Banana Syrup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440915 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Banana Syrup Market Size

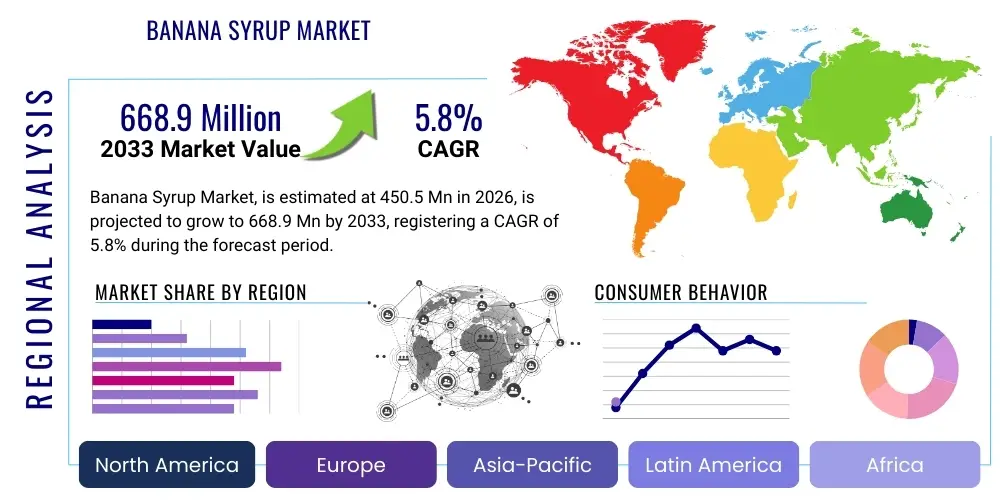

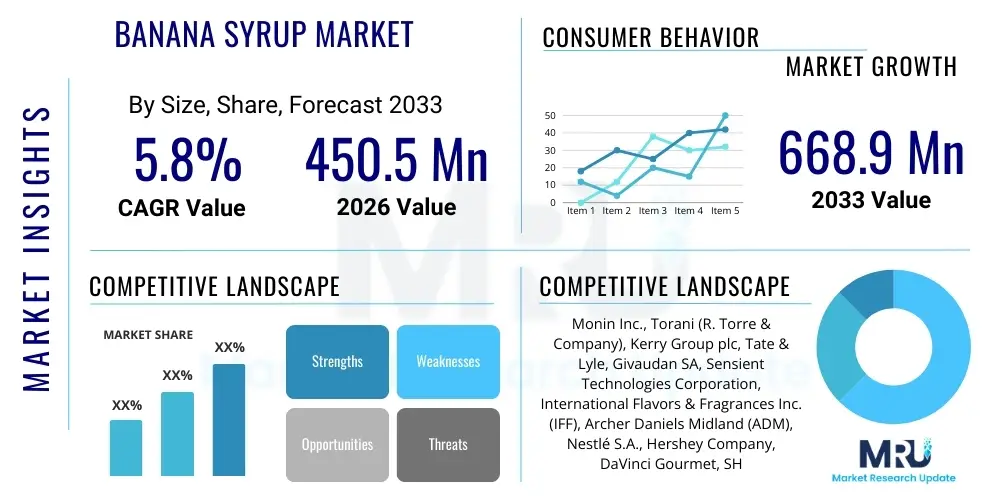

The Banana Syrup Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.9 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally underpinned by the escalating demand for natural and exotic flavor profiles in the food and beverage industry, particularly within gourmet coffee shops, craft breweries, and high-end culinary applications. The versatility of banana syrup, allowing it to be integrated into diverse products from dairy alternatives to baked goods, further solidifies its position for sustained market expansion over the forecast period.

Banana Syrup Market introduction

The Banana Syrup Market encompasses the production, distribution, and sale of concentrated liquid sweeteners derived from or flavored with bananas. This product serves as a versatile flavoring agent, colorant, and sweetener, widely utilized across various sectors, including the food service industry, household consumption, and industrial food processing. Major applications span mixology for cocktails and mocktails, as a topping for desserts like ice cream and pancakes, and as a key ingredient in specialty beverages, baked goods, and confectioneries. The inherent appeal of banana syrup lies in its ability to deliver a distinct, tropical flavor profile that caters to consumer desires for novel and natural ingredients. Key driving factors include the rapid expansion of the coffee culture globally, increasing consumer experimentation with global food flavors, and the growing demand for natural, fruit-based ingredients as replacements for artificial flavoring compounds, particularly in health-conscious markets. Furthermore, its stability and ease of integration into liquid matrices make it a preferred ingredient for industrial-scale food formulation.

Product Description involves both natural banana syrups, which are typically made from banana puree and juice concentrates, and artificially flavored varieties, though the market trend strongly favors the natural extracts due to clean-label movements. Natural banana syrups offer nutritional benefits associated with the fruit itself, such as potassium and vitamins, although these are often reduced during processing. The quality metrics for banana syrup depend heavily on Brix levels (sugar content), viscosity, and the authenticity of the flavor profile. As manufacturers increasingly focus on differentiation, the development of organic, non-GMO, and low-sugar banana syrup formulations has become a critical competitive strategy, responding directly to evolving consumer health mandates. These premium varieties often command higher price points but capture significant market share among affluent consumer demographics and high-end cafes.

The major applications are highly concentrated within the HORECA sector (Hotels, Restaurants, Cafes), where custom beverages and artisanal desserts rely heavily on unique flavorings. Beyond food service, the industrial application in yogurt, dairy products, non-alcoholic beverages, and breakfast cereals represents a substantial volume segment. The benefits derived from using banana syrup include flavor standardization across product batches, extended shelf life compared to fresh banana fruit, and simplified inventory management for bulk users. The primary driving factors are the globalization of food tastes, which accelerates the adoption of tropical flavors worldwide, and continuous product innovation in terms of flavor intensity and texture, alongside strategic marketing efforts emphasizing its natural origins and versatility in culinary applications, thereby expanding its user base significantly.

Banana Syrup Market Executive Summary

The Banana Syrup Market is characterized by robust growth, propelled primarily by significant business trends focusing on product premiumization and clean-label sourcing. Manufacturers are increasingly investing in sustainable and organic banana sourcing to meet the ethical consumption demands of developed markets in North America and Europe. A major segment trend involves the rapid adoption of banana syrup in the Ready-to-Drink (RTD) beverage sector, where it provides a stable, appealing flavor base for teas, sparkling waters, and nutritional shakes. Furthermore, digitalization in distribution, utilizing advanced e-commerce platforms, is enabling specialty syrup brands to reach niche consumer groups directly, bypassing traditional retail bottlenecks. Competitive strategies are increasingly centering on proprietary flavor extraction techniques that maximize the natural aroma and color retention, distinguishing premium offerings from standard, artificially flavored competitors, thus driving average selling prices upwards.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market due to the proliferation of Western-style cafes and dessert parlors, particularly in high-growth economies like China and India, alongside the traditional use of bananas in regional cuisine. North America and Europe, while mature, remain dominant in terms of market value, driven by established consumer bases willing to pay a premium for organic and specialty flavors. Regulatory trends, especially those related to food safety and transparency regarding sugar content, are heavily influencing product reformulation across all regions, compelling manufacturers to pivot towards natural sweeteners and reduced-sugar variants, impacting both production costs and market positioning. Infrastructure improvements in cold chain logistics in developing economies are also facilitating the transport and storage of high-quality, natural banana extracts, supporting localized market expansion.

Segment trends indicate a strong consumer shift towards liquid syrups derived from natural and non-GMO sources, often marketed specifically for dietary restrictions such as vegan or gluten-free diets. The Food Service application segment retains the largest share, leveraging the high volume required by major chain restaurants and multinational coffee houses. However, the Household segment is witnessing accelerated growth, fueled by increased home baking, gourmet cooking, and the popularity of DIY beverage creation following global periods of restricted movement. Distribution channel analysis highlights the continued dominance of B2B sales (direct to industrial users and food service distributors), though B2C sales via online platforms are rapidly gaining importance, reflecting a broader consumer movement towards convenience and direct-to-consumer accessibility. Overall, the market remains highly dynamic, responsive to health trends, and competitive in innovation.

AI Impact Analysis on Banana Syrup Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Banana Syrup Market predominantly revolve around three critical areas: supply chain resilience, precision flavor formulation, and automated quality control (QA/QC). Consumers and industry stakeholders seek to understand how AI can mitigate the volatility associated with sourcing fresh banana feedstock, which is highly susceptible to climate change and agricultural diseases. Key concerns include leveraging predictive analytics to forecast crop yields and price fluctuations, thereby ensuring stable raw material supply for continuous syrup production. Furthermore, there is significant interest in how machine learning algorithms can be employed to analyze consumer taste preferences across different geographies, allowing manufacturers to rapidly adjust flavor profiles, Brix levels, and ingredient lists (e.g., specific combinations of natural sweeteners) to maximize market penetration and appeal. The overarching expectation is that AI will drive efficiency and enhance product consistency.

The application of AI extends significantly into the manufacturing and quality assurance phases. Users frequently ask about the use of computer vision and sensor fusion techniques for real-time monitoring of the syrup's production line, focusing on critical attributes such as color consistency, clarity, and viscosity. Traditional manual QA processes are time-consuming and prone to human error, prompting interest in AI-driven systems capable of detecting minute deviations in batch quality instantaneously, thereby reducing waste and ensuring compliance with stringent food safety standards. Predictive maintenance, another major theme in user questions, focuses on utilizing AI to monitor processing equipment (mixers, pasteurizers, filling machines) to prevent unplanned downtime, which is crucial for high-volume syrup production facilities, minimizing operational disruptions and ensuring timely market supply.

From a market strategy perspective, user inquiries highlight AI’s role in optimizing promotional activities and personalized marketing. Machine learning models analyze vast datasets of transactional history and social media sentiment to determine the most effective promotional timing and targeted retail channels for specific banana syrup variants (e.g., organic vs. standard, cocktail use vs. baking use). This level of precision marketing moves away from broad campaigns toward hyper-targeted engagement, optimizing marketing spend and improving customer lifetime value. Consequently, the adoption of AI is not merely about operational improvement but is seen as a transformative tool for strategic decision-making across the entire value chain, enabling companies to achieve higher levels of responsiveness and competitive advantage in a crowded flavor market.

- Enhanced predictive demand modeling for banana feedstock sourcing and inventory management, minimizing spoilage risks.

- AI-driven flavor profiling and rapid iteration of syrup recipes based on real-time consumer trend data analysis.

- Automated quality control (QA/QC) using computer vision to monitor color, clarity, and viscosity during bottling.

- Optimization of supply chain logistics routes and temperature control settings using machine learning algorithms.

- Personalized marketing campaigns identifying specific end-user segments likely to purchase gourmet or specialty banana syrup variants.

- Robotic Process Automation (RPA) in packaging and labeling, increasing throughput and reducing labor costs.

- Predictive maintenance schedules for processing equipment, reducing unexpected downtime in high-volume production.

DRO & Impact Forces Of Banana Syrup Market

The Banana Syrup Market is shaped by several distinct dynamics encompassing Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces influencing market growth. Key drivers include the exponential increase in consumption of specialty coffee and tea beverages globally, the rising popularity of global and tropical flavor profiles among millennials and Gen Z consumers, and continuous product innovation leading to healthier options like low-sugar and high-fiber syrups. These factors create a strong positive momentum, encouraging new entrants and expansion by existing players. Conversely, the market faces significant restraints, primarily centered around the volatility of raw material prices—bananas being susceptible to climate change and disease outbreaks—and the general consumer concern regarding high sugar content in standard syrup formulations, leading to preference shifts towards fresh fruit alternatives. The impact forces are thus balanced between strong consumer pull for exotic flavors and inherent supply chain vulnerabilities and health-related scrutiny.

Significant opportunities exist in emerging economies, particularly in Asia and Latin America, where rapid urbanization and increasing disposable incomes are fueling the adoption of Western-style food and beverage consumption patterns. Furthermore, the development of natural, non-caloric banana syrup derivatives, utilizing advanced sweetener technologies, presents a critical opportunity to overcome the 'sugar content' restraint, appealing directly to the massive diabetic and weight-management demographics. Technological advancements in sustainable packaging and aseptic processing also offer routes to market differentiation and reduced environmental impact, aligning with corporate sustainability goals. The combination of market drivers and perceived opportunities far outweighs the restraints in the long term, suggesting a net positive impact force propelling sustained CAGR, provided companies effectively manage raw material sourcing risks and innovate aggressively on the health front.

The interaction of these DRO elements creates intense competitive pressure, forcing manufacturers to innovate constantly. For instance, the restraint concerning raw material volatility is driving opportunities in vertical integration and long-term sourcing contracts, establishing more resilient supply chains. Similarly, the opportunity in low-sugar formulations is driven directly by the restraint imposed by health concerns regarding traditional syrups. The overall impact forces compel market participants towards high-quality, naturally sourced, and functionally superior products. Companies that successfully navigate supply chain complexities and aggressively pursue clean-label formulations are poised to capture premium segments and dominate future market share. The primary force sustaining growth remains the robust demand from the expanding food service sector, consistently seeking novel, stable, and easily incorporated flavorings.

Segmentation Analysis

The Banana Syrup Market is intricately segmented based on several critical parameters, including Type (Natural vs. Artificial), Source (Organic vs. Conventional), Application (Food Service, Industrial, Household), and Distribution Channel (B2B vs. B2C). This granular segmentation allows manufacturers to tailor products to specific end-user needs and regional taste profiles. The dominance of the Food Service segment highlights the substantial reliance of coffee chains, bars, and dessert parlors on these consistent flavor bases, while the rapid growth in the Household segment reflects changing consumption patterns towards at-home preparation and gourmet endeavors. Analyzing these segments is essential for strategic market entry and resource allocation.

Segmentation by Type reveals a strong market trend favoring natural banana syrups, driven by global clean-label initiatives and consumer demands for ingredients perceived as healthier and less processed. Although artificial variants are often more cost-effective and possess longer shelf lives, their market share is gradually eroding, especially in developed markets like Western Europe. The source segmentation, differentiating between organic and conventional bananas, is increasingly important; organic banana syrup commands a significant price premium and is critical for accessing high-end retailers and certified organic food establishments. Geographic variations in these preferences are notable, with North America and Europe showing high affinity for organic products, while price sensitivity dictates higher conventional consumption in parts of APAC and Latin America.

- By Type:

- Natural Banana Syrup

- Artificial Banana Syrup

- By Source:

- Organic

- Conventional

- By Application:

- Food Service (HORECA)

- Industrial Processing (Dairy, Confectionery, Beverages)

- Household/Retail

- By Distribution Channel:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

Value Chain Analysis For Banana Syrup Market

The value chain for the Banana Syrup Market begins with the highly sensitive upstream segment, which involves the cultivation, harvesting, and initial processing of bananas. This stage is characterized by high operational risk due to climate variability, pest management, and the need for immediate post-harvest handling to prevent spoilage, particularly when aiming for high-quality natural extracts. Key upstream activities include securing reliable sources of specific banana varieties (e.g., Cavendish, plantains, or specialized cooking bananas for different flavor profiles), initial washing, sorting, and transportation to processing units. Contract farming and vertical integration are crucial strategies employed by major syrup producers to mitigate price volatility and ensure a consistent supply of quality raw material, which directly impacts the final syrup flavor and color profile. The efficiency of upstream logistics dictates the cost structure significantly.

The midstream phase, focusing on manufacturing and processing, is where value is added through complex industrial activities such as peeling, pulping, enzymatic treatment, clarification, concentration (evaporation), pasteurization, and blending with sweeteners, stabilizers, and preservatives. Technological sophistication in this stage is paramount, especially the use of vacuum evaporation or reverse osmosis to concentrate the banana juice while minimizing thermal degradation of flavor compounds. Quality control checks (Brix level, pH, microbial testing) are rigorous at this stage. Direct processing plants located near banana plantations offer logistics advantages, reducing transit time and preserving freshness. The shift towards clean-label manufacturing has increased the complexity of this stage, requiring the substitution of artificial stabilizers with natural gums and acids, often increasing production costs but enhancing market appeal.

The downstream segment includes distribution and sales channels, which are bifurcated into Direct (B2B) and Indirect (B2C). B2B channels involve direct sales to industrial food processors and large food service chains (e.g., multinational coffee shops), requiring bulk packaging and specialized delivery logistics. Indirect channels primarily target the end-consumer through hypermarkets, specialized gourmet stores, and increasingly, high-growth e-commerce platforms. Distribution effectiveness is heavily reliant on a robust cold chain or, for shelf-stable syrups, efficient ambient storage and rapid order fulfillment. Potential customers, including restaurant chefs and industrial procurement managers, prioritize consistency, packaging suitability, and competitive bulk pricing, making direct relationships and regional warehousing essential for sustained market presence and penetration in diverse geographical areas.

Banana Syrup Market Potential Customers

Potential customers for Banana Syrup are diverse and span the entire food and beverage ecosystem, categorized mainly into industrial processors, food service operators, and the retail household segment. Industrial processors constitute a primary buyer group, utilizing banana syrup as a consistent, standardized flavoring agent in dairy products (yogurts, ice cream), confectionery (gummies, hard candies), baked goods (muffins, fillings), and both alcoholic and non-alcoholic beverages (cocktails, smoothies, ready-to-drink juices). These buyers prioritize bulk quantity, stable pricing, and technical specifications, such as heat stability and specific Brix concentrations, crucial for large-scale formulation consistency. The procurement decisions in this segment are highly rational and driven by cost-in-use and supply security, often requiring multi-year contractual agreements to guarantee volumes and price stability.

The Food Service sector (HORECA) represents perhaps the most visible and dynamic segment of potential customers. This includes specialty coffee shops, fast-casual restaurants, bars, and catering companies. Chefs and mixologists frequently purchase banana syrup for its convenience and ability to introduce tropical flavor notes consistently across their menus, ranging from custom espresso drinks and lattes to signature cocktails and dessert toppings. For this segment, key purchase criteria include flavor authenticity, ease of use (pump dispensers), premium packaging, and smaller, manageable volumes compared to industrial orders. The trend towards artisanal and unique flavor combinations continually drives demand from this customer group, fueling the need for specialized, often high-end or organic, banana syrup formulations.

Finally, the household and retail consumer segment constitutes a growing customer base, driven by an increased interest in home cooking, baking, and gourmet beverage preparation. Consumers purchase banana syrup through supermarkets, specialty food stores, and online marketplaces for direct use as a topping for breakfast foods (pancakes, waffles) or as an ingredient in homemade desserts and drinks. Purchase decisions in this segment are influenced by brand reputation, perceived health benefits (low sugar, natural ingredients), attractive packaging, and shelf visibility. The shift towards convenience foods and the desire to replicate café-quality beverages at home have significantly accelerated the growth of the B2C market for banana syrups, with consumers often seeking small-batch or specialty artisanal offerings that emphasize naturality and exotic provenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Monin Inc., Torani (R. Torre & Company), Kerry Group plc, Tate & Lyle, Givaudan SA, Sensient Technologies Corporation, International Flavors & Fragrances Inc. (IFF), Archer Daniels Midland (ADM), Nestlé S.A., Hershey Company, DaVinci Gourmet, SHOTT Beverages, Sweetbird Syrups, Amoretti, and Jordan's Skinny Syrups. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Banana Syrup Market Key Technology Landscape

The technological landscape in the Banana Syrup Market is primarily defined by advanced processing methods aimed at maximizing flavor retention, extending shelf stability, and achieving required physical properties such as viscosity and clarity. A critical technology involves enzymatic liquefaction and clarification, which enhances the extraction efficiency of banana pulp while breaking down complex carbohydrates to improve syrup texture and reduce cloudiness, yielding a purer, more visually appealing product. Furthermore, modern concentration techniques, particularly multi-effect vacuum evaporation or low-temperature evaporation, are essential for removing excess water efficiently without subjecting the delicate banana flavor compounds to damaging high heat. These technologies directly support the production of premium natural banana syrups by preserving the authentic aroma profile, which is highly valued by the food service industry.

Aseptic processing and Ultra-High Temperature (UHT) sterilization are also cornerstone technologies, particularly important for bulk industrial syrups and products intended for markets with long distribution chains or ambient storage conditions. UHT ensures microbial safety and extended shelf life (often exceeding 12 months) without requiring chemical preservatives, aligning with clean-label objectives. Specialized filling technologies, including hot-fill and customized viscosity fillers, ensure accurate portioning and prevent separation or crystallization within the final packaged product. Innovation also focuses on natural preservation methods, utilizing high-pressure processing (HPP) in some cases, although this is less common for high-Brix syrups, or integrating natural antioxidants like ascorbic acid to prevent color degradation over time, maintaining product appeal.

In response to sustainability mandates and demand for functional ingredients, advanced extraction technologies are gaining traction. Techniques such as supercritical fluid extraction (SFE) or ultrasonic-assisted extraction are being researched to isolate specific bioactive compounds or intense flavor essences from banana peels or pulp residues, potentially leading to 'value-added' banana syrup co-products or highly concentrated flavor boosters. Digitalization plays a supporting technological role, with sophisticated sensor networks deployed throughout the production line to monitor pH, temperature, and Brix levels in real-time, feeding data into process control systems. This automation ensures batch-to-batch consistency—a non-negotiable requirement for large industrial and multi-location food service customers—and optimizes resource consumption, minimizing waste and enhancing overall manufacturing efficiency.

Regional Highlights

- North America: This region holds a dominant market share, characterized by high consumer spending on specialty coffee, gourmet desserts, and cocktail mixology. The United States and Canada are highly receptive to exotic, natural, and organic banana syrup variants, driving demand for premium-priced products. The strong presence of international food service chains and a highly evolved retail landscape facilitate rapid product adoption. Strict food labeling regulations concerning artificial ingredients also incentivize manufacturers to focus heavily on natural formulations and reduced-sugar offerings. Innovation in this region is often focused on unique flavor combinations and functional benefits, such as syrups fortified with vitamins or high fiber content.

- Europe: The European market is highly mature, marked by a strong preference for clean-label, ethically sourced, and certified organic ingredients, particularly in countries like Germany, the UK, and France. Banana syrup consumption is robust in both the industrial segment (used heavily in yogurts and bakery fillings) and the food service sector. Regulatory frameworks, such as the EU's directives on sugar content and artificial colors, heavily influence product reformulation. Demand is increasingly sophisticated, with consumers showing interest in origin-specific banana extracts or fair-trade certified products, driving competition among specialty syrup providers to highlight sustainable sourcing practices and transparent supply chains.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and the Westernization of dietary patterns. Countries like China, India, and Southeast Asian nations are witnessing explosive growth in the café and modern casual dining culture, directly boosting demand for flavor syrups. While price sensitivity remains a factor in certain segments, the premiumization trend is strong in major metropolitan areas. The local availability of banana crops also offers regional producers a distinct cost advantage, leading to intense competition between local and international players. Industrial application in processed snacks and localized beverage formats is expanding rapidly.

- Latin America (LATAM): As a major global banana production hub, LATAM plays a crucial role both as a sourcing region for global manufacturers and as a growing consumer market. Domestic consumption of banana-flavored products, including syrups, is high, driven by cultural familiarity and availability. The regional market is currently fragmented, with a mix of large international brands and smaller, local producers focusing on highly localized flavor profiles. Growth is projected to be steady, particularly in Mexico and Brazil, supported by growing tourism and expanding food processing industries that utilize locally sourced materials for both domestic consumption and export.

- Middle East and Africa (MEA): This region shows specialized growth, particularly in the urban centers of the GCC countries (Saudi Arabia, UAE), where the food service industry is dynamic and highly dependent on imported gourmet ingredients. Banana syrup is popular in high-end hotels and cafes catering to expatriates and affluent local populations. Africa’s potential lies primarily in its role as a raw material source, though domestic consumer markets are gradually developing in large economies like South Africa and Nigeria, where packaged food consumption is increasing due to shifting lifestyles and urbanization trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Banana Syrup Market.- Monin Inc.

- Torani (R. Torre & Company)

- Kerry Group plc

- Tate & Lyle

- Givaudan SA

- Sensient Technologies Corporation

- International Flavors & Fragrances Inc. (IFF)

- Archer Daniels Midland (ADM)

- Nestlé S.A.

- Hershey Company

- DaVinci Gourmet

- SHOTT Beverages

- Sweetbird Syrups

- Amoretti

- Jordan's Skinny Syrups

- Syrup Masters International

- Bristol Syrup Company

- Star Kay White

- Virginia Dare Extract Co.

- Agrana Beteiligungs-AG

Frequently Asked Questions

Analyze common user questions about the Banana Syrup market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary applications are driving the growth of the Banana Syrup Market?

The primary driver for market growth is the expansion of the global specialty coffee and tea culture, where banana syrup is frequently utilized to create flavored lattes, cold brews, and premium handcrafted beverages. The food service sector (HORECA) remains the largest consumer, alongside increasing use in industrial confectionery and ice cream manufacturing for standardized flavoring.

How do natural and artificial banana syrups differ in market positioning and consumer appeal?

Natural banana syrups, derived from real fruit extracts, command a higher market price and appeal directly to consumers prioritizing clean-label ingredients, perceived health benefits, and authentic flavor profiles. Artificial variants, while cost-effective and highly stable, are seeing declining growth in developed markets due to increasing health scrutiny regarding synthetic food additives and sweeteners.

Which geographical region exhibits the fastest growth rate for banana syrup consumption?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is projected to record the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid urbanization, Westernization of food consumption habits, and the proliferation of café chains and dessert parlors demanding new and exotic tropical flavor options for their menus.

What are the key challenges related to the raw material supply chain for banana syrup manufacturers?

The main challenges involve the significant volatility of banana raw material prices, which are highly susceptible to agricultural risks such as climate change impacts, disease outbreaks (like TR4), and geopolitical instability in major exporting regions. This volatility necessitates strategic sourcing contracts and robust inventory management to ensure stable production costs and consistent quality for final syrup products.

Are there significant health-related trends influencing the innovation in banana syrup products?

Yes, significant health trends demand lower sugar content and natural alternatives. Manufacturers are heavily innovating by developing reduced-sugar or sugar-free banana syrups, often utilizing natural sweeteners like stevia or monk fruit, and focusing on organic, non-GMO, and preservative-free formulations to align with consumer demands for healthier, clean-label functional ingredients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager