Banana Juice Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443577 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Banana Juice Market Size

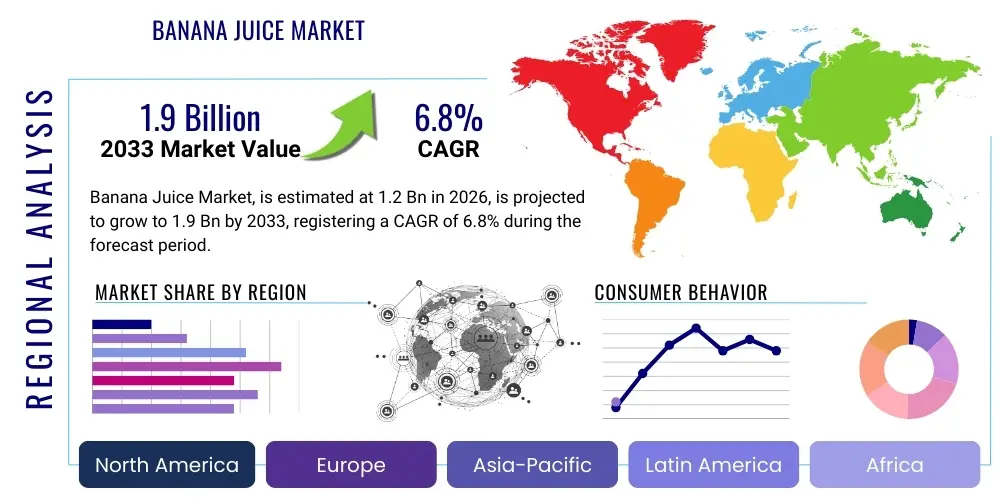

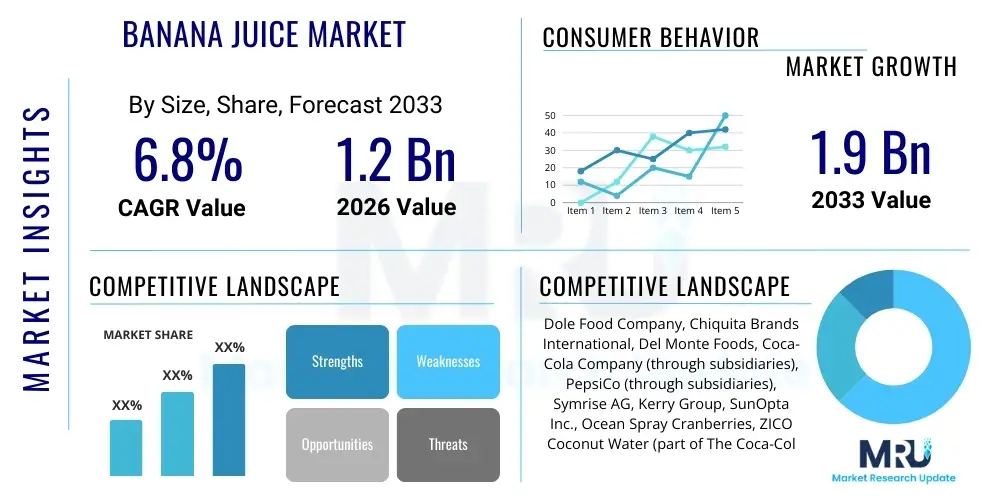

The Banana Juice Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.9 Billion by the end of the forecast period in 2033.

Banana Juice Market introduction

The Banana Juice Market encompasses the production, distribution, and consumption of beverages derived primarily from bananas, often blended with other fruits or stabilizers to enhance flavor profile, texture, and shelf life. Traditionally, banana juice faced challenges related to rapid enzymatic browning, high viscosity, and textural instability, which limited its widespread commercialization compared to citrus or apple juices. However, advancements in processing technologies, such as microfiltration, high-pressure processing (HPP), and specific enzyme treatments, have successfully mitigated these obstacles, allowing manufacturers to offer stable, palatable, and nutrient-dense banana juice products.

The primary applications of banana juice extend beyond direct consumption as a beverage; it is increasingly used as a key ingredient in smoothies, functional drinks, dairy alternatives, and flavor bases within the food processing industry. The product is valued for its inherent nutritional benefits, including high levels of potassium, Vitamin B6, Vitamin C, and natural sugars, making it an excellent source of quick energy and electrolyte replenishment. This inherent nutritional profile positions banana juice strongly within the burgeoning health and wellness sector, appealing to athletes and consumers seeking natural, minimally processed functional beverages.

The market growth is fundamentally driven by rising consumer awareness regarding the benefits of incorporating diverse fruit juices into their diet, coupled with a general shift away from artificial sweeteners toward natural fruit sources. Furthermore, the robust supply chain of raw bananas, particularly in key producing regions in Asia Pacific and Latin America, ensures raw material availability. Manufacturers are also focusing on innovation, developing fortified versions and unique flavor combinations (e.g., banana-passion fruit or banana-ginger) to capture wider consumer interest and overcome the historical perception of banana juice as overly heavy or singular in taste.

Banana Juice Market Executive Summary

The Banana Juice Market is experiencing robust expansion, underpinned by significant shifts in consumer health priorities and technological innovation within the beverage industry. Business trends indicate a strong focus on clean label ingredients and natural energy sources, driving manufacturers to invest heavily in processing techniques that preserve the nutritional integrity and natural color of the banana pulp while extending shelf stability. Major companies are prioritizing sustainable sourcing practices and ethical supply chain management to meet the increasing demand for transparent product origin, thereby mitigating reputational risks associated with large-scale agricultural operations. Strategic mergers and acquisitions are frequently observed, aimed at consolidating production capabilities and expanding regional distribution networks, particularly in high-growth urban centers where demand for premium, exotic fruit juices is highest.

Regionally, the Asia Pacific (APAC) stands out not only as the primary sourcing hub for raw materials but also as a rapidly growing consumption market, propelled by expanding middle classes and increasing disposable incomes in countries like India and China. North America and Europe, however, maintain their position as key markets for premium and functional banana juice variants, where consumers are willing to pay a premium for certified organic and fortified products targeting specific health outcomes (e.g., digestive health, pre- and post-workout recovery). Latin America demonstrates strong market potential due to cultural familiarity with the ingredient and strong domestic production, facilitating accessible price points for mass-market consumption, though infrastructure improvements remain essential for wider export capabilities.

Segment-wise, the Pure Banana Juice category is witnessing considerable growth, favored by health-conscious consumers, although the Banana Blend segment dominates overall market share due to superior flavor profiles and textural consistency achievable through blending. Packaging innovation is skewed toward aseptic cartons and small format PET bottles, catering to on-the-go consumption preferences prevalent in developed markets. The distribution channel analysis highlights the continued dominance of supermarkets and hypermarkets, but e-commerce platforms are rapidly gaining traction, offering specialized products and reaching niche consumer segments focused on specific dietary requirements, such as vegan or gluten-free options.

AI Impact Analysis on Banana Juice Market

Common user inquiries concerning AI in the Banana Juice Market often revolve around optimizing the notoriously challenging banana supply chain—specifically, questions about improving yield prediction, minimizing post-harvest losses, and ensuring consistent quality of fruit used for juice extraction. Consumers and industry stakeholders are keen to understand how AI-driven demand forecasting can stabilize pricing and how machine learning algorithms might aid in developing novel preservation techniques to tackle enzymatic browning and oxidation, which historically plague banana-based products. Furthermore, there is significant interest in personalized nutrition; users frequently ask how AI can analyze individual health data to recommend specific banana juice formulations (e.g., fortified with particular vitamins or minerals) or optimize marketing strategies based on real-time consumer behavior and dietary trends, making the juice segment more tailored and competitive against established beverages.

AI's influence is pivotal across the entire value chain, starting with agricultural intelligence where predictive analytics models use satellite imagery and weather data to forecast optimal harvesting times, ensuring bananas are processed at peak ripeness for maximum sweetness and nutrient density. In manufacturing, AI monitors processing parameters such as temperature, pressure, and enzyme concentration during juice extraction and stabilization, allowing for instantaneous adjustments that maintain batch consistency and reduce waste. This precision engineering addresses historical concerns about quality variability in banana juice production, leading to higher consumer acceptance and reduced operational costs for manufacturers.

Furthermore, artificial intelligence is transforming market outreach and consumer interaction. Through advanced natural language processing (NLP) and image recognition, AI tools analyze vast datasets of consumer feedback, social media sentiment, and purchase history to identify unmet market needs and emerging flavor trends, accelerating the product innovation cycle. For instance, AI can detect subtle shifts in preference towards low-sugar or high-protein juice blends much faster than traditional market research methods, enabling rapid development of AEO-optimized products. This adoption of smart technologies is vital for the banana juice market to overcome niche positioning and compete effectively with mainstream fruit juices, offering a sustainable and technologically advanced alternative.

- AI-driven Predictive Harvesting: Optimizing harvest timing based on maturity index and logistics to reduce spoilage and ensure peak quality fruit for processing.

- Automated Quality Control: Utilizing computer vision and machine learning models to detect defects or variations in raw material and finished product consistency (color, viscosity).

- Supply Chain Optimization: Real-time inventory management and dynamic routing of distribution networks, minimizing transit time and mitigating cold chain failures.

- Personalized Nutrition Marketing: AI algorithms recommending tailored banana juice blends based on user profiles, fitness goals, or dietary restrictions, enhancing consumer engagement.

- Demand Forecasting: Improving inventory accuracy and reducing stockouts or overstocking by predicting regional consumption patterns with high precision.

- Novel Preservation Development: Accelerating R&D for natural preservatives and flavor stabilization techniques through iterative simulation and data analysis.

DRO & Impact Forces Of Banana Juice Market

The dynamics of the Banana Juice Market are dictated by a complex interplay of driving forces, inherent restraints, and emerging opportunities, all of which contribute to the overall impact forces shaping its trajectory. The primary driver is the global consumer shift towards natural and functional beverages, where banana juice's reputation as a rich source of potassium, electrolytes, and sustained energy aligns perfectly with wellness trends. However, the market faces significant restraints, chiefly related to the technical difficulties in achieving long shelf stability and preventing oxidation without heavy chemical treatments, coupled with the high processing costs required for texture stabilization. These forces create a nuanced market environment where innovation in processing technology acts as a critical opportunity, potentially unlocking new markets and enabling premium pricing strategies, while high capital expenditure for these technologies acts as a formidable barrier to entry for smaller manufacturers.

A key driver for sustained growth is the increasing awareness of the versatile uses of banana juice beyond a simple beverage, especially its application in sports nutrition and as a base for dairy-free smoothies and milk alternatives. This diversification of application broadens the addressable market significantly. Conversely, a major restraint is the perception of banana juice being excessively caloric or high in natural sugars compared to water-based juices, leading to some consumer hesitation in weight-conscious demographics. Furthermore, supply chain vulnerability in certain key producing regions, often susceptible to environmental changes or political instability, poses a perennial challenge to consistent raw material sourcing, amplifying price volatility and production risks for manufacturers reliant on international trade routes.

The most compelling opportunity lies in the development and marketing of fortified, low-sugar, and organic banana juice blends targeted at specific demographic needs, leveraging advanced preservation technologies like HPP which appeal to the clean-label movement. The rising trend of exotic and non-traditional fruit flavors in established Western markets also presents a chance for banana juice to transition from a niche offering to a mainstream staple. The cumulative impact forces, therefore, favor technologically advanced players who can mitigate the textural and stability restraints through innovation, capitalize on the health trend drivers, and strategically utilize emerging market opportunities, ultimately leading to a moderate to high growth potential constrained only by resource-intensive processing demands.

Segmentation Analysis

The Banana Juice Market is extensively segmented based on several key parameters including type, packaging, distribution channel, and application, allowing for a detailed analysis of consumption patterns and market penetration across different consumer groups. Understanding these segments is crucial for manufacturers to tailor their product offerings, optimize distribution strategies, and target promotional campaigns effectively. The type segmentation differentiates between pure banana juice, which is often challenging to produce and sell commercially due to thickness, and banana blends, which utilize other fruit juices (e.g., orange, apple, mango) or water to achieve desired viscosity and flavor balance, typically dominating the mass market. Packaging types reflect consumer preferences for convenience, shelf life, and sustainability, while distribution channels map the accessibility of products to consumers globally, ranging from traditional brick-and-mortar stores to rapidly expanding online platforms.

Segmentation by application clarifies the end-use utility of banana juice, identifying its role primarily in the beverage sector for direct consumption, but also significantly within the broader food industry where it serves as a natural thickener, sweetener, or flavoring agent in yogurts, desserts, and functional food bars. The relative growth rates within these segments highlight the shift towards functional and health-oriented applications. For instance, the use of banana juice in pre- and post-workout recovery drinks, owing to its potassium content, is a rapidly expanding niche application, commanding higher profit margins and driving innovation in specific formulation types, such as concentrated or freeze-dried formats designed for easy mixing.

Moreover, geographical segmentation, though addressed in a subsequent section, is interwoven with these segments, as regional flavor preferences and purchasing power significantly influence which product types and packaging formats succeed. For example, high-volume, affordable tetra packs might dominate consumption in emerging economies, whereas smaller, premium glass bottles showcasing high-pressure processed (HPP) juice are preferred in developed Western markets emphasizing minimal processing and perceived quality. The strategic importance of granular segmentation lies in identifying high-value consumers who prioritize factors like organic certification or sustainability credentials, enabling focused marketing expenditure and optimized supply chain efficiency tailored to the specific demands of each segment.

- By Type:

- Pure Banana Juice (100% Extract)

- Banana Juice Blends (Mixed with other fruit juices like orange, mango, or apple)

- Concentrates and Purees

- Nectars (Juice with added water and sweeteners)

- By Packaging:

- Cartons (Aseptic packaging, highly prevalent for stability)

- PET Bottles

- Glass Bottles (Premium and HPP segments)

- Cans

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail (E-commerce)

- Food Service (Hotels, Restaurants, Cafes)

- By Application:

- Beverage Industry (Direct Consumption, Smoothies)

- Food Processing Industry (Yogurt Flavoring, Desserts, Infant Food)

- Nutraceuticals and Functional Foods (Sports Drinks, Supplements)

Value Chain Analysis For Banana Juice Market

The value chain for the Banana Juice Market begins with the upstream activities of raw material sourcing and cultivation, primarily conducted in tropical regions of Asia Pacific, Latin America, and Africa. Upstream analysis focuses heavily on sustainable agricultural practices, pest and disease management (particularly fungal diseases like Panama disease), and optimizing yield and quality through modern farming techniques. The challenge here is balancing high-volume output with consistency and certification standards (e.g., Fair Trade or organic). Post-harvest handling is a critical initial step, requiring rapid transport and effective chilling to minimize physical damage and enzymatic degradation, which are significant concerns for soft fruits like bananas, directly impacting the quality and cost-efficiency of the final juice product.

The central phase involves primary and secondary processing. Primary processing includes washing, peeling, pulping, and preliminary stabilization steps, often involving thermal treatment or enzyme inactivation to prevent browning and achieve the initial liquid state. Secondary processing is more complex, incorporating advanced techniques like clarification, filtration, pasteurization (or HPP for premium products), blending with other juices or stabilizers, and aseptic filling to ensure extended shelf life. This manufacturing segment requires significant capital investment in specialized machinery capable of handling the high viscosity and solids content of banana pulp. Efficient manufacturing is paramount to controlling operational costs, which are higher than standard citrus juice production due to the fruit's fibrous nature and stability requirements.

The downstream analysis focuses on distribution and market access, utilizing both direct and indirect channels. Indirect distribution, leveraging supermarkets, hypermarkets, and broad-reaching third-party logistics (3PL) providers, accounts for the majority of sales volume, benefiting from established retail infrastructure and cold chain capabilities. Direct distribution, although smaller in volume, is increasingly vital through manufacturer-owned digital platforms and niche health food stores, allowing brands to maintain tighter control over pricing, consumer experience, and brand messaging, especially for premium or specialized functional juice lines. The final stage involves rigorous marketing and sales activities, utilizing targeted digital campaigns and AEO-optimized content to educate consumers on the unique health benefits and quality attributes of the specific banana juice product, differentiating it from traditional fruit beverages.

Banana Juice Market Potential Customers

Potential customers for the Banana Juice Market are diverse, encompassing various demographic and psychographic profiles driven by health consciousness, lifestyle convenience, and specific dietary needs. The primary end-users are individuals aged 25–45 who lead active lifestyles, including gym enthusiasts, athletes, and professionals seeking natural sources of energy and quick recovery post-physical exertion. These buyers prioritize the potassium and electrolyte content of banana juice, often utilizing it as a cleaner, less processed alternative to manufactured sports drinks. This segment is characterized by a higher willingness to pay for functional, organic, or HPP-processed varieties that offer maximum nutrient retention and minimal additives, aligning with clean-label consumption patterns and demanding high transparency regarding sourcing and manufacturing processes.

A second major customer segment includes parents and caretakers seeking nutritious, appealing beverages for children. Due to its naturally sweet profile and smooth texture (especially in blended formats), banana juice serves as an excellent vehicle for essential vitamins and minerals, often appealing to children who might reject more tart or intensely flavored juices. Manufacturers strategically target this segment with smaller, convenient packaging sizes and blends that mitigate concerns over sugar content by focusing on fiber and nutritional value. The acceptance of banana juice in infant food and purees further solidifies its position within the early life nutrition market, demanding stringent quality control and safety standards from the manufacturers supplying these specialized products.

Furthermore, institutional buyers, such as hospitals, schools, corporate cafeterias, and food service providers, represent significant bulk purchasers. For these customers, banana juice is valued for its versatility as a foundational ingredient in smoothies, baked goods, and dietary supplements, providing natural sweetness and consistency. The growth of the vegan and plant-based movements also positions banana juice, particularly pure concentrate or puree formats, as a vital ingredient for creating dairy alternatives and non-dairy creamy beverages. This B2B segment demands reliable, large-scale supply contracts and consistent quality, pushing manufacturers to invest in standardized industrial processing techniques and long-term storage solutions like aseptic bag-in-box packaging to minimize logistical complexity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dole Food Company, Chiquita Brands International, Del Monte Foods, Coca-Cola Company (through subsidiaries), PepsiCo (through subsidiaries), Symrise AG, Kerry Group, SunOpta Inc., Ocean Spray Cranberries, ZICO Coconut Water (part of The Coca-Cola Company), Tropical Juice Co., Ripe Bananas LLC, Fresh Del Monte Produce, Döhler Group, Rauch Fruchtsäfte, AGRANA Beteiligungs-AG, Diana Food (Symrise), Naturex (Givaudan), Sunkist Growers, Inc., and leading regional co-operatives. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Banana Juice Market Key Technology Landscape

The commercial viability of the Banana Juice Market is highly dependent on advanced food processing technologies designed to overcome the inherent challenges associated with banana pulp—namely, enzymatic browning, high viscosity, and microbial spoilage. Traditional thermal pasteurization, while effective for sterilization, often results in significant nutrient degradation and undesirable cooked flavors, necessitating the adoption of cutting-edge preservation methods. High-Pressure Processing (HPP) has emerged as a revolutionary technology in the premium segment; HPP uses intense pressure (up to 6,000 bar) instead of heat to inactivate pathogens and spoilage organisms, successfully extending shelf life while preserving the fresh flavor, color, and nutritional profile of the banana juice. This technology is critical for manufacturers targeting the clean-label, high-value consumer base who demand minimal processing.

Another crucial technological area involves enzyme treatment and filtration systems. Because banana pulp is rich in starch and pectin, the resulting juice is often thick and cloudy, requiring significant manipulation to achieve a desirable liquid consistency. Manufacturers employ specific pectinase and amylase enzymes to break down these compounds, followed by ultrafiltration or microfiltration techniques. These filtration processes efficiently remove insoluble solids, clarifying the juice and reducing viscosity without resorting to excessive water dilution or chemical additives. Furthermore, the selection of enzyme types and optimization of reaction parameters are increasingly driven by specialized AI systems to ensure consistent, highly clarified juice output, which is particularly vital for concentrates used in downstream applications.

Aseptic filling and packaging technology represents the final frontier in technological excellence, ensuring the product maintains its sterile state post-processing and during distribution. Aseptic carton packaging (Tetra Pak being a leading provider) allows for ambient distribution and storage, significantly reducing cold chain logistical costs and environmental impact, thereby enabling greater market penetration in regions with limited refrigeration infrastructure. The integration of advanced oxygen barrier materials in packaging is also essential to combat the rapid oxidation of banana compounds, which causes browning and flavor degradation. Continuous technological investment in these areas—HPP, sophisticated enzyme systems, and high-barrier aseptic packaging—is fundamental for any company seeking leadership in the globally competitive banana juice sector, ensuring product quality and market competitiveness against long-established mainstream fruit juices.

Regional Highlights

The Banana Juice Market exhibits distinct regional dynamics driven by factors such as raw material availability, consumer preferences for exotic flavors, health trends, and established retail infrastructure. The Asia Pacific (APAC) region is foundational to the global banana juice industry, serving as the largest production hub for raw bananas globally, specifically countries like India, China, the Philippines, and Indonesia. While much of the production initially catered to fresh consumption, rapid industrialization and urbanization in the region are driving significant investment in modern processing facilities. This allows local manufacturers to tap into the burgeoning domestic demand for convenient, packaged fruit juices, leading to APAC displaying the highest volume growth potential, focusing primarily on affordable, blended, and nectar categories distributed widely through traditional and modern trade channels.

North America and Europe represent the high-value, premium segments of the banana juice market. In these developed regions, consumption is characterized by a strong demand for clean-label, functional, and organic products. Consumers are highly receptive to novel processing techniques such as HPP, valuing the perceived nutritional superiority and freshness associated with minimal thermal treatment. The market here is less about volume and more about specialized offerings, including fortified banana juice targeting sports nutrition, or exotic blends positioned as gourmet health beverages. Regulatory environments in Europe, specifically concerning sugar content and mandatory nutritional labeling, are highly stringent, compelling manufacturers to innovate with natural sugar alternatives or focus on 100% fruit juice products, making the competition fierce among premium, health-oriented brands vying for shelf space in specialized organic stores and high-end supermarkets.

Latin America holds a unique position, being a major producer and consumer simultaneously. Countries such as Ecuador, Colombia, and Brazil possess abundant banana cultivation, resulting in lower raw material costs and making banana juice a culturally familiar and economically viable beverage choice for the local populace. The market is primarily driven by domestic consumption of highly accessible and affordable juice formulations, often consumed fresh or minimally processed. However, infrastructural limitations, particularly in sophisticated cold chain logistics and advanced processing technology adoption, often hinder their ability to compete effectively in the global export market for premium, shelf-stable products. Nonetheless, as international trade agreements improve and technological transfer occurs, Latin America is poised to increase its contribution to the global export of concentrates and purees, targeting the manufacturing needs of downstream food processors in Europe and North America.

The Middle East and Africa (MEA) region presents significant growth opportunities, largely due to rising disposable incomes, urbanization, and a strong cultural affinity for sweet and nutrient-dense fruit beverages. Demand in the MEA is concentrated in urban centers, often favoring imported or locally manufactured products utilizing high-quality imported concentrates. Specific demand is noted in functional beverages catering to the climate and dietary habits. Africa, particularly South Africa and Egypt, is both a producer and consumer, but the market suffers from fragmentation and reliance on basic processing methods. Investment in modern infrastructure across the Gulf Cooperation Council (GCC) countries is facilitating the rapid expansion of modern retail formats, making packaged banana juice increasingly available and contributing positively to regional consumption figures over the forecast period.

- Asia Pacific (APAC): Highest volume growth, major raw material source, shifting from traditional consumption to packaged juice formats driven by urbanization in India and China. Focus on affordable blends and nectars.

- North America: Leading market for premium, high-value, and functional banana juice variants (HPP, organic, sports recovery). Strong consumer demand for clean-label transparency and specialized health benefits.

- Europe: High regulatory pressure mandates innovation in low-sugar and 100% juice formulations. Key market for concentrated puree imports and high-quality, specialty organic juice products.

- Latin America (LATAM): Major production hub, strong domestic consumption of affordable, traditional juice. High potential for concentrate export upon infrastructure and technological upgrade.

- Middle East and Africa (MEA): Emerging market driven by rising disposable incomes and preference for sweet, exotic beverages. Growth spurred by expansion of modern retail in the GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Banana Juice Market, encompassing producers of raw materials, manufacturers of processed juice, and companies specializing in functional ingredients and distribution.- Dole Food Company

- Chiquita Brands International

- Del Monte Foods

- The Coca-Cola Company (through specialized brands)

- PepsiCo, Inc. (through specific beverage lines)

- Symrise AG

- Kerry Group

- SunOpta Inc.

- Ocean Spray Cranberries, Inc.

- Fresh Del Monte Produce Inc.

- Döhler Group

- Rauch Fruchtsäfte GmbH

- AGRANA Beteiligungs-AG

- Diana Food (Symrise subsidiary)

- Naturex (Givaudan)

- Sunkist Growers, Inc.

- Tropical Juice Co.

- Ripe Bananas LLC

- NutriAsia, Inc.

- Refresco Group N.V.

Frequently Asked Questions

Analyze common user questions about the Banana Juice market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why is banana juice less common than orange or apple juice?

Banana juice is less common primarily due to technical challenges associated with its processing; the banana fruit's high starch and pectin content causes excessive viscosity, and it rapidly undergoes enzymatic browning (oxidation), leading to poor texture and color unless specialized and costly processing techniques like HPP or advanced enzyme treatments are applied, which limits its widespread, affordable commercialization.

What are the primary health benefits of consuming banana juice?

The primary health benefits of banana juice stem from its rich nutritional profile, notably high levels of potassium, which supports electrolyte balance and cardiovascular health, and Vitamin B6, which is vital for metabolic function. It also serves as a quick source of natural energy and carbohydrates, making it popular in sports nutrition for pre- and post-workout recovery.

How is the shelf life of commercial banana juice extended without artificial preservatives?

Manufacturers extend the shelf life of banana juice without relying solely on artificial preservatives by utilizing advanced technologies such as High-Pressure Processing (HPP), which sterilizes the juice using intense pressure instead of heat, and through aseptic packaging (e.g., specialized cartons) which creates a sterile, oxygen-free environment, effectively preserving freshness and nutritional value for longer periods.

Which geographical region dominates the global banana juice market consumption?

North America and Europe currently dominate the market in terms of value, driven by high consumer willingness to pay for premium, organic, and functional juice varieties. However, the Asia Pacific (APAC) region leads in terms of overall volume consumed and raw material production, characterized by rapid growth in packaged beverage consumption among its large, expanding middle-class population.

What role does High-Pressure Processing (HPP) play in the banana juice industry?

HPP is crucial for the premium segment of the banana juice market as it preserves the juice by inactivating microbes without using high heat, thereby maintaining the fresh flavor, natural color, and essential nutrients that would otherwise be destroyed by traditional pasteurization methods. This allows brands to market a superior, clean-label product favored by health-conscious consumers and athletes.

Are banana juice blends healthier than pure banana juice?

The healthiness of banana juice blends versus pure juice depends on the formulation. Pure banana juice is nutrient-dense but often very high in natural sugars and calories. Blends, when mixed with lower-calorie juices like water or vegetable extracts and without added sugars, can offer a more balanced nutritional profile, better texture, and reduced sugar content per serving, aligning with modern dietary preferences.

How is sustainability affecting the sourcing of bananas for juice production?

Sustainability is a major factor, driving demand for certified raw materials (e.g., Fair Trade or Rainforest Alliance). Manufacturers are increasingly scrutinizing their supply chains to ensure ethical labor practices and environmentally responsible farming, including minimizing water usage and pesticide application, leading to preference for suppliers adhering to stringent social and environmental governance standards.

What are the major challenges in the distribution of banana juice?

Major distribution challenges include maintaining the cold chain for temperature-sensitive products, particularly HPP or minimally processed juices, and managing the logistics of bulk raw banana transport from tropical farms to advanced processing centers. For regions with poor infrastructure, reliable cold chain logistics are prohibitively expensive, favoring shelf-stable aseptic carton distribution instead.

How do manufacturers stabilize the texture of banana juice?

Manufacturers stabilize the inherently thick, pulpy texture of banana juice primarily through the use of specific enzymes (pectinase and amylase) that break down starches and pectin, followed by advanced clarification techniques such as ultrafiltration. This reduces viscosity and achieves a smoother, more palatable consistency, often necessary before mixing into blends or concentrates.

What is the market potential for banana juice concentrates?

The market potential for banana juice concentrates is exceptionally high, particularly in B2B applications. Concentrates significantly reduce storage and shipping costs due to lower volume and weight, making them ideal for long-distance transport. They are essential base ingredients for large-scale manufacturers of functional beverages, flavorings, infant foods, and industrial food processing.

How does AI contribute to reducing waste in the banana juice production process?

AI significantly contributes to waste reduction by implementing predictive maintenance on processing equipment, minimizing unexpected downtime and product loss. More critically, AI-driven computer vision systems analyze raw bananas post-harvest to sort and grade fruit with extreme precision, diverting sub-optimal quality bananas away from premium juice lines to ensure consistent quality and minimize batch rejection due to spoiled or substandard raw material.

What are the key differences between banana juice and banana nectar?

Banana juice, especially pure juice, is derived directly from the fruit pulp and retains most of the natural solids and nutrients. Banana nectar, by regulatory definition and common practice, involves adding water, sweeteners (sugar or corn syrup), and often citric acid to the banana puree or concentrate to achieve a thinner consistency and modulate sweetness, resulting in a less concentrated fruit content.

Which type of packaging is most prevalent for mass-market banana juice?

Aseptic cartons (e.g., Tetra Pak) are the most prevalent type of packaging for mass-market banana juice globally. They offer excellent barrier properties against light and oxygen, enable long shelf life without refrigeration, and are generally cost-effective and lighter than glass or PET, making them highly efficient for broad distribution networks.

How are organic and non-GMO certifications impacting market growth?

Organic and Non-GMO certifications are significantly impacting market growth by driving the premium segment, particularly in North America and Europe. These certifications serve as key trust indicators for discerning consumers, allowing certified brands to command higher price points and capture market share from conventional competitors, thereby accelerating innovation in organic sourcing and processing methods.

What is the forecasted growth trend for banana juice in the functional beverage category?

The growth trend for banana juice within the functional beverage category is robustly positive. Its natural high potassium, carbohydrate, and electrolyte content uniquely positions it as a clean-label alternative to artificial sports drinks. Manufacturers are increasingly fortifying it with proteins or additional vitamins, enhancing its appeal to the rapidly expanding fitness and wellness consumer base seeking sustained, natural energy and effective hydration.

What technological advancements are addressing the challenge of enzymatic browning?

Enzymatic browning is primarily addressed through rapid enzyme inactivation techniques, often involving flash pasteurization or specific acid treatments immediately after pulping, such as adding ascorbic acid (Vitamin C). Additionally, the application of High-Pressure Processing (HPP) effectively manages the browning enzymes while preserving the fresh color and flavor profile more successfully than traditional high-heat methods.

Who are the primary buyers of industrial banana juice purees and concentrates?

The primary industrial buyers are large-scale food processors, including manufacturers of dairy and non-dairy yogurts, infant food, baked goods, ice creams, and compound beverage companies. They utilize the purees and concentrates as natural sweeteners, thickeners, and flavor bases due to their consistent quality and reduced logistical footprint compared to fresh fruit.

How is climate change posing a risk to the banana juice supply chain?

Climate change poses a significant risk as extreme weather events, altered rainfall patterns, and rising temperatures severely impact banana yields and increase the prevalence of destructive fungal diseases like Fusarium Wilt (Panama Disease). This uncertainty necessitates diversification of sourcing regions and substantial investment in climate-resilient farming practices to maintain a stable raw material supply for juice production.

What is the competitive landscape like between pure banana juice and banana juice blends?

The competitive landscape shows that banana juice blends currently hold a dominant market share in volume due to their superior stability, palatability, and affordability. However, pure banana juice, especially HPP varieties, competes strongly in the premium, niche health segment where consumers prioritize maximal nutrient content and zero additives, despite the higher price point and shorter shelf life.

What factors drive the preference for banana juice in the sports nutrition sector?

In the sports nutrition sector, banana juice is favored for its high potassium content, crucial for muscle function and preventing cramps, and its easily digestible, high glycemic index carbohydrates, which offer immediate and sustained energy replenishment post-exercise. Its natural origin and minimal processing in premium versions also appeal to athletes seeking clean fuel sources.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager