisticated legal systems, and an early embrace of cutting-edge products, notably specialized professional liability, and parametric catastrophe coverage. The European market, while mature, is navigating complexities introduced by divergent national regulations and the overarching strictures of GDPR, which drives robust demand for highly tailored cyber and data liability products. Europe is also a global hub for specialty lines, including marine, aviation, and reinsurance. Asia Pacific (APAC) is positioned as the primary growth engine, where rapid infrastructure development, urbanization, and a swelling middle-class entrepreneurial base in China, India, and ASEAN nations are expanding the addressable market for commercial lines. This growth is compounded by increasing regulatory mandates for workers' protection and property insurance compliance. Conversely, Latin America and the Middle East & Africa (MEA) exhibit solid, yet more concentrated growth, highly dependent on large-scale infrastructure, energy, and extractive industry projects, requiring specialized political risk and construction insurance solutions, signaling significant untapped potential contingent upon regulatory stabilization and economic diversification.

Analysis of market segmentation reveals several pivotal dynamic shifts influencing insurer strategy. The Cyber Insurance segment is experiencing hypertrophic growth, consistently surpassing all other traditional lines, reflecting the escalating financial exposure associated with ubiquitous digitalization. Within liability, coverage is evolving beyond basic general liability to address complex contemporary risks such as intellectual property infringement, complex algorithmic bias, and product recalls in highly specialized manufacturing. Distribution dynamics show a calculated reliance on a hybrid model: while direct digital channels and platform ecosystems are growing in importance for processing high volumes of standardized SME policies efficiently, the foundational role of specialized commercial brokers and agents remains absolutely indispensable for handling large, complex, and highly negotiated accounts. The adoption of usage-based insurance (UBI) models, facilitated by IoT integration in commercial vehicles and industrial machinery, underscores a major trend towards micro-segmentation and dynamic pricing, allowing risk transfer solutions to be precisely aligned with actual operational exposure and client behavior in real-time. This segmentation complexity requires carriers to maintain multi-faceted distribution and underwriting capabilities to serve the entire spectrum of B2B clients.

AI Impact Analysis on B2B Insurance Market

The discourse surrounding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the B2B Insurance Market is dominated by critical questions concerning operational efficiency gains versus ethical governance and strategic risk handling. Common user inquiries frequently focus on whether AI can genuinely manage the inherent complexity of bespoke commercial risks, such as large property valuations or highly technical professional indemnity cases, which often lack the extensive, standardized datasets characteristic of consumer insurance. Users are consistently seeking clarification on the limitations of algorithmic underwriting, particularly concerning judgmental risks requiring nuanced human interpretation of unique operational contexts, and whether the adoption of AI will lead to the widespread redundancy of specialized human underwriters and complex claims adjusters. Furthermore, significant concern is directed toward the security and privacy implications of feeding massive, confidential commercial datasets into AI models, as well as the need for transparent and bias-free algorithms to ensure fair pricing and non-discriminatory access to essential coverage for all business sizes and profiles. These inquiries reveal a dual perspective: immense expectation for technology to solve efficiency bottlenecks, coupled with necessary skepticism regarding the replacement of seasoned human expertise and the imperative for robust regulatory oversight in autonomous decision-making processes.

AI is systematically revolutionizing the core functions of the B2B insurance lifecycle, transforming archaic processes into data-driven, predictive operations. In the underwriting phase, machine learning models are now capable of ingesting and correlating exponentially more data points than human underwriters, including regulatory filing changes, global trade sanctions lists, geospatial risk mapping, and real-time financial health indicators. This advanced computational capacity provides highly granular, forward-looking risk profiles, effectively reducing risk selection errors and significantly accelerating the quote-to-bind cycle for complex commercial policies. The outcome of this shift is not necessarily replacement, but augmentation: human underwriters are strategically redirected to focus their cognitive capital on evaluating genuinely unique, high-value, or unprecedented risks, such as new space ventures or emerging liability associated with specialized medical devices. AI-driven catastrophe modeling is also achieving new levels of precision, enhancing insurers' ability to accurately price exposure to evolving perils like climate change impacts, improving capital adequacy, and optimizing reinsurance purchasing strategies against systemic risks.

The influence of AI extends profoundly into client service and claims management, offering tangible improvements in speed and client experience. Through the application of Natural Language Processing (NLP) and advanced semantic analysis, AI systems can rapidly analyze voluminous policy documents, loss runs, incident reports, and legal filings, automating preliminary assessment and validation processes. For B2B clients facing business interruption, this translates directly into significantly faster claims notification processing and reduced financial downtime. Furthermore, sophisticated ML models are deployed in fraud detection, moving beyond simple rule-based systems to identify complex, collusive, or non-obvious anomalous patterns across millions of commercial claims in real-time, which is crucial given the high financial magnitude of commercial losses. The next wave of innovation involves Generative AI, anticipated to overhaul client interaction by creating context-aware digital assistants capable of drafting customized policy summaries, handling complex coverage inquiries, and providing tailored risk mitigation recommendations, thereby improving the perceived quality and responsiveness of B2B client engagement, moving the industry towards true intelligence-based service delivery.

- AI optimizes predictive risk modeling using real-time IoT, satellite imagery, and telemetry data for dynamic commercial pricing.

- Automated underwriting pipelines enhance speed, scalability, and consistency across standard and increasingly complex commercial lines.

- Machine learning algorithms detect complex and sophisticated fraud patterns in high-value B2B claims by analyzing non-linear data relationships.

- Generative AI significantly improves policy drafting efficiency, accelerates creation of customized endorsements, and enhances context-aware client communication.

- Computer vision, remote sensing technology, and drone integration support rapid assessment of large-scale commercial property damage and catastrophic business interruption claims.

- AI integration necessitates the immediate development of robust ethical guidelines and regulatory frameworks for transparency and bias mitigation in automated pricing and risk selection algorithms.

- Enhanced AI-driven catastrophe modeling and aggregation analysis improves capital reserve planning, optimizes reinsurance placement, and refines exposure management for systemic risks.

DRO & Impact Forces Of B2B Insurance Market

The B2B Insurance Market dynamic is meticulously shaped by a powerful confluence of external and internal forces, categorized into Drivers (D), fundamental Restraints (R), strategic Opportunities (O), and pervasive Impact Forces. Key drivers, such as the relentless acceleration of global digitalization across all industries, are creating vast new classes of unquantified risk, notably mandating robust forms of cyber, data breach, and IT errors & omissions coverage. Simultaneously, the increasing complexity of multinational operations and stringent international regulatory regimes compel businesses to secure advanced professional indemnity and highly regulated Directors and Officers (D&O) coverage. However, the market’s expansion is inherently restrained by the persistent difficulty in accurately modeling and quantifying these nascent and non-traditional risks—such as intellectual property valuation, systemic risk derived from hyper-interconnected global supply chains, and liability arising from autonomous systems. This modeling gap often leads to either conservative under-pricing or prohibitive over-pricing, hindering widespread market adoption. Opportunities are primarily concentrated in the specialization of risk products, targeting underserved, high-growth niche markets like renewable energy projects, advanced space insurance, and sophisticated pandemic risk pooling mechanisms. These intertwined forces collectively determine the required speed of innovation, the profitability and stability of specific insurance lines, and the overall trajectory of capital allocation within the global B2B insurance ecosystem.

Driving forces for market expansion are structurally tied to sustained global economic growth and the systemic increase in operational complexity. As corporations expand their geographical reach and integrate sophisticated technologies, their exposure to global geopolitical instability, complex cross-border litigation, and macroeconomic volatility increases significantly, creating a continuous and urgent demand for sophisticated, multi-jurisdictional insurance solutions. The increasingly litigious global business climate, especially in high-stakes sectors like pharmaceuticals, financial technology, and specialized manufacturing, serves as a primary driver for professional liability and errors & omissions insurance, essential for maintaining business continuity. Furthermore, the undeniable financial impact of climate change has transitioned from a theoretical risk to a major underwriting factor; this necessitates the continuous development of novel risk transfer mechanisms covering physical property losses, agricultural output instability, and prolonged business interruption directly attributable to extreme weather events. The crucial shift where insurers transition into proactive risk advisors, offering integrated loss prevention and resilience services alongside indemnity, solidifies their position as indispensable strategic partners rather than mere financial safety nets, thereby reinforcing market growth.

Conversely, market expansion is routinely impeded by significant operational friction and a pronounced shortage of highly specialized, next-generation underwriting talent. Effective B2B underwriting necessitates a scarce combination of deep vertical industry knowledge, sophisticated quantitative risk modeling skills, and legal acuity—a talent pool that struggles to keep pace with the velocity of technological and commercial risk evolution. Critically, the prevalence of fragmented and often antiquated legacy IT infrastructure among many established insurance carriers represents a substantial financial and temporal barrier, inhibiting the rapid adoption of new cloud-based digital platforms, real-time data analytics, and automated workflow systems, thereby significantly lengthening innovation cycles. Furthermore, significant price sensitivity remains a constraint among the vast population of small and medium enterprises (SMEs), particularly concerning non-mandatory or newly introduced coverage types like high-limit cyber insurance, which limits deep market penetration in this volume-critical segment. Overcoming these entrenched restraints demands extensive and sustained capital investment in modern, scalable technology stacks, coupled with a concerted strategic focus on attracting, training, and retaining actuarial, data science, and specialized industry talent capable of navigating the complex risks of the 21st-century commercial environment.

Segmentation Analysis

Segmentation is an indispensable analytical framework for navigating the highly variegated B2B Insurance Market, providing essential insights into differential risk appetites, product uptake rates, and optimal distribution methods across the entire corporate client base. The market's inherent heterogeneity dictates that solutions must be tailored, reflecting the unique financial, regulatory, and operational environments of distinct industrial sectors. Initial segmentation by insurance type—differentiating between core products like commercial property and liability versus specialty lines such as cyber and D&O—clearly highlights differential growth kinetics, with specialty coverage consistently outstripping traditional lines due to the rapid evolution of digital and governance risks. This structured view also illuminates the complex dynamics of distribution channels, contrasting the entrenched reliance on high-touch traditional agency and broker networks for managing and placing large, complex exposures against the increasing economic viability of deploying direct digital channels for efficiently serving standardized policies to the SME segment. Understanding the relative maturity and penetration within each segment is paramount for carriers aiming to strategically optimize their portfolio composition, enhance underwriting profitability, and refine market-appropriate service delivery models.

Further granular analysis necessitates detailed segmentation by end-user industry, which starkly demonstrates how catastrophic risk exposure and regulatory mandates diverge across economic verticals. For example, the healthcare and life sciences segment mandates highly specialized regulatory liability coverage (e.g., clinical trials, medical malpractice, HIPAA/GDPR compliance), while the heavy manufacturing and industrial sectors place a premium on complex machinery breakdown, product recall, and sophisticated supply chain disruption insurance solutions. This industry-specific demand matrix compels insurers to develop highly specialized underwriting teams, adopt customized risk assessment protocols that reflect industry norms, and continually update policies to reflect technological advancements unique to that sector (e.g., automation in logistics). Geographic segmentation is equally critical, as it maps market opportunity against local economic factors, regulatory complexity, and the regional concentration of specific high-risk industries, such as offshore energy production in the Gulf of Mexico or semiconductor manufacturing in East Asia. These geographic variables profoundly influence premium volume, acceptable limits, and historical loss ratios across continents, serving as a fundamental input for global strategic planning and capital deployment decisions by multinational carriers.

The market’s structure also depends significantly on segmentation by enterprise size, which dictates both product simplicity and distribution strategy. Small and Medium Enterprises (SMEs) often seek bundled, cost-effective, and easy-to-understand insurance packages, primarily utilizing direct or online broker channels for speed and efficiency. Their relative lack of internal risk management sophistication drives demand for simplified policy language and automated tools. Conversely, Large Enterprises (LEs) require customized, multi-line, multi-jurisdictional insurance programs, often necessitating complex captive insurance arrangements or significant layers of reinsurance. These large placements are almost exclusively executed through international brokerage houses, where relationships, expertise in global regulatory compliance, and negotiation capability are the primary value propositions. The successful navigation of the B2B market requires carriers to maintain scalable product architectures—offering both high-volume, standardized digital solutions for SMEs and highly flexible, relationship-driven bespoke services for the corporate sector.

- By Insurance Type:

- Commercial Property Insurance (CAT Exposure, Business Interruption)

- General Liability Insurance (Premises, Operations)

- Professional Liability (Errors & Omissions) Insurance (Malpractice, Consulting Errors)

- Directors & Officers (D&O) Liability Insurance (Shareholder Litigation, Regulatory Actions)

- Workers' Compensation Insurance (Occupational Injury/Illness)

- Cyber Insurance (Data Breach, Ransomware, System Failure BI)

- Marine and Aviation Insurance (Cargo, Hull, Liability)

- Trade Credit and Political Risk Insurance (Non-Payment, Expropriation)

- Specialty Lines (e.g., Parametric, Fine Art, Energy, Space)

- By Enterprise Size:

- Small and Medium Enterprises (SMEs) (Targeted by Insurtech/Digital)

- Large Enterprises (Complex, Multi-national Programs)

- By Distribution Channel:

- Brokers and Agents (Dominant for complex risk, advisory services)

- Direct Writers (High efficiency, standardized products)

- Bancassurance (Partnered bank distribution)

- Digital/Online Platforms (Insurtech Aggregators)

- By End-User Industry:

- Manufacturing (Supply Chain, Machinery Breakdown)

- Financial Services (Regulatory Risk, Professional Indemnity)

- Healthcare and Life Sciences (Malpractice, Clinical Trial Liability)

- Technology and Telecommunications (IP Risk, E&O)

- Construction and Engineering (Contractual Liability, Surety)

- Energy and Utilities (Environmental Liability, Offshore Operations)

- Professional Services (Legal, Accounting, Consulting)

Value Chain Analysis For B2B Insurance Market

The Value Chain for the B2B Insurance Market is a multi-layered structure that commences with critical upstream functions dedicated to capital deployment and predictive risk intelligence, flows through the core process of risk transformation (underwriting), and concludes with downstream market distribution and efficient claims resolution. Upstream analysis fundamentally involves sophisticated actuarial science, optimal capital allocation decisions, strategic reinsurance procurement to manage extreme event volatility, and the design of innovative products tailored to evolving corporate risks. Crucially, this phase is now highly dependent on intensive risk data acquisition—requiring inputs from external third-party data aggregators, sophisticated modeling firms, satellite remote sensing, and pervasive IoT sensor networks. The effectiveness of this upstream function directly governs the insurer's fundamental capacity to absorb and diversify commercial risk, determining the economic viability and competitive edge of their ultimate pricing structure. Effective reinsurance partnership is non-negotiable for large B2B carriers, enabling them to strategically offload catastrophic or systemic exposures (e.g., massive cyber losses or major cat events), thereby preserving the stability of their balance sheets and significantly expanding their underwriting appetite for high-value commercial accounts globally.

Midstream activities encapsulate the core competencies of the insurance enterprise: expert underwriting, policy administration, and portfolio management. B2B underwriting is fundamentally a high-skill, analytical process demanding deep vertical specialization to correctly evaluate complex exposures, such as pollution liability in industrial operations or long-tail liability associated with advanced engineered products. The deployment of advanced data analytics and AI tools within this midstream phase is rapidly transforming it, speeding up decision-making and improving risk segmentation accuracy. Policy issuance, rigorous tracking, ongoing compliance management, and the necessary regulatory filings represent the essential administrative scaffolding that ensures legal validity and operational continuity. Downstream segments define market access and client fulfillment through two primary mechanisms: distribution channels and claims handling. While streamlined direct distribution channels, increasingly facilitated by digital application programming interfaces (APIs) and client portals, effectively service standardized SME products by prioritizing speed and lowering acquisition costs, the most complex commercial risks and major accounts remain reliant on the indirect distribution model.

The distribution landscape exhibits a carefully maintained hybrid structure. Direct channels, powered by automated Insurtech platforms, are optimized for efficiency and serve products that require minimal human intervention, such as basic workers' compensation or low-limit general liability policies for smaller firms. Conversely, indirect distribution remains overwhelmingly dominant for specialty and highly negotiated lines, including complex D&O, bespoke global cyber policies, or trade credit for multinational enterprises. In this context, the professional expertise and negotiation leverage provided by specialized commercial brokers and agents are invaluable; they not only facilitate placement but also provide essential pre-underwriting risk advisory services, manage cross-border regulatory compliance, and serve as the critical relationship manager between the technically focused insurer and the demanding corporate client. Optimal value chain management today focuses intensely on the digital integration of upstream data intelligence with midstream underwriting decisions, ensuring that policy construction is directly informed by predictive analytics, and subsequently linking these processes tightly with rapid, transparent downstream claims adjudication. Comprehensive optimization across this entire chain, heavily reliant on intelligent automation and resilient cloud infrastructure, is now the primary source of sustainable competitive advantage, enabling carriers to drastically reduce time-to-market for innovative products and achieve superior loss ratios through enhanced risk selection quality.

B2B Insurance Market Potential Customers

The primary potential customers in the B2B Insurance Market are diverse organizational entities ranging across nearly every industry vertical globally, unified by their inherent need to protect assets, personnel, and reputation from financial catastrophe and systemic operational loss. These customers include large multinational corporations (MNCs) that require highly sophisticated, integrated global insurance programs covering geopolitical risk, multi-jurisdictional liability, intricate marine cargo exposure, and specialized captive insurance solutions. Mid-sized enterprises (MEs) represent another substantial and growing customer base, typically prioritizing comprehensive, yet scalable, insurance packages covering core commercial property, broad general liability, and escalating exposure to advanced cyber threats as their digital footprints rapidly expand. The required complexity of the insurance product is highly correlated with the size and operational sophistication of the customer, necessitating that insurers maintain highly flexible product architectures and underwriting appetites to effectively service this wide spectrum of clients.

A rapidly expanding and strategically important segment of potential customers includes specialized, high-growth entities within the technology and advanced service sectors, such as cutting-edge Artificial Intelligence development firms, complex biotechnology companies, and disruptive financial technology (Fintech) innovators. These customers inherently drive intense demand for specialized liability insurance related to intellectual property infringement, errors in product efficacy (e.g., autonomous systems), and stringent regulatory compliance specific to nascent or evolving technologies. Furthermore, government contractors, public infrastructure providers, and critical utility companies constitute a distinct, high-stakes segment requiring specialized political risk coverage, high-limit surety bonding, and bespoke insurance solutions for large-scale, long-duration projects like utility construction or large IT modernization efforts. The key purchasing criterion for all these diverse potential customers extends beyond the mere insurance policy itself, placing a critical emphasis on integrated risk management advisory capabilities, guaranteed rapid and fair claims handling, and the demonstrable financial stability and claims-paying ability of the underwriting carrier, thereby heavily weighting the service element over simplistic price competition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.4 Billion |

| Market Forecast in 2033 | USD 1,154.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz SE, AXA SA, Chubb Limited, The Travelers Companies Inc., Zurich Insurance Group Ltd., Berkshire Hathaway (GEICO), American International Group (AIG), Munich Re Group, Swiss Re Group, Marsh & McLennan Companies, Willis Towers Watson, Lloyd’s of London, Tokio Marine Holdings Inc., Sompo Holdings Inc., Liberty Mutual Insurance, Hannover Re, Scor SE, Beazley PLC, QBE Insurance Group, CNA Financial Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

B2B Insurance Market Key Technology Landscape

The technological architecture supporting the B2B insurance market is undergoing a profound structural evolution, rapidly migrating away from inefficient, siloed legacy systems toward integrated, data-centric platforms that leverage advanced computational intelligence and automation. The core technologies driving this transformation are the widespread deployment of sophisticated Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These systems are indispensable for dynamic pricing adjustments, highly refined risk segmentation in complex commercial underwriting, and significantly accelerating the timeline for claims finalization. Specifically, AI/ML models are trained to synthesize vast volumes of non-linear, heterogeneous data—including real-time supply chain sensor data, public financial health filings, regulatory watch lists, and proprietary loss history databases—to generate hyper-precise, predictive risk scores for commercial entities that are continuously updated. Furthermore, distributed ledger technology, primarily Blockchain, is gaining significant momentum, particularly for managing the complexities inherent in multi-party reinsurance contracts, automating premium distribution, and executing claims payouts via transparent smart contracts, which drastically reduces transactional friction and enhances trust within the commercial risk transfer ecosystem.

A critical foundational technology is the widespread integration of the Internet of Things (IoT) into commercial and industrial operations. IoT devices, including highly sophisticated fleet telematics in commercial trucking, predictive maintenance sensors in manufacturing machinery, and integrated smart building management systems, are essential enablers of the next generation of Usage-Based Insurance (UBI) and Pay-As-You-Go models in the B2B sector. This continuous stream of operational data permits insurers to fundamentally shift their underwriting focus from static, backward-looking historical assessments to proactive, continuous risk monitoring and loss prevention engagement. To manage and process these exponential data inflows, scalable Cloud Computing infrastructure—both public and hybrid models—is requisite, providing the necessary elasticity and computational power to simultaneously run multiple complex actuarial and predictive risk models across global operational territories. Crucially, the deployment of robust Application Programming Interfaces (APIs) has become standard practice, fostering seamless and secure connectivity between the insurer’s core systems, external broker platforms, specialist risk assessors, and the complex internal risk management systems of large corporate clients, facilitating a truly integrated and efficient digital ecosystem for B2B risk management.

Specialized technologies such as Geospatial Analytics and advanced Remote Sensing techniques, utilizing high-resolution satellite imagery and sophisticated drone technology, are now considered indispensable tools for rapid, large-scale commercial property risk assessment, particularly in regions prone to catastrophic natural events like seismic activity, storm surges, or wildfires. These technologies deliver precise, rapid, and objective damage quantification post-event, significantly improving the accuracy and accelerating the timeline of B2B claims adjustment, which directly minimizes the duration of costly business interruption for the corporate client. However, the effective and widespread adoption of this advanced technological stack necessitates an overarching strategic focus on Cyber Resilience within the insurance organization itself. Due to the highly sensitive aggregation of proprietary commercial, financial, and operational data, insurance carriers are increasingly targeted by sophisticated cyber adversaries. Therefore, investment in advanced threat detection capabilities, resilient system architectures, and stringent data governance protocols is not merely optional but a foundational prerequisite for leveraging technology effectively and maintaining client trust in the evolving B2B insurance domain.

Regional Highlights

The B2B Insurance Market demonstrates widely divergent growth patterns and structural characteristics across major global regions, heavily influenced by their respective economic maturation levels, unique regulatory mandates, and specific concentrations of high-value industrial activities.

- North America: This region maintains its position as the global market leader, characterized by unparalleled market maturity, dominant technological adoption, and a highly demanding corporate client base. The United States and Canada are international pioneers in developing and rapidly scaling specialized coverage lines, particularly cutting-edge Cyber Insurance, sophisticated D&O Liability, and advanced environmental liability. The high frequency of litigation, combined with complex, multi-layered regulatory frameworks (e.g., state-specific insurance and workers' compensation laws), enforces strong mandatory insurance uptake. North America leads global Insurtech investment, focusing intensely on leveraging AI for fully automated underwriting and providing comprehensive, value-added risk consulting services, predominantly catering to the enormous, high-growth technology, biotechnology, and financial services sectors. The market is intensely competitive, prioritizing underwriting speed, specialized industry expertise, and superior claims resolution capabilities.

- Europe: The European market is defined by a deep history of specialized commercial risk management and the complexities introduced by regulatory harmonization efforts, such as Solvency II for capital requirements and GDPR for stringent data privacy. Demand for coverage is robustly concentrated in sophisticated professional liability and cyber risk due to the punitive nature of data protection laws. Western Europe (led by the UK, Germany, and France) forms the structural core, featuring highly entrenched and expert brokerage networks and sustained, high demand for specialized trade credit, surety bonding, and political risk insurance driven by extensive intra-regional and global trade connections. Peripheral and Eastern Europe are experiencing accelerated digital transformation and rising insurance penetration, offering attractive growth avenues for streamlined SME market solutions.

- Asia Pacific (APAC): APAC is undeniably the fastest-growing geographical segment globally, propelled by explosive industrialization, massive state-backed infrastructure and urbanization projects (driving substantial demand for construction, engineering, and liability insurance), and steadily increasing insurance density across burgeoning economies like China, India, and the ASEAN nations. While emerging economies prioritize foundational commercial property and general liability coverage to support initial industrial growth, developed markets (e.g., Japan, South Korea, Australia) exhibit advanced uptake of high-limit specialty lines, including sophisticated risk transfer for semiconductor manufacturing and complex financial indemnity. The region's inherent vulnerability to large-scale natural catastrophes (typhoons, tsunamis, earthquakes) mandates heavy reliance on advanced global reinsurance mechanisms and localized catastrophe modeling expertise to manage volatility.

- Latin America (LATAM): Market expansion in LATAM is intrinsically linked to its strong commodity production, large-scale energy sector projects, and rapid urbanization trends. High levels of political and economic volatility across several key countries create persistent and substantial demand for political risk insurance, currency fluctuation hedging products, and large-scale surety bonds necessary for major capital projects. Market maturity varies significantly; established economies like Brazil, Mexico, and Chile benefit from more developed and transparent regulatory frameworks and increased carrier competition. Digitalization adoption is gaining critical momentum, focused primarily on using mobile and online platforms to access the vast, historically underserved Small and Medium Enterprise (SME) segment with basic commercial offerings.

- Middle East and Africa (MEA): Growth in the MEA region is heavily concentrated within the affluent Gulf Cooperation Council (GCC) states, driven by immense public and private investment in giga-projects, energy sector expansion, and ambitious national economic diversification initiatives (e.g., Saudi Vision 2030). Consequently, demand is intensely focused on construction all-risk insurance, specialized energy liability, and sophisticated marine cargo coverage linked to massive port development. Africa, outside of the GCC, offers vast, untapped long-term potential; however, market development is presently constrained by fragmented regulatory stability, lower average economic insurance penetration rates, and a concentration on essential property and basic liability coverage necessary for local commerce.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the B2B Insurance Market.- Allianz SE

- AXA SA

- Chubb Limited

- The Travelers Companies Inc.

- Zurich Insurance Group Ltd.

- Berkshire Hathaway (GEICO)

- American International Group (AIG)

- Munich Re Group

- Swiss Re Group

- Marsh & McLennan Companies

- Willis Towers Watson

- Lloyd’s of London

- Tokio Marine Holdings Inc.

- Sompo Holdings Inc.

- Liberty Mutual Insurance

- Hannover Re

- Scor SE

- Beazley PLC

- QBE Insurance Group

- CNA Financial Corporation

Frequently Asked Questions

Analyze common user questions about the B2B Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between B2B and B2C insurance products?

B2B insurance is fundamentally characterized by its profound complexity, high customization requirements, much higher policy limits, specialized underwriting based on specific industrial, regulatory, and legal exposures (e.g., intellectual property risk, complex D&O liability), and an essential reliance on expert brokers for policy placement. B2C insurance, conversely, is typically standardized, volume-driven, and focused on predictable personal asset protection and simple liabilities.

How is the rise of cyber risk reshaping commercial insurance offerings?

Cyber risk currently represents the fastest-growing segment, driving urgent demand for dedicated coverage that comprehensively addresses financial losses stemming from data breaches, crippling system downtime (business interruption), sophisticated ransomware attacks, and escalating regulatory fines (like those under GDPR or CCPA). To mitigate risk, insurers are now integrating mandatory pre-loss risk mitigation services, suchg as incident response planning and threat assessments, directly into these policies.

What critical role do commercial brokers and agents play in the current B2B insurance distribution model?

Commercial brokers and agents remain absolutely indispensable for B2B transactions, particularly for placing large, complex, and specialized corporate risks. They provide high-level strategic advisory services, conduct sophisticated external risk analysis, navigate fragmented regulatory environments across multiple jurisdictions, and expertly negotiate bespoke policy terms that automated direct digital platforms are currently unable to replicate.

How does technological integration (Insurtech, AI, IoT) specifically benefit B2B clients?

Technology benefits B2B clients primarily by enabling faster, more analytically precise risk assessments, which leads directly to fairer and more dynamic pricing structures, and by facilitating dramatically quicker claims resolution through automation and real-time data ingestion. Crucially, IoT data supports preventative risk management programs, proactively helping businesses detect and mitigate potential losses before significant financial damage occurs.

Which geographical region is expected to demonstrate the highest growth rate in B2B insurance?

The Asia Pacific (APAC) region is decisively forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated expansion is fueled by massive regional infrastructure investments, explosive industrialization, sustained urbanization, and rapidly increasing corporate insurance penetration rates across key emerging economies, notably China, India, and the dynamic markets of Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager