Ballistic Parachute Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442530 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Ballistic Parachute Market Size

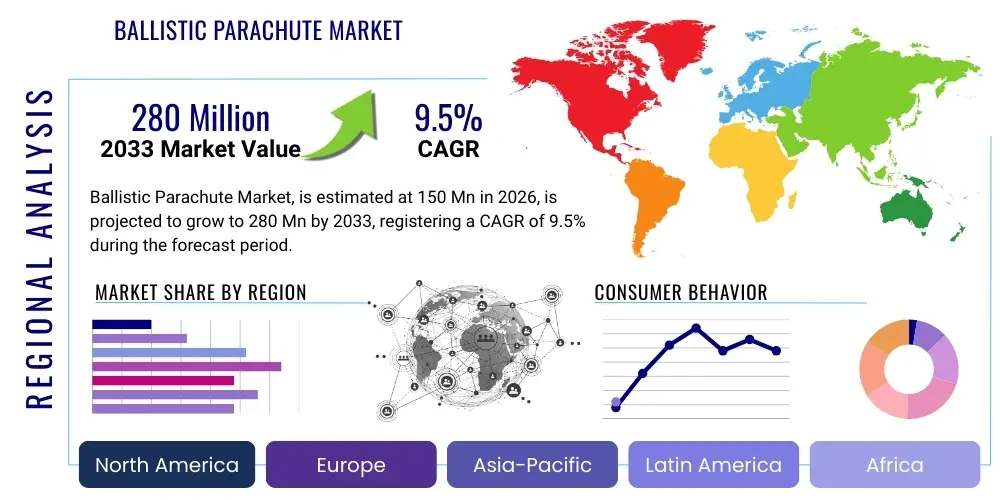

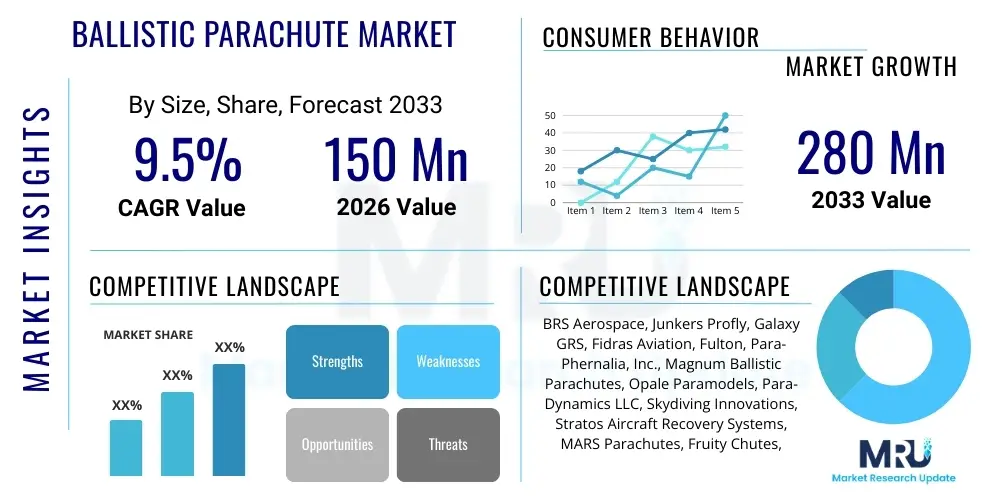

The Ballistic Parachute Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 280 Million by the end of the forecast period in 2033.

Ballistic Parachute Market introduction

The Ballistic Parachute Market encompasses the design, manufacturing, and integration of safety systems utilizing explosively deployed or rocket-assisted recovery parachutes for aircraft, particularly unmanned aerial vehicles (UAVs) and light general aviation aircraft. These systems are critical safety devices designed to autonomously deploy a parachute canopy at low altitudes or in catastrophic failure scenarios, ensuring the safe descent and minimal impact damage to the airframe, payload, and, most importantly, ground infrastructure or personnel. This technology significantly enhances the operational safety envelope for complex aerial systems and is becoming standard equipment, driven by stringent regulatory requirements across global aviation authorities.

The core product involves a dedicated recovery system that is armed upon takeoff and triggered either manually by the pilot or autonomously by an onboard flight termination system (FTS) based on predefined parameters such as excessive bank angle, loss of control, or low altitude anomalies. Major applications span commercial drone delivery services, aerial mapping and inspection, critical infrastructure surveillance, and manned general aviation where adherence to safety standards, such as those established by the FAA and EASA, necessitates robust recovery capabilities. The increasing adoption of UAVs in urban environments and beyond visual line of sight (BVLOS) operations directly fuels the demand for reliable ballistic parachute solutions, making compliance a key industry catalyst.

Key benefits derived from integrating ballistic parachute systems include reduced insurance premiums, enhanced operational flexibility in congested airspace, and the preservation of high-value assets and sensitive payloads in the event of failure. Driving factors include the global proliferation of commercial drone fleets, regulatory mandates requiring certified recovery systems for operating over people, and continuous technological advancements improving deployment reliability and reducing system weight. The market is characterized by innovations focusing on lighter composite materials, faster deployment sequences using advanced propellant technologies, and smarter integration with existing flight control architectures to prevent inadvertent deployment while ensuring reliability when needed.

Ballistic Parachute Market Executive Summary

The Ballistic Parachute Market is currently experiencing robust expansion, primarily steered by critical regulatory shifts mandating enhanced safety standards for aerial systems, particularly in the rapidly evolving Unmanned Aerial Systems (UAS) sector. Business trends indicate a strong move toward integrated solutions, where parachute systems are embedded within the airframe design rather than being aftermarket additions. This integration is crucial for maximizing aerodynamic efficiency and ensuring seamless compatibility with flight control software, driving partnerships between parachute manufacturers and major drone and light aircraft original equipment manufacturers (OEMs). Furthermore, there is a pronounced investment in miniaturization technologies, aiming to create recovery systems suitable for smaller, sub-25 kg commercial drones while maintaining high reliability and fast deployment speeds essential for urban operations.

Regionally, North America maintains market dominance due to early adoption of advanced general aviation safety regulations and being the epicenter for major drone service providers testing complex BVLOS operations. Europe is showing the fastest growth, propelled by the implementation of EASA’s U-space regulations, which necessitate sophisticated risk mitigation for drone operations in dense urban airspaces. The Asia Pacific region, particularly China and India, is rapidly emerging as a significant market, driven by massive governmental and commercial investments in infrastructure inspection, logistics delivery via drones, and military modernization efforts. These regional trends emphasize different regulatory approaches, yet all converge on the mandatory need for reliable mid-air failure recovery systems to ensure public safety.

Segment trends highlight the critical role of the UAV/Drone segment, which is expected to witness the highest CAGR, outpacing traditional light aircraft applications. Within the technology segment, solid-fuel rocket deployment systems remain the dominant choice due to their proven reliability and rapid activation capability, although hybrid and pneumatic systems are gaining traction for applications requiring cleaner, reusable, or more precisely controlled deployment force profiles. The commercial application segment, covering package delivery, agricultural mapping, and cinematic filming, is driving volume, while the defense sector continues to prioritize customized, high-reliability systems for specialized reconnaissance and tactical missions, focusing on high-g deployment tolerance and minimal electromagnetic signature.

AI Impact Analysis on Ballistic Parachute Market

User inquiries regarding AI's influence on the Ballistic Parachute Market frequently revolve around predictive failure analysis, enhanced decision-making for autonomous deployment, and integration with complex flight termination logic. Key themes include the expectation that AI will dramatically reduce false positives while simultaneously guaranteeing deployment efficacy under novel failure modes. Users are concerned with how AI-driven flight anomaly detection can distinguish between recoverable temporary turbulence and catastrophic structural or system failure requiring immediate parachute activation. Expectations center on AI providing a highly refined, contextual deployment trigger, moving beyond simple sensor thresholds (like altitude or speed) to complex modeling of aircraft health and flight path prediction, thereby improving overall recovery success rates and mission safety margins.

The immediate impact of Artificial Intelligence (AI) and Machine Learning (ML) within the Ballistic Parachute Market is centered on enhancing the intelligence of the Flight Termination Systems (FTS). AI algorithms can process vast amounts of real-time telemetry data—including vibration analysis, motor performance, battery health, and atmospheric conditions—to predict potential failures minutes or seconds before they become critical. This predictive capability allows the ballistic system to be armed or pre-charged based on a calculated risk score, significantly reducing the reaction time needed for deployment. Furthermore, ML models are being trained on millions of simulated failure scenarios to optimize deployment parameters such as deployment altitude, drift compensation, and parachute reefing/staggering sequences, ensuring the safest possible landing trajectory irrespective of the failure location or atmospheric variables.

AI also plays a transformative role in post-incident analysis and system validation. By logging and analyzing deployment data (both successful and simulated), manufacturers can use AI to identify subtle design or operational weaknesses that traditional testing methodologies might overlook. This feedback loop accelerates the iterative design process, leading to next-generation ballistic systems that are lighter, more reliable, and capable of operating under a wider range of environmental stressors. The integration of AI-enabled situational awareness ensures that the parachute system is not merely a reactive last resort but an integral, predictive element of the overall vehicle safety architecture, crucial for securing regulatory approval for advanced BVLOS operations over populated areas.

- AI-driven predictive failure modeling enhances FTS trigger accuracy.

- Machine Learning optimizes deployment timing and trajectory based on real-time factors.

- AI minimizes false positives by distinguishing transient errors from critical failures.

- Automated post-incident data analysis accelerates system design refinement and reliability improvements.

- Enhanced integration with autonomy stacks facilitates safer operation in complex, regulated airspaces.

DRO & Impact Forces Of Ballistic Parachute Market

The Ballistic Parachute Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively determining its trajectory and exposure to external impact forces. A primary driver is the accelerating proliferation of Unmanned Aerial Vehicles (UAVs) across industrial and commercial sectors, coupled with regulatory pressure globally mandating robust safety equipment for flight operations, especially Over People (OOP) or Beyond Visual Line of Sight (BVLOS). However, restraints persist, notably the high initial cost of certified systems and the weight penalty imposed on lighter drones, which directly impacts flight duration and payload capacity. Opportunities are vast, particularly in developing smart, highly integrated FTS systems and expanding into emerging applications like urban air mobility (UAM) and large cargo drone markets. The primary impact forces include stringent regulatory compliance requirements and the ongoing technological race to achieve lighter, faster, and reusable deployment mechanisms, influencing market competitiveness and adoption rates.

Specific market drivers include the continuous advancement of drone technology, necessitating equally sophisticated safety measures to protect the escalating value of drone payloads and associated investments. The increasing use of drones in critical applications such as infrastructure inspection, emergency response, and logistics creates an imperative for zero-tolerance failure rates, making reliable ballistic recovery systems indispensable. Furthermore, heightened public awareness concerning drone safety, particularly in metropolitan areas, pushes regulatory bodies like the FAA and EASA to enforce stricter certification standards, compelling drone operators to invest in high-quality, proven recovery solutions. This external regulatory impetus serves as a structural driver, insulating the market from purely economic fluctuations by making the technology a mandatory component of operational readiness.

Conversely, the market faces notable restraints, most critically the perception of high maintenance and refurbishment costs associated with pyrotechnic deployment systems, which require replacement after any activation. The added weight and complexity of installing ballistic systems can also be a barrier for micro-UAV manufacturers where every gram of weight is critical for flight efficiency. Opportunities for growth lie in the development of hybrid deployment systems (e.g., combining CO2 cartridges with small rockets) offering better weight-to-performance ratios and increased reusability, lowering the total cost of ownership. The burgeoning Urban Air Mobility (UAM) sector, focused on passenger and large cargo transport, represents a substantial long-term opportunity requiring exceptionally large, ultra-reliable ballistic recovery systems that can safely recover vehicles weighing several tons, fundamentally shifting the technological requirements within the segment.

The market faces impact forces stemming from materials science breakthroughs (e.g., lighter and stronger canopy fabrics) and geopolitical shifts affecting defense procurement cycles. Economic downturns may temporarily slow commercial drone fleet expansion, affecting immediate demand, but regulatory momentum ensures a baseline demand level. Safety recalls or high-profile failures of uncertified systems in the broader market could trigger a tightening of regulations, positively impacting certified ballistic parachute providers by weeding out lower-quality competitors and reinforcing the value of proven, reliable technology.

Segmentation Analysis

The Ballistic Parachute Market is comprehensively segmented based on technology type, application, end-use, and geographical presence, providing a detailed framework for understanding market dynamics and competitive positioning. Segmentation by Type focuses on the propellant or method used for rapid deployment, differentiating between solid-fuel rockets, which offer high power and speed but are single-use, and hybrid or pneumatic systems that prioritize weight savings, lower deployment forces, and sometimes reusability. This technical differentiation dictates the system’s suitability for various aircraft sizes and operating envelopes, affecting cost and integration complexity.

Analysis by Application highlights the crucial division between the burgeoning UAV/Drone segment and the established General Aviation (Light Aircraft) segment. The Drone sector is further subdivided into commercial (e.g., delivery, mapping) and military/defense applications, each with distinct needs regarding stealth, reliability, and deployment speeds. The General Aviation segment primarily serves private pilots and flying clubs seeking certified, whole-aircraft recovery solutions. End-use segmentation clarifies whether systems are procured by military organizations, large commercial fleet operators, or private/civil users, reflecting varying needs for certification rigor, mass customization, and post-sales support.

Understanding these segments allows market participants to tailor their product offerings, R&D investments, and marketing strategies effectively. For instance, manufacturers focused on the commercial drone segment must prioritize weight reduction and FAA/EASA compliance, whereas those targeting defense applications must emphasize reliability under extreme conditions and customization for specialized airframes. The robust growth observed in the sub-25 kg commercial drone segment globally underscores the necessity for optimized, cost-effective recovery systems that minimize the trade-off between safety integration and flight efficiency.

- By Type:

- Solid-fuel Rocket Deployment

- Hybrid Rocket Deployment

- Pneumatic/CO2 Cartridge Deployment

- Spring/Elastic Deployment (Niche)

- By Application:

- Unmanned Aerial Vehicles (UAVs)/Drones

- Commercial & Civil Applications (e.g., Delivery, Mapping)

- Military & Defense Applications (e.g., Reconnaissance, Surveillance)

- Light Aircraft (General Aviation)

- Experimental Vehicles and Testing Platforms

- By End-Use:

- Defense Sector

- Commercial Operators and Service Providers

- Civil/Private Users

- Governmental and Emergency Services (e.g., Police, Fire Departments)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Ballistic Parachute Market

The value chain for the Ballistic Parachute Market is highly specialized, beginning with upstream raw material suppliers and culminating in complex installation and end-user training. The upstream analysis focuses on critical component suppliers, including manufacturers of high-strength nylon and specialized synthetic fabrics (like Kevlar or Vectran) for canopy and harness construction, pyrotechnic propellant suppliers for solid-fuel systems, and electronics providers for the Flight Termination Systems (FTS), including accelerometers, barometers, and sophisticated microprocessors. Quality control at this stage is paramount, as the integrity of the materials directly dictates the system’s reliability under high stress. Manufacturers rely on long-term supplier relationships to ensure consistency and traceability for certification purposes, often involving dual sourcing to mitigate supply chain risks inherent in specialized materials.

The manufacturing and assembly phase involves precision engineering for the deployment mechanisms, including the rocket motor or pneumatic system, the parachute packaging (which must ensure rapid, tangle-free deployment), and the FTS housing and integration points. Direct manufacturing is dominated by a few specialist aerospace companies that possess the expertise required for handling explosive components and meeting rigorous airworthiness standards. The distribution channel is bifurcated: Direct sales dominate the General Aviation sector, involving direct agreements with airframe manufacturers (OEMs) or specialized avionics installers. Conversely, the high-volume drone market often utilizes indirect channels, relying on specialized UAV component distributors, authorized resellers, and system integrators who bundle the recovery system with the drone platform before sale to the end-user.

Downstream analysis centers on installation, certification, and post-sales support. For certified light aircraft, installation must be performed by certified maintenance organizations (MROs) and inspected by regulatory bodies. For commercial drones, while installation might be simpler, certification of the integrated system is crucial, often requiring collaborative efforts between the parachute vendor and the drone manufacturer to secure operational approvals (like FAA Part 107 waivers). Post-sales activities, including system refurbishment after deployment, mandatory component lifespan replacements, and training end-users on safe arming and disarming procedures, represent a significant, recurring revenue stream for manufacturers, reinforcing the importance of a robust, global service network. The value chain is characterized by high barriers to entry due to the necessary regulatory compliance and the specialized nature of the technology involved.

Ballistic Parachute Market Potential Customers

The Ballistic Parachute Market targets a diverse yet highly specific group of customers characterized by their need for mandatory safety compliance and asset protection in aerial operations. The largest segment of potential customers comprises commercial drone operators and fleet managers engaging in high-value or high-risk activities, such as critical infrastructure inspection (power lines, oil pipelines), precision agriculture, heavy-lift logistics, and aerial cinematography, especially when operations occur over populated areas (OOP) or far from the ground crew (BVLOS). These buyers prioritize certification (e.g., ASTM standards or equivalent), reliability statistics, and minimized weight penalty, as their business model depends on maximizing drone flight time and payload capacity while adhering to strict governmental operational permits.

A second crucial customer segment involves original equipment manufacturers (OEMs) of light general aviation aircraft and Unmanned Aerial Systems (UAS). These customers integrate ballistic parachute systems directly into their airframes as a core safety feature to enhance product marketability and achieve necessary type certification from aviation authorities globally. For light aircraft manufacturers, the emphasis is on whole-aircraft recovery systems certified for low-altitude deployment, providing an essential layer of pilot and passenger safety. Furthermore, governmental entities, including defense organizations, border patrol agencies, and search and rescue services, constitute a significant end-user base. These customers demand highly customized, rugged, and reliable systems capable of surviving extreme environmental conditions and rapid, high-g deployments, often for protecting sensitive military or surveillance payloads.

Finally, hobbyists and private owners of experimental and high-performance recreational drones also form a growing, though lower-volume, customer base. While their requirements might be less stringent regarding certification than commercial operators, they still seek reliable systems to protect their investment in expensive equipment. Educational and research institutions operating specialized, experimental aerial platforms also represent potential buyers, requiring robust, flexible recovery solutions for testing and development purposes. The core unifying factor across all these customer types is the valuation placed on minimizing risk, protecting assets, and securing regulatory approval for sophisticated aerial operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 280 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BRS Aerospace, Junkers Profly, Galaxy GRS, Fidras Aviation, Fulton, Para-Phernalia, Inc., Magnum Ballistic Parachutes, Opale Paramodels, Para-Dynamics LLC, Skydiving Innovations, Stratos Aircraft Recovery Systems, MARS Parachutes, Fruity Chutes, S.C. Flybox SRL, Butler Parachute Systems, Unmanned Systems Source, Apco Aviation, UAV Navigation, Advanced Rescue Technology, Cumulus Parachute Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ballistic Parachute Market Key Technology Landscape

The Ballistic Parachute Market is defined by continuous technological innovation focused on three core pillars: reducing system weight, increasing deployment reliability across diverse flight envelopes, and enhancing integration intelligence. The shift from purely pyrotechnic (solid-fuel) systems toward hybrid and pneumatic solutions represents a major trend. Hybrid systems often utilize a small pyrotechnic charge to initiate a gas generator, offering more controlled deployment force and lower recoil compared to traditional rockets, making them safer for lightweight drone platforms. Pneumatic systems, which use compressed air or CO2 cartridges, are gaining traction for smaller platforms due to their reusability, reduced regulatory hurdles related to explosives handling, and minimal heat signature, although they typically offer lower initial deployment acceleration than rockets.

A significant technological focus is placed on the Flight Termination System (FTS) electronics, moving from basic altitude and tilt sensors to highly sophisticated, autonomous deployment computers. Modern FTS units incorporate multi-sensor fusion, utilizing GPS, inertial measurement units (IMUs), and airspeed sensors to precisely determine the aircraft's state and trajectory. This allows for intelligent decision-making, ensuring deployment only when the aircraft is unrecoverable, maximizing the effective operating ceiling while minimizing accidental activation. Further advancements include automatic drift mitigation features, where the FTS calculates the predicted landing zone based on wind speed and automatically adjusts the descent rate or deploys a steered canopy to minimize landing impact velocity and optimize asset recovery location.

Material science innovation also plays a critical role in system performance. Manufacturers are aggressively adopting ultra-lightweight, high-tenacity synthetic fibers, such as proprietary composite nylon and Vectran, for parachute canopies and risers. These materials provide superior strength-to-weight ratios, allowing for larger canopy surface areas—critical for safe descent of heavier loads—without incurring excessive weight penalties. Furthermore, novel packaging techniques, including vacuum compression and specialized folding patterns, are being employed to ensure the canopy extracts completely and rapidly in under a second, a critical performance metric for low-altitude recoveries. The integration of advanced diagnostics and health monitoring systems that communicate system readiness via telemetry is standard for high-end military and commercial certified products.

Regional Highlights

The global demand for ballistic parachute systems demonstrates distinct regional variations driven by regulatory environments, the maturity of the drone market, and general aviation culture.

- North America (U.S. and Canada): Market leader characterized by strict regulatory frameworks (FAA/Transport Canada) and a large general aviation fleet. The U.S. commercial drone sector, driven by complex Part 107 waivers for operations Over People (OOP) and BVLOS, is the primary growth engine, necessitating ASTM-certified recovery systems. High defense spending also contributes significantly to demand for custom, military-grade recovery solutions for tactical UAVs.

- Europe (Germany, UK, France): High-growth region, heavily influenced by the European Union Aviation Safety Agency (EASA) regulations, particularly the specific requirements for UAS operational categories (Open, Specific, Certified). EASA’s emphasis on risk mitigation in urban environments directly drives the adoption of certified ballistic parachutes for commercial drone operations, fostering significant demand across major EU member states.

- Asia Pacific (APAC) (China, Japan, India): Fastest-growing regional market, propelled by rapid industrialization, governmental investment in drone technology for logistics and surveillance, and expansive agricultural applications. While regulations are heterogeneous, large-scale drone manufacturers in China are integrating recovery systems proactively to access international markets, representing a massive volume opportunity. India's burgeoning UAV sector, supported by government initiatives, is expected to accelerate adoption.

- Latin America (LATAM): Emerging market driven by mining, infrastructure monitoring, and agricultural mapping needs using drones. Market growth is constrained by uneven regulatory maturity and budget limitations but shows high potential as regional governments standardize drone operational guidelines.

- Middle East and Africa (MEA): Growth is primarily concentrated in the defense and oil/gas sectors, utilizing high-value UAVs for security, pipeline inspection, and border surveillance. Demand is focused on specialized, robust systems capable of operating in harsh desert environments, requiring high reliability and heat tolerance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ballistic Parachute Market.- BRS Aerospace

- Junkers Profly

- Galaxy GRS

- Fidras Aviation

- Fulton

- Para-Phernalia, Inc.

- Magnum Ballistic Parachutes

- Opale Paramodels

- Para-Dynamics LLC

- Skydiving Innovations

- Stratos Aircraft Recovery Systems

- MARS Parachutes

- Fruity Chutes

- S.C. Flybox SRL

- Butler Parachute Systems

- Unmanned Systems Source

- Apco Aviation

- UAV Navigation

- Advanced Rescue Technology

- Cumulus Parachute Systems

Frequently Asked Questions

Analyze common user questions about the Ballistic Parachute market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Ballistic Parachute System and how does it differ from traditional parachutes?

A Ballistic Parachute System (BPS) uses a mechanism, typically a solid-fuel rocket or CO2 cartridge, to rapidly deploy a parachute canopy at low speeds and altitudes, often autonomously. Unlike traditional freefall parachutes, which rely on drag and manual deployment initiation, the BPS forcibly extracts the canopy almost instantaneously, ensuring safe recovery even during rapid loss of control scenarios close to the ground.

What regulatory standards govern the use of ballistic parachutes on commercial drones?

For commercial drone operations in the U.S., the primary standard is ASTM F3322-22 (Standard Specification for Small UAS Parachutes), which dictates reliability and performance metrics for recovery systems used in operations Over People (OOP). In Europe, EASA regulations require that recovery systems be validated as part of the operational risk assessment (SORA) for Specific category operations.

Are ballistic parachute systems reusable or do they require replacement after deployment?

The system is generally designed for a single activation per deployment mechanism. Systems using pyrotechnic or rocket motors require the replacement of the cartridge, rocket, and often the parachute components (lines and canopy inspection) after use. Pneumatic (CO2) systems often allow for easier repacking and cartridge replacement, offering greater cost efficiency for testing and multiple deployments.

Which aircraft segment is the primary growth driver for the Ballistic Parachute Market?

The Unmanned Aerial Vehicle (UAV) or Drone segment is the primary growth driver. The rapid expansion of commercial drone applications (e.g., delivery, mapping, surveillance) and the necessity for regulatory compliance for BVLOS and OOP operations mandate the integration of certified ballistic recovery systems, driving higher volume demand compared to the relatively stable general aviation sector.

How is AI being utilized to improve ballistic parachute reliability and performance?

Artificial Intelligence (AI) is integrated into the Flight Termination System (FTS) to enhance decision-making. AI algorithms analyze real-time flight telemetry (IMU, GPS, sensor data) to predict system failures and optimize deployment timing, ensuring the parachute is activated precisely when failure is inevitable, minimizing false deployments, and maximizing the chance of a successful, safe recovery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager