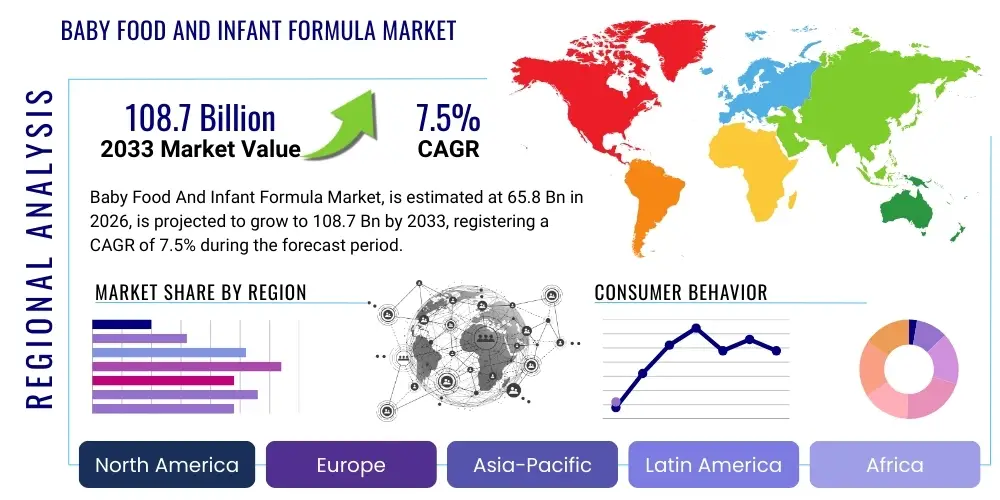

Baby Food And Infant Formula Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443380 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Baby Food And Infant Formula Market Size

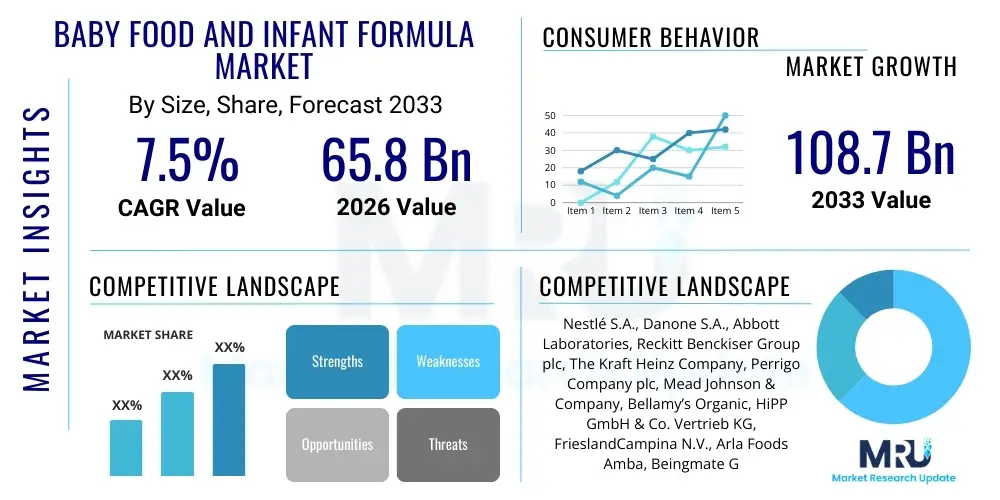

The Baby Food And Infant Formula Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 65.8 billion in 2026 and is projected to reach USD 108.7 billion by the end of the forecast period in 2033. This robust expansion is fueled by increasing global birth rates, rising participation of women in the workforce, and heightened consumer awareness regarding specialized nutritional requirements during early childhood development. The urbanization trend, particularly in developing economies, coupled with significant advancements in product formulation—such as the inclusion of Human Milk Oligosaccharides (HMOs) and probiotics—are major contributing factors driving this exponential valuation increase. Furthermore, manufacturers are focusing heavily on clean-label and organic offerings to meet the growing demand from health-conscious millennial parents.

Baby Food And Infant Formula Market introduction

The Baby Food and Infant Formula Market encompasses all commercially prepared, processed, and packaged nutritional products designed specifically for infants and toddlers up to 36 months of age. These products serve as essential substitutes or supplements for breast milk, ensuring children receive balanced macro and micronutrients crucial for cognitive, physical, and immune system development. Infant formula, the most critical segment, provides complete nutritional support for newborns, typically formulated using cow milk protein or specialized ingredients for hypoallergenic needs. Baby food, spanning purees, cereals, snacks, and finger foods, is introduced during the weaning phase to transition infants onto solid diets. Major applications include hospital feeding, routine home nutrition, and addressing specific dietary conditions such as lactose intolerance or allergies. The market growth is fundamentally driven by high demand for convenient, ready-to-feed options among time-constrained parents, coupled with stricter governmental regulations ensuring product safety and quality worldwide.

Baby Food And Infant Formula Market Executive Summary

The Baby Food and Infant Formula Market is characterized by intense innovation centered around functional ingredients and premiumization, defining current business trends. Regional disparities persist, with Asia Pacific dominating consumption due to large population bases and rapid economic development, while North America and Europe lead in advanced research and product innovation, particularly concerning organic and clean-label foods. Key segment trends show a rapid shift towards specialized formulas, including those featuring HMOs and prebiotics, reflecting parental desire for products that mimic the benefits of breast milk. The prepared baby food segment is undergoing a revolution with the introduction of fresh, refrigerated, and plant-based alternatives, moving away from traditional shelf-stable jars. Strategic collaborations between market leaders and ingredient suppliers, coupled with substantial investments in manufacturing safety and supply chain transparency, are shaping the competitive landscape, prioritizing consumer trust and product integrity.

AI Impact Analysis on Baby Food And Infant Formula Market

User queries concerning AI in the Baby Food and Infant Formula market predominantly revolve around three key themes: ensuring the safety and traceability of sensitive ingredients, developing personalized nutritional solutions based on infant profiles, and optimizing complex, global supply chains to prevent contamination and recalls. Users seek assurances that AI technologies can elevate product quality control beyond traditional inspection methods, specifically in detecting minute contaminants or verifying ingredient sourcing authenticity via blockchain integration. Furthermore, there is high expectation for AI-driven platforms that leverage genetic data or consumption patterns to recommend specific formula types or weaning schedules, addressing the rising consumer demand for precision nutrition tailored to individual developmental needs. The overarching expectation is that AI will streamline operations, minimize risk, and ultimately enhance the nutritional efficacy and safety of products delivered to vulnerable populations.

- AI enhances quality control and food safety through real-time detection of contaminants during processing.

- Predictive analytics optimize supply chain logistics, minimizing inventory holding times and preventing stockouts of essential products.

- Machine learning facilitates personalized nutrition plans by analyzing individual infant biometric and health data.

- AI-powered chatbots and virtual nutritionists provide 24/7 personalized parental guidance on feeding schedules and product selection.

- Computer vision systems automate inspection processes for packaging integrity and label compliance, reducing human error.

- Blockchain integration, managed by AI, ensures end-to-end traceability of ingredients from farm to shelf, boosting consumer trust.

DRO & Impact Forces Of Baby Food And Infant Formula Market

The market dynamics are governed by powerful drivers, strict restraints, and promising opportunities, collectively shaping the future trajectory of the Baby Food and Infant Formula sector. Primary drivers include the global increase in working mothers seeking convenient, nutritious feeding solutions, coupled with significant advancements in nutritional science leading to sophisticated product formulations like specialty and therapeutic formulas. These innovations address specific infant health needs, increasing market penetration. Conversely, the market faces stringent restraints primarily related to intense governmental scrutiny and strict regulatory standards regarding ingredient sourcing, marketing practices, and labeling, which impose high operational costs and barriers to entry. Additionally, recurrent product recalls due to contamination concerns, even if minor, severely impact consumer confidence and brand loyalty, creating significant market volatility. Opportunities abound in untapped emerging markets, the ongoing shift towards organic and non-GMO product lines, and leveraging e-commerce and direct-to-consumer models for enhanced market reach and personalization.

Impact forces in this sector are particularly strong due to the vulnerability of the end consumers. The availability of high-quality raw materials, especially dairy proteins and specialized micronutrients, is a constant pressure point; fluctuations in commodity prices and supply chain disruptions directly influence final product cost and formulation consistency. Furthermore, consumer perception and trust act as a pivotal force; any negative media coverage or sustained campaigns promoting breastfeeding over formula can substantially curb demand. The force of competitive intensity is extremely high, dominated by a few global giants who control brand recognition, research budgets, and distribution networks, often engaging in fierce price wars or rapid product innovation cycles to secure market share. Regulatory changes, particularly concerning the banning of certain marketing tactics or mandating new ingredient requirements, exert immense external force, demanding constant compliance updates and significant capital expenditure for re-formulation.

The interplay of these forces mandates that companies prioritize strategic agility. To mitigate the restraint of regulatory complexity, manufacturers are investing heavily in preemptive compliance strategies and specialized legal teams. To capitalize on growth opportunities, firms are aggressively expanding their digital footprint and supply chain capabilities in high-growth regions like Southeast Asia and Latin America. The core strategy revolves around balancing the imperative for highly innovative, specialized products (Drivers) with the absolute necessity of maintaining flawless safety records and navigating restrictive advertising rules (Restraints), making operational excellence and transparent communication the ultimate competitive advantage.

Segmentation Analysis

The Baby Food and Infant Formula market is comprehensively segmented based on product type, ingredient source, distribution channel, and target age group, enabling manufacturers to tailor offerings to specific consumer needs and regulatory environments. Product segmentation dictates the functional use of the product, ranging from wet baby food purees designed for early weaning to specialized milk formulas for infants with allergies. Ingredient segmentation highlights the growing consumer preference for organic, non-GMO, and plant-based options, reflecting global dietary trends and sustainability concerns. Analyzing these segments provides crucial insights into shifting parental purchasing behavior, allowing companies to allocate R&D resources effectively towards high-potential niches such as prebiotics and probiotics integration within standard formula bases, ensuring sustained market relevance and profitability.

- By Product Type:

- Infant Formula (Standard, Follow-on, Toddler Milk, Specialty Formula)

- Prepared Baby Food (Cereals, Pureed, Snacks, Finger Foods)

- Other Baby Food (Drinks, Juices)

- By Ingredient Source:

- Dairy-based (Cow Milk, Goat Milk)

- Plant-based (Soy, Rice, Oat)

- Organic

- Conventional

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Pharmacies/Drug Stores

- Online Retail Channels

- Specialty Stores

- By Target Age Group:

- 0–6 Months (Stage 1)

- 6–12 Months (Stage 2)

- 12–36 Months (Stage 3/Toddler)

Value Chain Analysis For Baby Food And Infant Formula Market

The value chain for the Baby Food and Infant Formula Market is complex, beginning with highly specialized upstream activities that demand rigorous quality control and certification. Upstream analysis focuses on the sourcing of critical raw materials, primarily high-quality dairy components (whey, lactose), plant proteins (soy), specialized fats and oils, and essential micronutrient additives (vitamins, minerals, HMOs). This phase requires secure supplier relationships, intensive testing for contaminants, and certifications such as organic or non-GMO status. Manufacturing involves sophisticated processes like homogenization, pasteurization, spray-drying (for formula), and aseptic processing (for prepared foods), followed by stringent packaging under sterile conditions to ensure shelf life and safety. Efficiency in this stage, including energy optimization and waste reduction, is vital for maintaining margins in a highly competitive sector where price sensitivity exists alongside premium expectations.

The middle segment of the value chain is dominated by logistics, distribution channel management, and regulatory compliance. Products move through complex distribution networks, including direct sales to hospitals or indirect routes through wholesalers and major retail chains. Direct distribution emphasizes speed and traceability, often utilizing refrigerated transport for specialized or fresh products. Indirect channels require strong inventory management and promotional support to compete for shelf space in major supermarkets and pharmacies. Regulatory adherence plays an enormous role here; differing labeling, import, and testing requirements across international borders necessitate localized packaging and documentation, driving up complexity and requiring deep expertise in global trade regulations. The success of this stage hinges on minimizing product damage and maintaining temperature control to preserve nutritional integrity.

Downstream analysis centers on retail and consumption. Traditional distribution heavily relies on supermarkets, hypermarkets, and specialized pharmacies, which leverage high foot traffic and consumer trust. However, the rapidly expanding online retail channel is disrupting this structure, offering greater convenience, wider product selections, and direct-to-consumer opportunities. E-commerce platforms facilitate subscription models and specialized product searches, appealing to niche consumer segments (e.g., parents seeking specific hypoallergenic formulas). Effective downstream strategy now integrates omnichannel retail, utilizing digital engagement and loyalty programs to build long-term relationships, coupled with highly localized marketing efforts sensitive to cultural preferences regarding infant feeding practices and nutritional claims.

Baby Food And Infant Formula Market Potential Customers

The primary customer base for the Baby Food and Infant Formula Market consists overwhelmingly of parents and primary caregivers, particularly those with infants aged zero to 36 months, who prioritize convenience, nutritional completeness, and product safety above other factors. This demographic is increasingly informed, utilizing digital resources and social networks to research ingredient lists, compare nutritional benefits, and verify product origins, making transparency a non-negotiable expectation. A crucial secondary segment includes medical and institutional buyers, such as pediatric hospitals, maternity wards, and governmental aid programs, which purchase large volumes of highly regulated, often specialized, formulas for clinical use or public health initiatives. These institutional buyers focus heavily on certifications, reliable supply, and clinically proven efficacy, adhering to strict procurement guidelines.

Furthermore, demographic shifts are expanding the potential customer profile. The rising trend of working parents, especially in developed and rapidly urbanizing economies, drives demand for shelf-stable, convenient, ready-to-use baby food and formula that minimizes preparation time without compromising quality. This segment is less price-sensitive and highly receptive to premium, organic, and functionally enhanced products like those containing DHA/ARA, lutein, or HMOs. Conversely, in emerging markets, customers are often more price-sensitive but equally concerned about basic safety and efficacy, leading to demand for value-based, locally sourced formula and processed food products that meet international safety standards but remain economically accessible. Catering to both the premium, specialty segment and the value-conscious mainstream requires diversified product lines and tailored marketing strategies that resonate with distinct purchasing motivations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.8 Billion |

| Market Forecast in 2033 | USD 108.7 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Danone S.A., Abbott Laboratories, Reckitt Benckiser Group plc, The Kraft Heinz Company, Perrigo Company plc, Mead Johnson & Company, Bellamy’s Organic, HiPP GmbH & Co. Vertrieb KG, FrieslandCampina N.V., Arla Foods Amba, Beingmate Group Co. Ltd., Yashili International Holdings Ltd., H&H Group (Biostime), Ausnutria Dairy Corporation Ltd., Fonterra Co-operative Group, R&R Baby, Hain Celestial Group, Hero Group, NurturMe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Food And Infant Formula Market Key Technology Landscape

The technological landscape of the Baby Food and Infant Formula market is rapidly evolving, driven by the dual needs for enhanced safety and superior nutritional quality. Advanced food processing technologies, such as sophisticated spray drying techniques for powdered formula, are essential for maintaining the integrity of sensitive components like probiotics and vitamins during manufacturing. High-Pressure Processing (HPP) is increasingly utilized in the prepared baby food segment as a non-thermal pasteurization method, extending shelf life while preserving the fresh taste, texture, and nutrient density that modern consumers demand, distinguishing these products from traditional heat-treated options. Furthermore, encapsulation technology is becoming crucial for stabilizing and delivering bioactives like Omega-3 fatty acids and specific strains of beneficial bacteria, ensuring their viability until consumption and enhancing their bio-availability, which is a major selling point in the premium formula category.

In terms of quality assurance and supply chain integrity, two technologies stand out: advanced spectroscopic analysis and blockchain integration. Spectroscopic methods (e.g., Near-Infrared or Mass Spectrometry) allow for rapid, non-destructive testing of incoming raw materials and finished products, detecting contaminants, verifying nutrient profiles, and ensuring batch consistency far faster than conventional lab testing. This speed is critical for preventing widespread contamination events. Blockchain technology, leveraged primarily for supply chain traceability, creates immutable records of every step a product takes—from raw ingredient cultivation to final retail placement. This level of transparency addresses critical consumer trust deficits resulting from past recalls and allows regulators and consumers alike to instantly verify the origin and handling history of the product, particularly important for specialized organic or grass-fed formulations.

Digitalization and automation technologies are transforming manufacturing efficiency and regulatory compliance. Robotics and automated filling lines minimize human contact, thereby significantly reducing the risk of contamination during packaging—a critical factor in aseptic environments. Furthermore, the adoption of sophisticated Enterprise Resource Planning (ERP) systems, integrated with Laboratory Information Management Systems (LIMS), ensures real-time tracking of production metrics, simplifies complex regulatory documentation processes (such as adherence to FDA or EFSA standards), and facilitates immediate response during recall scenarios. These integrated digital tools represent the foundational technological investment required for companies to scale operations globally while upholding the highest standards of safety and compliance expected in the infant nutrition sector.

Regional Highlights

Regional dynamics play a profound role in shaping the demand and competitive structure of the Baby Food and Infant Formula market, influenced by varying demographic trends, disposable incomes, regulatory frameworks, and cultural preferences regarding infant feeding. Asia Pacific (APAC) currently holds the dominant share in terms of volume and is projected to exhibit the highest growth rate during the forecast period. This dominance is driven by high birth rates in countries like India and Indonesia, the rapid increase in middle-class disposable income, and the urbanization effect leading to greater reliance on convenient commercial baby food solutions. China, despite a fluctuating birth rate, remains the largest single market globally due to premiumization trends and a deep-seated consumer willingness to pay high prices for imported, trusted international brands following historical domestic safety concerns.

North America and Europe are mature markets characterized by stringent quality controls, strong regulatory oversight, and advanced product innovation. These regions are market leaders in the adoption of specialized and therapeutic formulas, organic options, and innovative ingredients like HMOs and unique probiotics strains. The growth here is volume-stable but value-driven, meaning manufacturers focus on high-margin, premium products to capture market share rather than relying solely on population growth. European countries, particularly Germany and France, emphasize sustainable sourcing and clean-label verification, pushing manufacturers toward transparent supply chains and minimal additives. Regulatory hurdles, such as strict limitations on formula advertising (especially in Europe), necessitate creative and education-focused marketing strategies.

Latin America (LATAM) and the Middle East and Africa (MEA) represent significant opportunities for future market penetration. LATAM is seeing rising formula consumption as more women enter the workforce, though economic instability in some nations can restrain high-end product purchases. MEA, particularly the GCC countries and South Africa, presents rapid growth potential fueled by high fertility rates and increasing purchasing power. However, companies operating in MEA must contend with diverse regulatory environments, logistical complexities related to temperature control and distribution across varied geographies, and cultural nuances regarding feeding traditions. Success in these emerging markets relies on tailoring product formats and pricing strategies to local economic realities while maintaining international quality standards.

- Asia Pacific (APAC): Dominates market volume; driven by China, India, and ASEAN nations' growing middle class and high birth rates. Focus on imported and premium brands (e.g., specialty formulas).

- North America: High penetration of organic and specialized formulas; innovation concentrated on DHA/ARA enrichment and clean-label trends. Stringent FDA regulatory environment demands high compliance standards.

- Europe: Value-driven growth; market characterized by strict EFSA regulations, a strong emphasis on sustainability, and high demand for locally sourced and non-GMO ingredients.

- Latin America (LATAM): Growing consumption driven by urbanization and working mothers; opportunity exists in expanding distribution to underserved rural areas. Price sensitivity is a key factor.

- Middle East and Africa (MEA): High growth potential due to robust fertility rates; presents logistical challenges and requires localized product adjustments to meet diverse cultural and religious dietary needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Food And Infant Formula Market.- Nestlé S.A.

- Danone S.A.

- Abbott Laboratories

- Reckitt Benckiser Group plc

- The Kraft Heinz Company

- Perrigo Company plc

- Mead Johnson & Company

- Bellamy’s Organic

- HiPP GmbH & Co. Vertrieb KG

- FrieslandCampina N.V.

- Arla Foods Amba

- Beingmate Group Co. Ltd.

- Yashili International Holdings Ltd.

- H&H Group (Biostime)

- Ausnutria Dairy Corporation Ltd.

- Fonterra Co-operative Group

- R&R Baby

- Hain Celestial Group

- Hero Group

- NurturMe

Frequently Asked Questions

Analyze common user questions about the Baby Food And Infant Formula market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Infant Formula market?

The primary driver is the rising participation of women in the global workforce, which increases demand for convenient, nutritionally complete substitutes or supplements to breastfeeding, coupled with continuous scientific advancements in formula composition, such as the addition of Human Milk Oligosaccharides (HMOs).

How significant is the role of organic ingredients in the Baby Food segment?

Organic ingredients are highly significant, representing a major premiumization trend. Consumers seek organic options due to perceived health benefits, avoidance of pesticides, and concerns regarding genetically modified organisms (GMOs). This segment consistently demonstrates higher growth rates than conventional offerings.

What regulatory challenges face Baby Food manufacturers globally?

Manufacturers face intense regulatory scrutiny globally, particularly regarding marketing practices, health claims, and ingredient sourcing. Compliance with strict standards set by bodies like the FDA in the US and EFSA in Europe, along with managing frequent product recall risks, constitutes the core regulatory challenge.

Which geographical region holds the largest market share for Baby Food and Infant Formula?

Asia Pacific (APAC) holds the largest market share, driven by its vast population base, increasing disposable incomes in key economies like China and India, and rising urbanization leading to a higher dependence on commercial baby feeding products.

How is technology being utilized to ensure product safety and quality in this market?

Technology ensures safety through advanced quality control using spectroscopic analysis for contaminant detection, automated robotic packaging to minimize human contact, and blockchain integration to provide transparent, tamper-proof traceability of ingredients from the source to the consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Baby Food and Infant Formula Market Size Report By Type (Standard cows milk-based formulas, Soy-based formulas, Hypoallergenic formulas, Lactose-free formulas:), By Application (0-6 Months, 6-12 Months, >12 Months), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Baby Food and Infant Formula Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Standard cows milk-based formulas, Soy-based formulas, Hypoallergenic formulas, Lactose-free formulas), By Application (0-6 Months, 6-12 Months, >12 Months), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager