Baby Food and Drink Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441418 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Baby Food and Drink Market Size

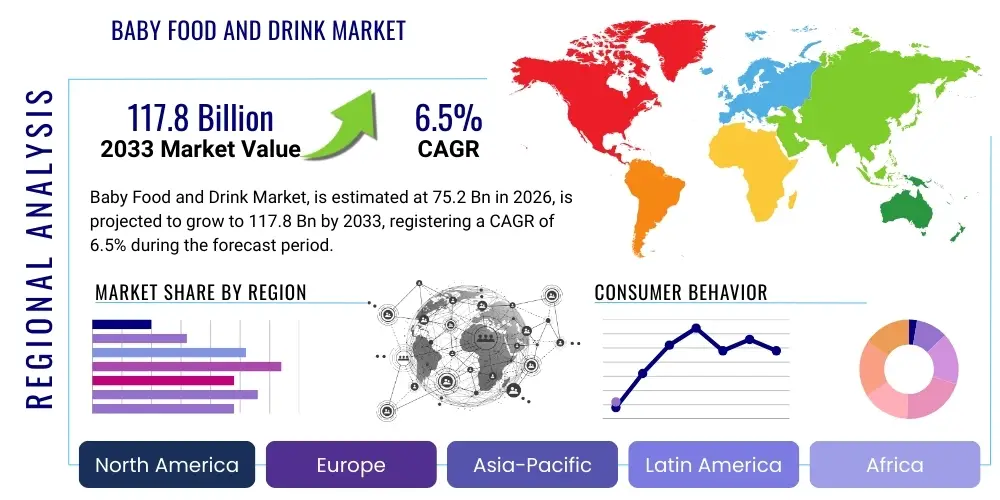

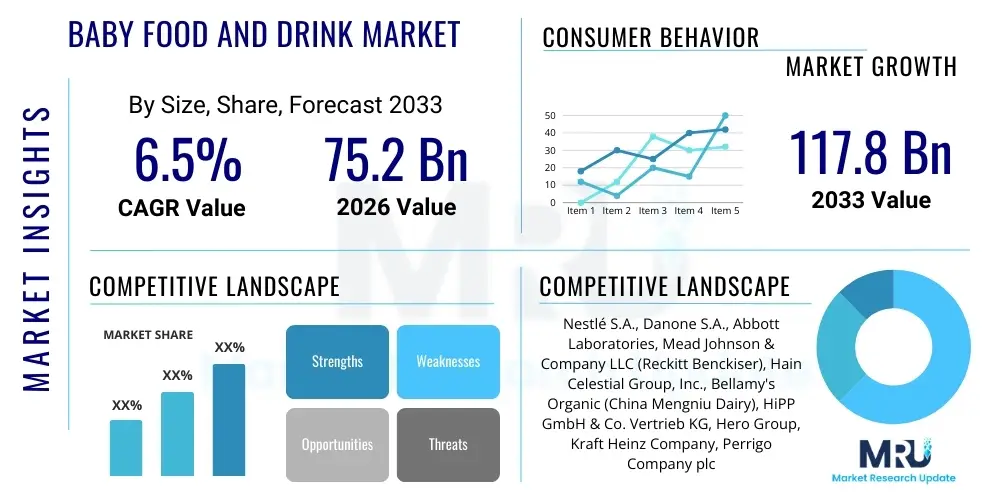

The Baby Food and Drink Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 75.2 Billion in 2026 and is projected to reach USD 117.8 Billion by the end of the forecast period in 2033.

Baby Food and Drink Market introduction

The Baby Food and Drink Market encompasses all commercially prepared edible products specifically formulated and manufactured for infants and toddlers, typically aged six months to two years. This vast category includes a wide range of products, such as infant milk formula, dried baby food (like cereals), prepared baby meals (purees and ready-to-eat), baby snacks, and specialized nutrient-fortified beverages. These products are crucial components of infant nutrition, designed to supplement or transition away from breast milk, providing essential macro and micronutrients required for healthy physical and cognitive development during early childhood. The formulation of these products is highly regulated globally to ensure safety, quality, and nutritional adequacy, often adhering to strict guidelines set by health organizations.

The primary applications of baby food and drink products revolve around providing convenience, consistent nutrition, and facilitating the weaning process. For modern parents facing time constraints, ready-to-eat and formula products offer practical solutions without compromising dietary requirements. Furthermore, specialized products address common infant dietary issues, such as allergies or reflux, through hypoallergenic or sensitive formulations. A major benefit driving market expansion is the increasing global awareness regarding the critical importance of the first 1,000 days of a child's life, leading parents to seek nutrient-dense, easily digestible, and scientifically backed feeding options. The market continually innovates, focusing on organic ingredients, clean labels, and specialized texture development to aid oral motor skills.

Several key factors are driving the substantial growth observed in the Baby Food and Drink Market. A fundamental driver is the sustained increase in the number of working women globally, which correlates with higher demand for convenient, ready-made feeding solutions. Rapid urbanization, coupled with rising disposable incomes in emerging economies, allows more families to afford premium and specialized baby nutrition products. Moreover, high birth rates in regions like Asia Pacific and Africa contribute significantly to the consumer base expansion. Health and wellness trends also play a pivotal role, pushing manufacturers toward organic, non-GMO, and preservative-free product lines, aligning with heightened parental scrutiny regarding ingredient sourcing and preparation methods. These societal shifts collectively underpin the sustained positive trajectory of the market.

Baby Food and Drink Market Executive Summary

The global Baby Food and Drink Market is characterized by robust business trends centered on sustainability, personalization, and digital engagement. Companies are heavily investing in supply chain transparency, utilizing blockchain technologies and rigorous sourcing protocols to address consumer demand for verifiable ingredient origin, especially concerning organic and specialty crops. A critical business trend involves the shift towards plant-based and allergen-free formulations, reflecting growing parental concerns about food sensitivities and evolving dietary preferences. Furthermore, mergers and acquisitions remain frequent, driven by larger corporations seeking to integrate innovative, niche organic brands or expand their geographical footprint into high-growth developing markets. Digital marketing and e-commerce penetration are accelerating, becoming primary channels for product discovery, comparison, and purchase, necessitating sophisticated digital strategies from market leaders.

Regionally, the market dynamics exhibit pronounced variations. Asia Pacific (APAC) dominates the market share, fueled by a large population base, increasing penetration of Western lifestyle preferences, and rising affluence, particularly in China and India, leading to greater adoption of premium infant formula and prepared foods. North America and Europe, while mature, remain crucial centers for innovation, driving demand for specialized products like probiotics, prebiotics, and fortified snacks aimed at early cognitive development. These regions also enforce stringent regulatory standards, compelling global manufacturers to maintain high levels of product quality and safety compliance. Latin America and the Middle East and Africa (MEA) represent high-potential emerging markets, characterized by rapid modernization of retail infrastructure and increasing governmental focus on public health and infant nutrition standards, offering significant untapped potential for market penetration in accessible price points.

Segmentation trends indicate strong momentum across specific product types and distribution channels. Infant Milk Formula, while mature, continues to hold the largest market share due to its established role as a primary breast milk substitute, but prepared baby food and baby snacks are experiencing the fastest growth rates. This acceleration is attributed to increasing consumer demand for diversification in infant diets and convenience during the weaning process. Within distribution, online retail is emerging as the fastest-growing channel, providing consumers with unparalleled access to a global range of specialized products, often bypassing traditional brick-and-mortar limitations. Concurrently, the organic segment within both food and drink categories is capturing a premium price point, reflecting consumer willingness to pay higher prices for perceived health benefits and ethical production methods.

AI Impact Analysis on Baby Food and Drink Market

Common user questions regarding AI's impact on the Baby Food and Drink Market primarily focus on themes of nutritional personalization, supply chain security, and quality control. Users often inquire whether AI can analyze individual infant biometric data or genetic markers to recommend truly customized dietary plans, moving beyond generalized age-based recommendations. Concerns frequently center on the ethical use of this sensitive health data and ensuring AI-driven quality checks maintain, rather than compromise, the stringent safety standards required for infant consumption. Furthermore, there is significant interest in how AI and machine learning can optimize raw material sourcing, predict contamination risks, and minimize waste throughout the complex global supply chain, ensuring product freshness and safety from farm to table. The analysis reveals high user expectation for AI to enhance both the safety and personalization aspects of infant nutrition.

- AI-Powered Personalized Nutrition: Algorithms analyze growth patterns, allergies, and nutrient absorption to recommend customized feeding schedules and product formulations, moving towards micro-personalized dietary solutions for infants.

- Supply Chain Optimization: Machine learning models predict demand fluctuations, optimize inventory management, and identify potential bottlenecks in the raw material supply chain, improving efficiency and reducing spoilage of perishable goods.

- Enhanced Quality Control and Safety: AI-driven image recognition and sensor technology monitor production lines for foreign objects, packaging defects, and ingredient anomalies in real-time, significantly exceeding the capabilities of manual inspection and reducing recall risks.

- Formulation and R&D Acceleration: AI simulates the impact of new ingredient combinations on nutritional profiles and palatability, dramatically speeding up the research and development cycle for novel baby food products (e.g., specialized prebiotic blends).

- Consumer Interaction and Support: Chatbots and virtual assistants powered by natural language processing (NLP) provide immediate, personalized responses to parental queries regarding product usage, ingredients, and common feeding challenges, enhancing customer loyalty and support infrastructure.

- Predictive Market Trend Analysis: AI algorithms scan social media, retail data, and health journals to forecast emerging parental preferences (e.g., sustainable packaging, specific superfoods), allowing manufacturers to rapidly adjust product portfolios to capture new market opportunities.

DRO & Impact Forces Of Baby Food and Drink Market

The Baby Food and Drink Market is shaped by a critical balance of drivers, restraints, and opportunities, collectively managed by powerful external impact forces. The dominant drivers include rising disposable income, rapid urbanization leading to nuclear family structures, and heightened awareness among parents regarding the necessity of proper early-life nutrition, often fueled by educational campaigns from health authorities. Conversely, the market faces significant restraints, primarily stringent regulatory frameworks that necessitate complex and costly product testing and approval processes. Concerns over the price premium associated with organic and specialty baby foods limit penetration in lower-income demographics. However, substantial opportunities exist, particularly in the development of functional baby foods fortified with immunity-boosting components and the expansion of the e-commerce distribution network, providing access to previously unreachable rural and semi-urban populations. These internal dynamics are continuously influenced by powerful external forces, including demographic shifts, technological advancements in food processing, and global fluctuations in commodity prices for key ingredients like milk solids and organic produce.

Impact forces acting upon the market determine the severity and speed of change. Competitive intensity remains high, driven by the presence of both multinational conglomerates and agile local startups focusing on niche segments like clean label or ethnic baby foods. This rivalry forces continuous innovation in packaging, formulation, and marketing. Substitute products, particularly the persistent cultural preference for home-cooked baby food in many regions, act as a consistent dampener on market growth, necessitating that commercial products demonstrate superior convenience and verified nutritional value. Supplier power is moderate; while staple ingredients are widely available, specialized organic and non-GMO components often come from concentrated sources, granting suppliers leverage. Buyer power is high due to the emotional nature of the purchase—parents are extremely discerning and price-sensitive regarding quality and safety, leading to strong brand loyalty but quick defection if quality concerns arise. Overall, the market thrives on technological improvements in sterilization and nutrient retention, while simultaneously battling restrictive regulatory environments designed to protect vulnerable infant populations.

The interplay between opportunities and restraints necessitates strategic maneuvering by market players. For instance, the opportunity presented by the functional food trend (e.g., adding probiotics for gut health) must be carefully navigated against the regulatory restraint concerning health claims allowable on infant product packaging. Market growth is structurally sound, supported by fundamental demographic tailwinds, yet profitability is often squeezed by the cost of maintaining impeccable quality standards and navigating the fragmented global regulatory landscape. Successful companies are those that effectively harness technology to reduce production costs while investing heavily in clinical trials and transparent labeling to build unwavering consumer trust, effectively mitigating the restraining forces through strategic investment and operational excellence.

Segmentation Analysis

The Baby Food and Drink Market is comprehensively segmented based on product type, ingredient source, and distribution channels, reflecting the diverse nutritional needs and purchasing behaviors of global consumers. Product segmentation highlights the dominance of Infant Milk Formula, which caters to the foundational needs of infants from birth, alongside the fast-growing segments of Prepared Baby Food and Baby Snacks, designed for the weaning stage and supplementary nutrition. Ingredient segmentation, primarily divided into organic and conventional, showcases the increasing premiumization of the market, driven by parental desires for minimized exposure to pesticides and artificial additives. Analyzing these segments provides a clear map of consumer preferences, guiding manufacturers in product development and market entry strategies tailored to specific demographic and regional demands.

- By Product Type:

- Infant Milk Formula (Standard, Follow-on, Specialty/Therapeutic)

- Prepared Baby Food (Wet/Purees, Meals, Pouches)

- Dried Baby Food (Cereals, Flakes)

- Baby Snacks and Beverages (Finger Foods, Biscuits, Juices, Water)

- By Ingredient Source:

- Organic Baby Food and Drink

- Conventional Baby Food and Drink

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies and Drug Stores

- Online Retail Channels

- Convenience Stores and Others

- By Age Group:

- 0 to 6 Months

- 6 to 12 Months

- 12 to 24 Months

Value Chain Analysis For Baby Food and Drink Market

The value chain for the Baby Food and Drink Market is intricate and highly specialized, beginning with the meticulous procurement of high-quality, often organic and specialized, raw materials (upstream analysis). This phase involves sourcing milk solids, specialized grains, fruits, vegetables, and proprietary nutrient blends, requiring rigorous quality assurance from suppliers to meet infant consumption standards. Following procurement, the materials undergo specialized processing, blending, and sterilization (manufacturing phase), ensuring nutrient retention while eliminating pathogenic risks. Logistics and distribution (downstream analysis) are critical, focusing on maintaining cold chains for certain products and efficiently distributing shelf-stable goods across diverse retail landscapes, from large supermarkets to local pharmacies and increasingly complex direct-to-consumer online channels. Regulatory compliance overlays every stage, adding complexity and cost, but ensuring product safety and maintaining consumer trust.

Upstream analysis focuses heavily on vertical integration or long-term partnerships with certified farmers and suppliers, particularly crucial for the fast-growing organic segment. Manufacturers must ensure traceability from the farm level, often necessitating advanced monitoring systems to track pesticide usage, soil quality, and genetic modification status. The financial commitment required for these stringent sourcing requirements often results in concentrated supplier power for niche ingredients. Processing involves advanced technologies like High Pressure Processing (HPP) and aseptic packaging, aimed at extending shelf life without relying on chemical preservatives, a key consumer demand. Research and development is heavily emphasized upstream to formulate products that meet evolving nutritional science recommendations and address common issues like infant allergies or digestive difficulties.

Downstream analysis highlights the complexity of distribution channels. Direct distribution to major retailers (Supermarkets/Hypermarkets) allows for high volume sales and brand visibility. Indirect channels, particularly the specialized Online Retail segment, offer broader geographic reach and the ability to market niche, specialty products directly to consumers, bypassing traditional gatekeepers. Pharmacies and Drug Stores remain vital for formula sales and advice, acting as trustworthy hubs for parents seeking scientifically backed options. Effective channel management requires differentiated pricing strategies, tailored packaging sizes, and aggressive digital marketing aimed at the highly engaged parental demographic. The success downstream is intrinsically linked to establishing strong brand loyalty, driven by quality assurance and ease of access.

Baby Food and Drink Market Potential Customers

The primary customers for the Baby Food and Drink Market are the parents and guardians of infants and toddlers, spanning the crucial developmental period from birth up to two years of age. This demographic is segmented broadly into first-time parents who often rely heavily on established major brands and recommendations from pediatricians, and experienced parents who are more likely to seek specialized, premium, or organic alternatives based on previous feeding experiences. Geographically, customers in developed economies often prioritize convenience and specialized ingredients (e.g., specific protein hydrolysates), while those in emerging markets prioritize foundational nutritional adequacy and affordability. This customer base is characterized by high levels of information seeking, heavily relying on online reviews, pediatric recommendations, and health blogs to make purchasing decisions, signifying a high sensitivity to product reputation and trust.

A significant segment of potential customers includes grandparents and other caregivers who purchase supplementary items, although the main decision-making power resides with the parents. Within the direct parent segment, a growing sub-group consists of affluent, health-conscious millennials who drive the demand for plant-based, clean-label, and sustainable packaging options. These consumers often utilize online subscription services for recurring purchases. Another critical segment includes parents seeking therapeutic or allergy-specific formulas (e.g., lactose-free, soy-based, or extensively hydrolyzed protein formulas) due to medical necessity, making them less price-sensitive and highly loyal to proven, effective brands. Manufacturers must therefore develop marketing narratives that address both the need for convenience and the paramount concern for health and safety across this diverse purchasing group.

The evolving customer base also reflects changes in feeding habits and weaning processes. As pediatricians increasingly recommend earlier introduction of varied textures and flavors, parents are becoming buyers of transitional foods like baby snacks and textured purees earlier than in previous decades. This shift expands the average consumption period for commercial baby food products. Furthermore, the demographic shift towards older parenthood in many industrialized nations means these customers often possess higher disposable income, enabling them to invest in premium and specialized functional foods aimed at cognitive development, such as those fortified with DHA and ARA. Targeting these potential customers effectively requires emphasizing scientific validation, transparent ingredient lists, and ease of use in busy modern lifestyles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 75.2 Billion |

| Market Forecast in 2033 | USD 117.8 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson & Company LLC (Reckitt Benckiser), Hain Celestial Group, Inc., Bellamy's Organic (China Mengniu Dairy), HiPP GmbH & Co. Vertrieb KG, Hero Group, Kraft Heinz Company, Perrigo Company plc, Beingmate Co., Ltd., FrieslandCampina, Töpfer GmbH, Little Spoon, Happy Family Organics (Danone), Else Nutrition, NurturMe, Yumi, Once Upon a Farm, Gerber Products Company (Nestlé) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Food and Drink Market Key Technology Landscape

The technological landscape of the Baby Food and Drink Market is predominantly focused on advanced processing techniques, automation, and traceability systems designed to maximize product safety, nutritional value, and shelf stability. A core technology is Aseptic Processing and Packaging, which enables the production of preservative-free, ready-to-eat purees and meals with extended shelf lives, crucial for the growing pouch and prepared food segments. Furthermore, High-Pressure Processing (HPP) is increasingly adopted, offering a non-thermal pasteurization method that preserves the natural flavor, color, and nutrient integrity of fruits and vegetables better than traditional heat sterilization, aligning perfectly with consumer demand for minimally processed foods. Automation utilizing robotics and high-speed filling lines ensures consistency and reduces the risk of human error or contamination during the manufacturing process, a critical factor for highly sensitive infant products.

Beyond manufacturing, the integration of digital technologies for supply chain transparency is a major trend. Blockchain technology is emerging as a critical tool, providing an immutable ledger for tracking ingredients from their origin (farm or dairy) through processing, distribution, and finally to the retail shelf. This enhances consumer trust by offering verifiable proof of authenticity and quality, particularly vital in the aftermath of past food safety scares globally. Simultaneously, analytical techniques such as advanced chromatography and mass spectrometry are continually refined for rapid, highly sensitive detection of contaminants, allergens, and adulterants, ensuring compliance with the world’s most stringent food safety regulations, thereby safeguarding infant health and corporate reputation.

In the realm of product development, specialized encapsulation and drying technologies are gaining traction. Technologies like spray drying and freeze-drying are essential for producing high-quality milk formulas and dried cereals, ensuring stable suspension of sensitive ingredients like probiotics, DHA, and vitamins. Encapsulation techniques protect these sensitive functional ingredients during processing and storage, ensuring their bioavailability when consumed by the infant. Furthermore, technologies focusing on specialized filtration and purification are crucial for producing hypoallergenic and specialty formulas, isolating specific protein fractions or removing allergens effectively. Continuous investment in these sophisticated manufacturing and quality control technologies defines the competitive edge in this highly trust-dependent industry.

Regional Highlights

The global Baby Food and Drink Market exhibits significant regional disparities in terms of growth rates, product preferences, and regulatory environments, necessitating tailored market entry strategies.

- Asia Pacific (APAC): APAC is the dominant market region, driven by high birth rates, rapid urbanization, and increasing household wealth, particularly in China and India. The demand here is massive for infant milk formula due to regulatory changes promoting formula consumption and increasing difficulty for mothers to maintain exclusive breastfeeding in urban, working environments. Japan and South Korea lead in technological adoption and demand for premium, functional baby snacks and pouches, while Southeast Asian countries offer high growth potential for value-for-money conventional products.

- North America: This region is characterized by high consumer awareness regarding health and sustainability, driving substantial growth in the organic, non-GMO, and specialized therapeutic formula segments. Convenience is paramount, leading to high adoption of ready-to-eat purees in pouches and sophisticated baby snacks. The market is mature but highly innovative, with a constant influx of startups focusing on allergen-free and niche dietary requirements. Stringent FDA regulations maintain a high barrier to entry but ensure market stability and product quality.

- Europe: Europe is defined by some of the strictest food safety and labeling standards globally, particularly enforced by the European Food Safety Authority (EFSA). Germany and the UK are major markets, with a strong consumer preference for locally sourced, transparently labeled products, fueling the dominance of brands specializing in organic and sustainable practices (e.g., the HiPP brand strength). France and Italy show high adoption of specialized formulas endorsed by pediatric recommendations. Innovation focuses on gut health ingredients like prebiotics and human milk oligosaccharides (HMOs).

- Latin America (LATAM): LATAM represents an emerging market with significant expansion potential. Brazil and Mexico are the primary consumption hubs, experiencing growth due to rising disposable incomes and modern retail development. While price sensitivity remains a factor, the middle class is increasingly willing to invest in fortified formula and entry-level prepared baby food. Market development is slightly hampered by economic volatility but supported by governmental initiatives promoting infant health standards.

- Middle East and Africa (MEA): This is the fastest-growing region, albeit starting from a smaller base, driven by high population growth and substantial investment in health infrastructure in Gulf Cooperation Council (GCC) countries. There is a strong reliance on imported premium formula and specialized products. African markets, characterized by high birth rates, focus primarily on affordable, nutrient-dense cereals and supplementary feeding programs, creating a dual-market structure where premium and mass-market products coexist.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Food and Drink Market.- Nestlé S.A.

- Danone S.A.

- Abbott Laboratories

- Mead Johnson & Company LLC (Reckitt Benckiser)

- The Hain Celestial Group, Inc.

- Bellamy's Organic (China Mengniu Dairy)

- HiPP GmbH & Co. Vertrieb KG

- Hero Group

- The Kraft Heinz Company

- Perrigo Company plc

- Beingmate Co., Ltd.

- FrieslandCampina

- Töpfer GmbH

- Little Spoon

- Happy Family Organics (Danone)

- Else Nutrition

- NurturMe

- Yumi

- Once Upon a Farm

- Gerber Products Company (Nestlé)

Frequently Asked Questions

Analyze common user questions about the Baby Food and Drink market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Baby Food and Drink Market?

The Baby Food and Drink Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033, driven by increasing parental income and demand for prepared nutritional convenience.

Which product segment holds the largest share in the global Baby Food and Drink Market?

Infant Milk Formula currently holds the largest market share globally due to its necessity as a primary substitute for breast milk and the high demand generated by working parents worldwide, particularly in the Asia Pacific region.

How is the trend towards organic ingredients affecting the Baby Food and Drink industry?

The organic ingredients trend is a major driver, resulting in significant market premiumization. Consumers are actively seeking certified organic, non-GMO, and clean-label products, compelling manufacturers to invest in transparent sourcing and sustainable production practices to meet rising consumer demand for safety assurance.

What role does e-commerce play in the distribution of baby food products?

Online retail is the fastest-growing distribution channel, providing unparalleled convenience, wider product selection (especially specialized and imported brands), and direct-to-consumer models like subscription services. E-commerce platforms facilitate direct engagement and personalized offers to parents.

How do stringent regulations impact the competitiveness of the Baby Food and Drink Market?

Stringent governmental and international regulations (such as EFSA and FDA standards) act as a high barrier to entry, requiring substantial investment in clinical trials, quality control, and testing. While increasing operational costs, these regulations solidify consumer trust and favor established global players with resources for compliance.

What are the key technological advancements shaping the manufacturing process of baby food?

Key technological advancements include Aseptic Processing and High-Pressure Processing (HPP) for preservative-free shelf stability, along with the integration of Blockchain technology for enhanced supply chain traceability and robust AI systems for real-time quality assurance and contamination detection.

Which region is expected to demonstrate the highest growth potential for baby food and drinks?

The Asia Pacific (APAC) region is expected to maintain the highest growth potential, largely driven by significant demographic advantages, including high birth rates in India and emerging Southeast Asian nations, coupled with increasing adoption of commercial feeding solutions in urban areas.

What are the main restraints limiting the market growth in developing countries?

Primary restraints in developing countries include high price sensitivity among lower-income groups for premium products, persistent cultural preferences for traditional homemade baby food, and challenges in establishing reliable cold chain logistics and modern retail infrastructure in rural areas.

How are baby snacks evolving to meet modern parental demands?

Baby snacks are evolving rapidly, shifting from simple biscuits to complex finger foods, often fortified with functional ingredients like whole grains, probiotics, and targeted vitamins (DHA). The focus is on clean ingredients, non-GMO status, and textures that promote the development of oral motor skills and independent eating habits in toddlers.

What is the significance of the 1,000-day window in driving the demand for specialty baby food?

The first 1,000 days (from conception to age two) are scientifically recognized as critical for lifelong health. This heightened awareness drives parents to prioritize specialty, scientifically formulated baby foods and drinks containing functional components like iron, zinc, and specialized fatty acids (DHA/ARA) to support optimal brain and immune system development.

How does AI contribute to personalized nutrition in the Baby Food and Drink Market?

AI analyzes data points such as growth curves, allergen profiles, and regional nutritional deficiencies to generate highly individualized dietary recommendations. This capability allows manufacturers to develop or recommend specific product combinations tailored to the unique metabolic and developmental needs of individual infants, moving beyond standard age-based feeding guidelines.

What is the primary factor driving the demand for ready-to-eat prepared baby food pouches?

The primary factor is convenience, particularly among dual-income households and busy modern families. Pouches offer portion control, reduced preparation time, and portability while minimizing mess, making them ideal for feeding infants while traveling or during busy schedules outside the home.

Who are the key consumers driving demand for specialized therapeutic formulas?

The key consumers are parents whose infants have confirmed dietary issues, such as severe food allergies (like Cow's Milk Protein Allergy), lactose intolerance, or gastrointestinal disorders. These purchases are medically driven, resulting in high brand loyalty and minimal price elasticity for effective, pediatrician-recommended therapeutic options.

In the value chain, what is the most critical aspect of the upstream analysis for baby food manufacturers?

The most critical aspect is stringent quality assurance and traceability of raw materials. Given the vulnerability of infants, manufacturers must ensure verifiable origin, lack of contaminants (heavy metals, pesticides), and certification (especially for organic components) right from the farming stage to maintain regulatory compliance and consumer trust.

How does the increasing trend of working mothers influence the market structure?

The rising number of working mothers directly boosts the demand for high-convenience products like infant formula and pre-packaged meals. This demographic shift necessitates solutions that are quick, easy to prepare, and nutritionally reliable, altering retail demand away from purely traditional, home-prepared feeding methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager