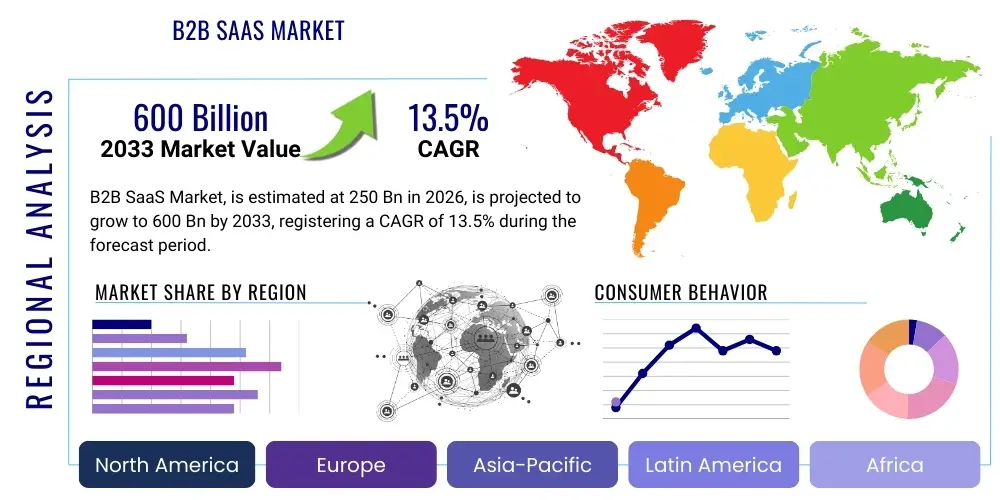

B2B SaaS Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441928 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

B2B SaaS Market Size

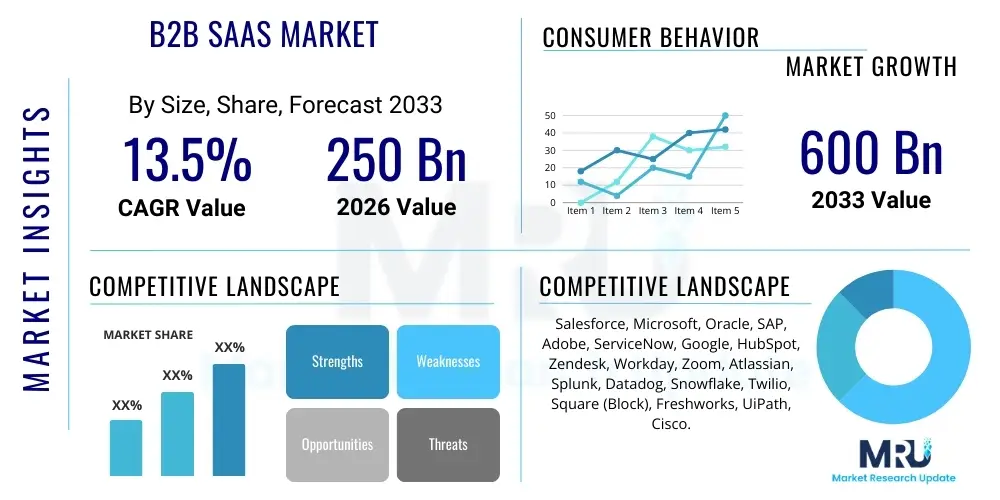

The B2B SaaS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at USD 250 Billion in 2026 and is projected to reach USD 600 Billion by the end of the forecast period in 2033.

B2B SaaS Market introduction

The Business-to-Business Software as a Service (B2B SaaS) market encompasses cloud-based software solutions designed specifically to address the operational and strategic needs of businesses, facilitating functions ranging from Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) to specialized industry applications like FinTech or HealthTech management. These solutions are characterized by subscription models, multi-tenancy architecture, and automatic updates, offering scalability and reduced total cost of ownership compared to traditional on-premise software. The inherent flexibility and accessibility of B2B SaaS have made it an indispensable tool for digital transformation across small, medium, and large enterprises globally, driving efficiency and enabling remote operations.

The primary applications of B2B SaaS span virtually every functional area within an organization. Major segments include sales and marketing automation platforms, human capital management (HCM) systems, collaboration tools, and cybersecurity solutions delivered via the cloud. Key benefits driving widespread adoption include enhanced operational agility, rapid deployment timelines, and predictable expense management through OpEx rather than CapEx investments. Furthermore, B2B SaaS platforms often integrate seamlessly with other enterprise systems via open APIs, creating sophisticated, interconnected digital ecosystems that support complex business processes and data analytics.

Driving factors for sustained market growth include the accelerating pace of global digitalization, the increasing necessity for remote work infrastructure, and the continuous innovation cycles introducing advanced features like embedded Artificial Intelligence (AI) and machine learning capabilities. The growing adoption of cloud-first strategies by organizations transitioning away from legacy systems, coupled with the rising demand for robust data security and compliance management through specialized SaaS offerings, further solidifies the market trajectory. Vertical SaaS solutions, tailored for specific industries, are also gaining significant traction by offering deep functional relevance unmatched by horizontal platforms.

B2B SaaS Market Executive Summary

The B2B SaaS market is experiencing robust expansion driven by sustained enterprise investment in digital transformation and cloud modernization initiatives. Current business trends emphasize the shift toward vertical SaaS offerings, focusing on industry-specific pain points, and the integration of sophisticated AI functionalities, particularly generative AI, into core business applications to enhance productivity and automation. Mergers and acquisitions remain a vital strategy for market consolidation and technology acquisition, especially concerning niche platforms specializing in advanced analytics or compliance. Enterprises are prioritizing platforms that offer consumption-based pricing and highly scalable infrastructure to manage fluctuating demand.

Regionally, North America maintains its dominance due to high technological maturity, significant VC funding for SaaS startups, and the presence of major cloud infrastructure providers. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by rapid SME digitalization in emerging economies like India and Southeast Asia, alongside governmental support for cloud adoption. Europe is characterized by stringent data protection regulations, driving demand for specialized compliance SaaS, while the Middle East and Africa (MEA) are emerging as significant growth areas, particularly in FinTech and government modernization SaaS solutions.

Segmentation trends highlight the increasing fragmentation of the market, moving beyond generic horizontal applications. Functional segmentation shows rapid growth in specialized areas such as conversational AI SaaS, cybersecurity SaaS (e.g., identity and access management), and low-code/no-code platforms designed to democratize application development within organizations. Deployment models remain predominantly public cloud, but hybrid SaaS environments are gaining importance among heavily regulated industries requiring partial control over data residency and security infrastructure. Enterprise size segmentation indicates that while large enterprises are the largest revenue generators, the SME segment provides the highest volume growth opportunity due to lower penetration rates.

AI Impact Analysis on B2B SaaS Market

User inquiries regarding AI's impact on the B2B SaaS market primarily center on five critical areas: efficiency gains through automation (e.g., "How much will AI reduce manual tasks?"), the necessity for new pricing models reflecting AI value ("Will AI features require premium tiers?"), competitive displacement risks ("Will generic AI tools replace specialized SaaS?"), data privacy implications of training large models, and the democratization of complex functions like data analysis and content generation via embedded generative AI. Users seek clarity on whether AI is an incremental feature or a fundamental architectural shift, focusing on measurable ROI and vendor strategies for integrating sophisticated machine learning without compromising data security or regulatory compliance.

- AI-driven automation fundamentally transforms workflow management, increasing efficiency in functions like customer support (chatbots, auto-responses) and sales (lead scoring, predictive forecasting).

- Generative AI integration enables new product categories, such as AI-powered content creation tools and intelligent code assistants, enhancing developer productivity and accelerating time-to-market.

- Advanced AI capabilities are becoming table stakes for modern SaaS platforms, pressuring vendors to differentiate through proprietary domain-specific models and ethical AI governance frameworks.

- The rise of AI necessitates changes in infrastructure and data processing capabilities, favoring serverless architecture and specialized data management SaaS solutions designed for large-scale model training and inference.

- AI drives hyper-personalization of user experiences and allows for proactive identification of anomalies, significantly enhancing cybersecurity SaaS and operational intelligence platforms.

- New pricing strategies are emerging, often involving usage-based or value-based metering specifically for high-compute AI features, shifting revenue streams.

DRO & Impact Forces Of B2B SaaS Market

The B2B SaaS market is propelled by persistent digital transformation mandates, global expansion of remote and hybrid work models, and the continuous influx of venture capital supporting disruptive cloud technologies. Restraints include significant challenges related to data security and privacy compliance across diverse international regulatory frameworks (e.g., GDPR, CCPA), intense market competition leading to price compression in horizontal segments, and vendor lock-in concerns slowing adoption in highly sensitive sectors. Opportunities are primarily centered on verticalization, targeting unmet needs in niche industries, leveraging generative AI for product innovation, and expanding into emerging geographies with high digital adoption potential.

Driving forces include the cost efficiency and scalability inherent in subscription models, coupled with the rapid evolution of supporting technologies like 5G and edge computing, which enhance SaaS performance and accessibility. The shift from CapEx to OpEx spending for IT resources also lowers the barrier to entry for smaller businesses, widening the addressable market significantly. Furthermore, the necessity for robust interoperability and API ecosystems promotes growth by allowing complex enterprise systems to function cohesively, increasing the overall utility of individual SaaS solutions.

Impact forces currently shaping the market include regulatory changes regarding data sovereignty, which influences regional deployment strategies; the increasing power of hyperscalers (AWS, Azure, Google Cloud) in dictating infrastructure costs and integration standards; and the growing enterprise focus on sustainability, favoring cloud solutions that reduce physical IT footprint. These forces necessitate strategic vendor focus on compliance certifications, multi-cloud compatibility, and demonstrable security postures to maintain market relevance and customer trust.

Segmentation Analysis

The B2B SaaS market is segmented across multiple dimensions including application type, deployment model, organization size, and industry vertical, reflecting the diversity of enterprise needs and technological maturity levels. This complex segmentation allows vendors to target specific buyer personas with highly tailored feature sets and pricing strategies. The ongoing trend toward specialization means that while horizontal applications (like generalized CRM) still hold substantial market share, growth is increasingly driven by vertical SaaS (V-SaaS) solutions designed to integrate industry-specific workflows, compliance, and data standards directly into the platform.

- By Application: Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Human Capital Management (HCM), Supply Chain Management (SCM), Business Intelligence & Analytics, Collaboration & Communication, Cybersecurity, Project Management.

- By Deployment Model: Public Cloud, Private Cloud, Hybrid Cloud.

- By Organization Size: Small and Medium-sized Enterprises (SMEs), Large Enterprises.

- By Industry Vertical: BFSI, Retail & E-commerce, Healthcare, Manufacturing, IT & Telecom, Government & Public Sector, Energy & Utilities.

- By Pricing Model: Subscription-Based, Usage-Based, Freemium.

Value Chain Analysis For B2B SaaS Market

The B2B SaaS value chain begins with upstream activities focused heavily on foundational infrastructure and development. This includes the hyperscalers (AWS, Azure, GCP) providing the underlying cloud computing resources, operating systems, and core data services, alongside specialized vendors offering development tools, API management platforms, and security components. Initial stages also involve extensive market research, design thinking, and product development lifecycles focused on identifying and validating precise business pain points, particularly in the increasingly competitive vertical segments.

The midstream phase involves the core activities of the SaaS provider itself: application development, quality assurance, infrastructure management, data processing, and ongoing maintenance. Critical elements here include ensuring high availability, robust security certifications (e.g., ISO 27001, SOC 2), and continuous feature deployment (CI/CD). Sales and marketing activities, which are predominantly digital, also form a significant part of the midstream, focusing on inbound strategies, content marketing, and demonstrating rapid ROI to prospective B2B buyers.

Downstream activities center on distribution and customer retention. Distribution channels are varied, including direct sales teams targeting large enterprises, indirect channels via channel partners, system integrators (SIs), managed service providers (MSPs), and specialized SaaS marketplaces. The crucial component downstream is customer success management, which focuses on onboarding, training, technical support, and ensuring high utilization rates and low churn. High customer retention rates are paramount in the SaaS model, making post-sale support and continuous feedback loops critical for long-term viability and expansion revenue.

B2B SaaS Market Potential Customers

The potential customer base for the B2B SaaS market is exceptionally broad, encompassing organizations across all sizes and industry verticals globally, united by the need for operational efficiency, scalability, and digital modernization. Large enterprises constitute the primary revenue source, often requiring complex, integrated ERP, CRM, and bespoke vertical solutions, prioritizing vendor stability, robust security guarantees, and extensive customization capabilities to align with established organizational processes.

Small and Medium-sized Enterprises (SMEs) represent the fastest-growing customer segment. These buyers prioritize ease of use, rapid implementation, lower initial investment costs, and flexible, transparent pricing models. They heavily leverage specialized, affordable, out-of-the-box SaaS solutions for core functions like accounting, project management, and basic HR, often relying on public cloud deployment models and digital distribution channels.

Specific vertical customers, such as financial institutions (BFSI), healthcare providers, and manufacturing firms, represent high-value targets for specialized vertical SaaS. These customers require platforms engineered specifically to meet stringent regulatory requirements (e.g., HIPAA, Dodd-Frank), industry standards, and unique integration needs (e.g., linking production floor data with ERP systems), making domain expertise a critical factor in vendor selection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Billion |

| Market Forecast in 2033 | USD 600 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce, Microsoft, Oracle, SAP, Adobe, ServiceNow, Google, HubSpot, Zendesk, Workday, Zoom, Atlassian, Splunk, Datadog, Snowflake, Twilio, Square (Block), Freshworks, UiPath, Cisco. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

B2B SaaS Market Key Technology Landscape

The B2B SaaS technology landscape is currently defined by three foundational pillars: sophisticated multi-cloud architecture, pervasive integration through microservices and APIs, and the rapid adoption of AI/ML models. Modern SaaS platforms utilize resilient, scalable infrastructure built on Kubernetes and serverless functions, ensuring automatic scaling and high fault tolerance necessary for global enterprise operations. Emphasis is placed on adopting Infrastructure as Code (IaC) principles to manage complex, distributed environments efficiently, guaranteeing compliance and consistency across various regions and cloud providers.

Integration capabilities are critical, moving beyond simple data synchronization to deep operational interoperability achieved through well-documented, secure REST and GraphQL APIs. This enables SaaS vendors to integrate seamlessly into the enterprise tech stack, reducing implementation friction and accelerating time-to-value for customers. Data platforms within SaaS solutions are evolving rapidly, incorporating advanced warehousing technologies like Snowflake and Databricks, enabling real-time analytics and supporting the intensive data demands of embedded machine learning algorithms and predictive functions.

Furthermore, security technology forms a non-negotiable layer. Modern B2B SaaS platforms incorporate zero-trust architectures, advanced identity and access management (IAM) solutions, and continuous vulnerability scanning (DevSecOps) throughout the development pipeline. The push toward robust data governance technology ensures compliance with global privacy regulations, positioning security and trust as primary competitive differentiators beyond core application functionality.

Regional Highlights

- North America: Dominates the B2B SaaS market share due to early adoption of cloud technology, mature digital infrastructure, and the high concentration of both SaaS providers and venture capital funding. The U.S. remains the primary innovation hub, driving advancements in AI-powered SaaS and specialized compliance tools.

- Europe: Characterized by strong regulatory demands, particularly around data protection (GDPR). This drives significant demand for regional and vertical SaaS solutions focused on privacy compliance and data sovereignty. Western Europe (UK, Germany, France) is the core market, with rapid growth observed in specialized FinTech and HealthTech SaaS.

- Asia Pacific (APAC): Exhibits the highest CAGR, driven by mass digitalization initiatives across emerging economies like India, China, and Southeast Asia. Government support for cloud adoption and rapid growth in the SME sector are key drivers. The market favors mobile-first SaaS solutions optimized for diverse connectivity environments.

- Latin America (LATAM): Showing accelerated growth, particularly in Brazil and Mexico, fueled by increasing mobile penetration and foreign investment. Demand is strong for localized ERP and CRM systems that address regional taxation and regulatory complexities.

- Middle East and Africa (MEA): An emerging market where large-scale government and energy sector digitization projects drive demand for enterprise-grade SaaS. Cloud infrastructure investments by hyperscalers are lowering barriers, leading to increased uptake in cybersecurity and vertical solutions tailored for regional economic requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the B2B SaaS Market.- Salesforce

- Microsoft

- Oracle

- SAP

- Adobe

- ServiceNow

- Google (Google Cloud & Workspace)

- HubSpot

- Zendesk

- Workday

- Zoom

- Atlassian

- Splunk

- Datadog

- Snowflake

- Twilio

- Square (Block)

- Freshworks

- UiPath

- Cisco

- Intuit

- DocuSign

- Palo Alto Networks

- CrowdStrike

- Veeva Systems

Frequently Asked Questions

Analyze common user questions about the B2B SaaS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the B2B SaaS market?

The B2B SaaS market is projected to expand significantly, reaching an estimated USD 600 Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033, driven primarily by continuous digital transformation and AI integration.

How is Generative AI fundamentally changing B2B SaaS products?

Generative AI is shifting B2B SaaS from reactive tools to proactive intelligence platforms, enabling deeper automation, personalized user workflows, predictive analytics, and the creation of entirely new functionalities like code generation and sophisticated content drafting within enterprise applications.

Which geographical region holds the largest market share in B2B SaaS?

North America currently holds the dominant market share due to early technological adoption, mature cloud infrastructure, and extensive venture capital investment, although the Asia Pacific (APAC) region is forecasted to achieve the highest growth rate during the forecast period.

What are the key differences between horizontal and vertical B2B SaaS?

Horizontal B2B SaaS (e.g., standard CRM) serves broad business functions across multiple industries, focusing on ubiquity and scale. Vertical SaaS (V-SaaS) is tailored to specific industry needs (e.g., HealthTech, FinTech), embedding regulatory compliance and specific workflows, thereby offering deeper functional relevance.

What are the primary challenges restraining B2B SaaS market growth?

The main restraints include escalating concerns over data security and sovereignty, the complexity of navigating diverse international regulatory environments (such as GDPR and CCPA), and intense market competition leading to potential pricing pressures and customer churn risks.

The imperative for organizations globally to maintain a competitive edge through technological superiority is cementing the long-term growth prospects of the B2B SaaS sector. The evolution is moving beyond mere cloud hosting to platforms that provide embedded business intelligence, predictive modeling, and highly specialized automation tailored to specific industry value chains. Vendors that successfully integrate ethical AI practices, ensure superior data governance, and maintain flexible consumption-based pricing models are best positioned to capture market share and sustain high revenue growth. Strategic investment in vertical markets, particularly in highly regulated sectors like healthcare and finance, promises differentiated returns, shielding vendors from the intense commoditization pressure often seen in generalized horizontal applications. Furthermore, the strategic focus on ecosystem development and seamless API integration is paramount, as enterprises increasingly demand interconnected solutions that eliminate data silos and streamline complex, multi-application business processes. This structural shift highlights the industry's maturation from simple cloud delivery to complex digital operational platforms.

The long-term viability of B2B SaaS hinges on minimizing operational complexity for the end-user while maximizing underlying technological sophistication. Key technology shifts, such as the full transition to serverless computing and the implementation of decentralized identity management, are reducing infrastructure overhead for vendors and improving security assurances for customers. Market consolidation through strategic acquisitions allows major players to rapidly expand their product portfolios and geographical reach, often absorbing innovative niche players to gain intellectual property in areas like specialized AI or compliance technology. This M&A activity is expected to continue shaping the competitive landscape, creating fewer, larger ecosystems that aim to fulfill all of an enterprise’s digital needs within a single, integrated vendor framework. This ecosystem strategy is crucial for countering the risk of vendor sprawl and managing the increasing complexity of IT procurement and management for large multinational clients.

Addressing the constraints related to data localization and security remains a central theme for international B2B SaaS providers. The ability to deploy and manage data across multiple geographic regions while adhering to regional data residency requirements is becoming a core competency. This often requires significant investment in regional data center infrastructure and specialized compliance teams. Opportunities abound in transforming antiquated business processes within public sector organizations and heavily regulated industries, where the adoption curve has been slower but the long-term contract value is substantial. The next wave of SaaS innovation will likely focus on leveraging quantum computing precursors and advanced optimization algorithms to deliver efficiencies unattainable with current technology, particularly in SCM and complex financial modeling SaaS products.

The segmentation by application continues to evolve dynamically, with specialized areas like Environmental, Social, and Governance (ESG) reporting SaaS, robotic process automation (RPA) tools, and decentralized identity management experiencing exponential growth. Enterprise purchasing decisions are increasingly guided by measurable metrics like Return on Investment (ROI) and Total Cost of Ownership (TCO), favoring vendors who can clearly articulate the business impact of their subscription fees. The emergence of platform ecosystems means that many vendors are transitioning from selling point solutions to offering comprehensive suites, blurring the lines between traditional segmentation categories. The competitive battleground is shifting from feature parity to superior integration capabilities and ecosystem partnerships, providing customers with comprehensive solutions rather than fragmented tools.

Furthermore, the shift towards consumption-based pricing models, often termed "usage-based SaaS," is gaining traction, particularly in infrastructure-heavy services like data warehousing (Snowflake) or communication platforms (Twilio). This model appeals to B2B buyers seeking flexibility and direct correlation between cost and value derived, contrasting with fixed subscription models that may result in wasted capacity. This trend requires sophisticated billing and metering capabilities from vendors, fundamentally altering revenue recognition and forecasting strategies. For organization size, while SMEs demand simplicity and affordability, large enterprises are increasingly adopting composable architectures, selecting the best-of-breed solutions for different functions and relying heavily on the vendor's API reliability and microservices architecture for seamless operation.

The dominance of public cloud deployment is maintained by the cost advantages and vast scalability provided by hyperscalers. However, hybrid and private cloud deployments remain critical in sectors like government, defense, and high-security finance, where strict regulatory mandates necessitate tighter control over infrastructure and data location. The future trajectory suggests increased sophistication in hybrid deployments, utilizing specialized SaaS tools to manage data workloads that span across on-premise, private cloud, and multiple public cloud environments. This complex environment creates a strong market for specific SaaS solutions focused on multi-cloud management, visibility, and unified security policies. The intersection of these technological and strategic segments defines the diverse and rapidly expanding B2B SaaS landscape.

The impact of AI extends deeply into the sales process itself, with AI-driven sales enablement SaaS providing deep insights into buyer behavior, optimizing marketing spend, and accelerating conversion funnels. Vendors are utilizing AI to predict churn risks among their existing customer base, allowing customer success teams to intervene proactively, thus lowering the historically high cost of customer acquisition inherent in B2B markets. The ongoing development of Large Language Models (LLMs) and specialized foundation models is lowering the development barrier for creating sophisticated AI features, which is expected to democratize access to advanced analytics even for smaller B2B customers who previously lacked the resources for in-house data science teams. This democratization fuels further market adoption across the SME segment.

Geopolitical factors are significantly influencing regional market dynamics. For instance, increasing trade tensions and the global shift toward economic regionalization are prompting companies to seek regional SaaS providers to mitigate supply chain risks and ensure regulatory compliance within specific trading blocs. This trend particularly benefits localized vertical SaaS vendors in Europe and APAC. Investment in infrastructure in the MEA region, particularly driven by sovereign wealth funds, is catalyzing demand for B2B SaaS solutions focused on smart city management, national digital identity programs, and large-scale public safety initiatives, representing greenfield opportunities for vendors specializing in complex governmental and utility sector applications. The competitive landscape is therefore increasingly regionalized, requiring global players to adopt highly flexible, localized deployment and operational strategies.

Further analysis of the value chain reveals that cybersecurity and compliance services are increasingly integrated earlier into the product development stage (Shift Left Security), moving from a peripheral concern to a core architectural requirement. The monetization strategy throughout the value chain is also evolving, with increasing use of partner ecosystems (e.g., consultants, SIs) who not only distribute the product but also add significant value through implementation, customization, and ongoing managed services. This channel leverage is vital for market penetration in complex enterprise environments. Upstream, the reliance on open-source frameworks and development communities continues to accelerate innovation, though it also introduces complexities related to licensing and security vulnerabilities that specialized third-party SaaS tools are emerging to address.

The focus on environmental sustainability is transforming the B2B SaaS offering. Enterprises are increasingly demanding SaaS solutions that provide metrics on their cloud usage carbon footprint, driving the development of specialized "Green IT" or sustainability SaaS platforms. This trend is driven not only by corporate social responsibility but also by emerging global regulations requiring mandatory ESG reporting, creating a substantial market opportunity for tools that automate data aggregation, analysis, and disclosure related to environmental and social impact. This new vertical area represents a potent avenue for growth and differentiation against incumbent, generalized providers. The convergence of technology innovation, regulatory pressure, and corporate mandates ensures that the B2B SaaS market will remain dynamic and highly valuable.

Specific market segments demonstrating exceptional resilience and growth include the DevOps and developer tools SaaS category, fueled by the accelerating pace of software development and the need for seamless, continuous integration and deployment (CI/CD) pipelines. Platforms like Atlassian (Jira, Confluence) and GitLab are foundational to modern software teams. Simultaneously, the cybersecurity SaaS segment, particularly in areas like Cloud Security Posture Management (CSPM) and Extended Detection and Response (XDR), is benefiting from the constant escalation of cyber threats and the complexity of managing distributed cloud workloads. These specialized, mission-critical application areas command premium pricing and demonstrate lower price sensitivity compared to commodity productivity tools, ensuring strong revenue streams for specialized vendors. This bifurcation between mission-critical, high-value SaaS and standardized, cost-optimized commodity SaaS defines the current market maturity.

The enterprise procurement process for B2B SaaS is becoming more sophisticated, moving beyond single-user adoption to multi-stakeholder purchasing committees involving IT, Finance, Legal, and Functional Heads. This requires vendors to provide detailed documentation on compliance, security architecture, financial ROI models, and integration roadmaps. The rise of FinOps (Cloud Financial Management) practices within organizations also means that buyers are demanding greater transparency and control over their cloud consumption, fueling demand for third-party SaaS cost management and optimization tools. The ability of a B2B SaaS vendor to navigate this complex procurement landscape, demonstrating both technical superiority and clear business value, is now a critical determinant of commercial success in the large enterprise segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager