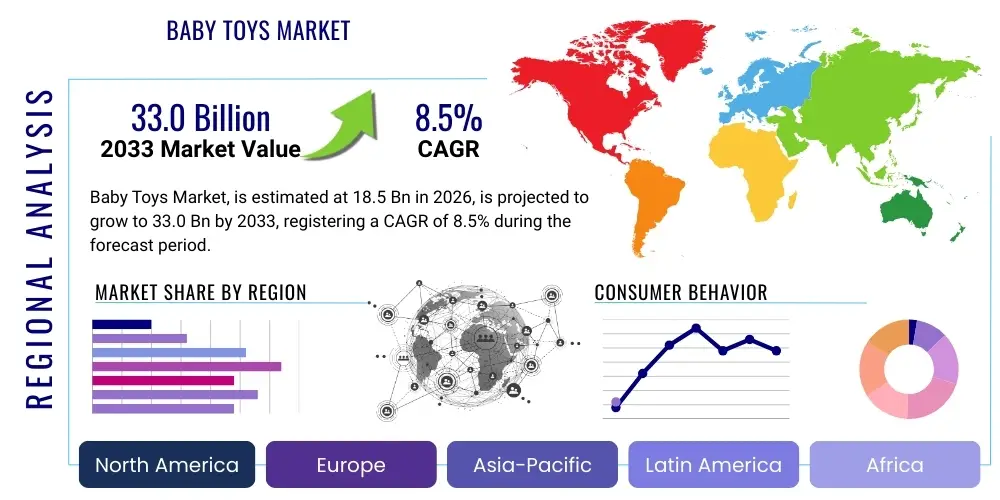

Baby Toys Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443586 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Baby Toys Market Size

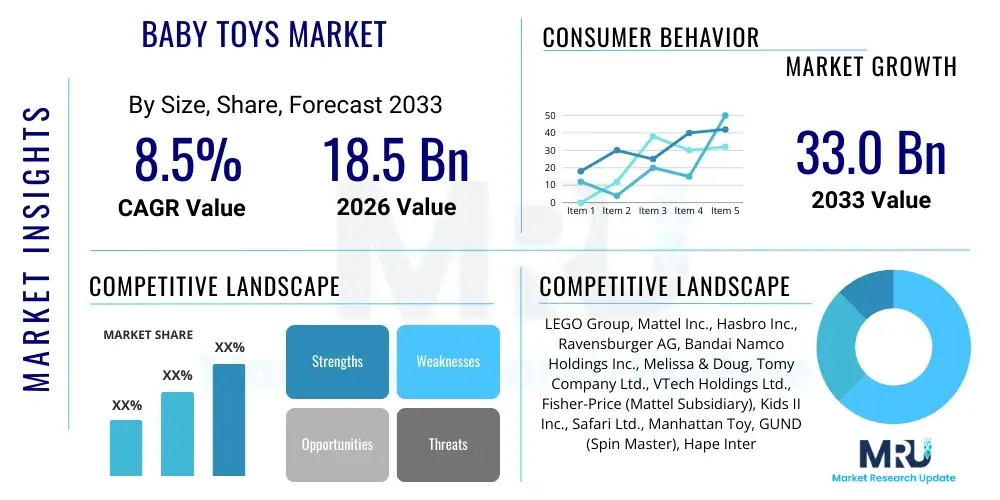

The Baby Toys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 33.0 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by increasing parental awareness regarding the importance of early childhood development, coupled with rising disposable incomes in emerging economies, facilitating greater expenditure on premium, educational, and safety-certified toys. Furthermore, rapid digitization and the proliferation of e-commerce channels have significantly broadened market accessibility, enabling specialized and niche toy manufacturers to reach a global consumer base, contributing materially to the overall market valuation surge during the forecast horizon.

Baby Toys Market introduction

The Baby Toys Market encompasses a wide variety of products designed specifically for infants and toddlers, typically categorized by age suitability, developmental stage, and material composition. These products range from basic rattles and teethers to sophisticated electronic learning devices and developmental activity centers. The fundamental objective of these toys is to stimulate cognitive, motor, sensory, and social skills during critical early years. Key product types include soft toys, activity gyms, stacking toys, musical instruments, and bath toys, all manufactured under stringent safety regulations to mitigate choking hazards and exposure to toxic materials. The market's scope is defined by the age group from newborn up to 36 months, focusing intensely on pedagogical value and certified safety standards.

Major applications of baby toys extend beyond mere entertainment; they are essential tools for educational play and psychological development. For instance, high-contrast toys aid in visual development, while shape sorters and blocks enhance fine motor skills and spatial reasoning. The modern consumer increasingly views these purchases as investments in their child's future developmental trajectory, rather than discretionary spending. This perception shift is particularly strong in developed nations where attachment parenting philosophies and early education emphasis are highly prevalent. The application landscape is continuously evolving, incorporating elements of STEAM (Science, Technology, Engineering, Arts, and Mathematics) education even at the infant level, ensuring that toys are not only fun but also scientifically validated for maximizing developmental potential.

The primary benefits driving this market include demonstrable improvements in infant brain development, language acquisition, and problem-solving abilities. Driving factors are multifaceted, including high birth rates in certain regions, increasing nuclear family structures resulting in concentrated spending per child, and aggressive marketing campaigns by global players highlighting developmental benefits. Moreover, innovation in material science—such as the adoption of sustainable and hypoallergenic materials—is attracting environmentally conscious parents. Regulatory support mandating higher safety standards for imported and domestically produced baby goods also instills consumer confidence, further catalyzing market growth and favoring established, certified brands over unorganized alternatives, thereby accelerating the market’s premiumization trend globally.

Baby Toys Market Executive Summary

The Baby Toys Market is experiencing significant upward momentum, characterized by a fundamental shift toward digitally integrated, educational, and sustainable products. Business trends indicate strong merger and acquisition activities, particularly focusing on expanding digital platforms and securing intellectual property related to pedagogical toy design. Major corporations are investing heavily in research and development to introduce smart toys that utilize sensors, low-level AI, and connectivity for personalized learning experiences. Furthermore, supply chain resilience remains a key business focus post-pandemic, with companies diversifying manufacturing bases away from traditional hubs to mitigate future geopolitical or health-related disruptions, prioritizing fast, ethical sourcing methods and transparent manufacturing practices to reassure discerning consumers.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive population bases, rising affluence in countries like China and India, and a cultural emphasis on providing the best resources for children's education from birth. North America and Europe, while maturing, maintain high market values due to premium pricing, advanced regulatory frameworks, and high adoption rates of sophisticated, high-tech toys. The demand across all regions is intrinsically linked to socio-economic indicators, including GDP growth and female labor participation rates, which influence household disposable income allocations toward specialized baby products. Government initiatives supporting early childhood education also significantly impact regional demand dynamics, creating supportive environments for market expansion.

Segmentation trends highlight the dominance of the 0-12 months age group segment, often requiring frequent replacement and specialized sensory items. However, the 12-36 months segment shows the highest growth trajectory due to the demand for complex activity centers and constructive play items that prepare children for preschool. Product-wise, electronic and remote-controlled toys are capturing substantial market share, displacing traditional plastic toys, although wooden and eco-friendly material segments are witnessing a robust revival driven by sustainability concerns. Distribution analysis reveals that e-commerce penetration is rapidly outpacing traditional specialized retail outlets, necessitating robust digital marketing and fulfillment strategies for competitive success, alongside investments in experiential retail formats that complement the online presence.

AI Impact Analysis on Baby Toys Market

User queries regarding AI in the Baby Toys Market typically center on the integration of smart technologies, ethical implications concerning data privacy, and the efficacy of AI-powered educational tools. Consumers are keenly interested in how Artificial Intelligence can personalize play patterns, adapt difficulty levels dynamically, and provide real-time feedback to parents about developmental milestones. Key themes reveal concerns about screen time versus physical play balance, data security collected by connected toys, and the necessity of such advanced technology for early development. Parents seek assurance that AI enhancements genuinely improve learning outcomes without compromising safety or fostering over-reliance on digital interfaces. This indicates a strong market pull toward "invisible AI"—technology that seamlessly enhances the physical toy experience rather than dominating it, prioritizing tangible interaction over digital consumption for infants.

The integration of AI, machine learning, and advanced sensor technology is enabling a new generation of interactive baby toys that move beyond simple cause-and-effect responses. These smart toys can recognize patterns in a child's interaction, understand simple voice commands (voice recognition for language development), and adjust the complexity of tasks, thereby creating a highly personalized learning path. For instance, AI-driven activity mats can track a baby's reaching and grasping movements, signaling optimal times for introducing new stimuli. This level of personalized engagement provides a strong competitive differentiator for manufacturers capable of developing robust, yet secure, computational play devices that meet parental expectations for developmental efficacy and digital safety while adhering to stringent global privacy regulations such as COPPA in the US and GDPR in Europe.

Further, AI is fundamentally changing the manufacturing and distribution aspects of the market. AI-driven demand forecasting improves inventory management, reducing waste and overstocking, while predictive analytics assist in identifying emerging safety issues or popular design trends early in the product lifecycle. On the consumer side, chatbots and AI assistants are increasingly used by brands to guide parents through complex product selections based on their child's specific developmental needs and age range, enhancing the customer journey and improving conversion rates within the highly fragmented online retail space dedicated to baby essentials. This optimization across the value chain, from predicting material needs to tailoring end-user recommendations, maximizes operational efficiency and consumer satisfaction simultaneously.

- AI-enabled personalized learning trajectories and adaptive content delivery in educational toys.

- Enhanced voice recognition and natural language processing in dolls and interactive plush toys for early communication skills.

- Implementation of machine vision systems in activity centers to track fine motor skills development and movement patterns.

- Predictive analytics in manufacturing for optimized material sourcing, quality control, and reducing safety recalls.

- Improved customer service through AI-powered recommendation engines guiding product selection based on child age and developmental goals.

- Ethical design considerations focusing on robust data encryption and compliance with global children's online privacy regulations (e.g., COPPA).

- Development of AI algorithms to optimize toy complexity based on real-time observation of a child's frustration or boredom levels.

DRO & Impact Forces Of Baby Toys Market

The dynamics of the Baby Toys Market are shaped significantly by powerful drivers and countervailing restraints, creating unique investment opportunities. The primary driver is the accelerating consumer preference for high-quality, scientifically proven developmental toys, often referred to as "edutainment." This is coupled with the pervasive influence of social media and parenting blogs which amplify awareness of new pedagogical methods and products, pressuring parents to invest early. However, the market faces constraints related to stringent regulatory requirements concerning material safety (e.g., BPA-free, lead-free mandates), which increases manufacturing costs and time-to-market. Additionally, the constant threat of counterfeit products, particularly in emerging markets, erodes brand value and consumer trust, posing a substantial challenge to legitimate manufacturers who bear the full compliance burden.

Opportunities abound in the sustainable and smart toy segments. There is a burgeoning demand for toys made from biodegradable plastics, certified organic fabrics, or sustainably harvested wood, driven by global environmental activism and parental desire to reduce their family's ecological footprint. Furthermore, integrating augmented reality (AR) and virtual reality (VR) elements, cautiously applied to minimize screen strain, presents a technological opportunity to bridge physical and digital play experiences for older toddlers (24-36 months). Geographical expansion into underserved rural areas of large emerging economies, facilitated by improved logistic networks and e-commerce infrastructure, represents a critical market expansion opportunity for scale, particularly through partnerships with local distribution experts.

The interplay of these factors defines the impact forces within the industry. The increasing reliance on certifications (CE, ASTM, ISO) acts as a powerful barrier to entry for smaller, unorganized players, consolidating market power among established corporations capable of managing complex compliance requirements. Simultaneously, the rapid evolution of technology, particularly miniaturization and battery longevity, enables the continuous introduction of highly sophisticated electronic toys, forcing traditional manufacturers to innovate or face obsolescence. Social and demographic shifts, particularly the trend towards having children later in life and spending more resources per child, amplify the market's premiumization trend, allowing higher profit margins for brands associated with safety and educational excellence and deepening the segmentation between mass-market and high-end offerings.

Segmentation Analysis

The Baby Toys Market is rigorously segmented based on product type, material, age group, and distribution channel, providing a granular view of consumer demand patterns and growth hotspots. Understanding these segmentations is critical for effective market strategy formulation, enabling manufacturers to tailor product development and marketing efforts precisely to the needs of specific consumer cohorts. The market structure reflects the complexity of infant development stages, necessitating a diverse portfolio that caters to rapid changes in physical and cognitive capabilities from birth through the toddler years. This diversity mandates distinct material choices, safety tolerances, and educational foci across different segments, driving specialized manufacturing processes and specialized retail strategies.

Product type segmentation reveals a core reliance on traditional segments like soft toys and rattles, which maintain stability, contrasted with the exponential growth seen in electronic and educational categories. Material segmentation highlights the shift away from conventional, low-cost plastics toward safer, often higher-cost alternatives such as silicone, organic cotton, and certified wooden components, driven by parental health concerns and sustainability goals. This trend ensures long-term viability for environmentally conscious brands. Age group segmentation remains the most critical axis, as safety and developmental appropriateness are paramount, dictating product design specifications rigorously enforced by global safety bodies.

Finally, the distribution channel breakdown showcases the dramatic digital migration, where online platforms offer unparalleled product variety and direct-to-consumer engagement, fundamentally disrupting traditional brick-and-mortar retail dominance. However, physical stores, particularly specialty boutiques, remain vital for offering personalized guidance and allowing sensory engagement with products, an important factor for parents making high-value purchasing decisions. The ongoing strategic efforts involve integrating online and offline experiences (omnichannel retail) to maximize reach and customer satisfaction across all consumer touchpoints.

- By Product Type:

- Dolls and Stuffed Toys (Including Plush Toys and Figurines)

- Activity Toys (Playmats, Activity Gyms, Mobiles, Walkers)

- Rattles and Teethers (Silicone, Wood, and Sensory Teethers)

- Musical Toys (Electronic Keyboards, Shakers, and Sound Books)

- Construction Sets (Stacking Cups, Blocks, Shape Sorters)

- Electronic Learning Toys and Smart Toys (Tablets, Interactive Books, AI-connected devices)

- Bath Toys and Water Play Items (Floating Toys, Water Scoops)

- By Material:

- Plastic (BPA-free, Recycled Polypropylene and ABS)

- Wood (FSC-Certified Sustainable Wood, Bamboo)

- Silicone and Rubber (Food-grade, Natural Rubber)

- Fabric/Textile (Organic Cotton, Hypoallergenic Polyester Fillings)

- Metal (Limited use, primarily in mobility aids like walkers, conforming to strict non-lead standards)

- By Age Group:

- 0 to 6 Months (Infant Sensory Focus, Tummy Time aids)

- 6 to 12 Months (Motor Skills Focus, Crawling encouragement, grasping)

- 12 to 24 Months (Cognitive and Language Focus, Cause-and-effect learning)

- 24 to 36 Months (Pre-K Readiness Focus, Role-playing, complex sorting)

- By Distribution Channel:

- Specialty Stores (e.g., Toy R Us, specialized baby boutiques offering consultation)

- Hypermarkets/Supermarkets (Mass Retail for volume sales)

- Online Retail (E-commerce Platforms, Amazon, Flipkart, Tmall, and D2C Websites)

- Department Stores and Warehouse Clubs

Value Chain Analysis For Baby Toys Market

The value chain for the Baby Toys Market is characterized by highly specialized stages, beginning with complex upstream material sourcing and culminating in sophisticated multi-channel distribution. Upstream analysis focuses on procuring raw materials, including certified non-toxic plastics, sustainable wood, organic cotton, and increasingly, high-grade electronics and sensory components. Material compliance with global safety standards (e.g., REACH, EN71, ASTM F963) is the primary upstream challenge, dictating costs and supplier selection. Manufacturers must ensure transparency and traceability in their supply chain to meet consumer and regulatory demands for product safety and ethical sourcing, often requiring rigorous third-party audits of material suppliers to certify environmental and labor standards.

The manufacturing stage involves design (emphasizing developmental psychology), rigorous prototyping, mass production, and stringent quality control testing to achieve mandatory certifications. Innovation here is driven by design for safety and longevity, minimizing small parts and maximizing durability. Advanced manufacturing techniques, including precision molding and automated assembly, are crucial for maintaining consistency and scalability. Downstream analysis focuses on moving the finished goods to the end consumer. Distribution channels are bifurcated into direct and indirect methods. Direct channels include brand-owned e-commerce sites and flagship retail stores, allowing higher margin capture and direct feedback integration, which is invaluable for fast product improvement cycles.

Indirect channels involve large volume movers such as mass hypermarkets, specialized toy retail chains, and rapidly growing third-party online marketplaces (Amazon, Alibaba), which require extensive logistical coordination and optimized packaging for shipping efficiency. The increasing prominence of online retail (a key distribution channel) has compressed certain elements of the traditional value chain, minimizing the role of intermediate wholesalers in many developed markets. However, specialized retail still plays a crucial role in providing hands-on consumer experience and expert consultation, especially for first-time parents. Effective inventory management and rapid response to viral product trends are paramount for channel success, requiring investment in robust enterprise resource planning (ERP) systems synchronized across global operations.

Baby Toys Market Potential Customers

The primary end-users and buyers in the Baby Toys Market are parents, particularly Millennial and Generation Z parents, who are characterized by high digital literacy, intense focus on educational outcomes, and a strong preference for transparent, sustainable brands. Grandparents also represent a significant customer segment, often focused on purchasing premium or classic heritage toys as gifts, emphasizing nostalgia and proven safety. Institutional buyers, such as preschools, daycare centers, pediatric clinics, and children's hospitals, constitute another important customer group, purchasing toys in bulk for developmental and therapeutic purposes, often prioritizing durability, ease of cleaning, and compliance with strict institutional cleaning protocols and safety requirements suitable for group settings.

Specific customer profiles often include "First-Time Parents" (high anxiety, heavily reliant on recommendations and certifications), "Eco-Conscious Parents" (prioritizing wooden and organic materials, willing to pay a premium), and "Tech-Forward Parents" (seeking smart, connected, and AI-enabled toys that promise measurable developmental metrics). Marketing strategies must be nuanced to address these varying psychographics, utilizing channels ranging from pediatric recommendations for the safety-conscious to social media influencers for the trend-driven. The decision-making process is highly research-intensive, making robust online presence, credible educational content, and transparent sourcing information critical for conversion, particularly during peak purchasing periods like holiday seasons and birthdays.

The increasing trend of delayed parenthood often results in higher disposable income per child, allowing consumers to choose premium, specialized products over mass-market items. This segmentation of potential customers based on income and education level fuels the demand for high-end developmental toys designed by educational experts. Consequently, companies that successfully brand their products as essential developmental aids, rather than mere playthings, secure greater customer loyalty and command higher average selling prices, effectively capturing the affluent segments of the market and establishing durable brand equity built on perceived value and safety assurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 33.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LEGO Group, Mattel Inc., Hasbro Inc., Ravensburger AG, Bandai Namco Holdings Inc., Melissa & Doug, Tomy Company Ltd., VTech Holdings Ltd., Fisher-Price (Mattel Subsidiary), Kids II Inc., Safari Ltd., Manhattan Toy, GUND (Spin Master), Hape International, Cloud B, Infantino, Skip Hop (Carter's), Lovevery, PlanToys, Green Toys |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Toys Market Key Technology Landscape

The technology landscape within the Baby Toys Market is rapidly shifting towards integration of smart and connected features aimed at enhancing interactivity and providing data-driven insights to parents. Primary technological advancements include the miniaturization of safe, low-power electronic components, enabling the embedding of sensors, microprocessors, and Bluetooth/Wi-Fi modules into traditionally non-electronic toys. This facilitates the development of "smart activity gyms" or "connected plush toys" that track baby interaction, measure time spent in different play modes, and generate personalized reports on developmental progress accessible via companion mobile applications. Security protocols, including robust data encryption and mandatory parental controls, are essential technological requirements to ensure compliance and maintain consumer trust in these connected devices, addressing critical data privacy concerns from the outset.

Furthermore, technology related to material science is driving innovation in manufacturing. The shift towards sustainable materials necessitates advancements in plant-based plastics (bio-plastics), recycled polymers, and food-grade silicone production that can withstand rigorous safety testing and repeated use. This requires sophisticated chemical engineering and material blending techniques to ensure durability and certified non-toxicity, which is paramount for infant products. Additive manufacturing (3D printing) is also gaining traction, particularly in the prototyping and limited-run production of highly customized, specialized developmental aids and therapeutic toys. This technology allows for rapid iteration of ergonomic designs tailored to specific motor skill challenges, providing manufacturers with agility in responding to highly personalized market demands and achieving quicker turnaround times from concept to certified product launch.

The integration of Augmented Reality (AR) represents a novel frontier, used primarily for enriching the play experience of static items (like blocks or picture books) without requiring the child to directly engage with a screen. AR applications, viewed by parents on a tablet, can overlay digital elements onto physical toys, offering interactive narratives or animated feedback that enhances the educational value and engagement potential. Though less pervasive than sensor technology, AR holds significant promise for blurring the lines between physical and digital play in a developmentally appropriate manner, further cementing the role of technology as a facilitator of, rather than a replacement for, tangible play experiences, especially in the 24-36 month segment where cognitive engagement is highest.

Regional Highlights

Regional dynamics play a crucial role in the Baby Toys Market, reflecting disparities in birth rates, disposable income, cultural attitudes towards early education, and regulatory environments. The global market is divided into five key geographical regions, each presenting unique growth vectors and consumer preferences that influence product mix and market entry strategies.

- North America: This region maintains a significant market share characterized by high expenditure per child and a strong preference for branded, high-tech, and certified safety toys. The U.S. market specifically drives demand for personalized learning systems and sophisticated smart toys. Regulatory bodies like the CPSC enforce strict safety standards, fostering a mature market where innovation in safety and educational efficacy commands premium pricing. Canada mirrors these trends with strong emphasis on imported goods and robust e-commerce penetration.

- Europe: Europe is defined by a deep commitment to sustainability and strict environmental standards (e.g., EU Toy Safety Directive, REACH). The market shows high demand for wooden, organic, and ethically sourced toys, particularly in Scandinavian countries and Germany. France and the UK contribute substantially through established retail chains and a focus on aesthetically pleasing, durable, and culturally rich play items, emphasizing long-term value over short-term trends. Regulatory compliance here is a primary determinant of market success.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by sheer population size, rapidly increasing urbanization, and escalating middle-class disposable income, particularly in China, India, and Southeast Asia. The focus is increasingly shifting from low-cost mass-market items to premium, imported, or domestically produced toys that carry strong educational credentials, driven by intense parental competition regarding early academic achievement. E-commerce is the dominant distribution channel here, enabling widespread reach into second and third-tier cities.

- Latin America (LATAM): Growth in LATAM is promising but volatile, constrained in some areas by economic instability. Brazil and Mexico are key growth engines, showing increasing adoption of international brands and a growing willingness to invest in developmental toys. The market is highly price-sensitive, necessitating robust localized manufacturing and efficient distribution networks to penetrate lower-income segments effectively, with a strong demand for durable and multi-functional products.

- Middle East and Africa (MEA): The MEA market is fragmented. The Gulf Cooperation Council (GCC) countries exhibit high spending power, driving demand for luxury and internationally recognized brands, often imported from Europe and North America. In contrast, the African segment is primarily driven by essential, durable, and affordable toys. Infrastructure challenges in distribution and retail complexity present hurdles, but rising birth rates offer significant long-term potential, especially in South Africa and Nigeria, where local manufacturing is slowly gaining ground.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Toys Market, providing analysis of their strategic initiatives, product portfolios, regional presence, and competitive positioning.- LEGO Group

- Mattel Inc.

- Hasbro Inc.

- Ravensburger AG

- Bandai Namco Holdings Inc.

- Melissa & Doug

- Tomy Company Ltd.

- VTech Holdings Ltd.

- Fisher-Price (Mattel Subsidiary)

- Kids II Inc.

- Safari Ltd.

- Manhattan Toy

- GUND (Spin Master)

- Hape International

- Cloud B

- Infantino

- Skip Hop (Carter's)

- Lovevery

- PlanToys

- Green Toys

Frequently Asked Questions

Analyze common user questions about the Baby Toys market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Baby Toys Market?

The primary factor driving growth is the increasing global parental awareness regarding the critical importance of early childhood developmental stimulation. This has led to a significant shift in consumer spending towards premium, educational, and developmentally appropriate toys (often referred to as 'edutainment' products) that enhance cognitive and motor skills in infants and toddlers.

Which product segment holds the largest market share in the Baby Toys industry?

Activity Toys, including playmats, activity gyms, and activity centers, currently hold a substantial market share. These products offer multi-sensory stimulation and are utilized from the earliest stages of infancy, making them staple purchases. However, the Electronic Learning Toys segment is projected to exhibit the fastest growth rate due to technological integration.

How significant is the trend of sustainable materials in the manufacturing of baby toys?

The shift towards sustainable materials is highly significant and constitutes a major market opportunity. Consumers, particularly in North America and Europe, are increasingly demanding toys made from certified non-toxic, eco-friendly, and durable materials such as sustainable wood, organic fabrics, and plant-based plastics, influencing product design and supply chain ethics across the industry.

What role does e-commerce play in the distribution of baby toys?

E-commerce plays a dominant and rapidly growing role, enabling manufacturers to bypass traditional retail barriers and reach a wider global audience directly (D2C). Online retail platforms provide parents with extensive product research options, comparison tools, and access to niche, specialized, and international toy brands not readily available in local physical stores, driving market expansion.

Are smart or AI-enabled baby toys safe for infant development?

AI-enabled toys, when developed responsibly, are designed to be safe and developmentally beneficial by offering personalized learning experiences and tracking progress. Safety concerns primarily revolve around physical hazards (battery safety) and data privacy. Reputable brands ensure compliance with strict global standards (like COPPA and GDPR) and focus on 'invisible AI' that enhances physical play without compromising essential sensory interaction.

Which geographical region offers the most promising growth opportunities?

The Asia Pacific (APAC) region, driven by escalating disposable incomes, large populations, and a strong cultural emphasis on early education in major economies like China and India, is projected to offer the most promising long-term growth opportunities for the baby toys market, despite facing complex logistical and regulatory landscapes.

What are the key safety standards manufacturers must adhere to?

Key safety standards globally include the ASTM F963 in the US, the EN 71 series in Europe (EU Toy Safety Directive), and ISO 8124 internationally. These standards cover mechanical and physical properties, flammability, chemical content (e.g., phthalates and heavy metals), and electrical safety, ensuring toys are non-toxic and free from choking hazards.

How do demographic factors influence consumer spending on baby toys?

Demographic factors such as delayed parenthood (resulting in higher disposable income per child) and the rise of nuclear family structures significantly boost expenditure on premium and specialized baby toys. Urbanized, well-educated parents typically invest more in certified developmental products than previous generations, favoring quality over quantity.

What distinguishes Activity Toys from Electronic Learning Toys?

Activity Toys typically focus on physical interaction, texture, and basic motor skill development (e.g., mats, rattles, stacking blocks), often being non-electronic. Electronic Learning Toys incorporate microprocessors, lights, sounds, and potentially AI to teach concepts like letters, numbers, and language through interactive digital or audio feedback, targeting cognitive skills.

What challenges do counterfeit products pose to the market?

Counterfeit products pose a severe challenge by undermining consumer safety and brand trust. These unregulated goods often bypass essential safety testing, potentially containing toxic materials or presenting choking hazards. They also erode the intellectual property and revenue of legitimate manufacturers, requiring brands to invest heavily in brand protection and supply chain authentication technologies.

How are environmental concerns impacting toy material selection?

Environmental concerns are leading to a pronounced shift away from standard plastics, especially PVC. Manufacturers are prioritizing biodegradable, recycled, and renewable resources, such as FSC-certified wood and corn-based bio-plastics. This trend is driven by consumer demand for sustainable products and corporate social responsibility initiatives aimed at reducing the market's environmental footprint.

What technological advancements are driving manufacturing efficiency in this sector?

Manufacturing efficiency is being driven by the implementation of advanced robotics for assembly, AI-powered quality control systems (reducing defects), and predictive maintenance of machinery. Furthermore, sophisticated ERP systems are optimizing global supply chain logistics and demand forecasting, leading to reduced production lead times and lower operational costs.

Why is safety certification crucial for baby toy manufacturers?

Safety certification is crucial as it demonstrates compliance with mandatory national and international standards, minimizing legal liability, establishing essential consumer trust, and acting as a necessary prerequisite for market entry in regulated geographies. Without valid certifications, toys cannot be legally sold in most major markets like the EU and the US.

Which age group segment shows the highest growth rate?

The 12 to 36 Months age group segment is demonstrating the highest growth rate. This is primarily due to the increasing demand for complex, high-value developmental and role-playing toys (like construction sets and advanced cognitive toys) that align with pre-school readiness and enhanced vocabulary building.

How do consumer reviews and social media influence purchasing decisions?

Consumer reviews and social media platforms are highly influential, serving as key sources of information for modern parents. Positive reviews and endorsements from trusted parenting influencers or pediatricians often validate the perceived quality and developmental efficacy of a toy, significantly accelerating purchase intent, especially for premium or niche brands.

What is the 'premiumization' trend in the Baby Toys Market?

The 'premiumization' trend refers to consumers' willingness to spend higher amounts on toys perceived to offer superior safety, developmental benefits, material quality (e.g., sustainable, organic), and brand heritage. This trend is sustained by rising disposable income among educated urban parents who prioritize investment in durable, educational products.

How does global trade volatility affect the Baby Toys supply chain?

Global trade volatility, including tariffs, geopolitical tensions, and shipping disruptions (like those seen post-pandemic), significantly affects the supply chain by increasing raw material costs, logistics expenses, and lead times. Manufacturers are mitigating this by regionalizing production and diversifying sourcing to enhance resilience and reduce reliance on single manufacturing hubs.

What are the implications of the shift towards direct-to-consumer (D2C) sales models?

The shift to D2C models allows manufacturers higher profit margins, greater control over brand messaging, and direct collection of consumer data. This enables faster product iteration and personalized marketing strategies, strengthening brand loyalty and reducing reliance on traditional, margin-cutting third-party retailers.

How is sensory development catered to within the Baby Toys Market?

Sensory development is catered to through specialized products like high-contrast visual stimulation toys for newborns, textured teethers for tactile exploration, and musical toys for auditory development. The 0-12 month segment relies heavily on multi-sensory stimulation, driving innovation in material textures, sounds, and visual complexity.

What constitutes a 'Smart Toy' in the context of the Baby Toys Market?

A 'Smart Toy' is a connected toy incorporating sensors, AI, or microprocessors to interact with the child dynamically, often providing personalized feedback or adaptive play difficulty. Examples include connected play mats that monitor movement or plush toys that adjust responses based on recognized speech patterns, all linking to parental monitoring apps.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager