Baby Puffs and Snacks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442016 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Baby Puffs and Snacks Market Size

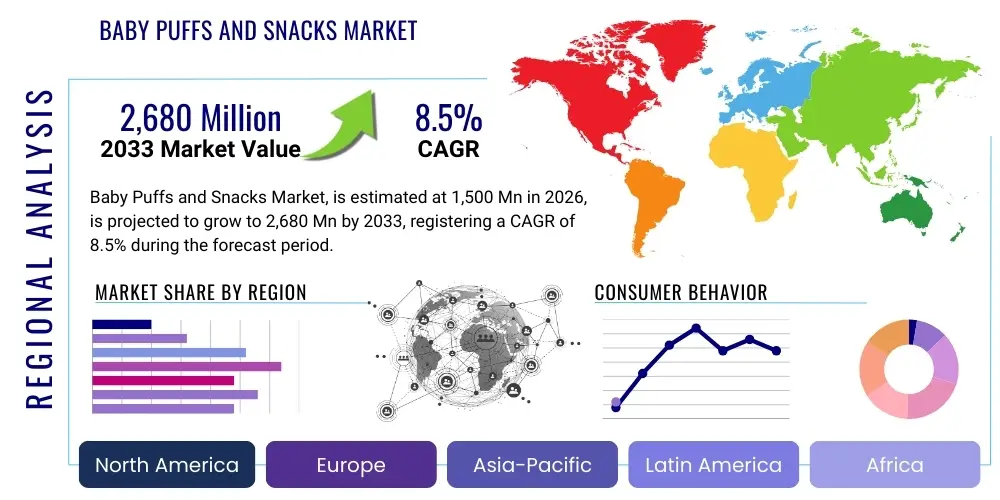

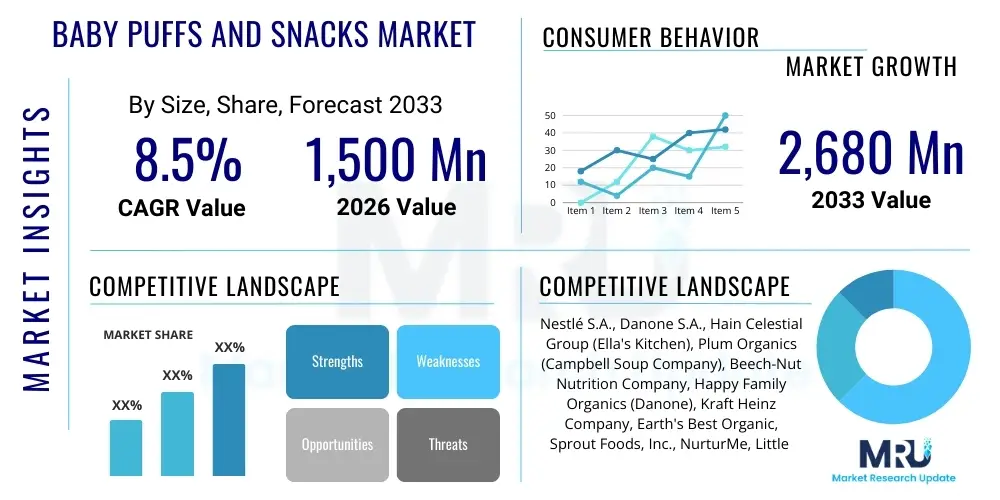

The Baby Puffs and Snacks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1,500 Million in 2026 and is projected to reach USD 2,680 Million by the end of the forecast period in 2033. This robust expansion is fueled primarily by increased awareness among millennial parents regarding early childhood nutrition and the growing demand for convenient, ready-to-eat, and nutrient-dense feeding options that support self-feeding skills and motor development in infants and toddlers.

Baby Puffs and Snacks Market introduction

The Baby Puffs and Snacks Market encompasses a specialized range of processed food products designed for infants typically between six months and three years of age, facilitating the transition from pureed foods to solid textures. These products, often based on grains like rice, corn, or quinoa, or utilizing fruit and vegetable bases, are characterized by their easily dissolvable nature, small size, and minimal risk of choking, making them ideal first finger foods. The primary application of these snacks is to serve as supplemental nutrition, promoting independent eating habits and offering a convenient solution for on-the-go feeding, thereby reducing mealtime stress for caregivers and providing developmentally appropriate textures for oral motor skill enhancement.

The core benefits associated with baby puffs and snacks extend beyond mere caloric intake; they often deliver essential micronutrients such as iron, zinc, and B vitamins, vital for rapid infant growth and cognitive development. Modern market offerings increasingly focus on "clean label" formulations, emphasizing organic ingredients, non-GMO sourcing, and the absence of artificial colors, preservatives, or excessive added sugars, directly addressing parental scrutiny regarding food safety and quality. The convenience factor is a substantial market driver, as the busy lifestyles of modern dual-income households necessitate portable and easy-to-manage snack options that maintain high nutritional standards while offering a perceived safe product profile.

Several critical factors are currently driving the sustained growth of this sector. These include the global rise in disposable income in emerging economies, enabling greater expenditure on premium infant nutrition products, coupled with significant marketing efforts by major food corporations focused on the developmental advantages of finger foods. Furthermore, the increasing penetration of organized retail and e-commerce platforms has dramatically improved product accessibility, allowing niche and organic brands to reach wider consumer bases. Stringent regulatory standards for infant food quality, paradoxically, also act as a driver, reassuring parents of product safety and quality integrity, thus fostering brand loyalty within this highly sensitive consumer segment.

Baby Puffs and Snacks Market Executive Summary

The Baby Puffs and Snacks market is experiencing a significant shift characterized by innovation in ingredient sourcing and manufacturing processes, driven by evolving consumer preferences favoring natural and functional foods. Key business trends indicate a strong move towards diversification, with companies introducing products featuring novel ingredients such as ancient grains (e.g., sorghum, millet), probiotics for gut health, and unique flavor profiles derived solely from fruits and vegetables, minimizing reliance on traditional sweet or salty seasoning. Mergers and acquisitions remain a pivotal strategy, allowing established players to quickly integrate smaller, innovative organic brands, capturing new market share and intellectual property related to clean-label manufacturing techniques and specialized ingredient supply chains, particularly in the rapidly growing plant-based and allergy-friendly segments.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to booming population bases, rising affluence, and the increasing adoption of Western feeding practices, particularly in urban centers of China and India. North America and Europe, while mature, dictate premiumization trends, focusing intensely on sustainable packaging, carbon footprint reduction, and stringent traceability mechanisms, setting the global benchmark for safety and ethical sourcing. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, characterized by rapid urbanization and the expansion of modern retail infrastructure, creating a fertile ground for market entry, although penetration is currently limited by price sensitivity and the dominance of traditional, homemade baby food preparation methods.

Segment trends highlight the dominance of the 'Fruit and Vegetable Based' segment, reflecting parental efforts to increase dietary fiber and micronutrient intake while minimizing exposure to refined starches. The 'Online Distribution Channel' segment demonstrates the highest growth momentum, facilitated by the convenience of subscription models and direct-to-consumer services, which resonate strongly with time-constrained parents. Furthermore, segmentation by product format shows an increasing acceptance of teething wafers and soft-baked snacks alongside traditional puffs, diversifying product offerings to cater to specific stages of infant oral development. This segmented growth underscores the necessity for companies to offer holistic product lines that cater to the sequential developmental milestones of infants from six months through toddlerhood, ensuring sustained customer lifetime value.

AI Impact Analysis on Baby Puffs and Snacks Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Baby Puffs and Snacks market primarily center on food safety, personalized nutrition recommendations, and optimization of the complex global supply chain required for organic and specialized ingredients. Parents and caregivers are highly concerned about AI's potential role in enhancing contaminant detection, ensuring ingredient traceability from farm to shelf, and providing instantaneous verification of clean-label claims, thus boosting consumer trust in brands. Furthermore, users expect AI to personalize dietary planning based on a child's allergies, developmental stage, and nutritional gaps, moving beyond generic guidance. The underlying theme is leveraging AI to elevate transparency and predictive quality control within a market where product integrity is paramount.

AI is fundamentally transforming manufacturing efficiency and product innovation within the baby food sector. In manufacturing, machine learning algorithms are utilized for predictive maintenance on production lines, drastically reducing downtime and ensuring continuous adherence to hygienic standards. Crucially, computer vision systems are deployed for high-speed, non-destructive quality inspection, identifying minute defects in product consistency, color, and size far more accurately than human inspectors, which is vital for consistency in dissolvability and safety. This application of AI directly translates into higher perceived product quality and reduced recall risks, addressing key consumer anxieties about product variability and physical hazards.

Beyond manufacturing, AI significantly impacts consumer interaction and product development. Natural Language Processing (NLP) tools analyze vast volumes of parental feedback, social media discussions, and customer reviews in real-time to identify emerging ingredient preferences, potential product adverse reactions, and regional flavor demand shifts. This data-driven approach allows R&D teams to accelerate the creation of novel, high-demand products, such as those targeting specific microbial profiles (prebiotics/probiotics) or specialized dietary needs (e.g., gluten-free, dairy-free). Moreover, AI-powered e-commerce platforms optimize inventory forecasting for perishable ingredients and personalized marketing efforts, ensuring product availability and relevant consumer outreach.

- Enhanced Ingredient Traceability: AI platforms track organic components from source to final packaging, minimizing fraud and enhancing food safety assurances.

- Predictive Quality Control: Machine learning models analyze sensor data in real-time to detect minute production deviations, ensuring product uniformity and safety compliance.

- Personalized Nutritional Recommendations: AI algorithms leverage developmental data to suggest appropriate puff and snack products based on age, allergies, and nutritional requirements.

- Optimized Supply Chain Logistics: AI manages cold chain monitoring and demand forecasting for perishable ingredients, reducing waste and ensuring fresh stock.

- Accelerated R&D Cycles: NLP analyzes consumer feedback globally to rapidly identify market gaps and emerging clean-label ingredient trends.

DRO & Impact Forces Of Baby Puffs and Snacks Market

The market dynamics are fundamentally shaped by the interplay between strong parental demand for nutritious, safe, and convenient options (Drivers), the complex regulatory environment and high cost of organic sourcing (Restraints), and the massive potential inherent in emerging markets and functional food integration (Opportunities). Drivers, such as rising global incomes and urbanization leading to demand for convenience, are continuously pushing the market forward. Restraints, including strict government regulations on infant food labeling and the inherent fragility of global supply chains for specialized, certified ingredients, necessitate significant upfront investment and operational complexity for manufacturers. Opportunities exist primarily in exploiting digital distribution channels and innovating around sustainable, attractive packaging solutions that appeal to the environmentally conscious millennial parent, setting the stage for aggressive market expansion in regions with increasing middle-class populations.

The primary drivers propelling market expansion include the increasing focus on early childhood development, which emphasizes texture introduction and self-feeding abilities. This aligns perfectly with the function of dissolvable snacks. Further impetus comes from intensive marketing campaigns that educate parents on the benefits of these specialized snacks over traditional, less nutritionally appropriate adult snacks. However, this growth trajectory is consistently challenged by powerful restraints. These include consumer price sensitivity in developing markets, where premium pricing for organic and imported products limits widespread adoption. Moreover, the recurrent threats of product recalls due to metal contaminants or labeling errors, though rare, severely erode consumer trust, mandating manufacturers to invest heavily in meticulous quality assurance systems that often increase operational costs and retail prices.

Opportunities for sustained growth are manifold, revolving largely around product differentiation and geographical expansion. Innovation in functional snacks—incorporating ingredients like probiotics, prebiotics, and specific omega fatty acids tailored for brain health—represents a significant avenue for premiumization. The untapped potential in large emerging economies, coupled with expanding e-commerce infrastructure, allows brands to circumvent traditional, costly retail distribution barriers, offering direct access to large consumer bases. The prevailing impact forces are therefore strongly positive, driven by sustained demographic growth and affluence, but tempered by the necessity for manufacturers to navigate a stringent regulatory landscape and manage highly sophisticated, transparent supply chains to maintain consumer confidence and competitive advantage in a densely populated market segment.

Segmentation Analysis

The Baby Puffs and Snacks Market is analyzed extensively across multiple dimensions to accurately gauge consumer behavior, market concentration, and growth potential within specific product categories and distribution networks. Segmentation by Product Type (Puffs, Teething Wafers, Baked Snacks) helps determine which formats are preferred for various developmental stages, with puffs typically dominating the introductory phase due to their ease of dissolution. Segmentation by Ingredient Base (Fruit & Vegetable, Grain Based, Cereal) reflects nutritional priorities, revealing a growing consumer preference for vegetable-focused products that minimize early exposure to excessive sweetness. Analyzing the market through Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail) is critical for understanding access points and the rising influence of e-commerce platforms in driving sales volume and market visibility.

Detailed segmentation analysis confirms that the shift towards specialized ingredient bases is a defining trend. Consumers are actively seeking products labeled as free from major allergens (e.g., dairy, soy, gluten), leading to a rapid expansion of the 'Other Ingredient Bases' sub-segment, including those featuring pulses or specialized grain blends. Geographically, segmentation underscores the necessity for localized product strategies, as flavor preferences and regulatory compliance vary significantly across North America, Europe, and the dynamic Asia Pacific regions. For instance, rice-based snacks hold a greater cultural relevance and market share in certain Asian countries compared to oat or corn-based varieties prevalent in Western markets, necessitating product line adaptation.

Furthermore, segmentation by Age Group (6-12 Months, 12-24 Months, 24-36 Months) provides granular insights into purchasing patterns, where younger infants primarily consume puffs and teething wafers, while the older toddler group increasingly transitions to nutrient bars and baked shapes offering more complex textures and higher caloric density suitable for active energy expenditure. This detailed breakdown allows market players to precisely target marketing campaigns and optimize shelf placement strategies, ensuring that product availability aligns with the sequential feeding needs and developmental milestones of the target consumer demographic, maximizing both sales volume and brand positioning as a partner in infant development.

- Product Type: Puffs, Teething Wafers, Baked Snacks, Other Extruded Snacks

- Ingredient Base: Fruit & Vegetable Based, Grain Based (Rice, Corn, Oats), Cereal Based, Organic/Non-GMO Based

- Flavor Profile: Sweet (Fruit/Vegetable Derived), Savory, Unflavored

- Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Pharmacies/Drug Stores, Online Retail (E-commerce, D2C)

- Age Group: 6-12 Months (Introductory), 12-24 Months (Transitional), 24-36 Months (Toddler)

Value Chain Analysis For Baby Puffs and Snacks Market

The value chain for the Baby Puffs and Snacks market is characterized by stringent quality control requirements at every stage, commencing with the upstream sourcing of raw materials, which is particularly complex due to the emphasis on certified organic, non-GMO, and pesticide-free ingredients. Upstream analysis highlights that the integrity of the supply chain relies heavily on strong relationships with specialized agricultural producers capable of meeting exacting safety standards and providing detailed traceability documentation. The high cost of organic certification and the volatility of agricultural commodity prices often dictate the final retail price, making input cost management a critical determinant of competitive advantage and profitability in this segment.

The processing and manufacturing stage involves specialized extrusion, baking, and blending technologies designed to achieve the specific dissolvable texture and nutritional composition required for infant consumption. This middle stage is highly capital-intensive, requiring advanced quality control systems, including metal detection, laboratory testing for contaminants (e.g., heavy metals), and allergen isolation protocols. Efficiency in this stage, driven by automation and sophisticated thermal processing, is crucial. Following manufacturing, the downstream segment, comprising warehousing, inventory management, and distribution, must adhere to strict environmental controls to maintain product freshness and prevent contamination, especially given the typically longer shelf lives and delicate nature of baby snack packaging.

Distribution channels are multifaceted, utilizing both direct and indirect routes. Indirect distribution, primarily through large supermarkets, hypermarkets, and specialized baby stores, accounts for the majority of sales volume, capitalizing on parental convenience for one-stop shopping. Direct channels, increasingly prominent via e-commerce (both retailer platforms and brand-owned D2C models), offer manufacturers greater control over branding, pricing, and direct consumer data collection. The choice of channel significantly impacts market reach and cost structure; while traditional retail offers wide visibility, online distribution provides targeted access to niche health-conscious consumers and supports subscription models, demonstrating superior growth rates and inventory efficiency compared to conventional retail logistics.

Baby Puffs and Snacks Market Potential Customers

The primary customer base for the Baby Puffs and Snacks Market consists of caregivers, overwhelmingly millennial and Gen Z parents, characterized by higher educational attainment, increased digital literacy, and a profound emphasis on proactive health and wellness for their children. These buyers are typically highly discerning, performing extensive research before purchase, often relying on peer reviews, pediatrician recommendations, and information derived from online parenting forums and social media influencers. Their purchasing decisions are heavily weighted towards products offering verifiable health benefits, organic certification, transparent ingredient lists, and evidence of sustainable or ethical business practices, viewing baby snacks not just as food, but as a component of developmental support.

A significant segment of potential customers includes parents seeking convenience without compromise, often belonging to dual-income households facing significant time constraints. For this demographic, the "on-the-go" portability, resealable packaging, and low-mess attributes of puffs and snacks are critical selling points. Furthermore, there is a distinct, rapidly growing sub-segment comprising parents managing food sensitivities or allergies in their children. These buyers actively seek products marketed specifically as 'allergy-friendly' or 'free-from,' leading to sustained demand for specialty lines utilizing alternative grain sources like cassava, millet, or certified gluten-free oat bases, driving innovation within the potential customer ecosystem and necessitating highly specialized product formulations.

Geographically, potential customers are concentrated in urban and peri-urban centers globally, where access to organized retail and e-commerce infrastructure is robust, facilitating the purchase of premium, branded infant nutrition. In emerging markets, the rising middle class, increasingly exposed to global nutritional standards and marketing, represents an expanding pool of potential consumers transitioning away from traditional, unprocessed weaning foods toward commercially prepared, packaged snacks. Marketing efforts must therefore be highly localized, addressing cultural food norms while emphasizing the modern benefits of nutritional fortification, safety, and guaranteed consistency, appealing directly to the aspiration for providing the best possible start for their infants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,500 Million |

| Market Forecast in 2033 | USD 2,680 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Danone S.A., Hain Celestial Group (Ella's Kitchen), Plum Organics (Campbell Soup Company), Beech-Nut Nutrition Company, Happy Family Organics (Danone), Kraft Heinz Company, Earth's Best Organic, Sprout Foods, Inc., NurturMe, Little Freddie, HiPP GmbH & Co. Vertrieb KG, Gerber (Nestlé), Holle baby food AG, Organix Brands Ltd., Once Upon a Farm, Healthy Times, Baby Gourmet Foods Inc., Serenity Kids, Pure Spoon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Puffs and Snacks Market Key Technology Landscape

The production of baby puffs and snacks relies heavily on specialized food processing technologies focused on achieving optimal texture, nutrient retention, and unparalleled safety standards, positioning technological adoption as a major competitive differentiator. Extrusion technology is central to the manufacturing of puffs, requiring precise control over temperature, moisture, and pressure to create the characteristic porous structure that allows for easy melting in an infant's mouth, mitigating choking hazards. Advanced baking and drying techniques are utilized for wafers and other baked snacks, focusing on preserving the integrity of heat-sensitive micronutrients like Vitamin C and certain B vitamins. Furthermore, the integration of robotics and automated sorting systems ensures minimal human contact throughout the manufacturing and packaging process, drastically reducing the risk of biological contamination, which is a key regulatory concern in this sensitive food sector.

Packaging technology is another critical area of innovation, moving beyond basic product preservation to include functionality and sustainability, directly responding to high parental expectations. Modern solutions incorporate sophisticated barrier films to protect sensitive ingredients from oxidation and moisture, thus extending shelf life naturally without relying on artificial preservatives. Furthermore, the industry is increasingly adopting sustainable packaging materials, including compostable or fully recyclable plastics and plant-based polymers, driven by consumer demand in developed markets. Traceability technologies, utilizing blockchain or sophisticated data logging across the supply chain, are gaining prominence, allowing manufacturers to rapidly pinpoint the source of any contamination issue, bolstering confidence in product integrity and demonstrating compliance with stringent global food safety protocols.

In terms of quality assurance, technology plays a pivotal role in ensuring that every batch meets the highest safety benchmarks, particularly concerning heavy metal and pesticide residue limits, which are tightly regulated for infant products globally. Near-Infrared (NIR) spectroscopy and advanced laboratory analysis tools provide rapid, non-destructive compositional analysis, verifying nutritional claims and detecting adulteration in raw materials before processing. The deployment of Enterprise Resource Planning (ERP) systems customized for food manufacturing allows for seamless integration of supply chain data with production scheduling and quality control records, creating a verifiable digital trail for regulatory audits and consumer transparency initiatives. This focus on technological assurance provides a robust competitive moat for brands that successfully demonstrate superior, continuous quality monitoring.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, pricing, and regulatory landscape of the Baby Puffs and Snacks Market, reflecting differences in disposable income, cultural feeding practices, and market maturity. North America, dominated by the United States and Canada, represents a mature but highly innovative market. Here, growth is driven by premiumization, where consumers readily pay more for organic, non-GMO, and specialized functional ingredients (e.g., snacks incorporating hidden vegetables or bone broth bases). The region exhibits high penetration of e-commerce and D2C brands, setting the pace for sustainable packaging and transparency standards, although regulatory scrutiny concerning heavy metal content remains a continuous challenge influencing formulation practices.

Europe mirrors North America in its demand for clean labels and organics, with countries like Germany, the UK, and France holding significant market share. However, the European market is uniquely influenced by stringent regulatory frameworks set by the European Food Safety Authority (EFSA), often resulting in slightly different product formulations compared to the US market, particularly regarding permitted sweeteners and fortification levels. Consumer trust is paramount, leading to strong reliance on established national brands and certifications like the EU Organic label. The market in Eastern Europe is rapidly expanding, fueled by increasing disposable incomes and the adoption of organized retail formats, providing major brands with new avenues for market entry and sustained volume growth.

Asia Pacific (APAC) is the engine of future market growth, characterized by significant demographic advantages and rapidly increasing urbanization. China and India are the primary growth centers, driven by a burgeoning middle class willing to spend on imported or high-quality infant nutrition products perceived as safer than local alternatives. While convenience is a major selling point, brand trust and guaranteed safety are non-negotiable for APAC consumers, often favoring global, established players. Latin America and the Middle East & Africa (MEA) are emerging, albeit slower, markets where economic volatility and underdeveloped retail infrastructure present barriers. However, rising awareness of infant nutrition and health education initiatives are slowly accelerating adoption, particularly in metropolitan hubs like São Paulo, Dubai, and Johannesburg, positioning these regions as long-term growth opportunities.

- North America (NA): High maturity, rapid adoption of functional and organic products, strong e-commerce influence, focus on heavy metal risk mitigation.

- Europe (EU): Driven by stringent EFSA regulations, high demand for clean-label and certified organic products, strong brand loyalty in Western economies.

- Asia Pacific (APAC): Fastest growing region due to urbanization and rising incomes (China, India), high sensitivity to brand reputation and safety assurance.

- Latin America (LATAM): Emerging market, growth concentrated in urban centers, price sensitivity impacts premium product adoption.

- Middle East & Africa (MEA): Nascent market, slow adoption, growth linked to modern retail expansion and health awareness campaigns, potential for imported premium brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Puffs and Snacks Market.- Nestlé S.A. (Gerber)

- Danone S.A. (Happy Family Organics)

- The Hain Celestial Group (Ella's Kitchen)

- Campbell Soup Company (Plum Organics)

- The Kraft Heinz Company

- Beech-Nut Nutrition Company

- Earth's Best Organic

- Sprout Foods, Inc.

- NurturMe

- Little Freddie

- HiPP GmbH & Co. Vertrieb KG

- Holle baby food AG

- Organix Brands Ltd.

- Once Upon a Farm

- Healthy Times

- Baby Gourmet Foods Inc.

- Serenity Kids

- Pure Spoon

- SQUISH

- Wai Lana Snacks

Frequently Asked Questions

Analyze common user questions about the Baby Puffs and Snacks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Baby Puffs and Snacks Market?

The primary driver is the increasing demand from millennial parents for convenient, safe, and nutritionally fortified finger foods that support the development of fine motor skills and self-feeding habits in infants, coupled with a strong preference for organic and clean-label ingredients globally.

How does the clean-label trend impact product formulation?

The clean-label trend necessitates the elimination of artificial colors, flavors, preservatives, and unnecessary added sugars, compelling manufacturers to use non-GMO, organic, and recognizable whole-food ingredients (fruits, vegetables, ancient grains) to maintain transparency and appeal to health-conscious caregivers.

Which region shows the highest growth potential for baby snacks?

The Asia Pacific (APAC) region exhibits the highest growth potential, fueled by rapidly expanding middle-class populations, increasing disposable incomes, and urbanization that drives demand for convenient, packaged, and internationally recognized infant nutrition brands, particularly in China and India.

What are the key technological advancements influencing the manufacturing process?

Key technological advancements include sophisticated extrusion techniques for ensuring dissolvable textures, the use of blockchain for end-to-end traceability of organic ingredients, and AI-driven computer vision systems for real-time quality control, ensuring consistent product safety and preventing contamination.

What are the main distribution channels driving Baby Puffs and Snacks sales?

While traditional Supermarkets/Hypermarkets remain significant, Online Retail (e-commerce and Direct-to-Consumer platforms) is the fastest-growing channel, offering superior convenience, targeted product access, and subscription models that resonate strongly with time-constrained, digitally native parents.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager