Baby Juice Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442887 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Baby Juice Market Size

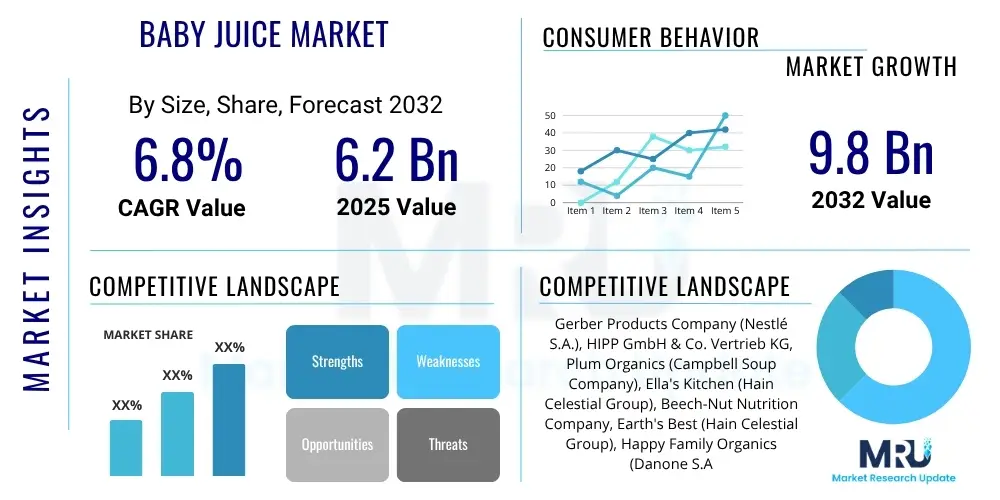

The Baby Juice Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Baby Juice Market introduction

The Baby Juice Market encompasses the production, distribution, and sale of fruit and vegetable beverages specifically formulated for infants and toddlers, typically aged six months to two years. These products are designed to meet strict nutritional and safety standards, often featuring reduced sugar content, no artificial additives, and fortification with essential vitamins and minerals crucial for early childhood development. Historically, pediatric guidelines have cautioned against excessive juice consumption due to sugar concerns, leading modern market innovators to focus heavily on healthier alternatives such as diluted purees, blends with vegetables, and organic, single-ingredient options to align with evolving health trends and parental preferences for wholesome, transparent ingredients.

The core product offering within this market includes 100% fruit juice, fruit and vegetable blends, and functional juices fortified with ingredients like Vitamin C, Calcium, and DHA. Major applications revolve around supplementing infants' diets during the weaning phase, providing hydration, and introducing new flavors and textures, though they are generally positioned as complementary to milk and solid foods rather than primary nutritional sources. The key driving factors propelling market expansion include rising disposable incomes in emerging economies, increased awareness regarding early childhood nutrition, robust marketing focusing on the convenience and organic nature of packaged baby foods, and continuous product innovation aimed at reducing sugar while maximizing nutritional value and appeal to health-conscious millennial parents.

Moreover, stringent regulatory environments, particularly in developed regions like North America and Western Europe, ensure product safety and quality, fostering consumer trust. These regulations mandate clear labeling regarding age appropriateness, ingredients, and nutritional profiles, pushing manufacturers toward cleaner, non-GMO, and traceable supply chains. The shift from traditional homemade weaning foods to professionally packaged, ready-to-consume baby juices reflects the busy lifestyles of modern parents, who prioritize convenience without compromising on perceived health benefits, thereby cementing the category's sustained relevance within the broader infant nutrition ecosystem.

Baby Juice Market Executive Summary

The Baby Juice Market is characterized by a strong emphasis on health, safety, and transparency, driven primarily by evolving regulatory standards and sophisticated parental demands. Current business trends indicate a significant pivot towards premiumization, with organic certification, low-sugar formulations, and innovative packaging formats—such as recyclable pouches—commanding higher market shares. Key market participants are heavily investing in vertical integration and sustainable sourcing practices to meet consumer demands for ethical products, while digital marketing strategies are increasingly crucial for building brand loyalty and providing educational content related to infant dietary guidelines.

Regionally, North America and Europe maintain dominance, primarily due to high levels of health awareness and established regulatory frameworks, though the Asia Pacific (APAC) region is demonstrating the most accelerated growth trajectory. This APAC expansion is fueled by rapid urbanization, increasing middle-class populations with higher purchasing power, and a growing acceptance of westernized baby feeding practices. Local manufacturers in APAC are focusing on developing indigenous flavor profiles and ensuring product accessibility through traditional retail channels alongside burgeoning e-commerce platforms. Conversely, mature markets focus on innovation in functional beverages, incorporating prebiotics and probiotics to support gut health.

Segmentation trends highlight the overwhelming consumer preference for organic juice variants, which typically command a premium price point, reflecting the widespread belief that organic ingredients minimize exposure to pesticides and artificial chemicals. Furthermore, the segmentation by distribution channel shows a pronounced migration towards online retail, offering parents unparalleled convenience and access to a wider variety of specialized, niche brands. Product-wise, fruit and vegetable blends are gaining momentum over single-fruit juices, as they address parental concerns about high sugar levels in pure fruit options while delivering a broader spectrum of essential micronutrients necessary for infant growth and development.

AI Impact Analysis on Baby Juice Market

User inquiries regarding the integration of Artificial Intelligence in the Baby Juice Market predominantly center on supply chain optimization, personalized nutrition recommendations, and enhanced quality control measures. Key themes emerging from these questions include how AI can ensure ingredient traceability and verify organic claims, the potential for predictive analytics to forecast demand for specialized low-sugar variants, and the role of machine learning in detecting contaminants faster than traditional quality assurance methods. Consumers and industry stakeholders are primarily seeking assurance that AI will lead to safer, more efficient production, alongside novel tools that genuinely aid parents in making informed purchasing decisions tailored to their infant's specific dietary needs and developmental stage, moving beyond generic product classifications to truly personalized solutions.

AI's influence is transforming several operational facets, beginning with advanced predictive modeling that allows manufacturers to anticipate seasonal fluctuations in raw fruit yields and consumer demand shifts for specific product formulations, optimizing inventory and reducing waste—a major sustainability concern for modern consumers. Furthermore, machine vision systems integrated into processing lines utilize deep learning algorithms to perform real-time quality inspection, identifying minor imperfections or contaminants in fruits and packaging at speeds and accuracies unattainable by human inspection, thereby significantly elevating product safety standards and compliance levels across the entire production matrix.

In the consumer-facing domain, AI powers sophisticated recommendation engines integrated into e-commerce platforms and parenting apps. These engines process vast amounts of data—including geographical location, child's age, dietary restrictions, and previous purchasing habits—to suggest the most suitable baby juice products, enhancing customer experience and driving targeted sales strategies. The use of natural language processing (NLP) is also improving customer service and grievance resolution, providing instant, accurate information regarding nutritional content, sourcing, and regulatory compliance, thereby increasing consumer trust in transparent brand operations.

- AI-driven supply chain optimization for verifiable ingredient sourcing and enhanced traceability.

- Predictive analytics for forecasting nuanced demand patterns of specialized low-sugar and organic baby juice lines.

- Machine learning algorithms deployed in quality control for instantaneous contaminant detection and food safety assurance.

- Personalized nutrition recommendation engines using parent and infant data to suggest tailored product options.

- Automation of production processes for efficiency gains and reduction of cross-contamination risks.

- Improved customer interaction and rapid FAQ resolution via NLP-powered chatbots regarding product formulations.

DRO & Impact Forces Of Baby Juice Market

The market dynamics are defined by a strong emphasis on health and safety (Drivers), countered by intense scrutiny regarding sugar content (Restraints), leading to significant diversification towards functional and organic variants (Opportunities). The primary driving forces include the growing global population of infants, increasing consumer awareness about the importance of early childhood nutrition, the rising adoption of packaged baby foods due to parental convenience, and the relentless marketing efforts emphasizing fortification with essential vitamins like Vitamin D and C. Conversely, the market faces significant hurdles due to global pediatric recommendations advising limited or zero juice intake for infants under one year, coupled with intense media and regulatory focus on combating childhood obesity, which pressures manufacturers to continually reformulate products to achieve minimal sugar content, often at a higher production cost.

The main opportunities lie in geographical expansion into high-growth markets across Asia Pacific and Latin America, where adoption rates of packaged infant foods are escalating rapidly alongside economic development. Furthermore, product innovation focusing on functional ingredients, such as incorporating vegetable purees, prebiotics, and unique blends that cater to specific developmental stages or allergy requirements, represents a lucrative avenue. Impact forces, therefore, include technological advancements in sterile packaging and processing that extend shelf life without compromising nutritional integrity, alongside stringent food safety regulations which act as a barrier to entry for smaller or less compliant firms, thereby consolidating market power among major, established players who can afford advanced quality assurance systems.

The competitive landscape is heavily influenced by the speed of product reformulation in response to public health directives; brands that successfully communicate low-sugar or zero added sugar status gain significant competitive advantages. The market is also heavily impacted by fluctuating commodity prices for fruits and vegetables, particularly organic variants, which necessitate robust supply chain management to maintain profitability and price stability for consumers. Ultimately, sustained success in this market is intrinsically linked to demonstrating unparalleled product safety and successfully navigating the delicate balance between providing appealing flavors for infants and adhering to strict nutritional guidelines preferred by pediatricians and informed parents.

Segmentation Analysis

The Baby Juice Market is comprehensively segmented based on product type, catering to specific nutritional requirements and age groups; by flavor profile, reflecting regional consumer preferences; by distribution channel, defining accessibility; and by nature, differentiating between conventional and premium organic offerings. Segmentation is crucial for manufacturers to target specific demographic pockets, particularly the highly discerning group of first-time parents who often rely on age-specific product recommendations. The market structure reflects a dominant shift toward blends that mitigate sugar concerns while maximizing nutrient density, moving away from simple, high-sugar fruit juices.

Product type segmentation typically involves ready-to-drink juices, concentrated juices requiring dilution, and juice blends mixed with purees or water, each serving different consumption scenarios and convenience levels. Distribution analysis is vital as it reveals the growing reliance on modern trade formats—supermarkets and hypermarkets—for bulk purchases, contrasted with the rapid expansion of e-commerce for specialized, premium, and subscription-based deliveries. Furthermore, the distinction between organic and conventional juice dictates pricing tiers and appeal, with organic products capturing a disproportionately high share of revenue in developed economies due to strong consumer trust in natural ingredients and sustainability commitments.

Flavor segmentation often includes classic fruit options like apple, grape, and pear, but modern innovation emphasizes less sweet options, such as carrot, beetroot, and mixed vegetable blends, designed to introduce infants to diverse palates early on. Geographically, the segmentation delineates markets based on economic maturity, regulatory strictness, and cultural acceptance of packaged baby food, allowing global players to tailor their portfolio (e.g., offering mango or tropical fruit flavors predominantly in Asian markets). This detailed segmentation provides the foundational framework for strategic market entry and sustained competitive positioning within the complex infant nutrition industry.

- By Product Type: 100% Fruit Juice, Fruit and Vegetable Blends, Juice Concentrates, Functional Juices (Fortified).

- By Flavor: Apple, Grape, Pear, Orange, Mixed Fruit, Vegetable Blends (Carrot, Beetroot, Spinach).

- By Nature: Organic, Conventional.

- By Distribution Channel: Supermarkets and Hypermarkets, Convenience Stores, Online Retail (E-commerce), Specialty Stores, Pharmacies/Drug Stores.

Value Chain Analysis For Baby Juice Market

The value chain for the Baby Juice Market commences with the upstream analysis, involving the meticulous sourcing of high-quality, often organic, fruits and vegetables, which necessitates strong contractual relationships with certified growers. This stage is crucial as it determines the raw material purity and compliance with strict residue limits, directly impacting the final product's claim (e.g., organic, non-GMO). Processing involves high-tech operations such as cold-pressing, pasteurization, and aseptic packaging to ensure microbial safety and maximum retention of vitamins and natural flavors. Capital investment in advanced processing technologies is a significant factor in maintaining competitive advantage and meeting regulatory scrutiny, specifically regarding thermal treatment and homogenization.

The downstream analysis focuses on marketing, distribution, and point-of-sale activities. Distribution channels are highly diversified, encompassing both direct and indirect routes. Direct distribution often involves sales to major retail chains (hypermarkets/supermarkets) and, increasingly, managing proprietary or dedicated e-commerce logistics for freshness and speed. Indirect distribution utilizes wholesalers, distributors, and specialized logistics providers to reach smaller retail outlets, pharmacies, and international markets. The shift towards online retail (e-commerce) is particularly transformative, requiring optimization for perishable goods logistics and highly targeted digital marketing campaigns aimed at parental communities and parenting influencers.

Brand building and communication are paramount in the downstream segment, requiring heavy investment in transparent labeling and clear health messaging to address parental concerns about sugar and additives. The distribution network must prioritize rapid turnover and appropriate storage conditions to maintain product integrity, particularly for products with limited preservative use. Efficiency in this segment directly correlates with brand visibility and market penetration, ensuring that safe, age-appropriate products are readily available across multiple purchasing touchpoints, from large urban retailers to remote regional outlets, often facilitated by robust third-party logistics (3PL) partnerships.

Baby Juice Market Potential Customers

The primary consumers of baby juice products are infants and toddlers typically ranging from six months to two years of age, though the purchasing decision-makers are almost exclusively parents and legal guardians, particularly mothers aged 25 to 40. These potential customers fall into two major segments: the highly health-conscious, affluent segment prioritizing premium, organic, and functionally fortified juices, and the convenience-seeking, middle-income segment looking for safe, affordable, and readily available options in mainstream retail channels. Both segments, however, share a fundamental requirement for certified safety, clear labeling, and compliance with pediatric recommendations, making trust and transparency the most potent purchasing drivers.

A crucial secondary customer segment includes pediatricians, hospitals, and specialized childcare centers, which often serve as authoritative sources of recommendation for parents. Manufacturers actively engage this segment through educational outreach, clinical trials, and sampling programs to establish credibility. Geographically, potential customers in developed nations demonstrate high loyalty towards established brands known for stringent quality control, while customers in rapidly developing economies exhibit high price sensitivity but are increasingly transitioning towards packaged products for convenience and perceived higher safety standards compared to local or traditional preparation methods. Marketing efforts must therefore be calibrated to address the specific anxieties and priorities of these diverse parental demographics, focusing on attributes ranging from superior nutrition to ease of portability.

Modern parents, especially millennials, exhibit a strong inclination towards products offering functional benefits beyond basic hydration, such as those promoting gut health (prebiotics) or cognitive development (DHA). They are highly digitally engaged, relying heavily on peer reviews, social media recommendations, and health apps for product validation. Therefore, manufacturers must view technology-savvy parents as the ultimate end-users whose information consumption habits dictate successful market entry and product scaling, prioritizing brands that offer sustainability credentials and detailed sourcing information alongside core nutritional value.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Danone S.A., Abbott Laboratories, Hain Celestial Group (Ella's Kitchen), Hero Group, Beech-Nut Nutrition Corporation, Earth's Best Organic, HiPP GmbH & Co. Vertrieb KG, Gerber Products Company, Organix Brands Ltd., Plum Organics, Kewpie Corporation, Sprout Foods, Inc., Röhlig Logistics GmbH & Co KG, Little Freddie, The Kraft Heinz Company, Yummy Spoonfuls, Happy Family Organics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Juice Market Key Technology Landscape

The Baby Juice Market relies heavily on advanced food processing and packaging technologies to ensure product safety, nutritional integrity, and extended shelf life without reliance on harsh chemical preservatives. Key technologies include High-Pressure Processing (HPP), which uses intense pressure rather than heat to eliminate pathogens, thereby retaining more vitamins, enzymes, and natural flavor profiles crucial for premium, 'fresh-like' juice products. Aseptic packaging technology is equally vital, allowing liquids to be sterilized and filled into pre-sterilized containers in a contamination-free environment, enabling non-refrigerated distribution and reducing reliance on traditional thermal pasteurization methods that can degrade heat-sensitive nutrients.

Beyond processing, traceability technologies utilizing blockchain are rapidly gaining traction, particularly in the organic segment, where verifying the origin and handling of raw materials is paramount to consumer trust. Blockchain provides an immutable ledger that tracks fruits from the farm, through processing, packaging, and distribution, offering unprecedented transparency that can be relayed directly to the consumer via QR codes on the packaging. Furthermore, clean-in-place (CIP) and sterile-in-place (SIP) systems are essential automated technologies within manufacturing facilities, minimizing the risk of cross-contamination between batches and ensuring compliance with stringent regulatory sanitation mandates, supporting high-volume, continuous production safely.

Innovation in packaging materials is another critical technological focus, driven by sustainability goals. Manufacturers are investing in lightweight, bio-based, and highly recyclable materials, particularly for single-serving pouches and bottles. The development of advanced barrier materials helps protect sensitive nutrients (like Vitamin C) from oxidation and light degradation over the product's lifespan. These technological investments are not just operational efficiencies but are foundational competitive differentiators, signaling a brand's commitment to both safety and environmental stewardship, which resonates strongly with the target parental demographic.

Regional Highlights

- North America: This region maintains a significant market share, driven by high consumer spending power and robust adoption of organic baby food products. The market here is mature but highly dynamic, characterized by continuous innovation in low-sugar and fortified functional beverages, specifically targeting developmental milestones. Regulatory bodies like the FDA exert substantial influence, forcing brands to strictly adhere to labeling requirements and age-appropriate nutritional guidelines. E-commerce penetration is extremely high, facilitating the growth of niche and premium brands which heavily market sustainability and detailed sourcing information to affluent, health-aware parents.

- Europe: Europe represents a crucial market, distinguished by some of the world's strictest food safety and labeling laws, particularly under the European Food Safety Authority (EFSA) mandates. Western European countries, notably Germany, the UK, and France, exhibit a high demand for bio and organic-certified baby juices. The trend is heavily skewed towards vegetable-based blends and products with zero added sugar, reflecting a strong cultural preference for preventive health measures in infancy. Manufacturers here focus heavily on environmental impact, with initiatives around sustainable packaging and reduced carbon footprint being key competitive advantages.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, propelled by demographic factors such as the world's largest infant population base, coupled with increasing disposable incomes and rapid urbanization. Countries like China, India, and Southeast Asian nations are witnessing a strong shift from traditional homemade baby foods to packaged commercial options due to convenience and perceived safety standards. While price sensitivity remains a factor, the middle class is increasingly willing to pay a premium for international brands and products fortified with locally relevant nutrients. Localized flavor adaptation (e.g., tropical fruits) and expansion through diverse retail formats, including local kirana stores alongside large hypermarkets, are key strategies here.

- Latin America (LATAM): The LATAM market growth is accelerating, though hampered slightly by economic volatility in certain countries. Demand is concentrated in major urban centers, driven by increased maternal employment rates necessitating convenient feeding solutions. There is growing recognition of international health standards, pushing local manufacturers to improve quality control. The market is primarily focused on conventional, affordable 100% fruit juices, but the premium organic segment is starting to emerge, particularly in Brazil and Mexico, reflecting initial stages of market premiumization.

- Middle East and Africa (MEA): This region offers nascent yet compelling growth opportunities, primarily concentrated in the Gulf Cooperation Council (GCC) countries where high per capita income supports the import of premium European and North American baby juice brands. The market is heavily reliant on packaged goods due to supply chain challenges in local fresh produce and a general consumer preference for certified international brands. The African market remains largely underserved by packaged products but shows potential in South Africa, where urbanization and modern retail expansion are steadily increasing accessibility and adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Juice Market.- Nestlé S.A.

- Danone S.A.

- Abbott Laboratories

- Hain Celestial Group (Ella's Kitchen)

- Hero Group

- Beech-Nut Nutrition Corporation

- Earth's Best Organic

- HiPP GmbH & Co. Vertrieb KG

- Gerber Products Company

- Organix Brands Ltd.

- Plum Organics

- Kewpie Corporation

- Sprout Foods, Inc.

- Röhlig Logistics GmbH & Co KG

- Little Freddie

- The Kraft Heinz Company

- Yummy Spoonfuls

- Happy Family Organics

- Wimm-Bill-Dann Foods (PepsiCo)

- Frucor Suntory

Frequently Asked Questions

Analyze common user questions about the Baby Juice market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Baby Juice Market?

The primary factor driving growth is the increasing parental demand for convenient, packaged infant nutrition options that are perceived as safe and nutritionally fortified, especially the rising global preference for organic, clean-label, and zero added sugar formulations that align with evolving pediatric health recommendations.

Are organic baby juices dominating the market share?

Organic baby juices are currently capturing a disproportionately high revenue share, particularly in developed markets like North America and Europe. This dominance is due to strong consumer willingness to pay a premium for products free from pesticides, GMOs, and artificial additives, signaling a critical trend towards product premiumization and clean sourcing.

How is the market addressing concerns regarding high sugar content in fruit juices?

The market is actively addressing sugar concerns through significant reformulation efforts, moving away from 100% fruit juices towards fruit and vegetable blends, diluted purees, and specialized functional beverages that contain naturally lower sugar levels or zero added sugars, often using natural sweeteners or extracts only where necessary, strictly adhering to global pediatric guidelines.

Which geographical region exhibits the fastest growth rate for baby juice consumption?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR) due to rapid economic development, increasing disposable income among the middle class, and the growing acceptance of packaged infant foods as a modern, convenient, and safe alternative to traditional feeding methods, particularly in high-population markets like China and India.

What role does technology play in ensuring the quality and safety of baby juice products?

Technology plays a crucial role by enabling advanced safety measures such as High-Pressure Processing (HPP) for nutrient retention, aseptic packaging for sterilization, and blockchain technology for providing transparent, end-to-end traceability of organic and clean ingredients, thus significantly enhancing consumer trust and regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager