Ball Screw Channel Diamond Roller Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442405 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Ball Screw Channel Diamond Roller Market Size

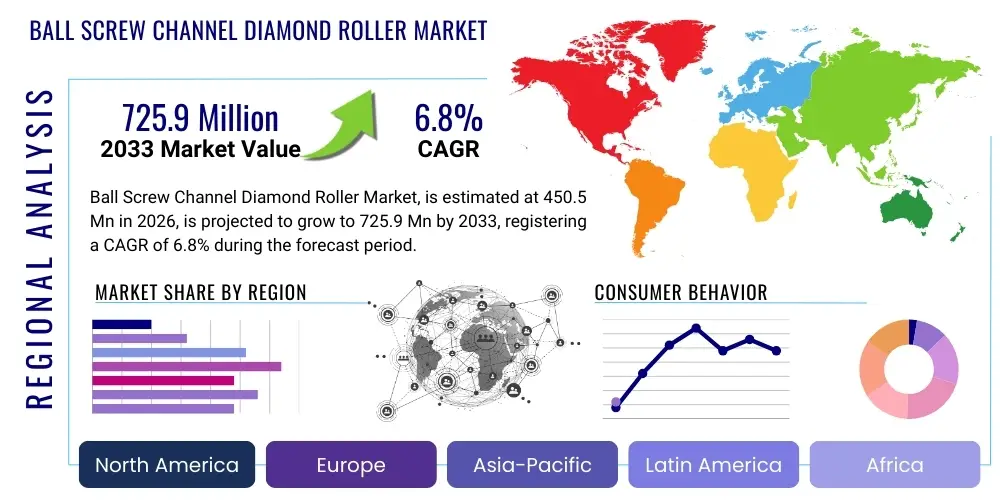

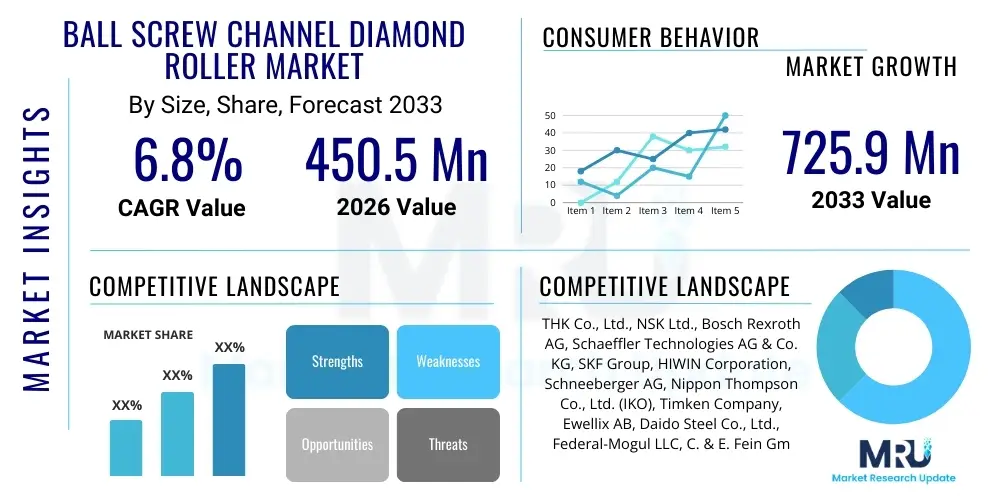

The Ball Screw Channel Diamond Roller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 725.9 million by the end of the forecast period in 2033.

Ball Screw Channel Diamond Roller Market introduction

The Ball Screw Channel Diamond Roller Market encompasses the production, distribution, and utilization of high-precision rolling elements specifically designed for use in advanced ball screw mechanisms. These specialized diamond-coated rollers replace traditional ball bearings in applications requiring superior load distribution, enhanced stiffness, reduced friction, and exceptional durability, particularly under high-speed and heavy-load conditions. The diamond coating significantly increases surface hardness and wear resistance, crucial for maintaining micron-level accuracy over extended operational cycles in demanding industrial environments.

The core product, the Ball Screw Channel Diamond Roller, serves as a critical component in linear motion systems across various high-tech sectors. Major applications include high-end Computer Numerical Control (CNC) machine tools, precision robotics used in assembly and manufacturing, semiconductor fabrication equipment (e.g., lithography and etching stages), aerospace actuation systems, and advanced medical imaging devices. These rollers are engineered to convert rotary motion into highly precise linear motion with minimal backlash, directly contributing to the overall performance and accuracy of automated machinery.

The market growth is primarily driven by the global push towards higher automation levels, the continuous technological advancements in manufacturing processes demanding tighter tolerances, and the exponential expansion of the semiconductor and electronics industries. Key benefits offered by these diamond rollers include superior dynamic and static stiffness, extended service life compared to conventional steel rollers, and enhanced thermal stability, ensuring reliable performance in environments with fluctuating operational temperatures. These performance advantages make them indispensable in applications where failure or reduced precision is unacceptable.

Ball Screw Channel Diamond Roller Market Executive Summary

The global Ball Screw Channel Diamond Roller Market is characterized by robust technological development and increasing integration into critical high-precision industries. Business trends indicate a strong shift towards specialized, custom-engineered roller systems designed to meet the unique specifications of advanced machinery manufacturers, particularly in East Asia and North America. Key manufacturers are heavily investing in material science research, focusing on improving the adhesion and uniformity of the diamond-like carbon (DLC) coatings to maximize component lifespan and operational efficiency. Furthermore, strategic partnerships between roller manufacturers and primary machinery OEMs are becoming prevalent to co-develop next-generation linear guides and actuators, securing supply chains and optimizing product integration early in the design phase, thus solidifying market positioning and driving competitive advantage.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, largely fueled by massive investments in semiconductor fabrication plants (fabs) and the prolific expansion of the automotive and electronics manufacturing sectors in China, South Korea, and Taiwan. North America and Europe remain crucial markets, driven by the demand for sophisticated aerospace, defense, and high-speed CNC machinery, requiring the highest standards of precision and reliability inherent in diamond roller technology. Specific growth accelerators in these mature markets include retrofitting older industrial equipment with modern, high-efficiency ball screw systems featuring these rollers to enhance productivity and reduce maintenance overhead. Political stability and favorable regulatory environments supporting advanced manufacturing infrastructure are critical determinants of regional market attractiveness, particularly for high-value components.

Segmentation trends reveal that the highest growth is concentrated in the segment related to ultra-high precision applications, specifically those utilizing rollers with superior surface finish and strict dimensional tolerances, often required by the 5-axis machining and semiconductor industries. By load capacity, high-load capacity rollers are seeing rapid adoption due to the increased size and payload requirements of modern industrial robots and heavy-duty automation systems. Moreover, the end-user vertical segmentation indicates strong emerging demand from the medical devices sector, where precision movement is paramount for surgical robots and diagnostic equipment, offering a diversified growth trajectory beyond traditional heavy machinery manufacturing.

AI Impact Analysis on Ball Screw Channel Diamond Roller Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ball Screw Channel Diamond Roller Market generally center on several key themes: how AI-driven predictive maintenance systems can utilize roller performance data to prevent failures, the role of AI in optimizing roller manufacturing processes for defect reduction, and how robotics integrated with advanced AI are increasing the demand for highly reliable linear motion components. Users frequently ask about the feasibility of real-time monitoring of vibration, temperature, and friction levels facilitated by AI algorithms, which could drastically extend the rollers' service intervals and minimize unexpected downtime. Concerns also revolve around the data infrastructure required to support such advanced monitoring systems and the standardization of data formats across different machinery types to enable comprehensive AI-based analysis, driving the need for smarter, sensor-integrated roller systems capable of continuous self-diagnosis.

The pervasive adoption of AI across industrial automation fundamentally increases the operational demands placed on critical mechanical components like ball screw channel diamond rollers. AI-optimized manufacturing lines and robotic cells often operate at higher speeds, heavier loads, and longer continuous cycles than conventional systems, necessitating components that offer unparalleled reliability and wear resistance. This increased operational intensity directly translates into heightened demand for the superior tribological properties offered by diamond-coated rollers. Furthermore, AI systems driving machine learning models for quality control in roller manufacturing promise a reduction in manufacturing variability, ensuring that every roller meets the stringent specifications required for high-precision applications, thereby reducing scrap rates and improving overall product consistency.

The implementation of AI in machine health monitoring fundamentally transforms the maintenance lifecycle of industrial machinery. AI algorithms analyze continuous streams of data—including acoustic emissions, thermal signatures, and torque fluctuations—to predict the onset of failure in linear guides and ball screws with greater accuracy than traditional methods. This capability shifts maintenance from reactive or scheduled interventions to truly predictive actions, requiring rollers that are not only robust but also compatible with advanced sensor integration for data collection. This predictive paradigm necessitates components that wear slowly and predictably, making the stable performance of diamond rollers essential for leveraging the full economic benefits of AI-driven industrial operations.

- AI drives demand for higher performance rollers due to increased automation speed and operational intensity.

- Predictive maintenance systems, powered by AI, require integrated sensors compatible with diamond roller assemblies to monitor wear and friction.

- AI optimization enhances the precision manufacturing of rollers, leading to stricter quality control and reduced material defects.

- Robotics and autonomous systems, guided by complex AI, depend on the zero-backlash and high stiffness provided by advanced ball screw channel diamond rollers.

- Machine learning algorithms utilize roller performance data (vibration, temperature) to forecast maintenance needs accurately, maximizing uptime.

- AI simulation tools are used during the design phase to optimize roller geometry and coating thickness for specific load profiles.

DRO & Impact Forces Of Ball Screw Channel Diamond Roller Market

The Ball Screw Channel Diamond Roller Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all contributing to substantial Impact Forces shaping the industry's trajectory. Key drivers center around the global proliferation of sophisticated industrial automation, particularly in the semiconductor, aerospace, and high-precision CNC machinery sectors, where the demand for micron-level accuracy and long operational life overrides component cost considerations. The intrinsic technical superiority of diamond rollers—offering significantly lower friction coefficients, higher load-bearing capacity, and enhanced stiffness compared to standard steel bearings—makes them essential for new generations of high-throughput manufacturing equipment. The increasing adoption of 5-axis machining centers and highly dynamic robotic systems further strengthens this demand, creating a sustained positive market force.

Conversely, the market faces notable restraints, primarily related to the high initial manufacturing cost associated with the deposition of diamond-like carbon (DLC) coatings and the specialized materials required for the roller substrate. This high cost can deter adoption in lower-specification or budget-sensitive automation projects, restricting market penetration primarily to high-end applications. Furthermore, the complexity of quality control for ultra-thin, highly uniform diamond coatings presents technical challenges, demanding specialized manufacturing expertise and rigorous testing protocols, which only a select number of specialized firms currently possess. Additionally, the limited availability of high-purity raw materials and the energy intensity of the CVD (Chemical Vapor Deposition) or PVD (Physical Vapor Deposition) coating processes pose supply chain and environmental concerns that manufacturers must address strategically.

Opportunities for growth are vast, particularly in developing next-generation coatings that offer enhanced thermal stability and even lower friction, thereby extending the application range into extreme environment operations, such as vacuum chambers for space technology or high-temperature furnaces. The burgeoning electric vehicle (EV) manufacturing sector, which requires high-precision assembly and battery handling systems, presents a significant untapped vertical for diamond rollers. Furthermore, miniaturization trends in consumer electronics and medical devices necessitate smaller, yet equally precise, linear motion systems, opening a lucrative niche for micro-scale ball screw channel diamond rollers. Strategic efforts focused on optimizing coating efficiency and reducing production costs through scaled manufacturing processes are critical to capitalizing on these emerging opportunities and mitigating the current cost restraint.

Segmentation Analysis

The Ball Screw Channel Diamond Roller Market is comprehensively segmented based on critical technical and application parameters, providing a detailed view of market dynamics and growth potential across diverse industrial landscapes. Primary segmentation categories include Load Capacity, Roller Diameter, Coating Type, and End-User Industry. This structured approach allows market participants to tailor their offerings to specific demands, ranging from heavy-duty industrial machinery requiring high static and dynamic load support to highly sensitive applications in optics and laboratory equipment demanding minimal frictional resistance and extreme positional accuracy. The complexity of these segments reflects the highly technical nature of the product and its integration into complex mechanical systems globally.

Analysis by Load Capacity is crucial, dividing the market into segments such as Heavy Duty, Medium Duty, and Light Duty, directly correlating with the target machinery (e.g., stamping presses versus 3D printers). Coating Type segmentation differentiates between specific material compositions, such as Hydrogenated DLC, Nitrogenated DLC, and metal-doped DLC, each offering unique trade-offs regarding hardness, friction coefficient, and corrosive resistance. Furthermore, the Roller Diameter segmentation is essential, impacting the design geometry and integration capability into various ball screw mechanisms, catering to both large industrial actuators and micro-actuators used in precision instrumentation. Understanding these distinct segments is vital for accurate competitive landscaping and strategic product development, ensuring alignment with evolving end-user requirements.

- By Load Capacity:

- Heavy Duty (High Load Applications)

- Medium Duty (Standard Industrial Applications)

- Light Duty (Precision and Small Scale)

- By Roller Diameter:

- Micro Rollers (Below 3 mm)

- Standard Rollers (3 mm to 10 mm)

- Large Rollers (Above 10 mm)

- By Coating Type:

- Hydrogenated Diamond-Like Carbon (a-C:H)

- Nitrogenated Diamond-Like Carbon (DLC:N)

- Metal-Doped Diamond-Like Carbon (Me-DLC)

- Tungsten Carbide-Based Coatings

- By End-User Industry:

- Machine Tools (CNC, Grinding, Milling)

- Semiconductor Manufacturing Equipment (Wafer Handling, Lithography)

- Robotics and Automation (Industrial Robots, Cobots)

- Aerospace and Defense (Actuation Systems)

- Medical Devices and Imaging

- Automotive Manufacturing (Assembly, Inspection)

Value Chain Analysis For Ball Screw Channel Diamond Roller Market

The value chain for the Ball Screw Channel Diamond Roller Market begins with sophisticated upstream activities focused on raw material procurement and specialized processing. This initial phase involves sourcing high-purity steel alloys (typically bearing steel or specialized stainless steel) necessary for the roller substrate, coupled with obtaining the carbon-rich gases or targets required for the diamond coating process. Upstream specialization also includes the critical pre-treatment steps, such as precision grinding and polishing of the roller surface to achieve the necessary roughness parameters before coating application. Suppliers in this stage often employ proprietary metallurgy and surface preparation techniques to ensure optimal adhesion and performance of the subsequent DLC layer, making material quality and initial machining precision paramount to the final product's efficacy and longevity.

Midstream activities are centered on the core manufacturing and value addition processes, including high-precision machining of the roller geometry, followed by the complex coating phase, typically involving Chemical Vapor Deposition (CVD) or Physical Vapor Deposition (PVD) techniques to apply the diamond-like carbon coating. This stage demands extremely high capital expenditure on specialized coating equipment and highly skilled technical personnel to manage the deposition parameters (temperature, pressure, gas flow) to ensure uniform coating thickness and internal stress management. Quality assurance, involving rigorous non-destructive testing for coating integrity, hardness measurement, and tribological performance testing, is an integral part of this value-adding stage before final assembly into the ball screw channel mechanism.

Downstream analysis focuses on the distribution channels and end-user integration. Distribution often utilizes both direct sales channels, targeting large Original Equipment Manufacturers (OEMs) in the CNC and semiconductor industries who require custom specifications and high volume, and indirect channels through specialized industrial distributors and system integrators catering to smaller manufacturers and aftermarket needs. Direct channels facilitate closer technical collaboration and quicker feedback loops essential for product iteration. The end of the chain involves the integration of the diamond rollers into the final machinery assembly—such as linear guides, actuators, or entire motion platforms—followed by extensive performance verification at the customer’s facility, demanding robust technical support and post-sales service from the roller manufacturer to ensure optimal system performance.

Ball Screw Channel Diamond Roller Market Potential Customers

Potential customers for Ball Screw Channel Diamond Rollers are predominantly high-value, high-precision manufacturing enterprises and technology developers who cannot compromise on accuracy, speed, or reliability in their automated systems. The primary buyers are large-scale machine tool manufacturers specializing in 5-axis and ultra-precision CNC grinding, milling, and turning centers, where the inherent stiffness and minimal friction of diamond rollers directly translate into superior surface finishes and tighter dimensional tolerances. These OEMs seek components that guarantee operational stability over years of intensive use, viewing the higher initial cost as a justifiable investment against reduced maintenance frequency and improved machine output quality, making them crucial anchor customers in the market landscape.

Another significant customer segment is the semiconductor and flat panel display equipment industry. Companies manufacturing lithography machines, wafer handling robots, and inspection systems are heavy consumers of these rollers, as the precision required for nano-scale manufacturing demands motion components with virtually zero error accumulation. In these cleanroom environments, the low-wear, low-particulate generation characteristics of DLC-coated rollers are particularly advantageous, minimizing contamination risk. Furthermore, the aerospace and defense sectors, utilizing these rollers in sophisticated flight control actuation systems and missile guidance mechanisms, represent a critical buyer group prioritizing reliability under extreme stress and variable environmental conditions (temperature, vacuum).

The burgeoning fields of advanced robotics and specialized medical equipment also represent high-growth potential customer bases. Robotics companies developing collaborative robots (cobots) and high-speed pick-and-place robots require dynamic linear motion components that can sustain high cycle rates and rapid accelerations without degradation, which the diamond rollers deliver. Similarly, manufacturers of advanced surgical robots, MRI machines, and particle accelerators utilize these rollers to ensure the precise, repeatable movements necessary for safe and effective operation. These end-users demand rigorous certification and validated performance data, establishing a high barrier to entry but offering long-term, lucrative contracts for established roller suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 725.9 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | THK Co., Ltd., NSK Ltd., Bosch Rexroth AG, Schaeffler Technologies AG & Co. KG, SKF Group, HIWIN Corporation, Schneeberger AG, Nippon Thompson Co., Ltd. (IKO), Timken Company, Ewellix AB, Daido Steel Co., Ltd., Federal-Mogul LLC, C. & E. Fein GmbH, Linak A/S, Kuroda Precision Industries Ltd., PBC Linear, Rollon S.p.A., AccuDrive Technology, PMI Group, Starlinger & Co. GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ball Screw Channel Diamond Roller Market Key Technology Landscape

The technological landscape of the Ball Screw Channel Diamond Roller Market is dominated by advancements in thin-film coating technology, primarily focusing on Diamond-Like Carbon (DLC) variants. Key technological developments center around improving the quality, uniformity, and adhesion strength of these coatings onto the steel substrate. Manufacturers are heavily investing in specialized Physical Vapor Deposition (PVD) and Plasma-Enhanced Chemical Vapor Deposition (PECVD) systems to achieve ultra-smooth, dense films with superior hardness (often exceeding 40 GPa) and low friction coefficients (sometimes below 0.05). The integration of gradient layers and doping agents (such as silicon, nitrogen, or titanium) is a cutting-edge area, optimizing the coating to handle specific environmental challenges like high humidity or vacuum, thereby significantly extending the rollers' application suitability beyond standard industrial settings and mitigating tribological failure risks.

Another crucial technological frontier involves the precision manufacturing and metrology of the roller geometry itself. Achieving the micro-geometrical accuracy required for the ball screw channel involves complex grinding and superfinishing processes. Manufacturers are deploying advanced non-contact measurement systems, such as white light interferometry and atomic force microscopy (AFM), to verify surface roughness and form deviations to sub-micron levels, ensuring minimal pre-load friction and optimal load distribution when integrated into the final assembly. These highly precise manufacturing techniques are essential to guaranteeing the ultra-low friction and high stiffness characteristics expected of diamond-coated components, directly impacting the dynamic performance and repeatability of the linear motion system in which they operate, particularly under high-speed reversing conditions typical in modern CNC machinery.

Furthermore, sensor integration and smart component technology are rapidly emerging as pivotal areas. Leading manufacturers are exploring the embedding of passive or active micro-sensors within the ball screw housing or the roller assembly itself, designed to monitor real-time performance parameters such as vibration, temperature, and acoustic emissions. This capability facilitates AI-driven predictive maintenance, moving the technology toward an IoT-enabled industrial component. Future technological developments are anticipated to include self-lubricating coatings that incorporate solid lubricants within the DLC matrix, reducing the reliance on external lubrication systems, thereby enhancing performance in contamination-sensitive environments like cleanrooms and further simplifying maintenance protocols for end-users worldwide, accelerating the return on investment for high-precision machinery.

Regional Highlights

Regional dynamics in the Ball Screw Channel Diamond Roller Market are heavily skewed towards regions with dominant advanced manufacturing and high-technology industry bases. The Asia Pacific (APAC) region stands out as the global powerhouse, driven by the immense manufacturing scale of countries like China, the technological sophistication of Japan (a key hub for CNC machinery and industrial robotics), and the massive capital expenditure in semiconductor fabrication facilities in Taiwan and South Korea. These nations demand vast quantities of high-precision motion components to support their high-throughput production lines, establishing APAC as both the largest consumer and the fastest-growing market due to ongoing infrastructure development and government support for high-tech industrialization, particularly in the realm of electric vehicle assembly and advanced consumer electronics production.

North America and Europe constitute the mature markets, characterized by high adoption rates in demanding niche sectors such as aerospace, defense, and specialized high-speed/high-accuracy machine tools. In North America, the reshoring of critical manufacturing, coupled with significant governmental investment in defense and advanced computing technologies, fuels sustained demand for components offering extreme reliability and longevity, making the premium diamond rollers highly desirable. Europe, with Germany, Italy, and Switzerland leading in precision machinery manufacturing, focuses on quality and technological leadership. The stringent engineering standards and regulatory requirements in these regions necessitate the use of best-in-class components, ensuring stable, albeit slower, growth compared to the expansive markets of Asia.

The Middle East and Africa (MEA) and Latin America (LATAM) currently represent nascent markets, primarily focused on modernization and industrial diversification, with adoption concentrated in oil and gas precision equipment (in MEA) and burgeoning automotive assembly sectors (in LATAM). While the volume of consumption is comparatively low, these regions present future growth opportunities as local governments invest in diversifying economies away from raw materials and towards value-added manufacturing processes. Increased foreign direct investment (FDI) in localized assembly plants and infrastructure projects demanding heavy-duty, reliable motion components will be key drivers for adoption in the latter half of the forecast period, requiring tailored market strategies from global suppliers focused on local technical support and supply chain development.

- Asia Pacific (APAC): Dominates the market due to massive semiconductor, CNC, and robotics manufacturing clusters (China, Japan, South Korea, Taiwan). Highest growth potential.

- North America: Strong demand from aerospace, defense contractors, and high-end specialized machine tool OEMs, prioritizing extreme reliability and technological performance.

- Europe: Key consumer driven by German, Swiss, and Italian precision engineering industries; focusing on high quality and long-term operational efficiency in complex automation systems.

- Latin America (LATAM): Emerging market driven by automotive production modernization and increasing regional industrial automation adoption.

- Middle East & Africa (MEA): Growth focused on oil and gas precision equipment maintenance and diversification into localized assembly operations, currently a smaller market share.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ball Screw Channel Diamond Roller Market.- THK Co., Ltd.

- NSK Ltd.

- Bosch Rexroth AG

- Schaeffler Technologies AG & Co. KG

- SKF Group

- HIWIN Corporation

- Schneeberger AG

- Nippon Thompson Co., Ltd. (IKO)

- Timken Company

- Ewellix AB

- Daido Steel Co., Ltd.

- Federal-Mogul LLC

- C. & E. Fein GmbH

- Linak A/S

- Kuroda Precision Industries Ltd.

- PBC Linear

- Rollon S.p.A.

- AccuDrive Technology

- PMI Group

- Starlinger & Co. GmbH

Frequently Asked Questions

Analyze common user questions about the Ball Screw Channel Diamond Roller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance benefits of using diamond rollers in ball screw channels?

The core benefits include vastly superior wear resistance, significantly reduced friction coefficients (leading to lower energy consumption and heat generation), and higher dynamic stiffness. This allows for unparalleled precision, faster operational speeds, and extended service life, which are critical in semiconductor and high-speed CNC applications.

How does the Diamond-Like Carbon (DLC) coating technology contribute to the roller's durability?

DLC coating provides extreme surface hardness, minimizing abrasive and adhesive wear typically experienced by conventional steel bearings. This coating also prevents micro-welding and pitting under high pressure, maintaining the roller's smooth surface geometry and ensuring consistent, low-friction operation over millions of cycles, maximizing component longevity.

In which industries are Ball Screw Channel Diamond Rollers most commonly applied?

The rollers are essential in industries requiring ultra-high precision motion control, most notably in the semiconductor manufacturing sector (wafer handling, etching), advanced Computer Numerical Control (CNC) machine tools (5-axis machining), high-speed industrial robotics, and critical aerospace actuation systems due to the need for absolute reliability and accuracy.

Are diamond rollers cost-effective despite their higher initial price point?

Yes, while the initial investment is higher than standard steel rollers, diamond rollers offer superior total cost of ownership (TCO). Their extended service life, reduced maintenance requirements, and the ability to enable higher machine throughput and precision result in substantial long-term cost savings and improved productivity for critical industrial operations.

What is the role of AI and IoT integration in the future development of these precision rollers?

Future development focuses on embedding smart functionality, such as micro-sensors, to enable continuous condition monitoring. AI algorithms then analyze this data (vibration, heat) for predictive maintenance, optimizing usage, preventing catastrophic failure, and aligning the roller technology with Industry 4.0 automation standards globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager