Bamboo Kitchenware Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441367 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Bamboo Kitchenware Market Size

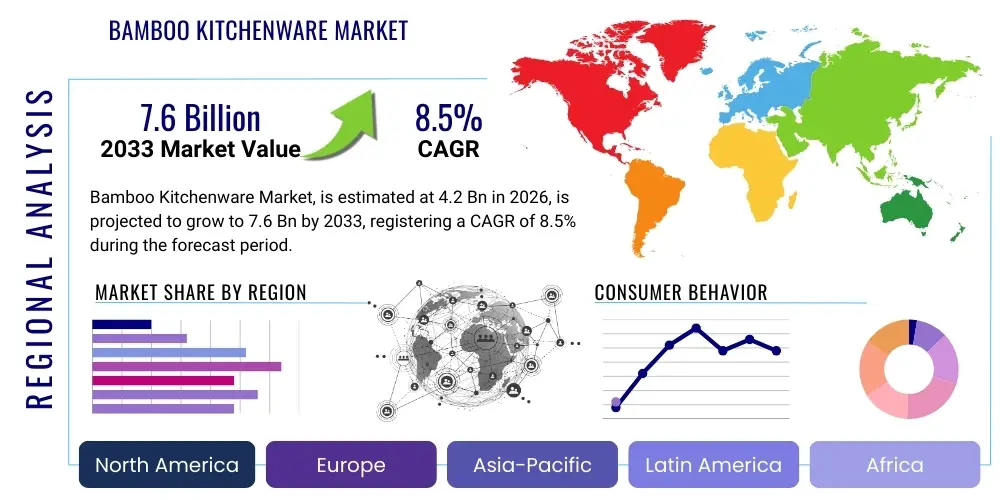

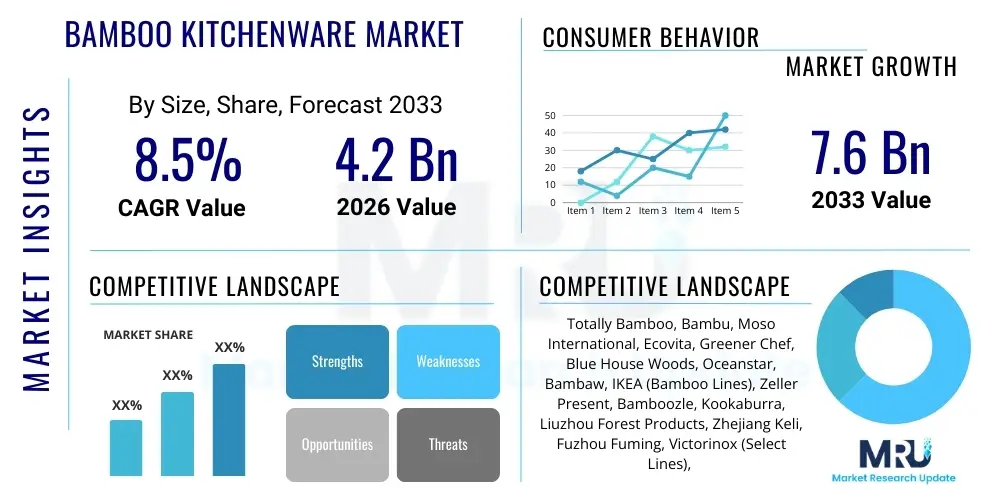

The Bamboo Kitchenware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by shifting global consumer preferences towards sustainable and eco-friendly home goods, coupled with increased awareness regarding the environmental impact of plastic and conventional materials. The inherent qualities of bamboo, such as its rapid renewability, durability, and antimicrobial properties, position it as a premium material choice in modern culinary environments, driving both volume sales and average selling prices across major regional markets.

Bamboo Kitchenware Market introduction

The Bamboo Kitchenware Market encompasses a diverse range of products manufactured primarily or entirely from processed bamboo wood, utilized for food preparation, serving, and storage within domestic and commercial settings. Key product categories include cutting boards, utensils (spatulas, spoons, forks), bowls, storage containers, and serving trays. Bamboo, being a grass, offers remarkable strength, lightweight characteristics, and inherent water resistance, making it superior to many traditional hardwood alternatives. Furthermore, its rapid harvest cycle—some species mature in 3–5 years compared to decades for traditional timber—solidifies its status as a leading sustainable resource in the modern material science landscape.

Major applications of bamboo kitchenware span across residential kitchens, where consumers seek aesthetic and durable replacements for plastic products, and the commercial sector, including high-end restaurants, hotels, and cafes committed to green operational standards. The global emphasis on reducing carbon footprints and waste generated by disposable or non-recyclable materials is a primary driving factor. Governments and regulatory bodies in various regions are increasingly promoting circular economy principles, indirectly boosting demand for natural, biodegradable, and sustainably sourced items like bamboo kitchenware. This regulatory push, combined with proactive consumer choices, establishes a strong foundation for sustained market expansion throughout the forecast period.

The core benefits driving market penetration include the eco-friendliness of bamboo, its durability, and its inherent antibacterial qualities, which appeal strongly to health-conscious consumers. The aesthetic appeal, characterized by a natural, minimalist design, also aligns well with contemporary interior trends. Key driving factors involve the exponential rise in environmental consciousness, aggressive marketing emphasizing sustainability by industry players, advancements in bamboo processing technologies improving product longevity and quality, and increasing disposable incomes in emerging economies allowing for investment in premium, eco-friendly household goods.

Bamboo Kitchenware Market Executive Summary

The Bamboo Kitchenware Market is poised for significant expansion, fueled predominantly by global shifts toward environmental responsibility and sustainable living practices. Business trends indicate a strong move toward direct-to-consumer (D2C) sales models, especially via dedicated e-commerce platforms specializing in sustainable home goods, allowing niche brands to compete effectively against established houseware giants. Product innovation is heavily focused on combining functionality with aesthetic appeal, leading to the development of hybrid products incorporating materials like silicone or recycled plastic alongside bamboo, enhancing grip, heat resistance, and specialized utility. Supply chain optimization, particularly in Asia Pacific regions where bamboo cultivation and processing capabilities are robust, remains critical for maintaining competitive pricing and product quality.

Regionally, Asia Pacific (APAC) dominates the market both in terms of production and consumption, driven by cultural affinity for natural materials, cost-effective manufacturing capabilities, and rapid urbanization supporting increased household expenditure on home goods. North America and Europe, however, exhibit the highest growth rates, primarily due to stringent environmental regulations, high consumer willingness to pay a premium for certified sustainable products, and pervasive marketing efforts centered on health and sustainability. Emerging markets in Latin America and MEA are beginning to show accelerated demand as sustainability narratives gain traction among middle-class populations, opening new avenues for market entry and distribution network development.

Segment trends highlight the dominance of cutting boards and basic utensil sets due to their high utility and replacement frequency. However, the fastest-growing segment is expected to be specialty storage and serving containers, reflecting the rise in home entertaining and meal preparation trends. The residential end-use sector remains the primary revenue contributor, though the commercial segment is rapidly adopting bamboo products to align institutional branding with green initiatives. Distribution channel analysis confirms the increasing importance of online retail, which provides global reach for specialized sustainable brands and detailed product information related to sourcing and certification, further empowering environmentally mindful purchase decisions.

AI Impact Analysis on Bamboo Kitchenware Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Bamboo Kitchenware Market primarily center on efficiency in supply chain management, personalized marketing, and sustainable sourcing optimization. Key themes observed include how AI can ensure verifiable ethical sourcing (tracking bamboo origin to prevent deforestation or labor issues), improve manufacturing precision to reduce material waste, and predict consumer trends for niche, sustainable product lines. Users are particularly concerned about AI's role in verifying genuine sustainability claims against 'greenwashing,' and optimizing logistics to reduce the carbon footprint associated with global shipping of bulkier natural products. The expectation is that AI tools will enhance operational transparency and efficiency, rather than directly transforming the physical product itself.

The application of AI and Machine Learning (ML) algorithms is revolutionizing the upstream segment of the value chain, specifically in resource management. Predictive analytics can forecast optimal harvesting times and yield quality based on localized climate data, ensuring sustainable forest management and consistent raw material input for manufacturers. Furthermore, AI-driven quality control systems deployed during the manufacturing process utilize computer vision to detect subtle defects in bamboo grain or structure, minimizing human error and significantly reducing material wastage, which is crucial for maintaining the environmental integrity of the final product. This precision in sorting and quality assurance translates directly into higher yield rates and reduced production costs.

Downstream, AI is fundamentally altering market access and consumer engagement. AI-powered recommendation engines and personalized digital advertising are highly effective in targeting the specific demographic that values sustainable and premium kitchenware, enhancing conversion rates for D2C brands. Moreover, chatbots and natural language processing (NLP) tools are being integrated into customer service platforms to quickly address specific consumer queries about product sustainability certifications, biodegradability, and end-of-life disposal instructions, thereby building trust and reinforcing the brand's commitment to environmental stewardship—a core differentiator in this competitive niche market.

- AI optimizes bamboo cultivation yield forecasts and sustainable harvesting schedules.

- Machine Learning enhances supply chain transparency, tracking raw material origin for ethical sourcing verification.

- Computer vision systems improve manufacturing quality control, reducing material waste during production.

- AI-driven personalization boosts marketing efficiency, targeting eco-conscious consumer segments.

- Predictive analytics optimize inventory levels, minimizing storage costs and mitigating the risk of obsolescence.

- NLP tools improve customer service, providing rapid, accurate information on product sustainability and certifications.

- AI can identify and mitigate logistics bottlenecks, helping reduce the carbon footprint of shipping operations.

DRO & Impact Forces Of Bamboo Kitchenware Market

The market dynamics are defined by powerful sustainability-driven forces balanced against logistical and cost constraints. Drivers include increasing global consumer demand for environmentally benign products, strong endorsements from environmental advocacy groups, and the inherent natural advantages of bamboo (durability, antibacterial properties, and rapid renewability). Restraints primarily involve the high initial cost compared to mass-produced plastic alternatives, variability in raw material quality and supply chain consistency, and the perception of bamboo being less durable than traditional hardwoods or metals in certain heavy-duty commercial applications. Opportunities lie in expanding product lines into niche areas like baby feeding supplies and specialized commercial catering equipment, leveraging advancements in material science to enhance durability, and capitalizing on emerging market growth through accessible online distribution models. These factors, particularly the confluence of regulatory support for sustainability and consumer preferences, create significant impact forces shaping pricing strategies and competitive positioning within the sector.

Drivers are heavily weighted towards macroscopic environmental and health trends. The documented health risks associated with plastic leaching, particularly Bisphenol A (BPA), are causing a systemic shift away from plastic storage and preparation tools, propelling bamboo as a safe, natural substitute. Furthermore, the global momentum generated by initiatives aimed at plastic reduction in oceans and landfills directly benefits bamboo producers, who can market their products as 100% biodegradable and compostable. Legislative actions, such as bans or heavy taxation on single-use plastics in major economies across the EU and parts of Asia, further institutionalize this demand, forcing retailers and foodservice providers to adopt sustainable alternatives rapidly. This regulatory push serves as a crucial, long-term market accelerator.

However, managing the restraints is essential for sustained growth. Scaling bamboo manufacturing requires sophisticated infrastructure and quality control, which can be challenging, particularly for small enterprises. The market must also contend with competition from other eco-friendly materials, such as recycled glass, stainless steel, and certified sustainable wood (FSC), which may offer different functional advantages. Addressing these restraints involves continuous investment in R&D to improve bamboo processing techniques (like carbonization or lamination) to enhance moisture resistance and longevity, coupled with effective consumer education to justify the premium pricing based on life-cycle value and environmental benefits. Successfully mitigating these constraints will unlock the full potential presented by the significant market opportunity in both residential upgrades and commercial institutional adoption.

Segmentation Analysis

The Bamboo Kitchenware Market is systematically segmented based on Product Type, Distribution Channel, and End-Use, providing a detailed view of consumer behavior and market uptake across various applications. Analysis of these segments is crucial for manufacturers to tailor product development, pricing, and distribution strategies effectively. The Product Type segmentation reveals consumer prioritization of highly functional items like cutting boards and basic utensil sets, driven by high utility and frequent usage. Conversely, the growth observed in specialty segments, such as unique serving ware and custom storage solutions, indicates a market maturation where consumers are seeking aesthetic differentiation alongside sustainability. These variations necessitate flexible production capabilities and targeted marketing campaigns that speak specifically to the functional needs of each product category.

Regarding Distribution Channels, the pronounced shift towards online retail reflects broader consumer trends towards convenience and information accessibility. E-commerce platforms, including large marketplaces and dedicated sustainable brand websites, allow consumers to thoroughly vet products based on their environmental certifications (e.g., organic, fair trade, FSC equivalent), which is often a decisive factor for eco-conscious buyers. While offline retail, particularly specialty home goods stores and high-end department stores, remains essential for tactile evaluation and immediate purchase, the online channel is instrumental in driving brand awareness and achieving global market reach. The competitive success in this market is increasingly dependent on an optimized omnichannel strategy that seamlessly integrates physical and digital shopping experiences.

The End-Use analysis confirms the residential sector as the bedrock of the market, driven by household turnover of non-sustainable items and growing awareness of kitchen safety. Nevertheless, the commercial segment presents a high-growth opportunity, underpinned by the corporate social responsibility (CSR) initiatives adopted by hotels, restaurants, and catering services. These commercial entities often purchase in bulk and prioritize certified eco-friendly options to enhance their brand image and comply with green building standards or hospitality sustainability ratings. Targeting commercial buyers requires different distribution networks and product specifications focused on industrial-level durability and scale, necessitating specialized product development efforts from market players.

- By Product Type:

- Cutting Boards

- Utensils and Gadgets (Spatulas, spoons, whisks)

- Bowls and Dishes

- Storage Containers (Canisters, bread boxes)

- Serving Ware (Trays, charcuterie boards)

- Others (Racks, accessories)

- By Distribution Channel:

- Offline Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Department Stores

- Online Retail

- E-commerce Platforms (Amazon, Etsy)

- Direct-to-Consumer (D2C) Websites

- Offline Retail

- By End-Use:

- Residential

- Commercial (Hotels, Restaurants, Cafes, Institutional Catering)

Value Chain Analysis For Bamboo Kitchenware Market

The value chain for bamboo kitchenware is intricate, commencing with sustainable cultivation and ending with the consumer's purchase, involving several critical stages of processing and distribution. The upstream segment involves the sourcing of raw materials, specifically fast-growing bamboo species like Moso. This stage is crucial for ensuring the sustainability credentials of the final product, involving ethical harvesting practices, certification, and initial processing steps like cutting, drying, and treating the bamboo stalks. Consistent quality control at this initial stage is paramount, as variations in moisture content or pest damage can compromise the integrity and longevity of the finished goods. Manufacturers often integrate backward to secure stable, certified raw material supplies, or form long-term partnerships with sustainable bamboo farms.

The midstream process encompasses manufacturing and fabrication, where raw bamboo is transformed into usable kitchenware components through complex processes such as lamination, molding, pressing, and finishing. Technology plays a significant role here, particularly in the lamination process used to create large, stable items like cutting boards, where precision gluing and pressing techniques minimize warping and maximize durability. Direct distribution channels involve manufacturers selling straight to consumers or large commercial clients, offering maximum control over branding and pricing, and facilitating direct feedback loops. Indirect distribution utilizes a variety of intermediaries, including national distributors, wholesalers, and third-party logistics providers, essential for reaching broad retail bases globally.

The downstream involves market access and final sale to the end-user. Distribution channels are bifurcated into traditional brick-and-mortar retail and digital e-commerce platforms. Offline retail demands strong relationships with mass market and specialty retailers, necessitating robust inventory management and merchandising efforts. Online retail, while offering vast geographic reach, requires significant investment in digital marketing, fulfillment infrastructure, and detailed product content that highlights sustainability certifications. Success in the downstream market relies heavily on effective logistics management and optimized inventory placement to meet fast-growing global demand while simultaneously minimizing the environmental cost associated with transportation and warehousing.

Bamboo Kitchenware Market Potential Customers

The primary customers for bamboo kitchenware are broadly defined by their commitment to environmental consciousness, willingness to invest in quality and durable home goods, and appreciation for natural aesthetics. The residential end-user segment includes environmentally conscious Millennials and Generation Z consumers who actively prioritize sustainable lifestyle choices, often researching product origins and certifications before purchase. This group is typically tech-savvy and responsive to D2C marketing and social media engagement, prioritizing transparency and verifiable eco-claims. They are the key drivers for replacement cycles of plastic items and early adopters of new bamboo-based products, such as specialty food prep tools and storage solutions.

Another significant segment within the residential market consists of health-conscious families and older demographics concerned about food safety and minimizing exposure to plastics. These buyers are motivated by the inherent antibacterial and non-toxic properties of bamboo, viewing it as a safer alternative for preparing and serving food, especially for children. Their purchasing behavior is often driven by perceived quality and durability, rather than solely by price, making them receptive to premium, long-lasting bamboo products that offer a high return on investment over time. They often rely on reviews, brand reputation, and recommendations from health and wellness influencers.

The commercial sector represents a rapidly expanding customer base, encompassing hotels, upscale restaurants, specialized cafes, and corporate catering services aiming to enhance their green credentials and operational sustainability profile. These institutional buyers prioritize products that meet stringent health codes, offer high resilience to heavy use and commercial washing cycles, and align with their corporate social responsibility metrics. For instance, high-end hospitality venues are increasingly replacing single-use plastic serving items and standard cutting boards with durable bamboo alternatives to market their establishments as eco-luxe. This customer group requires scalability, bulk purchasing options, and reliable supply chains, often engaging in direct contractual agreements with manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Totally Bamboo, Bambu, Moso International, Ecovita, Greener Chef, Blue House Woods, Oceanstar, Bambaw, IKEA (Bamboo Lines), Zeller Present, Bamboozle, Kookaburra, Liuzhou Forest Products, Zhejiang Keli, Fuzhou Fuming, Victorinox (Select Lines), Williams Sonoma (Private Labels), Jinhua Bamboo Products Co., Ltd., Anji Bamboo Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bamboo Kitchenware Market Key Technology Landscape

The technology landscape in the bamboo kitchenware sector is focused less on radical invention and more on sophisticated material processing techniques and manufacturing optimization to enhance durability, hygiene, and aesthetic quality. A critical technology is the development and refinement of formaldehyde-free adhesives used in the lamination of bamboo components, essential for creating large, stable items like cutting boards and bread boxes. Traditional adhesives often contain harmful chemicals, contradicting the natural and non-toxic ethos of bamboo products. The shift towards bio-based and food-safe resins is a major technological differentiator, ensuring the final product maintains its eco-friendly and health-safe credentials, appealing directly to the discerning consumer base.

Advanced techniques in bamboo carbonization and heat treatment are also pivotal. Carbonization involves treating bamboo under high heat and pressure, which alters the material's color, increases its hardness, and significantly improves its resistance to moisture, mold, and pests. This process is vital for kitchenware constantly exposed to water and varying temperatures, enhancing product lifespan and reducing the necessity for replacement, thereby reinforcing the sustainability narrative. Furthermore, the use of precision CNC machining and laser cutting technologies allows for intricate designs, consistent sizing, and seamless integration of bamboo components with other materials, such as stainless steel accents or silicone grips, expanding the functional versatility of the kitchenware range.

On the production side, the adoption of automated finishing and coating lines is enhancing throughput and quality consistency. Innovative protective coatings, often derived from natural oils or specialized waxes, are applied to seal the bamboo surface without compromising its non-toxic nature, improving stain resistance and ease of cleaning. These technological improvements collectively address historical consumer concerns regarding bamboo kitchenware maintenance and durability, helping to close the performance gap with conventional materials and accelerating commercial adoption. The commitment to technological advancement in processing ensures that bamboo remains a competitive, high-performance material in the modern kitchen environment.

Regional Highlights

Regional dynamics play a significant role in defining the Bamboo Kitchenware Market, reflecting diverse consumer preferences, manufacturing capabilities, and regulatory environments. Asia Pacific (APAC) currently holds the largest market share, driven primarily by China, which serves as the global manufacturing hub due to abundant bamboo resources and established processing infrastructure. Countries like China and Vietnam benefit from low labor costs and expertise in traditional bamboo craftsmanship, allowing them to produce high volumes competitively. The local consumption in APAC is also substantial, supported by cultural acceptance and a large population increasingly focusing on domestic kitchen upgrades and sustainable lifestyle trends, particularly in emerging urban centers across India and Southeast Asia.

North America and Europe represent the fastest-growing markets, exhibiting strong demand characterized by high average selling prices and a focus on certified sustainable and ethically sourced products. In these regions, the demand is largely propelled by stringent health and environmental regulations (e.g., EU directives on plastic waste) and a highly environmentally conscious consumer base willing to pay a premium for verified quality and sustainability certifications (like USDA Organic or various sustainable sourcing labels). Retailers in these regions prioritize exclusive, designer bamboo lines, emphasizing durability and aesthetic integration into modern home design. Marketing strategies here often rely on digital platforms and influencer collaborations focusing on wellness and responsible consumption.

Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets. Latin America, with its abundant natural resources and increasing focus on environmental protection, is seeing a rise in local bamboo cultivation and product manufacturing, reducing reliance on Asian imports. Consumer demand is growing, albeit sensitive to price points compared to Western markets. In MEA, particularly in the affluent Gulf Cooperation Council (GCC) countries, the adoption is driven by luxury consumer trends that favor natural, unique, and high-quality imported home goods, often adopted by the hospitality sector to enhance the ambiance of high-end resorts and restaurants. Investment in better supply chain infrastructure is crucial for unlocking the full market potential in these regions.

- Asia Pacific (APAC): Dominates manufacturing and overall market volume; driven by abundant raw materials (China, Vietnam) and robust domestic consumption fueled by urbanization and cultural affinity for natural materials.

- North America: High growth region characterized by premium pricing; strong regulatory support for sustainability and high consumer adoption of eco-certified products; key markets are the US and Canada.

- Europe: Exhibits rapid uptake due to strict plastic reduction policies (EU regulations); strong emphasis on ethically sourced and durable products; Germany, the UK, and France are primary demand centers.

- Latin America (LATAM): Emerging market with increasing local production capabilities; growing consumer environmental awareness but sensitive to price points; Brazil and Mexico show significant potential.

- Middle East & Africa (MEA): Growth concentrated in affluent GCC countries driven by the luxury hospitality sector and high-end consumer demand for quality, natural kitchen aesthetics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bamboo Kitchenware Market.- Totally Bamboo

- Bambu

- Moso International

- Ecovita

- Greener Chef

- Blue House Woods

- Oceanstar

- Bambaw

- IKEA (Bamboo Lines)

- Zeller Present

- Bamboozle

- Kookaburra

- Liuzhou Forest Products

- Zhejiang Keli

- Fuzhou Fuming

- Victorinox (Select Lines)

- Williams Sonoma (Private Labels)

- Core Kitchen

- Jinhua Bamboo Products Co., Ltd.

- Anji Bamboo Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Bamboo Kitchenware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trajectory of the Bamboo Kitchenware Market?

The market growth is primarily driven by escalating global environmental awareness and the widespread movement to replace non-biodegradable plastics with sustainable, rapidly renewable, and non-toxic materials like bamboo. Regulatory changes discouraging plastic use further accelerate this transition.

How does bamboo kitchenware compare to traditional wooden kitchenware in terms of durability?

Bamboo kitchenware often exceeds traditional hardwood in durability and hygiene. Bamboo’s tight grain structure makes it highly water-resistant and less porous, reducing the likelihood of warping, cracking, and moisture absorption compared to standard wood products, particularly when maintained properly.

Which geographical region accounts for the largest share in the manufacturing and supply of bamboo kitchenware?

The Asia Pacific (APAC) region, particularly China and Vietnam, holds the largest share in global manufacturing and supply due to abundant natural bamboo resources, established processing technologies, and cost-effective production capabilities, facilitating global export.

What are the key technological advancements influencing the quality of bamboo kitchenware?

Key technological advancements include the use of formaldehyde-free and bio-based adhesives for lamination, advanced carbonization techniques to enhance moisture and mold resistance, and precision CNC machining for improved component consistency and complex design execution.

Is the commercial sector, such as restaurants and hotels, adopting bamboo kitchenware significantly?

Yes, the commercial sector is a fast-growing segment. Hotels, restaurants, and catering services are increasingly adopting durable bamboo products to align with corporate sustainability mandates and enhance their brand image through the use of high-quality, eco-friendly operational and serving items.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager